Contract Costing

Diunggah oleh

Leslie GunnionDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Contract Costing

Diunggah oleh

Leslie GunnionHak Cipta:

Format Tersedia

CONTRACT COSTING

Contract Costing: Contract Costing is a method used in construction industry to nd out the cost and pro t of a particular construction assignment. The principles of job costing are also applicable in contract costing. In fact Contract Costing can be termed as an extension of Job Costing as each contract is nothing but a job completed. Contract Costing is used by concerns like construction rms, civil engineering contractors, and engineering rms. One of the important features of contract costing is that most of the expenses can be traced to a particular contract. Those expenses that cannot be traced to a particular contract are apportioned to the contract on some suitable basis. The cost computation in case of a contract is done on the following basis. A. Material Cost: Direct Material required for a particular contract is debited to the Contract Account. There may be some quantity of material which is returned back to the store. In such cases, material returned note is prepared and is either credited to the Contract Account or deducted from the material debited to the Contract Account. Similar treatment is given to the material transferred from one contract to another one. Material Transfer Note is prepared to record these transactions of transfer. Material remaining at the site at the end of a particular accounting period is shown as closing stock after valuation of the same and carried forward to the next period. B. Labor Cost: Wages paid to the workers engaged on a particular contract should be charged to that contract irrespective of the work performed by them. If there are common workers on more than one

contract and/or if the workers are transferred from one contract to the other contract, time sheets must be maintained and wages may be distributed on the basis of time spent on each contract. Some of the workers may be working in the central of ce or central stores, their wages can be apportioned to a particular contract on suitable basis like time spent etc.128 Methods of Costing - Job, Batch and Contract Costing C. Expenses: All expenses incurred for a particular contract should be charged to that contract. In case of any indirect expenses incurred for the organization as a whole, they should be charged to the contract on some suitable basis. Direct expenses can be charged directly to the contract. D. Plant and Machinery: Depreciation on the plant and machinery used for the contract is to be charged to the contract account. The depreciation may be charged on any of the following basis. If a plant is specially purchased for a particular contract and is expected to be used for the contract for long time, thus being exhausted at site, the total cost of the plant will be debited to the contract account. After the completion of the contract, if it is no longer required, it will be sold at the site itself and the sale proceeds are credited to the contract account. If it is not sold, the contract is credited with the depreciated [revalued amount] value]. Thus the amount of depreciation is debited to the contract account. The main drawback of this method is that the debit side of the contract account is unnecessarily in ated with the cost of the plant value and thus the cost of contract is shown very high. For removing this drawback, the difference between the original cost at the commencement of the contract and the depreciated value at the end of the period is worked out and charged to the contract account as depreciation.

If a plant is used for a contract for a short period, there is no need of debiting the cost of the plant to the contract account. The amount of depreciation is worked out on the basis of per hour and charged to the contract on that basis. The hourly rate is calculated by dividing the depreciation and other operating expenses of the plant by the total estimated working hours of the plant. Sometimes plants may be taken on hire for a particular contract. In such cases the amount of rent paid should be debited to the contract account. V. Subcontract: Sometimes due to certain situations, a sub contractor is appointed to carry out certain special work for the main contract. This special work done by the sub contractor becomes a direct charge to the main contract and accordingly debited to the contract account. The payments made to the sub contractor are charged to the main contract as direct expenses and no detailed break up of the same is required. Material supplied to the sub contractor without any charge, is debited to the contract account as direct material and machinery, tools etc supplied to him on rent should be depreciated on appropriate basis and debited to the contract account. Rent received for the use of such tools and machines should be credited to the contract account or deducted from the nal bill of the sub contractor. VI. Additional Work: Sometimes additional work may be necessary in addition to the work originally contracted for. This forms a separate charge and if the amount involved is large, a subsidiary contract is generally entered into with the contract. VII. Special Aspects Of Contract Account: There are certain special aspects of contract accounts. These

are discussed below. Certi ed Work: In contracts which are expected to continue for a long period of time, it is a normal practice that the contractor obtains certain sums from the contractee from time to time. This is done on the value of contract completed and certi ed by the architect/surveyor appointed by the contractee. The amount received by the contractor is not 100% of the value of the work certi ed but is less than the same, as the balance amount is kept as retention money. For recording this transaction, any of the following two methods may be usedI. In the rst method, the contract account is credited with the value mentioned in the certi cate and personal account of the contractee is debited. Cash received is credited with the contractees account and the balance is shown as a debtor representing the retention money. II. In the second method, the contract account is credited with the value of the certi cate and the contractees account is debited with amount payable immediately and a special retention money account is debited with the amount so retained. Treatment of Pro t on incomplete Pro t: Several contracts take more time than one nancial year before they are complete. The questions arises as to whether the pro ts on such contracts should be taken into consideration after the completion of the contract or whether a portion of the same should be taken into accounts every year on certain basis. If pro t is taken into consideration after the completion of contracts and if in a single year several contracts are completed, the pro ts shown will be very high while in another year, if none of the contracts are completed, amount of pro ts shown will be very low. Thus there will be distortions in the amount of pro ts. Therefore it becomes necessary to compute the amount of pro t on partly completed contracts and take credit of appropriate amount in the pro t and loss account by using the following guidelines. Value of certi ed work only should be taken into consideration while determining the pro t.

