AS11

Diunggah oleh

Bhavana Patil JangaleDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

AS11

Diunggah oleh

Bhavana Patil JangaleHak Cipta:

Format Tersedia

1

Accounting Standard (AS) 11 (Revised 2003)

THE EFFECTS OF CHANGES IN FOREIGN EXCHANGE RATES

Mandatory for Accounting Periods commencing on or after 1st April, 2004

Contents

Sr. No. Particulars 1 Glossary 2 3 4 Need & Objective Coverage At A Glance Accounting of FC Transactions

5 6 7 8 9

Accounting of Foreign Operations Accounting of Forward Exchange Contracts Disclosure AS 11 & Schedule VI AS 11 & International AS 21

Glossary

AS RE FSs Ex. Diff. FC US $ A/c RC Rs. Accounting Standard Reporting Enterprise (GSL) Financial Statements (BS, P & L etc) Exchange Difference Foreign Currency (US $ etc) United States Dollar Account Reporting Currency (Rs.) Rupees

Need & Objective

Export Sales Expenses in FC Domestic Sales Galaxy Foreign Purchases Indian Purchases

Expenses in Rs.

US $ Borrowings

Rs. Borrowings

Galaxys financial reports are in Rs. All financial transactions are to be recorded in Rs.

Which Ex. Rate ?

How to treat Ex. Diff. in A/cs

Coverage At A Glance

Direct business dealings with Customers, Suppliers etc. from local point

Foreign Currency Activities Tax Effect of Ex. Diff.

Business dealings through foreign based branch, JV, Subsidiary, Associate etc.

Accounting

Disclosure

Transitional Provisions

Foreign Currency Transactions

Foreign Operations

Forward Exchange Contracts

a) Conversion b) Recognition of Ex. Diff. c) Eg. : FC Transaction

a) b) c) d)

Classification of FO Conversion of FS Disposal of NFO Change in classification

Conversion of FC Transactions

Initially FC transactions shall be recorded at TDR * / AR For practical purpose Average Rate (AR) can be used in place of TDR. Appropriate Accounting Policy shall be established for the purpose. View Eg. AR Policy >>>>>>> *TDR = Spot Rate on Transaction Date Conversion Rate Table for FC Transactions (FCT) Classification of BS Items Monetary Items Initial A/cing TDR / AR TDR / AR TDR / AR ----Conversion at BS Dt Closing Rate (CR)* TDR/AR Valuation Date Rate Closing Rate

Non Monetary Carried @

Historical Cost Fair Value Contingent Liabilities *CR = Rate on BS Date

Back to Glance

Eg. : Average Rate (AR) Policy

Accounting Policy for Initial Recognition : Purchases & Sales in FC are recorded at

Customs Ex. Rates (Currently CBEC prescribes Customs Ex. Rates by Notification U/s. 14 (3) (a) of Customs Act, 1962) Other Transactions in FC are recorded at TDR i.e. Ex. Rates prevailing on Date of Transaction

Note :- AR should approximate to the TDR i.e. AR can not be used if Ex. Rates fluctuates significantly

<<<< Back

Recognition of Ex. Diff. - FCT

Settled after the BS Date

Purchase Agreement @ TDR / AR

Reported in BS @ Closing Rate Settled @ TDR / AR

Ex. Diff. arises EITHER on Settlement OR on Reporting in BS

The same should be recognized in P & L A/c for the period

Back to Glance

Eg. : Ex. Diff. on FC Transaction

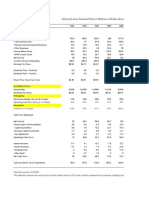

Accounting Year 2004-05 2005-06

Accounting of asset purchase as per revised AS 11 (2003)

Current Asset purchase worth US $ 1/= Spot Rates (Rs./$) Current Asset A/c Vendor A/c DR DR

Purchase 01.12.04 Payment 31.01.05 BS Dt 31.03.05 Payment BS Dt 30.04.05 31.03.06

50/50.00

52/50.00

47/3.00

46/47.00

52/-

Ex. Loss A/c

Rs. Current A/c Vendor A/c Ex. Gain A/c

DR

CR CR CR 50.00

2.00

52.00 3.00 46.00

5.00

5.00 1.00

Back to Glance

10

Classification of FO

Foreign Operation (FO) is defined as a subsidiary, associate, joint venture or branch based in a foreign country. Classified : Way in which financed & operates w.r.t. RE Particulars Definition Integral FO (IFO) Non Integral FO (NFO) FO whose activities are Negatively defined an integral part of the FO which is not an IFO activities of RE Extended arm of RE Selling Agent may just sell goods received from RE and remit proceeds back to RE Separate Entity Independent Branch Generates Income, Incurs Expenses, Accumulates Monetary Items, Borrows locally etc. etc.

