Chaikin Power Gauge Report GMCR 29feb2012

Diunggah oleh

Chaikin Analytics, LLCDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chaikin Power Gauge Report GMCR 29feb2012

Diunggah oleh

Chaikin Analytics, LLCHak Cipta:

Format Tersedia

Green Mtn Coffe (GMCR)

Industry: Food/Drug-Retail/Wholesale

Price: $65.93

Chaikin Power Gauge Report | Generated: Wed Feb 29 11:40 EST 2012 Power Gauge Rating

GMCR - Very Bearish

The Chaikin Power Gauge Rating for GMCR is very bearish due to very poor financial metrics, very bearish price/volume activity and negative expert opinions. The rating also reflects very strong earnings performance. GMCR's financial metrics are very poor due to a high price to book value ratio and high price to sales ratio.

TM

News Sentiment Rating

Neutral

GMCR Green Mtn Co.. February 17, 2012

Chaikin Sentiment Gauge for GMCR is neutral. Stories concerning GMCR have a balanced or neutral sentiment.

TM

News Sentiment :Neutral

Power Trend - 5 Year Chart

The Power Gauge distills a 20 factor model into a concise picture of a stock's potential.

High Potential

Neutral

Low Potential

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

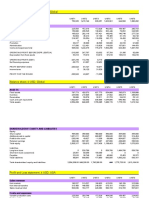

Financials & Earnings

Financial Metrics

Financial Metrics Rating

LT Debt/Equity Ratio

Very Bearish

GMCR's financial metrics are very poor. The company may be overvalued and has relatively low revenue per share. The rank is based on a high price to book value ratio, high return on equity, high price to sales ratio and relatively low cash flow.

Price to Book Value

Return on Equity

Price to Sales Ratio

Business Value

Assets and Liabilities

Ratio Current Ratio LT Debt/Equity TTM 2.41 0.30

Valuation

Ratio Price/Book Price/Sales TTM 5.02 3.85

Returns

Ratio Return on Invest Return on Equity TTM 13.6% 18.7%

Earnings Performance

Earnings Performance Rating

Earnings Growth

Very Bullish

GMCR's earnings performance has been very strong. The company has a history of strong earnings growth and has outperformed analysts' earnings estimates. The rank is based on high earnings growth over the past 3-5 years, better than expected earnings in recent quarters, an upward trend in earnings this year, a relatively high projected P/E ratio and consistent earnings over the past 5 years.

Earnings Surprise

Earnings Trend

Projected P/E Ratio

Earnings Consistency

5 Year Revenue and Earnings Growth

09/07 Revenue(M) Rev % Growth EPS EPS % Growth 341.65 51.63% $0.12 46.99% 09/08 500.28 46.43% $0.21 69.67% 09/09 803.04 60.52% $0.49 136.71% 09/10 1,356.78 68.95% $0.60 22.45% 09/11 2,650.90 95.38% $1.36 126.67%

EPS Estimates

Factor Quarterly EPS Yearly EPS Factor 3-5 year EPS Actual EPS Prev $0.46 $1.36 Actual EPS Growth 64.58% EST EPS Current $0.64 $2.66 Est EPS Growth 32.88% Change +0.18 +1.30 Change -31.70

EPS Surprise

Estimate Latest Qtr 1 Qtr Ago 2 Qtr Ago 3 Qtr Ago $0.36 $0.48 $0.36 $0.38 Actual $0.60 $0.47 $0.49 $0.48 Difference $0.24 $-0.01 $0.13 $0.10 % Difference 66.67 -2.08 36.11 26.32

EPS Quarterly Results

FY 09/10 09/11 09/12 Qtr 1 $0.10 $0.02 $0.68 Qtr 2 $0.19 $0.46 Qtr 3 $0.14 $0.38 Qtr 4 $0.20 $0.49 Total $0.62 $1.35 -

Fiscal Year End Month is September.

