Fedex Vs Ups

Diunggah oleh

kevin316Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Fedex Vs Ups

Diunggah oleh

kevin316Hak Cipta:

Format Tersedia

1.

Prepare to describe in class the competition in the overnight delivery industry, and the strategies by which those two firms are meeting the competition. What are the enabling and inhibiting factors facing the two firms as they pursue their goals? Do you think that either firm can attain a sustainable competitive advantage in this business? The almost fifty billion United States domestic delivery market can be broken down into three sections. They consist of letters weighing 0 to 2 pounds, packages weighing 2.0 to 70 pounds, and freight weighing over 70 pounds. The mode of transportation that these categories take are air and ground with the time categories being overnight, deferred delivery, three day delivery and regular delivery which occurs four or more days after pickup. The air express segment was a twenty five billion dollar portion of the US package delivery industry, and was concentrated in letters and packages, overnight and deferred, and air or air and ground. Virtually all FedEx business activities were in the air express segment of the package delivery industry. Only twenty two percent of UPSs revenues were derived from its next day air business. FedEx and UPSs competition for the dominance of the twenty five billion dollar domestic air express delivery market is rapidly changing and going into a competitive future. Overnight package delivery industry in the U.S. package delivery industry contributes fifty five percent from the air express segments. FedEx and UPS competed to dominate the air-express segment though UPS had only twenty two percent of its business in this segment as compared to FedEx. Both the companies have a strong customer focus which provides customized solutions for each client. During the early 90s, UPS tried to fight out the price competition against FedEx by providing its overnight services at half the price but the firms settled into a similar price pattern by the late 90s. At the same time, reducing unit costs became a priority by economies of scale, new technology and business process reengineering. Both FedEx and UPS had their own information management systems to keep track of the package movements. This suggests that both FedEx and UPS have a competitive advantage in their differentiating areas of business and the sustenance part of it can be confirmed in the following section of financial analysis. FedEx and UPS are package-delivery companies that together provide supply chain, transportation, logistics and related information services. FedEx has expanded from operating in twenty five U.S. cities, to serving international markets. Similarly, UPS initially operated just within the U.S. before expanding into Canada, Europe, Latin America and most recently, China. FedEx and UPS target the same markets and compete for presence in them. FedEx and UPS have some key differences with regards to their strategic approach to business (see Table 1 in appendix). FedEx, which is regarded as an innovative, entrepreneurial, and operational leader has a strategy that focuses on providing high quality services to its customers. FedExs technological innovations, including the COSMOS interface, enables it to provide timely delivery service to its customers and large clients. UPS has a strategy that is driven by its key success factors which have been efficiency and cost reduction. In the past, UPS was regarded as financially and operationally conservative due to its hesitant approach to investing in information technology. It was considered an industry follower, as it did not come up with unique 1

