Basel Iii

Diunggah oleh

Chanbor SutngaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Basel Iii

Diunggah oleh

Chanbor SutngaHak Cipta:

Format Tersedia

BASEL III is a global regulatory standard on bank capital adequacy, stress testing and market liquidity risk agreed

upon by the members of the Basel Committee on Banking Supervision in 2010-11.[1] This, the third of the Basel Accords (see Basel I, Basel II) was developed in response to the deficiencies in financial regulation revealed by the late-2000s financial crisis. Basel III strengthens bankcapital requirements and introduces new regulatory requirements on bank liquidity and bank leverage. For instance, the change in the calculation of loan risk in Basel II which some consider a causal factor in the credit bubble prior to the 2007-8 collapse: in Basel II one of the principal factors of financial risk management was out-sourced to companies that were not subject to supervision: credit rating agencies. Ratings of creditworthiness and of bonds, financial bundles and various other financial instruments were conducted without supervision by official agencies, leading to AAA ratings onmortage-backed securities, credit default swaps and other instruments that proved in practice to be extremely bad credit risks. In Basel III a more formal scenario analysis is applied (three official scenarios from regulators, with ratings agencies and firms urged to apply more extreme ones). The OECD estimates that the implementation of Basel III will decrease annual GDP growth by 0.05 to 0.15 percentage point.[2][3]. Outside the banking industry itself, criticism was muted. Bank directors would be required to know market liquidity conditions for major asset holdings, to strengthen accountability for any major losses.

Definition of 'Basel III'

A comprehensive set of reform measures designed to improve the regulation, supervision and risk management within the banking sector. The Basel Committee on Banking Supervision published the first version of Basel III in late 2009, giving banks approximately three years to satisfy all requirements. Largely in response to the credit crisis, banks are required to maintain

proper leverage ratios and meet certain capital requirements.

Investopedia explains 'Basel III'

Basel III is part of the continuous effort made by the Basel Committee on Banking Supervision to enhance the banking regulatory framework. It builds on the Basel I and Basel II documents, and seeks to improve the banking sector's ability to deal with financial and economic stress, improve risk management and strengthen the banks' transparency. A focus of Basel III is to foster greater resilience at the individual bank level in order to reduce the risk of system wide shocks.

Read more: http://www.investopedia.com/terms/b/basell-III.asp#ixzz1lzpx9mje

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Registration of Securities: Securities and Exchange CommissionDokumen6 halamanRegistration of Securities: Securities and Exchange CommissionmmeeeowwBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Equity: True-FalseDokumen46 halamanEquity: True-FalsedewiBelum ada peringkat

- Core Strategy 4.3Dokumen5 halamanCore Strategy 4.3Martin KedorBelum ada peringkat

- Ross12e Chapter05 TB AnswerkeyDokumen45 halamanRoss12e Chapter05 TB AnswerkeyZiyadGhaziBelum ada peringkat

- Icici Bank Rar 2015Dokumen42 halamanIcici Bank Rar 2015Moneylife Foundation0% (1)

- Chapter 3 - Sources of FinancingDokumen5 halamanChapter 3 - Sources of FinancingSteffany RoqueBelum ada peringkat

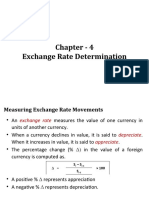

- Chapter - 4 Exchange Rate DeterminationDokumen14 halamanChapter - 4 Exchange Rate DeterminationAshiqur RahmanBelum ada peringkat

- Finance 2Dokumen7 halamanFinance 2Vũ Hải YếnBelum ada peringkat

- 3.4 Alternative Risk Transfer (Art)Dokumen62 halaman3.4 Alternative Risk Transfer (Art)david AbotsitseBelum ada peringkat

- A Practical Guide To Capitalisation of Borrowing Costs: November 2008Dokumen23 halamanA Practical Guide To Capitalisation of Borrowing Costs: November 2008adi darmawanBelum ada peringkat

- Impact of Inflation On The Financial StatementsDokumen22 halamanImpact of Inflation On The Financial StatementsabbyplexxBelum ada peringkat

- AE23 Questionnaire pt.2Dokumen4 halamanAE23 Questionnaire pt.2Roseann KimBelum ada peringkat

- Chapter 18Dokumen9 halamanChapter 18Selena JungBelum ada peringkat

- Pakistan Stock Exchange Limited: Internet Trading Subscribers ListDokumen3 halamanPakistan Stock Exchange Limited: Internet Trading Subscribers ListMuhammad AhmedBelum ada peringkat

- Week3Dokumen26 halamanWeek3saqib khanBelum ada peringkat

- SMCB PDFDokumen3 halamanSMCB PDFCherry BlasoomBelum ada peringkat

- DPC9 1208180022450694 01022021210649Dokumen2 halamanDPC9 1208180022450694 0102202121064928squashBelum ada peringkat

- Saint Vincent College of Cabuyao Financial Statement Analysis Quiz No. 1Dokumen8 halamanSaint Vincent College of Cabuyao Financial Statement Analysis Quiz No. 1jovelyn labordoBelum ada peringkat

- Sebi (Icdr), 2018Dokumen63 halamanSebi (Icdr), 2018Vedant KshatriyaBelum ada peringkat

- Different Types of Consulting Projects & EngagementsDokumen7 halamanDifferent Types of Consulting Projects & EngagementsCareer EdgeBelum ada peringkat

- A Study On Financial Performance of Nestle India LTD: Mr. A. David, Ms. T. DharaniDokumen3 halamanA Study On Financial Performance of Nestle India LTD: Mr. A. David, Ms. T. DharaniAntima RajvanshiBelum ada peringkat

- Markets and Commodity Figures: Total Market Turnover StatisticsDokumen6 halamanMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupBelum ada peringkat

- 3 o 1 VKMWP 6 JDokumen15 halaman3 o 1 VKMWP 6 JVinay KumarBelum ada peringkat

- Impact of Capital Market On Nigerai's Economic GrowthDokumen8 halamanImpact of Capital Market On Nigerai's Economic GrowthKwadwo TardieBelum ada peringkat

- Greenwich Associates Bond Etf Study 2018Dokumen8 halamanGreenwich Associates Bond Etf Study 2018tabbforumBelum ada peringkat

- Alita's Resume 2022 PDFDokumen1 halamanAlita's Resume 2022 PDFBrahmBelum ada peringkat

- CCPSDokumen2 halamanCCPSelitevaluation2022Belum ada peringkat

- FY 2014 MYRX Hanson+International+TbkDokumen11 halamanFY 2014 MYRX Hanson+International+TbkRaya AndreiniBelum ada peringkat

- FM QB New NewDokumen22 halamanFM QB New NewskirubaarunBelum ada peringkat

- Risk ManagementDokumen12 halamanRisk ManagementAhmed RazaBelum ada peringkat