Taro Pharma 3 Years Sales and Ebidta Growth

Diunggah oleh

JohnJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Taro Pharma 3 Years Sales and Ebidta Growth

Diunggah oleh

JohnHak Cipta:

Format Tersedia

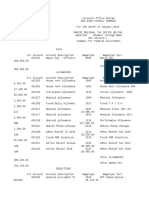

44.5 outstanding shares in millions From GAAP UnauditedAudited Press release 327.351 336.73 54.215 55.10 21.19 23.

00 75.40 78.10 44.39 1.00 355.936 71.835 18.45 90.28 360.46 66.44 18.88 85.32 44.10 0.99 392.535 86.465 18.83 105.29 392.67 80.92 18.83 99.75 52.39 1.18 505.70 204.00 18.73 222.73 182.70 4.11 23.67% 12.23% 9.24% 18.43% EBIDTA/ OI/NI Margin% 16.36% 23.19% 13.18% y-o-y EBIDTA growth

2008 Sales OI D&A EBIDTA NI EPS 2009 Sales OI D&A EBIDTA NI EPS 2010 Sales OI D&A EBIDTA NI EPS 2011 Sales OI D&A EBIDTA NI EPS

7.05%

8.94% 20.61% 25.40% 13.34% 16.91%

28.78% 40.34% 44.04% 36.13% 123.29%

2012 as Q4 annualized

Sales OI ~40% yoy EBIDTA growth D&A Est ~17% yoy Sales growth EBIDTA NI EPS

592.40 298.00 20.00 318.00 274.80 6.18

Q4 2011 148.1 50.30% 74.5 53.68% 46.39%

17.14%

74.06% 68.7

Valuationper share multiples 10.00 71.46 15.00 107.19 20.00 142.92

Unaudited Earnings Press Releases posted here

Net sales of $329.0 million, $7.7 million lower. This change was largely due to increases in the accruals for sales deductions, due to timing. Operating income of $43.8 million, $11.3 million lower. This change was principally due to the aforementioned reduction in net sales and a $2.8 million impair Net income of $30.5 million, $13.9 million lower, due to the above mentioned reductions and the corresponding tax impact of adjustments.

For the year ended December 31, 2009, Taro estimates net sales of $360.5 million, compared to estimated net sales of $336.7 million in 2008. Gross profit in

Operating income in 2009 is estimated at $66.4 million, compared to an estimated $55.1 million in 2008. Net income in 2009 is estimated at $44.1 million, co

Net income for the year ended December 31, 2009 was adversely impacted by foreign exchange expenses of $7.8 million, while net income for the year ende

Net sales of $392.7 million, a 9.4% increase over 2009. Operating income increased 20.2% to $80.9 million, or 20.6% of net sales, compared to $67.3 million, or 18.8% of net sales, in 2009. As a result, net income was $52.4 million compared to net income of $121.3 million in 2009, a 56.8% decrease.

Net sales of $505.7 million, increased $113.1 million, or 28.8%, Gross profit, as a percentage of net sales was 65.2%, compared to 59.5%, Selling, marketing, general and administrative expenses decreased $14.0 million, or 13.0%, Operating income of $204.0 million, or 40.3% of net sales, compared to $86.5 million, or 22.0% of net sales, Net income was favorably impacted by FX income of $6.9 million, compared to FX expense of $5.3 million - a $12.2 million benefit, Net income attributable to Taro was $182.7 million compared to $64.1 million, a $118.6 million increase, resulting in diluted earnings per share of $4.11 comp

Fourth Quarter 2011 Highlights vs. 2010 Net sales of $148.1 million, increased $45.5 million, or 44.3%, Gross profit, as a percentage of net sales was 71.6%, compared to 59.6%, principally driven by increased selling prices on select products in the U.S. marke Selling, marketing, general and administrative expenses decreased $6.2 million, or 22.0%, Operating income of $74.5 million, or 50.3% of net sales, compared to $21.6 million, or 21.0% of net sales, Net income was negatively impacted by foreign exchange (FX) expense of $6.3 million, compared to $3.7 million, Net income attributable to Taro was $62.4 million, compared to $16.5 million, an increase of $45.9 million, resulting in diluted earnings per share of $1.40 com

ductions, due to timing. ion in net sales and a $2.8 million impairment charge for the Company's Ireland facility. mpact of adjustments.

s of $336.7 million in 2008. Gross profit in 2009 is estimated at $205.6 million, or 57.0% of net sales, compared to estimated gross profit of $189.4 million in 2008, or 56.3% o in 2009 is estimated at $44.1 million, compared to an estimated $44.4 million in 2008.

million, while net income for the year ended December 31, 2008 was positively impacted by a foreign exchange benefit of $17.4 million. The increase in foreign exchange expe

et sales, in 2009.

diluted earnings per share of $4.11 compared to $1.53.

ces on select products in the U.S. market as overall volumes were flat,

n diluted earnings per share of $1.40 compared to $0.38.

ss profit of $189.4 million in 2008, or 56.3% of net sales.

million. The increase in foreign exchange expenses was principally caused by the weakening of the U.S. dollar against the Canadian dollar.

