Auto Bailout Plan PDF American Stock Market Closed Mixed

Diunggah oleh

GraceJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Auto Bailout Plan PDF American Stock Market Closed Mixed

Diunggah oleh

GraceHak Cipta:

Format Tersedia

Auto Bailout Plan Unveiled; American Stock Market Closed Mixed

December 22, 2008

Global News & Information Global Capital Research Group

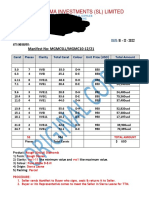

Major Global Indexes Dow Jones Index tumbled by 25.88 points or 0.30% at

8579.11 points as of closing.

Closing Margin (%)

American stock market closed mixed last Friday, with Dow

Dow Jones 8579.11 -0.30

Jones Index tumbled by 25.88 points or 0.30% at 8579.11

S&P 500 887.88 0.29

points; S&P 500 soared by 2.60 points or 0.29% at 887.88

UK:UKX 4286.93 -1.01

points, and NASDAQ Index moved up by 11.95 points or

Nikkei 225 8588.52 -0.91

0.77% at 1564.32 points.

Hang Seng 15127.51 -2.39

American government will pull General Motor and

Major Price Indicator

Chrysler out.

Closing Margin (%) Periodic bailout plan for two auto giants General Motor

WTI Crude Oil 33.87 -6.49 and Chrysler in America was unveiled after long-term

COMEX Gold 838.28 -1.72 discussion. The government decided on December 19 to

LME Copper 2930 1.74 distribute USD13.4bn from first part of the USD700bn for

LME Aluminum 1516 1.47 the two industrial giants as short-term loan. The fund will

BDI Index 818 -1.33 be allocated separately in December 2008 and early next

year. Moreover, should House of Representatives

Hong Kong Industries approve the second part of USD700bn bailout plan, the

Closing Margin (%) two giants will gain another USD4bn loans in February

Info & Tech 903.23 1.59 2009. These loans of total USD17.4bn will maintain their

Raw Material 5483.19 -2.72 operation before March the next year.

Telecom 1691.48 -3.12

Industrial Standard & Poor’s down regulated ratings of 11

758.35 -3.36

Goods financial institutes in Europe and America.

Energy 7452.60 -3.57 Financial risks increased on the whole, Standard & Poor’s

down-regulated ratings of 11 financial institutes last

Performance in Recent 5 Days Friday, including Goldman Sachs, Morgan Stanley,

Deutsche Bank, UBS, Bank of America, Citigroup,

JPMorgan Chase & Co., Wells Fargo, Barclays Bank,

RBS and Credit Suisse Global.

Bank of Japan cut benchmark interest rate by 20

points to 0.1%.

To ease further credit crunch and JPY appreciation, Bank

of Japan announced on Friday to cut its benchmark

--- Hang Seng Index ---- SSE Composite Index interest rate by 20 base points to 0.1% following Federal

Reserve’s rate cut to 0-0.25% on December 16.

As far as we are concerned, Japan’s rate cut was mainly from prospect of exchange rate.

World authoritative financial institutes like Federal Reserve, European Central Bank and Bank

of England all cut their interest rates substantially since the beginning of sub-prime crisis;

whereas extra-low interest rate in Japan prevented its central bank from further rate reduction,

which largely appreciated the JPY, seriously harmed its export industry and destroyed its

macro economy. After the rate cut, interest rate level in Bank of Japan will approach zero, thus

pro-active quantitative currency policy might be implemented once again.

Hang Seng Index closed low by 370.30 points or 2.39% at 15127.51 points.

Hong Kong market opened low and continued the trend later on; as of closing on Friday; Hang

Seng Index was down by 370.30 points or 2.39% to 15127.51 points, and Hang Seng Chinese

Enterprises Index was frustrated by 119.75 points or 1.40% at 8435.31 points.

Real estate shares outperformed Hang Seng Index.

