Accounting Study Guide

Diunggah oleh

lfrei003Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting Study Guide

Diunggah oleh

lfrei003Hak Cipta:

Format Tersedia

Accounting Study Guide

1. Segment Reporting:

From Spring 2006 Exam

PROBLEM #1. The Games Division of Toys-and-Stuff Inc. uses 500,000 batteries per year for its products. Curreently, Games buys the batteries from an outside supplier for $1.20 each. Power Division of Toys-and-Stuff makes batteries of the type used by Games Division and sells them at $1.30 each. Power's variable cost to produce each battery is $0.70. Power Division has ample manufacturing capacity to serve its regular customers and also meet the needs of Games Division.

Required: Answer each of the following questions independently.

1. If Power agrees to supply the batteries at $1.00, what will be the effect on the incomes of each of the divisions and on Toys-

and-Stuff as a whole? Toys Division Gain Current cost minus projected cost = ($1.20 - $1.00) *500,000 units = $100,000 increase in profits

Power Division Gain Profit on sale of new units = ($1.00 - 0.70) * 500,000 = $150,000 Total for company = $250,000 2. Why might Power's manager accept an offer as low as $0.70 per battery from Games?

When there are no capacity constraints, transfer pricing simply reallocates profits within the company. As long as a unit covers its

variable costs, the production increases the company's overall contribution margin increases.

3. Repeat requirement 1 assuming that Power has no excess capacity and so would lose outside sales if it supplies the batteries

to games, and then find the lowest per-battery price that Power's manager would accept for the 500,000 batteries. Toys Division Gain

Accounting Study Guide Current cost minus projected cost = ($1.20 - $1.00) * 500,000 = $150,000 Loss of contribution margin on outside sales = ($1.30 - $0.70) *500,000 = $300,000 Net loss to power division = $150,000 Total for company = ($50,000) Lowest price it will accept is $1.30 (its outside selling price)

4. Repeat requirement 1 assuming that Power has only 200,000 units of excess capacity and so would lose outside sales of

300,000 units if it supplied the 500,000 batteries needed by games. Toys Division Gain Current cost minus projected cost = ($1.00 - $0.70) * 500,000 = $150,000 Loss of contribution margin on outside sales = ($1.30 - $0.70) * 300,000 = $180,000 Net loss to power division = $30,000 Total for company = $70,000

5. Power again has 200,000 units of excess capacity. What is the lowest price that Power can accept for 500,000 units without

reducing its income? Profit lost with offer [300,000 * $0.60] divided by Units proposed [500,000] = $0.36 Profit necessary - variable costs ($0.70) + $0.36) = $1.06

Segement Reporting PROBLEM #2:

From Spring 2007 Review

The manager of the Scooter Division of United Products Company has given you the following information related to budgeted

operations for the coming year. Sales (100,000 units at $5) Variable cost at $2 per unit Contribution margin at $3 per unit Fixed Costs Division profit Division investment $ $ $ $ $ $ 500,000.00 200,000.00 300,000.00 120,000.00 180,000.00 800,000.00

Accounting Study Guide

The minimum required ROI is 20%. Required: Consider each part independently. 1. Determine the division's expected ROI using the DuPont formula> 22.50% Income x Sales = $180,000 x $500,000 Sales Investment $500,000 $800,000 0.225 .0225 = 22.5%

2. Determine the division's expected residual income. $20,000 Profit budgeted Minimum required return ($800,000 x 20%) Residual income budgeted $180,000 160,000 $20,000

3. The manager has the opportunity to sell an additional 10,000 units at $4.50. Variable cost per unit would be the same as budgeted, but fixed costs would increase by $10,000. Additional investment of $50,000 would also be required. If the manager accepts the special

order, by how much and in what direction will residual income change?

RI would increase by $5,000. This can de determined either by considering the changes in the variables or by preparing new data for total

operations. Considering only the changes: Increase in sales (10,000 x $4.50) Increase in variable costs (10,000 x $2) Increase in contribution margin Increase in fixed costs Increase in profit Increase in minimum required return($50,000 x 20%) Increase in RI $ $ $ $ $ $ $ 45,000.00 20,000.00 25,000.00 10,000.00 15,000.00 10,000.00 5,000.00

Accounting Study Guide

A new income statement and calculation of new total RI shows the following. Sales ($500,000 + $45,000) Variable cost (110,000 x 2) Contribution margin Fixed costs ($120,000 +10,000) Divisional profit Minimum required return ($850,000 x 20%) Residual Income The new $25,000 RI is $5,000 more than RI based on budgeted operations without the special order. $ $ $ $ $ $ $ 545,000.00 220,000.00 325,000.00 130,000.00 195,000.00 710,000.00 25,000.00

4. (a) Scooter's budgeted volume includes 20,000 units that Scooter expects to sell to the Olympia Division of United Products. However, the manager of Olympia Division has received an offer from an outside company to supply the 20,000 units at $4.20. If scooter Division does not meet the $4.20 price, Olympia will buy from the outside company. Scooter could save $25,000 in fixed costs if it dropped its volume from

100,000 to 80,000 units.

(a) Determine Scooter's profit assuming that it meets the $4.20 price.

$164,000. If Scooter accepts the lower price, revenue (and hence contribution margin) will be reduced by $0.80 per unit for 20,000 units. With no change in fixed cists, the $16,000 drop in contribution margin means a similar drop in profit. An income statement under the new

assumption would show the following:

Sales [($5 X 80,000) = ($4.20 X 20,000)] Variable costs ($2 x 100,000) Contribution margin Fixed Costs Divisional Profit

$ $ $ $ $

484,000.00 200,000.00 284,000.00 120,000.00 164,000.00

(b) Determine Scooter's profit if it fails to meet the price and loses the sales.

$145,000. If Scooter does not accept the lower price, the full contribution margin from sales to Olympia will be lost. The avoidable

fixed costs will be saved. The contribution margin lost would be $60,000 (20,000 units at $3), and the fixed costs saved would be $25,000.

Hence, divisional profit would drop $35,000 ($60,000 - $25,000) to $145,000 ($180,000 budgeted profit - $35,000).