processes to distinguish itself from its competitors. Since its IPO in 1999, UPS has made efforts to change its image through aggressive information technology investments and acquisitions. FedEx and UPS have goals of being in a strong financial position and providing high returns to shareowners. This is why both companies have been finding ways to cut costs through economies of scale and use of information technology. The strong rivalry between FedEx and UPS has led to matching each other in terms of capital investment expenditures and services they offer. Both companies have branched out to provide logistics services to large corporate clients and are also interested in expanding into the Chinese market, where there is high potential for growth. The enabling and inhibiting factors facing the two firms play a large part in how FedEx and UPS develop their short term and long term business strategies. One very important enabling factor for both companies is to increase service expansion and services offered. UPS is the larger of the two companies which causes it to benefit from economies of scale. They are able to experience cost advantages that may not be offered to FedEx because they are not buying and using services as much or as many as UPS is. Since UPS has been around longer than FedEx they have been able to link past efficiencies looking forward which enables them to understand the market a lot better. The ability to recognize changes in the market allows companies to experience long term survival. Lastly a key enabling factor that UPS faces is that it was the first mover in the industry. They have over sixty years of doing business which has developed a strong brand name for themselves which can be unrivaled by anyone. As far as FedEx goes their enabling factors are slightly different due to their later entry into the market. First, a major factor for them was they were the first company to purchase planes. This allowed them to increase flight time and decrease delays which untimely cut their delivery time. It also saved them a lot of money because they dont have to waste time on looking and competing on the best airlines. With the increase in air travels FedEx develop a hub and spoke strategy which is another enabling factor them. This strategy allowed them to really focus on getting packages to and from customers fast and easy. Lastly, an enabling factor for FedEx is that they are really keen on developing and utilizing the technological innovations. These innovations have allowed them to better link, track and follow every package they have which gives customers a sense of security. There are a couple major inhibiting factors facing FedEx and UPS. The first factor that these companies face is they are in major competition between each other as well as with local competitors like DHL and USPS. Both companies are eagerly anticipating any opportunity they can find that will set them apart from their competition. Expansion into other countries is a big step in which both companies aim to diversify themselves. However, it is hard to be diverse when they follow each around as seen with their move to China. The second inhibiting factor they both face is the constant need for change and innovation. In order to maintain a strong customer base and encourage company growth both companies need to be focused on technologies and ways that will increase the rate and efficiency of their business. Due to the similarities between UPS and FedEx, it is unlikely one will achieve a period of sustained competitive advantage. This is true because in this industry when one company does achieve a temporary competitive advantage the other company is copying the idea or obtaining a competitive advantage in a different area. This is evident when UPS 2

offered half-price for the overnight delivery aspect that FedEx offered. In a market that is limited in the advantages, it is unlikely that either company will hold a competitive advantage for a long period of time. 2. Why did FedExs stock price outstrip UPSs during the initiation of talks over liberalized air cargo routes between the U.S and China? Assuming a perfectly efficient stock, how might one interpret a 14% increase in FedExs market value of equity? As stated in the case on June 18, 2004, the United States and China reached an airtransportation agreement that affected the global air-cargo market by allowing an increase in the number of flights between the two nations. This agreement was perfect for the economy because was going to impact a lot of companies around the world. Stock prices began to grow mostly due to the predicted future growth of Chinas domestic as well as international goods market. The two major companies that had the highest predicted benefits were FedEx and UPS. This boosted investors confidence because Chinas economy had grown fifty percent since 2003 and this meant that there was huge opportunity. In 2004, FedExs stock price outperformed UPS and the S&P500 by a significant amount. UPS on the other hand, almost followed the S&P500 throughout the year (Chart 1). On Chart 2, we see that in 2004, FedExs stock price went from a low of $65 to a high of $100. As well as on Chart 3 UPSs stock price went from a low of $68 to a high of $89. Chart 1: FedEx vs. UPS vs. S&P500 in 2004 (Yahoo Finance)

Chart 2: FedExs stock price in 2004 Date Open High

Low

Close 3

Dec 1, 2004 Nov 1, 2004 Oct 1, 2004 Sep 1, 2004 Aug 2, 2004 Jul 1, 2004 Jun 1, 2004 May 3, 2004 Apr 1, 2004 Mar 1, 2004 Feb 2, 2004 Jan 2, 2004

95.04 91.12 85.98 82.30 81.70 81.55 73.41 72.10 74.97 68.69 67.35 67.70

100.92 96.63 91.12 88.90 82.80 83.47 81.82 74.60 76.07 75.26 69.97 70.40

95.02 89.64 84.57 81.88 76.25 78.83 72.28 69.35 71.60 65.88 64.91 64.84 Low 84.00 78.10 75.76 72.32 69.15 70.51 71.11 68.55 69.69 67.51 69.30 71.27

98.76 95.03 91.12 85.69 81.99 81.88 81.69 73.58 71.91 75.16 68.68 67.28 Close 86.68 84.15 79.18 75.92 73.05 71.96 75.17 71.72 70.15 69.84 70.63 71.27