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

Price Trend & Expert Opinions

Price/Volume Activity

Price/Volume Activity Rating

Relative Strength vs Market

Very Bearish

Price and volume activity for GMCR is very bearish. GMCR has underperformed the S&P 500 over 26 weeks and has a declining price trend. The rank for GMCR is based on its relative weakness versus the market, negative Chaikin money flow, a negative Chaikin price trend, a positive Chaikin price trend ROC and a decreasing volume trend.

Chaikin Money Flow

Price Trend

Price Trend ROC

Volume Trend

Relative Strength vs S&P500 Index

Chaikin Money Flow

Chart shows whether GMCR is performing better or worse than the market.

Chaikin Money Flow analyzes supply and demand for a company's stock.

Price Activity

Factor 52 Week High 52 Week Low % Change YTD Rel S&P 500 Value 111.62 40.35 35.88%

Price Activity

Factor % Change Price - 4 Weeks % Change Price - 24 Weeks % Change Price - 4 Wks Rel to S&P % Change Price - 24 Wks Rel to S&P Value 23.62% -40.52% 18.24% -49.16%

Volume Activity

Factor Average Volume 20 Days Average Volume 90 Days Chaikin Money Flow Persistency Value 5,951,940 7,741,953 52%

Expert Opinions

Expert Opinions

Earnings Estimate Revisions

Bearish

Expert opinions about GMCR are negative. Short interest in GMCR is high and insiders are not net buyers of GMCR's stock. The rank for GMCR is based on analysts revising earnings estimates upward, a high short interest ratio, insiders not purchasing significant amounts of stock, optimistic analyst opinions and price strength of the stock versus the Food/DrugRetail/Wholesale industry group.

Short Interest

Insider Activity

Analyst Opinions

Relative Strength vs Industry

Earnings Estimate Revisions

Current Current Qtr Next Qtr 0.64 0.72 Current Current FY 2.66 7 Days Ago % Change 0.64 0.72 0.00% 0.00%

Analyst Recommendations

Factor Mean this Week Mean Last Week Change Mean 5 Weeks Ago Value Buy Buy 0.00 Buy

EPS Estimates Revision Summary

Last Week Up Curr Qtr Curr Yr Next Qtr 0 0 0 0 Down 0 0 0 0 Last 4 Weeks Up 0 10 2 5 Down 9 0 7 0

30 Days Ago % Change 2.57 0.09

Next Yr

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

The Company & Its Competitors

GMCR's Competitors in Food/Drug-Retail/Wholesale

Company GMCR FARM NAFC CORE UNFI VSI SYY Power Gauge Historic EPS growth 64.58% 18.10% 2.06% 8.16% 13.47% 11.77% 3.87% Projected EPS growth 32.88% 14.50% 14.48% 20.50% 9.00% Profit Margin 9.32% -9.66% 0.93% 0.28% 1.59% 5.04% 2.80% PEG 0.75 0.83 1.65 1.17 1.70 PE 32.32 7.04 16.50 26.69 26.18 14.67 Revenue(M) 2,651 464 4,530 857 39,323

News Headlines for GMCR Green Mountain Coffee Roasters Completes Sale of Filterfresh Business to ARAMARK - Oct 3, 2011 Green Mountain Coffee Roasters Agrees to Sell Filterfresh Business to ARAMARK - Aug 29, 2011 Green Mountain Coffee Roasters Agrees to Sell Filterfresh Business to ARAMARK - Aug 29, 2011 Vt. utility to buy power from NH's Seabrook May 24, 2011 Green Mountain closes $905M Van Houtte acquisition - Dec 17, 2010

Company Details Green Mtn Coffe 33 COFFEE LANE WATERBURY, VT 05676 USA Phone: 8022445621 Fax: 802-244-5436 Website: http://http://www.greenmountaincoff ee.com Full Time Employees: 5,600 Sector: Retail/Wholesale

Company Profile Green Mountain Coffee Roasters engages in the production and marketing of awardwinning coffees, innovative brewing technology and gourmet single-cup brewing systems. The Company's operations are managed through three operating segments. The Specialty Coffee business unit sources, produces and sells coffee, cocoa, teas and other hot beverages. These varieties are sold primarily to wholesale channels. The Keurig business unit, a pioneer and leading manufacturer of gourmet single-cup brewing systems, targets its premium patented single-cup brewing systems for use at-home and away-from-home, mainly in North America. The Canadian business unit sources, produces and sells coffees in a variety of packaging formats, including K-Cup portion packs, whose brands include Van Houtte, Brlerie St. Denis, Brlerie Mont-Royal and Orient Express and its licensed Bigelow and Wolfgang Puck brands. Green Mountain Coffee Roasters is headquartered in Waterbury, Vermont.

