Market Sentiment Analysis Report For WE 090612 - Proshare

Diunggah oleh

ProshareJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Market Sentiment Analysis Report For WE 090612 - Proshare

Diunggah oleh

ProshareHak Cipta:

Format Tersedia

Market Sentiment Analysis for WE 080612

Sentiment Analysis Report W/E June 08, 2012

Sunday, June 10, 2012/ Proshare Research

The Diagnosis Analysis of the market activity in the week ended June 08, 2012 technically revealead an increase in pessimistic trading and growing sell tendency in the investors trading pattern as against weak market optimism and continued sell tendency observed in the previous weeks performance. Digging deeper, we discovered a strong reversal mode as the falling trend garned momemtum in the week, plunging futher the ASI below the 21,000 pyschological line driving by the growing sell tendency on top of increased market volatility. In the week just ended, sustained weak bargain tendency was observed across the major sectors as reversal mode continued to gain tempo, mainly towards big and medium CAP stocks. However, renewed and growing bargain drive was observed towards depressed stocks in few active sectors while their depressed postures remained attractive. Nevertheless, the sustained sell tendency continued to outweigh the weak buy side as most active and liquid stocks are yet to stablize while the short termist remained in control of market direction - a major reason for the continued pessimistic activities in the market. To date, the indecisive posture of the market remains high, alongside waning activity level as sideline attendants appeared to take positions subtly, yet remain a significant feature. Prescription and the likely expectation in the coming periods: More bottomed-out stocks are likely to decamp to gainers list in the coming period and so act as a possible game changer; while the expectation is that the blue chip stocks would successfully stabilize within trading range (and find new support levels). Meanwhile, the absence of more positive news in the market continues to stoke more pessimistic activities as stakeholders envisage a mild sell tendency to lure market participants into transactions in the coming periods.

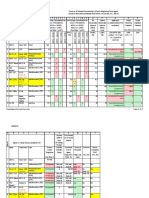

Market Diagnostic Score Card

Market Gauges Scores Remarks The negative posture was significantly impacted by activities towards big and medium cap stocks across the sectors. Weak bargain and continued reversal trend was observed when compared to -1.21% loss recorded in the previous week. This confirms the increase in pessimism and continued price correction witnessed in the week which further reflects the weak bargain The market RSI shows that market is in depressed posture while gaining reversal momentum. Market RSI closed lower as against previous week of 42.88. More importantly, this indicates further that market has slipped below OVERSOLD REGION mode. The chance of another round of rally has increased significantly. Nevertheless, the trend may persist due to lack of positive news to driver bargains. Illiquidity of some stocks, low purchasing power, low risk appetite, feeble confidence and wary posture of investors reflected here significantly- This is considered too high- an improved posture against 60.29% observed in the previous week.

ASI

-4.83%

Market Breadth

Negative

Market RSI

19.66 (depressed)

Indecision level (%)

57.53%

www.proshareng.com

Market Sentiment Analysis for WE 080612 There is a decline in the optimism level of the market against the previous outlook of 16.91%. However, there was weak bargain tendency as the optimistic activity on the bourse still closed weak at 32.76%, against total market activity, from 31.74% recorded in the previous week. There is an increase in pessimism level in the market - an unimpressive posture over the previous outlook of 22.79%. This shows that 26.71% of market participants in the week were pessimistic about the market.

Optimism Level

(%)

15.71%

Pessimism Level

(%)

26.71%

Proshare Research

Technically, market sentiments during the week favoured liquid and active stocks of Medium and Large CAP categories in Healthcare, Agriculture, Conglomerates and Oil & Gas sector(s) in that order which further revealed the sectors investors patronised in the week. On the other hand, it was observed that market sentiments moved against the Services, Consumer Goods, Financial Services, Construction/Real Estate and Industrial Goods sector(s) as sell sentiment was stronger in the sector(s).