Operates as Example

Effect of Rate Has immediate effect Do not have direct impact on Fluctuation on REs Cash Flows REs Cash Flows from from Operations Operations

View Indicators of NFO >>>>

11

Indicators of NFO

Major factor : Impact on cash flows from operations Other indicators of NFO are a) High degree of autonomy in carrying operations b) Low proportion of transactions with RE c) No dependence on RE for finance d) COP or services settled on its own e) Sales are in currencies other than RC (Rs.) f) Cash flows of RE are insulated from day-to-day activities of FO g) Sales prices are not responsive to Ex. Rate Fluctuations h) Existence of local demand for the product If cant be classified clearly then judgment is necessary for determination.

Back to Glance

12

Conversion of FSs of FO & Recognition of Ex. Diff. thereof

For Conversion IFO is treated as FC Transaction

Particulars

P & L Items Monetary Items Non Monetary carried @ Historical Cost Non Monetary carried @ Fair Value

Integral FO = FC Transaction

TDR / AR Closing Rate TDR / AR

Non Integral FO

TDR / AR Closing Rate Closing Rate

Valuation Date Rate

Closing Rate

Recognition of Recognized in P & Accumulated in FOREX Reserve Ex. Diff. L A/c as & when A/c (Accumulation will continue arise until disposal of NFO) Eg. >>

13

Eg. : Conversion of NFO FS

Particulars Share Capital Reserves Assets / Liabilities Rate 40/40/40/200 8000 Dr $ Dr. Rs. Cr $ 100 50 50 Cr. Rs. 4000 2000 2000 Acquisition of Galaxy Chemicals Inc., USA on 31.03.04 (Spot = 40/-)

On next BS Dt 31.03.05 (Spot = Rs. 50/-, AR = Rs. 45/-) Share Capital Opening Reserves Current Profit Assets / Liabilities Total Original Original AR = 45/CR = 50/400 400 20000 20000 100 50 20 230 400 4000 2000 900 11500 1600 20000

Back to Glance

FOREX Reserve (Balancing Figure)

14

Disposal of NFO

Particulars

Gain or Disposal Loss

Nature of Disposal 100% Disposal

on Recognize in P & L A/c

Part Disposal

Recognize in P & L A/c

Accumulated amt in 100% transfer Part amount transfer to FOREX Reserve A/c to P & L A/c P & L A/c on pro-rata basis When to trf FOREX Period in which gain or loss Reserve to P & L disposal is recognized in P & L A/c on

Back to Glance

15

Change in Classification of FO

Particulars P & L Items Conversion Rate for IFO = FCT TDR / AR NFO TDR / AR

Monetary Items

Non Monetary carried @ Historical Cost (FC) Non Monetary carried @ Fair Value (FC)

Closing Rate

TDR / AR Valuation Date Rate

Closing Rate

Closing Rate Closing Rate

IFO reclassified as NFO Ex. Diff. will arise on conversion of non-monetary items ;& The same shall be accumulated in FOREX Reserve

Eg.>>

NFO reclassified as IFO FOREX Reserve is continued until actual disposal of FO Translated amounts for Non Monetary Items are treated as Eg.>> historical cost of those items, from that date.

