Dof Local Assessment Regulation 1

Diunggah oleh

Vanny Joyce BaluyutDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Dof Local Assessment Regulation 1

Diunggah oleh

Vanny Joyce BaluyutHak Cipta:

Format Tersedia

ORDINANCE NO.

501 DOF LOCAL ASSESSMENT REGULATION 1-92 By authority of Section 201 of the Local Government Code, the Department of Finance issued Local Assessment Regulation No. 1-92 governing the conduct of general revision of real property assessments pursuant to Section 201 and 219 of R.A. 7160. Section 201. Appraisal of Real Property All real property, whether taxable or exempt, shall be appraised at the current and fair market value prevailing in the locality where the property is situated. The Department of Finance shall promulgate the necessary rules and regulations for classification, appraisal and assessment of real property pursuant to the provisions of this code. (Art. 292, IRR) Fair Market Value is the price at which a property may be sold by a seller who is not compelled to sell and bought by the buyer who is not compelled to buy.

Section 219. General Revisions of Assessment and Property Classification. - The provincial, city or municipal assessor shall undertake a general revision of real property assessments within (2) years and after the effectivity of this Code and every three (3) years thereafter. (Art. 310, IRR) Therefore: - A general revision of real property assessment is required by law every (3) years to make sure and in order that real properties are assessed at their current and fair market values. Section 218. Assessment Levels. - The assessment levels to be applied to the fair market value of real property to determine its assessed value shall be fixed by ordinances of sangguniang panlalawigan, sangguniang panlungsod or sangguniang bayan of municipality within the Metropolitan Manila Area, at the rates not exceeding the following: On Land: CLASS Residential Agricultural Commercial Industrial Mineral Timberland ASSESSMENT LEVELS 20% 40% 50% 50% 50% 20%

ORDINANCE NO. 501 AN ORDINANCE AMENDING SECTION 2A. 21 (a) (1) OF ORDINANCE NO. 397 OTHERWISE KNOWN AS REVENUE CODE OF PUERTO PRINCESA CITY OF 2008.

Section 1. Section 2A. 21. (a) (1) of Ordinance 397 is hereby amended to read as follows:

Section 2A. 2. 1. Assessment levels (a) The assessment levels to be applied to the fair market value of real property to determine its assessed value shall be as follows: (1) On Lands Class Residential Agriculture Commercial Industrial Mineral Timberland Assessment Levels 20% 15% 40% 40% 20% 20%

Section 2. Applicable Fair Market Values The schedule of fair market values as provided under Ordinance no. 56, herein appended as Annex A and made part and parcel of this Ordinance is hereby adopted for purposes of implementation of this Ordinance.

COMPARATIVE ASSESSMENT LEVELS On Land: CLASS LGC ( A. L. ) 20% 40% 50% 50% 50% 20% ORD. 56 (A. L.) 10% 10% 16.5% 16.5% 20% 15% ORD. 397 (A.L.) 10% 10% 20% 20% 20% 20% ORD. 501 (A.L.) 20% 15% 40% 40% 20% 20% % OF INCREASE (A.L.) 100 50 100 100 0 0

Residential Agricultural Commercial Industrial Mineral Timberland

Anda mungkin juga menyukai

- DOTR Memorandum Circular 2016 020-2016Dokumen12 halamanDOTR Memorandum Circular 2016 020-2016Anonymous dtceNuyIFIBelum ada peringkat

- Makati City Revenue CodeDokumen25 halamanMakati City Revenue CodeJuan Dela CruzBelum ada peringkat

- Write - Off Sample CasesDokumen16 halamanWrite - Off Sample CasesLiDdy Cebrero BelenBelum ada peringkat

- LRA Circular No. 11-2002 - Schedule of Fess of The LRADokumen16 halamanLRA Circular No. 11-2002 - Schedule of Fess of The LRAMelvin BanzonBelum ada peringkat

- Batangas City Revenue Code of 2009Dokumen168 halamanBatangas City Revenue Code of 2009jamie67% (3)

- Sec Memo Circular No.6 Series of 2008 Section 3Dokumen2 halamanSec Memo Circular No.6 Series of 2008 Section 3orlyBelum ada peringkat