Chart 3: UPS Stock Price in 2004 Date Open High Dec 1, 2004 84.37 89.11 Nov 1, 2004 79.16 84.69 Oct 1, 2004 75.98 79.30 Sep 1, 2004 72.92 76.00 Aug 2, 2004 71.96 73.16 Jul 1, 2004 75.08 75.29 Jun 1, 2004 71.62 75.26 May 3, 2004 70.20 71.88 Apr 1, 2004 69.84 72.21 Mar 1, 2004 70.40 70.46 Feb 2, 2004 71.40 71.97 Jan 9, 2004 72.43 73.33

There are several reasons why FedExs and UPSs stock prices rose during 2004. Most likely the most important factor was the new air-cargo agreement between the United States and China. This agreement had the potential to be a huge benefit to both companies because of its added new growth and profits. A second reason is because each company was capable of attracting more capital due to interest from investors. These investors were betting that the extra investments would benefit each company and allow them to grow along with Chinas economy. FedExs stock outgrew UPSs stock along with the S&P500. The first reason for this was because as stated in the case FedEx was looked upon as being agile, innovative, and entrepreneurial while UPS was large, very administrative, and an industry follower. These factors led investors to believe that FedEx will overtake UPS as a world parcel company and the largest company in China due to its take charge mindset. Another reason was that FedEx had better financials than UPS. Over the past years they had been produced better numbers and that was reason to believe that were going to keep producing quality figures. As seen in Table 1, FedEx had a better net income growth, better operating income growth, and lower average days outstanding. In this case if the past predicts what will 4

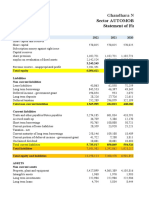

happen in the future then it is evidence that FedEx has a better position to take advantage of the cargo market in China. Even though FedEx had a lower ROA and ROE, it was assumed that its ability to innovate would help it succeed in China. Lastly, FedEx performance in 2003 was because of the current geographic segment. According to Table 2, FedEx makes thirty percent of its revenue from the international market while UPS only makes twenty four percent of its revenue from the international market which could lead investors to believe that FedEx is better suited for international markets. 2003 Table 1: Financials Net Income Growth Operating Income Growth Average Days Outstanding Return on Assets Return on Total Equity 2003 Table 2: Geographical Data Domestic Revenue International Revenue International as % of Domestic UPS (8.93%) 10.01% 51.60 days 10.44% 19.51% UPS $26,968 $6,517 24.16% FedEx 16.9% 23.30% 41.54 days 6.3% 11.39% FedEx $17,277 $5,210 30.16%

Assuming a perfectly efficient stock there are a couple of ways to interpret FedExs fourteen percent increase in market value. First, it can be assume that the investors market views FedEx as a potential better company to take advantage of the growth in China. Secondly, investors would look into past data in order to look into the future performance and see that FedExs innovative management and large overseas presence have allowed them to make decent profits in any economy. Lastly, after looking at the case Morgan Stanleys analyst believes that FedEx will be able to become successful in China. Their reasoning was that they have viewed all the possible flaws and paths of the investment. They looked at things like the size of the market, legal framework, liabilities, standards of living, transportation infrastructure, and commercial relationships. The analysts also looked at FedExs cost structure and stated that any increase in volume would flow directly to the firms bottom line which meant growth of equity. On the other hand it was unclear if UPS look at the downsides of China and were also more focused on a specific product rather than a range of products. Overall investors believed that FedEx was going to be successful so their stock price increased. Any investors looking at these two companies at the time had reason to believe that FedEx had a better chance of succeeding in China due to its large overseas presence, research of the country, and its ability to innovate and adapt. 3. How have FedEx and Ups performed since the early 1990s? Which firm is doing better? In class, prepare to discuss the insights you derived from the two firms financial statements, financial ratios, stock-price performance, and economic profit (EVA). Also, prepare to describe how EVA is estimated, and its strengths and weaknesses as a measure of performance. 5

