AP 205 Charitable

Diunggah oleh

kellypustejovskyDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

AP 205 Charitable

Diunggah oleh

kellypustejovskyHak Cipta:

Format Tersedia

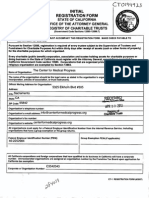

TEXAS APPLICATION FOR EXEMPTION CHARITABLE ORGANIZATIONS

SUSAN COMBS TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

Nonprofit charitable organizations should use this application to request exemption from Texas sales tax, hotel occupancy tax and franchise tax, if applicable. To receive a state tax exemption as a charitable organization, a nonprofit charitable organization must devote all or substantially all of its activities to the alleviation of poverty, disease, pain and suffering by providing food, drugs (medicine), medical treatment, shelter, clothing or psychological counseling directly to indigent or similarly deserving individuals for little or no fee. The organization's funds must be derived primarily from sources other than fees or charges for its services. Exemption from federal tax as a 501(c) organization is not required to qualify for exemption from state tax as a charitable organization. The exemption for charitable organizations is provided for in Sections 151.310, 156.102 and 171.062 of the Texas Tax Code, and more detailed information can be found in Comptrollers Rules 3.322, 3.161, 3.541 and 3.583. Some organizations will not qualify for an exemption as a charitable organization as that term is defined in Texas' law and rules, even though their activities may be charitable in nature. Such an organization might still qualify for exemption from Texas sales tax and franchise tax, if applicable, based on their exemption under certain sections of the Internal Revenue Code (IRC). Texas tax law provides an exemption from sales taxes on goods and services purchased for use by organizations exempt under Section 501(c)(3), (4), (8), (10) or (19). However, exempt organizations are required to collect tax on most of their sales of taxable items. See Exempt Organizations - Sales and Purchases, Publication 96-122. Texas law also provides an exemption from franchise taxes for corporations exempted from the federal income tax under IRC Section 501(c)(2), (3), (4), (5), (6), (7), (8), (10), (16), (19) or (25). If your organization has been granted federal tax exemption under one of the qualifying sections listed above, your organization will be granted an exemption from Texas sales tax, or sales and franchise tax, on the basis of the Internal Revenue Service (IRS) exemption, as required by state law. Organizations that qualify for exemption based on the federal exemption are not exempt from hotel occupancy tax because the hotel occupancy tax law does not recognize any federal exemptions. The laws, rules and other information about exemptions are online at: www.window.state.tx.us/taxinfo/exempt Send the completed application along with all required documentation to: Comptroller of Public Accounts Exempt Organizations Section P.O. Box 13528 Austin, TX 78711-3528 We will contact you within 10 working days after receipt of your application to let you know the status of your application. We may require an organization to furnish additional information to establish the claimed exemption. After a review of the material, we will inform the organization in writing if it qualifies for exemption. The Comptroller, or an authorized representative of the Comptroller, may audit the records of an organization at any time during regular business hours to verify the validity of the organizations exempt status. If you have questions or need more information, contact our Tax Assistance staff at (800) 252-5555 or in Austin at (512) 463-4600.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you. Contact us at the address or toll-free number listed on this form.

AP-205-1 (Rev.6-08/6)

AP-205-2 (Rev.6-08/6)

PRINT FORM

CLEAR FIELDS

TEXAS APPLICATION FOR EXEMPTION CHARITABLE ORGANIZATIONS

SECTION A 1. ORGANIZATION NAME

Remove All Staples

TYPE OR PRINT

Do NOT write in shaded areas.

(Legal name as provided in the formation document, or if unincorporated, the governing document.)

2. ORGANIZATION MAILING ADDRESS

Street number, P.O. Box or rural route and box number City State/Province ZIP Code County (or country, if outside the U.S.)

3. Texas taxpayer number (if applicable) ..............................................................................................................................

Month Day Year

4. a) Enter filing information issued by the Texas Secretary of State OR b)

File Number

File Date

Check this box if this organization is not registered with the Texas Secretary of State.

5. Federal Employer Identification Number (EIN) (Required if applying for exemption on the basis of a federal exemption) ................................................................................. 6. Earliest date organization provided services .................................................................................................................................. 7. Contact information of the person submitting this application

Name

Month Day

Year

E-mail Address Daytime Phone (Area code and number) Extension ZIP Code

Firm or Company Name Address

City

State

We will notify you by e-mail when the exemption has been added to let you know where the exemption can be verified online. If an e-mail address is not provided, indicate where our response should be mailed: organization's mailing address or mailing address of the submitter. SECTION B Please review the information below. If your organization is applying for exemption on the basis of an IRS exemption, complete Item 8. If your organization is applying for exemption as a charitable organization under Texas law and rules, complete Item 9.

