Essay On Public Sector Enterprises

Diunggah oleh

Venkata Mahendra PrasadDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Essay On Public Sector Enterprises

Diunggah oleh

Venkata Mahendra PrasadHak Cipta:

Format Tersedia

Essay on Public Sector Enterprises Reasons for Their Failure.

. Public Sector is the sector under Government control funded by the tax paying public and for the benefit of the nation. Prior to our Independence, we had essential services like Railways, Telephone, Posts and Telegraphs, Ordnance, Port Trusts etc. under Public sector. It was an age of discipline and strict ethical management. These are the stalwarts and forerunners which we inherited, immaculately formulated, run and maintained. Post-independence, we had a Government and the Constitution which was working towards an egalitarian society and the public sector was thought of as a way towards achieving self-reliance. Economic growth to develop a sound agricultural and industrial base, diversifying the economy and overcome economic and social backwardness. To add plausible excuses to this idea, the government forwarded the following ones:

To protect employment resulted in take over the sick units. To have countervailing power on the operation of private monopolies in selected areas resulted in steel, fertilizer and chemical units. To serve the needs of spare parts and equipment for strategically important sectors like Defence, Railways, and Telecommunications etc. To check prices of important articles resulted in setting up of consumer oriented industries.

Over a period of time, we find several public sector units some with good intentions, some with intentions which were inherently bad and self-motivated and others with no excuses at all. With the situation that in 1950-51 we had 5 number of public sector units with an investment of about Rs. 30 crores to the present number of 240 units with an investment of Rs. 252554 crores. The bulk of the investment is in basic industries like Steel, Coal, Power and Petroleum, Fertilizers etc. which is about 50 percent. The Public sector employment has two categories the first being administration, defence, health, education, research and activities to promote economic development. The second category is that of economic enterprises owned by the Centre, State and Union Territories. In 1971 the total number of employees in the Public Sector stood at 71 lakhs which grew to about 200 lakhs in 2000. the share vis--vis the private sector in transport, power, gas and communications stood at 95 percent in the public sector. The overall percentage of employment is 70% in the organized sector. Thus the Public sector has fulfilled one of the prime ideas behind it, that is generating employment but at what cost to the exchequer a factor which needs to be thoroughly analysed and one of the prime reasons for failure. Apart from generation of internal resources and payment of dividend, this sector has made substantial contribution to the exchequer through payment of corporate taxes, excise and customs duty and other duties. During the period 1997-2000 the Public Sector has contributed Rs. 48,000 crores to the economy thus occupying a prominent place in the economy and definitely growing in importance. These facts relate mostly to enterprises under the Central Government. But the

ones under the State control have flattered to deceive and are total drains on the exchequer bringing the total sector into disrepute. Compared to the performance of centrally controlled units, these State controlled ones have given deplorable returns, mostly in the negative. Enterprises in State Electricity Board, State Transport and Irrigation are the biggest culprits, but why? Primarily because of corruption. They are treated like nobodys children to be used for the personal benefit of the staff. Engineers belonging to these units have slush money to the tune of crores. The working quality and services rendered by them are indeed condemnable. This poor quality is again due to callous and indifferent work culture inculcated in them, since their inception in the Public Sector. They have become only sources of receiving illegal gratification, theft and harassment. Complaints filed in consumer forums all over the country point an accusing finger to the blatant collusion of staff with power thieves. The same units under private companies like Martin & Burn were extremely efficient and image conscious. What is needed is stricter administration, fixation of responsibility and forthright officials, able to call the spade a spade. The idea of privatization of these loss making units would not be of any help so long as there is this crisis of good management, PHD Chamber of Commerce and Industry has put the problem in the right perspective. The point is that there is a serious crisis of management that has plagued the public as well as private sector. If we succeed in enduring an efficient management culture and practices, probably the issue of privatization will be irrevalent, since in that environment both the Public Sector and the Private Sector would the working efficiently. The reasons for failure of Public Sector Units are many and need to be categorized properly. An exercise in this regard highlights the following, the most important being: Man-power far in excess of actual requirement, inadequate training and education of workers due to poor manpower planning. The top management should be open to employees of the undertakings and technical persons should be given proper training in management. Indiscipline amongst workers, poor management-labor relations and the lack of law enforcement agencies add to the woes. Ineffective management is another major factor which is the cause of inefficiency in the overall performance of Public Sector enterprises. Responsibilities are ill-defined and the officers take undue advantage of this. Bureaucrats are appointed as chairmen, managing directors and managers. Most of them are ill-qualified to do the job. To top this, the States have inculcated the practice of appointing defeated, over the hill, politicians to these posts, in most cases their qualifications are nil except proximity to power centers. What is needed is clearly defined responsibilities, the diminution of red-tape, power to take operational decisions and professional management. Political factors influence decisions from location of plant, passing of tenders to appointment of employees and management. In most of the cases those lead to considerable wastage of resources. This is also one of the reasons for delays in completion of the projects and over run in original estimated costs. Tied-aid was also responsible for over-runs as the compulsion to buy imported equipment on a non-competitive basis together with expensive twin-key contracts to the aid providers shot the original estimates. A survey conducted found most of the Public Sector units over-capitalized as an example of which the Trombay Fertilizer Project was showcased.

