(Smart Grid Market Research) Telecom and The Smart Grid, January 2012

Diunggah oleh

Zpryme Research and ConsultingJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

(Smart Grid Market Research) Telecom and The Smart Grid, January 2012

Diunggah oleh

Zpryme Research and ConsultingHak Cipta:

Format Tersedia

Learn more @ www.zpryme.com | www.smartgridresearch.

org January 2012

Zpryme Smart Grid Insights Presents:

Telecom & the Smart Grid:

An industry brief spotlighting the explosive growth of the U.S. telecom and smart grid communication market.

Copyright 2012 Zpryme Research & Consulting, LLC All rights reserved.

Telecom and the Smart Grid

Telecom and the Smart Grid

Millions of people experienced power outages on the East Cost of the United States as Hurricane Irene reached land. At the time people needed it most, the current electrical grid failed them. In the wake of this natural disaster, advocates of Smart Grid technology identified the potential impact of Smart Grid integration during such emergencies. In addition, Hurricane Irene demonstrated the enormous importance of communication in the Smart Grid. Because of the two way communications the Smart Grid provides between individual homes and the utility companies, outages could have been identified remotely, power re-routed, and energy restored more quickly. Currently, communication between utility companies and consumers is extremely limited, relying on consumers to notify utility companies of outages, and even requiring manual meter reading for billing purposes in some areas. Improved communication would allow automated monitoring of all systems and insure the highest possible efficiency, as well as allow customers to monitor energy consumption on a continuous basis. For the successful widespread adoption of the Smart Grid, establishing effective communications networks is paramount. The total Smart Grid Communications market is slated to experience tremendous market growth with a projected CAGR of 17% through 2015. The total market size in 2015 is projected to reach almost $1.6 Billion. The market is divided between Wired (with a CAGR of 10%) and Wireless Communications (with a CAGR of 26%). Currently the market size of wired communications is larger but wireless

1

www.zpryme.com | www.smartgridresearch.org

communications will surpass it by 2015 and prove a larger market as more investments are made.

U.S. Smart Grid Communications Network Market Value Forecast 2010 to 2015 | CAGR = 17% | in U.S. millions figure 1, source: Zpryme $1,593 $1,349 $1,164 $978 $735 $846

$1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0

2010

2011

2012

2013

2014

2015

$900 $800 $700

U.S. Smart Grid Communications Network Market Value Forecast Wired and Wireless | 2010 to 2015 | in U.S. millions figure 2, source: Zpryme

$828 $765

$701 $617 $477

$647

$600

$500 $400 $300 $200 $100 $0 2010 $257

$507

$338

$538

$440

$547

2011 2012 Wired (CAGR = 10%)

2013 2014 Wireless (CAGR = 26%)

2015

Zpryme Smart Grid Insights | January 2012

Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

Telecom and the Smart Grid

Current Market Conditions The Smart Grid is beginning to be deployed in multiple locations across the United States, as well as in countries throughout the world. Currently the world is mainly operating through legacy systems utilizing electrical technology that is up to 100 years old in some areas. The utility grid was established to move electricity from the utility company to customers homes or to businesses. It was not intended to allow instantaneous communication from separate smart meters in individualized locations back to the utility company. Over the last 100 years, technology has rapidly advanced to allow more efficient energy production. However, for the Smart Grid to be truly realized, improvements have to be made in many areas, including updating transmission lines, improving energy management systems, and updating the communication systems that the utility companies use. The main choice that utility companies must make in their communications plans is to decide between public and private networks. Utilizing a public network would allow them to take advantage of existing software and can be implemented immediately. However the firm may not be able to customize their platform to meet their specific needs. If the utility chooses to build a platform from scratch it can utilize a private network. However, there are likely to be delays in implementation and technical problems that must be addressed before widespread adoption. Whether the firm chooses to utilize a public or private network, several goals need to be established. First, the

