Cityam 2012-06-14

Diunggah oleh

City A.M.Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cityam 2012-06-14

Diunggah oleh

City A.M.Hak Cipta:

Format Tersedia

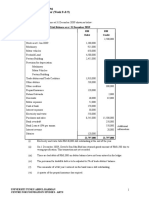

PREMIER LEAGUE BROADCASTING REVENUE

91/92 03/04 04/05 06/07 05/06 07/08 09/10 11/12 12/13 10/11 13/14

750

1,000

1,250

0

250

500

1,500

1,750

2,000

2,250

2,500

m

Estimated

BT

BT promoted to top

tier as price for live

rights jumps 70pc

The Cranfield MBA and Executive MBA

Cranfield School of Management has a global alumni network of over 15,000 members in over 120 countries, including business leaders such as

Alex Burns, CEO of Williams F1, Karan Bilimoria, founder of Cobra Beer, Sarah Willingham, restaurant entrepreneur, and Antony Jenkins,

CEO of Barclays Retail and Business Banking.

We have the most satisfied MBA graduates according to Forbes ranking of non-US business schools. www.cranfieldMBA.info/city

Come and meet us - 18.30,Wednesday 20 June, Church House Conference Centre, SW1

Rosen called

to resign on

WPP failure

INVESTORS are calling for Jeffrey

Rosen, the chairman of WPPs

compensation committee, to pay

the price for the advertising

giants embarrassment at its

annual general meeting yesterday.

The companys remuneration

report, which handed chief

executive Sir Martin Sorrell a 60

per cent pay rise last year, was

rejected by a whopping 59.5 per

cent of WPPs shareholders.

While a majority of 78 per cent

voted to re-elect Rosen, some

shareholders are demanding the

pay committee chairman holds

his hands up and steps down

from his position.

The option not to do anything,

in Rosens case, is just not on the

table, Abigail Herron, corporate

governance manager at WPP

shareholder Cooperative Asset

Management told City A.M.

He needs to be seen

demonstrating that this is not

going to be a repeat of last year,

when there was a high level of

shareholder dissent but no action

from WPP, she said.

Chairman Philip

Lader said WPP

will move

forward in the

best interests of

share owners.

BT shot into the lucrative world of

Premier League football yesterday,

splashing out 738m to share domes-

tic rights with BSkyB as the cost of

broadcasting live games rocketed by

an eye-watering 70 per cent.

Fierce competition for the rights,

believed to have involved channels

such as Al Jazeera and current holders

ESPN, saw the price of the three year

package jump to 3.018bn a huge rise

from its previous level of 1.78bn.

Sky will televise 166 Premier League

games in the UK throughout the new

round, which starts in August 2013

and ends in May 2016, paying an

astonishing 2.28bn to remain the

primary broadcaster.

Yet BTs move for 38 games over

three seasons reflects the increasing

rivalry that the News Corporation

controlled company faces for its dom-

ination of football coverage.

We are already investing 2.5bn in

fibre broadband, BTs chief executive

Ian Livingston said last night.

Securing Premier League rights fits

naturally with this, as consumers

increasingly want to buy their broad-

band and entertainment services

from a single provider.

The company sought to reassure

fans that it will talk to other media

providers so that games are made as

widely available as possible.

The result means that next season

could be the last in which ESPN

broadcasts live Premier League games

in the UK, although Premier League

CEO Richard Scudamore said he

hoped the firm would return to the

bidding table for future years.

The bid-

ding round

only included

games to be

shown live in the

UK. The rights for high-

lights programmes last fetched

179.7m, while the Premier League

also sells rights to broadcast games

abroad. The auctions for foreign cov-

erage of Premier League games from

2013-14 to 2015-16 begins this

September and lasts several months.

BY LAUREN DAVIDSON

FTSE 100 5,483.81 +10.07 DOW 12,496.38 -77.42 NASDAQ 2818.61 -24.46 /$ 1.55 unc / 1.23 -0.01 /$ 1.26 -0.01

MORE: Page 7

BUSINESS WITH PERSONALITY

LONDON2012

days to go

OUR GUIDE TO APPLES REVOLUTIONARY NEW LAPTOPS

See Page 22

43

www.cityam.com FREE ISSUE 1,652 THURSDAY 14 JUNE 2012

SPAIN DOWNGRADED

Certified Distribution

02/04/2012 till 29/04/2012 is 100,668

Sky

2.3bn

Total

738m

BTs bid secured the firm 18

first picks, ensuring that nearly

half of their 38 games should be big

clashes featuring the top sides.

