Capital Budgeting

Diunggah oleh

Varun YadavDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Capital Budgeting

Diunggah oleh

Varun YadavHak Cipta:

Format Tersedia

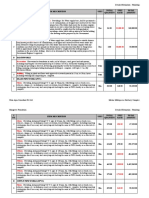

Capital Budgeting is the process by which the firm decides which long-term investments to make.

The decision to accept or reject a Capital Budgeting project depends on an analysis of the cash flows generated by the project and its cost. The following three Capital Budgeting decision rules will be presented: Payback Period it is the exact amount of time required for a firm to recover its initial investment by a firm in a project as calculated from cash inflows. Net Present Value (NPV) - The difference between the present value of cash inflows and the present value of cash outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. Internal Rate of Return (IRR) - The discount rate often used in capital budgeting that makes the net present value of all cash flows from a particular project equal to zero. Generally speaking, the higher a project's internal rate of return, the more desirable it is to undertake the project. Accounting Rate of Return-ARR provides a quick estimate of a project's worth over its useful life. ARR is derived by finding profits before taxes and interest. Discounting pay back period Profitability index What is difference between fund flow and cash flow statement? Difference Between Cash Flow and Funds Flow Statement Many people think that both cash and fund are same, however they both are different and so is the case with cash flow statement and funds flow statement. Lets look at some of the differences between cash flow and funds flow statement 1. While funds flow statement reveals the change in the working capital of a company between two balance sheet dates while cash flow statement reveals the change in the cash position of the company between two balance sheet dates. 2. As funds flow statement shows the change in working capital it deals with all the components of working capital while cash flow statement deals only with cash and cash equivalents. 3. In case of funds flow statement schedule of changes in working capital is prepared while in case of cash flow statement no such schedule is prepared. 4. While cash flow statement there is classification of cash flows as cash flow from operating activities, cash flow from investment activities and cash flow from financing activities, but as far as funds flow statement is concerned there is no such classification. 5. As cash flow statement is only concerned with cash related transactions it is can be easily understood by a person who does not have accounting knowledge which is not the case with funds flow statement. What is difference between balance sheet and cash flow & fund flow statement? What is difference between amortization, depreciation and depletion? Amortization: Gradual repayment of a loan in equal (or nearly equal) installments which include portions of interest and principal amounts.

Depreciation is used in accounting to try to match the expense of an asset to the income that the asset helps the company earn.

An accrual accounting method that companies use to allocate the cost of extracting natural resources such as timber, minerals and oil from the earth. What r preliminary expenses and how it is treated? Costs incurred in the formation of a firm, and in advertising, promotional activities, employee training, etc., before the firm can open its doors for business. Also called preliminary expenses or startup expenses. What is accounting equation? How is double entry better then single entry accounting? Advantages of Double Entry Over Single Entry System: In double entry system of bookkeeping as two fold aspect of each transaction is recorded in the books, a trial balance can be prepared to prove the arithmetical accuracy of the transaction. No trial balance can be prepared under single entry system and hence accuracy of books cannot be proved. In double entry system the risk of fraud or its non discovery is less. But under single entry system chances of fraud or mistake remaining undetected are very high. In double entry system a trading and profit and loss account can be prepared very easily. The proprietor can know the profit earned or loss suffered by has business. Under single entry system no trading and profit and loss account can be prepared scientifically and, hence, the proprietor will have no firm idea of profit earned or loss suffered. In double entry system a balance sheet can be prepared from the books of accounts. The correctness of assets and liabilities can be proved. The balance sheet called statement of affairs in a single entry system is prepared in an unsatisfactory manner. The assets and liabilities are not proved from records. Hence the correctness of assets and liabilities cannot be relied upon. what is contra entry? Book keeping entry that is entered on the opposite side of an earlier entry to cancel its effect on the account balance. What is bank reconciliation statement? Types of GAAP and difference between Indian and US GAAP? What is capital expenditure and revenue expenditure? Concept of business entity. What is bad debt? What is credit and debit balance? A debit balance is what you owe. It's entered as accounts receivable on the books of the lender and appears on your account statement as a liability. A credit balance is what you own. It's entered as accounts payable on the books of the lender and appears on your account statement as an asset.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Continuous Time Option Pricing Models: - Assumptions of The Black-Scholes Option Pricing Model (BSOPM)Dokumen42 halamanContinuous Time Option Pricing Models: - Assumptions of The Black-Scholes Option Pricing Model (BSOPM)rohanjha007Belum ada peringkat

