WPS SIF Creation Guide (English)

Diunggah oleh

june23amDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

WPS SIF Creation Guide (English)

Diunggah oleh

june23amHak Cipta:

Format Tersedia

STEP BY STEP GUIDE FOR SIF (SALARY INFORMATION FILE) CREATION Creation of a valid Salary Information File (SIF)

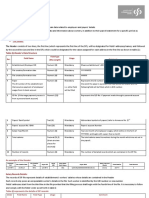

for submission to the bank for processing via WPS requires the following 5 steps: Step I : Opening a new salary file (Excel) Step II : Entering the requisite Employee Salary details Step III: Entering the requisite Employer details Step IV: Saving the file as .CSV file Step V : Renaming the file as .SIF file These steps are described below in detail. Step I - Open new Excel file. Step II - Enter Row-wise all EMPLOYEE RECORD DETAILS in below order: Column A: Type EDR in all rows.

Column B: Enter the 14 digit Person ID number provided by Ministry of Labour. This information is printed on the Employee Labour cards. If the number mentioned is less than 14 digits, in the file the field should be prefixed with zeros to add the count to 14 digits. Column C: Enter Agent ID. This is the 9 digit routing code which is assigned to the Employees Bank/ Agent where their account is held. In case of National Bank of Abu Dhabi, you can use the following routing code: National Bank of Abu Dhabi (NBAD) 803510106

Column D: Enter the Employees account number or Salary Card Number from the bank where the salary is to be credited. Should be max 16 characters.

Column E: Provide the PAY START DATE. Should be entered in format YYYY-MM-DD. For example if the pay period is for the month of October 09, then the PAY START DATE mentioned will be 2009-10-01. Column F: Provide the PAY END DATE. Should be entered in format YYYY-MM-DD. For example if the pay period is for the month of October 09, then the PAY START DATE mentioned will be 2009-1031. Column G: Enter the number of days for which the salary is being paid. For example if the salary is being paid for the full month of October which has 31 days in total, then the value entered will be 31.

Column H: Enter the FIXED INCOME AMOUNT to be paid to the worker. This would include all fixed payouts such as Basic Pay, HRA, and Transportation etc. The amount should be entered without , and with or without two decimals e.g. 1200.00 / 800 etc. If no contribution from this component then send 0.00 Column I: Enter the VARIABLE INCOME AMOUNT to be paid to the worker. Examples would be Overtime, incentives, bonus etc. The amount should be entered without , and with or without two decimals e.g. 1200.00 / 800 etc. If no contribution from this component then send 0.00 Column J: DAYS ON LEAVE FOR PERIOD. This shall be the number of days the employee has been on leave without pay in the pay period. If no leave has been availed off then indicate with zero 0.

Step III - The Last Row should contain Employer related information termed as SALARY CONTROL RECORD (SCR). Please note that this should be created at then end after completing the creation of Employee Salary details. The fields should be entered in the below order:

Column A: Type SCR.

Column B: Enter the 13 digit Employer Unique ID (Establishment Number) of the company with Ministry of Labour. This field will have to be padded with leading zeros if the length is less than the maximum specified length of 13 digits. This field is validated against the Master database held in WPS.

Column C: Enter Bank code of the Employer. This is the 9 digit routing code which is assigned to the Employers Bank where the corporate account is held.

Column D: Enter the File Creation Date. Must be in the format YYYY-MM-DD. For e.g. is the file is prepared by the employer on 25th October 2009, and then the date mentioned will be 2009-10-25. Column E: Enter the File Creation Time. Must be in the format HHMM. For e.g. if the file is prepared by the employer at 4:00 pm 30 mins then the time mentioned will be 1630. Column F: Enter the Salary Month. Must be in the format MMYYYY. For e.g. if the payment is being done for the month of October, then the month mentioned will be 102009.

Column G: Enter the EDR count. This is the total number of employees for whom the salary is being paid. Column H: Enter TOTAL SALARY AMOUNT paid to the workers. The amount should be entered without , and with or without two decimals e.g. 12000.00 / 80000 etc. It will be validated to be equal to the sum of all Fixed and Variable components indicated in all the EDR records in the file. Column I: Enter the Payment Currency. This is always to be entered as AED. Column J: Enter EMPLOYER REFERENCE NUMBER if applicable. This is an optional field to be entered by the employer only if they maintain a unique file identifier at their end. If not applicable then the field can be left blank.

