OECD Report - Comparability Adjustments - 2010

Diunggah oleh

superandrosaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

OECD Report - Comparability Adjustments - 2010

Diunggah oleh

superandrosaHak Cipta:

Format Tersedia

ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT

COMPARABILITY ADJUSTMENTS JULY 2010

Disclaimer: The attached paper was prepared by the OECD Secretariat. It bears no legal status and the views expressed therein do not necessarily represent the views of the OECD member states. For a more comprehensive description of the views of the OECD and its member states in relation to the arms length principle and transfer pricing, readers are invited to refer to the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations which were approved, in their original version, by the Committee on Fiscal Affairs on 27 June 1995 and by the Council of the OECD for publication on 13 July 1995 [C(95)126/FINAL] and were supplemented and updated since. In particular, a substantial revision of the Transfer Pricing Guidelines was approved by the Council of the OECD on 22 July 2010 (see www.oecd.org/ctp/tp or http://www.oecd.org/document/4/0,3343,en_2649_33753_45690500_1_1_1_1,00.html).

CENTRE FOR TAX POLICY AND ADMINISTRATION

COMPARABILITY ADJUSTMENTS

Introduction 1. Chapters I and III of the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (hereafter the TPG) contain extensive guidance on comparability analyses for transfer pricing purposes. Guidance on comparability adjustments is found in paragraphs 3.47-3.54 and in the Annex to Chapter III of the TPG. A revised version of this guidance was approved by the Council of the OECD on 22 July 2010 and can be downloaded from the Internet (see www.oecd.org/ctp/tp/cpm). All the references in this paper are references to the 2010 edition of the TPG. A. What is a comparability adjustment?

2. When applying the arms length principle, the conditions of a controlled transaction (i.e. a transaction between a taxpayer and an associated enterprise) are generally compared to the conditions of comparable uncontrolled transactions. In this context, to be comparable means that: None of the differences (if any) between the situations being compared could materially affect the condition being examined in the methodology (e.g. price or margin), or Reasonably accurate adjustments can be made to eliminate the effect of any such differences. These are called comparability adjustments. 3. Thus, a comparability adjustment is an adjustment made to the conditions of uncontrolled transactions in order to eliminate the effects of material differences which exist between them and the controlled transaction being examined. 4. For instance, assume that a taxpayer sells the same products to an associated enterprise and to an independent enterprise. Assume that the two sales transactions are comparable, except that, in the controlled transaction (sale by the taxpayer to its associated enterprise), the currency risk is borne by the taxpayer while in the uncontrolled transaction (sale by the taxpayer to an independent enterprise), the currency risk is borne by the customer. Assume that the different allocations of this risk in the controlled and uncontrolled transactions materially affect the comparison, because the currency risk is significant. In such a case, it may nevertheless be possible to use the uncontrolled transaction as a comparable to the controlled transaction, subject to an adjustment being made to eliminate the effects on the comparison of the different allocations of currency risk. 5. Examples of comparability adjustments include adjustments for accounting consistency designed to eliminate differences that may arise from differing accounting practices between the

July 2010

Page 2

controlled and uncontrolled transactions; segmentation of financial data to eliminate significant noncomparable transactions; adjustments for differences in capital, functions, assets, risks. 6. An example of a working capital adjustment designed to reflect differing levels of accounts receivable, accounts payable and inventory is provided in Section C hereafter. The fact that such adjustments are found in practice does not mean that they should be performed on a routine or mandatory basis. Rather, the improvement to comparability should be shown when proposing these types of adjustments (as for any type of adjustment). Further, a significantly different level of relative working capital between the controlled and uncontrolled parties may result in further investigation of the comparability characteristics of the potential comparable. B. When to do a comparability adjustment