Looking at the performance since the early 1990s, we can use financial statements and ratios to compare UPS and FedEx. According to the figures given in exhibits 9 and 10, FedExs cumulative EVA is ($2,252) million, whereas UPS has a cumulative EVA of $4,328 million. The economic value added figures shows that UPS has a much stronger value in comparison to FedEx from 1992-2003. Although FedEx has a larger international presence, UPS is better at using their capital. Looking at exhibit 9 and 10, we see that UPS is negative for five years in this time period while FedEx is in the red figures for eleven of twelve years. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. UPS has an average WACC of 10.99 percent as compared to FedEx with 11.33 percent. The total assets turnover ratio determines the amount of sales that are generated from each dollar of assets. The average of this ratio for the period 1992-2003 for FedEx is 1.49 and UPS is 1.47, indicating that FedEx is more capable of utilizing its assets to generate sales. The current ratio measures a company's ability to pay short-term obligations with its short-term assets. For the period 1992-2003, FedEx has an average current ratio of 0.99 as compared to UPS with 1.46. Therefore, UPS has a more efficient operating cycle and is more capable of paying its obligations. The Debt/Equity ratio measures a companys financial leverage by the proportion of debt and equity it uses to finance its assets. FedEx and UPS have an almost similar average D/E of 0.316 and 0.338 respectively. This indicates that UPS has been slightly more aggressive in financing its growth with debt. The net profit margin indicates how much out of every dollar of sales a company actually keeps in earnings. The average profit margin of FedEx is 3.69 percent and that of UPS is 8.65 percent. This shows that UPS has a better control over its costs as compared to FedEx. In regards to the stock prices UPS has outperformed FedEx in the years 1992-2003. UPS share price in 1992 was $9.25 and grew to $74.55 by 2003 (an increase of 705%). In comparison, FedExs stock price in 1992 was $10.19 and grew to $63.98 by 2003 (a 527% increase). Earnings per Share (EPS) is a measure of the portion of a company's profit allocated to each outstanding share of common stock. The average EPS of FedEx is $2.34 while that of UPS is $2.18. Therefore with regards to equity return analysis, UPS is a better company than FedEx. Based on the analysis of the financial and analytical ratios for UPS and FedEx, it is observed that UPS is performing better than FedEx. The strongest indicator is the monumental difference in value (EVA) when comparing the two companies.

4. If you had to identify one of those companies as excellent, which company would you choose? On what basis did you make your decision? More generally, what is the meaning of excellence in business? Judging the two companies, we would identify UPS as the excellent company. Although FedEx won the air competition agreement, UPS has consistently outperformed. UPS goal was a long-term competitive return to our shareholders, judging by the financials it is evident that this goal has been obtained. For the years 1992-2003, the sales, book assets, net income and operating income have all increased by over 7%. We also see the EPS as well as the stock price for UPS, increasing steadily from 1992. These all account for the accomplished goal of long-term competitive return for the shareholders. As discussed in question 2, UPS has outperformed FedEx financially speaking. This is a double negative for FedEx, not only are they being outperformed, they also did not live up to their goal of producing superior financial returns for their shareholders. Although UPS has experience employee strikes in the past, they have worked out the problems and currently almost double FedEx in total employees. Excellence in business begins with management. A management that is consistently meeting or exceeding expectations is one that will experience success. UPS is a company that has experienced continued accomplishment since its founding in 1907. The CEO, Scott Davis, has been with the company for 25 years, this illustrates a management that is in place (one of Warren Buffetts most important investing criteria). Excellence in business is having a standard that is valued by the customer and maintaining that standard. This is proven accurate when dealing with UPS through their customer service, speedy delivery and their relationship with shareholders. Excellence in business is not only proven in a companys financials but also their reputation and relationship with those involved with the company. Because of this, we feel that UPS can be defined as an excellent company.

Appendix 7

Table 1 Strategic Focus Point Operations

FedEx They focus on producing superior financial returns for shareowners by providing high value-added supply chain.

Work force

UPS Focuses on having a financially strong company, broad employee base and ownership. This provides long-term competitive advantage and good returns for its shareholders. FedEx has a People, Service, UPS has a system that does Profit philosophy which not allow for flexibility in focuses on employee employee schedules. This is participation. This allows for a often resisted by the non-unionized work force that companys heavily unionized works to achieve the goals of the workforce. company which ultimately betters it. FedEx main investment focus is in information technology. This is because its a way of improving quality delivery service to clients and customers. UPS invests in information technology as a means of improving efficiency in its delivery service to client and customers.

