LOP Calculation

Diunggah oleh

pradeeprajendran1988Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

LOP Calculation

Diunggah oleh

pradeeprajendran1988Hak Cipta:

Format Tersedia

Ist step Calculate gross profit ratio:As the starting point of this procedure you have to determine the

value of gross profit because loss of profit is easy to calculate by multiplying Gross profit with short of sale in that disturbance period . Net profit (+) Insured standing Charges of last year ------------------------------------Gross profit of last year ------------------------------------Gross profit ratio = Gross profit / sale of last year X 100 xxxx xxxx xxxx

2nd step Calculate shortage in sale due to loss of fire Actual sale of same period of loss xxxx

Add any increase in the end of sale (+) xxxx -----------------------------------------------xxxxx Less actual sale in dislocation period (-) xxxx -------------------------------------------------Shortage of sale in dislocation period xxxx

==================================

3rd step

Calculation of loss of profit

Loss of profit = shortage of sale X G.P. rate / 100

4th Step

Total amount for claim of loss of profit

Loss of gross profit Add increase in cost of working (+) --------------------------------------------xxxx Less saving in standing charges --------------------------------------------Amount of claim xxxx

xxxx xxxx

===================================

5th step

Apply average clause

Amount of claim = policy value / amount to be insured

Important notes

1. We will use of only less rate from following rates for calculating correct amount of loss pf profit Net profit + Insured standing charges of last accounting year -------------------------------------------------------------------------- X 100 Sale for the last accounting year

Or Policy value / sale of 12 months immediately proceeding fire as adjusted for trend .

2. The Indemnity period or dislocation period which will small, that period will be fixed for calculation of claim . 3. We will calculate loss of sale on the base of future trend of sale. 4. Insured standing charges means all expenses which are mentioned in the policy of loss of profit. Businessman wants to get these expenses in the case of mishappening. We can make its list

Traveling expenses Rent, rate and taxes not related with profit of business Advertising Interest on debentures and loans. Auditors fee Salaries of permanent staff Directors fee Salaries of permanent staff Wages of skilled workers All not described expenses must not more than 5% of described standing expenses .

Explanation with example

From the following information, find out the claim under loss of profit policy :2007 net profit for the year $ 10000 2007- Standing charges insured $ 6000 $ sales for 2007 $ 160000 Date of fire 1.1.2008 Period of dislocation 3 months Sales from 1.12007 to 31.3.2007 $ 54000 Sales from 1.1.2008 to 31.3.2008 $ 19400 Indemnity period 6 months Policy subject to average clause $ 11000 Trend in annual sales 10% increase Solution

Ist step Calculation of gross profit ratio Net profit + Insured standing charges of last yea ----------------------------------------------------------- X 100 Sale of last year

10000+6000 ---------------------- X 100 160000 = 10% 2nd step Shortage of sale Last years sale from 1.12007 to 31.3.2007 $ 54000 Add 10% for upward trend $ 5400--------------------------------------------------$ 59400 Less actual sale during dislocation period $ 19400----------------------------------------------------Shortage of sale $ 40000=====================================

3rd step Calculate of loss of profit Loss of sale X G.P. rate /100 40000 X 10/100 = 4000 4th step Total amount for claim of loss of profit Loss of gross profit 4000 Add increase in cost of working (+) nil Less saving in standing charges nil Amount of claim $4000 5th step Average clause

Since the policy is subject to average clause, it is necessary to find out whether expected profit of the current year was fully insured or not . Expected sale for current year Last year sale $ 160000 Add :Increase in current year 10% = $ 16000-------------------------------------------Total sale of current year = 176000--------------------------------------------Profit rate 10% The profit of current year = 176000 X 10% = $17600 But we take the policy of $ 11000 This is a case of under insurance. It means insurance company pays $ 110 of every $ 176 loss Claim = insurance policy / insurable profit X profit lost = 11000 / 17600 X 4000 = $ 2500 So , amount of claim would be $ 2500

Anda mungkin juga menyukai

- Rich Dad Poor DadDokumen26 halamanRich Dad Poor Dadchaand33100% (17)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Dari EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Penilaian: 3.5 dari 5 bintang3.5/5 (17)

- T-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury BillsDokumen5 halamanT-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury Billsbb2Belum ada peringkat

- Managerial Accounting CH 5Dokumen89 halamanManagerial Accounting CH 5ErinPeterson71% (17)

- CH 5 - 1Dokumen25 halamanCH 5 - 1api-251535767Belum ada peringkat

- Chapter-05 CVP RelationshipDokumen29 halamanChapter-05 CVP RelationshipShahinul Kabir100% (3)

