A Free Guide To Structured Products by SPGO

Diunggah oleh

benmurisonJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

A Free Guide To Structured Products by SPGO

Diunggah oleh

benmurisonHak Cipta:

Format Tersedia

Structured Product Guide

SPGO lets you compare, monitor and use structured products more safely for free. www.spgo.co.uk This document is a guide only and does not relate to any single investment. SPGO has not given any investment advice. Before making any investment, contact your financial adviser.

Structured Product Guide

Introduction

The term structured product may seem confusing however it is simply a type of investment with a defined potential return. This simple guide aims to explain their key features, benefits and risks by walking through a few examples of some of the most popular types of structured product.

Key Benefits

Structured products can offer: 1. Potential investment protection, where the aim is to return at least your initial investment, if your investment view turns out to be incorrect 2. The ability to link your investment returns to a wide range of Underlying Assets including Developed World equities. Emerging Market equities, commodities, collective funds etc 3. The potential to increase the sensitivity of your returns to the Underlying Asset versus a direct investment into it e.g. a product may offer the chance to get back a 20% return even though the underlying equity index has only gone up 10% over the same time period 4. 5. 6. The potential to receive an attractive level of interest (or yield) on your investment The potential to receive a positive return in a flat or falling equity market environment Above all, an increased level of certainty over your maximum and minimum levels of return under different market conditions

Key Risks

Like any other investment, structured products have an element of risk. Some of the key risks include: 1. The company (normally a large bank) that agrees to pay the returns due under your product fails or is unable to pay you back the investment returns 2. If you wish to sell your investment before the scheduled maturity date you may get back less than you invested even if the Underlying Asset e.g. the FTSE 100 equity index or S&P 500 equity index has risen during this period 3. Depending on which structured product you buy, the repayment of any initial investment may be dependent on the performance of some Underlying Asset e.g. the FTSE 100 equity index, the S&P 500 equity index or perhaps the price of gold. This means that if the Underlying Asset performs poorly, then your structured product may also perform poorly 4. Most structured products do not give you the benefit of any dividends that may be paid on the Underlying Asset

What is a Structured Product?

The term structured is a term which refers to the fact that each product is made up of a combination of financial instruments. The aim of combining these instruments is to create an investment which defines exactly what you can expect to receive back from your investment under different scenarios. This is why structured products are sometimes called defined return products. It also means that before you invest in a structured product, you can fully understand how the return on your investment will be calculated and better understand the associated risks. You can then compare the potential risk and returns from the structured product with the potential risk and returns of alternative ways to access the Underlying Asset e.g. by buying shares, collective funds or some other method. Structured products are not investments that should be considered in a silo, but should be compared on a level playing field with the potential investment returns available elsewhere.

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

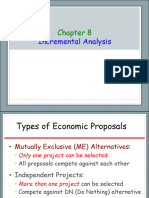

Building Blocks

The overall return of a structured product is typically made up of two components: 1. 2. The Protection Component The Performance Component Both of these components may be linked to the movement or performance of an Underlying Asset such as the FTSE 100 equity index or Emerging Market equities for example over a set time period. These 2 building blocks of a structured product are described further below.

The Underlying Asset

150 140 130 120 110 100 % 90 80 70 60 50 40 Underlying Asset

The performance of the Underlying Asset is the main driver of the return you can expect from the Performance Component which, with the return from the Protection Component, makes up your overall return from a structured product. You can chose to link the returns of a structured product to a very wide range of Underlying Assets, however some of the most common are shown below: Shares For example a Barclays Bank Plc share, a BP Plc share or the shares of another large blue chip company listed on a major stock exchange Equity Indices Any major world equity index such as the FTSE 100 index, international indices such as the S&P 500 (USA) or Nikkei 225 (Japan) or Emerging Market equity indices. This helps to link your returns to a large number of shares and not just one or two Commodities Crude oil, gold, industrial metals, wheat, sugar etc Interest Rates Such as the Bank of England Base Rate Currencies Such as the rate of GBP Pounds Sterling to US Dollar or GBP Pounds Sterling versus the currency of an Emerging Market country for example Funds Access to collective investment funds and hedge fund performance with the defined return a structured product can offer Baskets A portfolio of Underlying Assets, such as the FTSE 100, S&P 500 and Hang Seng Index (China) Multi Asset A diversified portfolio of a range of Underlying Assets from different asset classes, such as combining both crude oil and the FTSE 100 equity index