Sector Performance Sector Movers FIDSON, GLAXOSMITH, NEIMETH, MAYBAKER Direction & Trading Psychology Growing and sustained active bargain tendency observed in the sector(s), indicating attractive posture of stock(s)within the sector(s) Renewed bargain sentiments observed in the sector(s) due to depressed and attractive prices that followed the heavy sell tendency observed in the previous week Growing and sustained active bargain tendency observed in the sector(s), indicating attractive posture of stock(s)within the sector(s) Indecisive (No active transactions)

Healthcare

5.98%

Agriculture Conglomerates

2.99% 1.92%

LIVESTOCK TRANSCORP

Oil & Gas

0.45%

ETERNAOIL, JAPAULOIL

ICT Natural Resources

0.00% 0.00% LONGMAN, IKEJAHOTEL, ACADEMY, REDSTAREX

Services

-0.10%

Waning sell tendency observed in the sector(s)- as active bargain sentiments observed towards some attractive stocks cushioned the sell pressure Mild sell tendency resumed in the sector(s)- Speculative trading pattern dictates the direction amid weak bargain posture

Consumer Goods

-0.31%

DANGSUGAR, NB, UNILEVER, DANGFLOUR, CADBURY UBN, GTASSURE, ACCESS, UNITYBNK, STERLNBANK, FIRSTBANK, FCMB, UBA, CONTINSURE, PRESTIGE, FIDELITY BANK JBERGER, UAC-PROP ASHAKACEM, DANGCEM, CCNN, CUTIX, DNMEYER, BAGCO, CAP, WAPCO

Financial Services

-1.19%

Continued and Growing sell tendency observed in the sector(s) as profiteering dominates

Construction/Real Estate

-1.99%

Industrial Goods

-2.33%

Heavy sell tendency observed in the sector(s)- Speculative trading pattern dictates the direction as profit taking tendency sets in

Proshare Research

www.proshareng.com

Market Sentiment Analysis for WE 080612

Stock Trend & Direction We conducted a review of stocks that have sharpened market direction and performance in the week - using technical tools like RSI, MACD, VOLUME, MFI, CANDLESTICK, MOVING AVERAGES, BOLLIGER BANDS and ACCUMULATION & DISTRIBUTION to reveal investors sentiments towards the market movers.

THE BIG VOLUME First Bank experienced moderate sell tendency and negative sentiments to record 6.1% loss in the week as against the modest gain of +0.8% gain recorded in the previous week supporting the weak bargain drive witnessed towards the stock as distribution dominated the trading activities in the week while the general bearish trend in the market had an overbearing impact on the performance of the stock. Be that as it may, the stock maintained its bullish range to close neutral and bullish in short and mid-long term period respectively as revealed by price moving average, indicating the stock is yet to attain bearish mode. In addition, the two days bearish position of MACD further buttressed the weak bargain drive observed in the week while the sharp fall in RSI revealed the active distribution and sell momentum amid bearish volume posture. Technical Conclusion on Sentiments: Barring unforeseen market price volatility, the stock has moderate possibility to extend the trend as the sell tendency gained momentum in the last session. The chart below shows MACD, candlestick, RSI and volume

analysis.

Zenith Bank experienced waning sell tendency and mixed sentiments to record modest gain of +0.4% as against the -9.1% loss recorded in the previous week - a better performance when compared with the recent four weekly consecutive losses, following the 12-months high of N15.59 recorded on May 3th 2012. The outlook for the stock will suggest that we may have reached the end of current price correction taking place, as the stock seems to stabilise around N13.25k to form a new support level. On the other hand, the bearish position of MACD suggests a weak bargain posture while the stock closed neutral and remained bullish in short and mid-long term respectively as revealed by its price moving average indicating that the stock is yet to attain bearish mode.

www.proshareng.com

Market Sentiment Analysis for WE 080612

Technical Conclusion on Sentiments: The stock has a moderate possibility of experiencing an uptrend in the coming periods as sell pressures appear to have waned, suggesting that the depressed posture of the stock may actually encourage new bargains as revealed by RSI. The chart below shows MACD, candlestick, RSI and volume analysis.

THE GAINERS MAYBAKER experienced an improved bargain drive and sustained positive sentiment in the week to record +26.2% gain as against +14.6% gain in the previous week as a sustained bullish sentiment was observed towards the stock as its depressed posture continued to stoke sustain bargain drive in the week, just as we had envisaged in our

previous sentiments analysis dated June 1st 2012.

