Ratio Analysis (1) .1

Diunggah oleh

Rafa IbrahimDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ratio Analysis (1) .1

Diunggah oleh

Rafa IbrahimHak Cipta:

Format Tersedia

Financial Analysis

Ratio Analysis Techniques

Important Learning Terms

Ratio Types of Ratios Liquidity Ratios Asset management/Activity ratios Financial Leverage/Gearing ratios Profitability ratios Market valuation ratios Ratio limitations

A ratio: Is the mathematical relationship between two quantities in the form of a fraction or percentage. Ratio analysis: is essentially concerned with the calculation of relationships which after proper identification and interpretation may provide information about the operations and state of affairs of a business enterprise. The analysis is used to provide indicators of past performance in terms of critical success factors of a business. This assistance in decision-making reduces reliance on guesswork and intuition and establishes a basis for sound judgement. Note: A ratio on its own has little or no meaning at all. Consider a current ratio of 2:1. This means that for every 1 monetary value of current liabilities there are 2 of assets. However each business is different and each has different working capital requirements. From this ratio, we cannot make any comments about the liquidity of the business, whether it carries too much or too little working capital. Significance of Using Ratios The significance of a ratio can only truly be appreciated when:

1. It is compared with other ratios in the same set of financial statements. 2. It is compared with the same ratio in previous financial statements (trend analysis). 3. It is compared with a standard of performance (industry average). Such a standard may be

either the ratio which represents the typical performance of the trade or industry, or the ratio which represents the target set by management as desirable for the business.

Types of Ratios A: Liquidity Ratios

Liquidity refers to the ability of a firm to meet its short-term financial obligations when and as they fall due.

The main concern of liquidity ratio is to measure the ability of the firms to meet their shortterm maturing obligations. Failure to do this will result in the total failure of the business, as it would be forced into liquidation.

Current Ratio The Current Ratio expresses the relationship between the firms current assets and its current liabilities. Current assets normally includes cash, marketable securities, accounts receivable and inventories. Current liabilities consist of accounts payable, short term notes payable, short-term loans, current maturities of long term debt, accrued income taxes and other accrued expenses (wages).

The rule of thumb says that the current ratio should be at least 2, that is the current assets should meet current liabilities at least twice. What does the calculated ratio tells us? In 2000, the company only had 85 cents worth of current assets for every dollar of liabilities. This grew to 92 cents in 2002 indicating increasing trend on liquidity, however the company is still unable to support its short-term debt from its currents assets. Quick Ratio Measures assets that are quickly converted into cash and they are compared with current liabilities. This ratio realizes that some of current assets are not easily convertible to cash e.g. inventories. The quick ratio, also referred to as acid test ratio, examines the ability of the business to cover its short-term obligations from its quick assets only (i.e. it ignores stock). The quick ratio is calculated as follows insert Clearly this ratio will be lower than the current ratio, but the difference between the two (the gap) will indicate the extent to which current assets consist of stock. B: Asset Management/Activity Ratios If a business does not use its assets effectively, investors in the business would rather take their money and place it somewhere else. In order for the assets to be used effectively, the business needs a high turnover. Unless the business continues to generate high turnover, assets will be idle as it is impossible to buy and sell fixed assets continuously as turnover changes. Activity ratios are therefore used to assess how active various assets are in the business. Note: Increased turnover can be just as dangerous as reduced turnover if the business does not have the working capital to support the turnover increase. As turnover increases more working capital and cash is required and if not, overtrading occurs.

Asset Management ratios are discussed next. Average Collection Period The average collection period measures the quality of debtors since it indicates the speed of their collection. The shorter the average collection period, the better the quality of debtors, as a short collection period implies the prompt payment by debtors. The average collection period should be compared against the firms credit terms and policy to judge its credit and collection efficiency. An excessively long collection period implies a very liberal and inefficient credit and collection performance. The delay in collection of cash impairs the firms liquidity. On the other hand, too low a collection period is not necessarily favourable, rather it may indicate a very restrictive credit and collection policy which may curtail sales and hence adversely affect profit.