7. Comparability adjustments should be considered if (and only if) they are expected to increase the reliability of the results. Relevant considerations in this regard include the materiality of the difference for which an adjustment is being considered, the quality of the data subject to adjustment, the purpose of the adjustment and the reliability of the approach used to make the adjustment. 8. It bears emphasis that comparability adjustments are only appropriate for differences that will have a material effect on the comparison. Some differences will invariably exist between the taxpayers controlled transactions and the third party comparables. A comparison may be appropriate despite an unadjusted difference, provided that the difference does not have a material effect on the reliability of the comparison. On the other hand, the need to perform numerous or substantial adjustments to key comparability factors may indicate that the third party transactions are in fact not sufficiently comparable. 9. It is not always the case that adjustments are warranted. For instance, an adjustment for differences in accounts receivable may not be particularly useful if major differences in accounting standards were also present that could not be resolved. Likewise, sophisticated adjustments are sometimes applied to create the false impression that the outcome of the comparables search is scientific, reliable and accurate. 10. It is not appropriate to view some comparability adjustments, such as for differences in levels of working capital, as routine and uncontroversial, and to view certain other adjustments, such as for country risk, as more subjective and therefore subject to additional requirements of proof and reliability. The only adjustments that should be made are those that are expected to improve comparability. 11. Ensuring the needed level of transparency of comparability adjustments may depend upon the availability of an explanation of any adjustments performed, the reasons for the adjustments being considered appropriate, how they were calculated, how they changed the results for each comparable and how the adjustment improves comparability.

July 2010

Page 3

Country experience Indian courts have released several decisions relevant to comparability adjustments and in particular to the extent to which comparability adjustments performed are sufficiently reliable. The need to perform in certain cases comparability adjustments to eliminate differences in working capital, risk, growth and R&D expenses was laid down in Mentor Graphics [Mentor Graphics (Noida) (P.) Ltd. v. DCIT, Circle 6(1), New Delhi [2007] 109 ITD 101 (DELHI) / 112 TTJ 408] and confirmed in several decisions since. In Philips Software Centre [Philips Software Centre (P.) Ltd. v. ACIT, Circle 12(2) [2008] 26 SOT 226 (BANG.)] ITAT approved comparability adjustments being made to eliminate differences on account of different functions, assets and risks, and specifically for differences in risk profile, working capital and accounting policies. On the other hand, if the differences between the companies or transactions are so material that it is not possible to perform a reasonably accurate adjustment, then the comparables should be rejected [Mentor Graphics (ibid) and Egain Communication (P.) Ltd. v. Income-tax Officer, Ward 1(4), Pune [2008] 23 SOT 385 (PUNE)]. Furthermore, a working capital adjustment should not be performed in a particular case if its effect would be very marginal [Sony India (P.) Ltd. v. Deputy Commissioner of Income-tax, Circle 9(1) [2008] 114 ITD 448 (DELHI)]. A remaining difficulty is the subjective question of determining what a reasonably accurate comparability adjustment is. In Sony India (ibid), ITAT upheld an overall flat adjustment of 20 per cent proposed by the Transfer Pricing Officer for differences in intangible ownership and risks assumed in the controlled transaction and comparables as being fair and reasonable. By contrast, in CIT v. Philips Software Centre [CIT v. Philips Software Centre Pvt. Ltd. (2009) TIOL-123-HCKAR-IT], the High Court of India examined whether the Tribunal was correct in allowing a flat comparability adjustment of 11.72% (6.46% working capital adjustment +5.25% risk adjustment) ignoring all important issues like the quality of adjustment data, purpose and reliability of the adjustment performed to be considered before making adjustment on account of capital and risk, and found this contrary to Rule 10B(3)(ii) which provides for only reasonably accurate adjustment, and accordingly stayed the operation of judgement of ITAT. Other questions addressed in Indian decisions with respect to comparability include the use of data from other years than the year of the controlled transaction [Mentor Graphics (ibid)]; acceptability as comparables of companies in start-up years and of loss-making companies [Mentor Graphics (ibid) and Skoda Auto India Pvt. Ltd. v. ACIT (2009-TIOL-214-ITAT-PUNE)]; acceptability as comparables of companies with low employee costs [Mentor Graphics (ibid)]; exclusion from the set of comparables of companies with significant other income such as interest, dividends, licenses [Egain Communication (ibid)]; treatment of pass-through costs [Sony India (P.) Ltd. (ibid)]; underutilisation of capacity [Sony India (P.) Ltd. (ibid) and Skoda Auto India (ibid)]; acceptability of a comparability adjustment for a very material difference [Essar Shipping Limited v. Deputy Commissioner of Income Tax (2008-TIOL-652-ITAT-MUM)]; selection of the point of adjustment within the arms length range [Mentor Graphics (ibid) and Sony India (P.) Ltd. (ibid)]; use of multiyear data in case of different product cycles [Skoda Auto India (ibid)]; etc.