Information Technology

Anda mungkin juga menyukai

- Poland A2 MotorwayDokumen8 halamanPoland A2 MotorwayArun Kumar K100% (3)

- Estimation of Cost of Capital: Case: The Boeing 7E7Dokumen125 halamanEstimation of Cost of Capital: Case: The Boeing 7E7jk kumarBelum ada peringkat

- Nike Vs New Balance-Case StudyDokumen16 halamanNike Vs New Balance-Case StudySarahBelum ada peringkat

- The Battle For Value FedEx UPSDokumen23 halamanThe Battle For Value FedEx UPSCoolminded CoolmindedBelum ada peringkat

- Airborne Express Cost AnalysisDokumen6 halamanAirborne Express Cost AnalysisAndrew NeuberBelum ada peringkat

- The Battle For Value FedEx UPSDokumen23 halamanThe Battle For Value FedEx UPSHeo Mam100% (1)

- Case Study 4 - Fed-Ex vs. UPSDokumen9 halamanCase Study 4 - Fed-Ex vs. UPSPat Cunningham100% (1)

- Southwest Airlines PDFDokumen9 halamanSouthwest Airlines PDFYashnaBelum ada peringkat

- Part 1Dokumen2 halamanPart 1Jia LeBelum ada peringkat

- Case - Airborne ExpressDokumen4 halamanCase - Airborne ExpressSean Lim0% (1)

- Fedex TigerDokumen7 halamanFedex TigerMurti Kusuma Dewi100% (1)

- GUNA FIBRES Case Study QuestionsDokumen2 halamanGUNA FIBRES Case Study QuestionsAnupam Dutt Shukla0% (1)

- List of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationDokumen2 halamanList of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationArnold TampubolonBelum ada peringkat

- The Financial DetectiveDokumen1 halamanThe Financial Detectiveburrnic20% (1)

- Fedex AssignmentDokumen20 halamanFedex AssignmentAibak Irshad100% (2)

- Nucleon IncDokumen10 halamanNucleon Incsummi64Belum ada peringkat

- UPS Vs FedEx - FinalDokumen15 halamanUPS Vs FedEx - Finaltharrah1100% (1)

- UPS Marketing PlanDokumen8 halamanUPS Marketing PlanmaverickgmatBelum ada peringkat

- FedEx Vs UpsDokumen9 halamanFedEx Vs UpsJohn WilliamsBelum ada peringkat

- FedEx Strategic Analysis Including Value Chain SWOT Porter S 5 PDFDokumen30 halamanFedEx Strategic Analysis Including Value Chain SWOT Porter S 5 PDFhs138066Belum ada peringkat

- Jetblue Strategic Plan ProposalDokumen15 halamanJetblue Strategic Plan Proposalapi-280467957Belum ada peringkat

- BCE: INC Case AnalysisDokumen6 halamanBCE: INC Case AnalysisShuja Ur RahmanBelum ada peringkat

- Strengths and Weakness of Airborne FedexDokumen2 halamanStrengths and Weakness of Airborne FedexSrilakshmi ShunmugarajBelum ada peringkat

- Uv6790 PDF EngDokumen20 halamanUv6790 PDF EngRicardo BuitragoBelum ada peringkat

- Fed Ex - Case Study - tcm152-174356Dokumen4 halamanFed Ex - Case Study - tcm152-174356Hoa TrancongBelum ada peringkat

- Deutsche BrauereiDokumen38 halamanDeutsche BrauereiTazkia Munia0% (1)

- Decko Co Is A U S Firm With A Chinese Subsidiary ThatDokumen1 halamanDecko Co Is A U S Firm With A Chinese Subsidiary ThatM Bilal SaleemBelum ada peringkat

- Eli LDokumen6 halamanEli LKaruna GaranBelum ada peringkat

- Ups - Case StudyDokumen4 halamanUps - Case StudyMahmood Karim67% (9)

- The Battle For Value Fedex Vs UPSDokumen10 halamanThe Battle For Value Fedex Vs UPSAbdul Wajid Zafar100% (1)

