Bank Reconciliation

Diunggah oleh

Vinh Ngo NhuDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bank Reconciliation

Diunggah oleh

Vinh Ngo NhuHak Cipta:

Format Tersedia

BANK RECONCILIATION 1.

The transfer journal would be most likely to be used as the book of prime entry to record which of the following double entries ? a. A cash sale b. The payment of a supplier c. The purchase of a long-term asset d. Discount received 2. Who should not prepare a creditors control ? a. Accounts supervisor b. Purchase day book clerk c. Sales day book clerk d. Assistant accountant 3. What is not a purpose of control accounts ? a. Provide a total of debtors and creditors at any time b. Avoid preparation of sales ledger accounts c. Identify errors in the day books and posting to the general ledger d. Check the accuracy of entries in the individual accounts 4. Which of the following items would you adjust the cash book for when preparing a bank reconciliation statement ? i. Outstanding deposits ii. Unpresented cheques iii. Standing order payment omitted iv. Bank charges a. I,ii b. I,iv c. I,ii,iv d. Iii and iv 5. The balance on the cash account for a business at the end of June was an overdraft of $89.93. At that date there were also unpresented cheques totaling $154.38 and an outstanding deposit of $60.00. It was also discovered that during the month of June the bank had charged the business interest on its overdraft for the previous wuater of $16.45 What is the correct balance on the cash account at the end of June ? a. $73.48 overdrawn b. $ 106.38 overdrawn c. $167.86 overdrawn d. $200.76 overdrawn 6. A business has a debit balance on its cash book of $148 but the bank statement shows a different balance. The following items have also been discovered: - The bank statement shows that there were bank charges for the period of $10 which have not been recorded in the cash account; - A standing order payment for $25 has also been mistakenly omitted from the cash account; - Cheques totaling $125 had been written and posted to suppliers but had not yet been presented; 1

7.

8.

9.

10.

11.

12.

A cheque for $85 had been paid into bank but was still outstanding What is the balance on the bank statement ? a. $73 b. $113 c. $153 d. $223 The bank statement shows a balance at the bank of $1,360, whilst the cash book balance on the same date is $1,250. The discrepancy can be explained by: a. Unpresented ledgement of $110 b. Bank charges of $110 not yet recorded in the cash book c. Bank interest received of $55 credited in the cash book d. A dishonoured cheque for $55 which the business did not know about until it was returned, after the date of the bank statement On 31 December Jolyns cash book shows a balance of $293. The bank statement for 31 December shows a balance of $151. The difference could be due to : a. Uncredited lodgements for which adjustment to the cash book is necessary b. Uncredited lodgements for which no adjustment to the cash book is necessary c. Bank interest received as revealed by the bank statement, for which adjustment to the cash book is necessary d. Bank interest received as revealed by the bank statement, for which no adjustment to the cash book is necessary Which of the following statement is true ? Uncredited lodgement a. Constitute an error in the cash book b. Constitute an error in the bank statement c. Result from the cash book being out of date compare with the bank statement d. Result from the bank statement being out of date compare with the bank statement Which of the following would not affect bank reconciliation ? a. Dishonoured cheque b. Discount received c. Bank interest d. Lodgement not presented A cheque appears in the bank statement the same day as it appears in the cash book. Why would this occur ? a. It has been posted to the payee b. It has been used to withdraw cash for wages c. It has gone through the bank clearing system d. It represents payment to a shopkeeper in a foreign country Which document in a well run sole trader business show the same balance as recorded in the business cash book ? a. The latest cheque book counterfoil b. The bank statement c. The paying in book d. The petty cash book 2

13. Which transaction is recorded in the bank before the business cash book ? a. A cashed cheque b. Payment of a credit card bill c. Bank charges d. A cash sale 14. Which of the following is not a statement which reconciles or controls ? a. Bank reconciliation statement b. Control account c. Computerised ledger account d. Trial balance 15. Which of the following would not appear in a bank statement ? a. A credit card purchase b. A debit card purchase c. A BACS transfer to pay wages d. An EFTPOS transfer for an internet sale 16. When would a trial balance not agree ? a. When the bank reconciliation indicates there are outstanding itmes in the clearing system b. When sales ledger control account indidicates there is a contra item with the purchase ledger control account c. When a supplier statement omits an invoice for goods received d. When the analysis columns in the petty cash book have not been recorded in the general ledger

Anda mungkin juga menyukai

- PAC - Bank Reconciliations and Accounting Concepts TestDokumen5 halamanPAC - Bank Reconciliations and Accounting Concepts TestNadir MuhammadBelum ada peringkat

