Mumbai Off 1q12

Diunggah oleh

Nidhi MahuleDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Mumbai Off 1q12

Diunggah oleh

Nidhi MahuleHak Cipta:

Format Tersedia

MARKETBEAT

OFFICE SNAPSHOT

MUMBAI, INDIA

A Cushman & Wakefield Research Publication

Q1 2012

ECONOMY

Preliminary estimates by the Central Government suggest that Indias GDP growth rate will be 6.9% for fiscal year 2011-2012, compared to 8.4% in 20102011. The slowdown in the GDP growth rate was mainly due to the effects of the global economic uncertainty including the concerns on fiscal sustainability in Europe, coupled with poor performance of the agricultural and manufacturing sectors in the local economy. However, the Government has committed itself to predict a GDP growth of 7.6% (+/- 0.25%) in the coming fiscal year (2012-2013). There has been an improved flow of foreign direct investments in the preceding months of 2012, perhaps an indication of the year ahead. Predictions of a better economic environment in the U.S. and the Euro zone are expected to impact the Indian markets favorably. IT/ITeS and domestic BFSI majors in the country have already indicated plans to grow, thereby indicating a strong demand for office space during the year.

Vacancy has remained largely stable at 20.6% at almost the same level as the last quarter. In the CBD however, vacancy increased to 14.3% as most occupiers moved out to other locations. Despite healthy absorption and growth in enquires, rentals have remained stable due to availability of space options across all micro markets.

OUTLOOK

Fresh supply of approximately 2.35 msf is expected to be infused in the next quarter. Rentals across all micro markets are likely to remain stable during this time owing to competitive pressure from upcoming supply. BKC is expected to witness increased transaction activity in the coming quarter as its prominence has risen over the CBD. STATS ON THE GO

1Q12 Overall Vacancy Grade A CBD Rents Absorption (sf) 20.6% 275 1,423,282 Q-O-Q CHANGE 1.45% 0 323,282 Y-O-Y CHANGE 33.67% -8.3% 35.5% 12 MONTH OUTLOOK

RESILIENT DEMAND & REDUCED PRECOMMITMENTS

The commercial office market in Mumbai regained some momentum in the first quarter of 2012. The city recorded an absorption level of approximately 1.4 million square feet (msf) spread across all micro markets. This is an increase of 30% over the last quarter. The BFSI sector remained the highest demand driver with nearly 27% of share in absorption. The growth trend of absorption levels in the IT/ITeS sector also remained buoyant. The market however, witnessed reduced pre-commitments since companies preferred to take up space in ready developments due to high availability. Quite a few large deals were executed during the quarter. However, demand for space in the range of 6,000 square feet (sf) to 40,000 sf was dominant. Absorption was concentrated in BKC (29%) followed by Thane-Belapur Road (23%) and Lower Parel (19%). Locations along the Western Express Highway like Goregaon and Malad, which mainly included BFSI captive units, garnered high levels of interest among corporates due to large talent pools in surrounding residential catchments and easy accessibility.

ECONOMIC INDICATORS

INDIA GDP Growth CPI Growth Industrial Production WPI Growth

SOURCE: RBI & Central Statistics Office, India *Q-O-Q Change ** Y-O-Y Change, Dec 2011

2011 6.9% 7.7%* 4.4** 6.9%*

2012F 7.6%** 8.2%* 5.8** 6.3%**

2013F 8.6% 7.0% 4-5% 6.0%

GRADE A CBD RENTAL VS. VACANCY RATES

STABLE VACANCY RATE OWING TO REDUCED SUPPLY

Supply remained subdued during the first quarter of 2012 and was recorded at 1.44 msf, which is 47% less than the last quarter. Interestingly, 42% of the additions during the first quarter pertain to office developments for non-IT companies in contrast to the trend where they contributed just 10% of supply in the previous quarter. Several projects across Lower Parel, Andheri and ThaneBelapur Road were delayed due to modest demand and pending approvals.