The answer could also be arrived at by reference to the income statement prepared in (a). The contribution margin lost would be $44,000 (20,000 x the lower contribution margin of $2.40), with fixed costs savings of $25,000. The net decline in profits would be $19,000 ($44,000 - $25,000),

which, when subtracted the $164,000 total profit shown in the income statement in (a) equals $145,000.

Accounting Study Guide

A third, somewhat longer, approach to the problem would be to prepare an income statement assuming the sales to Olympia are not

made. This approach, too, shows a new divisional profit of $145,000. Sales ($5 x 80,000) Variable costs ($2 x 80,000) Contribution margin Fixed Costs ($120,000 - $25,000) Divisional Profit $ $ $ $ $ 400,000.00 160,000.00 240,000.00 95,000.00 145,000.00

(c) Determine the effect on the company's total profit if Scooter meets the $4.20 price.

Changes in transfer prices do not, in themselves, change total profit. Only if changes in transfer prices cause managers to change their operations and actions can total profit change. In this situation, the manager of Scooter Division had planned to sell to Olympia Division and the income statement was budgeted accordingly. If he accepts the lower price, he will still be selling to Olympia. Similarly, the manager of Olympia Division had planned to buy from Scooter Division. He will still buy from Scooter Division, but at a lower price. The only thing that has changed is the transfer price. The reduction in the profit of Scooter Division (because of the lower contribution margin) will be exactly offset by the increased profit of Olympia Division (because of that division's

lower costs). Hence, the company's total profit will not change. (d) Determine the effect on the company's total profit if Scooter does not meet the price. The company will lose $19,000 if Olympia buys from an outside supplier. ($164,000 - $145,000)

#2 CAPITAL BUDGETING:

From Spring 2006 Exam

Parkman Co. wants to introduce a new product. The managers' best estimates follow. Selling price Variable costs Sales Volume $ 20.00 $ 12.00 30,000 units per year

Bringing out the new product requires a $50,000 increase in working capital during the five year development period, as well as the purchase of new equipment costing $250,000 and having a five-year useful life with no salvage value. The new equipment has cash operating costs of $100,000 per year and will be depreciated using the straight-line method, ignoring the half-year convention. Parkman is in the 40% tax bracket and has 12% cost of capital.

Required: Determine the net present value of this investment opportunity.

Accounting Study Guide

Additional contribution margin (30,000 * $8) Cash operating costs Additional pre-tax cash flow Depreciation Increase in taxable income Increase in income taxes Net cash flow per year

Tax Computation $ 240,000.00 $ 100,000.00 $ 140,000.00 $ 50,000.00 $ 90,000.00 $ 36,000.00

Cash Flow $ 240,000.00 $ 100,000.00 $ 140,000.00

$ 36,000.00 $ 104,000.00

Operating cash flow, years 1-5 ($104,000 * 3.605) Recover of working capital at year 5 = $50,000 * .567= Present value of future cash flow Less:Investment (Machine and working capital at time 0) NPV

$ 374,920.00 $ 28,350.00 $ 403,270.00 $ (300,000.00) $ 103,270.00

Capitol Budgeting PROBLEM #2:

Verma Inc., which has a cutoff rate of 14% and a tax rate of 405, owns a machine with the following characteristics: Book value (and tax basis) Current market value Expected salvage value at end of its 5 year remaining life Annual depreciation expense, straight-line method Annual cash operating costs $ $ $ $ $ 40,000.00 30,000.00 8,000.00 30,000.00

Verma's managers look for opportunities consistent with their desire to create a JIT manufacturing environment. The managers believe that by replacing the old machine and rearranging part of the production area, the company could reduce its investment in inventory by $60,000 as well as save on operating costs. The

replacement machine has the following characteristics. Purpase price Useful life Expected salvage value $ 100,000.00 5 years $ -

Accounting Study Guide

Annual cash operating costs Annual straight-line depreciation expense

$ $

12,000.00 20,000.00

Rearrangment costs are expected to be $12,000 and can be expensed immediately for both book and tax purposes. By the end of the life of the new machine, Verma's managers expect to be further advanced in their implementation of the JIT philosophy and so do not anticipate returning to the prior, higher level of

inventory. Required: Determine whether Verma should purchase the new machine and undertake the plant rearrangement.

Answer: The project should be accepted. The NPV is $40,355. Investment Required Tax Purchase price of new machine Selling price of existing machine Book value of existing machine Loss for tax purposes Tax savings at 40% Cost of plant rearrangement Tax savings at 40% Reduction of working capital requirments Net required investment $ 30,000.00 $ 40,000.00 $ (10,000.00) $ 4,000.00 $ 12,000.00 $ 4,800.00 Cash Flow $ 100,000.00 $ (30,000.00)

$ (4,000.00) $ 12,000.00 $ (4,800.00) $ (60,000.00) $ 13,200.00

Notice that the reduction in working capital is treated as a reduction of the required investment. Because the company does not expect to return to its prior inventory policies at the end of the life of this project, the calculation of cash flows from the project will not include a corresponding outflow in the project's final year. We calculate the annual cash flows and present values for this replacement decision using first the incremental approach and then the toal-project

approach. Incremental Approach - Annual Cash Flows

Savings in operating costs ($30,000 - $12,000) Additional depreciation ($20,000 - $8,000) Increase in taxable income Increased tax at 40% Net annual cash inflow Present value factor for 5-year annuity at 14%

Tax $ 18,000.00 $ 12,000.00 $ 6,000.00 $ 2,400.00

Cash Flow $ 18,000.00

$ $ $

(2,400.00) 15,600.00 3.43

Accounting Study Guide Present value of annual cash inflows Required investment Net present value $ $ $ 53,554.80 13,200.00 40,354.80

Total-Project Approach--Keep Existing Machine Tax $ 30,000.00 $ 8,000.00 $ 22,000.00 $ 15,200.00 Cash Flow $ 30,000.00

Cash operating costs Depreciation Total Expenses Tax Savings at 40% Net cash outflow Present Value factor for 5-year annuity at 14% Present value of annual operating inflows