- Affidavit of Release, Waiver, and Quitclaim (Marcasa)Dokumen1 halamanAffidavit of Release, Waiver, and Quitclaim (Marcasa)Dax MonteclarBelum ada peringkat

- Affidavit LtoDokumen1 halamanAffidavit LtoChristian Rivera100% (1)

- Sec Reportorial RequirementsDokumen2 halamanSec Reportorial RequirementsAnonymous qDb8S3koEBelum ada peringkat

- 2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFDokumen191 halaman2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFRamon PamosoBelum ada peringkat

- Immigration Memorandum Circular No. SBM 2014-006Dokumen4 halamanImmigration Memorandum Circular No. SBM 2014-006Leo VenezuelaBelum ada peringkat

- Rmo 32-01Dokumen5 halamanRmo 32-01matinikkiBelum ada peringkat

- Final Demolition OrderDokumen2 halamanFinal Demolition OrderKriziaItaoBelum ada peringkat

- 83 2015Dokumen8 halaman83 2015Jerik Solas100% (1)

- BOI Citizen's CharterDokumen32 halamanBOI Citizen's CharterPam MarceloBelum ada peringkat

- Application For Provisional Authority Before The National Telecommunications CommissionDokumen6 halamanApplication For Provisional Authority Before The National Telecommunications CommissionManang Ven TioBelum ada peringkat

- Petition For Dropping LTFRBDokumen3 halamanPetition For Dropping LTFRBMegan Camille SanchezBelum ada peringkat

- Administrator Inventory of EstateDokumen1 halamanAdministrator Inventory of EstateManny Sandicho100% (1)

- BIR Accredited Agent Banks - RDO 25ADokumen3 halamanBIR Accredited Agent Banks - RDO 25AChinky De Los ReyesBelum ada peringkat

- Affidavit SpaDokumen4 halamanAffidavit SpadoloresBelum ada peringkat

- Administer PropertyDokumen1 halamanAdminister PropertyHannahQuilangBelum ada peringkat

- Decision No. 2018-294 DTD March 15 2018 PDFDokumen6 halamanDecision No. 2018-294 DTD March 15 2018 PDFAnj EboraBelum ada peringkat

- Burgos Pangasinan Revenue CodeDokumen73 halamanBurgos Pangasinan Revenue Coderichard raquelBelum ada peringkat

- 2005 Davao City Revenue CodeDokumen289 halaman2005 Davao City Revenue CodeJocel Isidro Dilag75% (4)

- Commissioner of Internal Revenue v. First Global Byo Corp., C.T.A. EB Case No. 2168 (C.T.A. Case Nos. 9172, 9212 & 9242), (July 1, 2021)Dokumen16 halamanCommissioner of Internal Revenue v. First Global Byo Corp., C.T.A. EB Case No. 2168 (C.T.A. Case Nos. 9172, 9212 & 9242), (July 1, 2021)Kriszan ManiponBelum ada peringkat

- October 2017 BIR APPOINTMENTSDokumen24 halamanOctober 2017 BIR APPOINTMENTSAntoinette SmithBelum ada peringkat

- Notice of CessationDokumen3 halamanNotice of CessationAure CarilloBelum ada peringkat

- Bautista BTF Elcac Opcen EoDokumen2 halamanBautista BTF Elcac Opcen EojomarBelum ada peringkat

- Sworn Statement For Application of Permit To Use Loose Leaf Books of AccountsDokumen1 halamanSworn Statement For Application of Permit To Use Loose Leaf Books of AccountsTesston Bullion100% (1)

- UntitledDokumen2 halamanUntitledRhomirBelum ada peringkat

- Pasig Revenue Code PDFDokumen295 halamanPasig Revenue Code PDFJela Oasin33% (9)

- COA Resolution Number 2015-031Dokumen3 halamanCOA Resolution Number 2015-031gutierrez.dorie100% (7)

- TEMPLATE Certificate of No Pending CaseDokumen1 halamanTEMPLATE Certificate of No Pending CaseJazzera MustaphaBelum ada peringkat

- C. 7-9Dokumen14 halamanC. 7-9Christine Joy PrestozaBelum ada peringkat

- 20005rmo 10-05Dokumen16 halaman20005rmo 10-05Cheng OlayvarBelum ada peringkat

- Local Finance Circular No 1-05 PetroleumDokumen1 halamanLocal Finance Circular No 1-05 PetroleumMaximo CaliguiranBelum ada peringkat