- Tax 2 - Midterm ExamDokumen2 halamanTax 2 - Midterm ExamMichelle MatubisBelum ada peringkat

- Oil & Gas ExperienceDokumen7 halamanOil & Gas ExperienceEdmondBelum ada peringkat

- HW 6-19Dokumen9 halamanHW 6-19tgawri100% (2)

- Comparative Analysis of Public & Private Bank (Icici &sbi) - 1Dokumen108 halamanComparative Analysis of Public & Private Bank (Icici &sbi) - 1Sami Zama100% (1)

- CAR and EAR Brief WriteupDokumen17 halamanCAR and EAR Brief Writeuppradeeprajendran1988Belum ada peringkat

- Evaluate and Authorize Payment RequestsDokumen15 halamanEvaluate and Authorize Payment RequestsMagarsaa Hirphaa100% (3)

- CHAPTER 8 AnswerDokumen14 halamanCHAPTER 8 AnswerKenncyBelum ada peringkat

- Definition and Explanation of Contribution MarginDokumen2 halamanDefinition and Explanation of Contribution MarginFaizan ChBelum ada peringkat

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyDokumen5 halamanTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- Understand CVP Analysis and Break-Even PointDokumen18 halamanUnderstand CVP Analysis and Break-Even PointPeter ParkBelum ada peringkat

- Profit Planning and CVP AnalysisDokumen33 halamanProfit Planning and CVP AnalysisVanessa Claire MontalbanBelum ada peringkat

- Review ch.6Dokumen15 halamanReview ch.6LâmViên100% (9)

- TCC Midc Company ListDokumen4 halamanTCC Midc Company ListAbhishek SinghBelum ada peringkat

- Papers On The Philippine Financial Crisis and Its Roots - A.Lichauco, J. Sison & Edberto Malvar VillegasDokumen28 halamanPapers On The Philippine Financial Crisis and Its Roots - A.Lichauco, J. Sison & Edberto Malvar VillegasBert M Drona100% (1)

- CAR - Munich ReDokumen16 halamanCAR - Munich ReArmando RussellBelum ada peringkat

- Healthcare Industry in India PESTEL AnalysisDokumen3 halamanHealthcare Industry in India PESTEL AnalysisAASHNA SOOD 1827228Belum ada peringkat

- Tybcom NotesDokumen182 halamanTybcom NotesAnant DivekarBelum ada peringkat

- S.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingDokumen34 halamanS.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingAnant DivekarBelum ada peringkat

- CVP Solved QAsDokumen272 halamanCVP Solved QAsKhalid Mahmood63% (8)

- Exercise 6-5 (20 Minutes) : Per Unit Percent of SalesDokumen11 halamanExercise 6-5 (20 Minutes) : Per Unit Percent of SalesPrasoon SriBelum ada peringkat

- Question 3 - CVP AnalysisDokumen13 halamanQuestion 3 - CVP AnalysisMsKhan0078100% (1)

- Installment Sales - ReportDokumen50 halamanInstallment Sales - ReportDanix Acedera100% (1)

- 516 HW327 SolDokumen5 halaman516 HW327 SolJimmy PrehnBelum ada peringkat

- AS5Dokumen13 halamanAS5Andrea RobinsonBelum ada peringkat

- PR Week 5 CVPDokumen3 halamanPR Week 5 CVPAyhuBelum ada peringkat

- Marginal CostingDokumen2 halamanMarginal Costingrupeshdahake8586Belum ada peringkat

- Module 2 HWDokumen5 halamanModule 2 HWdrgBelum ada peringkat

- AnswerDokumen7 halamanAnswerNa HàBelum ada peringkat

- Akuntansi Sektor PublikDokumen90 halamanAkuntansi Sektor PublikFicky ZulandoBelum ada peringkat

- Syllabus: Unit 4: Unit 2 Cost Volume Profit AnalysisDokumen20 halamanSyllabus: Unit 4: Unit 2 Cost Volume Profit AnalysisKetan GuptaBelum ada peringkat

- 1 ++Marginal+CostingDokumen71 halaman1 ++Marginal+CostingB GANAPATHYBelum ada peringkat

- Adam Bataineh Ch5Dokumen10 halamanAdam Bataineh Ch5Omar AssafBelum ada peringkat

- Assumptions of CVP AnalysisDokumen10 halamanAssumptions of CVP AnalysisJonathan BausingBelum ada peringkat

- CVP Solved QAsDokumen259 halamanCVP Solved QAsErika delos SantosBelum ada peringkat