$ (15,200.00) $ 14,800.00 $ 3.43 $ 50,808.40

But New Machine Cash Operating costs Depreciation Total Expense Tax Savings at 40% Net cash inflow Present value factor for 5-year annuity at 14% Present value of annual inflows Net outlay required for machine Net present value of future outflows Tax $ 12,000.00 $ 20,000.00 $ 32,000.00 $ 12,800.00 Cash Flow $ 12,000.00

$ $ $ $ $

12,800.00 800.00 3.433 2,746.40 13,200.00 10,453.60

The exiting machine has a present value of outflows of $50,808, while the new machine has a present value of outflows of $10,454. The NPV in favor of replacing the existing machine is $40,354($50,808-$10,454), the same as we computed under the incremental approach. Using the new machine will result in new annual cash inflows rather than out-flows. This happends because depreciation is so high that the tax savings is greater than the annual cash operating costs. Do not conclude that if a replacement asset yeilds a positive cash flow, it is automatically a wise investment. In the example used here, if the project had not included the expectation of a reduction in inventory the replacement would

not be wise.

Accounting Study Guide PROBLEM 2(a): Summit Maintenance Technology sells a software package that companies can use to manage their facility and equipment maintenance functions. Features incldue work order tracking, maintenance history reporting, repair history reporting, and parts inventory management. The software is used mainly by large organizations such as airports, manufacturing plants, office complexes, hospitals, and commercial bakeries. A unique aspect of Summit's product is that it has a very intuitive interface and can be accessed via the Web with Summit providing application servers, database and security. Thus, firms that implement the system do not need to add IT staff or equipment. Currently, Summit is negotiating with Ogden National Airport, which has considerable maintenance challenges. For example, the airport has six employees whose sole job is relamping (i.e., replacing light bulbs). In total, the maintenance department at Ogden has 45 employees who maintain escalators, elevators, trams, lighting, and perform painting and other miscellaneour maintenance duties.

Craig Bradley, a senior manager at Ogden National Airport, has held a series of meetings with Summit and has identified

the following cost savings: 1. The company can avoid purchasing a server costing $10,000 next year. 2. Due to better tracking, parts inventory can be reduced. The effect on purchases is $30,000, $20,000, and $10,000 over the next three years. 3. The company will need one less maintenance employee with an annual salary and benefits of $60,000. 4. The company is currently paying $5,000 per year to upgrade its maintenance software. Craig anticipates that the changes to Ogden for software and consulting services will be as follows:

Initial costs -- $90,000 "program fee" plus $55,000 consultant charges fofr systems integration and customization of reports. Ongoing costs -- $14,000 annual program fee after the initial year plus $6,000 per year consulting charges for ongoing

customization beyond the initial year. Required: Calculate the net present value (NPV) assuming a required rate of return of 15 percent. In performaing your calculations, use a three-year time horizon and ignore taxes. Should Ogden invest in the new software?

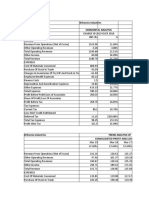

Accounting Study Guide Answer: Time Initial program fee Initial consulting charges Ongoing charges IT equipment Parts equipment Maintenance employee Old software upgrade Total Present value factors at 15% 0 (90,000.00) (55,000.00) 1 2 3

$ $

$ (20,000.00) $ $ 10,000.00 $ 30,000.00 $ $ 60,000.00 $ $ 5,000.00 $ $ (145,000.00) $ 85,000.00 $ $ 1.00 $ 0.87 $ $ (145,000.00) $ 73,916.00 $

(20,000.00) $ (20,000.00) 20,000.00 60,000.00 5,000.00 65,000.00 0.76 49,146.50 $ $ $ $ $ $ 10,000.00 60,000.00 5,000.00 55,000.00 0.66 36,162.50

NPV

$ 14,225.00

From Quiz #4: Suppose you can buy a machine for a new line of umbrellas that you want to produce for $100,000. The machine has a five year life, and will be depreciated straight-line with no salvage value. At the end of five years, you expect to sell the machine for $10,000. Sales price for the umbrellas will be $29 per unit and you will sell 5,000 units per year. Material and labor costs will be $11 and $10 per unit. Fixed SG&A expenses will be $5,000 and can be eliminated after the fifth year. Assume a tax rate of 35% and that all expenses and sales occur at year-end. Would you buy the machine to produce the umbrellas. Your discount rate = 10%. Answer: Item Yr Amount Factor 1 3.791 3.791 3.791 0.621 0.621 NPV -100000 98566 -12321 26537 6210 -2174 16818

Machine $ Contribution Margin 1 thru 5 Fixed Cost 1 thru 5 Depreciation Shield 1 thru 5 Selling Price year 5 Tax on gain on sale year 5 PV of machine purchase

-100000 $8*5000*.65 neg 5k x.65 2000*.35 1000 neg(10000-0)*.35

Accounting Study Guide

#3 Operational Budgeting:

From Spring 2006 Exam

Problem #1: The results of operations for the Jackson Manufacturing Company for the fourth quarter of 2005 were as follows(in 000's): Sales Less variable cost of sales Contribution margin Less fixed production costs Less fixed selling and admin expenses Income before taxes Less taxes on income Net Income $ $ $ $ 65,000.00 $ 105,000.00 $ $ $ $ 600,000.00 240,000.00 360,000.00 170,000.00 190,000.00 76,000.00 114,000.00

Note: Jackson Manufacturing uses the variable costing method. Thus, only variable production costs are included in inventory and cost of goods sold. Fixed production costs are changed to expense in the period incurred. The company's balance sheet as of the end of the fourth quarter of 2005 was as follows (in 000's):

Cash Accounts receivable Inventory Total Current Assets Property, plant and equipment Less accumulated depreciation Total assets Accounts payable Retained Earnings Common Stock Total liabilities and owners equity

$ 200,000.00 $ 120,000.00 $ 400,000.00 $ 720,000.00 $ 200,000.00 $ (100,000.00) $ 820,000.00 $ 12,000.00 $ 208,000.00 $ 600,000.00 $ 820,000.00

Additional Information: 1. Sales and variable costs of sales are expected to increase by 10 percent in the next quarter.