The project took 7 years to complete instead of the original projection of 3 years due to which the cost also shot up by 50 percent. Another factor responsible for mounting losses is the pricing policy. Due to persistent demand from vested interests and political compulsions, the price of products are kept abysmally low, of course, inferior quality is another reason, due to which commercial profitability is affected. Keeping all these factors in mind, the investments in Public Sectors appear to be a suicidal step for national economy and disinvestments in loss making units may be the right approach. They could be made profitable if the politicians, bureaucrats and employees stop treating these units as a milching cow and milch it as nobodys concern. Units of a Lesser God would be apt.

The public sector, with more than 130 Government of India Undertakings today, occupies a key position in the economy of the country. It has already grown into an industrial giant with more than Rs. 20,000 crores of investment. About one-fourth of it fin the railways, but steel, heavy electricals and oil industries also have a sizeable portion of the total investment. The private entrepreneurs are always in search of profit and this motive urges them to move in fields where the returns are high and certain. In a developing country or in an under-developed country, this tendency has many drawbacks. First, as more and more capital is injected in to the same type of business, competition increases and with it the costs go up. With increasing costs, prices also increase and markets arc hit. Second, development in an under-developed country is usually lopsided and only in certain directions. It is never equitably distributed over various regions of production. Consequently, people are seldom self-sufficient in respect of their needs and remain virtually slaves to outside or foreign traders. Before the introduction of planning in India, Indian businessmen put their money mainly in traditional business like jute and cotton, or in iron and steel. Jute and cotton was preferred because of their greater demand in foreign markets and iron and steel because of greater domestic potentialities. During the British regime, industry in India was yoked to subserve the needs of the British overlords and was, therefore, encouraged in branches or iieids which helped the British rulers. Even in those lields industrial development was carried out in a haphazard manner. It was only when the government entered the economic lields after independence and divided the countrys economic activity in three fields, heavy and basic industries, concurrent industries and private enterprise industries, that an all-round planned development was envisaged. The government alone was of course not in a position to plan socially and adjust their actions to make improvements, in all aspects of the citizens life so that social welfare and national as well as per capita incomes could be maximised. One of the vital arguments in favour of the public sector is that the government is better capable of controlling the greatest brains by virtue of the stability and status that go with government jobs. The government also has at it disposal the countrys resources, men and material, besides money It is the government that can stand losses in one direction and cover them from gains hi another. Lastly, the government can float an undertaking on the principle of minimum profits, or on a no-loss basis. These activities fall beyond the purview of

private business enterprise and hence governmental undertakings in industry are desirable^ oi- rather necessary, in an under-developed country. In other words, the economy of such a country needs to be duly controlled and unless and until capital acquires free movement and diverse channels to cater for highest tastes and improve the standards ol living, a free economy in a country would not work well. By any standards, the growth of the public sector in India lias been phenomenal, having by now been able to invest its own productive assets, recruit and train its own staff and management and conceive and execute its own products. This record has justified the peoples faith in the public sector as an instrument of national growth. The public sector is playing a prominent role in a wide rauge oLindustries, including steel, power generation, aircraft, computer and machine tools, coal, petroleum, copper, aluminium, financial infrastructure consumer items and even films. Each year, the public secter consolidates its gain, spreads out to new fields and sends shivers down the back of the private sector. Alongwith the increase in output and diversification1 of products has come a new outlook in management and internal relations in the public sector. Better utilisation of installed capacity, improved inventory and materials management, economy in the use of working capital,new monitoring systems, and quick handling to labour problems have inculcated* a sense of belonging among the employees. The public sector is now poised for a significant. breakthrough. Since 1972-73, it has been showing net profit. This may not have been commensurate with the huge investment, but the future prospects are bright. In the year 1976-77 the Public , Sector has made a gross profit of over Rs.400 crores. fill now, the main profiteering concerns were commercial ones like the Indian Oil Corporation, the Food Corportion of India and the State Trading Corporation. Now others, like the Bharat Heavy Electricals, have also begun to show profit. Though the concept of public sector was seriously initiated in 1956, it assumed a new direction in 1969 when the then Prime Minister Mrs. Gandhi embarked on the path of democratic advance. At the beginning of the first plan, there were only 5 public sector undertakings with a total investment of Rs. 290 million, their number increased to 74 at the end of the third plan with a total investment of Rs. 28,410 million.Since the public sector helps to strength economic independence of the country through modernising economy, it has become the main obstacle in the way of multinationals which want to gain foothold in the country. The public sector has been a subject of ideological and political controversy over the past many decades.-^Tn the post-independence period, when the importance of the public sector underlined in the industrial policy resolutions of 1948 and 1956. the big indu-trial houses and their political representatives came out heavily against it. Big business houses continued to make efforts to underplay the role of the public sector. Special Relevance to Developing Countries In developing countries, which are struggling overcome then economic backwardness, the public sector plays a most important role in their socio-economic progress. India today occupies a leading position among these developing countries primarily due to its economic achievements through the public sector. The report of the Bureau of Public Enterprises on the working of the public sector industrial projects during 1973-74 showed that the public sector had attained steady a growth in critical industrial sectors. The criticism against public sector that it is a continuous drain oil the exchequer is no longer valid in view