2

www.zpryme.com | www.smartgridresearch.org

security of these systems is of primary importance. Second, the systems must able to handle enormous data demands and be reliable, especially during times of emergency or during natural disasters when people need them the most. Coverage must be available to every energy consumer and be reliable at all times. In addition, the communication system must be able to grow as technology improves and as companies plan for the future, including both upgrading and maintenance. Smart meters are currently operating on 3G technologies, but 4G and 5G are planned for the future. The chosen communication system must be able to handle these upgrades without sacrificing performance or reliability. Finally, the cost of communication platforms must be competitive and cost effective, both in initial capital expenditures and in on-going update and maintenance costs. Utility companies are likely to choose an option that provides high profitability, while fulfilling the other goals for the firm. Currently, public networks are experiencing a higher CAGR at 39% but have a smaller market share at $64 million. Private networks are experiencing a CAGR of 21% and market share of $193 million. Although public networks will experience a larger growth rate, they will not surpass the private networks market share by the year 2015. Thus private networks will continue to dominate the market at $497 million compared to public networks $331 million in 2015.

Zpryme Smart Grid Insights | January 2012

Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

Telecom and the Smart Grid

$600 $500 $400 $300 $200 $100 $0 $64

U.S. Smart Grid Wireless Communications Network Market Value Forecast Public and Private| 2010 to 2015 | in U.S. millions source: Zpryme $497 $401 $356 $295 $237 $193 $145 $101 $192 $246 $331

have been improving the security of their systems and will continue to do so for all of their customers. They currently provide much more robust security measures than available with any private network. 2. Reliability: Public networks also provide excellent coverage. Cellular and cable technologies currently exist that have established communication pathways and lines, connecting every energy user. As developments in the cellular communication platform have evolved, the lapses in coverage between carriers have decreased. However, some places have higher latencies than others, and some even have dropped areas where communication is difficult. Cellular carriers also point out that alliances with utility companies will allow them to further develop the sphere of their service, decreasing uncovered areas. However, before it is adopted widespread, hybrid or other methods may have to be utilized to prevent missed communication and increase reliability. 3. Future Growth: Public networks are currently at a further stage of development than private networks. The communication infrastructure has developed proven software and distribution equipment that is currently in place. Because the technology used in public networks is already developed, renting space on a public network will prevent redundancies where features are developed that currently exist. The technology of public networks will also build on what is already developed, thus allowing public networks to grow at a faster rate than private networks. These systems perform constant upgrades

Zpryme Smart Grid Insights | January 2012

2010

2011

2012

2013

2014

2015

Public (CAGR = 39%)

Private (CAGR = 21%)

Public Networks Public networks will grow at a significantly higher CAGR over time and will likely provide a valuable solution for the utility firm in the future. However, the development of this solution will take time and will not surpass the private network market share by 2015. Public networks provide numerous benefits for the utility company. One of the biggest benefits for the utility company is that they can take advantage of the established status of the communication sphere. This includes security, reliability, availability, and speed, as well as taking advantage of future improvements and developments in the communication technology without improving their own systems. 1. Security: Public networks have been focused on security since its inception. Telecom companies

3

www.zpryme.com | www.smartgridresearch.org Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

Telecom and the Smart Grid

to insure they meet the bandwidth demands of their users. As they have developed the technology, the problems and bugs have been corrected and efficient strategies identified. In fact, they are constantly looking for ways to improve their existing communication product and will continue to create more efficient and updated systems. Because public communication provides for cellular and other communication service, they are also dedicated to the future 4G and 5G systems and can provide a communication platform for the foreseeable future. 4. Cost: The initial capital cost of renting space on a public network is significantly below that of building a private network. Public networks have a much lower initial cost and a much faster return on investment. The price of public networks has also decreased in recent years and will likely decrease further in the future. In 2005, the cost of a single meter per month was approximately $5. Today it has decreased to pennies per unit per month. When considering the maintenance and operational costs involved in a communication system, the price of a public network could be significantly more economical than the alternative in the long-term as well. Private Networks Many companies are also considering building proprietary private networks to meet their communication needs. Currently private networks experience a much higher

