Banc

Diunggah oleh

poojshahDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Banc

Diunggah oleh

poojshahHak Cipta:

Format Tersedia

Bancassurance in Practice

Mnchener Rck Munich Re Group

Munich Re Group

Bancassurance

in Practice

Contents

1 2 2.1 2.2 2.3 3 3.1 3.1.1 3.1.2 3.1.3 3.2 3.2.1 3.2.2 3.2.3 3.3 3.4 4 4.1 4.2 5 5.1 5.2 5.3 6 6.1 6.2 6.3 6.4 7 7.1 7.2 7.2.1 7.2.2 7.3 7.4 8

Introduction Entering Ways of Reasons Benefits into bancassurance entering into bancassurance for banks to enter into bancassurance from bancassurance for insurance companies

2 4 4 5 7 9 10 10 11 12 12 12 13 13 13 14 15 15 19 21 21 22 23 25 25 26 26 26 28 28 30 30 30 32 34 35 37

Bancassurance products Finance and repayment products Credit insurance Overdraft insurance Capital repayment Depositors products Depositors insurance Objective achievement insurance (bank savings plans) Pure investment products Simple standardized package products Other products Distribution channels Types and characteristics Cultural issues in distribution Remuneration packages and incentive schemes Objectives of remuneration and incentive schemes Remuneration of agency forces and agency management Remuneration of bank employees Training Sales force training for bancassurers Bank employee training for bancassurers Continuous training and supervision Quality customer service Operational procedures for bancassurance sales forces Allocation of bank branches to the sales force The referral system The basic principles An overview of the proposed system The branch referral process Guidelines for allocating commissions Contract review processes Appendix: Examples of rules for allocating commissions

Bancassurance

in Practice

Munich Re Group

Introduction

One of the most significant changes in the financial services sector over the past few years has been the appearance and development of bancassurance. Banking institutions and insurance companies have found bancassurance to be an attractive and often profitable complement to their existing activities. The successes demonstrated by various bancassurance operations, although not all of them have been successful, have attracted the attention of the financial services secto r, and further new operations continue to be set up regularl y. The purpose of this report is to inform the reader about ways in which a bancassurance operation can be set up. The report discusses the various observed methods in use today under each of the following headings: Contractual relationships between bank and insurer Product ranges Sales channels Remuneration methods and training in bancassurance

operations

The report does not seek to cover all aspects of banking or of insurance operations, but concentrates on the special needs of a bancassurance operation in the above areas. The focus on Europe is deliberate since most developments in bancassurance up to the mid-1990s took place in Europe. This report is timel y, howeve r, because banks and insurers in other parts of the world, e.g. the USA, Canada and Asia, are now developing bancassurance operations. In doing so, they seek to learn from the experiences of European bancassurers. Bancassurance covers a wide range of detailed arrangements between banks and insurance companies, but in all cases it includes the provision of insurance and banking products or services from the same sources or to the sam customer e base. Because there is a wide diversity of strategies, there is no standard model for bancassurance, even within a countr y. Available literature also shows a wide range of possible descriptions of bancassurance: The Life Insurance Marketing and Research Association s (LIMRAs) insurance dictionary defines bancassurance as the provision of Life insurance services by banks and building societies. Alan Leach, in his book, European Bancassurance Problems and prospects for 2000, describes bancassurance as the involvement of banks, savings banks and building societies in the manufacturing, marketing or distribution of insurance products. For the purpose of this report, the definition of bancassurance is the following: which will be used

Bancassurance is the provision of insurance and banking products and services through a common distribution channel and/or to the sam client base. e

Munich Re Group

Introduction

Bancassurance in Practice

This report contains seven

further chapters as follows:

Chapter 2 Entering into bancassurance analyses the reasons why banks and insurance companies enter into bancassurance arrangements and presents possible arrangements. Chapter 3 Bancassurance products analyses principles for the development ance products and describes bancassurance-specific products.

of bancassur-

Chapter 4 Distribution channels is devoted to the main features of the distribution channels used by bancassurers, the product lines of each channel and to the cultural differences in bancassurance. Chapter 5 Remuneration packages and incentive schemes presents the basic principles for designing remuneration and incentive schemes for bank staff and for sales agents in a bancassurance operation. Chapter 6 Training looks at the need for continuous training of staff and suggests basic training topics for each distribution channel. This chapter also covers quality customer service in a bancassurance operation. Chapter 7 Operational procedures for bancassurance sales forces describes processes managing the bancassurer s sales forces including the referral process. Chapter 8 Contract review processes discusses the need for and the headings covered under legal contracts in a bancassurance operation. The study is based on existing literature and on the many personal interviews and discussions which the author has had during his visits to many European bancassurers in the UK, Ireland, Portugal, France, Spain, Germany and Greece. It is also based on the author s experience from the practices that have been implemented at the author s employe r, EuroLife Ltd. EuroLife was established in 1989 as a joint venture between the Bank of Cyprus (the biggest financial institution in Cyprus) and Manulife Financial of Canada. EuroLife was set up and operates using bancassurance concepts. Its success has been such that within three years the company achieved top ranking in new busi- ness in the Cypriot insurance market. Eurolife, along with many bancassurers, operates a referral system for its specialist agents. This report refers to several aspects of the system. Howeve r, a number of bancassurers, e.g. in France, Spain and Portugal, operate largely without the use of agents primarily by bank employees selling over the counte r. The author believes that this report is relevant to both types of bancassurer and a good portion of the contents is also relevant to the over the counter concept.

for

Bancassurance

in Practice

Munich Re Group

Entering into bancassurance

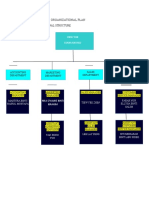

2.1 Ways of entering into bancassurance There is no single way of entering into bancassurance which is best for every insurer and every bank. As in all business situations, a proper strategic plan drafted according to the company s internal and external environmental analysis and the objectives of the organization is necessary before any decision is taken. There are many ways of entering into bancassurance. following: The main scenarios are the

One party s distribution channels gain access to the client base of the other part y. This is the simplest form of bancassurance, but can be a missed opportunity. If the two parties do not work together to make the most of the deal, then there will be at best only minimum results and low profitability for both parties. If, howeve r, the bank and the insurance company enter into a distribution agreement, according to which the bank automatically passes on to a friendly insurance company all warm leads emanating from the bank s client base, this can generate very profitable income for both partners. The insurance com- pany sales force, in particular usually only the most competent members of the sales force, sells its normal products to the bank s clients. The cooperation has to be close to have a chance of success. For the bank the costs involved besides those for basic training of branch employees are relatively low. A bank signs a distribution agreement with an insurance compan y, under which the bank will act as their appointed representative. With proper implementation this arrangement can lead to satisfactory results for both partners, while the financial investment required by the bank is relatively low. The products offered by the bank can be branded. A bank and an insurance company agree to have cross shareholdings between them. A member from each company might join the board of directors of the other compan y. The amount of interest aroused at board level and senior management level in each organization can influence substantially the success of a bancassurance venture, especially under distribution agreements using multidistribution channels. A joint venture: this is the creation of a new insurance company by an existing bank and an existing insurance compan y. A bank wholly or partially acquires an insurance compan y. This is a major undertaking. The bank must carefully define in detail the ideal profile of the targeted insurance company and make sure that the added benefit it seeks will materialize. A bank starts from scratch by establishing a new insurance company wholly owned by the bank. For a bank to create an insurance subsidiary from scratch is a major undertaking as it involves a whole range of knowledge and skills which will need to be acquired. This approach can however be very profitable for the bank, if it makes underwriting profits.