of the profits shown during 1976-77. The total resources generated by the public sector enterprises during the fourth plan period came to Rs. 4,380 crorc. Out of this, Rs. 70 crore by way of dividends. Rs. 564 crore as interest on Government loans, Rs. 230 crore as income tax and Rs. 2.256 crore, as excise duty. In 1973-74, 73 enterprises showed a total net profit, of Rs. 160.75 crore, while 41 enterprieses showed a loss of 91.62 crore. Thus, the working results of the 144 running enterprises showed a collective net profit of Rs. 64.42 crorc as against Rs. 17.74 crores in 1972-73. In 1971-72, the net working results had shown a loss of Rs. 19.02 crore. This improved performance was without an upward revision of prices of their products. The better results were due to better maintenance of plants and equipment, proper materials management and comparatively better labour management relations. The yeat> 1973-74 was also the [ast year of the fourth plan. The plan had set a target of Rs. 1.265 crore of internal resources to be generated by the public sector. As against this, the achievement at the end of 1973-74 was Rs. 1.260 crorc or 99.6 per cent of the target. The actual generation of internal resources at the end of the third plan was only Rs. 2S7 crorc. The yearwise growth of internal resources by the public sector enterprises during the fourth plan brings out certain interesting points. In 1969-70, the first year of the fourth plan, internal resource generation was to the tune of Rs. 194 crorc. In 1970-71, it rose to Rs. 204 crore or by 5.2 per cent, in 1971-72 to Rs. 215 crorc or by 5.4 per cent in 1972-73 to Rs. 260 crore or by 20.9 per cent and in 1973-74 to Rs, 387 crore or by 48.8 per cent. Compared to 1968-69, the last year of the third plan, the increase in the first year of the fourth plan was 36.6 per cent. The last two years of the fourth plan were again marked by a spurt in the growth rate of internal resources. This directly attributed to sustained improvement in the financial performance of public enterprises during these years. Deployment of Resources Some of the internal resources generated have been ploughed back by the public sector enterprises for financing renewals, replacements, monernisation and capital improvements. The extent of deployment of internal resources for capital expenditure averaged about 27 per cent in respect of 41 enterprises. The extent of self-financing of growth has been over Rs. 50 crore each in respect of the Hindustan Steel, Indian Oil, Fertiliser Corporation, Shipping Corporation, of India, Oil and Natural Gas Commission, Hindustan Aeronautics and Air India. The capacity utilisation in the manufacturing group of industries registered a significant improvement. Forty-five units recorded a capacity utilisation of more than 75 per cent, as against 41 in the previous year. In 23 units, it ranged between 50 per cent to 75 per cent as against 16 in the previous year. Only 16 units operated below 50 per cent capacity ultilisation during 1973-74 as against 25 in the previous year. All these facts indicate that public sector undertakings are becoming economically viable. By strengthening the independent economic base of the country, they are helping it to consolidate its political independence. Efforts are being made to professionalise the entire senior management cadre., At one time, top posts were given away as political rewards or to find billets for those who had outlived their usefulness in other spheres. These men had been conditioned by years of file pushing to a kind of management

wholly inconsistent with the needs of the sector. Most of the over 50,000 managers now have the right training and background. The public sector units have not only ceased to be a drain on the public exchequer but actually generated resources to the tune of Rs. 1,260 crore for the fourth plan, which was 99.6 per* cent of the target. v One of the significant achievements of the public sector has been taking over to many sick units which had been incurring heavy losses and putting them on the tails again. The public sectors contribution in meeting Indias industrial needs is considerable now. The Heavy Engineering Corporation has facilities to set up a one million ton capacity steel plant a year. -The Bharat Heavy Electricals can supply all the power generating equipment the countys needs. It is admitted that one of the banes of the public sector underutilisation of capacityremains to be solved. Vital capital resources go waste as a result of unused capacity, leading to heavy losses. But now an attempt is being made to introduce flexibility by manufacturing different types of equipment based on substantially the same fabricating faciliy with only slightly more investment. Towards Participative Management New schemes for workers association in industry is one of the points included in the then Prime Minister Indira Gandhis July 1975 package for economic regeneration. The ruling partys -election manifesto had also emphasised workers participation in management. As a matter of fact, the second Five Year Plan had stressed the importance of increased association of labour wUh management. Earlier, the Industrial Disputes Act had conferred statutory status on Works Committees which has existed in certain industrial units on a voluntary basis. However, despite these efforts to encourage clear association of labour with management, concrete results achieved in this direction so far have not been encouraging. Even after two decades, since the idea was first mooted in the second plan document, the scheme has at best remained a window dressing, although it does exist fn some form or the other in every industry. A scheme of participative management with direct role for employees has been introduced by the Government in the nationalised commercial banks. Under the scheme, union representatives have been appointed on the boards of directors, but the placement of employees on the boards has not constituted workers participation in the true sense of the term. The statutory committees, the voluntary bodies and composite boards have become a kind of form for each side exhoriting the other to do its duty. These expedients have not been able to resolve the conflict in the interests of labour and management. The reasons for the failure of these attempts to forge a fruitful partnership between labour and management are not far to seek. In the first place, the concept has neither been spell out in clear terms nor has it been precisely understood. Secondly, there has been a mutual distrust between management and the labour. the /ealouslv guarding its prerogative to take decisions affecting the future oflhe enterprise and the latter being apprehensive that involvement might blnnt their militancy to press for higher emoluments or more amenities. Inherent in this failure is lack of appreciation of the fact that labour participation in management is a process starting with consultation proceeding to delegation and culminating in decision making. There