- Tax XXXXDokumen60 halamanTax XXXXGerald Bowe ResuelloBelum ada peringkat

- Final Solution Winter 2017Dokumen27 halamanFinal Solution Winter 2017sunkenBelum ada peringkat

- Cost-Volume-Profit Relationships: Solutions To QuestionsDokumen79 halamanCost-Volume-Profit Relationships: Solutions To QuestionsMursalin HossainBelum ada peringkat

- Intermediate Financial Accounting II 1 1Dokumen146 halamanIntermediate Financial Accounting II 1 1natinaelbahiru74Belum ada peringkat

- CVP 2203workshopDokumen40 halamanCVP 2203workshopAyan ShahBelum ada peringkat

- Hilton CH 7 Select SolutionsDokumen25 halamanHilton CH 7 Select SolutionsHadeeqa Tul Fatima100% (1)

- Cost and Managerial Accounting: Assignment 2Dokumen5 halamanCost and Managerial Accounting: Assignment 2haseeb shaikhBelum ada peringkat

- Chapter 5 Cost Volume Profit RelationshiDokumen80 halamanChapter 5 Cost Volume Profit RelationshiBasit RazaBelum ada peringkat

- Assignment On Management AccountingDokumen17 halamanAssignment On Management Accountingbaburangpur100% (2)

- MCIT, IAET and GIT: Key Taxation ConceptsDokumen34 halamanMCIT, IAET and GIT: Key Taxation Conceptssha marananBelum ada peringkat

- 03 NotesDokumen5 halaman03 NotesMahendra JarwalBelum ada peringkat

- Control Administrative Selling Distribution Overhead CostsDokumen17 halamanControl Administrative Selling Distribution Overhead CostsBhavik AmbaniBelum ada peringkat

- Robinson Lawn Chair CompanyDokumen3 halamanRobinson Lawn Chair CompanymmmmmmmmmmmmmmmBelum ada peringkat

- Assignment On Management AccountingDokumen17 halamanAssignment On Management AccountingMarysun Tlengr100% (2)

- COMLAW TAX Atty GuideDokumen6 halamanCOMLAW TAX Atty GuideMarco Alejandro IbayBelum ada peringkat

- Marginal Costing 2Dokumen12 halamanMarginal Costing 2Prasun NaskarBelum ada peringkat

- Lecture-11 Relevant Costing LectureDokumen6 halamanLecture-11 Relevant Costing LectureNazmul-Hassan Sumon0% (2)

- Aprelim - Purely Business IncomeDokumen37 halamanAprelim - Purely Business IncomeAshley VasquezBelum ada peringkat

- Bill French Accountant: Case StudyDokumen4 halamanBill French Accountant: Case StudyYash Raj SinghBelum ada peringkat

- CH 5 - 3Dokumen24 halamanCH 5 - 3api-251535767Belum ada peringkat

- Insurance ClaimDokumen7 halamanInsurance ClaimNikhil NagendraBelum ada peringkat

- Financial Accounting 1 Unit 6Dokumen27 halamanFinancial Accounting 1 Unit 6chuchuBelum ada peringkat

- Decision Regarding Sales Force Size-IIDokumen17 halamanDecision Regarding Sales Force Size-IIShivendu SinghBelum ada peringkat

- Introduction To Managerial Accounting Canadian Canadian 4Th Edition Brewer Solutions Manual Full Chapter PDFDokumen68 halamanIntroduction To Managerial Accounting Canadian Canadian 4Th Edition Brewer Solutions Manual Full Chapter PDFotisfarrerfjh2100% (7)

- Module 1 - Installment SalesDokumen9 halamanModule 1 - Installment SalesCarlos Miguel TorresBelum ada peringkat

- Assignment 3 ACT502Dokumen6 halamanAssignment 3 ACT502Mahdi KhanBelum ada peringkat

- Business MathematicsDokumen68 halamanBusiness MathematicsCrizylen Mae LahoylahoyBelum ada peringkat

- Introduction To Managerial Accounting Canadian Canadian 4th Edition Brewer Solutions ManualDokumen72 halamanIntroduction To Managerial Accounting Canadian Canadian 4th Edition Brewer Solutions Manualcarlhawkinsjgwzqxabyt100% (23)

- InsuranceDokumen15 halamanInsuranceCharu AroraBelum ada peringkat

- Barings Bank Collapse Due to One TraderDokumen15 halamanBarings Bank Collapse Due to One TraderRamya MattaBelum ada peringkat