Further analysis indicates that the stock is yet to attain bullish mode as it closed neutral and remained in bearish range in both short and mid long term respectively as revealed by its price moving average, indicating a possible uptrend potential with growing bargain drive. The strong bullish position of MACD buttressed this further. Additionally, we observed a continued inflow of funds into the stock while a similar positive pattern was witnessed in the accumulation trend, buttressing the uptrend potential further. Curiously, the low volume trend affirms a hold position taken by investors who believe in the company and have adopted the sentiment analysts position. Technical Conclusion on Sentiments: the stock is yet to record weakness in uptrend momentum since picking up, thus indicating a further uptrend potential in the coming periods as revealed by its moving averages. However, a trend reversal is not in doubt as bears remain in control of the market. The chart below shows MACD, candlestick, RSI and

volume analysis.

www.proshareng.com

Market Sentiment Analysis for WE 080612

TRANSCORP experienced continued bargain tendency and sustained positive sentiments in the week to record +24.7% gain as against the +7.8% gain recorded in the previous week - renewed strong bargain tendency was observed as the stock broke its 9-mth resistance level of N1.07 (high price recorded on 02 August, 2011) during the week. The outlook reveals an extra ordinary bargain drive as the stock sustained a 6-wks uninterrupted uptrend, recording a 137% price appreciation to settle at a new 12-mths high of N1.21 with a growing bargain posture, despite the 5-wks general bearish trend in the market. However, analysis suggests that the stock is overbought i.e. trading at its top, indicating possible reversal anytime soon as revealed by RSI and MACD. Though, the stock is yet to display bargain weakness as most momentum indicators maintained a northward trend while the stock remained bullish in both short and mid-long term period as revealed by its price moving average. Technical Conclusion on Sentiments: The stock is overdue for price correction due to its prolonged overbought posture with a 137% price growth in the last six weeks. However, the bargain drive appeared very strong with potential to extend the uptrend as the market is yet to see any weakness in the uptrend momentum. Nevertheless, we advise a cautious bargain approach as short term retracement is not in doubt anytime soon. The chart below shows MACD, candlestick, RSI and volume analysis.

www.proshareng.com

Market Sentiment Analysis for WE 080612

THE LOSERS UBN experienced renewed sell activities and negative sentiments in the week to record a15.5% loss as against the +5.6% gain recorded in the previous week - sustained price correction trend was observed as the stock has been on the downtrend since 4weeks ago, following the 5weeks uptrend experienced recently. The outlook revealed active sell tendency as the stock recorded new lows throughout the week. The bearish posture of MACD buttresses the sell tendency further as the stock continues to slide towards the oversold region amid its bearish posture in both short and mid-long term period as revealed by the price moving average. In addition, the sustained bearish volume trend further reveals the active sell tendency as more of distribution was observed in the week amid sustained southward trend in money flow index. Technical Conclusion on Sentiments: the stock has a moderate tendency to extend the downtrend in the coming sessions. However, a trend reversal is not in doubt as the stock tried to stabilize at N3.17kobo in the last two sessions while the contraction of Bollinger bands reveals the high possibility of a sharp price movement in near term. The

chart below shows MACD, candlestick, RSI and volume analysis.

ASHAKACEM experienced continued sell tendency and sustained negative sentiments to record a -16.0% loss in the week as against the -2.9% loss recorded in the previous week - continued price correction with significant growth in sell tendency was observed in the week as the stock has been on a downtrend for upwards of 5-wks to record the 19% loss, following the 2-weeks rally witnessed recently. The outlook reveals a growing active sell tendency and bearish sentiment while the stock remains in a bearish mode in both short and mid-long term period as revealed by the price moving average. Additionally, the stock appeared depressed to close weak at an oversold region; the prolonged bearish posture of MACD buttressed this further while the volume trend and money flow index revealed similar negative trend amid continued distribution. Technical Conclusion on Sentiments: The sell tendency towards the stock remained strong, pointing to a moderate possibility of a further decline in the price movement. However, a trend reversal may not be in doubt as the depressed posture of the stock creates incentives for a bargain drive. The chart below shows MACD, candlestick, RSI and

volume analysis.