Value of work not certi ed should not be taken into consideration. In case of contracts which are less than 25% complete, no pro ts should be taken into consideration and consequently no credit should be taken to Pro t and Loss Account. In case of contracts which are more than 25% complete, but less than 50% complete, the following method should be used for computing the pro t to be credited to the Pro t and Loss Account. 1/3 Notional Pro t/ Cash Received/Work Certi ed. Notional pro t is the difference between the value of work certi ed and cost of work certi ed. It is computed in the following manner. Notional Pro t = Value of work certi ed [cost of work to date cost of work completed but not certi ed] In case of contracts complete between 50% and 90% [more than 50% but less than 90%] the following method is used for computing the pro t to be credited to the Pro t and Loss Account. 2/3 Notional Pro t X Cash Received/Work Certi ed In case of contracts completed 90% or more than that, it is considered to be almost complete. In such cases, the estimated total pro t is rst determined by deducting the total costs to date and additional expenditure necessary to complete the contract from the contract price. The portion of pro t so arrived is credited to the Pro t and Loss Account by using the following formula. Method I:- Estimated Pro t X Work Certi ed /Contract Price Method II:- Estimated Pro t X Work Certi ed /Contract Price Cash Received/Work Certi ed or Estimated Pro t Cash Received/Work Certi ed. The method II is preferable to the rst one. In case, additional expenditure to complete the contract not mentioned, the amount of pro t to be transferred to the Pro t and Loss Account is determined using the following formula. Notional Pro t Work Certi ed/Contract Price130 Methods of Costing - Job, Batch and Contract Costing

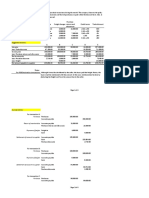

If there is a loss, the total amount of loss should be transferred to the Pro t and Loss Account by crediting the contract account. It will be observed that in case of incomplete contract, amount of pro t credited to the Pro t and Loss Account is reduced proportionate to the work certi ed and cash received. The reason is that this being unrealized pro ts should not be used for distribution of dividend. Similarly, the principle of conservatism should also be applied in computing and crediting the pro ts. Illustration: Compute a conservative estimate of pro t on a contract [80% complete] from the following particulars. Illustrate at least four methods of computing the pro t. Particulars Amount [Rs.] Total expenditure to date 1, 02,000 Estimated further expenditure to complete the contract [including contingencies] 20, 400 Contract price 1, 83,600 Work certi ed 1, 20,000 Work uncerti ed 10, 200 Cash received 97, 920 Solution: The amount of pro t on incomplete contract can be computed according to any of the following four methods. Before computing the same, we will compute the amount of pro t on the contract and then show the working of the methods. Pro ts on incomplete contract: Total Contract Price: Rs. 1, 83, 600 Less: Expenditure to date: Rs. 1, 02, 000 Estimated further expenditure: Rs. 20, 400 Total expenditure Rs. 1, 22, 400

Estimated Pro ts Rs.61, 200 o Amount of Pro t to be taken to the Pro t & Loss A/c o 1st Method: Rs.61, 200/Rs.183600 Rs.120000 = Rs.40, 000 o 2nd Method: Estimated Pro ts Work Certi ed/Contract Price Cash Received/Work Certi ed o Rs.61200 Rs.120000/Rs.183600 Rs.97920/Rs.120000 = Rs.32640 o 3rd Method: Estimated Pro ts Cost of Work to date/Estimated Total Cost o Rs.61200 Rs.102000/Rs.122400 = Rs.51000 o 4th Method: Estimated Pro ts Cost of Work to Date/Estimated Total Cost Cash Received /Work Certi ed o Rs.61200 Rs.102000/Rs.122400 Rs.97920/120000 = Rs.41616131 Cost and Management Accounting Special Points in Contract: I. Cost Plus Contracts: This type of contract is generally adopted when the probable cost of contract cannot be ascertained in advance with reasonable accuracy. In this type of contract, the contractor receives his total cost plus a pro t, which may be a percentage of cost. These types of contracts give protection to the contractor against uctuations in pro ts as he is guaranteed about his pro t irrespective of the actual costs. However in order to avoid any dispute in future, it is always advisable to specify the admissible costs in advance. Similarly the customer may also reserve the right of demanding cost audit in order to check the reliability of the claim of the contractor regarding increase in the costs. II. Target- price contracts: In such cases, the contractor receives an agreed sum of pro t over his pre-

