Capital Goods Industry Overview

Diunggah oleh

gaurav_garg7182Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Capital Goods Industry Overview

Diunggah oleh

gaurav_garg7182Hak Cipta:

Format Tersedia

Capital Goods: Strong show by fewer players Capital goods players generally find fourth quarter to be empirically strong

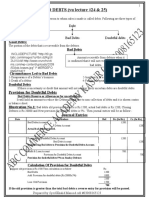

with impressive burnout of their healthy order book. However, factors such as environmental clearance, land and coal linkage etc continue to be a concern for the industry impacting the order inflow and / or execution / deliveries. Adding to this the cascading impact of hardening interest rates looming large. Aggregate revenue of capital goods industry as represented by the constituents of BSE Capital Goods Index was higher by 21% to Rs 52480 crore on the back of accelerated burnout of strong order book. The industry, which has built up strong capacity, was faced with delays in execution due to various client side issues and with that giving away in the fourth quarter facilitated strong revenue growth. Moreover the fixed cost has also spread over large volume resulting in higher margin for most of the players. The operating profit margin (OPM) expanded by 230 basis points (bps) to 17.6%, which coupled with higher sales, the operating profit was up by 38% to Rs 9209 crore. The other income was flat at Rs 833 crore, the interest cost was down by 37% to Rs 273 crore and the depreciation was higher by 26% to Rs 699 crore. Thus the PBT was up by 39% to Rs 9070 crore. But tax incidence stand lower the net profit was up by 57% to Rs 6218 crore. Industry heavy weights BHEL and Larsen & Toubro which account for over 60% of aggregate revenue and over 70% of aggregate net profit turned in strong performance for the quarter ended March 2011 and this has given strong colour to the aggregates despite some weak performance from BEML, BGR Energy etc. Players such as Suzlon and Punj Lloyd are still not completely out of the impact of lack of volumes to support fixed overheads due to delay in execution/ orders and one off items. Bharat Heavy Electricals, the PSU power equipment major has clocked a revenue growth of 32% to Rs 18380.50 crore facilitated by strong order book getting accelerated burn out on the back of enhanced capacity coming on stream from start of current fiscal. With OPM expand by 280 bps to 23.4% the operating profit was up by 49% to Rs 4293.60 crore and eventually the net profit was up by 47% to Rs 2798.04 crore. BHEL has changed the accounting policy on provision of warranties from creation of provision (@2.5% of contract value) at the time of trial production to creation of provision at 2.5% of the revenue progressively as and when it recognises the revenue. The impact of this accounting change on revenue was an increase of Rs 2772.79 crore and Profit before Tax by Rs 695.48 crore for FY2010-11. This is compared to Rs 444 crore indicated at the end of quarter Dec 2010. BHEL has also changed its accounting policy in respect of Employee benefits (from accrual basis to actuarial valuation) and the increase in PBT on account of this is Rs 240.75 crore. Further the depreciation rate for cranes has been changed to 8% per annum from 20% earlier as the same has been reclassified to General plant & Machinery from earlier Erection Equipment and thus the depreciation was lower by 80.62 crore (including Rs 49.03 crore pertain to earlier years) and resultant increase in PBT to the tune of Rs 46.80 crore. Though the core profitability did improve, BHEL's surge in profits was powered positively by this change in accounting policy. Larsen & Toubro, the engineering & construction major that was impacted by delayed/slowed down execution in major part of the year turned in a steady performance for the quarter. Its topline for the quarter ended March 2011, grew by 13% to Rs 15384.21 crore and its net profit was up by 17% to Rs 1686.21 crore. However excluding the EO income, the net profit was up by 12% to Rs 1504.65 crore. The core engineering & construction business of the company registered 13% growth in its revenue to Rs 13664.31 crore and its PBIT was up by 8% to Rs 1990.62 crore. On the other hand the Transmission & Distribution equipment manufacturers though continue to face the brunt of intense competition and lack of order flow, there was an improved show from players such as Areva T&D. Sales of Areva T&D was up by 28% to Rs 994.91 crore on the back of higher volume. With fixed overheads spread over higher volumes, the OPM was up 270 bps to 8.4% and the operating profit was up 90% to Rs 83.71 crore. The net profit was eventually up 729% to Rs 28.78 crore. And with higher volume The power systems business of other industry major Crompton Greaves registered subdued performance. The standalone revenue of CG for the quarter was higher by 9% (to Rs 1765.19 crore) with the upside in revenue come from consumer products and industrial Systems as the revenue of power systems was down by 1% to Rs 819.39 crore. But the standalone net profit was lower by 6% to Rs 217.64 crore dragged largely by weak operating performance by power (down 8% to Rs 147.92 crore) and industrial systems (down 18% to Rs 64.21 crore). On the other hand the consolidated revenue of CG was up by 16% to Rs 2908.03 crore and the net profit was down by 18% to Rs 251.43 crore. Outlook Capital goods sector enjoys the comfort of strong orders book even while faced with delay / slowdown in order inflow on the back of issues such as environment, land acquisition issues, coal linkage for power plants, litigation etc. The sluggish order inflow now, will cloud the medium term prospects of the industry. India per se needs huge investments to build its infrastructure, and fortunately, the government is taking initiatives to sort specific policy issues on environment, land acquisitions, coal linkages, litigations etc, which add sheen to long term outlook. Meanwhile, earlier there was drying up of orders from NHAI. But oflate it has started finalizing orders auguring well for players offering construction services/project development and construction equipment. However the intense competition especially in the lower-medium