www.proshareng.com

Market Sentiment Analysis for WE 080612

Due Diligence

Valuation/Investment Ratio Book Value (N'm) Book Value/Per Share Price to Book EPS PE Profitability ROE (%) PAT Margin (%) PBT Margin (%) Revenue Growth Proshare Research 6.74% 26.57% 31.26% 42.49% 4.83% 26.57% 31.80% 33.36% -1.12% -3.79% -3.79% -3.45% 3.35% 100.78% 118.45% -22.44% 33.85% -79.64% -109.31% -8.32% 18.75% 17.19% 22.92% 8.49% FIRSTBANK 363,638 11.14 0.00 0.75 14.37 ZENITHBANK 397,830 12.67 0.00 0.61 22.05 MAYBAKER 3,118 3.18 0.00 -0.04 -49.84 TRANSCORP 15,514 0.60 0.00 0.02 60.18 UBN - 184,571 -10.90 0.00 -3.69 -0.86 ASHAKACEM 19,047 8.51 0.00 1.60 5.37

Price Trend

Price Performance

52 Weeks High 52 weeks Low 3 Month's (%) 6 Month's (%) 12 Month's (%) Price Trend Current Price 15 Days MA 30 Days MA 50 Days MA 200 Days MA Proshare Research 10.80 11.21 11.07 10.65 10.06 13.50 14.25 14.56 13.95 12.79 1.78 1.43 1.55 1.7898 2.47 1.21 0.95 0.77 0.67 0.65 3.17 3.61 4.02 3.65 4.32075 8.57 10.06 10.26 9.93 12.73 FIRSTBANK 13.65 7.95 -2.35% 27.06% -20.65% ZENITHBANK 15.59 11.45 -2.88% 17.39% -10.00% MAYBAKER 4.00 1.23 -28.80% -1.66% -55.50% TRANSCORP 1.21 0.50 108.62% 120.00% 31.52% UBN 11.15 1.96 44.97% 51.67% 53.14% ASHAKACEM 24.47 8.01 -22.02% -32.52% -64.07%

www.proshareng.com

Market Sentiment Analysis for WE 080612

DISCLAIMER/ADVICE TO READERS:

While the website is checked for accuracy, we are not liable for any incorrect information included. The details of this publication should not be construed as an investment advice by the author/analyst or the publishers/Proshare. Proshare Limited, its employees and analysts accept no liability for any loss arising from the use of this information. All opinions on this page/site constitute the authors best estimate judgement as of this date and are subject to change without notice. Investors should see the content of this page as one of the factors to consider in making their investment decision. We recommend that you make enquiries based on your own circumstances and, if necessary, take professional advice before entering into transactions. Further enquiries should be directed to the authors analyst@proshareng.com .

Tags: Sentiment Analysis, Market Sentiments, Due Diligence, Technical Analysis, Bollinger band, Fibonacci, Candlestick, Money Flow Index, Proshare Research, The Analyst, Bullish Trend, Bearish Trend, Weak Bargain, Profit Taking, Short-termists, Price Correction, Trend Reversals, Volume Trend, Price Performance, Financial Services, proshareng.com, Nigerian Stock Exchange, Equities Market, NCM, Investors, Shareholders, Stock Recommendations, First Bank of Nigeria, Zenith bank Plc, May Baker Plc, Transcorp, Union Bank of Nigeria, Ashaka Cement

www.proshareng.com

Anda mungkin juga menyukai

- Service Delivery Propelled by Innovations in The NCM - June 2014 SSS ReportDokumen13 halamanService Delivery Propelled by Innovations in The NCM - June 2014 SSS ReportProshareBelum ada peringkat

- The Nigerian Capital Market Service Report - Improvement On Minimal Market ActivitiesDokumen18 halamanThe Nigerian Capital Market Service Report - Improvement On Minimal Market ActivitiesProshareBelum ada peringkat

- Technical Analyst Reviews/Calls July 2014Dokumen74 halamanTechnical Analyst Reviews/Calls July 2014ProshareBelum ada peringkat

- Cement Sub Sector Review - Turnover, PBT and Share Price 2011 - 2012Dokumen2 halamanCement Sub Sector Review - Turnover, PBT and Share Price 2011 - 2012ProshareBelum ada peringkat

- 66 Stocks On The Caution List For 2013 @NSE - ProshareDokumen4 halaman66 Stocks On The Caution List For 2013 @NSE - ProshareProshareBelum ada peringkat

- Aliko Dangote - 1 Year in Charge of The NSE PresidencyDokumen23 halamanAliko Dangote - 1 Year in Charge of The NSE PresidencyIsaac OsagieBelum ada peringkat