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

Risk Versus Reward

Like any investment, a structured product involves an element of risk. Typically, the greater the degree of risk you take on, the greater the potential returns although a greater return is of course not guaranteed. This widely accepted concept can be easily seen within a structured product. A product that will pay back all of the initial investment at maturity, regardless of the performance of the Underlying Asset (Full Capital Protection) is likely to be viewed as lower risk than a product that has no capital protection at all (Non-Capital Protected). As such, where the product will Full Capital Protection may offer investors 1.5 times the rise in the FTSE 100 index at maturity, the Non-Capital Protected Product may offer investors 3 times the rise of the FTSE 100. The Non-Capital Protected product does not benefit from Full Capital Protection, but to compensate, investors can make up to three times the rise in the index. It has a high a higher level of risk and therefore a higher potential investment return. Depending of your view of how the Underlying Asset will perform over the investment term, your attitude to risk and your individual circumstances, either product above could be better suited to you. It is for this reason that you should work closely with your financial adviser before you look to invest. Structured Products typically have a predefined investment term, with most products ranging from 1 to 6 year investment terms. This does not mean that you are unable to sell your investment before the end of the term, however if you do you may get back less than you invested.

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

The Protection Component

The Protection Component is one of the main building blocks that make up the overall defined return of a structured product. This is the component that determines how much of your initial investment may be paid back at maturity. This can range from the full repayment of your initial investment (Full Capital Protection) to Non Capital Protected which is similar to the risk you would expect from investing in a share or collective fund, or Partial/Conditional Capital Protection which typically aims to pay back all of your initial investment provided the Underlying Asset has not fallen by a certain amount e.g. halved in value over the term. These different levels of protection are explained in more detail below. All of the different levels of capital protection are subject to the Counterparty risk (see the section on Counterparty risk below for more details).

Full Capital Protection

Structured products will Full Capital Protection, also referred to as having 100% Capital Protection aim to pay back at least the full amount you initially invested upon maturity of the product at the end of the investment term. When combined with the Performance Component, the investor then has an investment where they are able to get positive returns but cannot get back less than the sum they invested originally at the end of the investment term. The below graph shows the percentage of the initial amount invested into the structured product that the Protection Component will return at the end of the investment term, depending on the performance of the Underlying Asset over the same period. The red line shows the level of the Underlying Asset on the final day of the products term. You can see that no matter where the Underlying Asset (Red Line) is at the end of the investment term, the Protection Component (Blue Surface) will still return 100% of the initial amount invested into the structured product. If the Underlying Asset at the end of the investment term has fallen, investors benefit from getting back all of their initial money rather than potentially losing money had they invested into a collective fund or bought shares directly in the Underlying Asset for example.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 Underlying Asset Protection Component

At maturity is the Underlying Asset above its starting level?

Yes

Each Structured Products pays out 100% of the initial amount invested plus the Performance Component

No

At maturity is the Underlying Asset at its starting level? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset below its starting level? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

Non Capital Protected

Non Capital Protected structured products refer to the situation where an investors initial investment is not protected from any potential falls in the value of the Underlying Asset over the investment term. For example, if you invested into a share that halved in value over the investment term, you would expect your initial investment to half. Typically, investors in a Non Capital Protected structured product are never any worse off than investors who have chosen to invest directly into the Underlying Asset (ignoring any dividends you may earn by investing directly into the Underlying Asset). The red line in the diagram below shows the level of the Underlying Asset on the final day of the product term. You can see that if the Underlying Asset is below its starting level at the end of the investment term then the investors initial money invested is reduced by an equivalent amount. For example, if the Underlying asset halved in value over the term, an investor would get back 50 for every 100 invested into the product. Investors do not benefit from any form of capital protection but are likely to have a greater potential return than if they had invested into the same product with Full Capital Protection for example.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 30 Underlying Asset Protection Component

At maturity is the Underlying Asset above its starting level?

Yes

Each Structured Products pays out 100% of the initial amount invested plus the Performance Component

No

At maturity is the Underlying Asset at its starting level? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset below its starting level? Each Structured Product pays out 100% of the initial amount invested, less an amount equal to the fall in the Underlying Asset, for example if the Underlying Asset has fallen by 20%, then the Structured Product pays out 80% of the initial investment plus the Performance Component

Yes

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

Partial/Conditional Capital Protection

Partial/Conditional Capital Protection describes the situation where the amount an investor gets back at maturity is dependent on how the Underlying Asset e.g. the FTSE 100 index or S&P 500 index has performed over the investment term. There are typically three types of Partial/Conditional Capital Protection used to create structured products: 1. Partial Capital Protection 2. Conditional Capital Protection - observed daily 3. Conditional Capital Protection- observed at maturity We take a closer look at each below.