Item 8. Check here to apply for an exemption on the basis of a federal exemption. Return the completed application with a copy of the entire IRS determination letter and any addenda. The organization name on the IRS determination letter must match the organization's legal name as listed in the Articles of Incorporation or governing document. If the IRS determination letter was issued more than four years prior to the current date, include a copy of a current IRS verification letter. To obtain a current letter, contact the IRS at (877) 829-5500. Item 9. Check here to apply for exemption as a charitable organization. The following documents must be included with your application. Information may be in the form of a bulletin, brochure, written statement or Web site: A copy of your organizations actual or proposed two-year budget; a detailed description of all of the organizations activities; any amount of charges for services, how the charges are determined; and the criteria the recipients must meet to receive the services. Include a written statement or brochures, pamphlets or Web site addresses that describe the activities of the organization. A copy of any application used to determine eligibility for the organization's services. A copy of the IRS determination letter, if your organization is exempt under a qualifying section of the IRC or if the organization is affiliated with a parent entity that has a federal group exemption under one of the qualifying IRC sections. Attach a letter of verification from the parent entity that confirms the organization is a recognized subordinate under its federal group exemption. If the parent organization has not yet obtained exemption from Texas franchise tax and/or sales tax, provide a copy of the parent organization's entire IRS group exemption ruling letter along with the letter of affiliation. Special note to unincorporated entities: Include your organization's governing documents, such as bylaws or constitution. Special note to non-Texas corporations: Include a file-stamped copy of your organization's formation documents AND a current Certificate of Existence from the Secretary of State or equivalent officer in your home state.

Anda mungkin juga menyukai

- Ap 207Dokumen2 halamanAp 207Garrett DukeBelum ada peringkat

- Ap 209Dokumen2 halamanAp 209Steven FirminBelum ada peringkat

- How to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateDari EverandHow to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StatePenilaian: 3.5 dari 5 bintang3.5/5 (9)

- Center For Medical Progress California RegistrationDokumen10 halamanCenter For Medical Progress California RegistrationelicliftonBelum ada peringkat

- 5013c Filing ProcedureDokumen8 halaman5013c Filing ProcedureOretha Brown-JohnsonBelum ada peringkat

- Terminate FormDokumen1 halamanTerminate FormTiffany DacinoBelum ada peringkat

- Checklist NonprofitDokumen5 halamanChecklist Nonprofitkatenunley100% (1)

- Public Inspection of Attachments To A 501 (C) (3) Organization's Form 990-T, Exempt Organization Business Income Tax ReturnDokumen69 halamanPublic Inspection of Attachments To A 501 (C) (3) Organization's Form 990-T, Exempt Organization Business Income Tax Returndavidchey4617Belum ada peringkat

- Set Up and TaxDokumen5 halamanSet Up and Taxbarg1113Belum ada peringkat

- Articles of Incorporation - OregonDokumen4 halamanArticles of Incorporation - OregonjohnhickernellBelum ada peringkat

- Background Check Authorization FormDokumen7 halamanBackground Check Authorization FormShabBelum ada peringkat

- 501 (C) (4) Instructions For Set-UpDokumen4 halaman501 (C) (4) Instructions For Set-UpPratus WilliamsBelum ada peringkat

- 2010 Small Business Presentation For HAULDokumen20 halaman2010 Small Business Presentation For HAULErin McClartyBelum ada peringkat

- Benevolent Funds Program 2011-09-21 ToolkitDokumen22 halamanBenevolent Funds Program 2011-09-21 ToolkitNational Association of REALTORS®100% (1)

- IRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusDokumen16 halamanIRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusgeneisaacBelum ada peringkat

- Part 4. Examining Process Chapter 76. Exempt Organizations Examination Guidelines Section 29. Apostolic Associations - IRC 501 (D)Dokumen8 halamanPart 4. Examining Process Chapter 76. Exempt Organizations Examination Guidelines Section 29. Apostolic Associations - IRC 501 (D)El Cristo NegroBelum ada peringkat

- CA-1032 RevisedDokumen9 halamanCA-1032 RevisedSandy Zertuche50% (2)

- Background Release Form - Offer DocumentDokumen9 halamanBackground Release Form - Offer DocumentLatasha wilson100% (1)

- Background Check Form 04Dokumen10 halamanBackground Check Form 04Richard Blanc100% (1)

- Applicant Disclosure and Release For Consumer and Investigative Consumer ReportsDokumen3 halamanApplicant Disclosure and Release For Consumer and Investigative Consumer Reportsmarcela batchanBelum ada peringkat

- Background Investigation Consumer Disclosure and Authorization FormDokumen6 halamanBackground Investigation Consumer Disclosure and Authorization FormDavid Menges100% (1)