Step IV- Saving the file as .CSV file. Once the file is prepared, please save the file as per the below specification: Click on Save As File Name should be saved as EMPLOYER UNIQUE ID FILE CREATION DATE FILE CREATION TIME File naming convention should be:

E.g., If your Ministry of Labour Employer ID is 9656258 and file was created on 25th October, 2009 at 4.30pm, then the file name should be: 9656258091025163000 Save as Type extension should be selected as CSV (Comma delimited) Click on Save.

Step V- Rename the file as SIF instead of CSV. E.g. 9656258091025163000.sif. Once done, it will look like below if opened in Notepad:

This SIF file is your Salary File which needs to be submitted to the bank for processing through WPS.

Anda mungkin juga menyukai

- Four Best Uncensored AI Art GeneratorsDokumen16 halamanFour Best Uncensored AI Art Generatorsmoneygain4ever100% (1)

- Question Sets For C - Programming: 10. Write A C Program To Calculate Simple Interest and Compound Interest PrintDokumen10 halamanQuestion Sets For C - Programming: 10. Write A C Program To Calculate Simple Interest and Compound Interest PrintMahesh VemulaBelum ada peringkat

- Oracle Hrms Core HRDokumen90 halamanOracle Hrms Core HRYogita Sarang100% (3)

- Upload Manual Bulk Payments - 040216Dokumen17 halamanUpload Manual Bulk Payments - 040216Nakul Markhedkar75% (4)

- ANIRUDDHADokumen68 halamanANIRUDDHAAniruddha ChakrabortyBelum ada peringkat

- Sap Bank ReconcilationDokumen39 halamanSap Bank ReconcilationRajathPreethamH100% (1)

- 2018 RF1 Excel TemplateDokumen14 halaman2018 RF1 Excel TemplateCherilyn RiveralBelum ada peringkat

- 4HANA Asset Accounting ConfigurationDokumen142 halaman4HANA Asset Accounting ConfigurationT SAIKIRANBelum ada peringkat

- Bapi For Fb01Dokumen9 halamanBapi For Fb01Niroop Raj50% (2)

- Ms Access Practical QuestionsDokumen2 halamanMs Access Practical QuestionsRishi Karki81% (166)

- IoT Fundamentals 2.0 Lansing CC - June 6Dokumen38 halamanIoT Fundamentals 2.0 Lansing CC - June 6Cristianovsky CvBelum ada peringkat

- Philhealth Monthly Textfile Rf1Dokumen6 halamanPhilhealth Monthly Textfile Rf1Aiza Querobines Balag100% (1)

- Rental Billing StatementDokumen6 halamanRental Billing StatementIsabel SilvaBelum ada peringkat

- RDBMS Sample QuestionsDokumen4 halamanRDBMS Sample QuestionsJyothikaBelum ada peringkat

- SAP FB70 & FB75 Transaction Code Tutorials: Customer Invoice and Credit Memo PostingDokumen14 halamanSAP FB70 & FB75 Transaction Code Tutorials: Customer Invoice and Credit Memo PostingERPDocs100% (6)

- PTI Post-Tensioning Manual 6th EditionDokumen362 halamanPTI Post-Tensioning Manual 6th Editionjackj_1820739838% (12)

- Iso 17637 VTDokumen15 halamanIso 17637 VTИван ИвановBelum ada peringkat

- Asset Accounting ConfigurationDokumen145 halamanAsset Accounting ConfigurationShaily DubeyBelum ada peringkat

- FB60 Create A Vendor Invoice TDokumen6 halamanFB60 Create A Vendor Invoice TNicolaj DriegheBelum ada peringkat

- WPS File FormatDokumen10 halamanWPS File Formatanwarali1975Belum ada peringkat

- Park DocumentDokumen23 halamanPark Documentchitharanjan kotekarBelum ada peringkat

- FD01 Create Customer Sap SD ModuleDokumen9 halamanFD01 Create Customer Sap SD ModuleRoking KumarBelum ada peringkat

- Lab 2 21511 CIS183 PDFDokumen2 halamanLab 2 21511 CIS183 PDFJenny_Manalansan_839Belum ada peringkat

- PF Memeber Creat PaymentsDokumen2 halamanPF Memeber Creat PaymentsGanga RajamBelum ada peringkat

- FCHN DisplayCheckRegisterDokumen3 halamanFCHN DisplayCheckRegisterSingh 10Belum ada peringkat

- Monthly RF1 Excel TemplateDokumen12 halamanMonthly RF1 Excel Templateyetzky26Belum ada peringkat

- Homework Exercise 2aDokumen5 halamanHomework Exercise 2aPutera Egi MosesBelum ada peringkat