- Secretary'S Certificate: Republic of The Philippines) City of Baguio .) S.SDokumen1 halamanSecretary'S Certificate: Republic of The Philippines) City of Baguio .) S.ScaicaiiBelum ada peringkat

- Cancellation LetterDokumen1 halamanCancellation LetterChristine CanoyBelum ada peringkat

- Annex C RMO 33-2019-Estate Tax AmnestyDokumen1 halamanAnnex C RMO 33-2019-Estate Tax AmnestyKate Hazzle JandaBelum ada peringkat

- Akbayan Et Al V Marcos - DQ PetitionDokumen13 halamanAkbayan Et Al V Marcos - DQ PetitionVERA FilesBelum ada peringkat

- Annex - A - Ptu LooseleafDokumen1 halamanAnnex - A - Ptu LooseleafPaola VirataBelum ada peringkat

- LMP Board ResoDokumen2 halamanLMP Board ResoDilg SurallahBelum ada peringkat

- 1702 NewDokumen11 halaman1702 NewDIVINE WAGTINGANBelum ada peringkat

- Quality Accreditation ChecklistDokumen1 halamanQuality Accreditation ChecklistJohn Paulo Q. Partacalao100% (1)

- Secretary's Certificate DBPDokumen1 halamanSecretary's Certificate DBPJomari GabatoBelum ada peringkat

- Bir RulingDokumen4 halamanBir Rulingdranreb ursabiaBelum ada peringkat

- Vacancies and SuccessionDokumen52 halamanVacancies and SuccessionKristel Yeen100% (1)

- Affidavit of LossDokumen2 halamanAffidavit of LossAviLopezBelum ada peringkat

- Petron ContractDokumen3 halamanPetron ContractMichael Garcia100% (1)

- Revocation of Special Power of AttorneyDokumen2 halamanRevocation of Special Power of AttorneyDani Eseque100% (1)

- ORD NO.111S.2007 ENVIRONMENTAL AND SANITARY FEES New RatesDokumen15 halamanORD NO.111S.2007 ENVIRONMENTAL AND SANITARY FEES New RatesJulie Ann EnadBelum ada peringkat

- Affidavit of Discrepancy SampleDokumen2 halamanAffidavit of Discrepancy SampleEstela Omagtang100% (1)

- Monthly Report FebDokumen3 halamanMonthly Report Febmanzanillamarielle21Belum ada peringkat

- Alejandro Ty v. Hon. Trampe & Municpal Treasurer of PasigDokumen7 halamanAlejandro Ty v. Hon. Trampe & Municpal Treasurer of PasigL.A. ManlangitBelum ada peringkat

- Real Property Assessment &taxation - Engr NonatoDokumen54 halamanReal Property Assessment &taxation - Engr NonatoBrenda Olshopee100% (3)

- REM1 Hand OutDokumen42 halamanREM1 Hand OutFrancis LBelum ada peringkat

- REAL PROPERTY TAXATION BOOK II Title II FINALDokumen13 halamanREAL PROPERTY TAXATION BOOK II Title II FINALNeil Mervyn LisondraBelum ada peringkat

- LTOM Updated BOOK 1Dokumen55 halamanLTOM Updated BOOK 1Angelynne N. Nievera88% (8)

- Ord, 41-01 Fair Market Values - TaguigDokumen32 halamanOrd, 41-01 Fair Market Values - TaguigAldrinmarkquintana50% (4)

- SMV Updating and General Revision and General Revision of Real Property AssessmentsDokumen27 halamanSMV Updating and General Revision and General Revision of Real Property Assessmentseva t. abrasaldo100% (1)

- Youth Amba 2014 Application Form FinalDokumen2 halamanYouth Amba 2014 Application Form FinalVanny Joyce BaluyutBelum ada peringkat

- CADTDokumen24 halamanCADTVanny Joyce Baluyut100% (1)

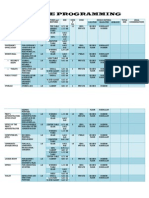

- Space ProgrammingDokumen4 halamanSpace ProgrammingVanny Joyce Baluyut0% (1)

- Insular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Dokumen8 halamanInsular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Vanny Joyce BaluyutBelum ada peringkat