Inventory Turnover This ratio measures the stock in relation to turnover in order to determine how often the stock turns over in the business. It indicates the efficiency of the firm in selling its product. It is calculated by dividing he cost of goods sold by the average inventory.

The ratio shows a relatively high stock turnover which would seem to suggest that the business deals in fast moving consumer goods. The company turned over stock every 24 days in 2000 and every 28 days in 2002.

The trend shows a marginal increase in days which indicates a slow down of stock turnover. The high stock turnover ratio would also tend to indicate that there was little chance of the firm holding damaged or obsolete stock.

Total Assets Turnover Asset turnover is the relationship between sales and assets The firm should manage its assets efficiently to maximise sales. The total asset turnover indicates the efficiency with which the firm uses all its assets to generate sales. It is calculated by dividing the firms sales by its total assets.

Generally, the higher the firms total asset turnover, the more efficiently its assets have been utilised.

Fixed Asset Turnover The fixed assets turnover ratio measures the efficiency with which the firm has been using its fixed assets to generate sales. It is calculated by dividing the firms sales by its net fixed assets as follows:

Generally, high fixed assets turnovers are preferred since they indicate a better efficiency in fixed assets utilisation.

From the above calculations: It appears that the activity of the business is relatively constant, with a slight upward trend. The ratio also confirms that the business places a much greater reliance on working capital than it does on the fixed assets as the fixed assets (2001 and 2002) turned over more quicker than stock turnover.

C: Financial Leverage (Gearing) Ratios The ratios indicate the degree to which the activities of a firm are supported by creditors funds as opposed to owners. The relationship of owners equity to borrowed funds is an important indicator of financial strength.

The debt requires fixed interest payments and repayment of the loan and legal action can be taken if any amounts due are not paid at the appointed time. A relatively high proportion of funds contributed by the owners indicates a cushion (surplus) which shields creditors against possible losses from default in payment. Note: The greater the proportion of equity funds, the greater the degree of financial strength. Financial leverage will be to the advantage of the ordinary shareholders as long as the rate of earnings on capital employed is greater than the rate payable on borrowed funds. The following ratios can be used to identify the financial strength and risk of the business.

Equity Ratio The equity ratio is calculated as follows:

This indicates that only 32.1% of the total assets in 2002 is supplied by the ordinary stockholders and this has shown a slight decrease from 32.8% in 2000. A high equity ratio reflects a strong financial structure of the company. A relatively low equity ratio reflects a more speculative situation because of the effect of high leverage and the greater possibility of financial difficulty arising from excessive debt burden.

Debt Ratio This is the measure of financial strength that reflects the proportion of capital which has been funded by debt, including preference shares. This ratio is calculated as follows:

With higher debt ratio (low equity ratio), a very small cushion has developed thus not giving creditors the security they require. The company would therefore find it relatively difficult to raise additional financial support from external sources if it wished to take that route. The higher the debt ratio the more difficult it becomes for the firm to raise debt. Debt to Equity ratio This ratio indicates the extent to which debt is covered by shareholders funds. It reflects the relative position of the equity holders and the lenders and indicates the companys policy on the mix of capital funds. The debt to equity ratio is calculated as follows:

The debt to equity ratio shows that for every 1 dollar of shareholders funds in 2002 there was 2.12 dollars of debt. This compares to 2.05 dollars in 2000. This ratio is extremely high and indicates the financial weakness of the business.

Times Interest Earned Ratio This ratio measure the extent to which earnings can decline without causing financial losses to the firm and creating an inability to meet the interest cost. The times interest earned shows how many times the business can pay its interest bills from profit earned. Present and prospective loan creditors such as bondholders, are vitally interested to know how adequate the interest payments on their loans are covered by the earnings available for such payments. Owners, managers and directors are also interested in the ability of the business to service the fixed interest charges on outstanding debt.