Partial Capital Protection

Partial Capital Protection is similar in nature to the Full Capital Protection version described above, however instead of the product paying back all of the initial investment at the end of the product term, it will only pay back a certain fixed portion of it for example, 80% or 90%. If a product is 90% Capital Protected, this means for each 100 invested, the product will pay back at least 90 at the end of the investment term. Dont forget it may also pay back more depending on what the Performance Component is worth at the end of the investment term. We go through this in more detail later on in this guide. The diagram below shows the percentage of the initial money invested into the product the Protection Component will be worth at the end of the products term. The red line shows the level of the Underlying Asset on the final day of the products term. You can see that no matter where the Underlying Asset (red line) is at the end of the investment term, the Protection Component (blue surface) remains at 90% of the initial investment amount. This means for the Protection Component alone, an investor would get back 90 per 100 invested into the product.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 30 Underlying Asset Protection Component

At maturity is the Underlying Asset above its starting level?

Yes

Each Structured Products pays out 90% of the initial amount invested plus the Performance Component

No

At maturity is the Underlying Asset at its starting level? Each Structured Product pays out 90% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset below its starting level? Each Structured Product pays out 90% of the initial amount invested plus the Performance Component

Yes

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

Conditional Capital Protection - observed daily

Conditional Capital Protection is different to Full Capital Protection and Partial Capital Protection. This type of capital protection normally describes a situation where all of the money you initially invested into a product is returned at the end of the product term, as long as the Underlying Asset has never fallen by a specific amount, typically 50% or 40% from its starting level. This level is normally called the Barrier Level and in the case of daily observed barriers, is monitored typically at the end of every day throughout the investment term. For example, if the Barrier Level is 50% of the starting level of the Underlying asset and the Underlying Asset does indeed fall by 50% from its starting point at some point over the term of the product, then your initial investment is typically reduced in line with the fall in the Underlying Asset at maturity. In this case, if the Underlying Asset did hit the 50% Barrier Level and at the end of the investment term it closed at a level of 50% of the initial level, then an investor would get back half of the initial investment amount i.e. only 50 of an initial investment of 100 would be repaid. If the Barrier Level is never hit during the investment term however, an investor would receive back the full amount of money they invested into the product plus any return from the Performance Component. Before considering a product with Conditional Capital Protection your view should be that the Underlying Asset is unlikely to breach the stated Barrier Level. The below diagram shows the amount a product would return at maturity if the Barrier Level has never been hit throughout the term. The red line shows the level of the Underlying Asset on the final day of the products term. You can see that even if the Underlying Asset has fallen in value over the term an investor will still get back all of the initial investment unless the index has closed below the 50% of its starting level Barrier at maturity of the product. The key thing to remember is that in the first graph below, the Barrier Level during the term of the product is considered NOT to have been breached. In this case then, if the Underlying Asset closed at 60% of its initial level at maturity, an investor would get back all of their initial money invested into the product. In this way they are typically considered to be lower risk than structured products that are Non Capital Protected.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 30 Underlying Asset Capital at Risk Barrier Level

In the next diagram below we assume that the Barrier Level HAS been hit at some point throughout the investment term. The red line shows the level of the Underlying Asset on the final day of the products term. You can see that the initial investment amount is reduced in line with the performance of the Underlying Asset from its starting level, even if it finishes above the 50% Barrier Level (grey line) on the final day of the investments term. The key point is that for products with Conditional Capital Protection with barriers that are observed daily, if on any day during the investment term, the Underlying Asset hits the Barrier Level and at the end of the investment term has fallen in value, then an investors initial investment will be reduced in line with the fall in the Underlying Asset over the term.

Protection Component

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 30 Underlying Asset Capital at Risk Barrier Level Protection Component

At maturity is the Underlying Asset above its starting level?

Yes

Each Structured Products pays out 100% of the initial amount invested plus the Performance Component

No

At maturity is the Underlying Asset at its starting level? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

Has the Underlying Asset remained above the Conditional Protection Daily Barrier on every day throughout the Term of the Product? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset at or above its starting level? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset below its starting level? Each Structured Product pays out 100% of the initial amount invested, less an amount equal to the fall in the Underlying Asseet, for example if the Underlying Asset has fallen by 20% then the Structured Product pays out 80% of the initial amount invested plus the Performance Component

Yes

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

Structured Product Guide

Conditional Capital Protection - observed at maturity

This style of product is similar to those with Conditional Capital Protection observed daily, except that the Barrier Level is only observed on the maturity date of the structured product rather than on every day throughout the investment term. For this reason, the observed at maturity version, is typically seen to be of a lower risk than the daily observed versions however they also typically have lower potential investment returns from the Performance Component. This is the risk versus reward mechanism in action. The diagram below shows that if the Underlying Asset at maturity (red line) falls to or below the Conditional Capital Protection Barrier Level (observed at maturity) (grey dashed line), then the Protection Component (blue surface) is reduced from 100% of the initial investment by an amount equal to the fall of the Underlying Asset over the investment term. However, on any occasion where the Underlying Asset closes above the grey dotted Barrier Level at maturity, the investor will get back all of their initial money invested plus any return from the Performance Component.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 30 Underlying Asset Capital at Risk Barrier Level Protection Component

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

10

Structured Product Guide

Conditional Capital Protection - observed at maturity

At maturity is the Underlying Asset above its starting level?