- New Microsoft Office Excel 2007 WorkbookDokumen1 halamanNew Microsoft Office Excel 2007 WorkbookRahul BagraitBelum ada peringkat

- PRM vs. FRM - Why I Chose PRMDokumen5 halamanPRM vs. FRM - Why I Chose PRMpradeeprajendran1988Belum ada peringkat

- AD 1-11 OvertimeDokumen6 halamanAD 1-11 Overtimepradeeprajendran1988Belum ada peringkat

- 1.over View of Banking OperationsDokumen27 halaman1.over View of Banking Operationspradeeprajendran1988Belum ada peringkat

- Money Market InstrumentsDokumen22 halamanMoney Market Instrumentspradeeprajendran1988Belum ada peringkat

- 1.need For BKG OpsDokumen19 halaman1.need For BKG Opspradeeprajendran1988Belum ada peringkat

- ICICI PRU OverviewDokumen31 halamanICICI PRU Overviewpradeeprajendran1988Belum ada peringkat

- Construction Work Schedule For Boundary WallDokumen1 halamanConstruction Work Schedule For Boundary WallBaburam ChaudharyBelum ada peringkat

- Amazon's Rise from Online Bookseller to Global Retail GiantDokumen2 halamanAmazon's Rise from Online Bookseller to Global Retail GiantJuliana MorenoBelum ada peringkat

- Setsco Training PDFDokumen12 halamanSetsco Training PDFJeganeswaranBelum ada peringkat

- 2011 - PSEP 01 Main Report PDFDokumen204 halaman2011 - PSEP 01 Main Report PDFNaveed ChandioBelum ada peringkat

- Prime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutiveDokumen3 halamanPrime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutivesayalikBelum ada peringkat

- Decentralization challenges and solutionsDokumen10 halamanDecentralization challenges and solutionsAvinash VenkatBelum ada peringkat

- Deed of Sale 2Dokumen6 halamanDeed of Sale 2Edgar Frances VillamorBelum ada peringkat

- Portfolio Management - Chapter 7Dokumen85 halamanPortfolio Management - Chapter 7Dr Rushen SinghBelum ada peringkat

- Income Tax Calculator 2018-2019Dokumen1 halamanIncome Tax Calculator 2018-2019Muhammad Hanif SuchwaniBelum ada peringkat

- 1 Fmom - Basic Supporting DocumentDokumen50 halaman1 Fmom - Basic Supporting DocumentArnold BaladjayBelum ada peringkat

- Full Download Fundamentals of Management Seventh Canadian Edition Canadian 7th Edition Robbins Test BankDokumen36 halamanFull Download Fundamentals of Management Seventh Canadian Edition Canadian 7th Edition Robbins Test Bankbloomaryonrush2qp6100% (38)

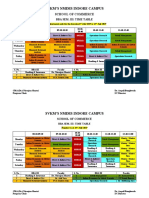

- Time-Table - BBA 3rd SemesterDokumen2 halamanTime-Table - BBA 3rd SemesterSunny GoyalBelum ada peringkat

- House Share Agreement Resident OwnerDokumen2 halamanHouse Share Agreement Resident Ownerburn dont freeze0% (1)

- Sales and Purchases 2021-22Dokumen15 halamanSales and Purchases 2021-22Vamsi ShettyBelum ada peringkat

- Iraqi Dinar - US and Iraq Reached On Agreement To IQD RV - Iraqi Dinar News Today 2024Dokumen2 halamanIraqi Dinar - US and Iraq Reached On Agreement To IQD RV - Iraqi Dinar News Today 2024Muhammad ZikriBelum ada peringkat

- A Synopsis Submitted in Partial Fulfilment: Road NetworksDokumen7 halamanA Synopsis Submitted in Partial Fulfilment: Road Networksmunish747Belum ada peringkat

- Local Business EnvironmentDokumen3 halamanLocal Business EnvironmentJayMoralesBelum ada peringkat

- Steel CH 1Dokumen34 halamanSteel CH 1daniel workuBelum ada peringkat

- More Unanswered QuestionsDokumen8 halamanMore Unanswered QuestionspermaculturistBelum ada peringkat

- The Value of Money The Value of Labor Power and The Marxian Transformation Problem Foley 1982Dokumen12 halamanThe Value of Money The Value of Labor Power and The Marxian Transformation Problem Foley 1982Espinete1984Belum ada peringkat

- Solar Crimp ToolsDokumen4 halamanSolar Crimp ToolsCase SalemiBelum ada peringkat

- US Internal Revenue Service: p1438Dokumen518 halamanUS Internal Revenue Service: p1438IRSBelum ada peringkat