July 2010

Page 4

C.

Example of a working capital adjustment

The assumptions about arms length arrangements in the following examples are intended for illustrative purposes only and should not be taken as prescribing adjustments or arms length arrangements in actual cases of particular industries. While they seek to demonstrate the principles of the TPG, those principles must be applied in each case according to the specific facts and circumstances of that case. This example is provided for illustration purposes as it represents one way, but not necessarily the only way, in which such an adjustment can be calculated. Furthermore, the comments below relate to the application of a transactional net margin method in the situations where, given the facts and circumstances of the case and in particular the comparability (including functional) analysis of the transaction and the review of the information available on uncontrolled comparables, such a method is found to be the most appropriate method to use. 12. This simple example shows how to make an adjustment in recognition of differences in levels of working capital between a tested party (TestCo) and a comparable (CompCo). Working capital adjustments may be warranted when applying the transactional net margin method. In practice they are usually found when applying a transactional net margin method, although they might also be applicable in cost plus or resale price methods. Working capital adjustments should only be considered when the reliability of the comparables will be improved and reasonably accurate adjustments can be made. They should not be automatically made and would not be automatically accepted by tax administrations. Why make a working capital adjustment? 13. In a competitive environment, money has a time value. If a company provided, say, 60 days trade terms for payment of accounts, the price of the goods should equate to the price for immediate payment plus 60 days of interest on the immediate payment price. By carrying high accounts receivable a company is allowing its customers a relatively long period to pay their accounts. It would need to borrow money to fund the credit terms and/or suffer a reduction in the amount of cash surplus which it would otherwise have available to invest. In a competitive environment, the price should therefore include an element to reflect these payment terms and compensate for the timing effect. 14. The opposite applies to higher levels of accounts payable. By carrying high accounts payable, a company is benefitting from a relatively long period to pay its suppliers. It would need to borrow less money to fund its purchases and/or benefit from an increase in the amount of cash surplus available to invest. In a competitive environment, the cost of goods sold should include an element to reflect these payment terms and compensate for the timing effect. 15. A company with high levels of inventory would similarly need to either borrow to fund the purchase, or reduce the amount of cash surplus which it is able to invest. Note that the interest rate

July 2010

Page 5

might be affected by the funding structure (e.g. where the purchase of inventory is partly funded by equity) or by the risk associated with holding specific types of inventory) 16. Making a working capital adjustment is an attempt to adjust for the differences in time value of money between the tested party and potential comparables, with an assumption that the difference should be reflected in profits. The underlying reasoning is that: A company will need funding to cover the time gap between the time it invests money (i.e. pays money to supplier) and the time it collects the investment (i.e. collects money from customers) This time gap is calculated as: the period needed to sell inventories to customers + (plus) the period needed to collect money from customers (less) the period granted to pay debts to suppliers.

The process of calculating working capital adjustments: Identify differences in the levels of working capital. Generally trade receivables, inventory and trade payables are the three accounts considered. The transactional net margin method is applied relative to an appropriate base, for example, costs, sales or assets. So, if the appropriate base is sales, then any differences in working capital levels should be measured relative to sales. Calculate a value for differences in levels of working capital between the tested party and the comparable relative to the appropriate base and reflecting the time value of money by use of an appropriate interest rate. Adjust the result to reflect differences in levels of working capital. The following example adjusts the comparables result to reflect the tested partys levels of working capital. Alternative calculations are to adjust the tested partys results to reflect the comparables levels of working capital or to adjust both the tested party and the comparables results to reflect zero working capital.

A practical example of calculating working capital adjustments 17. The following calculation is hypothetical. It is only to demonstrate how a working capital adjustment can be calculated.

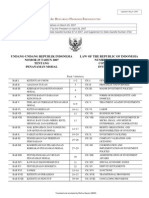

TESTCO Year 1 Sales Earnings Before Interest & Tax (EBIT) EBIT/Sales (%) $179.5m $1.5m 0.8% Year 2 $182.5m $1.83m 1% Year 3 $187m $2.43m 1.3% Year 4 $195m $2.54m 1.3% Year 5 $198m $1.78m 0.9%