Yes

Each Structured Products pays out 100% of the initial amount invested plus the Performance Component

No

At maturity is the Underlying Asset at its starting level? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

Has the Underlying Asset remained above the Conditional Protection Daily Barrier on every day throughout the Term of the Product? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset at or above its starting level? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset below its starting levvel but above the Conditional Protection Barrier? Each Structured Product pays out 100% of the initial amount invested plus the Performance Component

Yes

No

At maturity is the Underlying Asset below its Conditional Protection Barrier? Each Structured Product pays out 100% of the initial amount invested, less an amount equal to the fall in the Underlying Asseet, for example if the Underlying Asset has fallen by 50% then the Structured Product pays out 50% of the initial amount invested plus the Performance Component

Yes

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

11

Structured Product Guide

The Performance Component

The Performance Component is the building block of a structured product that is designed to create the return that an investor will receive in addition to the Protection Component. It is also the part of the product that links the overall defined return to the performance of the Underlying Asset. The return can either be paid out throughout the term of the structured product as an income/dividend, or at the end of the investment term (growth products). The Performance Component can be broken down into a range of broad categories: 1. Enhanced Returns 2. Income Returns 3. Absolute Returns

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

12

Structured Product Guide

Enhanced Returns

Enhanced Return style structured products allow an investor to increase the sensitivity of their returns to the Underlying Asset compared to investing into the Underlying Asset directly. For example, a product may return one and a half times the rise in the FTSE 100 equity index at maturity. If the FTSE 100 equity index was to rise by 40% over the investment term, you would get back a return of 1.5 x 40% or 60% of the initial amount invested at maturity. This can be compared to a return of 40% if they invested into a collective fund tracking the performance of the FTSE 100 equity index (ignoring any dividend payments). They would also normally get back all of their initial investment. The diagram below shows an Enhanced Return style structured product with Full Capital Protection at maturity. The Performance Component shows that investors receive back one and a half times any rise in the Underlying Asset at maturity. This is shown by the Performance Component (dark blue surface) being above the Underlying Asset performance (red line). The Protection Component shows that the investor will get back all of their initial investment regardless of the performance of the Underlying Asset over the term. Adding the Protection Component and the Performance Component together, you can see the overall defined return from the structured product. In situations where the Underlying Asset has risen over the investment term, the product gives an investor back an amount greater than the rise in the Underlying Asset. In scenarios where the Underlying Asset has fallen, investors are protected from the fall and all of their initial investment is returned.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 Underlying Asset Performance Component Protection Component

At maturity is the Underlying Asset above its starting level?

Yes

Each Structured Products pays out 100% of the initial amount invested plus 1.5 times the Underlying Asset positive performance from its starting level.

No

At maturity is the Underlying Asset at its starting level? Each Structured Product pays out 100% of the initial amount invested

Yes

No

At maturity is the Underlying Asset at or above its starting level? Each Structured Product pays out 100% of the initial amount invested

Yes

This is a one example of an Enhanced Return style structured product. More examples can be found on the SPGO platform at www. spgo.co.uk

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

13

Structured Product Guide

Income

Income style structured products give investors the opportunity to receive a pre-defined yield (or income) on pre-defined dates. They can be a useful source of income in times when dividends may be being cut and the yield from corporate bonds is low. The diagram below shows an Income style structured product with Conditional Capital Protection (observed daily). It shows that regardless of the Underlying Asset performance over the investment term (red line), the Performance Component pays out a fixed income. It also shows that if the Underlying Asset falls below the Conditional Capital Protection Barrier Level on any day during the investment term (grey dotted line), then the Protection Component is reduced in line with any fall of the Underlying Asset at maturity. For example, assume that the below product has a term of 1 year, a fixed income each year of 7%, a Barrier Level of 50% of the starting level of the FTSE 100 equity index and that this Barrier Level is observed every day throughout the investment term. At maturity, if the Barrier Level HAS been hit and the FTSE 100 equity index closes down 40% from its starting level at maturity, then the Performance Component would pay out 7% of the initial investment and the Protection Component would return 60% of the initial investment. Overall then, an investor would get back 60% + 7% i.e. 67%of their initial investment amount at the end of the term.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 30 Underlying Asset Capital at Risk Barrier Level Performance Component Protection Component

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

14

Structured Product Guide

Income

At maturity is the Underlying Asset above its starting level?