2008 2009 2010 2011 %y-o-y Growth - 3 Year Average 2012 est as Q42011-Annualized

EBIDTA in %y-o-y EBIDTA Sales in %y-o-y Sales $million Growth $million Growth 78.10 336.73 85.32 9.24% 360.46 7.05% 99.75 16.91% 392.67 8.94% 222.73 123.29% 505.70 28.78% 49.81% 14.92% 318 74.06% 592.40 17.14%

Anda mungkin juga menyukai

- Voice of Shareholders - SurveyDokumen11 halamanVoice of Shareholders - SurveyJohnBelum ada peringkat

- Taro Why The Valuation DiscountDokumen3 halamanTaro Why The Valuation DiscountJohnBelum ada peringkat

- Novexatin Expert Clinical OpinionDokumen14 halamanNovexatin Expert Clinical OpinionJohnBelum ada peringkat

- 12 Civ 8195 ComplaintDokumen51 halaman12 Civ 8195 ComplaintJohnBelum ada peringkat

- Anacor Investor Presentation June 2013 (Compatibility Mode)Dokumen51 halamanAnacor Investor Presentation June 2013 (Compatibility Mode)JohnBelum ada peringkat

- Quality Affordable Healthcare Products™: William Blair Growth Stock ConferenceDokumen37 halamanQuality Affordable Healthcare Products™: William Blair Growth Stock ConferenceJohnBelum ada peringkat

- Shareholder Proposals - Annual Shareholders MeetingDokumen3 halamanShareholder Proposals - Annual Shareholders MeetingJohnBelum ada peringkat

- Thirdpoint 4q12investorletter 010913Dokumen9 halamanThirdpoint 4q12investorletter 010913DistressedDebtInvestBelum ada peringkat

- Knight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012Dokumen13 halamanKnight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012JohnBelum ada peringkat

- 001 Investor Presentation June2012Dokumen27 halaman001 Investor Presentation June2012JohnBelum ada peringkat

- Dear Members of The TARO Boardv2-0927-LetterDokumen6 halamanDear Members of The TARO Boardv2-0927-LetterJohnBelum ada peringkat

- 13272520Dokumen23 halaman13272520JohnBelum ada peringkat

- Fusilev (Levoleucovorin) Humana Coverage PolicyDokumen6 halamanFusilev (Levoleucovorin) Humana Coverage PolicyJohnBelum ada peringkat

- TARO VIC ThesisDokumen3 halamanTARO VIC ThesisJohnBelum ada peringkat

- Amrn Response To Final RejectionDokumen4 halamanAmrn Response To Final RejectionJohnBelum ada peringkat

- TarominorityshareholderspetitiontoSpecialCommitteeandBoard 05202012Dokumen3 halamanTarominorityshareholderspetitiontoSpecialCommitteeandBoard 05202012JohnBelum ada peringkat

- Fairholme Case Study I (With Disclaimers)Dokumen27 halamanFairholme Case Study I (With Disclaimers)VariantPerceptionsBelum ada peringkat

- TARO ValuationDokumen2 halamanTARO ValuationJohnBelum ada peringkat

- Amended Claims-MarineDokumen5 halamanAmended Claims-MarineJohnBelum ada peringkat

- Patent CaseDokumen15 halamanPatent CaseJohnBelum ada peringkat

- 12815569Dokumen7 halaman12815569JohnBelum ada peringkat

- Lavin DeclarationDokumen21 halamanLavin DeclarationJohnBelum ada peringkat

- Disclosure ComparisonDokumen1 halamanDisclosure ComparisonJohnBelum ada peringkat

- Bill Ackman's Ira Sohn JCP PresentationDokumen64 halamanBill Ackman's Ira Sohn JCP PresentationJohnCarney100% (1)

- Marine Patent Applicant ArgumentsDokumen11 halamanMarine Patent Applicant ArgumentsJohnBelum ada peringkat

- TARO Valuation 2Dokumen1 halamanTARO Valuation 2JohnBelum ada peringkat

- Taro Pharmaceutical Industries LTDDokumen4 halamanTaro Pharmaceutical Industries LTDJohnBelum ada peringkat

- TaroPharmaceuticalIndustriesLtd 20F 20120405Dokumen157 halamanTaroPharmaceuticalIndustriesLtd 20F 20120405JohnBelum ada peringkat