- Cadbury PLC Sets New 4-Yr High, Drops in Today's SessionDokumen2 halamanCadbury PLC Sets New 4-Yr High, Drops in Today's SessionProshareBelum ada peringkat

- Investor Confidence Builds Up As 2012 Reverses Trend - 080113Dokumen4 halamanInvestor Confidence Builds Up As 2012 Reverses Trend - 080113ProshareBelum ada peringkat

- CIBN Presentation To NASS On CBN Act Amendment - May 28, 2012Dokumen11 halamanCIBN Presentation To NASS On CBN Act Amendment - May 28, 2012ProshareBelum ada peringkat

- Investing in Oando PLC Rights IssueDokumen22 halamanInvesting in Oando PLC Rights IssueProshare100% (1)

- 52 Weeks High and Lows in 2012 at The NSE - The AnalystDokumen8 halaman52 Weeks High and Lows in 2012 at The NSE - The AnalystProshareBelum ada peringkat

- Which Sector Made You Money in 2012 - TheAnalystDokumen10 halamanWhich Sector Made You Money in 2012 - TheAnalystProshareBelum ada peringkat

- The Crisis of Confidence in Insurance - Ekerete Gam IkonDokumen3 halamanThe Crisis of Confidence in Insurance - Ekerete Gam IkonProshareBelum ada peringkat

- Nigerian Market Is Completely Out of Bottomed-Out Stage - ProshareDokumen6 halamanNigerian Market Is Completely Out of Bottomed-Out Stage - ProshareProshareBelum ada peringkat

- NSE Remains A Leading Frontier Market in 2012 - 311212Dokumen3 halamanNSE Remains A Leading Frontier Market in 2012 - 311212ProshareBelum ada peringkat

- Investor Alert - Stocks That Made Headlines 110612Dokumen3 halamanInvestor Alert - Stocks That Made Headlines 110612ProshareBelum ada peringkat

- Guide To Investing in 2013 - ProshareDokumen8 halamanGuide To Investing in 2013 - ProshareProshareBelum ada peringkat

- Cash-Flow Challenges Cast Dark Cloud' Over Oil & Gas Stocks As Sector BleedsDokumen5 halamanCash-Flow Challenges Cast Dark Cloud' Over Oil & Gas Stocks As Sector BleedsProshareBelum ada peringkat

- Stocks No One Is Patronising - 100612Dokumen6 halamanStocks No One Is Patronising - 100612ProshareBelum ada peringkat

- 42 Stocks Listed From 2008 Till Date - How They Are Faring! - ProshareDokumen23 halaman42 Stocks Listed From 2008 Till Date - How They Are Faring! - ProshareProshareBelum ada peringkat

- In Nigeria, A Concrete Get-Rich Scheme - The Dangote StoryDokumen5 halamanIn Nigeria, A Concrete Get-Rich Scheme - The Dangote StoryProshareBelum ada peringkat

- Why Is This The Perfect Time To Identify Great StocksDokumen8 halamanWhy Is This The Perfect Time To Identify Great StocksProshareBelum ada peringkat

- 55 Stocks Trading at N0 50k Today - What NextDokumen43 halaman55 Stocks Trading at N0 50k Today - What NextProshareBelum ada peringkat

- Audited Results - Analysis of Quoted Stocks @120712Dokumen4 halamanAudited Results - Analysis of Quoted Stocks @120712ProshareBelum ada peringkat

- Market Slides Into Oversold Region 070612 - ProshareDokumen3 halamanMarket Slides Into Oversold Region 070612 - ProshareProshareBelum ada peringkat

- Will There Be A Revival in The IPO Markets Soon - 170612Dokumen5 halamanWill There Be A Revival in The IPO Markets Soon - 170612ProshareBelum ada peringkat

- CBN Act Amendment - CBN Memo To NASS - ProshareDokumen34 halamanCBN Act Amendment - CBN Memo To NASS - ProshareProshareBelum ada peringkat

- SEC Allotment of 2008 Stracomms Offer and Return of MoniesDokumen3 halamanSEC Allotment of 2008 Stracomms Offer and Return of MoniesProshareBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Digital Communication Quantization OverviewDokumen5 halamanDigital Communication Quantization OverviewNiharika KorukondaBelum ada peringkat