- Word Note Battle For Value FedEx Vs UPSDokumen9 halamanWord Note Battle For Value FedEx Vs UPSalka murarka100% (1)

- Fedex Term PaperDokumen17 halamanFedex Term PaperSravanthi VadlagattaBelum ada peringkat

- What Can The Historical Income StatementsDokumen3 halamanWhat Can The Historical Income Statementsleo147258963100% (2)

- Group-2 - Ben and Jerry CaseDokumen13 halamanGroup-2 - Ben and Jerry CaseShilpi Kumar100% (1)

- The Battle For Value, Fedex Corp. vs. The United Parcel Service, IncDokumen24 halamanThe Battle For Value, Fedex Corp. vs. The United Parcel Service, IncPurwedi Darminto100% (2)

- Coursehero 40252829Dokumen2 halamanCoursehero 40252829Janice JingBelum ada peringkat

- UPS Case StudyDokumen2 halamanUPS Case StudyCharysa Januarizka50% (2)

- Southwest Analysis 1Dokumen11 halamanSouthwest Analysis 1api-377711779100% (7)

- Country Hill CaseDokumen2 halamanCountry Hill CaseAlisha Anand [JKBS]Belum ada peringkat

- J.C. Penney Company (Click Here To View in Scribd Format)Dokumen13 halamanJ.C. Penney Company (Click Here To View in Scribd Format)interactivebuysideBelum ada peringkat

- Case Study Disney The Partnership Side of Global Business Model InnovationDokumen13 halamanCase Study Disney The Partnership Side of Global Business Model InnovationMuhammad HanifBelum ada peringkat

- Case 13Dokumen12 halamanCase 13Superb AdnanBelum ada peringkat

- Internal Analysis of FedEx VDokumen3 halamanInternal Analysis of FedEx Vjasmine8099100% (1)

- Airborne Team 6Dokumen4 halamanAirborne Team 6John PistoneBelum ada peringkat

- Ssustainability Scorecard 56743Dokumen4 halamanSsustainability Scorecard 56743killer dramaBelum ada peringkat

- Airborne CaseDokumen6 halamanAirborne CaseBach CaoBelum ada peringkat

- Case Study Be - Jet Blue EthicsDokumen4 halamanCase Study Be - Jet Blue EthicsNithin Joji Sankoorikkal0% (1)

- Krispy Kreme Doughnuts-Suggested QuestionsDokumen1 halamanKrispy Kreme Doughnuts-Suggested QuestionsMohammed AlmusaiBelum ada peringkat

- Investment Detective CaseDokumen1 halamanInvestment Detective CaseJonathan ZhaoBelum ada peringkat

- Fedex Date: September 23,2019 Price: $146.23 Company ProfileDokumen2 halamanFedex Date: September 23,2019 Price: $146.23 Company ProfileChristopher SnowBelum ada peringkat

- Assessment 3 (Dominos Case Study)Dokumen5 halamanAssessment 3 (Dominos Case Study)RishabBelum ada peringkat

- Paper - JCPenneyDokumen44 halamanPaper - JCPenneySyeda Fakiha AliBelum ada peringkat

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Dokumen6 halamanQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607Belum ada peringkat

- Auto Zone QuestionsDokumen1 halamanAuto Zone QuestionsmalimojBelum ada peringkat

- Accounting For The IphoneDokumen9 halamanAccounting For The IphoneFatihahZainalLim100% (1)

- Bam479 Caseiiii Paigesayler 11 20 20Dokumen34 halamanBam479 Caseiiii Paigesayler 11 20 20api-532529158Belum ada peringkat

- DuPont QuestionsDokumen1 halamanDuPont QuestionssandykakaBelum ada peringkat

- Executive SummaryDokumen3 halamanExecutive Summaryapi-532683276Belum ada peringkat

- Airbus A3XX Developing The World's Largest Commercial Jet - Objetives and QuestionDokumen1 halamanAirbus A3XX Developing The World's Largest Commercial Jet - Objetives and QuestionJaime Steven Soto ForeroBelum ada peringkat