Munich Re Group

Entering into bancassurance

Bancassurance in Practice

A group owns a bank and an insurance company which agree to cooperate in a bancassurance venture. A key ingredient of the success of the bancassurance operation here is that the group management demonstrate strong commitment to achieving the benefit. The acquisition (establishment) of a bank that is wholly or partially owned by an insurance company is also possible. In this case the main objective is usual- ly to open the way for the insurance company to use the bank s retail banking branches and gain access to valuable client information as well as to corporate clients, allowing the insurance company to tap into the lucrative market for company pension plans. Finally, it offers the insurance company s sales force bank product diversification (and vice versa). This form is used in m any cases as a strategy by insurance companies in their effort not to lose their market share to bancassurers. The best way of entering bancassurance depends on the strengths and weaknesses of the organization and on the availability of a suitable partner if the organization decides to involve a partne r. Whateve r the form of ownership , a very importan t facto r for the succes s of a bancassurance venture is the influence that one party s m anagem ent has on that of the othe r. An empowered liaison between respective managements, with regular se- nior management contacts, as well as sufficient authority to take operational and marketing decisions, is vital. Regular senior management meetings are also a vital element for a successful operation. There must be a strong commitment from the top management to achieving the aims in the business plan.

2.2 Reasons for banks to enter into bancassurance The main reasons why banks have are the following: decided to enter the insurance industry area

Intense competition between banks, against a background of shrinking interest margins, has led to an increase in the administrative and marketing costs and limited the profit margins of the traditional banking products. New products could substantially enhance the profitability and increase productivit y. Financial benefits to a bank s performance briefly outlined below: can flow in a number of ways, as

Increased income generated, in the form of commissions the business (depending upon the relationship)

and/or profits from

Reduction of the effect of the bank s fixed costs, as they are now also spread over the life insurance relationship Opportunity to increase the productivity of staff, as they now have the chance to offer a wider range of services to clients Severa l Europea n countrie s have mad e considerabl e regulator y change s regard- ing the banking and insurance sectors. Although regulatory changes vary from country to country there has been a pan-European trend towards the unive r- sal bank and the limitations of the past no longer exist. Banks are now able to operate across a broader range of activities, including insurance, via legally independent risk carriers. The insurance companies and banks are not compet-

Bancassurance

in Practice

Entering into bancassurance

Munich Re Group

ing within just the life insurance industry and banking industry respectively anymore but within the wider financial services marketplace. Customer preferences regarding investments are changing. For medium-term and long-term investments there is a trend away from deposits and toward insurance products and mutual funds where the return is usually higher than the return on traditional deposit accounts. This shift in investment preferences has led to a reduction in the share of personal savings held as deposits, traditionally the core element of profitability for a bank which manages clients mone y. Banks have sought to offset some of the losses by entering life insurance business. Life insurance is also frequently supported by favourable tax treatment to encourage private provision for protection or retirement planning. This preferential treatment makes insurance products more attractive to customers and banks see an opportunity for profitable sales of such products. The high operating expenses of bank branches have led many banks to decrease their branch network, as shown in the following table. The need for more efficient utilization of branches and bank employees is today as pressing as ever. Howeve r, in Italy the number of branches has increased due to the noticeable development in bancassurance. In the future, in view of ongoing consolidation, the bank branch networks will probably decrease as well. Country Branches 1999 6,964 44,711 27,088 25,512 2,973 6,357 15,473 2,130 Change 199099 24% 14% 51% 4% 29% 26% 26% 37% Branches per million pop. 1999 680 540 470 430 409 400 260 240 Change 199099 Decrease Decrease Increase Decrease Decrease Decrease Decrease Decrease

Belgium Germany Italy France Switzerland Netherlands United Kingdom Sweden

Source: European Central Bank

Analysis of available information on the customer s financial and social situation can be of great help in discovering customer needs and promoting or manufacturing new products or services. Banks believe that the quality of their client information gives them an advantage in distributing products profitabl y, compared with other distributors (e.g. insurance companies). The realization that joint bank and insurance products tomer as they provide more complete solutions than banking or insurance products. can be better for the custraditional standalone

For example, a policyholder takes out a permanent assurance with the aim of funding future education costs. At the same time, the policyholder can take out a loan (mortgage) and assign the life policy to the bank as beneficiar y. For the bank the benefits are increased sales and a more widely based relationship with the customer than would be possible with bank products onl y.

Munich Re Group

Entering into bancassurance

Bancassurance in Practice

Banks are experiencing the increased mobility of their customers, who to a great extent tend to have accounts with more than one bank. Therefore there is a strong need for customer loyalty to an organization to be enhanced. Client relationship management has become a key strateg y. To build and maintain client relationships, banks and insurers are forming partnerships to provide their clients with a wide range of bank and insurance products from one source. It is believed that as the number of products that a customer purchases from an organization increases the chance of losing that specific customer to a competitor decreases. M. Pezzulo of the American Bankers Association quoted the following odds against losing a customer: Current Deposit Current Current, Current, account only account only and deposit account deposit and loan deposit and other financial services 11 21 101 181 1001

Population growth rates have slowed significantly during the last decades in the western industrialized countries and this decrease in birth rates in conjunc- tion with increasing life span will have a significant impact on the age structure of the population in the future. As a result it is likely that there will be increas- ing pressure on public pension systems and an increasing need for additional retirement provisions or long-term investment products. Banks see an opportunity to meet clients growing needs in this area while making a profit. Banks are used to having long-term relationships with their customers. Banks have developed skills in deepening the relationship with their customers over time, for example by marketing extra services such as deposit funds or taxation advice. Life insurance operations are also used to managing a relationship over the long term with their customers. This allows similar skills to be practised and the bancassurer can make use of the best that each partner has to offe r. Apart from the benefits that can be derived from the possible wide spread of branches across the countr y, bancassurers can have a competitive advantage over traditional insurers (non-bancassurers), derived from the provision of custome r servic e throug h automate d telle r machine s (ATMs). In particula r the bancassurer can provide its customers with an ATM card that can be used to gain access to any ATM and request information such as cash values, unit price, policy status, next premium due date, loan accounts, surrender values, etc. This channel of customer service can easily be extended so that the customer can gain access to information regarding his bank accounts and insurance policies through his personal compute r. Finally the Internet can be considered as an additional customer service channel since the customer can gain access to information regarding his bank accounts and insurance policies through this network as well.

