Table of Contents

Diunggah oleh

Rashedul IslamDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Table of Contents

Diunggah oleh

Rashedul IslamHak Cipta:

Format Tersedia

Table of Contents

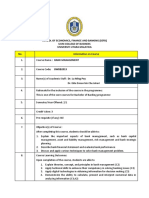

Description Letter on Transmittal Acknowledgement Executive Summary Chapter 1: Introduction 1.1 Importance of the Study 1.2 Objective of the Study 1.3 Historical Background of the Study 1.4 Methodology of the Report 1.5 Scope and Limitations of the Study Chapter 2: Evaluating the Authorities Involved in Credit Management of the City Bank 2.1 Organogram of Credit Department of City Bank 2.2 Individuals Responsibility of Organogram. 2.2.1 Directors 2.2.2 Credit Risk officer 2.2.3 Relation Ship Manager 2.2.4 Head of Credit Admin Chapter 3: Evaluating the Credit Policy and Procedures Followed by City Bank 3.1 Credit Policy of City Bank 3.2 Approval Process 3.3 Flow Chart of Approval Process 3.4 Services Offered by Credit Department 3.5 Credit Evaluation Principles 3.6 Most Important Features of City Banks Credit Policy 3.7 Determinants for Selection of Borrower 3.7.1 The Cs of Good & Bad Loan 3.7.2 Collection of Credit Information 3.8 Documentation of the Loan 3.8.1 Objectives of Documentation Against Loan/Advance 3.8.2 Steps for Documentation 3.8.3 When Document is Become Invalid

Page Number i ii iii 15 1 1 24 5 5 68 6 6 7 7 7 78 8 918 9 9 910 11 12 13 13 14 1415 1516 17 17 18 18

Chapter 4: Evaluating the Financing Pattern of Credit Facilities of City Bank 4.1 The Scenario of Deposit Portfolio Chapter 5: Evaluating the Sector Wise Credit Offered by the City Bank 5.1 Sector-Wise Credit Offered by City Bank 5.2 Sector-Wise Loans / Investment Including Bills Purchased and Discounted Chapter 6: Evaluating the Securities Offered by the Client Against Credit Facility 6.1 Security Against Advances 6.1.1 Types of Securities 6.1.2 Attributes of a Good Security:

6.1.3: Securities Against Loans/ Investments:

Chapter 7: Evaluating the Recovery Position of the Credit Facilities of the City Bank 7.1 Recovery Position of Credit Facility of City Bank Chapter 8: Find Out the Problems and their Probable Solution 8.1 SWOT Analysis of City Bank 8.2 Problems 8.2.1 Lack of Deposit for Credit Extensions 8.2.2 Mentally of not to repay the loan 8.2.3 Defective Legal System 8.2.4 Delay in Loan Sanction 8.2.5 Higher Rate of Interest for Credit 8.2.6 Changes in Policies 8.2.7 Irregularity in Providing Loan 8.3 Strength 8.4 Weaknesses 8.5 Opportunities 8.6 Threats

1919 19 19 2021 20 20 21 2223 22 22 22 2223 23 2424 24 24 2528 25 25 25 25 25 25 25 25 26 26 26 27 2728 28

Chapter 9: Evaluation of Impact of Credit Management on the Profitability of the City Bank 9.1 Maintaining Capital Adequacy 9.1.1 Capital Adequacy Ratio 9.2 Maintaining Satisfactory Liquidity 9.3 Value Added Statement 9.4 Market Value Added 9.5 Profitability Ratio 9.5.1 Return on Equity 9.5.2 Return on Asset Chapter 10: 10.1 Recommendation 10.2 Conclusion References: Table: Table 1: Scenario of Deposit Table 2: Sectors Wise Credit Offered by City Bank Table 3: Sectors Wise Loans/Investment Table 4: Securities Against Loans and Investments Table 5 : Recovery Position Table 6: Capital Adequacy Ratio Table 7: Value Added Statement Table 8: Return on Equity Table 9: Return on Asset Graph: Graph-1: The Scenario of Deposit of City Bank Graph 2: Recovery Position of Loan Graph 3: Capital Adequacy Ratio Graph 4: Market Value Added (MVA) Flow Chart: Flow chart1: Organogram of Credit Department Flow chart2: Approval Process

2933 29 29 2930 31 31 32 33 33 33 3435 34 35 36 19 20 21 23 24 2930 33 33 33 19 24 29 32 6 11

Anda mungkin juga menyukai

- NEW Handbook On Debt RecoveryDokumen173 halamanNEW Handbook On Debt RecoveryRAJALAKSHMI HARIHARAN100% (5)