BT will be able to show games

played at lunchtime on Saturdays

(usually 12.45pm) as well as a cluster

of matches on midweek evenings and

Bank holidays.

Yet Sky retains the vast majority of

the deal. All Sunday Premier League

games will be on Sky, as well as late

kicks offs on Saturdays and Mondays.

Jeremy Darroch, CEO

of Sky (right)

and BT boss Ian

Livingston (left)

60 per cent rejected

Sorrells pay deal

BY JULIAN HARRIS

70%

JUMP IN COST

3.018bn

MOODYS SLASHES CREDIT RATING AS CRISIS WORSENS

PREMIERLEAGUES

3BNTV BONANZA

15m

The Premier League's

opening season, TV

revenue

For 2013-14

to 2015-16

Now could hit 2bn

See Pages 2, 4-5,

The Forum Page 19

D

E

L

O

I

T

T

E

S

P

O

R

T

S

B

U

S

I

N

E

S

S

G

R

O

U

P

allister.heath@cityam.com

Follow me on Twitter: @allisterheath

IN BRIEF

Man United drops Asia IPO for US

nManchester United, the world's best-

supported football club, has ditched its

plans for an Asian stock market flotation

and is preparing to list in the United

States, according to sources with

knowledge of the deal. After first eyeing

a Hong Kong IPO, the Premier League

runners up, owned by the Glazer family,

had planned a $1bn listing in Singapore

in the second half of last year before

putting plans on hold because of market

turmoil. The US listing would come

either on the New York Stock Exchange

or its electronic rival Nasdaq. Credit

Suisse, JPMorgan Chase & Co, and

Morgan Stanley, which were part of the

original syndicate, are still working with

Manchester United, according to two

sources with knowledge of the situation.

Jefferies Group, which was not part of

the original syndicate, is talking to the

company about being added to the

group, according to one of the sources.

Blankfein: Goldman is job for life

n The chief executive and chairman of

Goldman Sachs said yesterday he has no

plans to relinquish his duties running the

bank. Speaking to reporters after a

breakfast appearance in Chicago, Lloyd

Blankfein quipped: I'm 57. What am I

going to do with the other 60 years of

my life? Blankfein said five of his

predecessors left Goldman for jobs with

the government, and six died while still

heading the firm.

Given Goldmans unpopularity on Main

Street, Blankfein said: I'd say the

government probably isn't going to call

me ... so that leaves staying forever and

dying at my desk.

Osborne eyes change of

strategy to boost liquidity

GEORGE Osborne is expected to use

tonights Mansion House speech to

reveal a new strategy aimed at boost-

ing liquidity in the banking system.

The chancellors attempt to ease

the credit logjam comes as both

companies and households continue

to struggle to access finance.

The move follows Bank of England

deputy governor Paul Tuckers

acknowledgement on Tuesday that

it needed to do more to alleviate

tight credit conditions.

In the same speech, Osborne will

also tell the City that he intends to

press ahead with plans to ring-fence

retail banking and give savers greater

protection if a lender collapses.

The reforms laid out by the Vickers

commission, come despite months

of wrangling with the EU as well as

domestic fears of a multi-billion

pound cost to banks.

Only small banks will be spared the

ring-fence but the overseas opera-

tions of banks which do not pose a

threat to financial stability will

escape being forced to hold an addi-

tional loss-absorbing buffer.

Osborne is expected to say: Weve

got to stop problems here in the City

of London spilling onto our high

streets and putting taxpayers

money at risk.

High-street banking will be ring-

Banks bow to EU bonus limit

Bankers bonuses across the European

Union are set to be limited by law, with

many bank lobbyists admitting in private

that they have lost the fight against a

European Parliament initiative to limit the

size of bonuses relative to salary. Some

banks still hope to increase the proposed

ratio from 1:1 to 2:1 or beyond, while

others are trying to limit the restriction to

upfront cash bonuses, excluding deferred

payouts. But many bankers now accept

the principle of a ratio as inevitable.