Real estate shares largely outperformed Hang Seng Index despite partial decrease. Cheung

Kong (0001.HK) and R&F Properties (2777.HK) ascended by 2.58% and 1.35% respectively,

meanwhile Henderson Land Development (0012.HK) and Sun Hung Kai Properties (0016.HK)

fell by 0.46% and 1.34% separately.

Financial sub-indexes underperformed.

Financial sub-indexes underperformed. On financial concern, HSBC Holdings (0005.HK)

largely decreased by 6.19% amid the sluggish market; whereas the six Chinese-funded banks

and three insurance enterprises moved mixed, with China Construction Bank (601939) and

PICC P&C (2328.HK) up by 3.67% and 1.10%, Bank of Communications (601328) closed

even, and other six enterprises saw decline ranged from 0.25% to 4.95%.

Disclaimer

This material is for information purposes only and should not be construed as an offer to sell or the solicitation of an

offer to buy any security in any jurisdiction. The information included herein has been compiled by TX Investment

Consulting (“TX”) from sources that it believes to be reliable, but no presentation or guarantee is made or given by TX

or any other person as to its accuracy, completeness or timeliness.

All opinions and estimates expressed are entirely those of TX as of the date appearing on this material only and are

subject to change without notice. Neither TX nor its analysts accept any liability whatsoever for any direct or

consequential loss arising from any use of this material or otherwise arising in connection therewith.

This material is strictly confidential to the recipient. No part of this material may be redistributed, reproduced, or

published by any person for any purpose without prior permission in writing from TX. All rights are reserved.

Investment Rating System

Performance of stock or sector relative to TX Free-float Index over next 6 months after research publications

Rating Remark

1 Buy Relative performance over TX Free-float

Index >15%

2 Overweight Relative performance over TX Free-float Index 5% ~

15%

3 Neutral Relative performance over TX Free-float Index -5%

~ 5%

4 Underweight Relative performance over TX Free-float Index -5%

~ -15%

5 Sell Relative performance over TX Free-float Index

<-15%

About China Stock Advice

China Stock Advice is a leading provider of investment research on stocks traded in China A-share market, dedicating

to bringing the investing world smart, accurate and original research reports of Shanghai and Shenzhen stock

exchange listed companies to the English speaking public. With the entire world’s attention on China,

chinastockadvice.com offers the first website that translates and creates reports tailored to companies listed on the

mainland stock exchange. For more information, please visit www.chinastockadvice.com.

For any further details, please contact us at:

USA: 416 Production St N, Aberdeen SD 57401

Bryan Kriech Tel: 1-866-338-8883

China: R 2309, Building A, Time Court, No. 6, Shuguang Xili, Chaoyang District, Beijing, China, 100028

Becky Zhao Tel: 1-888-883-8942

Kofi Duan Tel: 86-10-59225042

E-mail: service@chinastockadvice.com

If you have further questions on the content of this report, please contact:

86-10-66045555 or send E-mail to: service@txsec.com

Becky Zhao Tel: 1-888-883-8942

Kofi Duan Tel: 86-10-59225042

Email: service@chinastockadvice.com

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Summer ASQ 2010Dokumen6 halamanSummer ASQ 2010autonomyallianceBelum ada peringkat

- ACSI Travel Report 2018-2019: American Customer Satisfaction IndexDokumen14 halamanACSI Travel Report 2018-2019: American Customer Satisfaction IndexJeet SinghBelum ada peringkat

- Historicizing Precarious Work Forty Years of Research in The Social Sciences and HumanitiesDokumen47 halamanHistoricizing Precarious Work Forty Years of Research in The Social Sciences and HumanitiesBren Mmtz100% (1)

- Airbnb Travel Receipt RCBND8DMQM-2Dokumen1 halamanAirbnb Travel Receipt RCBND8DMQM-2Josiah Emmanuel CodoyBelum ada peringkat

- Bollinger: The SqueezeDokumen4 halamanBollinger: The SqueezeshorttermblogBelum ada peringkat

