Insured Financial Institutions by Asset Size

Diunggah oleh

Master ChiefHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Insured Financial Institutions by Asset Size

Diunggah oleh

Master ChiefHak Cipta:

Format Tersedia

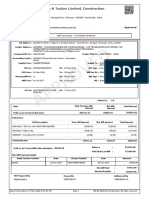

Table 1179.

FDIC-Insured Financial Institutions by Asset Size: 2010

[12,067.6 represents $12,067,600,000,000. Preliminary. Minus sign () indicates loss. See headnote, Table 1178]

Item

COMMERCIAL BANKS

Institutions reporting . . . . . . . . . . . . . . . . . .

Assets, total. . . . . . . . . . . . . . . . . . . . . . . . .

Deposits. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income . . . . . . . . . . . . . . . . . . . . . . . . .

Return on assets. . . . . . . . . . . . . . . . . . . . .

Return on equity . . . . . . . . . . . . . . . . . . . . .

Equity capital to assets. . . . . . . . . . . . . . . .

Noncurrent assets plus other real estate

owned to assets. . . . . . . . . . . . . . . . . . . . .

Net charge-offs to loans and leases . . . . . .

Percentage of banks losing money. . . . . . .

SAVINGS INSTITUTIONS

Institutions reporting . . . . . . . . . . . . . . . . . .

Assets, total. . . . . . . . . . . . . . . . . . . . . . . . .

Deposits. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income . . . . . . . . . . . . . . . . . . . . . . . . .

Return on assets. . . . . . . . . . . . . . . . . . . . .

Return on equity . . . . . . . . . . . . . . . . . . . . .

Equity capital to assets. . . . . . . . . . . . . . . .

Noncurrent assets plus other real estate

owned to assets. . . . . . . . . . . . . . . . . . . . .

Net charge-offs to loans and leases . . . . . .

Percentage of banks losing money. . . . . . .

Total

Less

than

$100 mil.

$100 mil.

to

$1 bil.

$1 bil.

to

$10 bil.

Greater

than

$10 bil.

Number. . . .

Bil. dol.. . . . .

Bil. dol.. . . . .

Bil. dol.. . . . .

Percent . . . .

Percent . . . .

Percent . . . .

6,529

12,067.6

8,514.3

79.2

0.66

5.99

11.10

2,325

131.9

112.0

(Z)

0.36

3.06

11.42

3,694

1,058.6

884.0

3.4

0.34

3.35

10.04

424

1,090.4

841.9

2.0

0.19

1.67

11.29

86

9,786.6

6,676.3

73.1

0.75

6.78

11.19

Percent . . . .

Percent . . . .

Percent . . . .

3.12

2.67

20.63

2.35

0.80

20.69

3.53

1.14

20.49

3.91

1.96

23.35

3.00

3.00

11.63

Number. . . .

Bil. dol.. . . . .

Bil. dol.. . . . .

Bil. dol.. . . . .

Percent . . . .

Percent . . . .

Percent . . . .

1,128

1,253.8

908.7

8.3

0.67

5.92

11.75

297

16.5

13.2

(Z)

0.08

0.58

14.36

674

233.1

184.7

0.7

0.29

2.71

10.99

21

662.9

450.3

6.2

0.95

8.15

12.29

136

341.3

260.5

1.4

0.42

3.83

11.07

Percent . . . .

Percent . . . .

Percent . . . .

3.07

1.47

23.23

2.56

0.55

32.66

2.96

0.80

20.18

3.32

1.90

14.29

2.66

1.24

19.12

Unit

Z Less than $500 million.

Source: U.S. Federal Deposit Insurance Corporation, Annual Report; Statistics on Banking, annual; and FDIC Quarterly

Banking Profile. See also <http://www.fdic.gov/bank/index.html>.

Table 1180. FDIC-Insured Financial InstitutionsNumber and Assets

by State and Island Areas: 2010

[In billions of dollars, except as indicated (13,321.4 represents $13,321,400,000,000). As of December 31. Information is obtained

primarily from the Federal Financial Institutions Examination Council (FFIEC) Call Reports and the Office of Thrift Supervisions

Thrift Financial Reports. Data are based on the location of each reporting institutions main office. Reported data may include

assets located outside of the reporting institutions home state]

State or

Island

Area

Total. . .

AL . . . . .

AK. . . . .

AZ . . . . .

AR. . . . .

CA. . . . .

CO. . . . .

CT. . . . .

DE. . . . .

DC. . . . .

FL . . . . .

GA. . . . .

HI. . . . . .

ID. . . . . .

IL. . . . . .

IN. . . . . .

IA. . . . . .

KS. . . . .

KY. . . . .

LA . . . . .

ME. . . . .

MD. . . . .

MA. . . . .

MI. . . . . .

MN. . . . .

MS. . . . .

MO. . . . .

MT. . . . .

NE. . . . .

Assets by asset size of bank

Number

of

Less

$1 bil. Greater

instituthan

to

than

tions

Total

$1 bil.

$10 bil.

$10 bil.