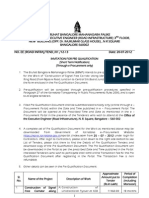

MUMBAI MARKET STATISTICS

SUBMARKET INVENTORY OVERALL VACANCY RATE UNDER CONSTRUCTION YTD CONSTRUCTION COMPLETIONS 0 98,000 0 0 331,500 0 250,000 0 757,500 0 1,437,000 YTD ABSOPTION GRADE A AVERAGE NET RENT (INR/SF/MTH) 4Q11* 275 260 170 280 115 90 85 65 40 45 275** 1Q12* 275 260 170 280 115 90 85 65 40 45 275** US$ SF/YR 1Q12* $64.37 $60.85 $39.79 $65.54 $26.92 $21.06 $19.89 $15.21 $9.36 $10.53 $64.37** EURO SF/YR 1Q12* 48.55 45.90 30.01 49.43 20.30 15.89 15.01 11.48 7.06 7.94 48.55**

CBD Worli Lower Parel Bandra-Kurla Andheri-Kurla Powai Malad Vashi Thane-Belapur Road Thane TOTALS

** GRADE A CBD Rentals

8,297,163 4,472,019 11,201,339 8,983,256 22,859,443 6,202,708 10,435,239 3,288,500 9,624,723 5,024,813 90,389,203

14.3% 14.6% 21.3% 4.0% 25.8% 4.5% 15.1% 15.9% 26.2% 25.0% 20.6%

120,000 474,250 3,026,000 5,040,000 4,756,921 0 2,721,042 950,000 1,688,666 2,620,000 21,396,879

0 7,677 272,800 415,500 242,918 37,000 84,500 20,887 332,000 10,000 1,423,282

* REFLECTS ASKING RENTALS All rentals are quoted for Warm Shell, which includes core facility, high-side air-conditioning and 100% power backup Conversion Rate: US$1= INR 51.27 and Euro 1 = INR 67.97

MARKET HIGHLIGHTS

SIGNIFICANT 1Q12 LEASE TRANSACTIONS BUILDING Crescenzo Synergy Mindspace Marathon Futurex SIGNIFICANT 1Q12 SALE TRANSACTIONS BUILDING Marathon Futurex MARKET Lower Parel BUYER Israel Consulate PURCHASE PRICE (US$) 5 mill SQUARE FEET 12,500 MARKET Bandra-Kurla Complex Airoli Lower Parel TENANT Sahara Cognizant Loreal BUILDING CLASS A A A SQUARE FEET 300,000 150,000 71,000

SIGNIFICANT 1Q12 CONSTRUCTION COMPLETIONS BUILDING Everest Infotech Park-2 Filix Lodha Supremus MARKET Thane-Belapur Road Bhandup Worli TENANT NA NA NA SQUARE FEET 577,500 156,000 98,000 COMPLETION DATE 1Q12 1Q12 1Q12

SIGNIFICANT 1Q12 PROJECTS UNDER CONSTRUCTION BUILDING The Capital Rupa Solitaire First International Financial Centre Oberoi Commerz II MARKET Bandra-Kurla Complex Thane-Belapur Road Bandra-Kurla Complex Goregaon TENANT NA NA NA NA SQUARE FEET 1,100,000 1,250,000 506,000 680,000 COMPLETION DATE 2Q12 2Q12 3Q12 3Q12

* RENEWAL - NOT INCLUDED IN LEASING ACTIVITY STATISTICS

1st Floor, Mafatlal House Padma Bhushan H.T.Parekh Marg Churchgate, Mumbai 400 020 Tel: +91 22 6657 5555 www.cushmanwakefield.com

This report contains information available to the public and has been relied upon by Cushman & Wakefield on the basis that it is accurate and complete. Cushman & Wakefield accepts no responsibility if this should prove not to be the case. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by our principals. 2012 Cushman & Wakefield, Inc. All rights reserved.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Edited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForDokumen1 halamanEdited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForChristopher RoyBelum ada peringkat