2. All sales are on credit with 80 percent collected in the quarter of sale Guide percent collected in the following qtr. Accounting Study and 20 3. Variable cost of sales consists of 50 percent materials, 30 percent direct labor and 20 percent variable overhead. Materials are purchased on credit: 90 percent are paid for in the quarter of purchase and the remaining amount is paid for in the quarter after purchase. The inventory balance is not expected to change. Also, direct labor and variable overhead are paid in the quarter the expenses are incurred. 4. Fixed production costs (other than $10,000 of depreciation) are expected to increase by 5 percent. Fixed production costs requiring payment are paid in the quarter they are incurred. 5. Fixed selling and administrative costs (other than $5,000 of depreciation expense) are expected to increase by 5 percent. Fixed selling and administrative costs requiring payment are paid in the quarter they are incurred. 6. The tax rate is expected to be 40 percent. All taxes are paid in the quarter they are incurred. 7. No purchases of property, plant, or equipment are expected in the first quarter of 2006. Required: (a) Prepare a budgeted income statement for the first quarter of 2006. (b) Prepare a budgeted statement of cash receipts and disbursements for the first quarter of 2006. Prepare a budgeted balance sheet as of the end of the first quarter of 2006. Answer: Sales Less variable cost of sales Contribution margin Less: Fixed production costs Less: Fixed sell and admin Income before taxes Income taxes Net Income $ 660,000.00 $ 264,000.00 $ 396,000.00 $ $ 67,750.00 110,000.00 $ 177,750.00 $ 218,250.00 $ 87,300.00 $ 130,950.00 10% increase 10% increase 5% cash expense 5% cash expense 40% of NIBT

Cash collected from sales 120,000 + .8($660,000) Cash payments Payment of material Payment of labor Payment for variable overhead Payment for fixed production costs(less depre) Payment for fixed sell and admin(less depre) Payment of income taxes Total cash payments Plus beginning cash balance Ending cash balance

$ 646,000.00 $ 130,800.00 $ 79,200.00 $ 52,800.00 $ 57,750.00 $ 105,000.00 $ 87,300.00 $ 512,850.00 $ 200,000.00 $ 333,150.00 (answer shows 335,150)

Accounting Study Guide

Cash Accounts Receivable Inventory PP&E Less Accum Depre Total Assets

$ $ $ $ 200,000.00 $ 115,000.00 $ $

333,150.00 from schedule above 132,000.00 .2*$660,000 400,000.00 Same as last year Same as last year 85,000.00 950,150.00

Accounts payable Retained earnings Common Stock Total Liab & SE

$ $ $ $

13,200.00 .1*$132,000 338,950.00 Last Year's + net income 600,000.00 Same as last year 952,150.00

(Totals Off because of 2K error from above)

From Spring 2007 Review: Problem #2: The following information is available for Crestmont stores. Budgeted sales for January, 2004 $ 200,000.00 Budgeted sales for February, 2004 $ 240,000.00 Cost data: Purchase price of product 60% of selling price Commission to salespeople 10% of sales Depreciation $2,000 per month Other operating expenses $42,000 per month, including $2,000 depreciation Crestmont Stores, Balance Sheet at December 31, 2003 Assets Equities Cash $ 20,000.00 Accounts payable for merchadise Accounts Receivable $ 110,000.00 Common Stock Inventory $ 150,000.00 Retained Earnings Building & equipment, net $ 200,000.00 Total Total $ 480,000.00 (a) Crestmont maintains inventory at 150% of the coming month's sales requirements. (b) Sales are collected 40% in the month' of sale, 60% in the following month. Purchases are paid 30% in the month of purchase, 70% in the following month. (d) All other expenses requiring cash are paid in the month incurred. (e) The board of directors plans to declare a $3,000 dividend on January 10, payable on January 25.

$ 80,000.00 $ 300,000.00 $ 100,000.00 $ 480,000.00

Accounting Study Guide Required: 1. Prepare a budgeted income statement for January. 2. Prepare a purchases budget for January. 3. Prepare a cash receipts budget for January. 4. Prepare a cash disbursement budget for January. 5. Prepare a cash budget for January. 6. Prepare a pro forma balance sheet as of January 31.

Answer: 1. Crestmont Stores, Budgeted Income Statement for January 2004 Sales Cost of Sales Gross profit Other variable costs, commissions (10%x$200,000) Contribution Margin Fixed Costs: Depreciation Other operating expenses Income

$ $ $ $ $

200,000.00 120,000.00 80,000.00 20,000.00 60,000.00

$ $

2,000.00 40,000.00

$ $

42,000.00 18,000.00

2. Crestmont Stores, Purchases Budget for January 2004 Cost of sales ($200,000 x 60%) Desired ending inventory ($240,000 X 60% X 150%) Total Requirements Beginning inventory, from beginning balance sheet Purchases

$ $ $ $ $

120,000.00 216,000.00 336,000.00 150,000.00 186,000.00

3. Crestmont Stores, Purchase Budget for January 2004 Collections from December sales, December 31 receivables Collections from January sales ($200,000 x 40%) Total

$ 110,000.00 $ 80,000.00 $ 190,000.00

Because sales are collected in full by the end of the month following sales, all accounts receivable at the end of a month are expected to be collected in the coming month. 4. Crestmont Stores, Cash Disbursements Budget for January 2004

Merchandise [($186,000 x 30%) + $80,000] Commissions ($200,000 x 10%) Fixed operating expenses Dividend Notice that depreciation is not a cash disbursement

Accounting Study Guide

$ 135,800.00 $ 20,000.00 $ 40,000.00 $ 3,000.00 $ 198,800.00

5. Crestmont Stores, Cash Budget for January 2004 Beginning balance Receipts(see above) Cash Available Disbursements Ending Balance $ 20,000.00 $ 190,000.00 $ 210,000.00 $ 198,800.00 $ 11,200.00

6. Crestmont Stores, Pro Froma Balance Sheet as of January 31, 2004 Assets Cash (cash budget) Accounts receivable(a) Inventory (purchase budget) Building and equipment(b) Total Equities Accounts Payable Common Stock Retained Earnings(d)

$ $ $ $ $

11,200.00 120,000.00 216,000.00 198,000.00 545,200.00

$ 130,200.00 $ 300,000.00 $ 115,000.00 $ 545,200.00

(a) 60% of January sales of $200,000 (40% was collected in January), (b) $200,000 beginning balance less $2,000 depreciation expense 70% of January purchases of $186,000 (30% was paid in January) (d) Beginning balance of $100,000 plus budgeted income of $18,000 minus divident of $3,000 Notice that cash declined by $8,800 (from $20,000 to $11,200) even though income was $18,000. If Crestmont's managers believe the budgeted cash balance of $11,200 is too low, they might begin to seek ways to increase that balance (e.g., a short-term bank loan).