- 2143 4646 1 PBDokumen19 halaman2143 4646 1 PBjayrenzo26Belum ada peringkat

- RA 7277 - Magna Carta of Disabled PersonsDokumen18 halamanRA 7277 - Magna Carta of Disabled PersonsVanny Joyce Baluyut100% (3)

- Chainsaw ActDokumen12 halamanChainsaw ActolofuzyatotzBelum ada peringkat

- G.R. No. 92492 June 17, 1993 - Thelma Vda. de Canilang v. Court of Appeals, Et Al.Dokumen11 halamanG.R. No. 92492 June 17, 1993 - Thelma Vda. de Canilang v. Court of Appeals, Et Al.Vanny Joyce BaluyutBelum ada peringkat

- G.R. No. 47593 September 13, 1941 - The Insular Life Assurance Co. v. Serafin D. Feliciano, Et Al. - 073 Phil 201Dokumen14 halamanG.R. No. 47593 September 13, 1941 - The Insular Life Assurance Co. v. Serafin D. Feliciano, Et Al. - 073 Phil 201Vanny Joyce BaluyutBelum ada peringkat

- UST GN 2011 Criminal Law ProperDokumen262 halamanUST GN 2011 Criminal Law ProperLariza AidieBelum ada peringkat

- Bill of Rights Reviewer FullDokumen31 halamanBill of Rights Reviewer Fullroansalanga100% (22)

- The Wake of Typhoon YolandaDokumen2 halamanThe Wake of Typhoon YolandaVanny Joyce BaluyutBelum ada peringkat

- Balanced Scorecard TemplateDokumen3 halamanBalanced Scorecard TemplateVanny Joyce BaluyutBelum ada peringkat

- G.R. No. 131622. November 27, 1998 Medel, Medel and Franco vs. Court of Appeals, Spouses Gonzales - 299 SCRA 481Dokumen8 halamanG.R. No. 131622. November 27, 1998 Medel, Medel and Franco vs. Court of Appeals, Spouses Gonzales - 299 SCRA 481Vanny Joyce BaluyutBelum ada peringkat

- Ordinance No. 506: An Ordinance Providing Guidelines For The Implementation of Ordinance No. 501Dokumen10 halamanOrdinance No. 506: An Ordinance Providing Guidelines For The Implementation of Ordinance No. 501Vanny Joyce BaluyutBelum ada peringkat

- Cases of Insurable InterestDokumen10 halamanCases of Insurable InterestVanny Joyce BaluyutBelum ada peringkat

- Different Economic SystemsDokumen24 halamanDifferent Economic SystemsVanny Joyce BaluyutBelum ada peringkat

- Cases of Insurable InterestDokumen10 halamanCases of Insurable InterestVanny Joyce BaluyutBelum ada peringkat

- G.R. No. 171035 - William Ong Genato v. Benjamin Bayhon, Et Al.Dokumen9 halamanG.R. No. 171035 - William Ong Genato v. Benjamin Bayhon, Et Al.Vanny Joyce BaluyutBelum ada peringkat

- Monitoring and Assessment Quality Objectives - Form - Admin.2Dokumen3 halamanMonitoring and Assessment Quality Objectives - Form - Admin.2Vanny Joyce BaluyutBelum ada peringkat

- Finals Reviewer - Labor StandardsDokumen36 halamanFinals Reviewer - Labor StandardsAldrich Alvaera100% (2)

- Torts and DamagesDokumen49 halamanTorts and DamagesRaffyLaguesmaBelum ada peringkat

- Motion To Re CalendarDokumen5 halamanMotion To Re Calendarabecard100% (3)

- Roy Memo On Mayorkas ImpeachmentDokumen13 halamanRoy Memo On Mayorkas ImpeachmentFox NewsBelum ada peringkat

- Lesson 5Dokumen10 halamanLesson 5Jane AntonioBelum ada peringkat

- PartnershipDokumen59 halamanPartnershipMayank AameriaBelum ada peringkat

- Legal EthicsDokumen7 halamanLegal EthicsZacky Dela TorreBelum ada peringkat

- India Polluter Pays PrincipleDokumen3 halamanIndia Polluter Pays Principleyogasri gBelum ada peringkat

