How cost-push and demand-pull inflation impact aggregate supply and prices

Diunggah oleh

tejas_41113748Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

How cost-push and demand-pull inflation impact aggregate supply and prices

Diunggah oleh

tejas_41113748Hak Cipta:

Format Tersedia

COST-PUSH INFLATION: Aggregate supply is the total volume of goods and services produced by an economy at a given price level.

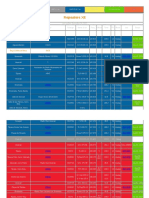

When there is a decrease in the aggregate supply of goods and services stemming from an increase in the cost of production, we have cost-push inflation. Cost-push inflation basically means that prices have been pushed up by increases in costs of any of the four factors of production (labour, capital, land or entrepreneurship) when companies are already running at full production capacity. With higher production costs and productivity maximized, companies cannot maintain profit margins by producing the same amounts of goods and services. As a result, the increased costs are passed on to consumers, causing a rise in the general price level (inflation). A company may need to increases wages if labourers demand higher salaries (due to increasing prices and thus cost of living) or if labour becomes more specialized. If the cost of labour, a factor of production, increases, the company has to allocate more resources to pay for the creation of its goods or services. To continue to maintain profit margins, the company passes the increased costs of production on to the consumer, making retail prices higher. Along with increasing sales, increasing prices is a way for companies to constantly increase their bottom lines and essentially grow. Another factor that can cause increases in production costs is a rise in the price of raw materials. This could occur because of scarcity of raw materials, an increase in the cost of labour and/or an increase in the cost of importing raw materials and labour. The government may also increase taxes to cover higher fuel and energy costs, forcing companies to allocate more resources to paying taxes. To visualize how cost-push inflation works, we can use a simple price-quantity graph showing what happens to shifts in aggregate supply. The graph below shows the level of output that can be achieved at each price level. As production costs increase, aggregate supply decreases from AS1 to AS2 (given production is at full capacity), causing an increase in the price level from P1 to P2. The rationale behind this increase is that, for companies to maintain (or increase) profit margins, they will need to raise the retail price paid by consumers, thereby causing inflation.

DEMAND-PULL INFLATION: Demand-pull inflation occurs when there is an increase in aggregate demand, categorized by the four sections of the macroeconomy: households, businesses, governments and foreign buyers. When these four sectors concurrently want to purchase more output than the economy can produce, they compete to purchase limited amounts of goods and services. Buyers in essence bid prices up, again, are causing inflation. This excessive demand, also referred to as too much money chasing too few goods, usually occurs in an expanding economy. For example, an increase in government purchases can increase aggregate demand, thus pulling up prices. Another factor can be the depreciation of local exchange rates, which raises the price of imports and, for foreigners, reduces the price of exports. As a result, the purchasing of imports decreases while the buying of exports by foreigners increases, thereby raising the overall level of aggregate demand. Finally, if government reduces taxes, households are left with more disposable income in their pockets. This in turn leads to increased consumer spending, thus increasing aggregate demand and eventually causing demand-pull inflation. When aggregate demand increases without a change in aggregate supply, the quantity supplied will increase. Looking again at the price-quantity graph, we can see the relationship between aggregate supply and demand. If aggregate demand increases from AD1 to AD2, in the short run, this will not change (shift) aggregate supply, but cause a change in the quantity supplied as represented by a movement along the AS curve. The rationale behind this lack of shift in aggregate supply is that aggregate demand tends to react faster to changes in economic conditions than aggregate supply. As companies increase production due to increased demand, the cost to produce each additional output increases, as represented by the change from P1 to P2. The rationale behind this change is that companies would need to pay workers more money (e.g. overtime) and/or invest in additional equipment to keep up with demand, thereby increasing the cost of production. Just like cost-push inflation, demandpull inflation can occur as companies, to maintain profit levels, pass on the higher cost of production to consumers prices.

Anda mungkin juga menyukai

- Inflation 2-10-2011Dokumen3 halamanInflation 2-10-2011Piya Piya TiwariBelum ada peringkat

- How Demand-Pull Inflation Arises When Aggregate Demand Exceeds SupplyDokumen1 halamanHow Demand-Pull Inflation Arises When Aggregate Demand Exceeds SupplyShubham KumarBelum ada peringkat

- Cause of InflationDokumen5 halamanCause of InflationNeil Quinsay BernalBelum ada peringkat

- The Theory of InflationDokumen16 halamanThe Theory of InflationJoseph OkpaBelum ada peringkat