16

Eg. : Reclassification IFO to NFO

BS Dt 31.03.05 (Original = 40/-, Closing = Rs. 50/-, AR = Rs. 45/-) Particulars Share Capital Op. Reserves Current Profit Ex. Gain Loss FOREX Reserve Monetary Liabilities Total Monetary Assets 230 400 300 50/50/11500 19500 15000 50/50/US $ 100 50 20 IFO Rate 40/40/45/Rs. 4000 2000 900 1100 500 11500 20000 15000 Rate 40/40/Original NFO Rs. 4000 2000 2000

Non Monetary @ Historical Cost

Total

100

400

45/-

4500

19500

50/-

5000

20000

<< Back

17

Eg. : Reclassification NFO to IFO

BS Dt 31.03.05 (Original = 40/-, Closing = Rs. 50/-, AR = Rs. 45/-) Particulars Share Capital Op. Reserves Current Profit FOREX Reserve Liabilities Total 230 50/400 $ 50 20 Rate NFO Rs. 4000 2000 900 1600 11500 20000 15000 5000 40/45/IFO Rs. 4000 2000 900 1600 11500 20000 15000 5000 Treated as Historical Cost from date of reclassification 20000

Back to Glance

Remarks

100 40/-

Continued until disposal of FO

Monetary Assets 300 50/Non Monetary @ 100 50/Historical Cost Total 400

20000

18

Forward Exchange Contract (FEC)

FEC is an agreement to exchange different currencies at Forward Rate # Particulars Hedging FEC Speculative FEC

1 Purpose

2 Eg.

Manage risks

Gain by calculated risks

Say Minimizing Ex. Rate Earn profit by trading in fluctuation risk associated FOREX with Accounts Receivable of USD 100K Purpose different hence different A/cting treatment

Premium/ Deferred over tenor of the Ignored Discount contract Ex. Diff.

3 Accounting

Recognize on the basis of Value of FEC is marked ex. rate movements to M.V. on BS Dt View Eg. >>>> View Eg. >>>>

4 Practical

Profit or Loss on Cancellation/Renewal is recognized in P & L A/c

19

Eg. : Hedging FEC

Accounts Receivable US $ Sale Dt 01.12.04 FEC Dt 01.12.04 BS Dt 31.03.05 Settlement Dt 30.04.05

1/=

Spot = 43/-

FR = 48/-

Spot = 45/-

Spot = 47.50

Accounting as per Revised AS 11 (2003) Accounting Premium (5/-) Ex. Gain Ex. Loss Ex. Loss Net Gain/ Year Amortization Rs. Calculation Rs. (Loss) 2004-05 2005-06 Total 5 * (4/5) 5 * (1/5) 4/1/5/43 45 45 - 47.50 (2/-) (2.50) 4.50 2/(1.50) 0.50

<< Back

20

Eg. : Speculative FEC

FEC Date Forward Purchase of Maturity Date Forward Rate Forward Rate available on BS date (31.03.05) for remaining maturity of the contract Ex. Loss in 2004-05 1st March, 2005 USD 1/30th June, 2005 Rs. 50/- per $ Rs. 48/- per $

Rs. 2/-

Back to Glance

21

Tax Effects of Foreign Ex. Diff.

There will be some tax effects associated with the gain or loss from exchange rate fluctuation These tax effects shall be accounted for in accordance with AS 22 i.e. Accounting for Taxes on Income

Back to Glance

22

Disclosure

An Enterprise shall specifically disclose 1. Ex. Diff. recognized in P & L A/c for the period 2. FOREX Reserve as part of Share Holders Funds 3. Reconciliation of Opening & Closing FOREX Reserve 4. Where RC is different from the currency of domiciled country, reasons thereof 5. Where RC currency has been changed from previous accounting period then reasons for such change 6. If classification of FO has been changed, then Nature & Reasons for Change Impact of change on Share Holders Funds Impact on Net Profit or Loss for each prior period, as if change is applicable from retrospective effect.

7. AS 11 encourages disclosure of Enterprises FC Risk Management Policy

Back to Glance

23

Transition on 1st April, 2004

Revised AS 11 is applicable from 1st April, 2004. Old AS 11 used the term Foreign Branch

instead of Foreign Operation Also it did not classified FOs as IFO & NFO

On 1st time application, if a Foreign Branch is

classified as NFO then accounting treatment pertaining to change in classification of FO shall be applied i.e. Accumulate Ex. Diff. on conversion of Non Monetary Items in FC Translation Reserve

24

AS 11 (2003) & Schedule VI

As per the announcement of ICAI # Particulars 1 Ex. Diff. on a/c of FC Liability linked to Fixed Asset Schedule VI Revised AS 11 (2003) Capitalize i.e. Recognize in P & L A/c adjust in carrying cost of Fixed Asset with Capitalization provision VI discontinued on revision in 2003 Until the revision of Schedule VI capitalization treatment will continue & it will still be considered to be complying with New AS 11 (2003)