Companies vent at Olympic gag

Ministers are under growing pressure from

companies, frustrated that they are unable

to shout about their involvement in

creating this summers Olympics. They

want the government to relax strict rules

drawn up by the International Olympic

Committee to protect the official sponsors.

France seeks stability package

France is pressing the EU to adopt a

financial stability package to stem the

eurozone crisis, believing negative market

reaction to the 100bn bailout of Spains

banks shows the need for more

comprehensive action.

Sub-sea cable business to float

The Indian telecoms group controlled by

Anil Ambani is set to spin off its subsea

cable business in a deal that could fetch

as much as $1bn. Reliance Comms said

yesterday it had been granted approval to

pursue an IPO for the business on the

Singapore stock exchange.

Drugs deal for London company

Proximagen, a biotechnology business

agreed yesterday to a buyout by Upsher-

Smith Laboratories, a specialist in

neurological medicines, for up to 357m.

Germany signals shift on Europe

redemption fund

The German government has begun

opening the door to shared debts for the

first time in a profound change of policy,

agreeing to explore proposals for a 2.3

trillion stabilisation fund in order to stop the

eurozones crisis escalating out of control.

Oil price could plunge to $50

The oil price could almost halve later this

year if the crisis in the Eurozone escalates,

Credit Suisse believes.

Esprits chairman steps down

Esprit Holdings chairman stepped down

yesterday, a day after its chief executive

said he would resign and less than a year

after the fashion retailer embarked on a

plan to revitalise its fading brand.

GM plans to close German factory

General Motors troubled European unit

Adam Opel plans to stop producing cars

after 2016 at its plant in Bochum,

Germany, signaling the first closing of a

major German auto factory since World

War II.

WHAT THE OTHER PAPERS SAY THIS MORNING

CULTURE secretary Jeremy Hunt

yesterday survived a crunch House

of Commons vote on his future by a

narrow margin of 290 to 252,

following a major operation by

Conservative whips.

Labour had forced a vote on

whether Hunt should be

investigated for breaches of the

ministerial code in relation to his

handling of the BSkyB takeover.

But Nick Cleggs decision to

order Lib Dems to abstain on the

issue meant Conservatives were

forced to travel from all over the

country to shore up support for

their beleaguered colleague. Tory

MP Justin Tomlinson even cut short

his honeymoon in the Mauritius

after being called to vote, thanking

his very understanding wife.

During a fiery debate Labour MP

Chris Bryant pushed parliamentary

protocol to its limits by directly

calling Hunt a liar, on the basis

that it was the subject of the

motion. But Hunt successfully

rebuffed accusations he had

purposely lied to parliament,

calling the allegations

disgraceful.

Earlier Labour leader Ed

Miliband said the issue was about

the prime ministers judgment,

which is so badly flawed even his

deputy won't support him.

Jeremy Hunt

survives crunch

ministerial vote

George Osborne expects banks to comply with his ring-fencing plans by 2019

2

NEWS

BY JAMES WATERSON

BY PETER EDWARDS

To contact the newsdesk email news@cityam.com

C

OULD Brussels have been taken

over by saboteurs, a secret army

of eurosceptic infiltrators and

spies masquerading as officials?

I only ask because it now almost

seems as if Spains bailout was delib-

erately designed not merely to fail but

to inflict maximum damage on the

Spanish economy and the entire

Eurozone. Rarely have I seen such

incompetence. Last nights decision

by Moodys to downgrade Spain

another three notches it is now just

higher than junk was made for sev-

eral reasons but the first, ironically,

was the bailout itself, which in reality

was merely a soft 100bn loan to the

already increasingly indebted Madrid

government. This will further

increase the countrys debt burden,

which has risen dramatically since

the onset of the financial crisis, as

Moodys put it. So there you go: the

EDITORS

LETTER

ALLISTER HEATH

It is clear that the Eurozone can no longer do anything right

THURSDAY 14 JUNE 2012

bailout was so damaging that it

might actually precipitate the need

for another bailout. Rarely has public

policy been so counter-productive; in

the old days, the law of unintended

consequences used to take many

years before it manifested itself. Now

it just takes a few days before it

becomes clear to all and sundry that

bailouts have achieved the opposite of

what they intended. As to Spain,

Moodys is warning that it could be

cut to junk within three months

time. Such a move would trigger

more chaos, including haircuts.