July 2010

Page 6

TESTCO Year 1 Working Capital (at end of year) Trade Receivables (R) Inventories (I) Trade Payables (P) Receivables (R) + Inventory (I) Payables (P) (R + I P) / Sales $30m $36m $20m $46m 25.6% $32m $36m $21m $47m 25.8% $33m $38m $26m $45m 24.1% $35m $40m $23m $52m 26.7% $37m $45m $24m $58m 29.3% Year 2 Year 3 Year 4 Year 5

COMPCO

Year 1

Year 2

Year 3

Year 4

Year 5

Sales Earnings Before Interest & Tax (EBIT) EBIT/Sales (%)

$120.4m $1.59m 1.32%

$121.2m $3.59m 2.96%

$121.8m $3.15m 2.59%

$126.3m $4.18m 3.31%

$130.2m $6.44m 4.95%

Working Capital (at end of year) Trade Receivables (R) Inventory (I) Trade Payables (P) Receivables (R) + Inventory (I) Payables (P) (R + I P) / Sales $17m $18m $11m $24m 19.9% $18m $20m $13m $25m 20.6% $20m $26m $11m $35m 28.7% $22m $24m $15m $31m 24.5% $23m $25m $16m $32m 24.6%

Working Capital Adjustment TestCos (R + I P) / Sales CompCos (R + I P) / Sales Difference (D) Interest Rate (i) Adjustment (D*i) CompCos EBIT/Sales (%) Working Capital Adjusted EBIT / Sales for CompCo July 2010

Year 1 25.6% 19.9% 5.7% 4.8% 0.27% 1.32% 1.59%

Year 2 25.8% 20.6% 5.1% 5.4% 0.28% 2.96% 3.24%

Year 3 24.1% 28.7% -4.7% 5.0% -0.23% 2.59% 2.35%

Year 4 26.7% 24.5% 2.1% 5.5% 0.12% 3.31% 3.43%

Year 5 29.3% 24.6% 4.7% 4.5% 0.21% 4.95% 5.16%

Page 7

Some observations An issue in making working capital adjustments is to determine the point in time at which the Receivables, Inventory and Payables should be compared between the tested party and the comparables. The above example compares their levels on the last day of the financial year. This may not, however, be appropriate if this timing does not give a representative level of working capital over the year. In such cases, averages might be used if they better reflect the level of working capital over the year. A major issue in making working capital adjustments involves the selection of the appropriate interest rate (or rates) to use. The rate (or rates) should generally be determined by reference to the rate(s) of interest applicable to a commercial enterprise operating in the same market as the tested party. In most cases a commercial loan rate will be appropriate. In cases where the tested partys working capital balance is negative (that is Payables > Receivables + Inventory), a different rate may be appropriate. In the case where payables < receivables + inventories, a borrowing rate is generally used because the company has to invest in the receivables (extent credit) and inventories (finance the inventory). In other words, the sums invested in receivables and inventory are greater than the return on the payment deferral the company received (the company has to borrow money for financing its investment in receivables and inventory). In the case where payables > receivables + inventories, a lending rate is generally used because in a way the company receives an additional advantage through the payment deferral. The rate used in the above example reflects the rate at which TestCo is able to borrow funds in its local market. This example also assumes that the same interest rate is appropriate for payables, receivables and inventory, but that may or may not be the case in practice. Where different rates of interest are found to be appropriately applicable to individual classes of assets or liabilities, the calculation may be considerably more complex than shown above. The purpose of working capital adjustments is to improve the reliability of the comparables. There is a question whether working capital adjustments should be made when the results of some comparables can be reliably adjusted while the results of some others cannot.

July 2010

Page 8

Anda mungkin juga menyukai

- New DGT Form - PER 25Dokumen5 halamanNew DGT Form - PER 25superandrosaBelum ada peringkat

- SE-50 THN 2013 TTG Pedoman Pemeriksaan Transfer PricingDokumen82 halamanSE-50 THN 2013 TTG Pedoman Pemeriksaan Transfer PricingsuperandrosaBelum ada peringkat

- Indonesian Tax Treaties QRGDokumen7 halamanIndonesian Tax Treaties QRGsuperandrosaBelum ada peringkat

- PER-48 THN 2010 TTG Mutual Agreement Procedure - EnglishDokumen20 halamanPER-48 THN 2010 TTG Mutual Agreement Procedure - EnglishsuperandrosaBelum ada peringkat

- IND-ENG-UU 25-2007 Penanaman ModalDokumen41 halamanIND-ENG-UU 25-2007 Penanaman ModalVelliana TanayaBelum ada peringkat

