DTC Agreement Between Malta and Germany

Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

DTC Agreement Between Malta and Germany

Hak Cipta:

Format Tersedia

Protocol

Amending the Agreement of 8 March 2001

between

the Federal Republic of Germany

and

Malta

for the Avoidance of Double Taxation

with respect to Taxes on Income and on Capital

-2-

The Federal Republic of Germany and Malta

Desiring to conclude a Protocol amending the Agreement of 8 March 2001 between the Federal Republic of Germany and Malta for the Avoidance of Double Taxation with respect to Taxes on Income and on Capital

Have agreed as follows:

Article I

Article 26 of the Agreement shall read as follows:

Article 26 Exchange of Information

(1) The competent authorities of the Contracting States shall exchange such information as is foreseeably relevant for carrying out the provisions of this Agreement or to the administration or enforcement of the domestic laws concerning taxes of every kind and description imposed on behalf of the Contracting States, of a Land or a political subdivision or local authority thereof, insofar as the taxation thereunder is not contrary to the Agreement. The exchange of information is not restricted by Articles 1, 2 and paragraph 2 of Article 27.

(2) Any information received under paragraph 1 by a Contracting State shall be treated as secret in the same manner as information obtained under the domestic laws of that State and shall be disclosed only to persons or authorities (including courts and administrative bodies) concerned with the assessment or collection of, the enforcement or prosecution in respect of, the determination of appeals in relation to the taxes referred to in paragraph 1, or the oversight

-3-

of the above. Such persons or authorities shall use the information only for such purposes. They may disclose the information in public court proceedings or in judicial decisions. Notwithstanding the foregoing provisions, the information may be used for other purposes when such information may be used for such other purposes under the laws of both States and the competent authority of the supplying State authorises such use.

(3) In no case shall the provisions of paragraphs 1 and 2 be construed so as to impose on a Contracting State the obligation:

a) to carry out administrative measures at variance with the laws and administrative practice of that or of the other Contracting State;

b) to supply information which is not obtainable under the laws or in the normal course of the administration of that or of the other Contracting State;

c) to supply information which would disclose any trade, business, industrial, commercial or professional secret or trade process, or information, the disclosure of which would be contrary to public policy (ordre public).

(4) If information is requested by a Contracting State in accordance with this Article, the other Contracting State shall use its information gathering measures to obtain the requested information, even though that other State may not need such information for its own tax purposes. The obligation contained in the preceding sentence is subject to the limitations of paragraph 3 but in no case shall such limitations be construed to permit a Contracting State to decline to supply information solely because it has no domestic interest in such information.

(5) In no case shall the provisions of paragraph 3 be construed to permit a Contracting State to decline to supply information solely because the information is held by a bank, other financial institution, nominee or person acting in an agency or a fiduciary capacity or because it relates to ownership interests in a person.

-4-

Article II Number 4 of the Protocol to the Agreement shall read as follows:

4. With reference to Article 26:

(1) If the requesting competent authority confirms that the requested information is foreseeably relevant to the purposes mentioned in Article 26 of the Agreement, the requested competent authority shall accept this confirmation provided that the request satisfies the following requirements: a) the identity of the person under examination or investigation;

b) a statement of the information sought including its nature and the form in which the requesting Contracting State wishes to receive the information from the requested Contracting State;

c) the tax purpose for which the information is sought;

d) grounds for believing that the information requested is held in the requested Contracting State or is in the possession or control of a person within the jurisdiction of the requested Contracting State;

e) to the extent known, the name and address of any person believed to be in possession of the requested information;

f) a statement that the request is in conformity with the law and administrative practices of the requesting Contracting State, that if the requested information was within the jurisdiction of the requesting Contracting State then the competent authority of the requesting Contracting State would be able to obtain the information under the laws of the requesting Contracting State or in the normal course of administrative practice and that it is in conformity with this Agreement;

-5-

g) a statement that the requesting Contracting State has pursued all means available in its own territory to obtain the information, except those that would give rise to disproportionate difficulties.

(2) The requested information shall also be foreseeably relevant in the case of a request for information where the name of the person is unknown and the requesting competent authority confirms to the requested competent authority that it has reasonable grounds for suspecting the existence of criminal tax matters involving assets situated or persons resident in the Contracting States. For the purposes of this paragraph the term criminal tax matters means tax matters involving intentional conduct which is liable to prosecution under the criminal laws of the requesting Contracting State.

(3) Insofar as personal data are supplied under Article 26, the following additional provisions shall apply:

a) The data-receiving State may use such data only for the stated purpose and shall be subject to the conditions prescribed by the data-supplying State.

b) The data-receiving State shall on request inform the data-supplying State about the use of the supplied data and the results achieved thereby.

c) Personal data may be supplied only to the competent authorities. Any subsequent supply to other authorities may be effected only with the prior approval of the supplying competent authority.

d) The data-supplying State shall be obliged to ensure that the data to be supplied are accurate and that they are foreseeably relevant for and proportionate to the purpose for which they are supplied. Any bans on data supply prescribed under applicable domestic law shall be observed. If it emerges that inaccurate data or data which should not have been supplied have been supplied, the data-receiving State shall be informed of this without delay. That State shall be obliged to correct or erase such data.