4

www.zpryme.com | www.smartgridresearch.org

market share than public networks and will continue to hold this advantage through 2015. Because they would control all parts of the communication platform, the utility company would be able to include only the features that they deem necessary. The utility company could then design a communications system that is specific to their needs, and avoid the expense of unnecessary technologies or capabilities. 1. Security: Because the communications platform would be custom built for the individual needs of the utility company, the security features would be established from its inception. Future communications programs will likely build on existing legacy systems and the security of such systems will continue to be improved over time. 2. Reliability: One key benefit of the private network over a public network is that the infrastructure of the network can insure coverage even during natural disasters or other emergencies. For example, the mesh network framework creates multiple communication pathways that will re-route information if an outage is experienced. It also creates an infrastructure where back-up systems are in place to handle these situations specifically. In addition, public networks are available in most places currently, however remote locations would not be accessible. The utility company would have to extend coverage to these locations. Creating a private network would eliminate these problems and potentially provide a more reliable coverage area.

Zpryme Smart Grid Insights | January 2012

Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

Telecom and the Smart Grid

3. Future Growth: One of the biggest advantages of private networks is that they offer tremendous potential for future growth. In fact, the utility company totally controls the direction and speed of this growth and can customize it in areas that it deems necessary. The utility company is then able to prioritize its growth goals and direct growth into areas that satisfy the overall business goals of the firm. Private networks can be built with increased robustness to meet the increased demands of the utility company in the future. In addition, private networks already experience a decreased latency of 10-100 milliseconds and this amount is able to meet needs of the Smart Grid today and in the foreseeable future. Through building the private network, the company would make a tremendous commitment for future use. By controlling the development of the communication platform, the program will grow with the company and continue to meet its needs. 4. Cost: One key benefit of private networks is that the government may provide a capital offset for creating a private network. This cost would offset revenues that the company incurs. This could potentially reduce tax costs, which could save the company millions of dollars in the long term. This also provides a tremendous savings in the short term. However, lobbying by public communication firms may reduce these benefits in the near future. The main costs of a private network over time are in upgrade and maintenance costs. Updating and maintaining the private network would be performed by the utility companys technicians and

5

www.zpryme.com | www.smartgridresearch.org Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

would be a constant endeavor. The utility would be solely responsible for these improvements and could prove a costly expense in the future. Trends in Communication Platforms Pacific Gas & Electric (PG&E) and Southern California Edison (SCE) have chosen to utilize private networks for their communication needs. Three main firms are the frontrunners in offering private networks for utility companies: Itron, Trilliant, and Sensus. As these, and others, begin to refine their products, they will be able to refine the technological offerings and become more cost competitive. In addition, these companies are able to work in the world market, where many regions do not offer the choice of a public network. Experience in these areas will only improve the private communication networks they offer. Consumers Energy in Michigan chose to utilize a public network through the cellular carrier, SmartSynch, to provide the communications platform for its Smart Grid. SmartSynch agreed to make modifications to its existing service offering to meet the specific needs of the utility firm. One key decision was that the cellular system did not require the huge initial capital investment and could be implemented quickly, since the cellular network is already in place and utilizes all the features that were important to Consumers Energy. Finally, in the United Kingdom, a hybrid communications platform is being adopted to meet the Smart Grid needs. Silver Spring Networks and Cable & Wireless Worldwide are

