Corporate Bridge - Investement Banking Prep Guide

Diunggah oleh

Dharmish ShahDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Corporate Bridge - Investement Banking Prep Guide

Diunggah oleh

Dharmish ShahHak Cipta:

Format Tersedia

Investment Banking Analyst Program Prep Guide - www.

edu

Thank you for trusting Corporate Bridge Training Program to help you reach your goals. In this Prep Guide, you will find information about the course structure as well as the online resources includ

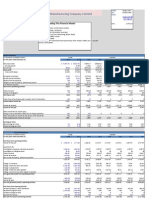

Total Number of Online Modules Online Downloadable PPTs / PDFs Online Excel Downloads (xls) Online Video Tutorials with Animation (hours) Test & Assessments (online and offline) Recommended Study Hours

S. No

Modules Name

M1

Overview

M2

Basic Financial Concepts

M3

Analysts Advanced Excel Tools

M4

VBA's and Macros

M5

Accounting for Equity Analysts

M6

Economics and Indicators Analysis

M7

Quantitative analysis

M8

Corporate Finance

M9

Nuts & Bolts of Equity Valuation Techniques

M10

Comprehensive Financial Modeling for Analysts

M11

IPOs - Initial Public Offer

M12

M&A - Mergers & Acquisitions

M13

Pitch Book Preparation

M14 M15

Investment Banking & Finance Interview Preparation CB Certification Test

Note (1) Downloadable PPTs / PDFs - These are presentations / reports used for explaining a concept. These presen (2) Excel Downloads - These are excel sheets / model templates with solutions and without solutions used to ex (3) Video Tutorials - These are animated video tutorials to enchance your learning. You can view these video tu (4) Tests & Assignments - These are designed to check your fundamentals on achieving regular milestones. Mo (5) Recommended Hours - Recommended hours represents Corporate Bridge assessment of the number of hou

About us - Corporate Bridge We, at Corporate Bridge provide real-world, hands-on, applied financial Online eLearnings for Corporates, Unive With expertise from top notch firms like JP Morgan, CLSA India, Morgan Stanley, Goldman Sachs etc and with a Academic learning and real industry. We have been partnering with students from some of the top notch institutio Contact Information B-104, Mangalaya, Off Marol Maroshi Road, Behind Sangeet Palza, Andheri (E), Mumbai 400 059 Email - info@educorporatebridge.com Telephone - +91 (22) 3222 5058; +91 92232 33659 To know more about other training programs, please visit www.educorporatebridge.com

yst Program Prep Guide - www.educorporatebridge.com

ing Program to help you reach your goals. bout the course structure as well as the online resources includes with this course and how you can best use Corporate Bridge Tra

15 137 163 67 30 271 Downloadable PPTs / PDFs (1) NA

Details This overview provides with with the basic introduction to Financial Research. It also demonstrates how to navigate Corporate Bridge Equity Research Course and how this course will be beneficial for becoming a successful research analyst Basic Financial Concepts is a basic module which will help people from nonfinance background like engineering or science graduates to get familiar with basic accounting and finance concepts and will help people from finance background to clear and revise their basic concepts which are useful in Equity Research. In your career as a finance professional, you would be using Excel day and night. So you should be very comfortable with using excel, not only that you should know the advanced techniques and shortcuts, which would save a lot of your time. Apart from that you should know various charts and graph functions which will not only help you visualize your inputs but will also make your pitch book look more attractive. Financial Analysts deals with lot of databases and excel functions and graphs. Many of these functions are complex and repetitive. In order to save time to regularly update their analysis worksheets, analysts write lot of Macros using simple as well as VBA coding to automate their worksheets and save time. This module provides you with the basic introduction to VBAs and Macros and how you can use these as a Research Analyst