arc different levels of participation which have to be attainted nrogressively and there are no short cuts. . The stages in which ture participation can be acheived are : (a) informative participation leading to consultation ; (b) associative participation leading to involvement in administrative process, and (c) decisive participation resulting m decision resulting in deci-.sion making at the board level. Right from the shop level, participation should permeate throughout the organisation to its apex. The bases of participation are economic psychological and social. Economically, there must be willing acceptance of the idea of partnership involving an obligation to increase productivity and the corresponding right to share the gain* Psychologically, there must be a sense of belonging. And socially, there must be a faith in the concept of industry as a social institution in which the employer, the employees as well as the community, have equal and inter-dependent interests. The public sector thus poses a challenge because of the large sums of money inverted in it.and in the course of time, as is evidenced by the present trends, it should be able to yield fair returns for linancing future development. As is the lot of the public sector, some ofthese returns may be in the form of nonmeasurable social benefits which raise the productivity of the nation and its taxable capacity. At the same time, there are other undertakings which yield direct returns to enable the building up of their own funds for further expansion or pay higher dividends to the public exchequer for investment in other critical areas. With this hope the bugbear of lack of resources, which Ins plagued the economy, should be a thing of the past. Public Sector Managers For quite a few years, recruitment to the public sector managerial cadre, particularly at the higher levels, had to be made either from the government services, or from the private sector. This was understandable. 1 he requirements of a rapidly growing public sector, scheduled to constitute the commanding heights of the economy, had to be met urgently. The Industrial Management Pool, set up for providing managers on a long term basis, was built around a nucleus of highly qualified people chosen through a rigorous process. For a variety of reasons, however, the IMP remained stagnantand was eventually disbanded. The personnel needs of public sector units were met on an ad hoc basis with some of the larger ones left free to persue their own policies for recruitment and training of managers at different levels. There was no cohesive scheme. With the sector now employing some 50,000 managers of different categories, of whom nearly 3.000 be-long to the senior echelons, the units cannot obviously be left to fend for themselves. It is particularly necessary to foster interaction and a measure of mobility among the undertakings to prevent managers from stagnating. Apparently, some of these considerations have weighed with the Bureau of Public Enterprises which is now considering a nine-point action plan for the speedy development of managerial talent from within the enterprises for manning the top posts. The plan, drawn up after discussions at a recent seminar, is intended to make the sector self-sufficient in its managerial resources. The seminar has recommended a fuller utilisation of the training facilitiesparticularly those of the larger undertakingswithin the sector and not a proliferation of training institutes. This approach has the great merit of giving the managers an insight into the peculiar problems of the sector as a whole, which would facilitate interplant mobility. The seminar has also called upon the Bureau to institute a standing advisory group on management training and development. This is a sector measure long overdue and will go a long way in creating a public a management cadre in the place of the novr defunct IMP.