- Inflation Hand-outDokumen4 halamanInflation Hand-outTashaneBelum ada peringkat

- INFLATION AND DEFLATION-minDokumen17 halamanINFLATION AND DEFLATION-minHoang Minh HienBelum ada peringkat

- ASSIGNMENTDokumen4 halamanASSIGNMENTAteeb AhmedBelum ada peringkat

- Measuring Inflation and Deflation RatesDokumen6 halamanMeasuring Inflation and Deflation Ratesstudent 1Belum ada peringkat

- Mohd Ayaz Raza BM 111 Asssingment 1Dokumen7 halamanMohd Ayaz Raza BM 111 Asssingment 1Mohd Ayaz RazaBelum ada peringkat

- Module10 SummaryDokumen6 halamanModule10 Summarytayyba NooorBelum ada peringkat

- Finm4 MidtermsDokumen17 halamanFinm4 MidtermsMARGARETTE LAGARE REALIZABelum ada peringkat

- Module 5 InflationDokumen7 halamanModule 5 Inflationexequielmperez40Belum ada peringkat

- MacroEconomics AssignmentDokumen13 halamanMacroEconomics AssignmentMayankBelum ada peringkat

- QUESTION: Explain How Elasticity of Demand Concept May Be Used by Government andDokumen5 halamanQUESTION: Explain How Elasticity of Demand Concept May Be Used by Government andChitepo Itayi StephenBelum ada peringkat

- A. Aggregate Expenditures: Macroeconomics Unit 3Dokumen20 halamanA. Aggregate Expenditures: Macroeconomics Unit 3Shoniqua JohnsonBelum ada peringkat

- Introduction of InflationDokumen45 halamanIntroduction of InflationSandeep ShahBelum ada peringkat

- Impact of InflationDokumen5 halamanImpact of InflationIlma FatimaBelum ada peringkat

- Inflation 2Dokumen19 halamanInflation 2Salma GamalBelum ada peringkat

- Aggregate SupplyDokumen63 halamanAggregate SupplyMuhammad RidhwanBelum ada peringkat

- Research - Eco3Dokumen3 halamanResearch - Eco3Anonymous iqc0nkBelum ada peringkat

- BE 4023 Tutorial 1Dokumen7 halamanBE 4023 Tutorial 1MC SquiddyBelum ada peringkat

- Factors that Cause Inflation & its Impact on Exchange RatesDokumen7 halamanFactors that Cause Inflation & its Impact on Exchange RatesMuhammad Zeshan AliBelum ada peringkat

- Intermediate Macroeconomics Sec 222Dokumen163 halamanIntermediate Macroeconomics Sec 222Katunga MwiyaBelum ada peringkat

- Demand Pull InflationDokumen4 halamanDemand Pull InflationqashiiiBelum ada peringkat

- Chapter 12Dokumen10 halamanChapter 12spamahmad07Belum ada peringkat

- InflationDokumen8 halamanInflationFergus DeanBelum ada peringkat

- Causes and Effects of InflationDokumen3 halamanCauses and Effects of InflationBurairBelum ada peringkat

- 10.1 Self-Correcting Mechanism With AD-AS: Aggregate DemandDokumen16 halaman10.1 Self-Correcting Mechanism With AD-AS: Aggregate Demandhellopink1Belum ada peringkat

- Types of Inflation Explained: Demand-Pull vs Cost-PushDokumen4 halamanTypes of Inflation Explained: Demand-Pull vs Cost-PushZiehan AyunieyBelum ada peringkat

- Aggregate SupplyDokumen6 halamanAggregate SupplyjhussBelum ada peringkat

- Preliminary Economics Practise Extended ResponseDokumen3 halamanPreliminary Economics Practise Extended Responseoiu7hjjs100% (2)

- MEBE - 05 - Aggregate Demand and SupplyDokumen40 halamanMEBE - 05 - Aggregate Demand and Supplynagarajan adityaBelum ada peringkat

- Inflation Document Summary Under 40 CharactersDokumen16 halamanInflation Document Summary Under 40 CharactersabrarbuttBelum ada peringkat

- Cost-Push Inflation ExplainedDokumen1 halamanCost-Push Inflation ExplainedLJ AbancoBelum ada peringkat

- Economic Analysis Ch.9.2023Dokumen12 halamanEconomic Analysis Ch.9.2023Amgad ElshamyBelum ada peringkat

- Inflation and Types of Inflation - TeacherDokumen38 halamanInflation and Types of Inflation - TeacheranandjeevBelum ada peringkat

