ExxonMobil Capital Employed and ROACE

Diunggah oleh

sam101sam101Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ExxonMobil Capital Employed and ROACE

Diunggah oleh

sam101sam101Hak Cipta:

Format Tersedia

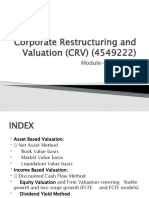

Table of Contents

FREQUENTLY USED TERMS Listed below are definitions of several of ExxonMobil's key business and financial performance measures. These definitions are provided to facilitate understanding of the terms and their calculation. CASH FLOW FROM OPERATIONS AND ASSET SALES Cash flow from operations and asset sales is the sum of the net cash provided by operating activities and proceeds from sales of subsidiaries, investments and property, plant and equipment from the Consolidated Statement of Cash Flows. This cash flow reflects the total sources of cash from both operating the Corporation's assets and from the divesting of assets. The Corporation employs a long-standing and regular disciplined review process to ensure that all assets are contributing to the Corporation's strategic objectives. Assets are divested when they are no longer meeting these objectives or are worth considerably more to others. Because of the regular nature of this activity, we believe it is useful for investors to consider sales proceeds together with cash provided by operating activities when evaluating cash available for investment in the business and financing activities, including shareholder distributions.

Cash flow from operations and asset sales 2009 2008 (millions of dollars) 2007

Net cash provided by operating activities Sales of subsidiaries, investments and property, plant and equipment Cash flow from operations and asset sales

28,438 1,545

59,725 5,985

52,002 4,204

29,983

65,710

56,206

CAPITAL EMPLOYED Capital employed is a measure of net investment. When viewed from the perspective of how the capital is used by the businesses, it includes ExxonMobil's net share of property, plant and equipment and other assets less liabilities, excluding both short-term and long-term debt. When viewed from the perspective of the sources of capital employed in total for the Corporation, it includes ExxonMobil's share of total debt and equity. Both of these views include ExxonMobil's share of amounts applicable to equity companies, which the Corporation believes should be included to provide a more comprehensive measure of capital employed.

Capital employed 2009 2008 (millions of dollars) 2007

Business uses: asset and liability perspective Total assets Less liabilities and noncontrolling interests share of assets and liabilities Total current liabilities excluding notes and loans payable Total long-term liabilities excluding longterm debt Noncontrolling interests share of assets and liabilities Add ExxonMobil share of debt-financed equity company net assets Total capital employed Total corporate sources: debt and equity perspective Notes and loans payable Long-term debt ExxonMobil share of equity Less noncontrolling interests share of total debt Add ExxonMobil share of equity company debt Total capital employed

233,323

228,052

242,082

(49,585) (58,741) (5,642) 5,043 $ 124,398 $

(46,700) (54,404) (6,044) 4,798 125,702 $

(55,929) (50,543) (5,332) 3,386 133,664

2,476 7,129 110,569 (819) 5,043 124,398

2,400 7,025 112,965 (1,486) 4,798 125,702

2,383 7,183 121,762 (1,050) 3,386 133,664

A-4

Table of Contents

RETURN ON AVERAGE CAPITAL EMPLOYED Return on average capital employed (ROCE) is a performance measure ratio. From the perspective of the business segments, ROCE is annual business segment earnings divided by average business segment capital employed (average of beginning and end-of-year amounts). These segment earnings include ExxonMobil's share of segment earnings of equity companies, consistent with our capital employed definition, and exclude the cost of financing. The Corporation's total ROCE is net income attributable to ExxonMobil excluding the after-tax cost of financing, divided by total corporate average capital employed. The Corporation has consistently applied its ROCE definition for many years and views it as the best measure of historical capital productivity in our capital-intensive, long-term industry, both to evaluate management's performance and to demonstrate to shareholders that capital has been used wisely over the long term. Additional measures, which are more cash flow-based, are used to make investment decisions.