Yes

Each Structured Products pays out 100% of the initial amount invested. The Income Return is paid on each Income date.

No

At maturity is the Underlying Asset at its starting level? Each Structured Products pays out 100% of the initial amount invested. The Income Return is paid on each Income date.

Yes

No

Has the Underlying Asset remained above the Conditional Protection Daily Barrier on every day throughout the Term of the Product? Each Structured Products pays out 100% of the initial amount invested. The Income Return is paid on each Income date.

Yes

No

At maturity is the Underlying Asset at or above its starting level? Each Structured Products pays out 100% of the initial amount invested. The Income Return is paid on each Income date.

Yes

No

At maturity is the Underlying Asset below its starting level? Each Structured Products pays out 100% of the initial amount invested, less an amount equal to the fall in the Undelrying Asset, for example if the Underlying Asset has fallen by 20% then the Product pays out 80% of the initial amount invested. The Income Return is paid on each Income date.

Yes

This is a one example of an Income style structured product. More examples can be found on the SPGO platform at www. spgo.co.uk

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

15

Structured Product Guide

Absolute Returns

Absolute Return style structured products give the investor the opportunity to receive a positive return even if the Underlying Asset has not risen in value over the investment term, as long as certain pre-defined conditions are met. The diagram below shows a three year structured product that pays a return of 30% as long as the Underlying Asset is at or above 75% of its starting level on the final day of the investment term. If the Underlying Asset is below 75% of its starting level on the final day of the term, then the 30% return is not paid. In addition, all of an investors initial investment is returned on the maturity date regardless of the performance of the Underlying Asset over the term. In the below example, the Performance Component has returned 30% of the initial amount invested and the Protection Component has returned 100% of an investors initial investment. In total then, an investor would receive back 130 for every 100 invested into the below structured product in the scenario where the Underlying Asset is above 75% or its starting level on the maturity date. This could have occurred even though the Underlying Asset had fallen by 20% over the same term for example. You can see then that Absolute Return style structured products can be a useful way of delivering a positive performance in a flat or falling equity market environment.

Example Maturity Returns

150 140 130 120 110 100 % 90 80 70 60 50 40 Underlying Asset Performance Component Protection Component

At maturity is the Underlying Asset above 75% of its starting level?

Yes

Each Structured Products pays out 100% of the initial amount invested plus 30% of the initial amount invested.

No

At maturity is the Underlying Asset at 75% of its starting level? Each Structured Products pays out 100% of the initial amount invested plus 30% of the initial amount invested.

Yes

No

At maturity is the Underlying Asset below 75% of its starting level? Each Structured Products pays out 100% of the initial amount invested.

Yes

This is a one example of an absolute return style structured product. More examples can be found on the SPGO platform at www. spgo. co.uk

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

16

Structured Product Guide

Counterparty Risk

A structured product is typically delivered as a type of loan to a company. We shall refer to this company as the Issuer, who is normally a large multi-national bank. Like any loan, there is a risk that the Issuer will be unable to repay some or all of the amount you have loaned them when the investment matures or if you choose to try to terminate the loan early i.e. sell the structured product before the end of the product term. This risk is known as Counterparty risk. This means that investing into a structured product carries the risk of losing all of your initial investment and any potential returns regardless of the type of capital protection advertised on the product. Counterparty risk is not limited to structured products and the same risk is present when investing into a corporate bond, or a high street bank deposit account above the Financial Services Compensation Scheme protection limit as an example. There is a range of useful information made widely available by rating agencies and the wider financial markets to allow investors to better understand the risks associated with the loan taker. You can find a summary of a range of this information on the SPGO platform as www.spgo.co.uk. If you require further information with regard to this, you should consult your financial adviser.

This guide is not intended as investment, legal or tax advice. If you are considering investing in a structured product please consult your financial adviser.

SPGO is a trading name of WH Ireland Ltd. WH Ireland Ltd is a company incorporated in England and authorised and regulated by the Financial Services Authority (FSA). WH Ireland Ltd is a member of the London Stock Exchange.