Accounting Study Guide

#4 Variances

From Spring 2006 Exam RampUp Storage Containers produces a 1,000 cubic foot metal storage unit that is used by storage companies and other businesses needing low-cost, mobile storage units. The units sell for $3,000 per unit. The company uses a standard costing system. At the start of 2004, standard costs were set as follows: Standard cost per unit: Material cost (6 prefabricated metal sheets x $200 Direct labor (10 hours x $20) Overhead ($500 per unit) Total $ $ $ $ 1,200.00 200.00 500.00 1,900.00

The overhead rate was calculated as follows: At the start of 2004 the company estimated that it would produce and sell 5,000 units, incur $500,000 of variable costs and $2,000,000 of fixed overhad costs>

Variable overhead Fixed overhead Total Divided by estimated production Overhead cost per unit

$ 500,000.00 $ 2,000,000.00 $ 2,500,000.00 $ 5,000.00 $ 500.00

Based on estimated sales, standard costs, and other information, the following budget was prepared: 2004 Budget (expected production and sales of 5,000 units) Sales Cost of Sales Gross Profit Selling, general, & admin expense Income from operations $ $ $ $ $ 15,000,000.00 9,500,000.00 5,500,000.00 3,900,000.00 1,600,000.00

During 2004, the company received an unexpected large order ($1,000 units) from a national storage company. The result was a substantial increase in the number of units produced and sold (6,000 units in total), Of the 6,000 units, 5,000 were sold at the standard price of $3,000 per unit and the 1,000 units sold to the national storage company were sold at $2,800 per unit. To produce the 6,000 units, the company incurred the following production costs:

Accounting Study Guide Material purchased and used (36,200 metal sheets x $200) Direct labor (62,000 hours x $21) Variable overhead Fixed overhead $ $ $ $ $ 7,240,000.00 1,302,000.00 594,000.00 2,480,000.00 11,616,000.00

Required: a. Calculate the production cost variances for material, labor and overhad and indicate whether they are favorable or unfavorable.

Answer: Material price variance: (AP - SP)AQ ($200 - $200)36.200 = 0 Material Quantity Variance: (AQ - SQ)SP (36,200 - 36,000) $200 = $40,000 UNFAVORABLE Labor Rate Variance: (SR-AR) AH ($20 - $21) 62,000 = $62,000 Unfavorable Labor Efficiency Variance: (AH - SH) SR (62,000-60,000)$20 = $40,000 Unfavorable Variable costs spending variance: (A*A) - (A*S) $594,000 - [60,000 * $10] = $26,000 Favorable Variable costs effectiveness variance: (A*S) - (S*S) [62,000 * $10] - [60,000 * $10] = $20,000 unfavorable Fixed costs budget variance (A*A) - (BUDGET) $2,480,000 - [2,000,000} = $480,000 Unfavorable Fixed costs volume variance: (Budget) - (Applied): [$2,000,000] - [6,000 * $400} = $400,000 favorable

PROBLEM #2 From Quiz #5 Assume your company applies variable overhead at a rate of $1.50 per direct labor hour and fixed overhead at a rate of $1.75 per direct labor hour. The company budgets 2 hours of labor to produce each of the 5900 units scheduled for production. The company incurs actual variable overhead of $18,750 and actual fixed overhead of $21,500 to produce 6000 units during the year. In addition, it uses 11,800 direct labor hours. Calculate the four overhead variances for the current year. Answer: Variable cost Spending Variance 18750 minus $150(11800) 1050U Efficiency Variance $150(11800) minus $150(12000) 300F Fixed Cost Spending Variance Efficiency Variance

21500 minus 21500 minus 5900(2)1.75 minus

5900(2)1.75 6000(2)1.75

850U 350F

Accounting Study Guide

PROBLEM #3

From Spring 2007 Review: Baldwin Company makes stereo cabinets. The Deluxe model has the following requirements. Materials Direct Labor Variable overhead 50 feet of wood at $1.40 per foot 4 hours at $17 per hour $5 per direct labor hour

During June 20x4, the company made 1,200 Deluxe cabinets. Operating results were as follows: Materials purchases (78,000 feet at $1.45) Materials used Direct Labor (4,740 hours at $16.80) Variable overhead $113,000 63,200 feet $79,632 $25,500

Required Compute the standard variable cost per Deluxe cabinet and the variances for June 2004. Standard Variable Cost Materials (50 feet of wood at $1.40) Direct labor (4 hours at $17 per hour) Variable overhead at $5 per direct labor hour Total standard variable cost $ $ $ $ 70.00 68.00 20.00 158.00

Materials Variances for June 2004 Actual Cost of Materials Purchased $1.45 x 78,000 $113,100 $3,900 U Material Price Variance Budgeted Cost for 58,000 Feet $1.40 x 78,000 $109,200

Accounting Study Guide

Alternatively, 78,000 x ($1.40 - $1.45) = $3,900 unfavorable.