2.3 Benefits from bancassurance for insurance companies Insurance companies bancassurance: have identifed a number of benefits from involvement in

Bancassurance

in Practice

Entering into bancassurance

Munich Re Group

Source of new business previously unreached clients: the bank s client base may well be virgin territory for the insurance company and so a new source of business. Possible reasons: Geographic: the bank s clients are in a territory where the insurer has only a limited presence (if any), e.g. because the insurer s agency structure there is limited. Demographic: the bank s clients may form a very different group (e.g. by age, sex, purchasing habits) to the one which the insurer has previously courted. For example, an insurer who previously concentrated on high net worth individuals (HNWIs) can now gain access to a wider range of customers who will not all be HNWIs. Source of new business wider range of products (including banking products): the insurance company hopes to attract further business, from both existing and new policyholders, because of the fact that it can offer a wider range of services than before, i.e. it can give its customers access to banking as well as to insurance services. Source of new business products not otherwise feasible: the economics of the bancassurance operation may allow the insurer to offer products which are not feasible through the insurer s existing channels. For example, sales costs incurred under existing channels may force premium rates for a product to be uncompetitive, so the product is not sold. The costs via the bancassurance channel may be low enough to make it feasible. Administration economies of scale: the insurance company can offer to carry out the adminstration activities of the bancassurer s business, if for example the bancassurer is a separate compan y. Combining the bancassurer s business with the other business of the insurer can produce economies of scale in administra- tion costs (including capital expenditure). This in turn allows the insurer to improve profitability and to price future products with narrower margins, which helps to make the insurer s products more competitive. Finally, for both bank and insurer there is a great opportunity to learn and to make improvements in their own operation. Each gets exposure to the other s distinctive management styles, its objectives and measures and the pressures which it can exert and which it feels. The benefit comes when either company can implement changes as a result of the learning process.

Munich Re Group

Bancassurance

in Practice

Bancassurance

products

of bancassur-

This section analyses the guiding principles for the development ance products and describes how these products are structured.

All life insurance products are by nature products which belong to the wider financial services secto r. For a bancassurance operation in particula r, howeve r, the decision on the types of insurance products which it wants to sell is very closely bound up with the methods of distribution which it plans to use. This is because the effort and expertise needed to sell a given product must be appropriate to the skills and cost base of the chosen distribution method. A product which is very hard for the available distribution channels to sell is not going to be successful for the operation, whether in terms of sales volumes or of profits. The diagram below shows the relationship required sales effort and expertise. between product complexity and

Relationship between product complexity and required sales effort

Distribution

Increasing gross margins in products

Active

Passive Simple

Figure 1

Complex

Products

Apart from the traditional insurance products, bancassurers have developed special products in order to fulfil certain needs which emanate from banking transactions, or to improve certain products in order to make them more attractive and useful to the custome r. These products can be broken down into three categories: Finance and repayment products Depositors products Simple standardized package products These are discussed in turn in Sections 3.1 to 3.3. Section 3.4 lists further insurance products which might also be attractive to bancassurers customers.

Bancassurance

in Practice

Bancassurance

products

Munich Re Group

3.1 Finance and repayment products The concept of this group of products is fairly simple. A financial institution which grants loans or credit to individuals is concerned that, in the case of early death or permanent disability of the borrowe r, the outstanding loan or credit amount may not be recoverable. This will happen where the financial standing of the surviving family means that outstanding may not be easily recoverable, or when the repossession saleable, or when any resale amount of the item purchased amounts

by the loan amount might not be

is not sufficient for the repayment

of the loan.

Along with the financial loss, the lender also runs the risk of damaging its reputation among customers, since it will acquire the reputation of repossessing items on the unfortunate death of its clients, and the harassm ent of the unfortunate spouse and famil y. The borrower on the other hand has similar concerns. He does not wish to leave an outstanding loan to be repaid by his family after his death. He is also concerned about his possible inability to repay the loan or credit amount if he becomes permanently disabled. A category of products that can satisfy both parties is the finance and repayment product, the best known of which are the following.

3.1.1 Credit insurance Credit insurance can be offered in cases where a loan is granted to the customer and serves as additional security for the bank and financial protection to the customers property in the case of his death prior to the repayment of the loan. This normally involves a decreasing term life cover with an initial sum insured equal to the amount of the loan. The sum insured would decrease in line with the repayment of the loan amount. Upon the death of the insured person the amount payable would be equal to the outstanding loan amount, with or without the accrued interest at that time. If the outstanding loan amount decreases on a predetermined basis, then it is possible to calculate the appropriate premium at the date on which the loan was granted. In cases where the loan amount fluctuates according to the needs of the borrower or due to fluctuations in interest rates, a monthly premium based on the outstanding loan amount is a more equitable solution, provided that the outstanding amount is available for calculating the premium. Annual premium or single premium contracts can be offered in cases where the loan amount at all periods can be predetermined. Where the loan amount can fluctuate, single premiums are not permitted. In the case where a single premium is charged the premium amount is frequently added to the loan amount. Almost all loans covered under credit insurance schemes are of short repayment duration, i.e. up to 5 years.

10

Munich Re Group

Bancassurance

products

Bancassurance

in Practice

In cases where this scheme is a compulsory part of a loan the premiums charged can reflect the fact that there is no selection against the insurer on medical grounds (antiselection). In such cases the company can limit itself to simplified underwriting. The reduced processing costs can be passed on in the form of lower premiums. In cases where this scheme is not compulsor y, howeve r, further medical or occupational questions are asked for underwriting purposes. The extra work involved may force premiums to be increased. Permanent total disability benefit may be offered together with the decreasing term insurance since the ability of the borrower to repay the loan may depend on the borrower maintaining his income. In som cases temporary total disability benefit e covering the instalments payable is also offered. It is also possible for a bank to pay the premiums, which are very low, and use this as a marketing tool in order to attract new customers and sell its products more easil y. The marketing tool is to offer free protection in the case of death or permanent total disabilit y. The bank will include the cost of protection in the interest rate charged to borrowers. Credit insurance is suitable for arrangements mortgage loans, business loans, personal loans, hire purchase arrangements. such as

This cover can also be issued as a group policy covering all customers. The master policy remains with the bank and a certificate of insurance is given to each custome r.

3.1.2 Overdraft insurance Usually banks offer overdraft facilities to their customers. This is automatic credit up to a pre-agreed amount. For salaried customers this amount is usually two or three times their monthly salar y. This facility has no repayment term provided the salary is deposited in the bank and the credit always stays within the pre-agreed amount. In the case where the customer who was using the credit facility dies, this am ount has to be repaid by the heirs of the deceased. This practice usually creates problems for both the heirs and the bank. Overdraft insurance can help. Overdraft insurance can be offered in two different ways: a) The cover is equal to the credit facility used and a monthly premium is paid according to this amount. In the case where the customer dies and this credit facility has been used, the outstanding amount due will be repaid to the bank by the insurance compan y. In deciding whether to offer this option, the insurer must consider the risk that people who know their health is very poor can sharply increase the amount of credit taken shortly before their death.