26

NA

This sub module would be covering the fundamentals of macroeconomics. The purpose of this course is to give students a thorough understanding of the principles of economics that apply to an economic system as a whole. Such a course places particular emphasis on the study of national income and price-level determination and also develops students familiarity with economic performance measures, the financial sector, stabilization policies, economic growth and international economics. This module is very important from the perspective of understanding the external environment that affects the company analysis. For example exchange rates, commodity prices, GDP growth rates, interest rates, IIP Numbers, Non-farm Payroll data etc. This module provides an overview of business mathematics and associated functions used for Equity Research. This module is primarily helpful for students who come from the Non-quantitative background Corporate Finance allows you to value a project, based on the time value of money. In essence, you are discounting the value of future cash flows to determine if the value today makes the project worthwhile. This emphasizes the value of the concepts of corporate finance in Equity analysis, especially in DCF Valuation technique where we need to discount the future cash flows to determine the present worth of the company. Here the main concepts you would be learning are NPV, IRR etc. We will be using these formulas in DCF Valuation. Equity Valuation is the process of estimating the potential market value of a financial asset or liability. Valuations are required in many contexts including investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability, and in litigation. We will do valuations using two methods (a) Intrinsic Valuation Method (DCF) which means primarily determines the value by estimating the expected future earnings from owning the asset discounted to their present value (b) Relative value models determine the value based on the market prices of similar assets. Financial Modeling includes professionally forecasting future financial statements like Income Statements, Balance Sheets & Cash Flows. Firstly we apply financial modeling forecasting techniques on a hypothetically built-up case. Thereafter we will apply the same methodology on a LIVE COMPANY such as Asian Paints, Sun Pharma & Dr. Reddys for analysis. Investment Bankers help raise companies raise funds from secondary markets. Hence, they should be aware of IPO Procedures and processes. In this module, we cover the IPO basics, IPO regulatory aspects as well as LIVE applications of IPO modeling

34

NA

21

NA

25

Investment Bankers are primarily involved as advisory functions for Valuations, regulatory frameworks, initiations etc. Our module on M&A focuses more on M&A Process, Cash flow available for strategic purposes, Cash and stock mix for deal financing and Accretion/ dilution analysis. LIVE Merger Model Parkway acquisition of Apollo Hospital Pitch books are developed and presented to a potential client to win an engagement. As a future investment banker, be ready to spend countless hours developing pitch books, especially if you are in an industry group. Components of a pitch book may include: Market or Industry Overview & Overview of Potential Client. Live Case Study - Bayer & Solvay These videos help students understand the nuances of Investement Banking Careers, industry structure and various job openings Students take this test after the completion of the full course. This test is multiple choice Investment Banking certification test. Please attempt this test only after fully understanding all IB modules Total

11

12

NA NA 137

presentations / reports used for explaining a concept. These presentations can be readily downloaded using "right click" -> Save As s / model templates with solutions and without solutions used to explain the concepts. These excel sheets get downloaded directly to your ch eo tutorials to enchance your learning. You can view these video tutorials and simulatneously practice the concept along with the animated d to check your fundamentals on achieving regular milestones. Most practice tests are online tests which will provide you with immediate a ours represents Corporate Bridge assessment of the number of hours taken to complete this course by an average student. However, student

nds-on, applied financial Online eLearnings for Corporates, Universities & Students with practical, job-oriented, industry recognized eLear rgan, CLSA India, Morgan Stanley, Goldman Sachs etc and with a background of IIT-IIM, we always put continuous effort to design eLear been partnering with students from some of the top notch institutions like IIMC, IIML, IIMI, NMIMS, NITIE, SIMS etc. and have provided

ehind Sangeet Palza, Andheri (E), Mumbai 400 059

ms, please visit www.educorporatebridge.com

u can best use Corporate Bridge Training materials.

Excel Downloads (2) NA

Video Tutorials Tests & (mins) (3) Assignments (4) 123 NA

Recommended Study Hours (5) 2

46.06

79

307.92

30

117.28

NA

15

19

524.23

30

19

269.98

NA

103.77

NA

134.06

NA

16

153.62

20

640

70

720

NA

30

360

10

25

480

NA

20

NA

62.23 NA

NA 1 30

10 NA 271

163

4042.15

using "right click" -> Save As eets get downloaded directly to your chosen folder. e the concept along with the animated tutor. hich will provide you with immediate assessments and weak areas. However, some test are to be taken offline and you can check with the so an average student. However, students with background in Accounting, valuations and Excel maybe able to complete the course relatively

ob-oriented, industry recognized eLearnings and skills. s put continuous effort to design eLearning products in Finance that bridge the gap between , NITIE, SIMS etc. and have provided them with our eLearning Products.

you can check with the solutions provided plete the course relatively faster.