- AS-AD ModelDokumen5 halamanAS-AD ModelSunil VuppalaBelum ada peringkat

- University of Liberal Arts Bangladesh (ULAB)Dokumen13 halamanUniversity of Liberal Arts Bangladesh (ULAB)HasanZakariaBelum ada peringkat

- Unit IDokumen10 halamanUnit Ithanigaivelu4Belum ada peringkat

- Economic 4th SemDokumen9 halamanEconomic 4th SemSomnath PahariBelum ada peringkat

- Inflation and DeflationDokumen21 halamanInflation and DeflationFazra FarookBelum ada peringkat

- InflationDokumen6 halamanInflationDr. Swati GuptaBelum ada peringkat

- Causes and remedies of demand-pull inflationDokumen5 halamanCauses and remedies of demand-pull inflationHasan TareckBelum ada peringkat

- Chapter 4 The MacroeconomyDokumen18 halamanChapter 4 The MacroeconomyAndrea MelissaBelum ada peringkat

- Ace Institute of Management: Assignment: Inflation in NepalDokumen7 halamanAce Institute of Management: Assignment: Inflation in NepalRupesh ShahBelum ada peringkat

- Factors Affecting SupplyDokumen10 halamanFactors Affecting Supplyazhar ahmedBelum ada peringkat

- Micro Economics: An Essay-Centric Guide: Demand and Supply / Market EquilibriumDokumen8 halamanMicro Economics: An Essay-Centric Guide: Demand and Supply / Market EquilibriumKyu9930Belum ada peringkat

- Inflation: By: Prescious Ann Joy Eleuterio Lauren Julleza Nicole Aira BilbaoDokumen36 halamanInflation: By: Prescious Ann Joy Eleuterio Lauren Julleza Nicole Aira BilbaoLauren Saavedra JullezaBelum ada peringkat

- Aggregate Demand: Desire For Those Goods. As A Result of The Same Calculation Methods, The Aggregate Demand andDokumen3 halamanAggregate Demand: Desire For Those Goods. As A Result of The Same Calculation Methods, The Aggregate Demand andFaisal AwanBelum ada peringkat

- InflationDokumen8 halamanInflationSara Gooden - ThompsonBelum ada peringkat

- Macroeconomics EssayDokumen7 halamanMacroeconomics EssayAchim EduardBelum ada peringkat

- EEE (2021-22) Handout 04 Aggregate Demand Aggregate SupplyDokumen2 halamanEEE (2021-22) Handout 04 Aggregate Demand Aggregate SupplyMahak Gupta Student, Jaipuria LucknowBelum ada peringkat

- V. Outlook For Inflation: National Bank of RomaniaDokumen2 halamanV. Outlook For Inflation: National Bank of RomaniaLaurentiuMarianBelum ada peringkat

- Inflation Is A General Increase in The Price Level Relative To The Goods Available Which Results in ADokumen3 halamanInflation Is A General Increase in The Price Level Relative To The Goods Available Which Results in AMochammad YusufBelum ada peringkat

- Nature Causes &effectsDokumen23 halamanNature Causes &effectsVijaya SwaroopBelum ada peringkat

- Aggregate-Demand---Revision-NotesDokumen10 halamanAggregate-Demand---Revision-Notesvngo0234Belum ada peringkat

- Economics Exam: Section ADokumen6 halamanEconomics Exam: Section ALiam TennantBelum ada peringkat

- Economics Notes From IGCSE AIDDokumen50 halamanEconomics Notes From IGCSE AIDAejaz MohamedBelum ada peringkat

- Inflation-Conscious Investments: Avoid the most common investment pitfallsDari EverandInflation-Conscious Investments: Avoid the most common investment pitfallsBelum ada peringkat

- Kerala Tour KL 3 - Oct-Dec 20161466236195Dokumen3 halamanKerala Tour KL 3 - Oct-Dec 20161466236195tejas_41113748Belum ada peringkat

- Project Report On Sbi Mutual Fund PDFDokumen60 halamanProject Report On Sbi Mutual Fund PDFRenuprakash KpBelum ada peringkat

- Sector Analysis FinalDokumen63 halamanSector Analysis Finaltejas_41113748Belum ada peringkat

- Mbam-Log-2012-06-21 (11-42-49)Dokumen11 halamanMbam-Log-2012-06-21 (11-42-49)tejas_41113748Belum ada peringkat

- DLF Case LawDokumen3 halamanDLF Case Lawtejas_41113748Belum ada peringkat

- Leadership SkillsDokumen10 halamanLeadership SkillsYogender JainBelum ada peringkat