- Continuous Time Option Pricing Models: - Assumptions of The Black-Scholes Option Pricing Model (BSOPM)Dokumen42 halamanContinuous Time Option Pricing Models: - Assumptions of The Black-Scholes Option Pricing Model (BSOPM)rohanjha007Belum ada peringkat

- The Art of RetailingDokumen1 halamanThe Art of RetailingVarun YadavBelum ada peringkat

- Service SectorDokumen21 halamanService Sectorarshad24140% (1)

- Product ManagementDokumen2 halamanProduct ManagementVarun YadavBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Challenges Students Face in Conducting A Literature ReviewDokumen6 halamanChallenges Students Face in Conducting A Literature ReviewafdtunqhoBelum ada peringkat

- PSI 8.8L ServiceDokumen197 halamanPSI 8.8L Serviceedelmolina100% (1)

- Geography Cba PowerpointDokumen10 halamanGeography Cba Powerpointapi-489088076Belum ada peringkat

- Landini Tractor 7000 Special Parts Catalog 1820423m1Dokumen22 halamanLandini Tractor 7000 Special Parts Catalog 1820423m1katrinaflowers160489rde100% (122)

- Manual de Colisión Mazda 626 1986-1987Dokumen9 halamanManual de Colisión Mazda 626 1986-1987mark rueBelum ada peringkat

- Magnetic Properties of MaterialsDokumen10 halamanMagnetic Properties of MaterialsNoviBelum ada peringkat

- Service Manual JLG 1055 S-N01600727600Dokumen566 halamanService Manual JLG 1055 S-N01600727600RAPID EQUIPMENT RENTAL67% (6)

- Prime Time 3 Workbook GrammarDokumen2 halamanPrime Time 3 Workbook GrammarSourCreamBelum ada peringkat

- Fuel Supply Agreement - First DraftDokumen104 halamanFuel Supply Agreement - First DraftMuhammad Asif ShabbirBelum ada peringkat

- Internet Intranet ExtranetDokumen28 halamanInternet Intranet ExtranetAmeya Patil100% (1)

- WFP Situation Report On Fire in The Rohingya Refugee Camp (23.03.2021)Dokumen2 halamanWFP Situation Report On Fire in The Rohingya Refugee Camp (23.03.2021)Wahyu RamdhanBelum ada peringkat

- Reflection of The Movie Informant - RevisedDokumen3 halamanReflection of The Movie Informant - RevisedBhavika BhatiaBelum ada peringkat

- Fadm Project 5 ReportDokumen4 halamanFadm Project 5 ReportVimal AgrawalBelum ada peringkat

- PRU03Dokumen4 halamanPRU03Paul MathewBelum ada peringkat

- Legal DraftingDokumen28 halamanLegal Draftingwadzievj100% (1)

- Area & Perimeter - CRACK SSC PDFDokumen10 halamanArea & Perimeter - CRACK SSC PDFSai Swaroop AttadaBelum ada peringkat

- SYKES - Telework Work Area AgreementDokumen2 halamanSYKES - Telework Work Area AgreementFritz PrejeanBelum ada peringkat

- Market Research and AnalysisDokumen5 halamanMarket Research and AnalysisAbdul KarimBelum ada peringkat

- CPWA Code MCQDokumen43 halamanCPWA Code MCQSamrat Mukherjee100% (3)

- 03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019Dokumen52 halaman03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019samir bendreBelum ada peringkat

- Software Requirement SpecificationDokumen10 halamanSoftware Requirement SpecificationSushil SarrafBelum ada peringkat

- Mechanical FPD P.sanchezDokumen9 halamanMechanical FPD P.sanchezHailley DensonBelum ada peringkat

- Engineering MetallurgyDokumen540 halamanEngineering Metallurgymadhuriaddepalli100% (1)

- Pocket Pod PresetsDokumen13 halamanPocket Pod PresetsmarcusolivusBelum ada peringkat

- How To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasDokumen10 halamanHow To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasNowellyn IncisoBelum ada peringkat

- Cash & Cash EquivalentsDokumen2 halamanCash & Cash EquivalentsYoonah KimBelum ada peringkat

- DM2 0n-1abDokumen6 halamanDM2 0n-1abyus11Belum ada peringkat

- SPMT Stability of Hydraulic EngDokumen4 halamanSPMT Stability of Hydraulic Engparamarthasom1974Belum ada peringkat

- Executive Order No. 786, S. 1982Dokumen5 halamanExecutive Order No. 786, S. 1982Angela Igoy-Inac MoboBelum ada peringkat

- The 360 Degree Leader J MaxwellDokumen2 halamanThe 360 Degree Leader J MaxwellUzen50% (2)