Zpryme Smart Grid Insights | January 2012

Telecom and the Smart Grid

developing a comprehensive hybrid solution that would prevent any lapses in communication coverage. The goal of the project is to provide a low risk platform that meets the increased security, reliability, and dependability to create a network infrastructure. Although this system is being developed in England, the development of a hybrid system offers advantages of both the private and public network. It is built on existing and cutting edge communications technology and is specific to the unique needs of the utility company. Another unique feature is that it will offer a managed data center and managed data services, adding integration between the communications platform and the IT needs of the utility. If proven successful, the development of this hybrid system may demonstrate an alternative between the private and public network extremes. 2012 Outlook Currently many utility companies are waiting before adopting a communication platform to determine the success of these options. Since utility companies are typically conservative organizations, others are likely to examine the success of each of these enterprises before making any decisions on their own communications platform. Especially since the Smart Grid technology is a new technology and presents a risk in itself, others will likely follow the early adopters of the technology. The practices and choices these utility companies follow will likely be scrutinized and duplicated as more utility firms begin to implement Smart Grid technologies. The market for consumer facing energy management applications, software, and devices will enter a high-growth phase in

6

www.zpryme.com | www.smartgridresearch.org

2012 as utilities seek to leverage the full benefits of the smart grid.

Zpryme Smart Grid Insights | January 2012

Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

Telecom and the Smart Grid

Zpryme Credits

Editor Managing Editor Research Lead Megan Dean Sean Sayers Stefan Trifonov

Disclaimer

These materials and the information contained herein are provided by Zpryme Research & Consulting, LLC and are intended to provide general information on a particular subject or subjects and is not an exhaustive treatment of such subject(s). Accordingly, the information in these materials is not intended to constitute accounting, tax, legal, investment, consulting or other professional advice or services. The information is not intended to be relied upon as the sole basis for any decision which may affect you or your business. Before making any decision or taking any action that might affect your personal finances or business, you should consult a qualified professional adviser. These materials and the information contained herein is provided as is, and Zpryme Research & Consulting, LLC makes no express or implied representations or warranties regarding these materials and the information herein. Without limiting the foregoing, Zpryme Research & Consulting, LLC does not warrant that the materials or information contained herein will be error-free or will meet any particular criteria of performance or quality. Zpryme Research & Consulting, LLC expressly disclaims all implied warranties, including, without limitation, warranties of merchantability, title, fitness for a particular purpose, noninfringement, compatibility, security, and accuracy. Prediction of future events is inherently subject to both known and unknown risks, uncertainties and other factors that may cause actual results to vary materially. Your use of these and the information contained herein is at your own risk and you assume full responsibility and risk of loss resulting from the use thereof. Zpryme Research & Consulting, LLC will not be liable for any special, indirect, incidental, consequential, or punitive damages or any other damages whatsoever, whether in an action of contract, statute, tort (including, without limitation, negligence), or otherwise, relating to the use of these materials and the information contained herein.

www.zpryme.com | www.smartgridresearch.org

Zpryme Smart Grid Insights | January 2012

Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

Telecom and the Smart Grid

www.zpryme.com | www.smartgridresearch.org

Zpryme Smart Grid Insights | January 2012

Copyright 2011 Zpryme Research & Consulting, LLC All rights reserved.

Learn more @ www.zpryme.com | www.smartgridresearch.org Learn more @ www.zpryme.com | www.smartgridresearch.org