Return on average capital employed 2009 2008 (millions of dollars) 2007

Net income attributable to ExxonMobil Financing costs (after tax) Gross third-party debt ExxonMobil share of equity companies All other financing costs net Total financing costs Earnings excluding financing costs Average capital employed Return on average capital employed corporate total A-5

19,280 (303) (285) (483) (1,071)

45,220 (343) (325) 1,485 817

40,610 (339) (204) 268 (275)

$ $

20,351 125,050 16.3%

$ $

44,403 129,683 34.2%

$ $

40,885 128,760 31.8%

Anda mungkin juga menyukai

- HCL StudyDokumen13 halamanHCL StudyJyotirmay SahuBelum ada peringkat

- Analyzing and Interpreting Financial StatementsDokumen42 halamanAnalyzing and Interpreting Financial StatementsLiluBelum ada peringkat

- V. Basic Interprestation and Use of Financial StatementsDokumen12 halamanV. Basic Interprestation and Use of Financial StatementsJHERICA SURELLBelum ada peringkat

- US CMA - Part 2 TerminologyDokumen67 halamanUS CMA - Part 2 TerminologyAhad chyBelum ada peringkat

- Financial StatementDokumen16 halamanFinancial StatementCuracho100% (1)

- Return On Capital Employed ROCEDokumen2 halamanReturn On Capital Employed ROCERajesh Tipnis100% (1)

- Financial StatementsDokumen10 halamanFinancial StatementsFraulien Legacy MaidapBelum ada peringkat

- Financial Analysis: Submitted byDokumen18 halamanFinancial Analysis: Submitted bybernie john bernabeBelum ada peringkat

- Profit After TaxDokumen3 halamanProfit After TaxShruti VernekarBelum ada peringkat

- Free Cash FlowDokumen31 halamanFree Cash FlowKaranvir GuptaBelum ada peringkat

- Ratio Analysis of ITCDokumen22 halamanRatio Analysis of ITCDheeraj Girase100% (1)

- Chapter - 4: Analysis and Interpretation OF DataDokumen62 halamanChapter - 4: Analysis and Interpretation OF Dataprashanraj123Belum ada peringkat

- Leverage and The CapitalDokumen31 halamanLeverage and The CapitalDiana DianBelum ada peringkat

- Return On EquityDokumen6 halamanReturn On EquitySharathBelum ada peringkat

- Rough Work AreaDokumen7 halamanRough Work AreaAnkur SharmaBelum ada peringkat

- 3 Statement & DCF ModelDokumen17 halaman3 Statement & DCF ModelArjun KhoslaBelum ada peringkat

- RoeDokumen3 halamanRoeShakir AbdullahBelum ada peringkat

- 3 Statement & DCF ModelDokumen17 halaman3 Statement & DCF ModelarjunBelum ada peringkat

- AccountingDokumen8 halamanAccountingaku sexcBelum ada peringkat

- Lec 14 Fin Perf ManagementDokumen21 halamanLec 14 Fin Perf ManagementHaroon RashidBelum ada peringkat

- Analyzing and Interpreting Financial StatementsDokumen44 halamanAnalyzing and Interpreting Financial StatementsHazim Abualola100% (1)

- Finance Henry BootDokumen19 halamanFinance Henry BootHassanBelum ada peringkat

- Roi Ri EvaDokumen14 halamanRoi Ri EvaAhalik HamzahBelum ada peringkat

- Mid Term TopicsDokumen10 halamanMid Term TopicsТемирлан АльпиевBelum ada peringkat

- Capital and Revenue ExpendituresDokumen30 halamanCapital and Revenue ExpendituresBir MallaBelum ada peringkat

- BAV Lecture 3Dokumen8 halamanBAV Lecture 3Fluid TrapsBelum ada peringkat

- Return On InvestmentDokumen11 halamanReturn On InvestmentwinanaBelum ada peringkat

- CH 9 Capital StructureDokumen35 halamanCH 9 Capital StructureAsmi SinglaBelum ada peringkat

- 3Dokumen26 halaman3JDBelum ada peringkat

- Dr. Komal Taneja: Associate ProfessorDokumen52 halamanDr. Komal Taneja: Associate Professorlovely devadaBelum ada peringkat

- Evaluating A Firms Financial Performance3767Dokumen17 halamanEvaluating A Firms Financial Performance3767Yasser MaamounBelum ada peringkat

- What Are Financial StatementsDokumen3 halamanWhat Are Financial StatementsShelamae AlabastroBelum ada peringkat

- Definitions & FormulasDokumen9 halamanDefinitions & FormulasMystique ProgenitorBelum ada peringkat