Meanwhile, France, Germany and

other conflicting sources of power

and influence within the EU keep

making contradictory statements it

is almost impossible to decipher

Germanys comments in particular at

the moment. So what next? More

bailouts, presumably, until the cash

runs out. Cyprus could come soon. It

was also downgraded last night; its

economy is inextricably linked to

Greeces, which faces a major turning

point at the weekend when it decides

whether to back pro or anti austerity

parties. An election of the latter

would trigger almost certain default

and Grexit. We shall soon find out.

SHAREHOLDER SPRING

Im thoroughly enjoying the share-

holder spring. It is good to see the

a pay rise. For a start, one needs to

look at a shares total return, which

includes the dividend, but that is only

truly relevant over longer periods of

time, thanks to compounding.

The main issue is that the same peo-

ple who rant against excessive short-

termism in markets are often guilty

of falling into the same trap when

looking at a CEOs performance, espe-

cially in times of falling share prices,

which bolsters their case. As long as a

firms financial performance, proper-

ly measured, has been good, it should-

nt matter too much whether a share

price has dipped for a few quarters.

The converse is also true: a higher

share price should not in of itself suf-

fice to trigger a pay hike. Life is more

complicated than that.

owners of companies finally exercis-

ing their proprietorial rights and

duties. This is not about equality, class

war or fighting high pay, as some

observers would have us believe this

is a profoundly capitalist revolution,

with those who put up capital

attempting to regain control and

ensuring that high pay only goes

hand in hand with high levels of per-

formance. Bosses of publically traded

companies are employees not own-

ers regardless of whether they actu-

ally founded the firm they run. But

while it is right for shareholders to

crack down on rewards for failure,

and to make sure that even successful

bosses arent engaging in gratuitous

pay hikes, some arguments being

used by the discontents are flawed. It

makes no sense to take a companys

share price for a year and to use that

to determine whether a CEO deserves

fenced so that taxpayers are better pro-

tected when things go wrong. We will

be able to bail in creditors when a bank

fails rather than turning to the public

purse.

Osborne is persisting with controver-

sial plans to rank the rights of individ-

ual depositors above bondholders and

corporate creditors in the event of a

bank failure.

The Treasury will today publish a

white paper with a high and flexible

ring-fence between retail and invest-

ment banking. The division is set to

include equity and governance restric-

tions and a small amount of flexibility

inside the ring-fence for simple hedg-

ing tools where they are part of the

normal corporate banking set-up for

small business. The paper should also

confirm the details of plans to make it

easier for consumers to switch their

bank account provider.

Under the new system the Bank of

England and the Financial Services

Authority will publish reviews on how

prudential standards and conduct

requirements can act as a barrier to

market entry.

DEBATE: Page 19

THE FORUM: Page 18

The new jobs website for London professionals

CITYAMCAREERS.com

BRITAINS top tax officials were justi-

fied in making secret deals worth bil-

lions of pounds with major five major

corporates, a report says today.

HM Revenue & Customs achieved a

good outcome for the public purse

by resolving a series of long-running

disputes with the five unnamed firms

but was criticised for bypassing prop-

er governance procedures over the so-

called sweetheart deals.

The report, produced by the

National Audit Office, found the deals

were reasonable and that one may

have been better than reasonable.

The identity of the companies which

agreed the deals was not revealed but

they are believed to include Vodafone

and Goldman Sachs.

The NAO said the large tax

settlements were complex

and admitted: There is no

clear answer as to what rep-

resents the right tax liabili-

ty. The report was

commissioned after a review

into the deals by former

High Court judge

Sir Andrew Park.

HMRC was criti-

cised, however,

for failing to act

Auditor backs

HMRC tax deals

with Goldman

BY PETER EDWARDS on the concerns of its own specialist

staff over tax disputes. It did not

always keep notes of key meetings at

which the terms of settlements were

agreed with companies.