11

Bancassurance

in Practice

Bancassurance

products

Munich Re Group

b) The cover equals the maximum pre-agreed credit facility. In case of death the outstanding amount due will be repaid by the insurance compan y. If there is an excess between cover and the outstanding amount due this amount will be paid to the heirs of the custome r. Premiums in this case can be paid on a monthly or annual basis. In overdraft insurance the premium is usually adjusted every year according to the age of the custome r. A maximum age for this benefit usually exists. The premium can be paid by the customer or by the bank as an offer to its customers. This type of product is suitable for arrangements overdraft facilities, credit cards, unstructured debts. such as

3.1.3 Capital repayment For loans offered for mortgage, educational, personal or business reasons a repayment scheme through an insurance policy is possible. The customer is granted the loan and he pays to the bank only the loan interest. He also takes out an endowment that has a cover equal to the loan amount and with a duration equal to the repayment period of the loan. The premium is selected so that the maturity payout is very likely to be able to cover the full loan amount. The policy is always assigned to the bank and serves as a repayment tool whether the customer survives or not. These products have proved particularly attractive to customers in countries where life insurance products enjoy favourable tax treatment, or where interest rates charged by lenders on loans repaid by insurance policy proceeds are lower than for capital repayment loans. Due to the high investment element of these products, the premiums for such products are much higher than those of the credit and overdraft insurance that we have mentioned above, although the total cost of the loan to the borrower may not be very different.

3.2 Depositors products The second category of these special products consists of the so-called depositors products. The main types of depositors products are:

3.2.1 Depositors insurance This benefit is designed to attract the public to deposit money with a particular bank. It can be offered in all deposit accounts but usually a minimum deposit amount is required. The level of cover is usually determined by factors such as price and underwriting. A possible product is level term insurance with the premium rate changing every year. Another possibility is to offer accidental death cove r. Reasonable limits must be set regarding maximum age and maximum amounts. The premium in this

12

Munich Re Group

Bancassurance

products

Bancassurance

in Practice

case is usually paid by the bank but it can also be paid by the depositor with a proper marketing approach. The amount of cover is usually a multiple of the cash balance in the deposit account. In the case of death of the deposito r, this cash balance is increased accordingl y. The following table shows a possible scale. Cash balance (in US$) Up to 5,000 5,00019,999 20,000 and over Multiplied by 1 2 3 Amount to be paid in case of death Cash balance 2 x cash balance 3 x cash balance with a maximum of US$ 100,000

3.2.2 Objective achievement

insurance (bank savings plans)

This policy can be offered in special deposit accounts where systematic deposits are required to reach a predetermined objective amount at maturit y. Howeve r, if the depositor dies or suffers total permanent disabilit y, the difference between his objective amount and the cash balance of the account is paid to the depositor or the depositor s estate in addition to the cash balance. This can be offered by a decreasing term insurance only or in combination with permanent total disability benefit. In cases where the deposit amounts are not predetermined it is coverage that is a multiple of the average cash balance amount ceding 6 or 12 months, so that problems of antiselection can be it would still be possible for a customer to increase the account gain significant life cover without underwriting. advisable to offer during the prereduced. How- ever, balance rapidly and

As with depositors insurance, accidental death cover is another option. Where reasonable limits are set regarding maximum age and maximum amounts of coverage, this product can offer attractive profit margins.

3.2.3 Pure investment products These products have no insurance elements, i.e. no risk. They have traditionally been the domain of banks, but in some countries they enjoy favourable tax treatment if they are offered by an insurance compan y.

3.3 Simple standardized package products These products are usually group policies which combine covers and which cost the customer less than if they are bought individuall y. These products are usually sold over the counter by bank employees, so they need to be uncomplicated. An example would be household insurance together with waiver of premium on death cove r.

13

Bancassurance

in Practice

Bancassurance

products

Munich Re Group

3.4 Other products The objectiv e of produc t developmen t in mos t case s is to offer the wides t possible range of products so as to enable sales people to select the most suitable plan for each customer s specifi c needs . A furthe r rang e of product s whic h the bancassurer wants to offer to clients could include: Whole life Endowment Unit-linked products Term insurance products Family income benefit Waiver-of-premium benefit Permanent total disability benefit Income replacement benefit Accident and sickness products Hospitalization products Pension products

In deciding whether to offer these further products the bancassurer would need to consider whether these can be effectively sold by the employees and agents involved in the bancassurer s sales operation.

14

Munich Re Group

Bancassurance

in Practice

Distribution channels

4.1 Types and characteristics The type of distribution channels that a company uses affects the design and pricing of its products, as well as the way in which the products are promoted and perceived in the marketplace. Some bancassurers started out by selling simple products which could be sold in large volumes but which usually had low margins to cover expenses and profits. If we compare how products and distribution are related to the profits of an organization, we will come to the conclusion that the more complex the products sold are, the higher the required margins will need to be. Figure 1 shows this relationship. 1 Many banks entered bancassurance with a defensive strategy in their attempt to avoid market share erosion by insurance companies. Very soon, though, they realized that they could gain market share if they expanded their product range, developed a sales culture within their organizations, created a multi-channel distribution stucture and exploited the potential of the customer information that can enable the identification of customer needs. Bancassurers make use of various distribution channels:

Career agents Special advisers Salaried agents Bank employees Corporate agencies and brokerage firms Direct response

Using the broker channel, where the broker advises the customer and selects from among products offered by a number of companies, can also be attractive to banks. Howeve r, it is not understood as bancassurance (where there is a relationship with a particular insurance company). For the insurance compan y, this channel has disadvantages in that it is difficult to forecast how much business the insurer will receive from the broke r. Insurers do not favour the broker channel in bancassurance. The main characteristics of each of these channels are:

Career agents: career agents are full-time commissioned sales personnel holding an agency contract. Although some insurance companies offer such contracts to part-timers, within bancassurance operations such people are usually excluded. Career agents are generally considered to be independent contractors. Consequently an insurance company can exercise control only over the activities of the agent which are specified in his contract. Despite this limitation on control, career agents with suitable training, supervision and motivation can be highly productive and cost effective. Moreover their level of customer service is usually very high due to the renewal commissions, policy persistency bonuses, or other customer service-related awards paid to them.

Cf. Chapter 3, p. 9.

15

Bancassurance

in Practice

Distribution channels

Munich Re Group

Howeve r, many bancassurers avoid this channel, believing that agents might oversell out of their interest in quantity and not qualit y. Such problems with career agents usually arise, not due to the nature of this channel, but rather due to the use of improperly designed remuneration and/or incentive packages. Special advisers: special advisers are highly trained employees usually belonging to the insurance partne r, who distribute insurance products to the bank s corporate clients. Usually they are paid on a salary basis and they receive incentive compensation based on their sales. Otherwise they present the same characteristics as those of career agents, with the exception of their training which focuses on the group and business insurance sectors. Salaried agents: salaried agents have the same characteristics as career agents. The only difference in terms of their remuneration is that they are paid on a salary basis and they receive incentive compensation based on their sales. Some bancassurers, concerned at the bad publicity which they have received as a result of their career agents concentrating heavily on sales at the expense of customer service, have changed their sales forces to salaried agent status. Bank employees: bank employees can usually sell simple products. Howeve r, the time which they can devote to insurance sales is limited, e.g. due to limited opening hours and to the need to perform other banking duties. A further restriction on the effectiveness of bank employees in generating insurance business is that they have a limited target market, i.e. those customers who actually visit the branch during the opening hours. In many set-ups, the bank employees are assisted by the bank s financial advisers. In both cases, the bank employee establishes the contact to the client and usually sells the simple product whilst the more affluent clients are attended by the financial advisers of the bank which are in a position to sell the more complex products. The financial advisers either sell in the branch but some banks have also established mobile sales forces. If bank employees only act as passive insurance sales staff (or do not actively generat e leads) , then the bancassurer s potentia l can be severel y impeded . However, if bank employees are used as active centres of influence to refer warm leads to salaried agents, career agents or special advisers, production volumes can be very high and profitable to bancassurers. The branch manager of the bank has a decisive position: he generates the prospect lists, which are turned over to the sales people in the branch. Furthermore, he has to motivate his sales people to sell, to control the volume of business sold directly via the branch, and to monitor the warm leads. Set-up/acquisition of agencies or brokerage firms:

In the US, quite a number of banks cooperate with independent agencies or brokerage firms whilst in Japan or South Korea banks have founded corporate agencies. The advantage of such arrangements is the availability of specialists needed for complex insurance matters and in the case of brokerage firms the opportunity for the bank clients to receive offers not only from one insur- ance company but from a variety of companies. In addition, these sales chan- nels are more conceived to serve the affluent bank client. Direct response: in this channel no salesperson visits the customer to induce a sale and no face-to-face contact between consumer and seller occurs. The consumer purchases products directly from the bancassurer by responding to the

16

Munich Re Group

Distribution

channels

Bancassurance

in Practice

company s advertisement, mailing or telephone offers. This channel can be used for simple packaged products which can be easily understood by the con- sumer without explanation. The figure below illustrates the relationships between product complexit y, profitability, distribution channels, the degree of training required, and the acquisition costs. Product complexit y, distribution channels, training and margins Margins for expense and profit Product complexity Level of sales training

High

Complex products Group pension plans Asset m anagement Demanding products/ Customers Estate management (taxes) Endowment plans (with profits, revalorization) Ordinary products Unit trusts Mortgage endowments Mortgages Simple products Credit insurance Loan covers Deposit accounts Unit-linked products Term insurance Very simple products Personal accident

Special advisers

High

Mobile sales force/ Salaried agents

Bank staff

Bank staff/ Tellers (minimum training)

Direct response Low

Low

Figure 2

It seem very difficult for a single distribution channel to successfully reach the s bancassurer s goals and specific target markets. Many bancassurers are using multiple distribution channels. This way they avoid becoming locked into one channel and they can offer services to a greater number of target markets. Multiple distribution channels provide another valuable feature. They enable the enterprise to offer customers multiple options for access. Therefore, if a customer wants to see someone about a particular service on one day but wants to transfer funds at a later date, e.g. on a Saturday night, the availability of both branch office and 24-hour telephone access increase the service value to that custome r. Howeve r, conflicts may arise among the various channels and also within chan-

17

Bancassurance

in Practice

Distribution channels

Munich Re Group

nels under a multi-channel

system. To avoid this it is necessary

that

it is clear to all which products each channel may sell; colleagues within a channel are motivated to cooperate; of the importance of every link in the distribution

there is communication process;

cultural differences are communicated

and respected; process can be fulfilled by the

the goals of every partner in the distribution process; the specific role and performance expectations clearly stated, understood and accepted; communication

of each channel member are

between channels is encouraged; and committed to success. Figure 3 shows a posresponsibilities between bank employees and speon product complexit y. Developing and communifor an organization to reduce the risk of cross-

channel leadership is strong sible structure for assigning cialist sales staff depending cating structure is necessary channel conflict.

Client targeting, sale and service: Division of labour between insurance company and bank

Client targeting/ Needs analysis

Contacting the client

Sale

Service

Bank employee

Bank employee

Three possibilities of selling life insurance

Bank employee + Insurance sales expert

Bank employee sells alone

Bank employee and insurance sales expert sell together

Sales expert sells alone

Standard products only

Standard products + Complex business

Complex business only

Figure 3

18

Munich Re Group

Distribution

channels

Bancassurance

in Practice

4.2 Cultural issues in distribution The managers of banks and of life insurance companies can come from quite different cultures. There may be differences in the way of thinking and business approaches of bankers and managers of insurance companies. These differences create a communication and implementation problem in bancassurance operations. Banks are traditionally demand-driven organizations with a reactive selling philosoph y. Life insurance organizations are usually need-driven and have an aggressive selling philosoph y. It has been observed that this friction at the level of bank employees insurance salespeople arises from differing philosophies towards selling, regarding remuneration of life sales staff, and and life

the jealousies of bank employees

fears of cannibalization of deposits, e.g. the bank employee fears that the salesperson encourages withdrawal of bank deposits, putting the bank employees job in greater jeopard y. As a result the team spirit is negatively influenced and, since this is a crucial factor for the success of any operation, it has to be confronted. Cultural differences between the banking and the insurance industries must be understood, respected and lived with in order for the bancassurance venture to succeed. The development of a single culture is another possible solution but this requires a very strong commitment from the top management. This commitment must be continuously conveyed to all bank employees and life insurance agents. One way of achieving this is to develop a statement of mission for the new organization and to get the staff to commit to fulfilling this statement. This can help to ensure that there is a common path for the bank and the life insure r. Many organizations try to overcome these cultural differences through the elimination of insurance sales people and the provision of insurance products and services exclusively through bank employees. However this practice creates in four major problems: By eliminating the sales force, bank employees are forced to cross borders to a different profession where different skills are required and where the competition practices are different. The products that bank employees offer are usually simple packaged products or pure investment products in many cases without a risk element. Howeve r, simple packaged products are not always the best solution for the customer who is undoubtedly the centre of any success. Since the insurance industry offers tailo r-made products and services to its customers, the bancassurers who are using only bank employees to distribute their products will feel the pressure to switch to better products or to develop the proper distribution channels. All over the world, more and more consumers are becoming better

19

Bancassurance

in Practice

Distribution channels

Munich Re Group

informed and seek to buy the most appropriate product through distribution channel.

a preferred

Using only bank employees to sell insurance can severely limit the success of the bancassure r. The bank s target market is then only the custome r-base of the bank accessible to bank employees, e.g. those who come into the branch. More and more, bank customers can m anage their affairs without entering the bank branch and are therefore inaccessible to bank employees. Customer service offered in conjunction with the insurance policy is likely to be relatively poor since it is limited to banking hours. Insurance company agents can offer customer service at times more likely to suit the custome r.