- Liquidity Ratios Solvency Ratios Profitability Ratios Activity RatiosDokumen11 halamanLiquidity Ratios Solvency Ratios Profitability Ratios Activity RatiosKavee JhugrooBelum ada peringkat

- Pertemuan 9BDokumen36 halamanPertemuan 9Bleny aisyahBelum ada peringkat

- Return On Assets (ROA) : Index of Industrial Production IIP Purchasing Managers' Index PMIDokumen4 halamanReturn On Assets (ROA) : Index of Industrial Production IIP Purchasing Managers' Index PMIMuskan MBelum ada peringkat

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDokumen36 halamanFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (35)

- Dwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFDokumen36 halamanDwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFmiltongoodwin2490i100% (15)

- Ch-7 Approaches of Business ValuationDokumen46 halamanCh-7 Approaches of Business ValuationManan SuchakBelum ada peringkat

- Enterprise DCF Model: Module-2Dokumen56 halamanEnterprise DCF Model: Module-2Devika Rani100% (1)

- Unit 3.financialDokumen45 halamanUnit 3.financialLeire BegoñaBelum ada peringkat

- Cash Flow StatementDokumen51 halamanCash Flow StatementABDEL RAOUF ALFAKIBelum ada peringkat

- Definitions: References To Earnings Refer To Net Income (Loss) Attributable To ConocophillipsDokumen10 halamanDefinitions: References To Earnings Refer To Net Income (Loss) Attributable To ConocophillipsRidwan AbdurahmanBelum ada peringkat

- Working Capital and Fund Flow Statement of Modest Infrastucture LTDDokumen27 halamanWorking Capital and Fund Flow Statement of Modest Infrastucture LTDMegha HumbalBelum ada peringkat

- Investment CentreDokumen27 halamanInvestment CentreSiddharth SapkaleBelum ada peringkat

- Financial RatiosDokumen3 halamanFinancial RatiosSelina CelynBelum ada peringkat

- Financial Statement Analysis Questions We Would Like AnsweredDokumen9 halamanFinancial Statement Analysis Questions We Would Like AnsweredthakurvinodBelum ada peringkat

- Stock ResearchDokumen50 halamanStock Researchvikas yadavBelum ada peringkat

- What Are Financial Statements?: AssetsDokumen4 halamanWhat Are Financial Statements?: AssetsRoselyn Joy DizonBelum ada peringkat

- Return On Equity: Assets Minus Liabilities. ROE Is A Measure of How Well A Company Uses Investments ToDokumen2 halamanReturn On Equity: Assets Minus Liabilities. ROE Is A Measure of How Well A Company Uses Investments ToManoj KumarBelum ada peringkat

- Session 10,11,12 Financial Analysis - Performance EvaluationDokumen12 halamanSession 10,11,12 Financial Analysis - Performance EvaluationPooja MehraBelum ada peringkat

- IGNOU MBA MS - 04 Solved Assignment 2011Dokumen16 halamanIGNOU MBA MS - 04 Solved Assignment 2011Kiran PattnaikBelum ada peringkat

- Cele Caparo Energy LTD: (London Stock Exchange)Dokumen12 halamanCele Caparo Energy LTD: (London Stock Exchange)prani1507Belum ada peringkat

- Analysis and Interpretation of Financial StatementsDokumen25 halamanAnalysis and Interpretation of Financial StatementsAnim SaniBelum ada peringkat

- Some Financial KPIsDokumen3 halamanSome Financial KPIsHM.Belum ada peringkat

- Financial Management Theory and Practice 13th Edition Brigham Solutions ManualDokumen35 halamanFinancial Management Theory and Practice 13th Edition Brigham Solutions Manualrappelpotherueo100% (17)

- Understanding Financial Statements (Review and Analysis of Straub's Book)Dari EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Penilaian: 5 dari 5 bintang5/5 (5)

- Due Diligence DocumentationDokumen4 halamanDue Diligence DocumentationSivakumar KrishnamurthyBelum ada peringkat

- Chapter 15 - Mergers and AcquisitionsDokumen63 halamanChapter 15 - Mergers and AcquisitionsBahzad BalochBelum ada peringkat

- Fixed Price Vs Book Building MethodDokumen2 halamanFixed Price Vs Book Building MethodH. M. Akramul HaqueBelum ada peringkat