Specialist staff were sometimes

excluded from the final settlement

negotiations and the department did

not always ensure that these staff

involved understood the reasons for

settlement, the NAO said.

Margaret Hodge, chairman of the

public accounts committee said the

report confirmed concerns about the

uncontrolled way HMRC agreed

secret deals.

Vodafone said it welcomed the

report. Goldman said it takes its

responsibilities as a taxpayer very

seriously, adding: The settlement

covered matters dating back over a

decade and in the last 10 years

Goldman Sachs and its employees

have paid over 10bn in taxes to the

UK Revenue.

Separately campaign group UK

Uncut Legal Action has won permis-

sion from a High Court judge to chal-

lenge a deal between HMRC and

Goldman. It claims the bank was

let off paying 20m.

Jamie Dimon blames $2bn loss

on management chain failure

JPMORGAN Chase chief executive

Jamie Dimon used his much

anticipated appearance before

lawmakers to apologise for the

banks multi-billion dollar trading

loss but made clear he will still

criticise how Washington tries to

curb Wall Street.

The Senate Banking Committee

scheduled the hearing to grill

Dimon on how a hedging strategy

in a seemingly low-risk London

office morphed into a complex bet

BY HARRY BANKS that has produced at least $2bn

(1.28bn) in losses.

Asked if he had approved the

trading strategy, Dimon said, No. I

was aware of it, but I did not

approve it.

Dimon told the committee that

people throughout his

management chain of command

had failed. You can blame it on

anyone in that chain, he said.

He told senators the trades

started as a genuine hedge that

would make the firm a lot of money

if a credit crisis hit. What it

morphed into, I will not try to

defend, he added.

But Dimon said Washington must

not overreact to JPMorgans trading

loss and tighten new rules so much

that it hurts financial markets.

Dimon, confident and amiable

through most of yesterdays

hearing, appeared angry only

briefly in an exchange with a

senator over whether JPMorgan

needed taxpayer assistance during

the 2007-2009 financial crisis.

Shares of JPMorgan, the largest

US bank by assets, rose 1.6 per cent. Dimon said he was aware of the trading strategy but he had not approved it

Margaret Hodge raised

questions over HMRC officials

THE GOVERNMENT was last night

struggling to reaffirm its

commitment to the controversial

High Speed Two (HS2) railway

project following a claim that it

has been quietly dropped.

An anonymous Conservative

minister quoted in todays edition

of The Spectator is reported to

have said: The project is

effectively dead. The only thing

keeping it on life support is David

Camerons backing.

Coalition claims that it is still

committed to High Speed Two

BY JAMES WATERSON

Yesterday Cameron refused to

rule out a third runway at

Heathrow, seen as an alternative

project to HS2. At Prime Ministers

Questions he said the government

must not be blind to the

question of expanding airport

capacity and that it is important

to ensure Heathrow operates

better. But he also added that he

is keen to press ahead with HS2.

A Department for Transport

spokesman claimed last night:

The governments commitment

to HS2 has not changed.

THURSDAY 14 JUNE 2012

3

NEWS

cityam.com

BUNDESBANK claims on the

Eurosystem soared in the past six

months as investors pulled cash out

of weak economies and poured it

into Germany, new data has

revealed, leaving the central bank

and so German taxpayers heavily

exposed to the weaker economies.

The German central banks

exposure to the Target2 payments

system stood at 698.6bn (565.6bn)

at the end of May, up from 495.2bn

six months ago.

The exposure arises through inter-

bank transfers of cash flowing into

Germany, which leaves the

Bundesbank with claims against the

European Central Bank (ECB), and

the ECB with claims on other central

banks, and from the ECB pumping

liquidity into banks.

If the Eurozone broke up, that

could leave the German bank out of

pocket, as the leaving countries may

not honour their debts to the ECB.

To cover that cost, the German

government could issue debt to

recapitalise the ECB, said Simon

Ward from Henderson, or the ECB

could lend the money to recapitalise

the system, resulting in higher

inflation. Either way, the German

taxpayer loses out.

However, ECB boss Mario Draghi

has denied the exposures are a

problem, as the ECB takes collateral

in exchange for providing liquidity.