Power Gauge Ratings are created using a relative ranking system that assigns a rank of 0 to 100 (100 being the highest) to each stock in the universe. Rank is calculated by evaluating each of the stocks factors and combining them into a single number using a weighting formula. A stock's rank ranges from 100-0, where 100 is the strongest, and a rank of 95 indicates the stock is better than 95% of the stocks in the universe. Chaikin Stock Research(CSR) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority. CSR is not responsible for trades executed by users of this research report, our web site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1) includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct, complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin Power Tools. This report from Chaikin Power Tools is for informational purposes only and is not a recommendation to buy or sell securities.

LM 2.3 DS 3.0 LS 2.1

Data Provided by ZACKS Investment Research, Inc., www.zacks.com

Special offers to trade stocks from optionsXpress: www.chaikinpowertools.com

Anda mungkin juga menyukai

- Pick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsDokumen14 halamanPick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsChaikin Analytics, LLCBelum ada peringkat

- Resa P2 Final April 2008Dokumen15 halamanResa P2 Final April 2008Arianne Llorente100% (1)

- Business Analysis and Valuation 3 4Dokumen23 halamanBusiness Analysis and Valuation 3 4Budi Yuda PrawiraBelum ada peringkat

- FIN 420 Chapter 3 (Financial Ratio and Analysis)Dokumen20 halamanFIN 420 Chapter 3 (Financial Ratio and Analysis)Izzati Abd Rahim100% (1)

- Mango Corporation Financial Statement AnalysisDokumen7 halamanMango Corporation Financial Statement AnalysisJhodean Arevalo100% (1)

- Stock Research Report For Cooper Inds PLC CBE As of 9/22/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Cooper Inds PLC CBE As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Chaikin Power Gauge Report CVS 29feb2012Dokumen4 halamanChaikin Power Gauge Report CVS 29feb2012Chaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc CF As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc CF As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For MA As of 7/8/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For MA As of 7/8/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Research Report For ARG As of 6/23/11 - Chaikin Power ToolsDokumen4 halamanResearch Report For ARG As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Webmd Health CP WBMD As of 9/22/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Webmd Health CP WBMD As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For BBBY As of 7/8/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For BBBY As of 7/8/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For BAC As of 8/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For BAC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For GOOG As of 6/23/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For GOOG As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Chaikin Power Gauge Report JPM 08sep2011Dokumen4 halamanChaikin Power Gauge Report JPM 08sep2011Chaikin Analytics, LLC100% (2)

- Stock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc BIG As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc BIG As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For ACN As of 7/27/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For ACN As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For MRK As of 9/8/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For MRK As of 9/8/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Chaikin Power Gauge Report GILD 29feb2012Dokumen4 halamanChaikin Power Gauge Report GILD 29feb2012Chaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Brookdale Senr BKD As of 9/22/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Brookdale Senr BKD As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Manulife Finl MFC As of 9/22/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Manulife Finl MFC As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Amer Finl Group AFG As of 9/22/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Amer Finl Group AFG As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For AIG As of 8/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For AIG As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For CMCSA As of 9/8/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For CMCSA As of 9/8/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc EPD As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc EPD As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For AXP As of 6/23/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For AXP As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For GIB As of 7/27/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For GIB As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For URBN As of 6/23/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For URBN As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc AGCO As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc AGCO As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For WFC As of 8/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For WFC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For TW As of 7/27/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For TW As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For GS As of 8/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For GS As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc CYH As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc CYH As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For DD As of 7/27/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For DD As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For RIMM As of 6/23/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For RIMM As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For EMC As of 7/8/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For EMC As of 7/8/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc AUY As of 9/22/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc AUY As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For AXP As of 8/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For AXP As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Chaikin Power Gauge Report AAPL 22jan2012Dokumen4 halamanChaikin Power Gauge Report AAPL 22jan2012GM CapitalBelum ada peringkat