- Ssa 7163aDokumen4 halamanSsa 7163ahoneyjam89Belum ada peringkat

- MN Assumed Name RegistrationDokumen5 halamanMN Assumed Name RegistrationA. C.100% (1)

- Screen Them - Applicant SectionDokumen3 halamanScreen Them - Applicant SectionМацей ШмелевскиBelum ada peringkat

- US Social Security Form (Ssa-7050) : Wage Earnings CorrectionDokumen4 halamanUS Social Security Form (Ssa-7050) : Wage Earnings CorrectionMax PowerBelum ada peringkat

- Other Disclosures and AuthorizationsDokumen13 halamanOther Disclosures and AuthorizationsANKIT SINGHBelum ada peringkat

- Authorization To Conduct Background CheckDokumen4 halamanAuthorization To Conduct Background CheckGreg KowalskiBelum ada peringkat

- FFATA Data Collection Form.EDokumen2 halamanFFATA Data Collection Form.EandresBelum ada peringkat

- TCF-ICEE Credit Application 11 081Dokumen1 halamanTCF-ICEE Credit Application 11 081jasonparker80Belum ada peringkat

- Jacqueline Scanlin HR Business Partner-GDS: October 5, 2022 Personal & Confidential Via Electronic MailDokumen6 halamanJacqueline Scanlin HR Business Partner-GDS: October 5, 2022 Personal & Confidential Via Electronic MailTravaras PerryBelum ada peringkat

- Test FDDDokumen186 halamanTest FDDNicole PlescherBelum ada peringkat

- The Delta Chi Fraternity, IncDokumen4 halamanThe Delta Chi Fraternity, IncKevin CammBelum ada peringkat

- Document - 207 - Franchise DisclosureDokumen233 halamanDocument - 207 - Franchise DisclosureGarmRiftBelum ada peringkat

- How To Dispute Credit Report Errors: October 2011Dokumen6 halamanHow To Dispute Credit Report Errors: October 2011hello98023Belum ada peringkat

- Circle KDokumen491 halamanCircle Kpascal rosasBelum ada peringkat

- A. Applying Entity (Account Holder)Dokumen10 halamanA. Applying Entity (Account Holder)Reda Shuhumi100% (1)

- IRS - Tax Guide For ChurchesDokumen28 halamanIRS - Tax Guide For ChurchesTim McGheeBelum ada peringkat

- Organization of California Nonprofit, Nonstock CorporationsDokumen6 halamanOrganization of California Nonprofit, Nonstock CorporationsRyan LeporeBelum ada peringkat

- Hippa LetterDokumen6 halamanHippa LetterDan Ponjican100% (1)

- From Vision To Reality: A Guide To Launching A Successful Nonprofit OrganizationDokumen211 halamanFrom Vision To Reality: A Guide To Launching A Successful Nonprofit OrganizationNamibia Donadio100% (1)

- Disclosure and Release Form-SignedDokumen2 halamanDisclosure and Release Form-SignedDalitsoChapemaBelum ada peringkat

- 501 CDokumen20 halaman501 CEn Mahaksapatalika0% (1)

- Passportcopy 4389960 DOCSDokumen8 halamanPassportcopy 4389960 DOCSlisaBelum ada peringkat

- US Internal Revenue Service: A-99-62Dokumen3 halamanUS Internal Revenue Service: A-99-62IRSBelum ada peringkat

- Frequently Asked Questions: US Rotary Clubs and The IRSDokumen3 halamanFrequently Asked Questions: US Rotary Clubs and The IRSDavid Jhan CalderonBelum ada peringkat

- Department of The Treasury: Internal Revenue Service WASHINGTON, D.C. 20224Dokumen4 halamanDepartment of The Treasury: Internal Revenue Service WASHINGTON, D.C. 20224himself2462Belum ada peringkat

- Application For Release From Prohibition or Removal OrderDokumen13 halamanApplication For Release From Prohibition or Removal OrderMark ReinhardtBelum ada peringkat

- Lobbying Compliance, Registration and FilingDokumen10 halamanLobbying Compliance, Registration and FilingMichele Di FrancoBelum ada peringkat

- Sephora Job ApplicationDokumen7 halamanSephora Job Applicationapi-286234342Belum ada peringkat

- What Is A Tax ExemptionDokumen5 halamanWhat Is A Tax ExemptionVirgilio VolosoBelum ada peringkat

- Wells Fargo International Team MemberDokumen10 halamanWells Fargo International Team MemberNaresh NavuluriBelum ada peringkat

- Dispute To Creditor For Charge OffDokumen4 halamanDispute To Creditor For Charge Offrodney76% (21)

- Shadow Work JourmalDokumen14 halamanShadow Work JourmalDa'Vona RandleBelum ada peringkat