20

Munich Re Group

Bancassurance

in Practice

Remuneration packages and incentive schemes

5.1 Objectives of remuneration and incentive schemes Compensation packages and incentive schemes are critical factors for the success of bancassurance. The way compensation is allocated encourages the distribution channels to act according to what the organization feels is important. Compensation objectives should also contribute to the overall objectives of the organization. A compensation program, therefore, must be tailored to the needs of an organiza- tion and its employees. To raise productivity and lower costs in today s competitive economic environment, organizations are increasingly setting compensation objectives based on a pay-fo r-performance standard. In bancassurance Bank employees operations the need is to motivate each of the following groups: leads and sales

5

life insurance sales

involved in generating

Sales agents (if the bancassurer

uses that approach)

Bank branch management (for their effort in managing through the branch network) Sales agency managers (if at location)

Motivation is particularly important for the sales agents out in the field for whom self-discipline is the key to success. The remuneration terms should be attractive to each of the groups involved. In particula r, the designer of the remuneration package should seek to develop a package which helps each one of the groups to feel that they get a fair reward for their contribution. The possible range of benefits and incentives in a life insurance agent s compensation package is unlimited. Before proceeding to the design of the compensation package, an organization must consider the following: The compensation package is perhaps the most important element in a sales organization which will influence the volume of business, the costs, the profitabilit y, the productivity and the customer care. The way in which the package encourages certain behaviours and discourages others determines the kind of sales force a company attracts and retains. Indeed, it helps to set the tone for the whole sales organization within the com- pan y. In order to maintain their competitive position, financial services providers need to be sure they have the right people, in the right jobs, with the right skills, and at the right price. A package therefore needs to be designed to attract and retain the kind of people the company needs in order to develop the kind of sales organization the company wants.

21

Bancassurance

in Practice

Remuneration

packages and incentive schemes

Munich Re Group

In developing this package an organization must have clearly in mind the vision of how it wants to be in the future, not just now. Before its implementation the package must be clearly communicated and explained to every single person involved in the bancassurance venture. Products are always designed to cover certain expenses. Lower incurred acquisition costs will offer two important advantages: higher profitability to the company and/or lower prices to the customers. On the other hand, lower costs imply lower income to sales personnel which may result in higher agent turnove r. This in turn can lead to higher costs for the company (e.g. extra costs of recruitment, training, etc.) and consequently lower profitabilit y. Where the policy is with profits, the policyholder will also see reduced benefits. Product pricing is therefore another crucial factor and a careful balance between all parties must be achieved. Bancassurers should seek to align the compensation package with their financial targets. This encourages the sales force to work in a way which will make those financial targets easier to achieve. For example, if the expected profitability of product A is very low compared to product B, then the bancassurer will prefer its sales force to sell product B. It can encourage this by paying higher commission rates on product B.

5.2 Remuneration of agency forces and agency management Remuneration of insurance company agency forces has long been a matter for debate and has also been an area of great development and change. Remuneration tools for agents of a bancassurer are commonly similar to those used for other insurance agency forces: Initial commissions to encourage sale of new business Renewal commissions on persistent business Other fringe benefits pension, health insurance Guaranteed salaries (e.g. percentage of last year s commission) Death-in-service benefits to cover the agent s family Volume- and persistency-related commission loadings Other performance benefits, e.g invitations to conferences, or membership of select groups such as the Million Dollar Round Table in the USA Financial support for staff in training, e.g. loans repayable when the agent builds up income For managers of agency forces, whose role is not to sell business but to get their agents to do so profitably for the organization, remuneration packages can include further items which reflect this role. Examples include: percentage persistency of commissions earned by the agency team,

bonus (e.g. share of renewal commissions),

rewards when members of the agency team reach specified targets (e.g. member of Million Dollar Round Table), or when the manager succeeds in improving the agent s performance (e.g. agent exceeds sales targets), income protection measures in the event that agents in the team are reallocated to other teams by the organization (e.g. when agents move to an agency management role).

22

Munich Re Group

Remuneration

packages and incentive schemes

Bancassurance in Practice

Developing a package of benefits suitable for an agency force of a bancassurer involves setting suitable levels for each of these benefit types. Some benefits will be product-specific (e.g. commissions), while others are independent of the products or volumes being sold (e.g. death-in-service benefits as from a certain number of years of service). In setting benefit levels, distinctive features of a bancassurance need to be remembered are: operation which

The package needs to be one which will attract agents to work for the bancassure r. Many bancassurers have attracted agents from existing company sales forces, so a benchmark for the bancassurer will be the benefits provided by insurance companies to their sales forces. The bancassurer must be able to explain to the agent the reasons for the particular structure (e.g. as part of the interview process). Differences between a bancassurance and an insurance company package must correspond with the different objectives of the bancassurer for its agents, for example the fact that bancassurer agents are expected to give higher levels of customer service than insurance company agents. For a bancassurer with several channels, the terms must be considered for each channel separately to make each channel attractive to both potential agents and to the operation. One aspect in looking at terms for each channel is to bear in mind the opportunities each channel has for selling business and generating income. For example: The special adviser is competing with specialists for high-premium corporate business, where a warm lead seldom comes from the branch office. The role may also involve giving a lot of service and advice to the client, which in and of themselves do not generate income for the agent. The career agent focuses mainly on selling, if possible from warm leads. He can sell a wide range of products and his potential clients are accessible during business hours and also after business hours. Remuneration opportunities) terms must reflect the selling and servicing demand (as well as available to each group.

Some (at least) of the business sold by the agency force is due to warm leads provided by the bank. In turn, the agent has to do less prospecting and less work to make the sale. The initial commission paid to the agent should reflect this. The proportion not paid to the agent can be used, among other things, to reward the bank branch and its employees for their effort in making the sale.

5.3 Remuneration of bank employees The remuneration depends on whether the bank employee or the bank s financial advisers are involved in the sales process or whether the bank employees are providing warm leads. Any commission payable by the insurance company is, as a principle, to be credited to the bank s profit centre for the bancassurance operation. The bank s management sets the commission level for each manager and employee engaged in the bancassurance operation.

23

Bancassurance

in Practice

Remuneration

packages and incentive schemes

Munich Re Group

Selling in the bank s branches

(by employees

or by financial advisers):

For simple packaged products the payment of commission to the bank employee is not recommended since these products have low profit margins and do not require particularly great selling efforts. Instead employees could be rewarded with gifts and/or salary increments based on their selling perform- ance in promoting both banking and insurance products. Such performance could be quantified via the use of a points system where by the various prod- ucts are allocated as a number of points. For compulsory products linked to banking facilities no commission or other benefit will be offered since these do not require any selling effort on the part of employees. If, however the financial advisers of the bank are selling usually the more complex products like in the case of special advisers of the insurance company the remuneration to the bank may be the full commission for a particular plan. The financial advisers are usually paid on a salary basis and they receive incentive compensation based on their sales. Warm leads: In return for providing warm leads, the bank will get a share, say 50%, of the normal first year commissions. The actual split might be agreed upon the basis of the work done by each of the agent and the bank employee in achieving the average sale, which may vary, for example, by product type. A basis is needed for allocating this amount between branch staff (who provide the warm leads) and the bank s owners. A possible basis would be: Bank employees: Bank profitability: 25% 25% 50% commission can be split as follows: 15% 10%

The bank employees

Employee who generates Branch group award: The structure shown

the warm lead:

above generates

benefits as follows:

Financial rewards for employees

who generate warm leads

Financial rewards for managers and other staff of the bank branch who have supported bank activities while the assurance business was being generated Recognition of the branch s contribution to bank profits (which can be reflected in the performance rating by the bank of the branch management) Group awards or bonuses are more desirable when the contribution of the individual employee is either difficult to distinguish or depends on group cooperation.