- Capital RevenueDokumen20 halamanCapital RevenueYatin SawantBelum ada peringkat

- Franchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Dokumen512 halamanFranchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Favio C. Osorio PolarBelum ada peringkat

- Transkrip Akademik Academic Transcript Sementara: Mimosa PudicaDokumen2 halamanTranskrip Akademik Academic Transcript Sementara: Mimosa Pudicaanon_639661161Belum ada peringkat

- Benefits of NEC ContractsDokumen3 halamanBenefits of NEC ContractsAkaninyeneBelum ada peringkat

- Alexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002Dokumen45 halamanAlexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002andresabelr100% (1)

- Broker Commission Schedule-EDokumen19 halamanBroker Commission Schedule-EErvin Fong ObilloBelum ada peringkat

- Tech P: From Business Intelligence To Predictive AnalyticsDokumen2 halamanTech P: From Business Intelligence To Predictive AnalyticsAdam LimbumbaBelum ada peringkat

- Strategic Plan - BSBMGT517 - Manage Operational PlanDokumen21 halamanStrategic Plan - BSBMGT517 - Manage Operational PlanprayashBelum ada peringkat

- Subcontractor Default InsuranceDokumen18 halamanSubcontractor Default InsurancebdiitBelum ada peringkat

- Ee Roadinfra Tend 01Dokumen3 halamanEe Roadinfra Tend 01Prasanna VswamyBelum ada peringkat

- A Study On Financial Statement Analysis of HDFC BankDokumen11 halamanA Study On Financial Statement Analysis of HDFC BankOne's JourneyBelum ada peringkat

- 1995 NAFTA and Mexico's Maize ProducersDokumen14 halaman1995 NAFTA and Mexico's Maize ProducersJose Manuel FloresBelum ada peringkat

- MA1-Pre Exam (R)Dokumen2 halamanMA1-Pre Exam (R)BRos THivBelum ada peringkat

- Torex Gold - Corporate Presentation - January 2023 202Dokumen49 halamanTorex Gold - Corporate Presentation - January 2023 202Gustavo Rosales GutierrezBelum ada peringkat

- UNICART2 YaynDokumen13 halamanUNICART2 YaynMohammad BibarsBelum ada peringkat

- Digital Sector Note - July 2023Dokumen45 halamanDigital Sector Note - July 2023Lukas MullerBelum ada peringkat

- Disequilibrium MacroeconomicsDokumen4 halamanDisequilibrium Macroeconomicsmises55Belum ada peringkat

- 2.5 Cash Books: Two Column Cash BookDokumen6 halaman2.5 Cash Books: Two Column Cash Bookwilliam koechBelum ada peringkat

- 3i Final Part1Dokumen35 halaman3i Final Part1RS BuenavistaBelum ada peringkat

- Certified Trade Finance SpecialistDokumen4 halamanCertified Trade Finance SpecialistKeith Parker100% (2)

- Statement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionDokumen43 halamanStatement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasBelum ada peringkat

- BA 230.final Paper - CMBDokumen8 halamanBA 230.final Paper - CMBChristian Paul BonguezBelum ada peringkat

- Ch17 WagePayDokumen14 halamanCh17 WagePaydaBelum ada peringkat

- Compensation of General Partners of Private Equity FundsDokumen6 halamanCompensation of General Partners of Private Equity FundsManu Midha100% (1)

- CDP Problem Solving Matrix WorkshopDokumen3 halamanCDP Problem Solving Matrix WorkshopAmbosLinderoAllanChristopher100% (1)

- Freight Transportation Modelling: International ExperiencesDokumen13 halamanFreight Transportation Modelling: International ExperiencesShreyas PranavBelum ada peringkat

- Buffettology Sustainable GrowthDokumen12 halamanBuffettology Sustainable GrowthLisa KrissBelum ada peringkat

- Channel DynamicsDokumen5 halamanChannel DynamicsGhani Thapa20% (5)

- Cash Flow Management of Banijya BankDokumen19 halamanCash Flow Management of Banijya BankPrashant McFc Adhikary0% (1)