Budgeted Cost of Materials Used 63,200 x $1.40 $88,480 $4,480 U Material use variable

Budgeted Cost for 1,200 Units 1,200 x $70, or 1,200 x 50 x $1.40 $84,000

Labor Variances for June 2004 Direct Labor Costs Incurred $16.80 x 4,740 $79,632 $948 F Labor rate variance Budgeted Cost for 4,740 Hours $17.00 x $4,740 $80,580 $1,020 F Labor efficiency variance Variable Overhead Varianced for June 2004 Actual Variable Overhead $25,500 $1,800 U Budget variance Budgeted VO for 4,740 Hours $5.00 x 4,740 $23,700 Budgeted Costs for 4,740 Hours $17.00 x 4,740 $80,580

Budgeted Cost for 1,200 Units 1,200 x $68 or 1,200 x 4 x $17 $81,600

Accounting Study Guide Budgeted VO for 4,740 hours 4,740 x $5.00 $23,700 $300 F Efficiency Variance

Budgeted VO for 1,200 Units 1,200 x $20, or 1,200 x 4 x $5.00 $24,000

#5 CASH FLOW ANALYSIS

From Spring 2006 Exam

5. Lance Inc - Cash Flow Analysis (16 points) Based solely on the financial statements attached, fill in the 20 blanks on the attached cash flow statement for the year ended December 25, 2004 Consolidated Statements of Cash Flows LANCE, INC AND SUBSIDIARIES For the Fiscal Years Ended December 25, 2004, December 27, 2003, and December 28, 2002 (In Thousands)

Net Income Adjustments to reconcile net income to cash provided by operating activities: Depreciation Amortization Bad Debt Expense Gain or loss on sale of property Deferred Income Taxes Imputed Interest on Deferred Notes Other Changes in operating assets and liabilities: Accounts Receivable Inventory Prepaid Expense

24855 I/S 28282 167 1112 -710 1597 97

Note 1 I/S Note 1 See notes below. Subtract gain and add back los Note 6 Note 4

-5673 BB - (EB-BDE) 851 BB + Acquisition(386K) - EB 684

Accounting Study Guide

Accounts Payable Accured Income Taxes Other Net Cash Flow from Operating Activities Investing Activities: Purchases of Property and Equipment Proceeds from sale of property and equipment Acquisition of a business Net cash used in investing activities Financing Activities: Dividends Paid Issuance of common stock Issuance of debt Repayments of Debt Change in cash

4343 -288

-28961 Note 1 1591 Note 1 -3717 Note 4

-18869 see below 8302 B/S 2482 -5667 Note 4 15987

Retained Earnings B 155007 A 24855 S 18869 E 160993

B/S Net Income PLUG B/S

Retained Earnings

Retained Earnings

PP&E B A A S E

410576 28961 1241 18354 422424

Accum Depreciation B A A S E 710

249899 28282 0 17473 260708

Sales price - Adj basis = loss

Accounting Study Guide From Celestial Seasonings, Inc Celestial Seasonings, Inc Consolidated Statements of Cash Flows Year Ended September 30, 1999 Cash FLOWS FROM OPERATING ACTIVITIES: Net Income.. Adjustments to reconcile net income to net cash provided by (used in) operating activities: Depreciation. Amoritization of intangibles.. Amortization of financing fees.. Deferred Income Taxes.. Loss on Disposal of Assets.. Changes in operatin assets and liabilities: Accounts Receivable.. Inventory Prepaid income taxes. Prepaid expenses Accounts Payable.. Accured Liabilities and wages.. Accured income taxes Accured Interest Payable.. Net cash provided by (used in) operating activities

2487 I/S

1763 1,202 211 -3,442 63 -1729 12,464 106 -457 -2069 1,332

Note 1 I/S change in acc amortization from note 4 from note 9 or sum of change in current and nonc Sales price ($148) - Book value of assets sold ($2 Change in B/S amount Change in B/S amount Change in B/S amount Change in B/S amount Change in B/S amount Change in B/S amount

12 Change in B/S amount(if no balance is present, th 11,943

CASH FLOWS FROM INVESTING ACTIVITIES: Proceeds from sales of asset Capital expenditures.. Increase in intangible assets. (Increase) decrease in other assets. Net cash used in investing activities Cash Flows from Financing Activities: Proceeds from Common Stock Issuance Increase in long-term debt. Reduction in long-term debt.. Net Cash (used in) provided by Financing Activities.

148 -6274 -402 -3749 -10277

Note 4 Note 4 Change in cost of intangible assets ($27,759 - $2 Unexplained change in other asset account. EB (

681 Change of Common Stock and Capital Surplus 13,075 Note 4 -17,318 Unexplained change in other asset account BB ($ -3562

Accounting Study Guide NET DECREASE IN CASH AND CASH EQUIVALENTS. CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR. CASH AND CASH EQUIVALENTS AT END OF YEAR.. -1,896 B/S 2533 B/S 637

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

Accounting Study Guide

ow. Subtract gain and add back losses!

on(386K) - EB

Accounting Study Guide

Accounting Study Guide

amortization from note 4 sum of change in current and noncurrent deferred tax asset 148) - Book value of assets sold ($294-$83)

amount(if no balance is present, then "0"

t of intangible assets ($27,759 - $27,357) hange in other asset account. EB ($4,552) + Amortization ($211) - BB ($1,014)

mmon Stock and Capital Surplus

hange in other asset account BB ($15,073) + Borrowings ($13,075) - EB ($10,830)

Anda mungkin juga menyukai

- Accounting Basics for Non-AccountantsDokumen129 halamanAccounting Basics for Non-Accountantsdesikan_r100% (7)

- Allowable Deductions Part 1Dokumen3 halamanAllowable Deductions Part 1John Rich GamasBelum ada peringkat

- Module 2 - Strat ManDokumen4 halamanModule 2 - Strat ManElla MaeBelum ada peringkat

- PeerDokumen8 halamanPeerronnelBelum ada peringkat

- Audit of Cash QuizDokumen4 halamanAudit of Cash QuizAndy LaluBelum ada peringkat

- Polly's Pet Products Financial AnalysisDokumen6 halamanPolly's Pet Products Financial AnalysisMichael Aboelkhair100% (1)

- Performance MGMT Discussion QuestionsDokumen7 halamanPerformance MGMT Discussion QuestionsSritel Boutique HotelBelum ada peringkat

- Audit EngagementDokumen3 halamanAudit EngagementTyra Lim Ah KenBelum ada peringkat

- Example Real Estate ProjectDokumen28 halamanExample Real Estate Projectlfrei003100% (1)