- MC - 259198 - Hafizul Ikmal Bin MamunDokumen8 halamanMC - 259198 - Hafizul Ikmal Bin MamunHafizul Ikmal MamunBelum ada peringkat

- Case 4Dokumen10 halamanCase 4calvinBelum ada peringkat

- Ups Written ReportDokumen23 halamanUps Written Reportliselle18Belum ada peringkat

- Recitation Notes - Global and International BusinessDokumen4 halamanRecitation Notes - Global and International BusinessyelzBelum ada peringkat

- 02 Exercises - Accounting For NPOs v2Dokumen3 halaman02 Exercises - Accounting For NPOs v2Peter Andre GuintoBelum ada peringkat

- Malaysia Transmission System Reliability StandardsDokumen93 halamanMalaysia Transmission System Reliability Standardsadzli maherBelum ada peringkat

- PolaroidDokumen20 halamanPolaroidGaurav Kumar100% (1)

- Table of Contents COMPLETEDokumen14 halamanTable of Contents COMPLETEjustingollosossuBelum ada peringkat

- Indian Bond MarketDokumen4 halamanIndian Bond MarketAmritangshu BanerjeeBelum ada peringkat

- Corporation Law ReviewerDokumen14 halamanCorporation Law ReviewerYANG FLBelum ada peringkat

- Exam Code 1 ObDokumen4 halamanExam Code 1 ObHuỳnh Lê Yến VyBelum ada peringkat

- Capital & RevenueDokumen7 halamanCapital & RevenueDr Sarbesh Mishra50% (2)

- 2 Practical KM A Model That Works Arthur D LittleDokumen13 halaman2 Practical KM A Model That Works Arthur D LittleJuan Jose Escobar MoralesBelum ada peringkat

- Heavy OilDokumen6 halamanHeavy Oilsnikraftar1406Belum ada peringkat

- LIC Project ReportDokumen67 halamanLIC Project ReportKusum Pali50% (2)

- Ibd 092308Dokumen24 halamanIbd 092308cphanhuy100% (1)

- Energy Update LiberiaDokumen62 halamanEnergy Update LiberiaAbhijit Kumar GhoshBelum ada peringkat

- Module 1 Real Estate Development & Land ManagementDokumen40 halamanModule 1 Real Estate Development & Land Managementmalik_king2010Belum ada peringkat

- A Study On Financial Statement Analysis of HDFCDokumen63 halamanA Study On Financial Statement Analysis of HDFCKeleti SanthoshBelum ada peringkat

- Review Questions For Final Exam ACC210Dokumen13 halamanReview Questions For Final Exam ACC210AaaBelum ada peringkat

- Chapter 11 340-348Dokumen9 halamanChapter 11 340-348Anthon AqBelum ada peringkat

- CBBEDokumen23 halamanCBBECharuJagwaniBelum ada peringkat

- Annual Report 2019Dokumen304 halamanAnnual Report 2019fahadBelum ada peringkat

- Ghandhara NissanDokumen7 halamanGhandhara NissanShamsuddin SoomroBelum ada peringkat

- Issuances On Archax FlyerDokumen3 halamanIssuances On Archax FlyerWalid El AmineBelum ada peringkat

- BCG MatrixDokumen19 halamanBCG MatrixRishab MehtaBelum ada peringkat

- A Study of Customer Relationship Management in Iranian Banking IndustryDokumen7 halamanA Study of Customer Relationship Management in Iranian Banking IndustryonedademaBelum ada peringkat

- MarketSizing 20130129Dokumen26 halamanMarketSizing 20130129Ankesh Dev100% (1)

- Chater Two Leacture NoteDokumen26 halamanChater Two Leacture NoteMelaku WalelgneBelum ada peringkat

- 3 Profitable Pivot Point Strategies For Forex Traders - FX Day JobDokumen11 halaman3 Profitable Pivot Point Strategies For Forex Traders - FX Day Jobsushilraina1968100% (2)

- Financial Statement Analysis of Icici BankDokumen24 halamanFinancial Statement Analysis of Icici BankPadmavati UdechaBelum ada peringkat