- Stock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For DISH As of 7/27/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For DISH As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsDokumen4 halamanStock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc ATI As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc ATI As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsDokumen4 halamanStock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For UNH As of 7/27/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For UNH As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For HBC As of 8/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For HBC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc ETR As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc ETR As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsDokumen4 halamanStock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Chaikin Power Gauge Report CSCO 29feb2012Dokumen4 halamanChaikin Power Gauge Report CSCO 29feb2012Chaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For T As of 9/8/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For T As of 9/8/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For PNC As of 8/17/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For PNC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Combining Fundamental and Technical Analysis To Increase Trading ProfitsDokumen56 halamanCombining Fundamental and Technical Analysis To Increase Trading ProfitsChaikin Analytics, LLCBelum ada peringkat

- How To Start Investing and Trading in 5 Simple StepsDokumen63 halamanHow To Start Investing and Trading in 5 Simple StepsChaikin Analytics, LLCBelum ada peringkat

- Stock Market Tips From Marc ChaikinDokumen4 halamanStock Market Tips From Marc ChaikinChaikin Analytics, LLCBelum ada peringkat

- Investing in The Stock Market When It Is BearishDokumen61 halamanInvesting in The Stock Market When It Is BearishChaikin Analytics, LLCBelum ada peringkat

- Stock Market Tips From Marc ChaikinDokumen4 halamanStock Market Tips From Marc ChaikinChaikin Analytics, LLCBelum ada peringkat

- When To Sell and Short StocksDokumen44 halamanWhen To Sell and Short StocksChaikin Analytics, LLCBelum ada peringkat

- Rachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsDokumen26 halamanRachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsChaikin Analytics, LLC0% (1)

- Stock Research With Fundamental and Technical AnalysisDokumen59 halamanStock Research With Fundamental and Technical AnalysisChaikin Analytics, LLCBelum ada peringkat

- Pick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsDokumen14 halamanPick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsChaikin Analytics, LLCBelum ada peringkat

- How To Buy Options Using Cash-Secured PutsDokumen36 halamanHow To Buy Options Using Cash-Secured PutsChaikin Analytics, LLCBelum ada peringkat

- 5 Simple Steps For Investing SmarterDokumen66 halaman5 Simple Steps For Investing SmarterChaikin Analytics, LLCBelum ada peringkat

- Find The Best Stocks and ETFs To BuyDokumen56 halamanFind The Best Stocks and ETFs To BuyChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For STX As of 2/29/12 - Chaikin Power ToolsDokumen4 halamanStock Research Report For STX As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Find Best Stocks To Invest in With Stock Investing ToolsDokumen29 halamanFind Best Stocks To Invest in With Stock Investing ToolsChaikin Analytics, LLC100% (1)

- Stock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For MDR As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For MDR As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsDokumen4 halamanStock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsDokumen4 halamanStock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsDokumen4 halamanStock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For APA As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For APA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For A As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For A As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsDokumen4 halamanStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Stock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsDokumen4 halamanStock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCBelum ada peringkat

- Chaikin Power Gauge Report GILD 29feb2012Dokumen4 halamanChaikin Power Gauge Report GILD 29feb2012Chaikin Analytics, LLCBelum ada peringkat

- Chapter 6 Accounting For Bonus Issue and Right IssueDokumen26 halamanChapter 6 Accounting For Bonus Issue and Right IssueGregory Django DipuraBelum ada peringkat

- Reviewing key accounting conceptsDokumen13 halamanReviewing key accounting conceptschristine anglaBelum ada peringkat

- LT Emerging Business FundDokumen2 halamanLT Emerging Business FundSankalp BaliarsinghBelum ada peringkat