determined costs. In addition, a gure is agreed as the target gure and if actual costs are below this target, the contractor is eligible for bonus for the savings. III. Escalation Clause: In order to protect the contractor from the rise in the price, an escalation clause may be inserted in the contract. As per this clause, the contract price is increased proportionately if there is a rise in input costs like material, labor or overheads. The condition that may be laid down is that the contractor will have to produce a proof regarding the rise in the price.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Strategy Implementation: Translation of Strategic Thoughts Into Strategic ActionsDokumen27 halamanStrategy Implementation: Translation of Strategic Thoughts Into Strategic ActionsLeslie GunnionBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Marketing ManagementDokumen11 halamanMarketing ManagementLeslie GunnionBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- FDI in RetailDokumen4 halamanFDI in RetailLeslie GunnionBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Assign ppr4Dokumen10 halamanAssign ppr4Leslie GunnionBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Retail Analysis of Crossword Book StoreDokumen17 halamanRetail Analysis of Crossword Book Storeanand4444100% (4)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Sales Promotion StrategyDokumen1 halamanSales Promotion StrategyLeslie GunnionBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Unpriced Proposed Renovation of Bugolobi Flat, Block C For Uganda Coffee Development AuthorityDokumen39 halamanUnpriced Proposed Renovation of Bugolobi Flat, Block C For Uganda Coffee Development AuthoritynicolasBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Binary To DecimalDokumen8 halamanBinary To DecimalEmmanuel JoshuaBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Motivational QuotesDokumen39 halamanMotivational QuotesNarayanan SubramanianBelum ada peringkat

- Dania - 22 - 12363 - 1-Lecture 2 Coordinate System-Fall 2015Dokumen34 halamanDania - 22 - 12363 - 1-Lecture 2 Coordinate System-Fall 2015erwin100% (1)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Chinese MedicineDokumen16 halamanChinese MedicineTrisBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Russian Sec 2023-24Dokumen2 halamanRussian Sec 2023-24Shivank PandeyBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Akira 007Dokumen70 halamanAkira 007Ocre OcreBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Dry Docking QuotationDokumen4 halamanDry Docking Quotationboen jayme100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- ISO StandardsDokumen7 halamanISO StandardsHusnain BaigBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Sa Inc HCP English d10840Dokumen64 halamanSa Inc HCP English d10840Ayu AfiantyBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Artikel 8 - (CURRICULUM EVALUATION)Dokumen12 halamanArtikel 8 - (CURRICULUM EVALUATION)Kikit8Belum ada peringkat

- Jim 1000 RC 3Dokumen33 halamanJim 1000 RC 3singingblueeBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Utah Vaccine AdministrationDokumen1 halamanUtah Vaccine AdministrationOffice of Utah Gov. Spencer J. CoxBelum ada peringkat

- Glorious Mysteries 1Dokumen5 halamanGlorious Mysteries 1Vincent safariBelum ada peringkat

- Format Mini Lesson Plan: What Is Narrative Text?Dokumen3 halamanFormat Mini Lesson Plan: What Is Narrative Text?Muhammad FahrurajiBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Boonton Radio Corporation - The Notebook 12Dokumen8 halamanBoonton Radio Corporation - The Notebook 12Luiz Roberto PascotteBelum ada peringkat

- Machine Learning and Supply Chain Management - ADokumen5 halamanMachine Learning and Supply Chain Management - AAhmed AbassBelum ada peringkat

- Chapter 2 Fluid StaticsDokumen26 halamanChapter 2 Fluid StaticsSoban Malik100% (1)

- Jeep TJ Torque SpecsDokumen4 halamanJeep TJ Torque SpecsmaulotaurBelum ada peringkat

- Heat Cured ElastomersDokumen40 halamanHeat Cured ElastomerslberrierBelum ada peringkat

- 11 My Immigration Story - Tan Le QuestionsDokumen3 halaman11 My Immigration Story - Tan Le QuestionsMallika Nand NairBelum ada peringkat

- ACI 318M-11 RC Bracket and Corbel Design - v0.03 - 2017-04-10Dokumen5 halamanACI 318M-11 RC Bracket and Corbel Design - v0.03 - 2017-04-10arken123Belum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- 2010 DOE FEMP Exterior Lighting GuideDokumen38 halaman2010 DOE FEMP Exterior Lighting GuideMoideen Thashreef100% (1)

- Bashar CitateDokumen7 halamanBashar CitateCristiana ProtopopescuBelum ada peringkat

- IRremote Library, Send & Receive Infrared Remote ControlDokumen4 halamanIRremote Library, Send & Receive Infrared Remote ControlJayant SwamiBelum ada peringkat

- Three Moment Equation For BeamsDokumen12 halamanThree Moment Equation For BeamsRico EstevaBelum ada peringkat

- Handout No. 03 - Purchase TransactionsDokumen4 halamanHandout No. 03 - Purchase TransactionsApril SasamBelum ada peringkat

- Kalbelia Dance Rajasthan - Kalbelia Rajasthani Folk Dance KalbeliaDokumen6 halamanKalbelia Dance Rajasthan - Kalbelia Rajasthani Folk Dance KalbeliarahulgabdaBelum ada peringkat

- Grade 7 - R & C - Where Tigers Swim - JanDokumen15 halamanGrade 7 - R & C - Where Tigers Swim - JanKritti Vivek100% (3)

- Term Paper Gender RolesDokumen5 halamanTerm Paper Gender Rolesea8d1b6n100% (1)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)