7,657 13,321.4

1,440.2

1,431.7 10,449.5

144

225.3

28.3

5.3

191.7

6

5.0

1.2

3.8

40

13.8

6.2

7.6

130

58.2

25.5

21.2

11.5

272

473.7

61.9

89.8

322.0

117

49.2

19.7

19.1

10.4

54

82.9

15.6

25.5

41.8

27

960.8

3.4

26.1

931.4

6

1.7

1.7

247

151.2

56.0

59.9

35.3

268

270.0

51.9

26.1

192.0

9

39.9

1.4

10.2

28.3

18

8.1

4.5

3.5

607

327.3

100.0

69.1

158.2

146

66.3

29.0

37.3

360

66.1

49.2

16.9

326

63.0

40.1

22.9

198

54.7

34.9

19.8

156

62.7

34.3

16.7

11.8

29

29.3

11.0

7.2

11.1

87

34.4

21.7

12.7

165

256.6

43.3

57.8

155.5

136

68.1

28.2

26.3

13.6

404

61.3

51.8

9.4

91

59.2

20.2

25.4

13.6

336

129.3

56.2

44.1

29.0

73

22.1

10.2

11.9

224

54.1

26.1

14.9

13.1

NV. . . . .

NH. . . . .

NJ . . . . .

NM. . . . .

NY. . . . .

NC. . . . .

ND. . . . .

OH. . . . .

OK. . . . .

OR. . . . .

PA . . . . .

RI. . . . . .

SC. . . . .

SD. . . . .

TN. . . . .

TX . . . . .

UT. . . . .

VT . . . . .

VA . . . . .

WA. . . . .

WV. . . . .

WI . . . . .

WY. . . . .

Number

of

institutions

29

24

117

53

186

100

92

239

248

34

216

14

83

83

191

615

57

14

115

79

65

276

37

AS. . . . .

GU. . . . .

FM. . . . .

PR. . . . .

VI. . . . . .

1

1

3

7

2

State or

Island

Area

Assets by asset size of bank

Less

$1 bil. Greater

than

to

than

Total

$1 bil.

$10 bil.

$10 bil.

1,247.4

3.7

20.0 1,223.7

9.9

8.9

1.1

174.4

29.1

54.2

91.1

18.9

11.0

7.9

643.7

47.1

123.1

473.5

1,728.4

24.8

25.0 1,678.6

24.8

13.3

11.5

2,285.9

42.8

33.1 2,210.0

79.6

33.2

18.1

28.2

38.2

5.8

6.8

25.6

281.2

59.5

91.2

130.5

136.1

2.5

5.6

128.0

38.2

21.8

16.4

1,287.8

11.2

13.5 1,263.1

86.6

45.2

16.9

24.5

374.8

109.2

106.3

159.3

346.3

11.2

45.4

289.6

5.7

4.2

1.5

492.0

28.5

39.0

424.5

66.1

17.1

35.6

13.4

25.4

11.1

14.3

148.2

55.9

21.5

70.7

7.6

7.6

0.1

0.1

1.3

77.9

0.2

0.1

0.1

1.3

0.2

33.2

44.7

Represents zero. ASAmerican Samoa, GUGuam, FMFederated States of Micronesia, PRPuerto Rico.

VIVirgin Islands.

Source: U.S. Federal Deposit Insurance Corporation, Statistics on Banking, annual.

U.S. Census Bureau, Statistical Abstract of the United States: 2012

Banking, Finance, and Insurance 737

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- VA-OIG - Review of Battle Creek VAMCDokumen37 halamanVA-OIG - Review of Battle Creek VAMCMaster ChiefBelum ada peringkat

- Pioneer VSX522 Receiver - Manual EnglishDokumen39 halamanPioneer VSX522 Receiver - Manual EnglishMaster ChiefBelum ada peringkat

- Factual & Legal Approach To Human Rights Abuses by PMSC in IraqDokumen336 halamanFactual & Legal Approach To Human Rights Abuses by PMSC in IraqMaster Chief100% (1)

- Welcome To The United States A Guide For New ImmigrantsDokumen124 halamanWelcome To The United States A Guide For New ImmigrantsSaa100% (1)

- The United States Flag Federal Law Relating To DisplayDokumen17 halamanThe United States Flag Federal Law Relating To DisplayMaster ChiefBelum ada peringkat

- DFAST 2013 Results 20130307Dokumen74 halamanDFAST 2013 Results 20130307ZerohedgeBelum ada peringkat

- Local Rules - Eastern District Court of VirginiaDokumen95 halamanLocal Rules - Eastern District Court of VirginiaMaster ChiefBelum ada peringkat

- Kinloch Mayor Keith Conway Pleads Guilty To Fraud, Embezzlement, Witness TamperingDokumen1 halamanKinloch Mayor Keith Conway Pleads Guilty To Fraud, Embezzlement, Witness TamperingMaster ChiefBelum ada peringkat

- Complete Alex Prose Ref HandbookDokumen16 halamanComplete Alex Prose Ref Handbookphilqb2Belum ada peringkat

- Public Law 112-81Dokumen566 halamanPublic Law 112-81Master ChiefBelum ada peringkat