Anda mungkin juga menyukai

- EduCBA - Equity Research TrainingDokumen90 halamanEduCBA - Equity Research TrainingJatin PathakBelum ada peringkat

- LBO Model - TemplateDokumen9 halamanLBO Model - TemplateByron FanBelum ada peringkat

- 07 DCF Steel Dynamics AfterDokumen2 halaman07 DCF Steel Dynamics AfterJack JacintoBelum ada peringkat

- Lbo W DCF Model SampleDokumen43 halamanLbo W DCF Model SamplePrashantK100% (1)

- Merger Model PP Allocation BeforeDokumen100 halamanMerger Model PP Allocation BeforePaulo NascimentoBelum ada peringkat

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDokumen46 halaman1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaBelum ada peringkat

- Wall Street Prep Financial Modeling Quick Lesson DCF1Dokumen18 halamanWall Street Prep Financial Modeling Quick Lesson DCF1NuominBelum ada peringkat

- 107 16 BIWS Financial Statements ValuationDokumen50 halaman107 16 BIWS Financial Statements ValuationFarhan ShafiqueBelum ada peringkat

- Private Equity Unchained: Strategy Insights for the Institutional InvestorDari EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorBelum ada peringkat

- Lbo W DCF Model SampleDokumen33 halamanLbo W DCF Model Samplejulita rachmadewiBelum ada peringkat

- J Crew LBODokumen15 halamanJ Crew LBOTom HoughBelum ada peringkat

- $ in Millions, Except Per Share DataDokumen59 halaman$ in Millions, Except Per Share DataTom HoughBelum ada peringkat

- Critical Financial Review: Understanding Corporate Financial InformationDari EverandCritical Financial Review: Understanding Corporate Financial InformationBelum ada peringkat

- Wall Street Prep DCF Financial ModelingDokumen7 halamanWall Street Prep DCF Financial ModelingJack Jacinto100% (1)

- LBO Valuation Model 1 ProtectedDokumen14 halamanLBO Valuation Model 1 ProtectedYap Thiah HuatBelum ada peringkat

- Yates Financial ModellingDokumen18 halamanYates Financial ModellingJerryJoshuaDiazBelum ada peringkat

- Operating Model Build v33Dokumen22 halamanOperating Model Build v33chandan.hegdeBelum ada peringkat

- Simple LBO ModelDokumen14 halamanSimple LBO ModelSucameloBelum ada peringkat

- 22 22 YHOO Merger Model Transaction Summary AfterDokumen101 halaman22 22 YHOO Merger Model Transaction Summary Aftercfang_2005Belum ada peringkat

- 50 13 Pasting in Excel Full Model After HHDokumen64 halaman50 13 Pasting in Excel Full Model After HHcfang_2005Belum ada peringkat

- CAT ValuationDokumen231 halamanCAT ValuationMichael CheungBelum ada peringkat

- DCF Model Training - 4Dokumen10 halamanDCF Model Training - 4mohd shariqBelum ada peringkat

- Ultimate Financial ModelDokumen36 halamanUltimate Financial ModelTom BookBelum ada peringkat

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Dokumen18 halaman1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeBelum ada peringkat

- Existing Building AnalysisDokumen15 halamanExisting Building AnalysisAmir H.TBelum ada peringkat

- DELL LBO Model Part 1 CompletedDokumen45 halamanDELL LBO Model Part 1 CompletedascentcommerceBelum ada peringkat

- Valuation - CocacolaDokumen14 halamanValuation - CocacolaLegends MomentsBelum ada peringkat

- LBO Model TemplateDokumen67 halamanLBO Model TemplateAlex TovBelum ada peringkat