2 Relation to old In line AS 11 (1994) Schedule provision 3 Implication

ICAI will be approaching Govt. for revision of Schedule VI

25

AS 11 (2003) & IAS

Particulars Scope Indian AS 11 International AS 21 Covers accounting of Major aspects of FECs are FECs covered under IAS 39 (Financial Instruments : Recognition & Measurement) Preferring elimination of alternatives, IASs alternative treatment is not recognized Permits alternative : Ex. Diff. on severe devaluation of currency can be included in carrying amt of asset s.t. conditions

Alternative A/cing in case of Severe Currency Devaluation Terminology w.r.t. FO

FOs are classified as FOs are classified as Integral & FOs that are integral to the Non Integral operations of RE & Foreign Entity

26

Thank You

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Notes To FSDokumen3 halamanNotes To FSdhez10Belum ada peringkat

- 18-3-SA-V1-S1 Solved Problems RaDokumen34 halaman18-3-SA-V1-S1 Solved Problems RaRajyaLakshmiBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- A Contribution To The Empirics of Economic GrowthDokumen39 halamanA Contribution To The Empirics of Economic GrowthJamesBelum ada peringkat

- Baf Hons CF NotesDokumen7 halamanBaf Hons CF NotesBhavana Patil JangaleBelum ada peringkat

- Structure of MF in IndiaDokumen2 halamanStructure of MF in IndiaBhavana Patil JangaleBelum ada peringkat

- Merger and Accquistion AssignmentDokumen9 halamanMerger and Accquistion AssignmentBhavana Patil JangaleBelum ada peringkat

- Financial RatioDokumen37 halamanFinancial RatioPRAGYAN PANDA100% (2)

- MF Reg IndiaDokumen23 halamanMF Reg IndiaAarunyaRajaBelum ada peringkat

- Vidyavarta Peer Reviewed International Journal April To June 2021 Special Issue NSS CollEGE MY PAPER ON PG 157Dokumen251 halamanVidyavarta Peer Reviewed International Journal April To June 2021 Special Issue NSS CollEGE MY PAPER ON PG 157Bhavana Patil JangaleBelum ada peringkat

- Time Value of MoneyDokumen5 halamanTime Value of MoneyBhavana Patil JangaleBelum ada peringkat

- Sybaf Dividend DecisionsDokumen13 halamanSybaf Dividend DecisionsBhavana Patil JangaleBelum ada peringkat

- F D C S: Inancing Ecisions Apital TructureDokumen54 halamanF D C S: Inancing Ecisions Apital TructurePrabhatiBelum ada peringkat

- BMS - Cost of CapitalDokumen22 halamanBMS - Cost of CapitalBhavana Patil JangaleBelum ada peringkat

- Ind As1 BookDokumen122 halamanInd As1 BookBhavana Patil JangaleBelum ada peringkat

- New Doc 09-Mar-2021 11.04 AmDokumen18 halamanNew Doc 09-Mar-2021 11.04 AmBhavana Patil JangaleBelum ada peringkat

- Accountency - Not For Profit OrganisationDokumen63 halamanAccountency - Not For Profit OrganisationApollo Institute of Hospital Administration67% (3)

- Chapter 01 - Introductory To Mergers and AcquisitionsDokumen10 halamanChapter 01 - Introductory To Mergers and AcquisitionsSom DasBelum ada peringkat

- Portfolio Management: Suggested Answers and Examiner's CommentsDokumen15 halamanPortfolio Management: Suggested Answers and Examiner's CommentsBhavana Patil JangaleBelum ada peringkat

- 4-Ch. (Reconstitution of Partnership (Version.-3)Dokumen51 halaman4-Ch. (Reconstitution of Partnership (Version.-3)iswarya_nBelum ada peringkat

- 2-Ch. (Partnership Firm-Basic Concepts (Ver.-5)Dokumen51 halaman2-Ch. (Partnership Firm-Basic Concepts (Ver.-5)VP SengarBelum ada peringkat