- Diemberger CV 2015Dokumen6 halamanDiemberger CV 2015TimBelum ada peringkat

- CL 5313 17021-1 Requirements Matrix-1458-5Dokumen6 halamanCL 5313 17021-1 Requirements Matrix-1458-5Ana AnaBelum ada peringkat

- BPO UNIT - 5 Types of Securities Mode of Creating Charge Bank Guarantees Basel NormsDokumen61 halamanBPO UNIT - 5 Types of Securities Mode of Creating Charge Bank Guarantees Basel NormsDishank JohriBelum ada peringkat

- Problems of Teaching English As A Foreign Language in YemenDokumen13 halamanProblems of Teaching English As A Foreign Language in YemenSabriThabetBelum ada peringkat

- Unit 1 Writing. Exercise 1Dokumen316 halamanUnit 1 Writing. Exercise 1Hoài Thương NguyễnBelum ada peringkat

- The Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToDokumen21 halamanThe Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToBik Bok50% (2)

- Binomial ExpansionDokumen13 halamanBinomial Expansion3616609404eBelum ada peringkat

- Doe v. Myspace, Inc. Et Al - Document No. 37Dokumen2 halamanDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comBelum ada peringkat

- Equipment, Preparation and TerminologyDokumen4 halamanEquipment, Preparation and TerminologyHeidi SeversonBelum ada peringkat

- LON-Company-ENG 07 11 16Dokumen28 halamanLON-Company-ENG 07 11 16Zarko DramicaninBelum ada peringkat

- Clean Agent ComparisonDokumen9 halamanClean Agent ComparisonJohn ABelum ada peringkat

- Ks3 Science 2008 Level 5 7 Paper 1Dokumen28 halamanKs3 Science 2008 Level 5 7 Paper 1Saima Usman - 41700/TCHR/MGBBelum ada peringkat

- Department of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Dokumen8 halamanDepartment of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Evelyn DEL ROSARIOBelum ada peringkat

- Environment ManagerDokumen234 halamanEnvironment ManagerAbhishek kumarBelum ada peringkat

- Artificial IseminationDokumen6 halamanArtificial IseminationHafiz Muhammad Zain-Ul AbedinBelum ada peringkat

- Ali ExpressDokumen3 halamanAli ExpressAnsa AhmedBelum ada peringkat

- The Online Medical Booking Store Project ReportDokumen4 halamanThe Online Medical Booking Store Project Reportharshal chogle100% (2)

- Ramdump Memshare GPS 2019-04-01 09-39-17 PropsDokumen11 halamanRamdump Memshare GPS 2019-04-01 09-39-17 PropsArdillaBelum ada peringkat

- Newcomers Guide To The Canadian Job MarketDokumen47 halamanNewcomers Guide To The Canadian Job MarketSS NairBelum ada peringkat

- May, 2013Dokumen10 halamanMay, 2013Jakob Maier100% (1)

- Supreme Court rules stabilization fees not trust fundsDokumen8 halamanSupreme Court rules stabilization fees not trust fundsNadzlah BandilaBelum ada peringkat

- (Variable Length Subnet MasksDokumen49 halaman(Variable Length Subnet MasksAnonymous GvIT4n41GBelum ada peringkat

- PCSE_WorkbookDokumen70 halamanPCSE_WorkbookWilliam Ribeiro da SilvaBelum ada peringkat

- Module - No. 3 CGP G12. - Subong - BalucaDokumen21 halamanModule - No. 3 CGP G12. - Subong - BalucaVoome Lurche100% (2)

- Numerical Methods: Jeffrey R. ChasnovDokumen60 halamanNumerical Methods: Jeffrey R. Chasnov2120 sanika GaikwadBelum ada peringkat

- Chapter 1: The Critical Role of Classroom Management DescriptionDokumen2 halamanChapter 1: The Critical Role of Classroom Management DescriptionJoyce Ann May BautistaBelum ada peringkat

- Finance at Iim Kashipur: Group 9Dokumen8 halamanFinance at Iim Kashipur: Group 9Rajat SinghBelum ada peringkat

- Roadmap For Digitalization in The MMO Industry - For SHARINGDokumen77 halamanRoadmap For Digitalization in The MMO Industry - For SHARINGBjarte Haugland100% (1)

- NetsimDokumen18 halamanNetsimArpitha HsBelum ada peringkat