Anda mungkin juga menyukai

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- (Smart Grid Market Research) Brazil: The Smart Grid Network, Zpryme Smart Grid Insights, October 2011Dokumen12 halaman(Smart Grid Market Research) Brazil: The Smart Grid Network, Zpryme Smart Grid Insights, October 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) Malaysia: The Smart Grid Has Landed, March 2012Dokumen8 halaman(Smart Grid Market Research) Malaysia: The Smart Grid Has Landed, March 2012Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) IT Systems and The Smart Grid, January 2012Dokumen8 halaman(Smart Grid Market Research) IT Systems and The Smart Grid, January 2012Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) Top 20 Smart Grid Vendors by ARRA Award Total AmountEnergy 2.0: Smart Grid Roadmap, 2012 - 2022, June 2012 by ZprymeDokumen1 halaman(Smart Grid Market Research) Top 20 Smart Grid Vendors by ARRA Award Total AmountEnergy 2.0: Smart Grid Roadmap, 2012 - 2022, June 2012 by ZprymeZpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) Coal Production Cost OutlookDevelopment Costs (Vs. Natural Gas & Renewables) (Part 2 of 3), January 2012Dokumen7 halaman(Smart Grid Market Research) Coal Production Cost OutlookDevelopment Costs (Vs. Natural Gas & Renewables) (Part 2 of 3), January 2012Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) Residential Solar & The Smart Grid, Zpryme Smart Grid Insights, September 2011Dokumen11 halaman(Smart Grid Market Research) Residential Solar & The Smart Grid, Zpryme Smart Grid Insights, September 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) China Electricity Profile, Zpryme Smart Grid Insights, December 2011Dokumen11 halaman(Smart Grid Market Research) China Electricity Profile, Zpryme Smart Grid Insights, December 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) Coal Production Cost Outlook (Part 1 of 3), December 2011Dokumen6 halaman(Smart Grid Market Research) Coal Production Cost Outlook (Part 1 of 3), December 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) India: Smart Grid Legacy, Zpryme Smart Grid Insights, September 2011Dokumen12 halaman(Smart Grid Market Research) India: Smart Grid Legacy, Zpryme Smart Grid Insights, September 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) South Korea: Smart Grid Revolution, Zpryme Smart Grid Insights, July 2011Dokumen12 halaman(Smart Grid Market Research) South Korea: Smart Grid Revolution, Zpryme Smart Grid Insights, July 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) (Part 3 of 3 Part Series) : The U.S. Smart Meter Uprising, Zpryme Smart Grid Insights, August 2011Dokumen8 halaman(Smart Grid Market Research) (Part 3 of 3 Part Series) : The U.S. Smart Meter Uprising, Zpryme Smart Grid Insights, August 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) (Part 2 of 3 Part Series) : The U.S. Smart Meter Uprising, Zpryme Smart Grid Insights, September 2011Dokumen10 halaman(Smart Grid Market Research) (Part 2 of 3 Part Series) : The U.S. Smart Meter Uprising, Zpryme Smart Grid Insights, September 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) (Part 1 of 3 Part Series) : The U.S. Smart Meter Uprising, Zpryme Smart Grid Insights, August 2011Dokumen10 halaman(Smart Grid Market Research) (Part 1 of 3 Part Series) : The U.S. Smart Meter Uprising, Zpryme Smart Grid Insights, August 2011Zpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Market Research) A Closer Look at DSM, Energy Storage and Distributed Generation August 2011 Zpryme Research Smart Grid InsightsDokumen10 halaman(Smart Grid Market Research) A Closer Look at DSM, Energy Storage and Distributed Generation August 2011 Zpryme Research Smart Grid InsightsZpryme Research and ConsultingBelum ada peringkat

- (Electric Vehicle Market Research) Paying at The Pump and EV Adoption Collide - Zpryme Research - July 2011Dokumen6 halaman(Electric Vehicle Market Research) Paying at The Pump and EV Adoption Collide - Zpryme Research - July 2011Zpryme Research and ConsultingBelum ada peringkat

- (Frozen Food Market Research) Frozen Food Insights - Zpryme Research - July 2011Dokumen14 halaman(Frozen Food Market Research) Frozen Food Insights - Zpryme Research - July 2011Zpryme Research and ConsultingBelum ada peringkat

- (Electric Vehicle Market Research) Paying at The Pump and EV Adoption Collide - Zpryme Research - July 2011Dokumen6 halaman(Electric Vehicle Market Research) Paying at The Pump and EV Adoption Collide - Zpryme Research - July 2011Zpryme Research and ConsultingBelum ada peringkat

- Smart Grid Market Research: China and Top Ten Federal Stimulus, Zpryme ReportsDokumen4 halamanSmart Grid Market Research: China and Top Ten Federal Stimulus, Zpryme ReportsZpryme Research and ConsultingBelum ada peringkat