-6-

e) Upon application the person concerned shall be informed of the supplied data relating to him and of the use to which such data are to be put. There shall be no obligation to furnish this information if on balance it turns out that the public interest in withholding it outweighs the interest of the person concerned in receiving it. In all other respects, the right of the person concerned to be informed of the existing data relating to him shall be governed by the domestic law of the Contracting State in whose sovereign territory the application for the information is made.

f) The data-receiving State shall bear liability in accordance with its domestic laws in relation to any person suffering unlawful damage as a result of supply under the exchange of data pursuant to this Agreement. In relation to the damaged person, the data-receiving State may not plead to its discharge that the damage had been caused by the data-supplying State.

g) If the domestic law of the data-supplying State provides for special provisions for the erasure of the personal data supplied, that State shall inform the data-receiving State accordingly. Irrespective of such law, supplied personal data shall be erased once they are no longer required for the purpose for which they were supplied.

h) The Contracting States shall be obliged to keep official records of the supply and receipt of personal data.

i) The data-supplying and the data-receiving States shall be obliged to take effective measures to protect the personal data supplied against unauthorised access, unauthorised alteration and unauthorised disclosure.

Article III

(1) This Protocol shall be subject to ratification; the instruments of ratification shall be exchanged as soon as possible in Berlin.

-7-

(2) This Protocol shall enter into force on the day of the exchange of the instruments of ratification. Upon the date of entry into force, this Protocol shall have effect in both Contracting States even on taxes levied prior to its entry into force.

(3) This Protocol shall be an integral part of the Agreement and shall remain in force for as long as the Agreement itself.

Done at Malta on 17 June 2010 in two originals, each in the German and English languages, both texts being equally authentic.

For the Federal Republic of Germany Bernd Braun

For Malta Tonio Fenech

Anda mungkin juga menyukai

- United States Second Round Peer ReviewDokumen148 halamanUnited States Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Guernsey Second Round Peer Review ReportDokumen148 halamanGuernsey Second Round Peer Review ReportOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- The Philippines Second Round Peer ReviewDokumen96 halamanThe Philippines Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- San Marino Second Round Peer ReviewDokumen104 halamanSan Marino Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Indonesia Second Round Peer ReviewDokumen126 halamanIndonesia Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- New Zealand Second Round Review (2018)Dokumen144 halamanNew Zealand Second Round Review (2018)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Kazakhstan Second Round Peer ReviewDokumen132 halamanKazakhstan Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Japan Second Round Peer ReviewDokumen112 halamanJapan Second Round Peer ReviewOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Germany Second Round Review (2017)Dokumen142 halamanGermany Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Ireland Second Round Review (2017)Dokumen116 halamanIreland Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Bahamas Second Peer Review Report (2018)Dokumen120 halamanBahamas Second Peer Review Report (2018)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Estonia Second Round Review (2018)Dokumen118 halamanEstonia Second Round Review (2018)OECD: Organisation for Economic Co-operation and Development100% (1)

- Cayman Islands Second Round Review (2017)Dokumen130 halamanCayman Islands Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Canada Second Round Review (2017)Dokumen124 halamanCanada Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Jamaica Second Round Review (2017)Dokumen116 halamanJamaica Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Mauritius Second Round Review (2017)Dokumen126 halamanMauritius Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Norway Second Round Review (2017)Dokumen120 halamanNorway Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Bermuda Second Round Review (2017)Dokumen146 halamanBermuda Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Australia Second Round Review (2017)Dokumen130 halamanAustralia Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Qatar Second Round Review (2017)Dokumen116 halamanQatar Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- DTC Agreement Between India and TurkmenistanDokumen14 halamanDTC Agreement Between India and TurkmenistanOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Statement of Outcomes GF Plenary 2016 PDFDokumen8 halamanStatement of Outcomes GF Plenary 2016 PDFOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- GF Annual Report 2016 PDFDokumen95 halamanGF Annual Report 2016 PDFOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- DTC Agreement Between India and TanzaniaDokumen16 halamanDTC Agreement Between India and TanzaniaOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- TIEA Agreement Between India and SeychellesDokumen7 halamanTIEA Agreement Between India and SeychellesOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- DTC Agreement Between India and UruguayDokumen17 halamanDTC Agreement Between India and UruguayOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- DTC Agreement Between India and Sri LankaDokumen16 halamanDTC Agreement Between India and Sri LankaOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- DTC Agreement Between Switzerland and IndiaDokumen31 halamanDTC Agreement Between Switzerland and IndiaOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- TIEA Agreement Between India and Saint Kitts and NevisDokumen9 halamanTIEA Agreement Between India and Saint Kitts and NevisOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- DTC Agreement Between India and RomaniaDokumen15 halamanDTC Agreement Between India and RomaniaOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Jagan Nath University, Bahadurgarh Department of Law Moot Court Competition, National Seminars Organized, Students Participation and Legal Awareness CampDokumen3 halamanJagan Nath University, Bahadurgarh Department of Law Moot Court Competition, National Seminars Organized, Students Participation and Legal Awareness CampRAJ KUMAR YADAVBelum ada peringkat