- Ratio 1Dokumen2 halamanRatio 1Bhavana Patil JangaleBelum ada peringkat

- Mutual FundsDokumen44 halamanMutual FundsAmita GargBelum ada peringkat

- Gross v. Shearson Lehman, 4th Cir. (2002)Dokumen10 halamanGross v. Shearson Lehman, 4th Cir. (2002)Scribd Government DocsBelum ada peringkat

- SalnDokumen2 halamanSalnAira Castillano CuevasBelum ada peringkat

- Coffee Shop Business Plan - Amit BhargavDokumen20 halamanCoffee Shop Business Plan - Amit BhargavAmit Bhargav100% (1)

- Barclays A Guide To MBS ReportsDokumen33 halamanBarclays A Guide To MBS ReportsguliguruBelum ada peringkat

- ch03 Part10Dokumen6 halamanch03 Part10Sergio HoffmanBelum ada peringkat

- Consult Creative Sector Tax Reliefs 180612Dokumen58 halamanConsult Creative Sector Tax Reliefs 180612aerfall232Belum ada peringkat

- Depository SystemDokumen13 halamanDepository SystemAdityaBelum ada peringkat

- Taxation of Corporate IncomeDokumen22 halamanTaxation of Corporate IncomeBendyBelum ada peringkat

- Professor Steve Markoff Preparation Assignment For Class #1: Fundamentals of AccountingDokumen4 halamanProfessor Steve Markoff Preparation Assignment For Class #1: Fundamentals of Accountinganon_733987828Belum ada peringkat

- Eureka Forbes Limited: Your Friend For LifeDokumen7 halamanEureka Forbes Limited: Your Friend For Lifeastha mittalBelum ada peringkat

- Stanaford V Genevese Et Al - Second Amended Class Action ComplaintDokumen55 halamanStanaford V Genevese Et Al - Second Amended Class Action ComplaintSam E. AntarBelum ada peringkat

- Bit CoinDokumen19 halamanBit Coinusama naveedBelum ada peringkat

- Ib Club Careers - Interview Tips PDFDokumen9 halamanIb Club Careers - Interview Tips PDFqcrvtbBelum ada peringkat

- Chaitanya Chemicals - Capital Structure - 2018Dokumen82 halamanChaitanya Chemicals - Capital Structure - 2018maheshfbBelum ada peringkat

- Macro Qch2Dokumen12 halamanMacro Qch2Yrence OliveBelum ada peringkat

- Trowers & Hamlins, Bulletin - Islamic Finance - IIFM MCM Agreement (November 2014)Dokumen2 halamanTrowers & Hamlins, Bulletin - Islamic Finance - IIFM MCM Agreement (November 2014)karim meddebBelum ada peringkat

- Practice Examination in Auditing ProblemsDokumen11 halamanPractice Examination in Auditing ProblemsAnonymous EgTu8E6OBelum ada peringkat

- Linear Tech Dividend PolicyDokumen25 halamanLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Branding & Priority BankingDokumen42 halamanBranding & Priority BankingGAUTAM BUCHHABelum ada peringkat

- NRDC Consolidated Coal Renewable Database 2017Dokumen38 halamanNRDC Consolidated Coal Renewable Database 2017Yan LaksanaBelum ada peringkat

- Chapter 8 Computation of Total Income and Tax PayableDokumen8 halamanChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurBelum ada peringkat

- Financial TableDokumen9 halamanFinancial Tableapi-299265916Belum ada peringkat

- Hedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersDokumen184 halamanHedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersHedge Clippers100% (2)

- Corpo ReviewerDokumen62 halamanCorpo ReviewerLorelie Sakiwat VargasBelum ada peringkat

- 4 Socioeconomic Impact AnalysisDokumen13 halaman4 Socioeconomic Impact AnalysisAnabel Marinda TulihBelum ada peringkat

- PitchBook 2H 2014 VC Valuations and Trends ReportDokumen16 halamanPitchBook 2H 2014 VC Valuations and Trends ReportsunnypankajBelum ada peringkat

- Oracle Fixed Asset RetirementsDokumen31 halamanOracle Fixed Asset RetirementsPeter MakramBelum ada peringkat

- Model Test Series-A: 2 National Certification Examination 2005 FOR Energy Managers and Energy AuditorsDokumen14 halamanModel Test Series-A: 2 National Certification Examination 2005 FOR Energy Managers and Energy AuditorsGokul VkBelum ada peringkat