The ratio is calculated as follows:

The companys major forms of credit are non-interest bearing (trade creditors) which results in the business enjoying very healthy interest coverage rates. In 2002 the company could pay their interest bill 16.5 times from earnings before interest and tax. However this is a massive drop from 51.5 times in 2001 and 37.7 times in 2000.

D: Profitability Ratios Profitability is the ability of a business to earn profit over a period of time. Although the profit figure is the starting point for any calculation of cash flow, as already pointed out, profitable companies can still fail for a lack of cash. Note: Without profit, there is no cash and therefore profitability must be seen as a critical success factors. A company should earn profits to survive and grow over a long period of time. Profits are essential, but it would be wrong to assume that every action initiated by management of a company should be aimed at maximising profits, irrespective of social consequences.

The ratios examined previously have tendered to measure management efficiency and risk. Profitability is a result of a larger number of policies and decisions. The profitability ratios show the combined effects of liquidity, asset management (activity) and debt management (gearing) on operating results. The overall measure of success of a business is the profitability which results from the effective use of its resources. Gross Profit Margin Normally the gross profit has to rise proportionately with sales. It can also be useful to compare the gross profit margin across similar businesses although there will often be good reasons for any disparity.

The ratio above shows the increasing trend in the gross profit since the ratio has improved from 15.2% in 2000 to 20.3% on 2002. This indicates that the rate in increase in cost of goods sold are less than rate of increase in sales, hence the increased efficiency.

Net Profit Margin This is a widely used measure of performance and is comparable across companies in similar industries. The fact that a business works on a very low margin need not cause alarm because there are some sectors in the industry that work on a basis of high turnover and low margins, for examples supermarkets and motorcar dealers. What is more important in any trend is the margin and whether it compares well with similar businesses.

The net margin ratio shows that the margin is fairly stable over time with slight improvement to 1.73% in 2001. However, to know how well the firm is performing one has to compare this ratio with the industry average or a firm dealing in a similar business. Return on Investment (ROI) Income is earned by using the assets of a business productively. The more efficient the production, the more profitable the business. The rate of return on total assets indicates the degree of efficiency with which management has used the assets of the enterprise during an accounting period. This is an important ratio for all readers of financial statements. Investors have placed funds with the managers of the business. The managers used the funds to purchase assets which will be used to generate returns. If the return is not better than the investors can achieve elsewhere, they will instruct the managers to sell the assets and they will invest

elsewhere. The managers lose their jobs and the business liquidates.

The ratio indicates that there is increase in the ROI from 8.38% in 2000 to 8.95% in 2002.

Return on Equity (ROE) This ratio shows the profit attributable to the amount invested by the owners of the business. It also shows potential investors into the business what they might hope to receive as a return. The stockholders equity includes share capital, share premium, distributable and non-distributable reserves. The ratio is calculated as follows:

Again, the profitability to ordinary shareholders is strong and showing an upward trend. Note that the return in 2002 as in all the years is after tax and the shareholders should be extremely comfortable with these returns. Earning Per Share (EPS) Whatever income remains in the business after all prior claims, other than owners claims (i.e. ordinary dividends) have been paid, will belong to the ordinary shareholders who can then make a decision as to how much of this income they wish to remove from the business in the form of a dividend, and how much they wish to retain in the business. The shareholders are particularly interested in knowing how much has been earned during the financial year on each of the shares held by them. For this reason, an earning per share figure must be calculated. Clearly then, the earning per share calculation will be:

Exercises 1. Reconsider the ratios which have been calculated for analysis on profitability. In your own words, analyse the trends in these ratios and discuss the linkage between ROI and ROE. 2. How will the gross margin ratio assist you in determining the profitability of a business? 3. In your own words, explain the calculation used for ROI.