- Quiz On Audit of CashDokumen11 halamanQuiz On Audit of CashY JBelum ada peringkat

- BRS, IASB FRMWKDokumen4 halamanBRS, IASB FRMWKNadir MuhammadBelum ada peringkat

- ACCTG102 MidtermQ1 CashDokumen13 halamanACCTG102 MidtermQ1 CashRose Marie93% (15)

- APDokumen38 halamanAPCyvee Joy Hongayo OcheaBelum ada peringkat

- Summative Financial StatementsDokumen11 halamanSummative Financial Statementskeisha santosBelum ada peringkat

- DocxDokumen16 halamanDocxLeah Mae NolascoBelum ada peringkat

- 01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Dokumen4 halaman01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Bea GarciaBelum ada peringkat

- FINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSDokumen9 halamanFINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSPau Santos76% (29)

- Ap-1402 CashDokumen22 halamanAp-1402 Cashjulie anne mae mendozaBelum ada peringkat

- Cash and Cash EqDokumen18 halamanCash and Cash EqElaine YapBelum ada peringkat

- 1201 Cash QuestionsDokumen12 halaman1201 Cash QuestionsAngel Mae YapBelum ada peringkat

- Latihan Acca v02Dokumen17 halamanLatihan Acca v02Indriyanti KrisdianaBelum ada peringkat

- Accounts Receivable 2Dokumen10 halamanAccounts Receivable 2jade rotiaBelum ada peringkat

- Handout - CashDokumen17 halamanHandout - CashPenelope PalconBelum ada peringkat

- ProbsDokumen27 halamanProbsDante Jr. Dela Cruz50% (2)

- Audit of Cash TheoryDokumen7 halamanAudit of Cash TheoryShulamite Ignacio GarciaBelum ada peringkat

- T1 BookDokumen22 halamanT1 BookDavin PathBelum ada peringkat

- Test Bank For Intermediate Accounting 17th Edition Stice DownloadDokumen68 halamanTest Bank For Intermediate Accounting 17th Edition Stice Downloadjasondaviskpegzdosmt100% (26)

- Reviewer - Cash & Cash EquivalentsDokumen5 halamanReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- Problem Solving (With Answers)Dokumen12 halamanProblem Solving (With Answers)sunflower100% (1)

- Q1 SMEsDokumen6 halamanQ1 SMEsJennifer RasonabeBelum ada peringkat

- Audit of Cash and Cash Equivalents: Problem No. 20Dokumen6 halamanAudit of Cash and Cash Equivalents: Problem No. 20Robel MurilloBelum ada peringkat

- Test 3 QuestionsDokumen8 halamanTest 3 QuestionsArt and Fashion galleryBelum ada peringkat

- Audit of Cash and Cash EquivalentsDokumen2 halamanAudit of Cash and Cash EquivalentsWawex Davis100% (1)

- BRS MCQsDokumen4 halamanBRS MCQsAbel Zacharia100% (1)

- Fa1 Batch 86 Test 19 March 24Dokumen6 halamanFa1 Batch 86 Test 19 March 24Paradox ForgeBelum ada peringkat

- Cash and Cash Equivalents ExamDokumen7 halamanCash and Cash Equivalents ExamRudydanvinz BernardoBelum ada peringkat

- Revenue CycleDokumen50 halamanRevenue CycleCardoza Ryan100% (1)

- Using Financial Accounting Information The Alternative To Debits and Credits 8th Edition Porter Test Bank DownloadDokumen91 halamanUsing Financial Accounting Information The Alternative To Debits and Credits 8th Edition Porter Test Bank DownloadSusan Williams100% (21)

- 11 ACCT 1AB CashDokumen17 halaman11 ACCT 1AB CashJustLike JeloBelum ada peringkat

- Theories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionDokumen15 halamanTheories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionRyan PatitoBelum ada peringkat

- E-Handout On Audit of Cash and Cash EquivalentsDokumen12 halamanE-Handout On Audit of Cash and Cash EquivalentsAsnifah AlinorBelum ada peringkat

- (Cash and Cash Equivalents Drills) Acc.106Dokumen18 halaman(Cash and Cash Equivalents Drills) Acc.106Boys ShipperBelum ada peringkat

- Audit of Cash and Cash Equivalents PDFDokumen4 halamanAudit of Cash and Cash Equivalents PDFRandyBelum ada peringkat

- Theory of Accounts Cash and Cash EquivalentsDokumen9 halamanTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- Accounting Cash Internal ControlsDokumen14 halamanAccounting Cash Internal ControlsDave A ValcarcelBelum ada peringkat

- SolutionsDokumen25 halamanSolutionsDante Jr. Dela Cruz100% (1)