24

Munich Re Group

Bancassurance

in Practice

Training

Training is a critical part of overall business performance. training starts, it is important to determine But even before any

who needs to receive training, what kinds of training are required, who will be responsible for providing training and for testing what the student has learned from the training. This chapter of the report focuses on the training needs of the people in the various distribution channels in a bancassurance venture, where these differ from the training of sales forces in a life insurance operation and from the training of branch staff and management in a banking operation. In addition, the need for quality customer service is discussed, tation in a bancassurance operation. as is its implemen-

6.1 Sales force training for bancassurers Sales agents and their managers in any selling organization, develop a range of knowledge and skills, for example product knowledge, application of selling techniques, motivation skills. including insurance,

and

Here we concentrate on the types of necessary managers in a bancassurance operation.

training for sales staff and sales

a) Bank products and distribution channels: the sales force will need to have (at least) basic knowledge of the banking products sold by the operation and of the range of distribution channels in force (not just the channels used to sell life insurance). b) Building up a relationship with bank staff: in many cases, the sales agent is reliant on the quality and quantity of warm leads from bank employees. In turn the sales agent can influence the value of leads either positively (by achiev- ing a high success rate in turning them into sales and commission) or nega- tivel y. The sales agent needs to learn to cooperate with bank employees and must learn how to build effective relationships with people whose job motivation may be very different to his/her own. c) The bank s expectations of customer service: the sales agent and sales manager must understand and be prepared to meet the standards for customer service which the bank expects in respect of its customers. The bank s standards will cover not only insurance business but other relationships (e.g. banking relationships) with the custome r. The sales staff must be trained to implement the standards.

25

Bancassurance

in Practice

Training

Munich Re Group

6.2 Bank employee training for bancassurers The bank employees ance business: will need to be trained in the following aspects of the insur-

Features of the insurance products sold How to identify and approach a potential customer Basic insurance needs Handling basic objections Other distribution channels and products Expected roles Procedures Remuneration and incentive schemes Cultures Customer service

Much of this list will be new to staff use d to bankin g transactions , so it is comparatively long. Howeve r, proper and regular training of bank employees is key to the success of the operation.

6.3 Continuous training and supervision Apart from initial training, there should be further training to support the development of the agent or employee. Some ways in which this can be done are: Agency meetings Bank branch meetings Area banking meetings In-house magazine Training circulars Area sales seminars Company library Video tapes Certified courses Lectures Training material booklets

A training activity record is a vital element for the manager of staff in a bancassurance operation, whether bank counter staff or sales agents, since any weakness can be spotted immediatel y. If the manager regularly reviews the training needs and achievements, he can identify where urgent training is needed. The manager who is able to be proactive instead of reactive can contribute a great deal to the success of the operation, since any weakness can be spotted immediatel y.

6.4 Quality customer service Quality customer service refers to every single activity that the compan y, its employees and the distribution channels undertakes for its customers. In all cases the objective of every person in the company should be to give added value to every transaction or communication, providing additional incentives to customers and enabling the company to

26

Munich Re Group

Training

Bancassurance in Practice

distinguish itself from competitors, improve its image among customers, keep its existing customers, attract new customers, and create additional sales among existing customers.

In a bancassurance venture quality customer service is even more important because the bank refers its customers to the insurance compan y. The bank s relationship with the customer can be damaged by poor service from the insure r. For this reason bank employees must be well informed about the customer service standards set by the insurer when they refer them to their customers. At the same time the insurance company staff (including the administrators who will deal with the customers questions in future) must be aware of the standards expected by the bank on behalf of their clients. These service standards should be written down and agreed upon between the bank and the insurance compan y. The first step in quality customer service is the development of the right mental attitude amongst bank staff and sales force so that both parties recognize that their primary role is to satisfy the custome r. Helping bank staff and sales force to develop the awareness of their own abilities and inherent strengths, to conquer anxieties and to share their ideas and experiences will help the staf fs performance and help them to appreciate their customers concerns. A two-way referral system, where the sales force refers customers to the bank for banking facilities, can be helpful because trust will be enhanced. Bank employees will be more understanding and more willing to help.

27

Bancassurance

in Practice

Munich Re Group

Operational procedures for bancassurance sales forces

7.1 Allocation of bank branches to the sales force The method by which bank branches will be allocated to the sales force should be known to everybody in advance. In practice, some of the branches will have bet- ter results and greater potential than others and each field manager will be asking for those branches to be allocated to his agenc y. A variety of methods for allocat- ing branches can be devised. The rest of this section describes one method used in practice and then dicsusses its assumptions and limitations. The first step in this allocation is to segment the bank s branch network into different areas so that the sales force can provide effective service to the branches. There are two main factors that will affect such a segmentation: Distance: the distance between the bank branches and the agency s offices must not be too great. This is so that the agents will find it easier to visit bank branches on a daily basis and be ready to respond to any telephone call from the branch quickl y. Number of agencies: the number of agencies and agents in each area should be sufficient so that they are able to cope with the number of customers generated by branches in the area. Certain rules should be followed before any allocation: The allocation can be done every year at a specifie date. More frequent reallocations should be avoided so that the agency has enough time to organize the branch business and establish good interpersonal and business relations. The company can withdraw any branch from an agency at any time if the production results are very low. This will give the company the flexibility for minor adjustments within the year to cope with changing needs. It will also press the agencies to have maximum performance at all times. The bank branches are allocated to the agency manager and it is his responsibility to assign them to his agents and inform the company accordingl y. The manager should not be allowed to personally sell any policies arising through bank branches. His job is to achieve maximum results through his agents. The production objectives of every branch are set according to its size. The following example shows in detail how branch allocation based on the above-mentioned factors can be implemented.

Assumptions 1. In the district in question, we have 47 bank branches. Each branch is allocated one of four possible production objectives regarding the number of policies

28

Munich Re Group

Operational

procedures

for bancassurance

sales forces

Bancassurance in Practice

they are expected to sell each period (monthly/quarterl follows: Number of branches with this objective (i) 15 10 10 12 47 Production objective (ii) 20 15 13 10

y, etc.). These are as

Total expected production (i) x (ii) 300 150 130 120 700

Total

2. In the same district we have five sales managers with a total of 74 agents. The sales managers are identified by the letters AE. We also have last year s (or month s) performance for each sales manage r, expressed as a percentage of last year s (month s) target. We are going to assume that the percentage target for each sales manager in the next period is the same as that achieved in the last period. Sales manager (1) A B C D E Number of agents (2) 10 22 18 11 13 Next year s target performance (3) 95% 65% 85% 163% 100% as follows: (5) = (4) x k 95 143 153 179 130 700

The branches can be allocated to every agency manager (1) A B C D E Total where k= Total expected production Total of 100% target branches 700 70 (2) 10 22 18 11 13 74 (3) 95% 65% 85% 163% 100%