India's public sector means less for more

By Kunal Kumdu MUMBAI - The Economic Model of India assigned a pivotal role to its public sector, which came to control "commanding heights" of the economy after the Indian parliament adopted a resolution in 1956 to achieve a "socialistic pattern of society" as a national goal. In pursuance to this goal, a large number of public sector units (PSUs) were set up in different sectors of the economy. Unfortunately, however, the expansion of the public sector took place not in the direction of the traditional, theoretically correct provision of public goods and infrastructure, but to non-traditional command over the economy, in particular: (a) Nationalization to occupy the "commanding heights" of the economy and regulations to protect them from internal and foreign competition, (b) Widespread subsidies, explicit and implicit, and (c) Administered prices and related regulations. By the close of the 1970s, it became evident the countries that had adopted the Soviet economic model succeeded neither in attaining growth nor alleviating poverty (eg, South Asian countries), while those that had followed essentially free-enterprise policies progressed at enviable rates and reduced poverty impressively (eg, East Asian countries). Having witnessed that outcome, a number of countries started backtracking. To mention a few: a drastic tax cut (from a 55% marginal income tax rate to 28%) in the United States under president Ronald Reagan (1981-89); privatization in the United Kingdom during Margaret Thatcher's rule (1979-90); denationalization in France under its socialist government (1980s); and extensive open-market experiments in communist China under the leadership of Deng Xiaoping (1979-1997). Those economies that stuck to their command policies scarcely climbed out of the hole. The climax was reached in 1991 when the Soviet economic model collapsed in its own land and the Soviet Union disintegrated. It may be asserted, in this connection, that it is not the size of the public sector as such, but the nontraditional functions that it has been required to perform that proved to be their bane. Implicit Inefficiencies Apart from measurable losses, opportunity costs, and deadweight losses, PSUs are plagued by several immeasurable inefficiencies. The latter are among the sources of measurable losses but also cause additional damages. On the one hand, the PSUs are invariably managed by senior bureaucrats, whose tenures are protected by civil service rules, which are scarcely affected by their productivity or the level of performance in the PSU concerned. These also reflect on the quality of management. The observations of India's Comptroller & Auditor General (CAG) for the period 2001-02 highlight deficiencies in the country's management of PSUs, which resulted in serious financial implications. The irregularities pointed out are broadly of the following nature: Unproductive expenditure/imprudent investment and loss of interest, financing charges amounting to Rs 7.13 billion (US$154 million) in 39 cases due to bad investments, pay and allowances for idle labor, injudicious import of components etc. Excess/irregular payment of Rs 2.90 billion in 12 cases was made to PSU staff of ex gratia, bonus, salaries, wages, extending benefits in excess of norms etc. Avoidable expenditure of Rs 1.46 billion in 32 cases due to use of unproven technology, delay in installation of equipment, failure to ensure correct specification of material, import/procurement of spares at higher rates, detention of vessel beyond lay time, power factor surcharge, poor cash management, payment of demurrage, customs duty, excise duty etc. Loss of Rs 1.03 billion occurred in 24 cases on account of undue favor to parties, defective agreement/contract terms, unrealistic feasibility study, wrong estimates, failure to obtain bank guarantee, delay in award of work, failure to make counter offer, failure to take financial safeguards, forfeiture of earnest money deposit etc.

Loss of revenue/sale proceeds of Rs 690 million in 18 cases due to delay in realization/non-realization of debts, purchase without working out parity calculations, unnecessary borrowings, manufacture of machines without order, unwarranted restriction on production, loss of generation of power, premature deal to sell an aircraft, non recovery of lease rentals etc. Avoidable loss of Rs 570 million in 11 cases due to delay in finalization of tenders, failure to invoke risk clause, non-compliance of terms of the contract, non-adherence to delivery schedule, finalization of contract documents without clients' approval etc. Loss of Rs 300 million in 10 cases due to adoption of incorrect tariff, excess settlement of claims, nonrealization of royalty etc. This takes the total estimated loss to Rs 14.07 billion for that year alone due to managerial inefficiencies. Then there are laws that loss-making PSUs cannot be shut down. Workers cannot be fired. The PSU losses are taken care of by the government. These conditions create the notorious incentive problem with regard to improving the health of the organization. On the other hand, the inefficiency problem is further exacerbated by continual political interference in the affairs of PSUs. Outside interference frustrates internal efforts to increase efficiency and productivity. Among the consequences of political interference, the following are prominent: Excess employment Political favors are done/returned by imposing workers on PSUs. As a result, almost all of them suffer from excess employment. In India, it is easy to hire a person, but firing one is extremely difficult. Protected by pro-labor legislation and political clout, not all workers may have the motivation or feel the pressure to work efficiently. Excessive cost per worker Irrespective of the levels and the rates of improvement (or decline) of productivity, in general PSU workers enjoy better amenities on top of job security. Understandably, they oppose privatization tooth and nail. Requirement of social services from commercial PSUs There are certain segments (health, education, transport etc) government should play a role in, either due to a lack of private participation or a lack of reach by private companies. However, we have a situation where even commercial PSUs are required to provide social services. Quite often the PSUs end up being personal fiefdoms of the ministers under whose control they happen to be. The ministers not only extract their pound of flesh but also force the PSUs to undertake activities in their constituencies for gaining political mileage. The additional cost, however, weakens the competitive position of the PSUs vis-a-vis the private domestic sector and foreign firms. While the requirement relieves the government of levying taxes to pay for social services, it is a highly inefficient way of providing the same. It certainly reduces the capacity of PSUs to compete with private sector firms. Unproductive activities Finally, the allegations of enhanced propensity for corruption and unproductive activities when PSUs exist cannot be easily brushed aside. Pilferage of electricity, kickbacks for jobs and appointments, sharing profits with suppliers, rent seeking, and graft and grab in general, are experienced by the common man. The results are for all to see. According to the audit carried out by the CAG in 2001-02 (their latest

available audit report), of the 268 central PSUs in India for which they could carry out the audit, only 139 earned profit. Their total profit was to the tune of Rs 469 billion. On the other hand, total loss recorded by the remaining was Rs 240 billion, which translates into an overall net profit of Rs 229 billion. The total equity investment by the government in these companies was to about Rs 914 billion, out of a total equity of Rs 1.09 trillion. Thus the government's share of total net profit was Rs 191 billion. Interestingly, during the same period, India's subsidy to the PSUs (related to administered prices) amounted to Rs 209 billion, much more than the overall net profit attributable to the government. During this period, total dividend received by the government was only Rs 60 billion. Need one say anything more to point out the actual state of affairs as far as the return on capital goes. The dismal story does not end there. Of these 268 companies, equity investment in 97 companies has been totally eroded by their accumulated losses. As a result, the accumulated net worth of these companies has become negative to the extent of Rs 477 billion. As a corollary, recovery of the loans extended to these companies by the government becomes doubtful. Conclusion Thus, if the objective of PSUs was to create economic surpluses for investment and growth, they have failed miserably. To the contrary, PSUs have gobbled up large chunks of productive resources, have become dens of inefficiency, and are suspected to be the breeding grounds for corruption. The story of the PSUs controlled by the local governments in different states in India is not different either, if not more worrying. But that's for the next part.