- Exam 2 Study GuideDokumen11 halamanExam 2 Study GuideAnonymous ewJy7jyvNBelum ada peringkat

- Pinochle Rules GuideDokumen2 halamanPinochle Rules GuidepatrickBelum ada peringkat

- FAQs MHA RecruitmentDokumen6 halamanFAQs MHA RecruitmentRohit AgrawalBelum ada peringkat

- MHRP Player SheetDokumen1 halamanMHRP Player SheetFelipe CaldeiraBelum ada peringkat

- MA KP3-V2H-2 enDokumen155 halamanMA KP3-V2H-2 enJavier MiramontesBelum ada peringkat

- Effect of Disinfectants On Highly Pathogenic Avian in Uenza Virus (H5N1) in Lab and Poultry FarmsDokumen7 halamanEffect of Disinfectants On Highly Pathogenic Avian in Uenza Virus (H5N1) in Lab and Poultry FarmsBalvant SinghBelum ada peringkat

- SOP For Storage of Temperature Sensitive Raw MaterialsDokumen3 halamanSOP For Storage of Temperature Sensitive Raw MaterialsSolomonBelum ada peringkat

- Rizal's First Return Home to the PhilippinesDokumen52 halamanRizal's First Return Home to the PhilippinesMaria Mikaela MarcelinoBelum ada peringkat

- Multiple Choice Questions Class Viii: GeometryDokumen29 halamanMultiple Choice Questions Class Viii: GeometrySoumitraBagBelum ada peringkat

- Myanmar Thilawa SEZ ProspectusDokumen92 halamanMyanmar Thilawa SEZ ProspectusfrancistsyBelum ada peringkat

- Mock-B1 Writing ReadingDokumen6 halamanMock-B1 Writing ReadingAnonymous 0uBSrduoBelum ada peringkat

- Army National Guard Military Funeral Honors Soldier S Training SOP 23 Nov 15Dokumen203 halamanArmy National Guard Military Funeral Honors Soldier S Training SOP 23 Nov 15LuisAndresBellavista100% (1)

- Economy 1 PDFDokumen163 halamanEconomy 1 PDFAnil Kumar SudarsiBelum ada peringkat

- Geometry First 9 Weeks Test Review 1 2011Dokumen6 halamanGeometry First 9 Weeks Test Review 1 2011esvraka1Belum ada peringkat

- International History 1900-99Dokumen5 halamanInternational History 1900-99rizalmusthofa100% (1)

- HAF F16 ManualDokumen513 halamanHAF F16 Manualgreekm4dn3ss86% (7)

- Ar 318Dokumen88 halamanAr 318Jerime vidadBelum ada peringkat

- History I.M.PeiDokumen26 halamanHistory I.M.PeiVedasri RachaBelum ada peringkat

- Repeaters XE PDFDokumen12 halamanRepeaters XE PDFenzzo molinariBelum ada peringkat

- ECUMINISMDokumen2 halamanECUMINISMarniel somilBelum ada peringkat

- BiOWiSH Crop OverviewDokumen2 halamanBiOWiSH Crop OverviewBrian MassaBelum ada peringkat

- Guna Fibres Case Study: Financial Forecasting and Debt ManagementDokumen2 halamanGuna Fibres Case Study: Financial Forecasting and Debt ManagementvinitaBelum ada peringkat

- Philippines Disaster Response PlanDokumen7 halamanPhilippines Disaster Response PlanJoselle RuizBelum ada peringkat

- Summer 2019 English Reinforcement LessonsDokumen31 halamanSummer 2019 English Reinforcement LessonsAizalonica GalangBelum ada peringkat

- St. Helen Church: 4106 Mountain St. Beamsville, ON L0R 1B7Dokumen5 halamanSt. Helen Church: 4106 Mountain St. Beamsville, ON L0R 1B7sthelenscatholicBelum ada peringkat

- NUC BIOS Update Readme PDFDokumen3 halamanNUC BIOS Update Readme PDFSuny Zany Anzha MayaBelum ada peringkat

- Kimone Wright - Registered Nurse ResumeDokumen2 halamanKimone Wright - Registered Nurse Resumeapi-365123958Belum ada peringkat

- Reflecting Surfaces Discussion BibliographyDokumen58 halamanReflecting Surfaces Discussion BibliographyAnanthanarayananBelum ada peringkat

- Oil Immersed TransformerDokumen8 halamanOil Immersed TransformerAbdul JabbarBelum ada peringkat

- Who Is Marine Le PenDokumen6 halamanWho Is Marine Le PenYusuf Ali RubelBelum ada peringkat