- LBO Test - 75Dokumen84 halamanLBO Test - 75conc880% (1)

- Financial Model Template Financial Model Template Financial Model TemplateDokumen29 halamanFinancial Model Template Financial Model Template Financial Model TemplatetfnkBelum ada peringkat

- IB Merger ModelDokumen12 halamanIB Merger Modelkirihara95100% (1)

- Complete Private Equity ModelDokumen16 halamanComplete Private Equity ModelMichel MaryanovichBelum ada peringkat

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDokumen10 halamanInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatBelum ada peringkat

- Financial Modeling ValuationDokumen82 halamanFinancial Modeling ValuationHarsh Ashish100% (2)

- NYSF Practice TemplateDokumen22 halamanNYSF Practice TemplaterapsjadeBelum ada peringkat

- Merger Model Sample BIWS JobSearchDigestDokumen7 halamanMerger Model Sample BIWS JobSearchDigestCCerberus24Belum ada peringkat

- Wind Valuation ModelDokumen87 halamanWind Valuation ModelprodiptoghoshBelum ada peringkat

- Exercises and Answers Chapter 5Dokumen8 halamanExercises and Answers Chapter 5MerleBelum ada peringkat

- Smilehouse Financial Model 051114Dokumen84 halamanSmilehouse Financial Model 051114Nguyen Thi Mai LanBelum ada peringkat

- Wealth & Asset ManagementDokumen17 halamanWealth & Asset ManagementVishnuSimmhaAgnisagarBelum ada peringkat

- COH Valuation ModelDokumen123 halamanCOH Valuation ModeleamonnsmithBelum ada peringkat

- Hammond Manufacturing Company Limited: Guide of Reading This Financial ModelDokumen4 halamanHammond Manufacturing Company Limited: Guide of Reading This Financial ModelHongrui (Henry) Chen100% (1)

- DELL LBO Model Part 2 Completed (Excel)Dokumen9 halamanDELL LBO Model Part 2 Completed (Excel)Mohd IzwanBelum ada peringkat

- Full Merger Model Kraft-Kellogg - ShellDokumen9 halamanFull Merger Model Kraft-Kellogg - ShellGeorgi VankovBelum ada peringkat

- Excel Power MovesDokumen28 halamanExcel Power Moveslovingbooks1Belum ada peringkat

- Financial Model Template TransactionDokumen39 halamanFinancial Model Template Transactionapi-400197296Belum ada peringkat

- Investment Banks, Hedge Funds and Private Equity: The New ParadigmDokumen16 halamanInvestment Banks, Hedge Funds and Private Equity: The New ParadigmPrashantKBelum ada peringkat

- LBO Analysis CompletedDokumen9 halamanLBO Analysis CompletedVenkatesh NatarajanBelum ada peringkat

- DCF Analysis JBDokumen10 halamanDCF Analysis JBNoah100% (3)

- Gymboree LBO Model ComDokumen7 halamanGymboree LBO Model ComrolandsudhofBelum ada peringkat

- Ultimate Financial ModelDokumen33 halamanUltimate Financial ModelTulay Farra100% (1)

- BpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)Dokumen66 halamanBpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)kunjan2165Belum ada peringkat

- JPM M&A BibleDokumen146 halamanJPM M&A BibleAly Kanji100% (1)

- Case 1 SwanDavisDokumen4 halamanCase 1 SwanDavissilly_rabbit0% (1)

- Autonomy Presentation 1 505952Dokumen14 halamanAutonomy Presentation 1 505952Roberto BaldwinBelum ada peringkat

- DCF TemplateDokumen9 halamanDCF TemplateShrikant ShelkeBelum ada peringkat

- Equity Research & Investment BankingDokumen24 halamanEquity Research & Investment BankingSarvesh PrasadBelum ada peringkat

- Native VLAN and Default VLANDokumen6 halamanNative VLAN and Default VLANAaliyah WinkyBelum ada peringkat

- Chapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Dokumen5 halamanChapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Kimberly Claire AtienzaBelum ada peringkat