- Taro GrowthDokumen1 halamanTaro GrowthJohnBelum ada peringkat

- Disclosure ComparisonDokumen1 halamanDisclosure ComparisonJohnBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Concept and Purpose of TaxationDokumen5 halamanConcept and Purpose of TaxationNaiza Mae R. Binayao100% (1)

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Dokumen2 halamanChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipBelum ada peringkat

- Flowchart of Tax Refund RemediesDokumen8 halamanFlowchart of Tax Refund RemedieschenezBelum ada peringkat

- Tax Digests - FandialanDokumen5 halamanTax Digests - FandialanjoyfandialanBelum ada peringkat

- Bruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LDokumen1 halamanBruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LManjunathBelum ada peringkat

- Consumer MathDokumen60 halamanConsumer MathJazz100% (3)

- Accounts Dr. CR.: December 31, 200XDokumen5 halamanAccounts Dr. CR.: December 31, 200X버니 모지코Belum ada peringkat

- Anchor Bank Shanghai Branch Income Tax ExclusionDokumen8 halamanAnchor Bank Shanghai Branch Income Tax ExclusiongraceBelum ada peringkat

- View Payslip OnlineDokumen1 halamanView Payslip OnlineArlene D. Panaligan44% (52)

- The Substantive Test of Charity in Lung Center. The Issue in Lung CenterDokumen3 halamanThe Substantive Test of Charity in Lung Center. The Issue in Lung CenterYuri SisonBelum ada peringkat

- Sunway T4 (TX4014) - Tax Computation (Business Income)Dokumen4 halamanSunway T4 (TX4014) - Tax Computation (Business Income)Ee LynnBelum ada peringkat

- OPSTAT - TemplateDokumen1 halamanOPSTAT - TemplateGokulBelum ada peringkat

- Budget Booklet 2020 by Avinash GuptaDokumen47 halamanBudget Booklet 2020 by Avinash GuptaSumit AnandBelum ada peringkat

- PRATIKSHADokumen10 halamanPRATIKSHAPratiksha GaikwadBelum ada peringkat

- PAYSLIP DETAILSDokumen3 halamanPAYSLIP DETAILSamitBelum ada peringkat

- Tax Guide PPT F Y 2022-2023 Only For CMPL 30122022Dokumen38 halamanTax Guide PPT F Y 2022-2023 Only For CMPL 30122022manish_readsBelum ada peringkat

- 3333Dokumen3 halaman3333ßhăñĕ ßîñğhBelum ada peringkat

- Fiscal Incentives Available To TEZ Operators and Registered EnterprisesDokumen2 halamanFiscal Incentives Available To TEZ Operators and Registered EnterprisesJCBelum ada peringkat

- Introduction To Transfer and Business Tax and Basic Concept of Succession and Will (Philippines)Dokumen16 halamanIntroduction To Transfer and Business Tax and Basic Concept of Succession and Will (Philippines)Randy Delumen100% (1)

- GST Impact on SMEs in IndiaDokumen33 halamanGST Impact on SMEs in IndiaMayur PatilBelum ada peringkat

- Preparation of Tax ReturnsDokumen6 halamanPreparation of Tax ReturnsChel GualbertoBelum ada peringkat

- Calculating CIT Payable for 3 EnterprisesDokumen3 halamanCalculating CIT Payable for 3 EnterprisesThu Phương NguyễnBelum ada peringkat

- Taxation VNM - ACCA F6Dokumen8 halamanTaxation VNM - ACCA F6Nguyễn Hải TrânBelum ada peringkat

- Anexo 3 - C4. Economista Carlos MarxDokumen4 halamanAnexo 3 - C4. Economista Carlos MarxDario CarrilloBelum ada peringkat

- S 0232 01Dokumen50 halamanS 0232 01Shahaan ZulfiqarBelum ada peringkat

- Pocket Tax Book 2023Dokumen120 halamanPocket Tax Book 2023Hary GunawanBelum ada peringkat

- Allegations Cancellation Notice For Aditya TelengDokumen3 halamanAllegations Cancellation Notice For Aditya TelengAaditya TelangBelum ada peringkat

- Ona Vs Commissioner On Internal RevenieDokumen2 halamanOna Vs Commissioner On Internal RevenieJustin LoredoBelum ada peringkat

- Activa Flex Computation v2019.08.01Dokumen2 halamanActiva Flex Computation v2019.08.01rhineheart romanBelum ada peringkat

- Annual Income Tax Return: - TAN Lance Adrian GUT IerrezDokumen4 halamanAnnual Income Tax Return: - TAN Lance Adrian GUT IerrezReina EvangelistaBelum ada peringkat