- 18B139, Laws On Mob-LynchingDokumen16 halaman18B139, Laws On Mob-LynchingMayank AameriaBelum ada peringkat

- Sfa - IpenzDokumen2 halamanSfa - Ipenzagilan005Belum ada peringkat

- Govt Sentencing Memo Hernandez FrieriDokumen19 halamanGovt Sentencing Memo Hernandez FrieriAlbertoNewsBelum ada peringkat

- Mitchell Et Al VDokumen15 halamanMitchell Et Al VLindymanBelum ada peringkat

- Office of The Sangguniang Kabataan: Barangay BanbanonDokumen2 halamanOffice of The Sangguniang Kabataan: Barangay BanbanonwebsterBelum ada peringkat

- PMC Staff Selection (Forms-3,4,5) - PMC Declaration Forms - Rev.1a (Apr-2023) - (Protected)Dokumen3 halamanPMC Staff Selection (Forms-3,4,5) - PMC Declaration Forms - Rev.1a (Apr-2023) - (Protected)Geyko RuslanBelum ada peringkat

- Cogeo-Cubao Operators Vs CADokumen1 halamanCogeo-Cubao Operators Vs CAJulianne Ruth TanBelum ada peringkat

- Stat Con MidtermDokumen2 halamanStat Con Midtermden obraBelum ada peringkat

- Memo RDokumen39 halamanMemo Rbhanusree1312Belum ada peringkat

- Heirs of Jane Honrales v. HonralesDokumen1 halamanHeirs of Jane Honrales v. HonralesLoveAnneBelum ada peringkat

- 055 NLR NLR V 61 AZIZ and Other Appellants and THONDAMAN and Others RespondentsDokumen7 halaman055 NLR NLR V 61 AZIZ and Other Appellants and THONDAMAN and Others RespondentsThilina Dhanushka GuluwitaBelum ada peringkat

- Monfort III v. SalvatierraDokumen9 halamanMonfort III v. SalvatierraValerie WBelum ada peringkat

- G.R. No. 211293, June 04, 2019 Doctrine:: Oriondo vs. COADokumen1 halamanG.R. No. 211293, June 04, 2019 Doctrine:: Oriondo vs. COAstephanie linajaBelum ada peringkat

- Notification Slip For Pre-Arrival Registration For Indian NationalsDokumen1 halamanNotification Slip For Pre-Arrival Registration For Indian NationalsAmit VermaBelum ada peringkat

- Land Bank vs. Spouses Avanceña DDokumen3 halamanLand Bank vs. Spouses Avanceña DJuris DoctorBelum ada peringkat

- Rule: Child Protection Restoration and Penalties Enhancement Act of 1990 and Protect Act; record-keeping and record inspection provisions: Depiction of sexually explicit performances; inspection of recordsDokumen16 halamanRule: Child Protection Restoration and Penalties Enhancement Act of 1990 and Protect Act; record-keeping and record inspection provisions: Depiction of sexually explicit performances; inspection of recordsJustia.comBelum ada peringkat

- 24-Ross Rica Sales Center, Inc. Vs Sps - Ong, G.R. No. 132197, August 16, 2005Dokumen4 halaman24-Ross Rica Sales Center, Inc. Vs Sps - Ong, G.R. No. 132197, August 16, 2005Elaika OrioBelum ada peringkat

- Judges Bench BookDokumen254 halamanJudges Bench BookWb Warnabrother HatchetBelum ada peringkat

- Oblicon Midterms TranscriptDokumen43 halamanOblicon Midterms TranscriptGlanela TapnioBelum ada peringkat

- Discrimination On The Basis of Sexual Orientation, Gender Identity and Expression (Sogie) in The PhilippinesDokumen11 halamanDiscrimination On The Basis of Sexual Orientation, Gender Identity and Expression (Sogie) in The PhilippinesRENE REY ALCODIABelum ada peringkat

- 53 P & I Club Present Service PhilosophyDokumen3 halaman53 P & I Club Present Service PhilosophyRanjeet Singh100% (1)

- Cases Legal ResearchDokumen60 halamanCases Legal ResearchJunior DaveBelum ada peringkat

- ADR Exam Reviewer (USB)Dokumen6 halamanADR Exam Reviewer (USB)Miguel Anas Jr.100% (2)