- ADB Loan Disbursement GuideDokumen151 halamanADB Loan Disbursement GuideWaseem AsgharBelum ada peringkat

- Guide to Improving Credit Approval Process and Risk ManagementDokumen99 halamanGuide to Improving Credit Approval Process and Risk ManagementVallabh Utpat100% (1)

- Bank lending policies procedures factors determining loan growth mixDokumen14 halamanBank lending policies procedures factors determining loan growth mixNadia VirkBelum ada peringkat

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDokumen1 halamanAlphaex Capital Candlestick Pattern Cheat Sheet InfographRyan Vassa PramudyaBelum ada peringkat

- Rating Based Modeling of Credit Risk: Theory and Application of Migration MatricesDari EverandRating Based Modeling of Credit Risk: Theory and Application of Migration MatricesPenilaian: 2 dari 5 bintang2/5 (1)

- CHAPTER 5 LESSON 4 Economic InstitutionsDokumen32 halamanCHAPTER 5 LESSON 4 Economic InstitutionsPrincess May Castillo Ramos100% (1)

- Credit and Lending Notes. MR Hussein Mbululo.-1Dokumen43 halamanCredit and Lending Notes. MR Hussein Mbululo.-1saidBelum ada peringkat

- Project Report On Credit Facilities at Central bank of India for Healthcare SectorDokumen45 halamanProject Report On Credit Facilities at Central bank of India for Healthcare SectorAbhas AgarwalBelum ada peringkat

- Roche Holdings AG Funding The Genentech AcquistionDokumen8 halamanRoche Holdings AG Funding The Genentech AcquistionIrka Dewi TanemaruBelum ada peringkat

- BFW3841 Lecture Week 1 Semester 1 2018Dokumen40 halamanBFW3841 Lecture Week 1 Semester 1 2018hi2joeyBelum ada peringkat

- Top Investment Banks MumbaiDokumen2 halamanTop Investment Banks MumbaiAbhishek SinghBelum ada peringkat

- Credit Appraisal and Risk Rating at PNBDokumen87 halamanCredit Appraisal and Risk Rating at PNBVishnu Soni100% (2)

- Credit AppraisalDokumen94 halamanCredit AppraisalpratikshaBelum ada peringkat

- Credit Policy 2006Dokumen100 halamanCredit Policy 2006natashamalhotraBelum ada peringkat

- OdishaDokumen12 halamanOdishaANKIT DWIVEDIBelum ada peringkat

- Chapter 2 - Determinants of Interest RatesDokumen36 halamanChapter 2 - Determinants of Interest RatesMai Lan AnhBelum ada peringkat

- Credit Risk Frontiers: Subprime Crisis, Pricing and Hedging, CVA, MBS, Ratings, and LiquidityDari EverandCredit Risk Frontiers: Subprime Crisis, Pricing and Hedging, CVA, MBS, Ratings, and LiquidityBelum ada peringkat

- Central Bank Balance Sheet and Real Business Cycles (2018)Dokumen234 halamanCentral Bank Balance Sheet and Real Business Cycles (2018)Quoc Phu Pham100% (1)

- Small Money Big Impact: Fighting Poverty with MicrofinanceDari EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceBelum ada peringkat

- Credit Operations and Risk ManagementDokumen8 halamanCredit Operations and Risk ManagementAl AminBelum ada peringkat

- Auditing Course OutlineDokumen4 halamanAuditing Course OutlinetufanBelum ada peringkat

- Ba7026 Banking Financial Services ManagemntDokumen122 halamanBa7026 Banking Financial Services ManagemntRithesh RaBelum ada peringkat

- Letter of TransmittalDokumen8 halamanLetter of Transmittalmd.jewel ranaBelum ada peringkat

- Agricultural Finance, Banking and CooperationDokumen11 halamanAgricultural Finance, Banking and CooperationPa Krishna SankarBelum ada peringkat

- CAMELS Analysis of City BankDokumen25 halamanCAMELS Analysis of City Bankzain zamanBelum ada peringkat

- FinalDokumen24 halamanFinalNgọc Hoàng Thị BảoBelum ada peringkat

- Basel III Capital Regulations OverviewDokumen284 halamanBasel III Capital Regulations OverviewShanker DasBelum ada peringkat

- 898-5548-Banking Law & PracticeDokumen7 halaman898-5548-Banking Law & PracticeSheikh_Ahmad_3600Belum ada peringkat

- Advances Management GuideDokumen8 halamanAdvances Management GuideVirendra PatilBelum ada peringkat

- AMCT Syllabus Financial FundamentalsDokumen2 halamanAMCT Syllabus Financial FundamentalsSd HussainBelum ada peringkat