17

Anda mungkin juga menyukai

- Credit Suisse Brochure SP Flexible enDokumen23 halamanCredit Suisse Brochure SP Flexible ensh2k2kBelum ada peringkat

- Structured Financial Product A Complete Guide - 2020 EditionDari EverandStructured Financial Product A Complete Guide - 2020 EditionBelum ada peringkat

- Accumulator Option PDFDokumen103 halamanAccumulator Option PDFsoumensahilBelum ada peringkat

- Sectors and Styles: A New Approach to Outperforming the MarketDari EverandSectors and Styles: A New Approach to Outperforming the MarketPenilaian: 1 dari 5 bintang1/5 (1)

- 7 Myths of Structured ProductsDokumen18 halaman7 Myths of Structured Productsrohanghalla6052Belum ada peringkat

- Barrier OptionsDokumen13 halamanBarrier Optionsabhishek210585Belum ada peringkat

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketDari EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketBelum ada peringkat

- Deep HedgingDokumen21 halamanDeep HedgingRaju KaliperumalBelum ada peringkat

- The High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsDari EverandThe High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsBelum ada peringkat

- Duration PDFDokumen8 halamanDuration PDFMohammad Khaled Saifullah CdcsBelum ada peringkat

- Managed Futures for Institutional Investors: Analysis and Portfolio ConstructionDari EverandManaged Futures for Institutional Investors: Analysis and Portfolio ConstructionBelum ada peringkat

- Structured Product - Credit Linked NoteDokumen8 halamanStructured Product - Credit Linked Notelaila22222lailaBelum ada peringkat

- Equity Collar StrategyDokumen3 halamanEquity Collar StrategypkkothariBelum ada peringkat

- Adaptive Asset AllocationDokumen24 halamanAdaptive Asset Allocationchalimac100% (2)

- 5.4.3 Term Structure Model and Interest Rate Trees: Example 5.12 BDT Tree CalibrationDokumen5 halaman5.4.3 Term Structure Model and Interest Rate Trees: Example 5.12 BDT Tree CalibrationmoritemBelum ada peringkat

- Structured Products OverviewDokumen7 halamanStructured Products OverviewAnkit GoelBelum ada peringkat

- Eun8e CH 005 PPTDokumen47 halamanEun8e CH 005 PPTannBelum ada peringkat

- Auto Call 1Dokumen24 halamanAuto Call 1Jérémy HERMANTBelum ada peringkat

- Modeling Autocallable Structured ProductsDokumen21 halamanModeling Autocallable Structured Productsjohan oldmanBelum ada peringkat

- 26 Structured RepoDokumen4 halaman26 Structured RepoJasvinder JosenBelum ada peringkat

- REPORT - Structured ProductsDokumen16 halamanREPORT - Structured Productsayushi_singhaniaBelum ada peringkat

- Optimal Delta Hedging For OptionsDokumen11 halamanOptimal Delta Hedging For OptionsSandeep LimbasiyaBelum ada peringkat

- Factor Investing RevisedDokumen22 halamanFactor Investing Revisedalexa_sherpyBelum ada peringkat

- Bonds with Embedded Options ValuationDokumen52 halamanBonds with Embedded Options ValuationkalyanshreeBelum ada peringkat

- ABN Equity Structured Products ManualDokumen40 halamanABN Equity Structured Products Manualmarco_aita100% (2)

- Derman Lectures SummaryDokumen30 halamanDerman Lectures SummaryPranay PankajBelum ada peringkat

- Arbitrage PresentationDokumen26 halamanArbitrage PresentationSanket PanditBelum ada peringkat

- Situation Index Handbook 2014Dokumen43 halamanSituation Index Handbook 2014kcousinsBelum ada peringkat

- Man AHL Analysis CTA Intelligence - On Trend-Following CTAs and Quant Multi-Strategy Funds ENG 20140901Dokumen1 halamanMan AHL Analysis CTA Intelligence - On Trend-Following CTAs and Quant Multi-Strategy Funds ENG 20140901kevinBelum ada peringkat

- 4.B - Types of Swaps PDFDokumen40 halaman4.B - Types of Swaps PDFChristopher Mendoza100% (1)

- Trend-Following Primer - January 2021Dokumen8 halamanTrend-Following Primer - January 2021piyush losalkaBelum ada peringkat

- Tactical Asset Allocation, Mebane FaberDokumen13 halamanTactical Asset Allocation, Mebane FabersashavladBelum ada peringkat

- Class 23: Fixed Income, Interest Rate SwapsDokumen21 halamanClass 23: Fixed Income, Interest Rate SwapsKarya BangunanBelum ada peringkat

- Determination of Forward and Futures PricesDokumen23 halamanDetermination of Forward and Futures PricesKira D. PortgasBelum ada peringkat

- Equity Structured Products Accumulator/ DecumulatorDokumen5 halamanEquity Structured Products Accumulator/ DecumulatorRajulBelum ada peringkat