size road project signals still the pie is not large enough to accommodate all as the industry has seen surge of new players. On the power generation and transmission equipment side the concern of delay in ordering and excess capacity looms large. But as we are nearing the completion of 11th five-year plan, the order for transmission and distribution equipment has to pickup leading to better capacity utilization and improvement in realization. As PowerGrid insists for local manufacturing in relation to HVDC orders, global competition in general and predatory Chinese and Korean players are kept out of fray, but the competition is wide open in other segments. Moreover the hardening interest rates are a cause of concern given its cascading impact on the industrial capex and demand for capital goods. Overall the outlook in the medium term is gloomy though the long-term outlook for Capital Goods sector continues to be bright.

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- 05 Expedition Audit L3Dokumen54 halaman05 Expedition Audit L3MateoLagardoBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Pakistan Financial Regulations - Vol 1Dokumen344 halamanPakistan Financial Regulations - Vol 1Khalid83% (6)

- Balance SheetDokumen32 halamanBalance SheetJanine padronesBelum ada peringkat

- Residual Income Model ExplainedDokumen12 halamanResidual Income Model ExplainedKanav GuptaBelum ada peringkat

- Lec-2 - Chapter 23 - Nation's IncomeDokumen33 halamanLec-2 - Chapter 23 - Nation's IncomeMsKhan0078Belum ada peringkat

- Midterm Review - Key ConceptsDokumen10 halamanMidterm Review - Key ConceptsGurpreetBelum ada peringkat

- CHAPTER-I INTRODUCTIONDokumen66 halamanCHAPTER-I INTRODUCTIONMohan JohnnyBelum ada peringkat

- ADAMS - 2021 Adam Sugar Mills Limited BalancesheetDokumen6 halamanADAMS - 2021 Adam Sugar Mills Limited BalancesheetAfan QayumBelum ada peringkat

- MGT 101 SampleDokumen9 halamanMGT 101 SampleWaleed AbbasiBelum ada peringkat

- Applying The CAMEL Model To Assess Performance ofDokumen11 halamanApplying The CAMEL Model To Assess Performance ofMai Anh NguyễnBelum ada peringkat

- 05Dokumen19 halaman05Emre TürkmenBelum ada peringkat

- Yes BankDokumen17 halamanYes BankTanu GulatiBelum ada peringkat

- An Assignment On Indian Banking SystemDokumen19 halamanAn Assignment On Indian Banking Systemjourneyis life100% (2)

- SHB's Answer To Nevin Shapiro ComplaintDokumen39 halamanSHB's Answer To Nevin Shapiro ComplaintsouthfllawyersBelum ada peringkat

- E3 - Revenue RCM TemplateDokumen51 halamanE3 - Revenue RCM Templatenazriya nasarBelum ada peringkat

- OlaDokumen2 halamanOlaanderspeh.realestateBelum ada peringkat

- Blue Print 3-5 Years Multi Finance: Marmin MurgiantoDokumen6 halamanBlue Print 3-5 Years Multi Finance: Marmin MurgiantoRicky NovertoBelum ada peringkat

- Engineering EconomyDokumen18 halamanEngineering EconomyWesam abo HalimehBelum ada peringkat

- Finman Chap3Dokumen66 halamanFinman Chap3Jollybelleann MarcosBelum ada peringkat

- PT Kalbe Farma TBK.: Summary of Financial StatementDokumen2 halamanPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuBelum ada peringkat

- Valuation of MiningDokumen7 halamanValuation of MiningCarlos A. Espinoza MBelum ada peringkat

- Chapter 17 Homework ProblemsDokumen5 halamanChapter 17 Homework ProblemsAarti JBelum ada peringkat

- DT Notes (Part I) For May & Nov 23Dokumen246 halamanDT Notes (Part I) For May & Nov 23Tushar MalhotraBelum ada peringkat

- Common Mistake and Exam TipsDokumen16 halamanCommon Mistake and Exam TipsNguyễn Hồng NgọcBelum ada peringkat

- Cash Flow Statement for Lopez IncDokumen4 halamanCash Flow Statement for Lopez IncAura Anggun Permatasari auraanggun.2021Belum ada peringkat

- Rule 88 Payment of Debts of The Estate DigestsDokumen3 halamanRule 88 Payment of Debts of The Estate Digestsmelaniem_1Belum ada peringkat

- Playing To Win: in The Business of SportsDokumen8 halamanPlaying To Win: in The Business of SportsAshutosh JainBelum ada peringkat

- Sailendra Yak TSA Presentation EnglishDokumen36 halamanSailendra Yak TSA Presentation EnglishInternational Consortium on Governmental Financial Management100% (1)

- 4024 Y18 SP 2Dokumen20 halaman4024 Y18 SP 2Noor Mohammad KhanBelum ada peringkat

- Documented Essay Final Draft WeeblyDokumen6 halamanDocumented Essay Final Draft Weeblyapi-241798291Belum ada peringkat