- A Lawyer's Guide To Powerful Pleadings PDFDokumen12 halamanA Lawyer's Guide To Powerful Pleadings PDFCMBDBBelum ada peringkat

- Agency Case Digests - Art. 1899-1918 - Atty. Obieta - 2D 2012Dokumen5 halamanAgency Case Digests - Art. 1899-1918 - Atty. Obieta - 2D 2012Albert BantanBelum ada peringkat

- Regina Ongsiako Reyes vs. Commission On Elections and Joseph Socorro B. TanDokumen2 halamanRegina Ongsiako Reyes vs. Commission On Elections and Joseph Socorro B. TanGraciana FuentesBelum ada peringkat

- Negotiable Instruments LawDokumen13 halamanNegotiable Instruments Lawhotjurist100% (11)

- Smartdoor Holdings, Inc. v. Edmit Industries, Inc. Et Al.Dokumen11 halamanSmartdoor Holdings, Inc. v. Edmit Industries, Inc. Et Al.Patent LitigationBelum ada peringkat

- Arrest Without Warrant in Bangladesh: Legal ProtectionDokumen14 halamanArrest Without Warrant in Bangladesh: Legal ProtectionAbu Bakar100% (1)

- Publico V VillapandoDokumen1 halamanPublico V VillapandoajyuBelum ada peringkat

- Woodchild Holdings, Inc. vs. Roxas Electric and Construction Company, Inc.Dokumen2 halamanWoodchild Holdings, Inc. vs. Roxas Electric and Construction Company, Inc.JonaBelum ada peringkat

- Metropolitan Waterworks and Sewerage System (MWSS) vs. CA and City of Dagupan (CITY)Dokumen2 halamanMetropolitan Waterworks and Sewerage System (MWSS) vs. CA and City of Dagupan (CITY)Lex CabilteBelum ada peringkat

- Sales Double Sales DigestDokumen21 halamanSales Double Sales Digestalex trincheraBelum ada peringkat

- 42 Usc 1983 Conspiracy AuthoritiesDokumen94 halaman42 Usc 1983 Conspiracy Authoritiesdavidchey4617100% (3)

- Homework - Case DigestDokumen2 halamanHomework - Case DigestYbur SigBelum ada peringkat

- 1983 Senate Hearing TranscriptDokumen1.037 halaman1983 Senate Hearing TranscriptStephen LoiaconiBelum ada peringkat

- Reyes v. RCPI Employees Credit Union Inc.Dokumen2 halamanReyes v. RCPI Employees Credit Union Inc.CeresjudicataBelum ada peringkat

- CONTRACT OF LEASE (Muntinlupa)Dokumen6 halamanCONTRACT OF LEASE (Muntinlupa)mrsjpendletonBelum ada peringkat

- Additional Information LetterDokumen2 halamanAdditional Information LetterinthewaysometimesBelum ada peringkat

- Memorandum of AssociationDokumen17 halamanMemorandum of AssociationFaraz Siddiqui100% (1)

- Neha Passport Application PDFDokumen2 halamanNeha Passport Application PDFAnmol KakkarBelum ada peringkat

- Pacumio-Civil Procedure DigestsDokumen404 halamanPacumio-Civil Procedure DigestsDaverick Pacumio100% (2)

- Withdrawal of AppearanceDokumen2 halamanWithdrawal of Appearancetet1986Belum ada peringkat

- People V. Teodoro: People of The PhilippinesDokumen2 halamanPeople V. Teodoro: People of The PhilippineseieipayadBelum ada peringkat

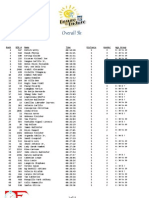

- Ensure To Endure Run 2012 5k OverallDokumen11 halamanEnsure To Endure Run 2012 5k OverallDavesBelum ada peringkat

- Law of Evidence PDFDokumen53 halamanLaw of Evidence PDFAditya HemanthBelum ada peringkat

- Understanding Corporate LawDokumen56 halamanUnderstanding Corporate LawNathalie Kayte Dunuan0% (1)

- 035 - Ka Wachi V Del QueroDokumen4 halaman035 - Ka Wachi V Del Querovick08Belum ada peringkat

- Outline EvidenceDokumen83 halamanOutline EvidenceJeanne ChauBelum ada peringkat

- Powervibe LLC v. Barbara - Document No. 7Dokumen2 halamanPowervibe LLC v. Barbara - Document No. 7Justia.comBelum ada peringkat

- PNP Form 6-A1 - Application For LicenseDokumen2 halamanPNP Form 6-A1 - Application For LicenseJustine Kei Lim-Ortega50% (4)

- Nda 3Dokumen7 halamanNda 3vart1992Belum ada peringkat