- Entity Registration ChecklistDokumen18 halamanEntity Registration Checklistjoey lara100% (1)

- MW FDDDokumen228 halamanMW FDDSteveMcGarrettBelum ada peringkat

- Fomtnp RRF 2013Dokumen2 halamanFomtnp RRF 2013L. A. PatersonBelum ada peringkat

- ViewCompletedForms PDFDokumen8 halamanViewCompletedForms PDFJulianPerezBelum ada peringkat

- Fatca Declaration Non Profit PhilippinesDokumen4 halamanFatca Declaration Non Profit PhilippinesAnomieBelum ada peringkat

- ANDSLITEDokumen1 halamanANDSLITESrishti GaurBelum ada peringkat

- CIR v. AlgueDokumen2 halamanCIR v. AlgueRaish RojasBelum ada peringkat

- Income From House PropertyDokumen3 halamanIncome From House PropertySneha PotekarBelum ada peringkat

- TaxDokumen6 halamanTaxBirs BirsBelum ada peringkat

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDokumen6 halamanNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comBelum ada peringkat

- U4.3 Optional Standard Deduction (Presentation Slides)Dokumen4 halamanU4.3 Optional Standard Deduction (Presentation Slides)Marc Geoffrey HababBelum ada peringkat

- ME Holding Corp vs. CADokumen2 halamanME Holding Corp vs. CAJeremae Ann CeriacoBelum ada peringkat

- Brief of Dtls of Direct Selling and PlanDokumen2 halamanBrief of Dtls of Direct Selling and PlanKangen WaterBelum ada peringkat

- UntitledDokumen2 halamanUntitledPMG Bhuswal ProjectBelum ada peringkat

- Bill Net Amount 6,16,115.00: Weight (-95Kg) - 3,370.00 Received Amount 04.10.23 3,00,000.00Dokumen2 halamanBill Net Amount 6,16,115.00: Weight (-95Kg) - 3,370.00 Received Amount 04.10.23 3,00,000.00sagarshinde8812Belum ada peringkat

- Projected Income StatementDokumen3 halamanProjected Income StatementSyeda Nida AliBelum ada peringkat

- Form 1099GDokumen2 halamanForm 1099GMarcus KreseBelum ada peringkat

- Bello 1200 - 1600Dokumen1 halamanBello 1200 - 1600Iriz BelenoBelum ada peringkat

- Payroll Accounting 2018 28th Edition Bieg Test BankDokumen15 halamanPayroll Accounting 2018 28th Edition Bieg Test Bankloanazura7k6bl100% (26)

- Taxation 2, Final Examination Student Name: Lagulao-Cabasan, Denise YDokumen3 halamanTaxation 2, Final Examination Student Name: Lagulao-Cabasan, Denise YDenise Lim-Yap Lagulao-CabasanBelum ada peringkat

- Purchase Transaction Reconciliation of Listing For EnforcementDokumen7 halamanPurchase Transaction Reconciliation of Listing For EnforcementMArk BarenoBelum ada peringkat

- CIR Vs American Express InternationalDokumen2 halamanCIR Vs American Express InternationalCheryl Churl100% (2)

- 194 Q and 206C (1H)Dokumen4 halaman194 Q and 206C (1H)harshBelum ada peringkat

- Illustrations PDFDokumen3 halamanIllustrations PDFCharrey Leigh FormaranBelum ada peringkat

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Dokumen2 halaman1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizBelum ada peringkat

- 5Dokumen2 halaman5Ankit TripathiBelum ada peringkat

- Copy B For Student 1098-T: Tuition StatementDokumen1 halamanCopy B For Student 1098-T: Tuition Statementqqvhc2x2prBelum ada peringkat

- Contoh Lampiran Pajak Luar Negri W8benDokumen1 halamanContoh Lampiran Pajak Luar Negri W8benIyap TriyadiBelum ada peringkat

- CFWB015Dokumen2 halamanCFWB015Yeshaya DorfmanBelum ada peringkat

- Tax InvoiceDokumen1 halamanTax InvoiceMR. MU.Belum ada peringkat

- Salary Income Tax Calculation in EthiopiaDokumen4 halamanSalary Income Tax Calculation in EthiopiaMulatu Teshome95% (38)

- BIR Forms (Official)Dokumen10 halamanBIR Forms (Official)annBelum ada peringkat

- January 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Dokumen8 halamanJanuary 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Mumtaz MakdaBelum ada peringkat

- Tax InterviewDokumen1 halamanTax Interviewperfora7orBelum ada peringkat

- Capital Gains Taxation Problems Part 1 PDFDokumen4 halamanCapital Gains Taxation Problems Part 1 PDFMitchie Faustino0% (1)