- Total Return Swaps On Corp CDOsDokumen11 halamanTotal Return Swaps On Corp CDOszdfgbsfdzcgbvdfcBelum ada peringkat

- Towers Watson Tail Risk Management Strategies Oct2015Dokumen14 halamanTowers Watson Tail Risk Management Strategies Oct2015Gennady NeymanBelum ada peringkat

- Pairs Trading G GRDokumen31 halamanPairs Trading G GRSrinu BonuBelum ada peringkat

- A Simple and Reliable Way To Compute Option-Based Risk-Neutral DistributionsDokumen42 halamanA Simple and Reliable Way To Compute Option-Based Risk-Neutral Distributionsalanpicard2303Belum ada peringkat

- MANAGING RISK FOR EXOTIC DERIVATIVESDokumen21 halamanMANAGING RISK FOR EXOTIC DERIVATIVESklausfuchsBelum ada peringkat

- Volatility Trading InsightsDokumen5 halamanVolatility Trading Insightspyrole1100% (1)

- Bonds With Embedded OptionsDokumen9 halamanBonds With Embedded OptionsSajib KarBelum ada peringkat

- UCL Lecture Notes on Martingale Pricing TechniquesDokumen20 halamanUCL Lecture Notes on Martingale Pricing TechniquesdoomriderBelum ada peringkat

- Understanding Yield Curves and Interest Rate RisksDokumen15 halamanUnderstanding Yield Curves and Interest Rate RiskskevBelum ada peringkat

- JPM MBS Primer PDFDokumen68 halamanJPM MBS Primer PDFAndy LeungBelum ada peringkat

- WP - Volatility Surface - VR (2012)Dokumen4 halamanWP - Volatility Surface - VR (2012)PBD10017Belum ada peringkat

- Principal-Protected Equity-Linked NoteDokumen5 halamanPrincipal-Protected Equity-Linked NoteSukanya SupawarikulBelum ada peringkat

- FIxed Income PresentationDokumen277 halamanFIxed Income PresentationAlexisChevalier100% (1)

- Stanley Partners Fund Investor Presentation SummaryDokumen24 halamanStanley Partners Fund Investor Presentation Summarytkgoon6349Belum ada peringkat

- (Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement DisasterDokumen9 halaman(Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement Disaster00aaBelum ada peringkat

- Expected Return On Bond Portfolio and Decompose Bond PortfolioDokumen12 halamanExpected Return On Bond Portfolio and Decompose Bond Portfolioduc anhBelum ada peringkat

- Hedging Illiquid AssetsDokumen16 halamanHedging Illiquid Assetspenfoul29Belum ada peringkat

- Interest Rate & Currency SwapsDokumen35 halamanInterest Rate & Currency SwapsiftekharvhaiBelum ada peringkat

- Adaptive Asset Allocation: A Primer: Butler - Philbrick - Gordillo & AssociatesDokumen30 halamanAdaptive Asset Allocation: A Primer: Butler - Philbrick - Gordillo & AssociatesAlexandreLegaBelum ada peringkat

- Structured Products in Equity MarketDokumen28 halamanStructured Products in Equity MarketaaimpossibleBelum ada peringkat

- Convexity and DurationDokumen20 halamanConvexity and DurationNikka CasyaoBelum ada peringkat

- Cambria Tactical Asset AllocationDokumen48 halamanCambria Tactical Asset Allocationemirav2Belum ada peringkat

- Daily Strategy Note: The Joy of Put SellingDokumen5 halamanDaily Strategy Note: The Joy of Put Sellingchris mbaBelum ada peringkat

- HSBC Project Report DRAFT1Dokumen94 halamanHSBC Project Report DRAFT1hikvBelum ada peringkat

- Financial Stability ActivityDokumen3 halamanFinancial Stability Activity[AP-Student] Lhena Jessica GeleraBelum ada peringkat

- Curso Forex Novato A Professional Más 60 Vídeos Explicativos PDFDokumen5 halamanCurso Forex Novato A Professional Más 60 Vídeos Explicativos PDFLUISA SANCHEZBelum ada peringkat

- The Magic Formula Investing Strategy ExplainedDokumen14 halamanThe Magic Formula Investing Strategy ExplainedChrisTheodorouBelum ada peringkat

- BUS227Dokumen70 halamanBUS227Dauda AdijatBelum ada peringkat

- Apprenticeships To Change The WorldDokumen36 halamanApprenticeships To Change The WorldKhawaja SohailBelum ada peringkat

- Integrated Management System) : (Prime Constructions LTDDokumen17 halamanIntegrated Management System) : (Prime Constructions LTDsniparagBelum ada peringkat