- TRI DUNG Outline of ThesisDokumen5 halamanTRI DUNG Outline of ThesisHuy Vu ChiBelum ada peringkat

- Letter of Transmittal: Sub: Submission of Internship ReportDokumen12 halamanLetter of Transmittal: Sub: Submission of Internship ReportjehanBelum ada peringkat

- Basel 3Dokumen287 halamanBasel 3boniadityaBelum ada peringkat

- Financial Report Analysis of Global IMEDokumen26 halamanFinancial Report Analysis of Global IMEशिवम कर्णBelum ada peringkat

- Consumer Banking in PakistanDokumen77 halamanConsumer Banking in Pakistannumair1989Belum ada peringkat

- Syllabus Aug 2022 NHTM 2Dokumen10 halamanSyllabus Aug 2022 NHTM 2Dương Thuỳ TrangBelum ada peringkat

- Internship Report On Credit Risk Management of Jamuna Bank LimitedDokumen22 halamanInternship Report On Credit Risk Management of Jamuna Bank LimitedZunaid Hasan57% (7)

- A Case Study Onsoutheast Bank LTD, Cda Avenue Branch, ChittagongDokumen66 halamanA Case Study Onsoutheast Bank LTD, Cda Avenue Branch, ChittagongTamim SikderBelum ada peringkat

- An Investigation Into Payment Trends and Behaviour-UK-1997-2007Dokumen189 halamanAn Investigation Into Payment Trends and Behaviour-UK-1997-2007dmaproiectBelum ada peringkat

- Credit Risk Management of BRAC Bank Limited'Dokumen39 halamanCredit Risk Management of BRAC Bank Limited'Tarequl IslamBelum ada peringkat

- Wakshuma MulgetaDokumen79 halamanWakshuma Mulgetamulugeta wakshumaBelum ada peringkat

- Internship Report Credit Management in Janata BankDokumen53 halamanInternship Report Credit Management in Janata BankKuasha Nirob81% (21)

- Table of ContentDokumen2 halamanTable of ContentKhan Md FayjulBelum ada peringkat

- Loan Management of CBL - UshaDokumen42 halamanLoan Management of CBL - UshaMd SalimBelum ada peringkat

- FmdaDokumen4 halamanFmdaSridhanyas kitchenBelum ada peringkat

- Intern 1 PDFDokumen81 halamanIntern 1 PDFNazmulHydierNeloyBelum ada peringkat

- Assessment of Credit Approval and Collection Management at United BankDokumen56 halamanAssessment of Credit Approval and Collection Management at United BankrobelBelum ada peringkat

- Silver River ManufacturingDokumen68 halamanSilver River Manufacturingप्रसान्त चौधरीBelum ada peringkat

- Nonperforming Loans in Asia and Europe—Causes, Impacts, and Resolution StrategiesDari EverandNonperforming Loans in Asia and Europe—Causes, Impacts, and Resolution StrategiesBelum ada peringkat

- Internship ReportDokumen6 halamanInternship ReportShristi50% (2)

- Rasida PrelimDokumen11 halamanRasida PrelimKibria RiyadeBelum ada peringkat

- UG B.B.a Banking B B A Banking - 122 23 Rural BankingDokumen216 halamanUG B.B.a Banking B B A Banking - 122 23 Rural BankingShandilya ShantanuBelum ada peringkat

- Internship Report HBLDokumen93 halamanInternship Report HBLMuhammad AyanBelum ada peringkat

- Assessment of Credit Provision Mechanism Incase Ofcommerial Bank of Ethiopia (Cbe) at Gondar Main BrachDokumen28 halamanAssessment of Credit Provision Mechanism Incase Ofcommerial Bank of Ethiopia (Cbe) at Gondar Main BrachKalicha Doyo67% (3)

- A212 Syllabus BWBB2013Dokumen6 halamanA212 Syllabus BWBB2013Hs HamdanBelum ada peringkat

- Internship Report On: "Foreign Remittance of Prime Bank LTD"Dokumen7 halamanInternship Report On: "Foreign Remittance of Prime Bank LTD"Md Khaled NoorBelum ada peringkat

- SSRN Id3855367Dokumen18 halamanSSRN Id3855367Chethana FrancisBelum ada peringkat

- Shambel Tegie 0902707 Kasahun Teshome ..0902574 Lijaddis Mosye ... 0902595 Mamene Atalay .0902605 Yaregal Kassahun ... 0902792Dokumen45 halamanShambel Tegie 0902707 Kasahun Teshome ..0902574 Lijaddis Mosye ... 0902595 Mamene Atalay .0902605 Yaregal Kassahun ... 0902792Fiteh KBelum ada peringkat