- Applied Auditing Audit of Investment: Problem No. 1Dokumen3 halamanApplied Auditing Audit of Investment: Problem No. 1JessicaBelum ada peringkat

- Homework #3 - Coursera32 PDFDokumen9 halamanHomework #3 - Coursera32 PDFAnurag SahrawatBelum ada peringkat

- Myob - Chart of AccountsDokumen4 halamanMyob - Chart of AccountsAr RaziBelum ada peringkat

- Prelim ExaminationDokumen9 halamanPrelim ExaminationShannel Angelica Claire RiveraBelum ada peringkat

- Quiz 2 Ncahs/ Discontinued Operation: FeedbackDokumen67 halamanQuiz 2 Ncahs/ Discontinued Operation: FeedbackAngela Miles DizonBelum ada peringkat

- Mock CPA Board Examinations ReviewDokumen8 halamanMock CPA Board Examinations ReviewLara Lewis Achilles100% (1)

- FABM 2 Practice Problems SCIDokumen3 halamanFABM 2 Practice Problems SCIMounicha Ambayec100% (4)

- AccountingDokumen5 halamanAccountingRaveena JainBelum ada peringkat

- Audit of Liabilities AdjustmentsDokumen27 halamanAudit of Liabilities AdjustmentsChinee CastilloBelum ada peringkat

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDokumen9 halamanEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanBelum ada peringkat

- Borrowing Cost and Government Grants Multiple ChoiceDokumen2 halamanBorrowing Cost and Government Grants Multiple Choicetough mama100% (2)

- Reviewer in Legal AccountingDokumen7 halamanReviewer in Legal AccountingPrincess Cruz MacalingaBelum ada peringkat

- Activity 6 - EthicsDokumen2 halamanActivity 6 - EthicsGwy HipolitoBelum ada peringkat

- Correction of ErrorsDokumen6 halamanCorrection of ErrorsJanjielyn MoralesBelum ada peringkat

- Learning Objective 11-1: Chapter 11 Considering The Risk of FraudDokumen25 halamanLearning Objective 11-1: Chapter 11 Considering The Risk of Fraudlo0302100% (1)

- Business Combination Drill PDFDokumen2 halamanBusiness Combination Drill PDFMelvin MendozaBelum ada peringkat

- Solutions Bank Recon and ARDokumen10 halamanSolutions Bank Recon and ARJaycel Yam-Yam VerancesBelum ada peringkat

- Solution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentDokumen39 halamanSolution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentCaryll Joy BisnanBelum ada peringkat

- Indirect Method Cash Flow Statement for Hill CompanyDokumen6 halamanIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumBelum ada peringkat

- Case 8 - Spartan Roofing Loan EvaluationDokumen15 halamanCase 8 - Spartan Roofing Loan EvaluationFritelle MacarenaBelum ada peringkat

- 8.0 TVM Financial PlanningDokumen2 halaman8.0 TVM Financial PlanningYashvi MahajanBelum ada peringkat

- Strategic Management - Module 6 - Strategy Evaluation and ControlDokumen2 halamanStrategic Management - Module 6 - Strategy Evaluation and ControlEva Katrina R. LopezBelum ada peringkat

- Petty Cash, Part 3 - Kuya Joseph's BlogDokumen5 halamanPetty Cash, Part 3 - Kuya Joseph's BlogCM LanceBelum ada peringkat

- Financial Accounting Problems: Problem I (Current Assets)Dokumen21 halamanFinancial Accounting Problems: Problem I (Current Assets)Fery AnnBelum ada peringkat

- Estate TaxDokumen2 halamanEstate Taxucc second yearBelum ada peringkat

- 01 - Audit of Cash & Cash EquivalentsDokumen4 halaman01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesBelum ada peringkat

- Auditing Problems and SolutionsDokumen45 halamanAuditing Problems and SolutionsRonnel TagalogonBelum ada peringkat

- Retrospectively in The First Set of Financial Statements Authorized For Issue AfterDokumen7 halamanRetrospectively in The First Set of Financial Statements Authorized For Issue Aftermax pBelum ada peringkat

- Business TaxationDokumen6 halamanBusiness TaxationMandy BloomBelum ada peringkat

- Aud2 CashDokumen6 halamanAud2 CashMaryJoyBernalesBelum ada peringkat

- Estate Tax Guide for PhilippinesDokumen50 halamanEstate Tax Guide for PhilippinesLea JoaquinBelum ada peringkat

- Activity Task Business CombinationDokumen7 halamanActivity Task Business CombinationCasper John Nanas MuñozBelum ada peringkat

- Audit of PPE accounts and related valuationDokumen8 halamanAudit of PPE accounts and related valuationAlyna JBelum ada peringkat

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFDokumen60 halamanAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeBelum ada peringkat

- Eight Areas of WasteDokumen18 halamanEight Areas of WasteMelody Altubar-BeatoBelum ada peringkat

- CORRECTING FINANCIAL STATEMENT ERRORSDokumen56 halamanCORRECTING FINANCIAL STATEMENT ERRORSKimberly Pilapil MaragañasBelum ada peringkat

- MODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsDokumen8 halamanMODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsJake Bundok100% (1)

- Far - Pre BoardDokumen17 halamanFar - Pre BoardClene DoconteBelum ada peringkat

- Mid PS3Dokumen8 halamanMid PS3heyBelum ada peringkat

- AFAR-07 (Home-Office & Branch Accounting)Dokumen7 halamanAFAR-07 (Home-Office & Branch Accounting)mysweet surrenderBelum ada peringkat

- CORPORATE LIQUIDATION STATEMENTDokumen73 halamanCORPORATE LIQUIDATION STATEMENTCasper John Nanas MuñozBelum ada peringkat

- Peer Mentoring PostTestDokumen7 halamanPeer Mentoring PostTestronnelBelum ada peringkat

- Ap 9004-IntangiblesDokumen5 halamanAp 9004-IntangiblesSirBelum ada peringkat

- Calculate Estate Tax for Married Filipino DecedentDokumen14 halamanCalculate Estate Tax for Married Filipino DecedentLea ChermarnBelum ada peringkat