- Biological Assets Sample ProblemsDokumen4 halamanBiological Assets Sample ProblemsKathleenBelum ada peringkat

- Project Document EiDokumen66 halamanProject Document EiPrathap ReddyBelum ada peringkat

- Beyond "The Arc of Freedom and Prosperity": Debating Universal Values in Japanese Grand StrategyDokumen9 halamanBeyond "The Arc of Freedom and Prosperity": Debating Universal Values in Japanese Grand StrategyGerman Marshall Fund of the United StatesBelum ada peringkat

- Gaming Ports MikrotikDokumen6 halamanGaming Ports MikrotikRay OhmsBelum ada peringkat

- 1Dokumen3 halaman1Stook01701Belum ada peringkat

- Syllabus PDFDokumen3 halamanSyllabus PDFBibin Raj B SBelum ada peringkat

- 2016 IT - Sheilding Guide PDFDokumen40 halaman2016 IT - Sheilding Guide PDFlazarosBelum ada peringkat

- Owners Manual Air Bike Unlimited Mag 402013Dokumen28 halamanOwners Manual Air Bike Unlimited Mag 402013David ChanBelum ada peringkat

- Eurocode 3: Design of Steel Structures "ReadyDokumen26 halamanEurocode 3: Design of Steel Structures "Readywazydotnet80% (10)

- Segregation in CastingDokumen17 halamanSegregation in CastingAsmaa Smsm Abdallh78% (9)

- Hydro Electric Fire HistoryDokumen3 halamanHydro Electric Fire HistorygdmurfBelum ada peringkat

- Lab Report SBK Sem 3 (Priscilla Tuyang)Dokumen6 halamanLab Report SBK Sem 3 (Priscilla Tuyang)Priscilla Tuyang100% (1)

- Santu BabaDokumen2 halamanSantu Babaamveryhot0950% (2)

- Bandhan Neft Rtgs FormDokumen2 halamanBandhan Neft Rtgs FormMohit Goyal50% (4)

- Recruitment SelectionDokumen11 halamanRecruitment SelectionMOHAMMED KHAYYUMBelum ada peringkat

- Axera D06Dokumen2 halamanAxera D06Cristián Fernando Cristóbal RoblesBelum ada peringkat

- Logiq v12 SM PDFDokumen267 halamanLogiq v12 SM PDFpriyaBelum ada peringkat

- Frellwits Swedish Hosts FileDokumen10 halamanFrellwits Swedish Hosts FileAnonymous DsGzm0hQf5Belum ada peringkat

- 24 DPC-422 Maintenance ManualDokumen26 halaman24 DPC-422 Maintenance ManualalternativblueBelum ada peringkat

- Famous Little Red Book SummaryDokumen6 halamanFamous Little Red Book SummaryMatt MurdockBelum ada peringkat

- UNCITRAL Guide United Nations Commission On International Trade LawDokumen56 halamanUNCITRAL Guide United Nations Commission On International Trade Lawsabiont100% (2)

- Predator U7135 ManualDokumen36 halamanPredator U7135 Manualr17g100% (1)

- MME 52106 - Optimization in Matlab - NN ToolboxDokumen14 halamanMME 52106 - Optimization in Matlab - NN ToolboxAdarshBelum ada peringkat

- Maritime Academy of Asia and The Pacific-Kamaya Point Department of AcademicsDokumen7 halamanMaritime Academy of Asia and The Pacific-Kamaya Point Department of Academicsaki sintaBelum ada peringkat

- Odisha State Museum-1Dokumen26 halamanOdisha State Museum-1ajitkpatnaikBelum ada peringkat

- I I Formularies Laundry Commercial Liquid Detergents 110-12-020 USDokumen6 halamanI I Formularies Laundry Commercial Liquid Detergents 110-12-020 USfaissalBelum ada peringkat

- Jee MainsDokumen32 halamanJee Mainsjhaayushbhardwaj9632Belum ada peringkat

- Ducted Split ACsDokumen31 halamanDucted Split ACsHammadZaman100% (1)