- FI para Usuários Finais - InglêsDokumen115 halamanFI para Usuários Finais - InglêsMarco Aurélio GalvãoBelum ada peringkat

- FB03 Display GL/AP Documents: PurposeDokumen2 halamanFB03 Display GL/AP Documents: PurposeSingh 10Belum ada peringkat

- P4 Upload Step by StepDokumen2 halamanP4 Upload Step by Stepcypriancourage100% (1)

- Employee Management System (EMS) : I. Complete The Following AssignmentDokumen4 halamanEmployee Management System (EMS) : I. Complete The Following AssignmentShahzad AlamBelum ada peringkat

- Salary and Overtime Pay Computation Using A Spread SheetDokumen4 halamanSalary and Overtime Pay Computation Using A Spread SheetJade ivan parrochaBelum ada peringkat

- Flexiform GuideDokumen36 halamanFlexiform GuideLoco DarkBelum ada peringkat

- Assignment 6Dokumen6 halamanAssignment 6minhaj mohdBelum ada peringkat

- Conversion To MYOB: Your Progress Your GradingDokumen5 halamanConversion To MYOB: Your Progress Your GradingŠĥỳ Äñïl0% (3)

- PR Payroll Salary - InfoDokumen6 halamanPR Payroll Salary - Infoddd7890dddBelum ada peringkat

- Fb50 - Posting of A DocumentDokumen5 halamanFb50 - Posting of A DocumentP RajendraBelum ada peringkat

- Index IsmDokumen16 halamanIndex Ismyash choudharyBelum ada peringkat

- Employee DetailsDokumen3 halamanEmployee DetailsK Srinivasa RaoBelum ada peringkat

- Qustion Paper SQL Final For ExamDokumen1 halamanQustion Paper SQL Final For ExamMaasrur NeehonBelum ada peringkat

- Practicas-1al 5Dokumen12 halamanPracticas-1al 5Deyber CardenasBelum ada peringkat

- Payroll RoadmapDokumen4 halamanPayroll RoadmapAmoghaPIPL HRBelum ada peringkat

- Document Installer NavigationDokumen14 halamanDocument Installer NavigationAbhishek GandhiBelum ada peringkat

- Time Clock Plus TipsDokumen1 halamanTime Clock Plus Tipsrofira9450Belum ada peringkat

- Entering A Deposit As400 Process: Wednesday or Friday Date. (These Are The Only Dates Driver Picks Up)Dokumen4 halamanEntering A Deposit As400 Process: Wednesday or Friday Date. (These Are The Only Dates Driver Picks Up)cristel jane FullonesBelum ada peringkat

- Sap-Fi/Co - 2 Cont : Sales TaxDokumen30 halamanSap-Fi/Co - 2 Cont : Sales Taxkrishna_1238Belum ada peringkat

- Apex Trigger Scenarios For Practice: by Dhananjay AherDokumen9 halamanApex Trigger Scenarios For Practice: by Dhananjay Aherkanchan jogiBelum ada peringkat

- FK01Dokumen20 halamanFK01abdulBelum ada peringkat

- DBMS Practical List PDFDokumen6 halamanDBMS Practical List PDFlBelum ada peringkat

- Intro ERP Using GBI Case Study FI (Letter) en v2.40Dokumen22 halamanIntro ERP Using GBI Case Study FI (Letter) en v2.40meddebyounesBelum ada peringkat

- Asset Transactions: 1. Make Various Non-Integrated Asset Acquisition Postings Business ExampleDokumen57 halamanAsset Transactions: 1. Make Various Non-Integrated Asset Acquisition Postings Business ExampleBharat KumarBelum ada peringkat

- DATABASEDokumen2 halamanDATABASEAyaan TOBelum ada peringkat

- Practice 2 - Restrict and SortDokumen2 halamanPractice 2 - Restrict and Sortmariamhossam243Belum ada peringkat

- Sapexercisegbi FiDokumen18 halamanSapexercisegbi FiWaqar Haider AshrafBelum ada peringkat

- BDC LSMW CustomerDokumen13 halamanBDC LSMW CustomerRavi kishore G100% (1)

- Fundamentals of SAP - CODokumen30 halamanFundamentals of SAP - COSmith JohnBelum ada peringkat

- Accounts Payable Cost Center AccountingDokumen6 halamanAccounts Payable Cost Center AccountingSri Kanth100% (1)

- Practice Home TasksDokumen5 halamanPractice Home Taskswaliaslam2002Belum ada peringkat

- SQL - Activity - 1.BDokumen1 halamanSQL - Activity - 1.BLance Mark FenolBelum ada peringkat