- Financial Accounting 1Dokumen35 halamanFinancial Accounting 1Bunbun 221Belum ada peringkat

- 19283198237Dokumen11 halaman19283198237xjammerBelum ada peringkat

- Theories Cash and Cash EquivalentsDokumen9 halamanTheories Cash and Cash EquivalentsJavadd KilamBelum ada peringkat

- 1st SummativeDokumen2 halaman1st Summativeje-ann montejoBelum ada peringkat

- PrAE 304 Auditing and Assurance - MidtermsDokumen6 halamanPrAE 304 Auditing and Assurance - MidtermsJeryl AlfantaBelum ada peringkat

- Auditing Quiz Solutions and Bank Reconciliation AnalysisDokumen4 halamanAuditing Quiz Solutions and Bank Reconciliation AnalysisstillwinmsBelum ada peringkat

- Cash and Cash Equivalents, Bank Reconciliation, and Proof of CashDokumen8 halamanCash and Cash Equivalents, Bank Reconciliation, and Proof of CashMichaelBelum ada peringkat

- APC 4 Reviewer Before FinalsDokumen38 halamanAPC 4 Reviewer Before Finalsjeremy groundBelum ada peringkat

- Bank ReconciliationDokumen18 halamanBank Reconciliationsahara manalaoBelum ada peringkat

- Cash and Cash Equivalents QuestionsDokumen5 halamanCash and Cash Equivalents QuestionsMikaerika AlcantaraBelum ada peringkat

- Q 029 We 4 UDokumen11 halamanQ 029 We 4 UxjammerBelum ada peringkat

- FAR-Cash & Cash Equivalents Theory-MCDokumen5 halamanFAR-Cash & Cash Equivalents Theory-MCOlive Grace CaniedoBelum ada peringkat

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDokumen10 halamanP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- Quiz On Cash Ga TheoriesDokumen5 halamanQuiz On Cash Ga TheoriesgarciarhodjeannemarthaBelum ada peringkat

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingDari EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingPenilaian: 4 dari 5 bintang4/5 (2)

- Bookkeeping Essentials: How to Succeed as a BookkeeperDari EverandBookkeeping Essentials: How to Succeed as a BookkeeperPenilaian: 1 dari 5 bintang1/5 (1)

- Bookkeepers' Boot Camp: Get a Grip on Accounting BasicsDari EverandBookkeepers' Boot Camp: Get a Grip on Accounting BasicsPenilaian: 5 dari 5 bintang5/5 (1)

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveDari EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveBelum ada peringkat

- Chapter 10 AuditOfCustoms&ExciseDutiesDokumen13 halamanChapter 10 AuditOfCustoms&ExciseDutiesVinh Ngo NhuBelum ada peringkat

- January 2014 University Visit ScheduleDokumen2 halamanJanuary 2014 University Visit ScheduleVinh Ngo NhuBelum ada peringkat

- Dec 2008Dokumen8 halamanDec 2008Jehan PereraBelum ada peringkat

- Fa2 Mock Test 3Dokumen14 halamanFa2 Mock Test 3Vinh Ngo Nhu57% (7)

- Accounting errors and adjustments explained in 17 stepsDokumen7 halamanAccounting errors and adjustments explained in 17 stepsVinh Ngo NhuBelum ada peringkat

- Acca f7 TestDokumen4 halamanAcca f7 TestVinh Ngo NhuBelum ada peringkat

- Ma1 Mock Test 1Dokumen5 halamanMa1 Mock Test 1Vinh Ngo Nhu83% (12)

- T3 2004 - Dec - QDokumen8 halamanT3 2004 - Dec - QVinh Ngo NhuBelum ada peringkat

- FA2 TEST 1 REVIEWDokumen15 halamanFA2 TEST 1 REVIEWVinh Ngo Nhu75% (4)

- Answer Fill in The Missing Words in The Sentences BelowDokumen2 halamanAnswer Fill in The Missing Words in The Sentences BelowVinh Ngo Nhu0% (1)

- Audit Planning and Risk AssessmentDokumen41 halamanAudit Planning and Risk AssessmentMan ChengBelum ada peringkat

- p1 Acca Lesson1Dokumen10 halamanp1 Acca Lesson1Vinh Ngo NhuBelum ada peringkat

- P3 Business Analysis Syllabus RationaleDokumen15 halamanP3 Business Analysis Syllabus RationaleVinh Ngo NhuBelum ada peringkat

- Answer: PH P 1,240: SolutionDokumen18 halamanAnswer: PH P 1,240: SolutionadssdasdsadBelum ada peringkat