- (Smart Grid Research & Survey) The New Energy Consumer by Zpryme, Sponsored by ItronDokumen49 halaman(Smart Grid Research & Survey) The New Energy Consumer by Zpryme, Sponsored by ItronZpryme Research and ConsultingBelum ada peringkat

- The Electric Vehicle Study 2010 by Zpryme Sponsored by Airbiquity (EV Consumer Survey Included)Dokumen70 halamanThe Electric Vehicle Study 2010 by Zpryme Sponsored by Airbiquity (EV Consumer Survey Included)Zpryme Research and ConsultingBelum ada peringkat

- China: Rise of The Smart Grid (By Zpryme Research, January 2011)Dokumen8 halamanChina: Rise of The Smart Grid (By Zpryme Research, January 2011)Zpryme Research and ConsultingBelum ada peringkat

- Top 10 US Utilities by DSM Investment Zpryme Smart Grid Insights March 2011Dokumen8 halamanTop 10 US Utilities by DSM Investment Zpryme Smart Grid Insights March 2011Zpryme Research and ConsultingBelum ada peringkat

- Smart Grid Appliance Report 2010 by Zpryme Smart Grid Insights (Markets: China, UK, US, Australia, Global)Dokumen31 halamanSmart Grid Appliance Report 2010 by Zpryme Smart Grid Insights (Markets: China, UK, US, Australia, Global)Zpryme Research and ConsultingBelum ada peringkat

- Advanced Smart Meter (AMI) Market Report by Zpryme (Tantalus Systems Corp. Sponsored)Dokumen12 halamanAdvanced Smart Meter (AMI) Market Report by Zpryme (Tantalus Systems Corp. Sponsored)Zpryme Research and ConsultingBelum ada peringkat

- Health Care Trends: Analysis of Real Changes in U.S. Health Care and Health Insurance Costs From 1998 To 2008, ZprymeDokumen21 halamanHealth Care Trends: Analysis of Real Changes in U.S. Health Care and Health Insurance Costs From 1998 To 2008, ZprymeZpryme Research and ConsultingBelum ada peringkat

- Electric Vehicle (V2G) Report 2010 - Smart Grid Insights - Zpryme & ZigBee AllianceDokumen74 halamanElectric Vehicle (V2G) Report 2010 - Smart Grid Insights - Zpryme & ZigBee AllianceZpryme Research and Consulting100% (1)

- Is The Health and Wellness Industry 'Recession Proof'? A Zpryme Market Research and Insights Perspective 2008Dokumen14 halamanIs The Health and Wellness Industry 'Recession Proof'? A Zpryme Market Research and Insights Perspective 2008Zpryme Research and ConsultingBelum ada peringkat

- 89.0 Percent or $152.3 Billion: Learn More BelowDokumen2 halaman89.0 Percent or $152.3 Billion: Learn More BelowZpryme Research and ConsultingBelum ada peringkat

- Chicago Golf Market United States Golf Market 2008 With 2010 To 2014 Projections Data Trends Report ZprymeDokumen2 halamanChicago Golf Market United States Golf Market 2008 With 2010 To 2014 Projections Data Trends Report ZprymeZpryme Research and ConsultingBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- WL 318 PDFDokumen199 halamanWL 318 PDFBeckty Ahmad100% (1)

- Rectifiers and FiltersDokumen68 halamanRectifiers and FiltersMeheli HalderBelum ada peringkat

- 2019 Course CatalogDokumen31 halaman2019 Course CatalogDeepen SharmaBelum ada peringkat

- Canon imageFORMULA DR-X10CDokumen208 halamanCanon imageFORMULA DR-X10CYury KobzarBelum ada peringkat

- A Fossil Hunting Guide To The Tertiary Formations of Qatar, Middle-EastDokumen82 halamanA Fossil Hunting Guide To The Tertiary Formations of Qatar, Middle-EastJacques LeBlanc100% (18)