- Deloitte - Transfer - Pricing For Energy SectorDokumen3 halamanDeloitte - Transfer - Pricing For Energy SectorsuperandrosaBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Accounting For Managers Chapter 1Dokumen53 halamanAccounting For Managers Chapter 1Filomena AndjambaBelum ada peringkat

- Trust DeedDokumen8 halamanTrust Deededdy_edwin23Belum ada peringkat

- Blcok-4 MCO-7 Unit-1 PDFDokumen24 halamanBlcok-4 MCO-7 Unit-1 PDFSoitda BcmBelum ada peringkat

- Anuj Verma's asset allocation notesDokumen23 halamanAnuj Verma's asset allocation notesSweta HansariaBelum ada peringkat

- Mount Sinai Beth Israel 2018 FinancialsDokumen51 halamanMount Sinai Beth Israel 2018 FinancialsJonathan LaMantiaBelum ada peringkat

- FRP FinalDokumen88 halamanFRP Finalgeeta44Belum ada peringkat

- Republic Act No. 7652Dokumen2 halamanRepublic Act No. 7652Ju BalajadiaBelum ada peringkat

- List of Banks in Malaysia with Swift CodesDokumen10 halamanList of Banks in Malaysia with Swift CodesQasseh ChintaBelum ada peringkat

- Company Law FiracDokumen6 halamanCompany Law FiracRohan PatelBelum ada peringkat

- Acquisition Goodwill CalculationsDokumen21 halamanAcquisition Goodwill CalculationsJack Herer100% (1)

- EECO - Problem Set - Annuities and PerpetuitiesDokumen10 halamanEECO - Problem Set - Annuities and PerpetuitiesWebb PalangBelum ada peringkat

- HSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseDokumen3 halamanHSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseRonitsinghthakur SinghBelum ada peringkat

- Cityneon Holidngs Limited 30-May-2016 SG CFDokumen19 halamanCityneon Holidngs Limited 30-May-2016 SG CFTan Teck WeeBelum ada peringkat

- Roadmap FASB 123R Share-Based Pymt - DeloitteDokumen280 halamanRoadmap FASB 123R Share-Based Pymt - DeloitteAlycia SkousenBelum ada peringkat

- E120 Fall14 HW6Dokumen2 halamanE120 Fall14 HW6kimball_536238392Belum ada peringkat

- Poland Case StudyDokumen3 halamanPoland Case StudyFastdog9128Belum ada peringkat

- Tutorial ContDokumen25 halamanTutorial ContJJ Rivera75% (4)

- Monetary Policy India Last 5 YearsDokumen28 halamanMonetary Policy India Last 5 YearsPiyush ChitlangiaBelum ada peringkat

- New Heritage DollDokumen26 halamanNew Heritage DollJITESH GUPTABelum ada peringkat

- Insurance and Consumer Protection ActDokumen40 halamanInsurance and Consumer Protection ActNadeem Malek100% (1)

- Liberia Industrial PolicyDokumen47 halamanLiberia Industrial PolicyMOCIdocsBelum ada peringkat

- Chapter 5 - Modern Portfolio ConceptsDokumen41 halamanChapter 5 - Modern Portfolio ConceptsShahriar HaqueBelum ada peringkat

- RRLDokumen5 halamanRRLJulie Ann SilvaBelum ada peringkat

- Alternative Investment Funds: Meaning, Taxation, Regulations & ListDokumen7 halamanAlternative Investment Funds: Meaning, Taxation, Regulations & Listsanket karwaBelum ada peringkat

- Investment Patterns and Banking ProductsDokumen21 halamanInvestment Patterns and Banking ProductsMelvin Mathew100% (1)

- Jagadish Prasad Bist Mba 2 Management Accounting: Presented byDokumen32 halamanJagadish Prasad Bist Mba 2 Management Accounting: Presented byJagadish BistBelum ada peringkat

- AS 26 - 123 To 138Dokumen16 halamanAS 26 - 123 To 138love chawlaBelum ada peringkat

- Chapter 04 XLSolDokumen11 halamanChapter 04 XLSolSyafira Taqia H FBelum ada peringkat

- Characteristics and Functions of MoneyDokumen2 halamanCharacteristics and Functions of MoneyAndroid HelpBelum ada peringkat