- Askari Leasing 2010Dokumen2 halamanAskari Leasing 2010tari787Belum ada peringkat

- BNK 603 - Tutorial 2 2020Dokumen3 halamanBNK 603 - Tutorial 2 2020Stylez 2707Belum ada peringkat

- Balance Sheet and Cash Flow AnalysisDokumen8 halamanBalance Sheet and Cash Flow AnalysisAntonios FahedBelum ada peringkat

- Financial Statement AnalysisDokumen2 halamanFinancial Statement Analysisagm25Belum ada peringkat

- Directors Report 2011 12 WCLDokumen146 halamanDirectors Report 2011 12 WCLsarvesh.bhartiBelum ada peringkat

- MarKs and Spencer Financial AnalysisDokumen10 halamanMarKs and Spencer Financial Analysispatrick olaleBelum ada peringkat

- Global company's profit, sales and expenses over 6 periodsDokumen68 halamanGlobal company's profit, sales and expenses over 6 periodsfereBelum ada peringkat

- FULL - ABIPRAYA - 11 April - Luh9EG20180628131928 PDFDokumen344 halamanFULL - ABIPRAYA - 11 April - Luh9EG20180628131928 PDFgioBelum ada peringkat

- Property-Type Diversification and REIT PerformanceDokumen27 halamanProperty-Type Diversification and REIT PerformanceUNLV234Belum ada peringkat

- Accounting For Corporate Combinations and Associations Australian 7th Edition Arthur Solutions ManualDokumen25 halamanAccounting For Corporate Combinations and Associations Australian 7th Edition Arthur Solutions Manualnicholassmithyrmkajxiet100% (22)

- Analyst Meet Presentation - 15022010Dokumen26 halamanAnalyst Meet Presentation - 15022010damani.manojBelum ada peringkat

- Financial Assets and Liabilities 2014-2018Dokumen3 halamanFinancial Assets and Liabilities 2014-2018MichStevenBelum ada peringkat

- BussinessPlan ManlilykhaDokumen27 halamanBussinessPlan ManlilykharolyniletoBelum ada peringkat

- Topic: Internship Report On Financial Performance of Aneesha Dye-Chem Company Limited Submitted ToDokumen35 halamanTopic: Internship Report On Financial Performance of Aneesha Dye-Chem Company Limited Submitted ToBadhan Roy BandhanBelum ada peringkat

- Solved According To A 2010 Study Conducted by The Toronto Based Social PDFDokumen1 halamanSolved According To A 2010 Study Conducted by The Toronto Based Social PDFAnbu jaromiaBelum ada peringkat

- Chapter 3 - IAS 1Dokumen10 halamanChapter 3 - IAS 1Bahader AliBelum ada peringkat

- PAS 1 Presentation of Financial StatementsDokumen18 halamanPAS 1 Presentation of Financial Statementslyzza joice javierBelum ada peringkat

- Solution Manual Advanced Accounting by Guerrero & Peralta Chapter-12 Solution Manual Advanced Accounting by Guerrero & Peralta Chapter-12Dokumen17 halamanSolution Manual Advanced Accounting by Guerrero & Peralta Chapter-12 Solution Manual Advanced Accounting by Guerrero & Peralta Chapter-12JomarBelum ada peringkat

- Syllabus SPRING 2024 ACCT 1311 Synchronous Full TermDokumen10 halamanSyllabus SPRING 2024 ACCT 1311 Synchronous Full TermNicola AborjayleBelum ada peringkat

- Grasim Annual Report FY10Dokumen151 halamanGrasim Annual Report FY10Vikas RalhanBelum ada peringkat

- Standalone Balance Sheet AnalysisDokumen4 halamanStandalone Balance Sheet AnalysisjayanathBelum ada peringkat

- Fundamental Analysis SeminarDokumen18 halamanFundamental Analysis SeminarAndrew WangBelum ada peringkat

- Chapter 13 Capital Structure and Leverage PDFDokumen16 halamanChapter 13 Capital Structure and Leverage PDFbasit111Belum ada peringkat