- Research Project Rough ReportDokumen73 halamanResearch Project Rough Reportpamidi shakeerBelum ada peringkat

- Banking History and ProductsDokumen14 halamanBanking History and ProductsRajesh YadavBelum ada peringkat

- Guideline On Stress Testing For Nigerian BanksDokumen30 halamanGuideline On Stress Testing For Nigerian BanksAgwu Obinna0% (1)

- Toaz - Info PNB Summer Internship Report PRDokumen90 halamanToaz - Info PNB Summer Internship Report PRalpesh sakariaBelum ada peringkat

- Laxmi Priya - Credit ManagementDokumen39 halamanLaxmi Priya - Credit Managementmoongem infocityBelum ada peringkat

- Part Two: Supply and Demand I: How Markets WorkDokumen42 halamanPart Two: Supply and Demand I: How Markets WorkAlexander QuemadaBelum ada peringkat

- Indian Financial System OverviewDokumen19 halamanIndian Financial System OverviewMadhav AgarwalBelum ada peringkat

- Powergrid: Yash Bhuthada SAP ID - 74011919001Dokumen32 halamanPowergrid: Yash Bhuthada SAP ID - 74011919001YASH BHUTADABelum ada peringkat

- Test Bank For Macroeconomics 5th Edition Charles I JonesDokumen9 halamanTest Bank For Macroeconomics 5th Edition Charles I Jonesselinahuong2eeay3Belum ada peringkat

- Causes of Delay and Cost Overruns in Nigerian Construction ProjectsDokumen7 halamanCauses of Delay and Cost Overruns in Nigerian Construction ProjectsMohammed TayyabBelum ada peringkat

- Asiatic PharmachemDokumen30 halamanAsiatic PharmachemJIGAR THAKKARBelum ada peringkat

- APARCHIT SUPER CURRENT AFFAIRS 350+ WITH FACTS November SET 1Dokumen76 halamanAPARCHIT SUPER CURRENT AFFAIRS 350+ WITH FACTS November SET 1Prakshi SaxenaBelum ada peringkat

- Filipino Entrepreneurs Face Challenges in Cash Flow ManagementDokumen5 halamanFilipino Entrepreneurs Face Challenges in Cash Flow ManagementJoshua Sta AnaBelum ada peringkat

- Transfer and Business TaxationDokumen78 halamanTransfer and Business TaxationLeianneBelum ada peringkat

- Eading: Download IGNOU Friend AppDokumen8 halamanEading: Download IGNOU Friend AppPreetiBelum ada peringkat

- 05-VVA - Tips Book - 10th SocialDokumen19 halaman05-VVA - Tips Book - 10th SocialMeenakshi sundaramBelum ada peringkat

- Kpi Ach 27 Desember 2021Dokumen53 halamanKpi Ach 27 Desember 2021Rizki KurniadiBelum ada peringkat

- 6143-MAR-EU-1029 - R0 (1) Approved MAR For Terminal Lug & Cable Accessories (Speedwell)Dokumen55 halaman6143-MAR-EU-1029 - R0 (1) Approved MAR For Terminal Lug & Cable Accessories (Speedwell)NAVANEETHBelum ada peringkat

- Home - Impanelled Hospital ListDokumen20 halamanHome - Impanelled Hospital ListeffefefeBelum ada peringkat

- Income and Expenditure NotesDokumen2 halamanIncome and Expenditure NotesRashmi Anand JhaBelum ada peringkat

- Travel Diary Template-India TripDokumen2 halamanTravel Diary Template-India TripShah KalpitBelum ada peringkat

- 12 Accruals & PrepaymentsDokumen6 halaman12 Accruals & PrepaymentsDayaan ABelum ada peringkat

- InvoiceDokumen2 halamanInvoicefinttel mobileBelum ada peringkat

- Cost Allocation: Joint-Cost SituationsDokumen84 halamanCost Allocation: Joint-Cost SituationsDr-YousefMHassanBelum ada peringkat

- ChallanFormDokumen1 halamanChallanFormrmzmuhammedBelum ada peringkat

- Acc 109 P3 Quiz No 2Dokumen2 halamanAcc 109 P3 Quiz No 2Wilmz SalacsacanBelum ada peringkat

- Econ 212 Spr2021syllabus NewDokumen5 halamanEcon 212 Spr2021syllabus NewlaraBelum ada peringkat

- Form MBP 1 & DIR 8Dokumen3 halamanForm MBP 1 & DIR 8ShoaibBelum ada peringkat

- Black Book M.com Yes BankDokumen56 halamanBlack Book M.com Yes Bankgpushpa644Belum ada peringkat