Anda mungkin juga menyukai

- Handbook of LNGDokumen3 halamanHandbook of LNGKai Yuan Teo0% (1)

- Mixed Refrigerant ProcessDokumen2 halamanMixed Refrigerant ProcessWade ColemanBelum ada peringkat

- MMPA633 - Transformative Governance - Jerson F. PuaDokumen8 halamanMMPA633 - Transformative Governance - Jerson F. PuaJohn Michael TalanBelum ada peringkat

- Critique Paper (Guzman, JW) - Finals RequirementDokumen9 halamanCritique Paper (Guzman, JW) - Finals RequirementCrisanto ApostolBelum ada peringkat

- FRP Above Ground Installation ManualDokumen32 halamanFRP Above Ground Installation ManualCarlos GutierrezBelum ada peringkat

- National Development Plan A Complete Guide - 2019 EditionDari EverandNational Development Plan A Complete Guide - 2019 EditionBelum ada peringkat

- Chapter 2 - The ExecutiveDokumen48 halamanChapter 2 - The ExecutiveZulamirul Aiman100% (1)

- Legal Framework of Public AccountabilityDokumen21 halamanLegal Framework of Public AccountabilityPia Monica DimaguilaBelum ada peringkat

- Tax Dec 3 (Pantawid Recit)Dokumen7 halamanTax Dec 3 (Pantawid Recit)D Del SalBelum ada peringkat

- Building Good Governance in IndonesiaDokumen18 halamanBuilding Good Governance in Indonesiabrilliant76Belum ada peringkat

- Graduate Studies Masters in Public AdministrationDokumen9 halamanGraduate Studies Masters in Public AdministrationANTHONY BALDICANASBelum ada peringkat

- Why Is There A Need To Study Economic DevelopmentDokumen1 halamanWhy Is There A Need To Study Economic DevelopmentjayceeBelum ada peringkat

- Group 7 Slavery in The Chocolate IndustryDokumen5 halamanGroup 7 Slavery in The Chocolate IndustryRomulo MarquezBelum ada peringkat

- Topic 3 - Public ExpenditureDokumen12 halamanTopic 3 - Public ExpenditureNAIROBI100% (1)

- Regulations in IndiaDokumen8 halamanRegulations in IndiaHimanshu GuptaBelum ada peringkat

- Jefferies Chemicals Primer Basic PlasticsDokumen41 halamanJefferies Chemicals Primer Basic PlasticsvishansBelum ada peringkat

- Indian Takeover CodeDokumen10 halamanIndian Takeover CodeMoiz ZakirBelum ada peringkat

- Will Federalism Address PH WoesDokumen26 halamanWill Federalism Address PH WoesBeaver Sean Felix CaraanBelum ada peringkat

- T - Spent Refinery CatalystsDokumen64 halamanT - Spent Refinery Catalyststhe0meBelum ada peringkat

- Bicol University: Government-Owned and Controlled CorporationDokumen4 halamanBicol University: Government-Owned and Controlled CorporationAra LimBelum ada peringkat

- E ProcurementDokumen17 halamanE ProcurementVivek MurugaiyanBelum ada peringkat

- Assignment 1 - Gov and DevtDokumen3 halamanAssignment 1 - Gov and DevtTin PrimeBelum ada peringkat

- Urban and Regional Planning Report (Local Government Code)Dokumen19 halamanUrban and Regional Planning Report (Local Government Code)Sherlock HoImes100% (1)

- MORATALLA Graft and Corruption Phil ExperienceDokumen23 halamanMORATALLA Graft and Corruption Phil ExperienceLeyCodes LeyCodesBelum ada peringkat

- Good Governance: The Inflation of An IdeaDokumen22 halamanGood Governance: The Inflation of An IdeaYudi NugrahaBelum ada peringkat

- Differentiate Between Privatization and Commercialization of Public Enterprise and Discuss It Merit and DemeritDokumen8 halamanDifferentiate Between Privatization and Commercialization of Public Enterprise and Discuss It Merit and DemeritUsman AbubakarBelum ada peringkat

- IT - BPO Sector in The Philippines: A Policy Analysis Using Punctuated Equilibrium TheoryDokumen15 halamanIT - BPO Sector in The Philippines: A Policy Analysis Using Punctuated Equilibrium TheoryJappy AlonBelum ada peringkat