- AC 3101 Discussion ProblemDokumen1 halamanAC 3101 Discussion ProblemYohann Leonard HuanBelum ada peringkat

- ABC Co acquisition goodwill calculationDokumen2 halamanABC Co acquisition goodwill calculationApril ManjaresBelum ada peringkat

- Advanced AuditingDokumen358 halamanAdvanced AuditingAnuj MauryaBelum ada peringkat

- Nonprofit Organization Cash FlowsDokumen6 halamanNonprofit Organization Cash FlowsCresca Cuello CastroBelum ada peringkat

- AC 510 Kimwell Chapter 5 Solutions 1Dokumen134 halamanAC 510 Kimwell Chapter 5 Solutions 1Jeston TamayoBelum ada peringkat

- Quiz 1Dokumen24 halamanQuiz 1Marwin AceBelum ada peringkat

- Cash and Cash Equivalents Multiple Choice QuestionsDokumen11 halamanCash and Cash Equivalents Multiple Choice Questionsjhela18Belum ada peringkat

- FA Mod1 2013Dokumen551 halamanFA Mod1 2013Anoop Singh100% (2)

- Completing Audit ProceduresDokumen7 halamanCompleting Audit ProceduresyebegashetBelum ada peringkat

- Audit of Educational InstitutionsDokumen3 halamanAudit of Educational InstitutionsjajoriaBelum ada peringkat

- Advanced Financial Accounting Midterm: For Questions 2-4Dokumen13 halamanAdvanced Financial Accounting Midterm: For Questions 2-4Mister MysteriousBelum ada peringkat

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDokumen13 halamanCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaWilsonBelum ada peringkat

- Asian financial crisis wreaked havoc on East Asian currenciesDokumen4 halamanAsian financial crisis wreaked havoc on East Asian currenciesTumbleweedBelum ada peringkat

- Cash and Accrual Discussion301302Dokumen2 halamanCash and Accrual Discussion301302Gloria BeltranBelum ada peringkat

- Revise Mid TermDokumen43 halamanRevise Mid TermThe FacesBelum ada peringkat

- ABC Family Channel: Capital BudgetingDokumen1 halamanABC Family Channel: Capital Budgetinglfrei003Belum ada peringkat

- Aztec Ratio SolutionsDokumen23 halamanAztec Ratio Solutionslfrei003Belum ada peringkat

- Rations and Technology ToolsDokumen9 halamanRations and Technology Toolslfrei003Belum ada peringkat

- Coca-Cola Company: Liabilities & Stockholder's EquityDokumen8 halamanCoca-Cola Company: Liabilities & Stockholder's Equitylfrei003Belum ada peringkat

- Chapter 1 NotesDokumen4 halamanChapter 1 Noteslfrei003Belum ada peringkat

- Final ReviewDokumen1 halamanFinal Reviewlfrei003Belum ada peringkat

- Chapter 1 NotesDokumen4 halamanChapter 1 Noteslfrei003Belum ada peringkat

- Group Work FA 1 - Group 7Dokumen9 halamanGroup Work FA 1 - Group 7Tri HuynhBelum ada peringkat

- Britannia Industries Financial AnalysisDokumen4 halamanBritannia Industries Financial AnalysisSneha BhartiBelum ada peringkat

- IA Prefinal Exam Submissions: Intermediate Accounting II Pre-FinalDokumen10 halamanIA Prefinal Exam Submissions: Intermediate Accounting II Pre-FinalClaire BarbaBelum ada peringkat

- IA 3 Final Assessment PDFDokumen5 halamanIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDokumen8 halamanChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangBelum ada peringkat

- Trading Account InsightsDokumen21 halamanTrading Account InsightsAshok NagpalBelum ada peringkat

- Far Reviewer Lecture Notes 1 - CompressDokumen21 halamanFar Reviewer Lecture Notes 1 - CompressAzure PremiumsBelum ada peringkat

- F.Rwtirement and Pension-1Dokumen9 halamanF.Rwtirement and Pension-1Madhu dollyBelum ada peringkat

- MarketLineIC GFL Environmental Inc Profile 310323Dokumen20 halamanMarketLineIC GFL Environmental Inc Profile 310323Jobin JoseBelum ada peringkat

- Completing THE Accounting Cycle: BKAL 1013 Chapter 4 1Dokumen51 halamanCompleting THE Accounting Cycle: BKAL 1013 Chapter 4 1Muhammad Franz FirdauzBelum ada peringkat

- Planning Forecasts - Short, Medium & Long Term Forecasting TechniquesDokumen31 halamanPlanning Forecasts - Short, Medium & Long Term Forecasting TechniquesAnonymous iCvmTVsUtBelum ada peringkat

- Business Studies Notes PDFDokumen85 halamanBusiness Studies Notes PDFJáçøb Ñímø100% (1)

- 01 The Accounting Environment and Accounting FrameworkDokumen39 halaman01 The Accounting Environment and Accounting Frameworkapostol ignacio100% (1)

- Introduction to Financial StatementsDokumen4 halamanIntroduction to Financial StatementsHoàng HuyBelum ada peringkat

- Accountancy & Auditing-I Subjective - 1Dokumen4 halamanAccountancy & Auditing-I Subjective - 1zaman virkBelum ada peringkat

- CHAPTER 9 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersDokumen1 halamanCHAPTER 9 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersMichBelum ada peringkat

- Module - WorksheetDokumen2 halamanModule - WorksheetKae Abegail GarciaBelum ada peringkat

- ACC100 Chapter 10Dokumen61 halamanACC100 Chapter 10ConnieBelum ada peringkat

- Module 2 Conceptual Framework For Financial ReportingDokumen9 halamanModule 2 Conceptual Framework For Financial ReportingVivo V27Belum ada peringkat

- Fabm3 M3Dokumen23 halamanFabm3 M3Jolina GabaynoBelum ada peringkat

- Possession NotesDokumen9 halamanPossession NotesSZBelum ada peringkat

- Billabong Case StudyDokumen13 halamanBillabong Case StudyVan Tran0% (1)