German central

bank exposed

to Greek exit

BY TIM WALLACE

STRUGGLING Eurozone members

Spain and Cyprus both saw their cred-

it ratings slashed last night as

Moodys warned that they had been

effectively shut out of international

markets.

Spains government bond rating

was cut to just one notch above junk

status to Baa3 from A3 with

Moodys saying its banking bailout

would take years to recover from.

The credit rating agency, which

said it could still lower Spains

rating further, cited a triple

whammy of its up to 100bn

banking bailout, very limited

access to international debt markets

and the weakness of its economy for

the move.

Moodys decision follows that of

rival Fitch which cut Spains rating

by three notches to BBB last week.

Moodys also cut its credit rating

on Cyprus sovereign debt by two

notches last night, citing rising risks

of a Greek exit from the euro

currency and the expected support

the government will have to give to

its ailing banks.

Both Spain and

Cyprus see their

ratings slashed

BY KATIE HOPE

Moodys rating cut, to Ba3 from

Ba1, is based on the assumption that

Cyprus will need to provide support

to its banks in excess of a prior

estimates of five to 10 per cent of

GDP.

Fears over a euro exit by Greece

could lead to faster withdrawals of

deposits from Cypriot banks Greek

branches, thereby straining liquidity,

Moodys said.

The rating cut came as Cyprus

yesterday indicated it is looking to

Russia and China as well as Europe

for the best possible bailout terms.

Speculation is mounting that an

international bailout for Cyprus is

imminent, with it seeking as much

as 4bn over a fifth of its economy.

Deputy Europe minister Andreas

Mavroyiannis said yesterday that

1.8bn was needed within the next

few weeks to recapitalise Cyprus

Popular Bank but that other banks

may need money too. He said Cyprus

would borrow a maximum of 4bn.

The country is seeking ways to

avoid tapping the EU because of

what Mavroyiannis described as the

negative connotation that comes

with it.

European Central Bank boss Mario Draghi denies the systems imbalances are a worry

THURSDAY 14 JUNE 2012

4

EUROZONE CRISIS

cityam.com

Q

How did this exposure arise?

A

When money is transferred from

a bank in Greece to a bank in

Germany through the Target2

payments system, the Bundesbank

creates the money in the account. It

is owed that amount by the

European Central Bank until such

time as it can be retrieved from

Greeces central bank.

Q

What happens if Greece leaves the

Eurozone?

A

The Greek central bank will not

pay up, leaving the Target2 system

and ECB with a shortfall. The gap

will then have to be paid by the

ECBs shareholders the largest of

which is the Bundesbank. That can

be funded either by the German

government borrowing money to

recapitalise the system, or the ECB

lending the cash, which would

monetise the shortfall, boosting

inflation. Either way, the German

taxpayer will have to take the hit.

Q

Can Germany stop their exposure rising?

A

No. It is unlikely that exposures to

Greece can rise much further its

banks have very little money left.

However, the inflows are also

coming from Spain and Italy, which

have a lot more cash.

Q

A

and

Where did this 698bn

exposure come from?

ITALYS borrowing costs jumped again

yesterday as the sovereign debt crisis

continued, while official data showed

industrial output plunging across the

Eurozone, underlining the crippling

impact on the real economy.

Prime Minister Mario Monti came

under pressure from MPs who

demanded he slow down his austerity

programme, asking him to borrow

more in an effort to boost short-term

economic growth.

The leader of the Democratic Left

party told Monti he should consider

pushing back its structural balanced

budget target, which is currently set

for next year.

Meanwhile Angelino Alfano from

the People of Liberty bloc said he will

continue to support Monti as long as

he tells German leader Angela Merkel

there may be a negative reaction if

she does not allow governments to

spend more.

However, German finance minister

Wolfgang Schauble defended the

unelected PM, saying If Italy contin-

ues along Montis path there will be

no risks, while Monti himself instead

called for more taxes, arguing it may

BY TIM WALLACE

make sense to impose a financial

transactions tax across the whole EU.

Markets put more downward pres-

sure on spending, charging the gov-

ernment 3.972 per cent to borrow

6.5bn (5.3bn) for one year up from

2.34 per cent a month ago.