- Guide to Public Debt TheoriesDokumen2 halamanGuide to Public Debt TheoriesRonnie TambalBelum ada peringkat

- Private Sector Vs Public SectorDokumen2 halamanPrivate Sector Vs Public SectorPradnya GoreBelum ada peringkat

- The Policy Making Process-1Dokumen12 halamanThe Policy Making Process-1Alford AlejandroBelum ada peringkat

- Government SpendingDokumen11 halamanGovernment SpendingRow TourBelum ada peringkat

- Market FailureDokumen8 halamanMarket FailuresassinemichelBelum ada peringkat

- Industrial Policy in PhilippinesDokumen6 halamanIndustrial Policy in PhilippinesSharon Rose GalopeBelum ada peringkat

- The Scope of EntrepreneurshipDokumen3 halamanThe Scope of EntrepreneurshipharpreetdapphuBelum ada peringkat

- The Role of The Public Sector Enterprises in The Indian EconomyDokumen6 halamanThe Role of The Public Sector Enterprises in The Indian Economysrikanth_ravindraBelum ada peringkat

- How Should A Civil Servant Conduct HimselfDokumen2 halamanHow Should A Civil Servant Conduct HimselfAagam Jain100% (1)

- Economic Modelling: Deficit Financing, National Debt and Ricardian EquivalenceDokumen15 halamanEconomic Modelling: Deficit Financing, National Debt and Ricardian EquivalencecbagriBelum ada peringkat

- A Transparency Disclosure Index Measuring Disclosures (Eng)Dokumen31 halamanA Transparency Disclosure Index Measuring Disclosures (Eng)AndriBelum ada peringkat

- Independent Directors RolesDokumen6 halamanIndependent Directors RolesVrushank Suthar100% (1)

- What Is Economic DevelopmentDokumen2 halamanWhat Is Economic DevelopmentNna Yd UJBelum ada peringkat

- Unit4 - Importance of Public Policy Study - Modern ContextDokumen10 halamanUnit4 - Importance of Public Policy Study - Modern Contextamit05842Belum ada peringkat

- The Influence of Political and Legal Challenges Facing MNCDokumen10 halamanThe Influence of Political and Legal Challenges Facing MNCjigar0987654321Belum ada peringkat

- Public ExpenditureDokumen8 halamanPublic Expenditurekilon miniBelum ada peringkat

- 8 Main Canons of Public ExpenditureDokumen12 halaman8 Main Canons of Public ExpenditureLala100% (2)

- Recent Trends in Industrial Growth in IndiaDokumen8 halamanRecent Trends in Industrial Growth in Indiaanubhav mishraBelum ada peringkat

- 10 Point Agenda 1Dokumen12 halaman10 Point Agenda 1jrduronio100% (1)

- Google EarthDokumen32 halamanGoogle EarthAbhishek Raj100% (1)

- EC10120-Economic Principles and Skills I - Why Do Countries Trade With Each OtherDokumen3 halamanEC10120-Economic Principles and Skills I - Why Do Countries Trade With Each OtherdpsmafiaBelum ada peringkat

- DitoDokumen42 halamanDitoHaynich WilliamsBelum ada peringkat

- Meaning and Nature of Public ExpenditureDokumen3 halamanMeaning and Nature of Public ExpenditureMuhammad Shifaz Mamur100% (1)

- Principles and Practice of Taxation Lecture Notes PDFDokumen20 halamanPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- Alex B. Brillantes JR - The State Reform of The State Bureaucracy and Building Capacities For DecentralizationDokumen13 halamanAlex B. Brillantes JR - The State Reform of The State Bureaucracy and Building Capacities For DecentralizationhamaredBelum ada peringkat

- Syllabus in Theory and Practice in Public AdministrationDokumen6 halamanSyllabus in Theory and Practice in Public AdministrationLeah MorenoBelum ada peringkat

- Case 18 American Red CrossDokumen3 halamanCase 18 American Red Crossjwright4180% (1)

- Business Environment Concept of Business Environment A Business Firm IsDokumen4 halamanBusiness Environment Concept of Business Environment A Business Firm IsMahipal Nehra100% (5)

- Introduction To Business EthicsDokumen18 halamanIntroduction To Business EthicsKaivalya Purushottam MawaleBelum ada peringkat

- Managing Human Resources in Global Era P HAL 48 CAT KAKI 59Dokumen283 halamanManaging Human Resources in Global Era P HAL 48 CAT KAKI 59Yogo StruggleBelum ada peringkat

- CorruptionDokumen13 halamanCorruptionTieraKhairulzaffriBelum ada peringkat

- GSISDokumen101 halamanGSISDon SumiogBelum ada peringkat

- The Economic Functions of GovernmentDokumen43 halamanThe Economic Functions of GovernmentHStobbsBelum ada peringkat

- Government Budget Objectives and ImpactDokumen21 halamanGovernment Budget Objectives and ImpactSireen IqbalBelum ada peringkat

- Public FinanceDokumen2 halamanPublic Financemohamed sheikh yuusufBelum ada peringkat

- FederalismDokumen6 halamanFederalismkayode100% (1)