4. When calculating EPS, explain how we should deal with preference shares dividends. E: Market Value Ratios These ratios indicate the relationship of the firms share price to dividends and earnings. Note that when we refer to the share price, we are talking about the Market value and not the Nominal value as indicated by the par value. For this reason, it is difficult to perform these ratios on unlisted companies as the market price for their shares is not freely available. One would first have to value the shares of the business before calculating the ratios. Market value ratios are strong indicators of what investors think of the firms past performance and future prospects. Dividend Yield Ratio The dividend yield ratio indicates the return that investors are obtaining on their investment in the form of dividends. This yield is usually fairly low as the investors are also receiving capital growth on their investment in the form of an increased share price. It is interesting to note that there is strong correlation between dividend yields and market prices. Invariably, the higher the dividend, the higher the market value of the share. The dividend yield ratio compares the dividend per share against the price of the share and is calculated as:

Notice a healthy increase in the yield from 2000 to 2002. The main reason for this is that the dividend per share increased while at the same time, the price of a share dropped. This is fairly unusual because share prices usually increase when dividends increase. However there could be number of reasons why this has happened, either due to the economy or to mismanagement, leading to a loss of faith in the stock market or in this particular stock. Normally a very high dividend yield signals potential financial difficulties and possible dividend payout cut. The dividend per share is merely the total dividend divided by the number of shares issued. The price per share is the market price of the share at the end of the financial year. Price/Earning Ratio (P/E ratio) P/E ratio is a useful indicator of what premium or discount investors are prepared to pay or receive for the investment. The higher the price in relation to earnings, the higher the P/E ratio which indicates the higher the premium an investor is prepared to pay for the share. This occurs because the investor is extremely confident of the potential growth and earnings of the share.

The price-earning ratio is calculated as follows:

1. High P/E generally reflects lower risk and/or higher growth prospects for earnings. 2. The above ratio shows that the shares were traded at a much higher premium in 2000 than were in 2002. In 2000 the price was 26.8 times higher than earnings while in 2002, the price was only 12 times higher. Dividend Cover This ratio measures the extent of earnings that are being paid out in the form of dividends, i.e. how many times the dividends paid are covered by earnings (similar to times interest earned ratio discussed above). A higher cover would indicate that a larger percentage of earnings are being retained and reinvested in the business while a lower dividend cover would indicate the converse.

Dividend pay-out ratio This ratio looks at the dividend payment in relation to net income and can be calculated as follows:

Note: Even though the dividend yield has increased, the dividend payout ratio has reduced, showing that a lower proportion of earnings was paid out as dividend. The ratio has only reduced slightly, however, from 50.7% in 2000 to 49.4% in 2002. Generally, the low growth companies have higher dividends payouts and high growth companies have lower dividend payouts.

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 9 - Digest - Mari Vs BonillaDokumen2 halaman9 - Digest - Mari Vs BonillaMarivic Escueta100% (1)

- Pugh MatrixDokumen18 halamanPugh MatrixSulaiman Khan0% (1)

- 208 C - Algebras: Marc Rieffel Notes by Qiaochu Yuan Spring 2013Dokumen55 halaman208 C - Algebras: Marc Rieffel Notes by Qiaochu Yuan Spring 2013Nikos AthanasiouBelum ada peringkat

- Observation: Student: Liliia Dziuda Date: 17/03/21 Topic: Movie Review Focus: Writing SkillsDokumen2 halamanObservation: Student: Liliia Dziuda Date: 17/03/21 Topic: Movie Review Focus: Writing SkillsLiliaBelum ada peringkat

- Timing Light Schematic or DiagramDokumen2 halamanTiming Light Schematic or Diagramprihharmanto antokBelum ada peringkat

- Mejia V Reyes - DumaguingDokumen1 halamanMejia V Reyes - DumaguingRonalyn GaculaBelum ada peringkat

- Thai Reader Project Volume 2Dokumen215 halamanThai Reader Project Volume 2geoffroBelum ada peringkat

- Dribssa Beyene Security Sector Reform Paradox Somalia PublishedDokumen29 halamanDribssa Beyene Security Sector Reform Paradox Somalia PublishedNanny KebedeBelum ada peringkat