- FBI Special Agent Darin Lee McAllister Sentenced - Federal Wire and Bankruptcy FraudDokumen1 halamanFBI Special Agent Darin Lee McAllister Sentenced - Federal Wire and Bankruptcy FraudMaster ChiefBelum ada peringkat

- Former FBI Agent SentencedDokumen1 halamanFormer FBI Agent SentencedMaster ChiefBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Tata 1Mg Healthcare Solutions Private LimitedDokumen3 halamanTata 1Mg Healthcare Solutions Private LimitedVipul KumarBelum ada peringkat

- NOC For Tuacahn High School For The Performing ArtsDokumen2 halamanNOC For Tuacahn High School For The Performing ArtsMcKenzie StaufferBelum ada peringkat

- Weekly 3home Learning Plan For Grade 3Dokumen16 halamanWeekly 3home Learning Plan For Grade 3Aiza MunlawinBelum ada peringkat

- Pt. Perusahaan Gas Negara (Persero) TBK: Work Inspection RequestDokumen1 halamanPt. Perusahaan Gas Negara (Persero) TBK: Work Inspection RequestDeni AlfakenzBelum ada peringkat

- Larsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000602 WOMDokumen2 halamanLarsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000602 WOMKannan GnanaprakasamBelum ada peringkat

- 003 Challenges of The 19th CenturyDokumen13 halaman003 Challenges of The 19th CenturyJason CuregBelum ada peringkat

- Chapter 1 - Investment ManagementDokumen13 halamanChapter 1 - Investment ManagementAiman AbousherBelum ada peringkat

- Ag - Econ.4.3 AgriculturalMarketing, TradeandPrices TheoryNoteDokumen140 halamanAg - Econ.4.3 AgriculturalMarketing, TradeandPrices TheoryNoteRajesh Kumar TripathiBelum ada peringkat

- Review of Related Literature Financial ManagementDokumen19 halamanReview of Related Literature Financial ManagementFav TangonanBelum ada peringkat

- Quiz 2 Final Term Assets - /15Dokumen3 halamanQuiz 2 Final Term Assets - /15Kristina Angelina ReyesBelum ada peringkat

- Membrane-Cryogenic Post-Combustion Carbon CaptureDokumen11 halamanMembrane-Cryogenic Post-Combustion Carbon CaptureJohn Jairo RamosBelum ada peringkat

- Assignment 2 ECON1194 2022A - NguyenHoangAnh - s3915023Dokumen15 halamanAssignment 2 ECON1194 2022A - NguyenHoangAnh - s3915023Anh NguyenBelum ada peringkat

- Economics QuestDokumen10 halamanEconomics QuestMd Ikrama AkhtarBelum ada peringkat

- Chapter 04 - AnswersDokumen22 halamanChapter 04 - Answers吴茗100% (1)

- 1531 Grammar Test 100Dokumen3 halaman1531 Grammar Test 100Azamat BozorovichBelum ada peringkat

- Size Chart: Road Touring CollectionDokumen2 halamanSize Chart: Road Touring Collectionreyesbox2_967521092Belum ada peringkat

- Economics Material - FinalDokumen37 halamanEconomics Material - FinalD RajasekarBelum ada peringkat

- Chapter 3Dokumen12 halamanChapter 3hariharanpBelum ada peringkat

- SSB800-1000-1000TL Installation Instructions en 06.2018 US 1Dokumen72 halamanSSB800-1000-1000TL Installation Instructions en 06.2018 US 1daboo sanatBelum ada peringkat

- Microeconomics Principles and Policy 13th Edition Baumol Blinder 130528061X Solution ManualDokumen2 halamanMicroeconomics Principles and Policy 13th Edition Baumol Blinder 130528061X Solution Manualroberto100% (30)

- BRD InvoicesDokumen29 halamanBRD InvoicesJTOCCN ORAIBelum ada peringkat

- 2 Interest - For STUDENTSDokumen4 halaman2 Interest - For STUDENTSSandy BellBelum ada peringkat

- Maricar Pedong Literature ReviewDokumen2 halamanMaricar Pedong Literature ReviewcarloBelum ada peringkat

- Applied Economics-Chapter 1Dokumen57 halamanApplied Economics-Chapter 1Trixie Ruvi AlmiñeBelum ada peringkat

- CPSD NigeriaDokumen115 halamanCPSD Nigeriaofoegbu1441Belum ada peringkat

- The Essential Guide To Bartering: Page - 1Dokumen22 halamanThe Essential Guide To Bartering: Page - 1Marcos Rodriguez100% (2)

- First Term Examination-2018: Patel Public SchoolDokumen2 halamanFirst Term Examination-2018: Patel Public SchoolApoorvaBelum ada peringkat

- W2 Introduction To EntrepreurshipDokumen12 halamanW2 Introduction To EntrepreurshipMark John Paul CablingBelum ada peringkat

- Tute 1 QuestionsDokumen4 halamanTute 1 QuestionsLê Thiên Giang 2KT-19Belum ada peringkat

- MTP May21 ADokumen11 halamanMTP May21 Aomkar sawantBelum ada peringkat