(4) = (2) x (3)/100 9.5 14.3 15.3 17.9 13.0 70.0

= 10

Expressed in words: Column (4) = equivalent number of agents, if each agent has a 100% target achievement Column (5) = target number of policies for each manager through the branches allocated to him/her

29

Bancassurance

in Practice

Operational

procedures

for bancassurance

sales forces

Munich Re Group

Having worked out the number of policies that each sales managers group (i.e. the value in Column 5) is expected to sell, the next step is to allocate branches. For example, sales manager A will be allocated branches which are close to his agents. The total target for those branches will equal the total target for sales manager A (i.e. 95 policies). In the table above, Column 4 assumes that each sales manager had the same target production in the coming year as he/she achieved in the previous year. Because Column 5 is calculated from Column 4, then the result in 5, and therefore the allocation of branches, also has the sam assumption. The formulas could be e developed to use different types of production target assumptions. Another important aspect which this formula does not consider is the ability of the sales manager to build good relationships with different branches. This aspect will be included in deciding on the branch allocation, for example: Are there branches with which the sales m anager has been successful past (where perhaps the relationship may be maintained)? Are there branches where the sales manager has not had a successful ship (and therefore should no longer work with that branch)? With what types of branches has the sales manager been successful branches should he perhaps take over in future)? in the

relation-

(and what

7.2 The referral system As already discussed, warm leads can provide a strong competitive advantage for a bancassurance operation. An efficient system for managing referrals of warm leads is therefore vital. This section describes a process for managing referrals.

7.2.1 The basic principles A formal and standardized referral system is needed. The responsibilities of all relevant parties must be clearly defined and each party must know its responsibilities under the system. The proper operation of the system (once designed) shoul d be safeguarde d throug h a designe d syste m of control s (that include s standards, monitoring, review procedures, etc.). The objectives of designing and implementing such a system are the following: referrals through

a) Maximization of the number of successful

the maximization of the total number of referrals, the optimization of the quality of referrals, the optimization of the quality of sales. b) Promotion of accountabilit y, transparency of activity and performance.

7.2.2 An overview of the proposed system The following diagram represents the system for managing referrals.

30

Munich Re Group

Operational

procedures

for bancassurance

sales forces

Bancassurance in Practice

Referral system

Training system

Selection procedures and system of allocation of branches to agents

Branch referral process

Control system

M easurement , evaluation and reward system (MER) This involves: 1. Defining job description 2. Setting objectives 3. Measuring activities/results 4. Evaluating and rewarding performance

Figure 4

At the heart of the system is the branch referral process. This explains who does what, when and how, in order to properly generate, fully record and effectively monitor referrals in bank branches. To make the referral system work effectivel y, it is essential to have the following systems in place: a) Training system A carefully designed and well-executed training system will provide all relevant parties with the necessary knowledge and will enable them to perform their duties in relation to the referral process. b) Selection procedures and system of allocation of branches to agents

Carefully designed and well-executed selection procedures will help safeguard the quality of agents servicing bank branches and increase commitment on the part of both the branches and the agents to the referral process. Similarl y, an intelligent system of allocation of branches to agents will help ensure that agents are allocated to branches on a sound basis that aims to support the development of the agent-branch relationship.

31

Bancassurance

in Practice

Operational

procedures

for bancassurance

sales forces

Munich Re Group

c) Measurement,

evaluation and reward system

A well-designed system of recording and measuring activity of bank staff and evaluating and rewarding performance, based on the recorded activit y, will complement the existing staff appraisal system with regard to performance in relation to the referral system. This encourages employees to be objective about their performance in making referrals. It also encourages employees to identify improvements to their performance and to the operation of the referral system. d) Control system An effective, non-bureaucratic system of controls will help mitigate the various risks that may undermine the smooth operation of the referral system. Examples of controls here include: Regular reporting of activity to the management assure r, for example, regarding the number of new warm leads generated, proportion of warm leads converted into sales, lapse experience on in-force contracts. The report should include comparable figures for earlier periods, results should be split so as to allow sources of differences to be identified (e.g. by branch and by product line). Benchmarking of the bancassurer s performance compared with other financial institutions, to identify differences and to pinpoint where the bancassurer might make improvements. of the bank and of the banc-

7.3 The branch referral process The following diagram shows how the referral process could operate.

32

Munich Re Group

Operational

procedures

for bancassurance

sales forces

Bancassurance in Practice

Start

Referrer identifies potential customer

Referrer contacts customer where possible

Referrer does not contact customer

Customer does not object to seeing salesperson Warm lead Referrer fills in three-part referral slip

Semi-cold

lead

Part 1 (blue) Kept by the referrer

Part 2 (green) Referrer passes this part on to salesperson

Part 3 (yellow) Referrer gives this to coordinator

Salesperson obtains more information on each referral from referrer

Salesperson contacts customer within two working days of receiving referral

Coordinato r update s Bancassurance Activity File (BAF) daily on new referrals

Salesperson gives feedback to branch coordinator once a week

Salesperso n give s feedbac k to referrer withi n two day s of taking referral

Coordinator

updates BAF

No Is referral still active? Stop

Yes Coordinator arranges to discuss case again

Salesperson

follows up on referral

Salesperson

updates coordinator

Figure 5

33

Bancassurance

in Practice

Operational

procedures

for bancassurance

sales forces

Munich Re Group

7.4 Guidelines for allocating commissions A bancassurer must set clear rules at the outset for commission payments to the bank and to the sales force. Complications can arise, for example, when more than one agent is involved with a client. The appendix describes several cases and suggests rules for dealing with such cases. The key question in defining these rules for a bancassurance operation is, Who owns the customer? The agent and the bank might each see themselves as the owner. The market trend seems to be, howeve r, for the bank to take precedence over a bancassurance agent, i.e. all clients referred to the agent are owned by the bank and the bank is entitled to a share of commissions and profit on all busi- ness generated by the agent from the bank client.

34

Munich Re Group

Bancassurance

in Practice

Contract review processes

Setting up a bancassurance operation will involve a number of contracts. Depending on the type of relationship being set up between a bank and an insurance compan y, these could include tied agency agreements (the bank commits itself to distribution of life insurance products of a single life insurance company); administration management agreements, if the administration of the sales force, or of the insurance contracts, is contracted to a third part y. In the UK, for example, this has been a popular means for banks and other deposit-takers such as building societies to set up new life insurance operations; salesman agreements between the bank or the life insurance operation on the one hand and the life insurance salesman on the othe r. Drawing up the contracts will involve legal advice and the contracts will be specific to the particular relationship being planned. Because of this, this document does not cover all aspects of the contracts, but instead highlights why well-drawn contracts make an important contribution to the continuing success of a bancassure r. It is important for all parties to agree on the standards expected of each party to the agreement. By defining the standards right at the start of the contract, each party knows what is expected of him in the deal. Furthermore, with known stand- ards, the performance of each of the parties to the contract can be measured in particular to see whether the agreed standards are being met. Also, defining contract review processes within the contract allows the parties to make changes in the nature of the relationship over time, when it benefits at least one part y. Types of change over time may include a bank withdrawing from a tied agency agreement insurance operation; and setting up its own life