- Emerald Debt Finance Firm PerformanceDokumen19 halamanEmerald Debt Finance Firm Performancelina oktavianiBelum ada peringkat

- Notes Holding CompanyDokumen4 halamanNotes Holding CompanySaurav NasaBelum ada peringkat

- FIN 485 Dr. Scott 8th Module NotesDokumen15 halamanFIN 485 Dr. Scott 8th Module NotesGeorge CongBelum ada peringkat

- Profitable Trading Strategies EbookDokumen42 halamanProfitable Trading Strategies Ebookplc2k588% (8)

- Epm Slides Unit 3 Jul 14Dokumen18 halamanEpm Slides Unit 3 Jul 14KalpeshBelum ada peringkat

- Moodys Approach To Rating The Petroleum Industry PDFDokumen32 halamanMoodys Approach To Rating The Petroleum Industry PDFMujtabaBelum ada peringkat

- Tata Coffee Analyst Presentation 13may2013Dokumen28 halamanTata Coffee Analyst Presentation 13may2013Rudra GoudBelum ada peringkat

- Merchant BankingDokumen41 halamanMerchant BankingPooja balwaniBelum ada peringkat

- 03 Denny Ermawan OkDokumen62 halaman03 Denny Ermawan OkAbdul ManafBelum ada peringkat

- Ebook IOP PDFDokumen125 halamanEbook IOP PDFamruta ayurvedalayaBelum ada peringkat

- MGMT 3000 Assignment 2016 v9 Miri (Final) - Copy - BlackboardDokumen14 halamanMGMT 3000 Assignment 2016 v9 Miri (Final) - Copy - BlackboardSahanBelum ada peringkat

- # 16 Bachrach Motor Co v. Lacson Ledesma (1937)Dokumen4 halaman# 16 Bachrach Motor Co v. Lacson Ledesma (1937)Karen RonquilloBelum ada peringkat

- Aarti Industries: All Round Growth ImminentDokumen13 halamanAarti Industries: All Round Growth ImminentPratik ChhedaBelum ada peringkat

- Graham Paul BarmanDokumen122 halamanGraham Paul BarmanMonique HoBelum ada peringkat

- Bank of Maharashtra 4Q FY 2013Dokumen11 halamanBank of Maharashtra 4Q FY 2013Angel BrokingBelum ada peringkat

- Credit Information in The PhilippinesDokumen4 halamanCredit Information in The PhilippinesPonkichi BearBelum ada peringkat

- Principles of Ed Seykota (Trend Follower)Dokumen7 halamanPrinciples of Ed Seykota (Trend Follower)Deng Qiang100% (4)

- Baroda Pioneer Asset Management Company LTDDokumen2 halamanBaroda Pioneer Asset Management Company LTDALLtyBelum ada peringkat

- HKSE-Listed Heng Fai Enterprises Appoints Dr. Lam, Lee G. As Vice Chairman & Non-Executive DirectorDokumen2 halamanHKSE-Listed Heng Fai Enterprises Appoints Dr. Lam, Lee G. As Vice Chairman & Non-Executive DirectorWeR1 Consultants Pte LtdBelum ada peringkat

- Heswall Local March 2013Dokumen40 halamanHeswall Local March 2013Talkabout PublishingBelum ada peringkat

- The Agility FactorDokumen9 halamanThe Agility FactorVenkatesh PadmanabhanBelum ada peringkat

- Gitman 0321286618 08Dokumen30 halamanGitman 0321286618 08Adiansyach PatonangiBelum ada peringkat

- Evercore Graduate BrochureDokumen14 halamanEvercore Graduate Brochureheedi0Belum ada peringkat

- Accounting Concepts and Business Performance Quiz 1 QuestionsDokumen9 halamanAccounting Concepts and Business Performance Quiz 1 QuestionsMohammad Usman TanveerBelum ada peringkat

- RAASI Cement HimanshuDokumen7 halamanRAASI Cement HimanshuSamarth MewadaBelum ada peringkat

- On SynonipsDokumen17 halamanOn SynonipsAnkitha KavyaBelum ada peringkat

- Subba ReddyDokumen47 halamanSubba Reddyankitjaipur0% (1)