- HCM HR Forms Full ManualDokumen11 halamanHCM HR Forms Full ManualDyana Salazar BlancoBelum ada peringkat

- Employee To Vendor Conversion in SAPDokumen6 halamanEmployee To Vendor Conversion in SAPVinay MuddanaBelum ada peringkat

- CHAPTER - 1 - MapReduceDokumen27 halamanCHAPTER - 1 - MapReduceDhana Lakshmi BoomathiBelum ada peringkat

- Pacsystems Rx3I: Central Processing UnitDokumen12 halamanPacsystems Rx3I: Central Processing UnitDekali FouadBelum ada peringkat

- Eticket - Rohit Gupta 5892137278569Dokumen3 halamanEticket - Rohit Gupta 5892137278569Rohit GuptaBelum ada peringkat

- Unit 9 - Lesson D: Identity Theft: Touchstone 2nd Edition - Language Summary - Level 3Dokumen2 halamanUnit 9 - Lesson D: Identity Theft: Touchstone 2nd Edition - Language Summary - Level 3Janeth GuerreroBelum ada peringkat

- Real Life Startup Pitch DeckDokumen55 halamanReal Life Startup Pitch DeckWalter TenecotaBelum ada peringkat

- Development Conversation Template GuideDokumen2 halamanDevelopment Conversation Template GuideKavitha Alva100% (1)

- Itec 101Dokumen3 halamanItec 101ChaseBelum ada peringkat

- Role of IctDokumen19 halamanRole of IctJann ericka Jao100% (1)

- Level 9.1: Instruction ManualDokumen26 halamanLevel 9.1: Instruction ManualakshayuppalBelum ada peringkat

- Computer Science Paper Scheme (Marks Distribution)Dokumen4 halamanComputer Science Paper Scheme (Marks Distribution)Honey BunnyBelum ada peringkat

- 05 MAS Distributed Constraint OptimizationDokumen124 halaman05 MAS Distributed Constraint Optimizationhai zhangBelum ada peringkat

- 10 Structure, Function and Maintenance Standard 1 ParteDokumen78 halaman10 Structure, Function and Maintenance Standard 1 ParteAugusto OliveiraBelum ada peringkat

- Pe1024-Mb-Mfb030-011200 38 GT#1 MBX PDFDokumen1 halamanPe1024-Mb-Mfb030-011200 38 GT#1 MBX PDFAldo Quispe HuarachiBelum ada peringkat

- NMON - Analyser User Guide For V6.6Dokumen34 halamanNMON - Analyser User Guide For V6.6carlosBelum ada peringkat

- Four Different Levels of MeasurementDokumen2 halamanFour Different Levels of MeasurementMaria Isabella RuaYanaBelum ada peringkat

- Log 20230325Dokumen3 halamanLog 20230325Hanggono Ari SwasonoBelum ada peringkat

- GBP CraneDokumen1 halamanGBP CraneHeldyApriandiBelum ada peringkat

- BRANDT HMA RG Series Agitators Spec Sheet EnglishDokumen1 halamanBRANDT HMA RG Series Agitators Spec Sheet EnglishChristopher MeyersBelum ada peringkat

- VI.4 LED TV Min 42 - Smart Google TV 43 Inch - Smart TV Terbaik POLYTRONDokumen25 halamanVI.4 LED TV Min 42 - Smart Google TV 43 Inch - Smart TV Terbaik POLYTRONTriaji SiswandiBelum ada peringkat

- Mini Catalogue Rev - 1 - 3 PDFDokumen14 halamanMini Catalogue Rev - 1 - 3 PDFmei lestianaBelum ada peringkat

- Basics of ArcGIS EnterpriseDokumen35 halamanBasics of ArcGIS EnterpriseShipra SuhasiniBelum ada peringkat

- Learning Management System (Lms Moodle)Dokumen14 halamanLearning Management System (Lms Moodle)FantaBelum ada peringkat

- Computer ArchitectureDokumen21 halamanComputer ArchitectureAsad JavedBelum ada peringkat

- Inductance of A Coil: Register To Download Premium Content!Dokumen14 halamanInductance of A Coil: Register To Download Premium Content!ankesh_ghoghariBelum ada peringkat

- 2.SV Maintenance Technology PracticeDokumen134 halaman2.SV Maintenance Technology PracticeWeihan KhorBelum ada peringkat

- Slem Housekeeping Grades 9 10 Week - 8Dokumen9 halamanSlem Housekeeping Grades 9 10 Week - 8Anne AlejandrinoBelum ada peringkat