- Asher - Bacteria, Inc.Dokumen48 halamanAsher - Bacteria, Inc.Iyemhetep100% (1)

- Adult Consensual SpankingDokumen21 halamanAdult Consensual Spankingswl156% (9)

- Sindhudurg Kokan All Tourism Spot Information WWW - Marathimann.inDokumen54 halamanSindhudurg Kokan All Tourism Spot Information WWW - Marathimann.inMarathi Mann92% (12)

- Isolasi Dan Karakterisasi Runutan Senyawa Metabolit Sekunder Fraksi Etil Asetat Dari Umbi Binahong Cord F L A Steen S)Dokumen12 halamanIsolasi Dan Karakterisasi Runutan Senyawa Metabolit Sekunder Fraksi Etil Asetat Dari Umbi Binahong Cord F L A Steen S)Fajar ManikBelum ada peringkat

- What Is Art?Dokumen14 halamanWhat Is Art?Sarvenaaz QaffariBelum ada peringkat

- Oscar Characterization TemplateDokumen3 halamanOscar Characterization Templatemqs786Belum ada peringkat

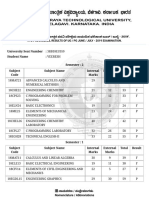

- VTU Result PDFDokumen2 halamanVTU Result PDFVaibhavBelum ada peringkat

- Imam Muhammad Baqir (As) BioDokumen5 halamanImam Muhammad Baqir (As) BioFatema AbbasBelum ada peringkat

- Questionnaire HRISDokumen4 halamanQuestionnaire HRISAnonymous POUAc3zBelum ada peringkat

- Carcinoma of PenisDokumen13 halamanCarcinoma of Penisalejandro fernandezBelum ada peringkat

- Lee Gwan Cheung Resume WeeblyDokumen1 halamanLee Gwan Cheung Resume Weeblyapi-445443446Belum ada peringkat

- AMU BALLB (Hons.) 2018 SyllabusDokumen13 halamanAMU BALLB (Hons.) 2018 SyllabusA y u s hBelum ada peringkat

- Unilateral Lower Limb SwellingDokumen1 halamanUnilateral Lower Limb SwellingLilius TangBelum ada peringkat

- CH 13 ArqDokumen6 halamanCH 13 Arqneha.senthilaBelum ada peringkat

- APARICIO Frances Et Al. (Eds.) - Musical Migrations Transnationalism and Cultural Hybridity in Latino AmericaDokumen218 halamanAPARICIO Frances Et Al. (Eds.) - Musical Migrations Transnationalism and Cultural Hybridity in Latino AmericaManuel Suzarte MarinBelum ada peringkat

- Chapter 2 Organizational Behavior - Robbins, JudgeDokumen3 halamanChapter 2 Organizational Behavior - Robbins, JudgeRes Gosan100% (2)

- Reaction PaperDokumen4 halamanReaction PaperCeñidoza Ian AlbertBelum ada peringkat

- Monograph SeismicSafetyDokumen63 halamanMonograph SeismicSafetyAlket DhamiBelum ada peringkat

- Journal of Cleaner Production: Kamalakanta Muduli, Kannan Govindan, Akhilesh Barve, Yong GengDokumen10 halamanJournal of Cleaner Production: Kamalakanta Muduli, Kannan Govindan, Akhilesh Barve, Yong GengAnass CHERRAFIBelum ada peringkat

- The Endless Pursuit of Truth: Subalternity and Marginalization in Post-Neorealist Italian FilmDokumen206 halamanThe Endless Pursuit of Truth: Subalternity and Marginalization in Post-Neorealist Italian FilmPaul MathewBelum ada peringkat

- Design and Implementation of Computerized Hospital Database MNT SystemDokumen13 halamanDesign and Implementation of Computerized Hospital Database MNT SystemOgidiolu Temitope EbenezerBelum ada peringkat

- Reading8 PilkingtonDokumen8 halamanReading8 Pilkingtonab_amyBelum ada peringkat