- AMM - Chapter 1Dokumen50 halamanAMM - Chapter 1Azizan RamlyBelum ada peringkat

- 1832 2011Dokumen148 halaman1832 2011William KaoBelum ada peringkat

- Fikir ProposalDokumen28 halamanFikir ProposalAbubeker KasimBelum ada peringkat

- Le Rapport Du Public Accounts Commitee Rendu PublicDokumen32 halamanLe Rapport Du Public Accounts Commitee Rendu PublicL'express Maurice100% (2)

- CAP 3400 Air Operator Certification Manual (Helicopters)Dokumen238 halamanCAP 3400 Air Operator Certification Manual (Helicopters)Saragh BhandaryBelum ada peringkat

- Principles of Auditing Other Assurance Services 19th Edition Whittington Test BankDokumen25 halamanPrinciples of Auditing Other Assurance Services 19th Edition Whittington Test BankJamesWilliamsonjqyz100% (38)

- IRCA Application Form 2015Dokumen7 halamanIRCA Application Form 2015shaistaBelum ada peringkat

- Bcom V Semester SyllabusDokumen23 halamanBcom V Semester SyllabusPriyadharshini RBelum ada peringkat

- EY Advisory ServicesDokumen3 halamanEY Advisory ServicesPhil LewisBelum ada peringkat

- Audit Ch. 1 3 FlashcardsDokumen20 halamanAudit Ch. 1 3 Flashcardst5nhakhobauBelum ada peringkat

- SNAP Test - MockDokumen21 halamanSNAP Test - MockDeeBelum ada peringkat

- Final Audit Report A V Steel SA1Dokumen31 halamanFinal Audit Report A V Steel SA1Nirmit Gandhi100% (1)

- Presentation of Financial Statements: IASB Documents Published To Accompany Ias 1Dokumen30 halamanPresentation of Financial Statements: IASB Documents Published To Accompany Ias 1Kemala Putri AyundaBelum ada peringkat

- Applied Indirect Taxation PDFDokumen352 halamanApplied Indirect Taxation PDFjerciBelum ada peringkat

- Advanced Accounting Materials Cover Home and Branch OperationsDokumen5 halamanAdvanced Accounting Materials Cover Home and Branch Operationsnivea gumayagayBelum ada peringkat

- CA - INTER COURSE MATERIAL MULTIPLE CHOICE QUESTIONSDokumen72 halamanCA - INTER COURSE MATERIAL MULTIPLE CHOICE QUESTIONSRoshinisai VuppalaBelum ada peringkat

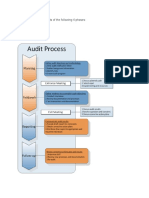

- Internal Audit Procedure With FlowchartDokumen4 halamanInternal Audit Procedure With FlowchartEric Anastacio100% (1)

- Fundamentals of Assurance EngagementsDokumen10 halamanFundamentals of Assurance EngagementsBryan Red AngaraBelum ada peringkat

- MML Annual Report 1-86Dokumen86 halamanMML Annual Report 1-86RajBelum ada peringkat

- Tri-Pack Annual ReportDokumen91 halamanTri-Pack Annual ReportTahir MahmoodBelum ada peringkat

- CPALE Syllabi 2018 PDFDokumen32 halamanCPALE Syllabi 2018 PDFLorraine TomasBelum ada peringkat

- Ecorp Annual Report 2018Dokumen129 halamanEcorp Annual Report 2018Adeel JavaidBelum ada peringkat

- Bank Negara Malaysia: Organisation StructureDokumen1 halamanBank Negara Malaysia: Organisation Structureshanizam ariffinBelum ada peringkat

- AR DJP 2014-Eng - 2Dokumen192 halamanAR DJP 2014-Eng - 2HenryBelum ada peringkat

- About Commercial Banks in EthiopiaDokumen91 halamanAbout Commercial Banks in EthiopiaDawit G. TedlaBelum ada peringkat

- @4 Auditing and Assurance Services - WSUDokumen125 halaman@4 Auditing and Assurance Services - WSUOUSMAN SEIDBelum ada peringkat

- House Hearing, 110TH Congress - An Overview of The Compact of Free Association Between The United States and The Republic of The Marshall Islands: Are Changes Needed?Dokumen168 halamanHouse Hearing, 110TH Congress - An Overview of The Compact of Free Association Between The United States and The Republic of The Marshall Islands: Are Changes Needed?Scribd Government DocsBelum ada peringkat

- Clearlake City Council Agenda PacketDokumen151 halamanClearlake City Council Agenda PacketLakeCoNewsBelum ada peringkat

- Iso 9000Dokumen136 halamanIso 9000BPushevaBelum ada peringkat