- Air Passenger Service Quality in Bangladesh: An Analysis On Biman Bangladesh Airlines LimitedDokumen55 halamanAir Passenger Service Quality in Bangladesh: An Analysis On Biman Bangladesh Airlines LimitedRupa Banik100% (1)

- APM Terminals Company PresentationDokumen28 halamanAPM Terminals Company Presentationchuongnino123Belum ada peringkat

- Final OutputDokumen44 halamanFinal OutputJopie ArandaBelum ada peringkat

- Mindquest Rules 2024Dokumen6 halamanMindquest Rules 2024carrybabaahmmmBelum ada peringkat

- 6-Directory Officers EmployeesDokumen771 halaman6-Directory Officers EmployeesBikki KumarBelum ada peringkat

- Lesson 2 - Transactions and Accounting EquetionDokumen5 halamanLesson 2 - Transactions and Accounting EquetionMazumder SumanBelum ada peringkat

- AIMA Report Dikshita and Deeksha Western RegionDokumen13 halamanAIMA Report Dikshita and Deeksha Western RegionJimmy PardiwallaBelum ada peringkat

- Lev Aloha Against Waiter ScamsDokumen31 halamanLev Aloha Against Waiter ScamsfedericusxBelum ada peringkat

- Manifest 232Dokumen2 halamanManifest 232Elev8ted MindBelum ada peringkat

- How The American Dream Has Changed Over TimeDokumen3 halamanHow The American Dream Has Changed Over TimeKellie ClarkBelum ada peringkat

- Economics MCQS Ebook Download PDFDokumen85 halamanEconomics MCQS Ebook Download PDFMudassarGillani100% (5)

- TCW MODULE Complete Version 2pdfdocxDokumen188 halamanTCW MODULE Complete Version 2pdfdocxReñer Aquino BystanderBelum ada peringkat

- Essay Report: ETH Zürich Cadastral System WS 2006/07Dokumen26 halamanEssay Report: ETH Zürich Cadastral System WS 2006/07cucosoxana100% (1)

- Professional Regulation Commission Professional Regulation Commission Professional Regulation Commission Professional Regulation CommissionDokumen1 halamanProfessional Regulation Commission Professional Regulation Commission Professional Regulation Commission Professional Regulation CommissionIvann RicafrancaBelum ada peringkat

- Chapter 16 Capital Expenditure DecisionsDokumen44 halamanChapter 16 Capital Expenditure DecisionsCamille Donaire Lim100% (2)

- Office Memorandum No - DGW/MAN/171 Issued by Authority of Director General of WorksDokumen2 halamanOffice Memorandum No - DGW/MAN/171 Issued by Authority of Director General of WorksDeep Prakash YadavBelum ada peringkat

- Org Management Week 10Dokumen15 halamanOrg Management Week 10Jade Lyn LopezBelum ada peringkat

- Agro IndustrializationDokumen24 halamanAgro IndustrializationDrasko PeracBelum ada peringkat

- Natural Ice CreamDokumen12 halamanNatural Ice CreamAkash Malik0% (1)

- Operation ManagementDokumen15 halamanOperation ManagementRabia RasheedBelum ada peringkat

- Production Possibility Frontiers, OC, MarginalismDokumen4 halamanProduction Possibility Frontiers, OC, Marginalismyai giniBelum ada peringkat

- Basic Processes, Production, Consumption, ExchangeDokumen3 halamanBasic Processes, Production, Consumption, ExchangeMmapontsho TshabalalaBelum ada peringkat

- Cabinet Members 2020Dokumen2 halamanCabinet Members 2020AMBelum ada peringkat

- CIR Vs Kudos, GR 178087, May 5, 2010Dokumen4 halamanCIR Vs Kudos, GR 178087, May 5, 2010katentom-1Belum ada peringkat

- Case For High Conviction InvestingDokumen2 halamanCase For High Conviction Investingkenneth1195Belum ada peringkat