- ch8 9 10Dokumen1.155 halamanch8 9 10DavidBelum ada peringkat

- Airasia If GroupDokumen17 halamanAirasia If Groupamirul asyrafBelum ada peringkat

- Discussion Problems: FAR Ocampo/Ocampo FAR.2907-Property, Plant and Equipment - Revaluation ModelDokumen3 halamanDiscussion Problems: FAR Ocampo/Ocampo FAR.2907-Property, Plant and Equipment - Revaluation ModelCV CVBelum ada peringkat

- All Schemes Half Yearly Portfolio - As On 31 March 2020Dokumen1.458 halamanAll Schemes Half Yearly Portfolio - As On 31 March 2020anjuBelum ada peringkat

- Trendsetter Term SheetPPTDokumen16 halamanTrendsetter Term SheetPPTMary Williams100% (2)

- Sample Test Bank Valuation Measuring and Managing The Value of Companies 6th Edition McKinseyDokumen7 halamanSample Test Bank Valuation Measuring and Managing The Value of Companies 6th Edition McKinseySandra Navarrete100% (1)

- Questionnaire On Investment Pattern of IndividualsDokumen3 halamanQuestionnaire On Investment Pattern of IndividualsJoyal Anthony PintoBelum ada peringkat

- ReportDokumen1 halamanReportumaganBelum ada peringkat

- The Philippine Public Sector Accounting StandardsDokumen8 halamanThe Philippine Public Sector Accounting StandardsRichel ArmayanBelum ada peringkat

- Part I Debby Kauffman and Her Two Colleagues Jamie HiattDokumen2 halamanPart I Debby Kauffman and Her Two Colleagues Jamie HiattAmit PandeyBelum ada peringkat

- 2019 Book HotPropertyDokumen220 halaman2019 Book HotPropertyViper BiancoBelum ada peringkat

- Eliminating EntriesDokumen81 halamanEliminating EntriesRose CastilloBelum ada peringkat

- DSP Mutual Fund OverviewDokumen5 halamanDSP Mutual Fund OverviewSarika AroteBelum ada peringkat

- SIP REPORT, 57, SNEHA YADAV MBA 2nd SEM (E), PimgDokumen39 halamanSIP REPORT, 57, SNEHA YADAV MBA 2nd SEM (E), PimgSHWETA GUPTA80% (5)

- Chapter 8 StudentDokumen15 halamanChapter 8 Studentmaha aleneziBelum ada peringkat

- Engineering Economics INSTRUCTIONS: Solve The Problems Independently. When Applicable, Provide Explanations ToDokumen3 halamanEngineering Economics INSTRUCTIONS: Solve The Problems Independently. When Applicable, Provide Explanations ToDescutido MargretBelum ada peringkat

- CH 4 The Dawn of A New Order in Commodity TradingDokumen7 halamanCH 4 The Dawn of A New Order in Commodity TradingDevang BharaniaBelum ada peringkat

- CH 4 - The Meaning of Interest RatesDokumen46 halamanCH 4 - The Meaning of Interest RatesAysha KamalBelum ada peringkat

- An Analysis of Demat Account and Online TradingDokumen90 halamanAn Analysis of Demat Account and Online TradingNITIKESH GORIWALEBelum ada peringkat

- Problem Overview:: 2B PeopleDokumen5 halamanProblem Overview:: 2B PeopleSebastian AlexBelum ada peringkat

- Valuation Methodologies ReviewDokumen43 halamanValuation Methodologies ReviewcamilleBelum ada peringkat

- Tiscon Case-Published Version Strategy Renewal at Tata SteelDokumen29 halamanTiscon Case-Published Version Strategy Renewal at Tata Steelsuhasinidx2024Belum ada peringkat

- Naples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoDari EverandNaples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoPenilaian: 5 dari 5 bintang5/5 (1)

- Arizona, Utah & New Mexico: A Guide to the State & National ParksDari EverandArizona, Utah & New Mexico: A Guide to the State & National ParksPenilaian: 4 dari 5 bintang4/5 (1)

- Best Dives West Hemisphere ExcerptDari EverandBest Dives West Hemisphere ExcerptPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- The Bahamas a Taste of the Islands ExcerptDari EverandThe Bahamas a Taste of the Islands ExcerptPenilaian: 4 dari 5 bintang4/5 (1)

- Japanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensDari EverandJapanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensBelum ada peringkat

- New York & New Jersey: A Guide to the State & National ParksDari EverandNew York & New Jersey: A Guide to the State & National ParksBelum ada peringkat

- South Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptDari EverandSouth Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptPenilaian: 5 dari 5 bintang5/5 (1)