- Arm BathDokumen18 halamanArm Bathddivyasharma12Belum ada peringkat

- Monster of The Week Tome of Mysteries PlaybooksDokumen10 halamanMonster of The Week Tome of Mysteries PlaybooksHyperLanceite XBelum ada peringkat

- Application of Fertility Capability Classification System in Rice Growing Soils of Damodar Command Area, West Bengal, IndiaDokumen9 halamanApplication of Fertility Capability Classification System in Rice Growing Soils of Damodar Command Area, West Bengal, IndiaDr. Ranjan BeraBelum ada peringkat

- Juan Martin Garcia System Dynamics ExercisesDokumen294 halamanJuan Martin Garcia System Dynamics ExercisesxumucleBelum ada peringkat

- Young Women's Sexuality in Perrault and CarterDokumen4 halamanYoung Women's Sexuality in Perrault and CarterOuki MilestoneBelum ada peringkat

- 7890 Parts-Guide APDokumen4 halaman7890 Parts-Guide APZia HaqBelum ada peringkat

- Theoretical and Actual CombustionDokumen14 halamanTheoretical and Actual CombustionErma Sulistyo R100% (1)

- 9600 DocumentDokumen174 halaman9600 Documentthom38% (13)

- Feline DermatologyDokumen55 halamanFeline DermatologySilviuBelum ada peringkat

- Compare Blocks - ResultsDokumen19 halamanCompare Blocks - ResultsBramantika Aji PriambodoBelum ada peringkat

- Phenomenological of in Church and TV WorshipDokumen18 halamanPhenomenological of in Church and TV WorshipCindy TirtaBelum ada peringkat

- Aleister Crowley and the SiriansDokumen4 halamanAleister Crowley and the SiriansJCMBelum ada peringkat

- IS 4991 (1968) - Criteria For Blast Resistant Design of Structures For Explosions Above Ground-TableDokumen1 halamanIS 4991 (1968) - Criteria For Blast Resistant Design of Structures For Explosions Above Ground-TableRenieBelum ada peringkat

- Ricoh 4055 PDFDokumen1.280 halamanRicoh 4055 PDFPham Nguyen Hoang Minh100% (1)

- Chapter 16 - Energy Transfers: I) Answer The FollowingDokumen3 halamanChapter 16 - Energy Transfers: I) Answer The FollowingPauline Kezia P Gr 6 B1Belum ada peringkat

- The Templist Scroll by :dr. Lawiy-Zodok (C) (R) TMDokumen144 halamanThe Templist Scroll by :dr. Lawiy-Zodok (C) (R) TM:Lawiy-Zodok:Shamu:-El100% (5)

- Air Arms S400 EXPDokumen3 halamanAir Arms S400 EXPapi-3695814Belum ada peringkat

- Lightwave Maya 3D TutorialsDokumen8 halamanLightwave Maya 3D TutorialsrandfranBelum ada peringkat

- Idioms & Phrases Till CGL T1 2016Dokumen25 halamanIdioms & Phrases Till CGL T1 2016mannar.mani.2000100% (1)

- RPG-7 Rocket LauncherDokumen3 halamanRPG-7 Rocket Launchersaledin1100% (3)

- Convocation ProgramDokumen125 halamanConvocation ProgramZirak TayebBelum ada peringkat

- OpenROV Digital I/O and Analog Channels GuideDokumen8 halamanOpenROV Digital I/O and Analog Channels GuidehbaocrBelum ada peringkat

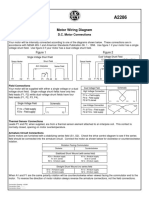

- Motor Wiring Diagram: D.C. Motor ConnectionsDokumen1 halamanMotor Wiring Diagram: D.C. Motor Connectionsczds6594Belum ada peringkat

- Diia Specification: Dali Part 252 - Energy ReportingDokumen15 halamanDiia Specification: Dali Part 252 - Energy Reportingtufta tuftaBelum ada peringkat

- Sradham ChecklistDokumen9 halamanSradham ChecklistpswaminathanBelum ada peringkat