- Capital FormationDokumen20 halamanCapital FormationNupoorSharmaBelum ada peringkat

- Introduction to Public Sector Role and ChallengesDokumen12 halamanIntroduction to Public Sector Role and ChallengesIshika AroraBelum ada peringkat

- Service Research Paper-SasmitDokumen12 halamanService Research Paper-SasmitSasmit PatilBelum ada peringkat

- BRM Mod1Dokumen37 halamanBRM Mod1Venkata Mahendra PrasadBelum ada peringkat

- IntroductionDokumen2 halamanIntroductionVenkata Mahendra PrasadBelum ada peringkat

- Information Technology IndustryDokumen30 halamanInformation Technology IndustryVenkata Mahendra PrasadBelum ada peringkat

- Ifrs 4th Aug 12Dokumen19 halamanIfrs 4th Aug 12Venkata Mahendra PrasadBelum ada peringkat

- Public Sector in India - Venkata Mahendra Prasad.Dokumen2 halamanPublic Sector in India - Venkata Mahendra Prasad.Venkata Mahendra PrasadBelum ada peringkat

- ERM 5 (Trade Union)Dokumen9 halamanERM 5 (Trade Union)Venkata Mahendra PrasadBelum ada peringkat

- Why Angry Birds Is So Successful and PopularDokumen6 halamanWhy Angry Birds Is So Successful and PopularVenkata Mahendra PrasadBelum ada peringkat

- ASME B16.9 InterpretationDokumen13 halamanASME B16.9 Interpretationkler_kathiaBelum ada peringkat

- Chapter 3 - METAL WORK, CASTING PROCESS AND HEAT TREATMENT ON STEELDokumen21 halamanChapter 3 - METAL WORK, CASTING PROCESS AND HEAT TREATMENT ON STEELتاج نيسهاBelum ada peringkat

- Chapter 8Dokumen12 halamanChapter 8Sathish KumarBelum ada peringkat

- En Slimstock RetailDokumen2 halamanEn Slimstock RetailDinesh PatilBelum ada peringkat

- 2 CGMP Meeting d1s3 Production Shah v3.0Dokumen58 halaman2 CGMP Meeting d1s3 Production Shah v3.0vsvsuresh2099100% (1)

- Jadwal Monitoring PMC Dan PMUDokumen4 halamanJadwal Monitoring PMC Dan PMUFirmanSimeulueBelum ada peringkat

- Production Question Set 2Dokumen70 halamanProduction Question Set 2ErKRGautamBelum ada peringkat

- UntitledDokumen18 halamanUntitledapi-270457521Belum ada peringkat

- SCM Building BlocksDokumen22 halamanSCM Building BlocksAashnaBelum ada peringkat

- Study Material Class Xii Geography PDFDokumen165 halamanStudy Material Class Xii Geography PDFAnonymous kKij6UhTZOBelum ada peringkat

- 1 1 6 P Vex Compoundmachinedesign 1Dokumen4 halaman1 1 6 P Vex Compoundmachinedesign 1api-319485005Belum ada peringkat

- 60mm Pavers Compressive Strength Profile (Mar-Apr 2017)Dokumen3 halaman60mm Pavers Compressive Strength Profile (Mar-Apr 2017)Frank MtetwaBelum ada peringkat

- Fosroc Supercast PVC Waterstops: Technical Data SheetDokumen4 halamanFosroc Supercast PVC Waterstops: Technical Data Sheetarvin jay santarinBelum ada peringkat

- Technical SpecificationsDokumen62 halamanTechnical SpecificationsRamu Nallathambi100% (1)

- 07 Rawlbolts Plugs AnchorsDokumen1 halaman07 Rawlbolts Plugs AnchorsLincolnBelum ada peringkat

- PmqaDokumen12 halamanPmqaAswathy AnilkumarBelum ada peringkat

- SP-2889 Epl PDSDokumen4 halamanSP-2889 Epl PDSjerrymcflyBelum ada peringkat

- Feedwater Heaters Inspection ProcedureDokumen2 halamanFeedwater Heaters Inspection ProcedureAlmario SagunBelum ada peringkat

- AICHE S01 02 FCC Debutanizer Revamp For Flexibility and AddiDokumen16 halamanAICHE S01 02 FCC Debutanizer Revamp For Flexibility and AddiSrbislav GenicBelum ada peringkat

- Case ReichardDokumen23 halamanCase ReichardDesiSelviaBelum ada peringkat

- Freilog (Pty) LTD - 2014Dokumen6 halamanFreilog (Pty) LTD - 2014FreilogBelum ada peringkat

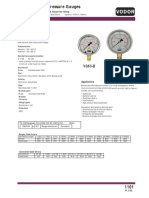

- VODOR压力表资料 PDFDokumen2 halamanVODOR压力表资料 PDFliu zhao liu zhaoBelum ada peringkat

- CuZn 39 PB 3Dokumen2 halamanCuZn 39 PB 3lomas34Belum ada peringkat

- LKM Steel Rainbow ChartDokumen1 halamanLKM Steel Rainbow ChartNazriBelum ada peringkat