In contrast, the US continued to ben-

efit from the flood of cash leaving

troubled Eurozone governments, with

its 10-year borrowing costs falling to a

new record low of 1.622 per cent.

Meanwhile new data showed

Eurozone industrial output as 2.3 per

cent lower in April than in the same

month of 2011.

Italy led the fall with a 9.2 per cent

collapse, followed by an 8.3 per cent

fall in Spain.

Greek outflows rise as analyst

calls voters complacent on euro

IF GREEKS realised the terrible state

of their countrys banks and

understood the risks of a Eurozone

exit, the flow of deposits from

banks would become much worse, a

top analyst claimed yesterday.

Deposits are already down 30 per

cent from their peak, falling by

between 6bn (4.9bn) and 7bn in

May, with the outflow accelerating

to between 500m and 700m per

day this week as the countrys

crucial general election approaches.

But Nomura analyst Lefteris

BY TIM WALLACE

Farmakis warned that Greek

depositors have yet to understand

the risks they are running by

keeping their money in the banks.

A large proportion of the

population are ignorant or

complacent or both about the

potential for a euro exit and the

consequent predicament for the

banking sector, he said.

However, there are not many safe

places other than banks to keep your

money if you dont have the luxury

of a bank account abroad, while the

fact that around 60 per cent of the

total are time deposits may have also

helped on the margin. Finally, many

people still do not think a euro exit

is possible.

IN BRIEF

European MPs back new powers

n European ministers yesterday backed

new powers for the EU executive to

exercise control over national budgets and

urge struggling countries to take a bailout.

The ministers agreement is necessary for

the new powers to become binding, but

negotiations will take months. If accepted,

the commission would be able to prepare a

proposal for ministers to recommend that

a Eurozone government ask for emergency

funding if its financial or problems

threatened the Eurozone as a whole.

Credit Agricoles Emporiki in focus

n French bank Credit Agricole is

considering walking away from its

troubled Greek Emporiki Bank unit and

letting it fail, according to the Wall Street

Journal. Another option under

consideration is for Credit Agricole to

merge Emporiki into a larger

conglomerate of Greek banks in which the

French lender's stake would be diluted to

about 10 per cent, the paper said. Credit

Agricole declined to comment.

One Spanish bank could close

n Spain may need to wind down one of

its bailed-out savings banks, the European

Union's competition chief said yesterday,

warning liquidation of a bank may be

preferable if the costs of rescuing it are too

high for taxpayers. The European

Commission is allowed to refuse a request

to rescue a bank if it considers the lender

too costly to save. Spain is awaiting final

approval from the European Commission

for the restructuring plan for three banks

rescued by the state: NCG Banco,

Catalunya Caixa and Banco de Valencia.

ANGELA MERKELS government failed to resolve a row with opposition parties

yesterday, holding up parliamentary ratification of both the EU's new fiscal treaty and

the Eurozones permanent rescue fund. Talks will resume next week.

MERKEL FAILS TO DO FISCAL COMPACT DEAL

Bank deposits have been leaving Greece

Jan04 Jan07 Jan10 Jul 11 Jul 08 Jul 05

260

240

220

200

180

160

140

120

100

bn

Depositsfrom

domesticresidents

Italian one-year borrowing costs hit a six-month high

Jun May Apr

4%

3%

2%

3.972%

THURSDAY 14 JUNE 2012

5

EUROZONE CRISIS

cityam.com

MPs beg Monti

to spend more

as yields soar

Weak US sales

weigh on hope

for recovery

BY CITY A.M. REPORTER

J SAINSBURY crowned itself a Jubilee

winner after chief executive Justin

King said the Queens celebrations

helped the retailer continue to beat

its rivals in the first quarter of 2012.

Like-for-like sales rose 1.4 per cent in

the 12 weeks to 9 June, while total

sales rose 3.8 per cent excluding fuel,

with savvy shoppers continuing to

save in order to splash out on special

occasions like the Jubilee.

But shares slid more than three per

cent yesterday, after sales were shy of

analyst forecasts and King refused to

reveal how much the Jubilee had

added to his sales.

Were not going to break out indi-

vidual weeks, King said but conced-

ing that it had enjoyed a record week

outside of Christmas in the run-up to

the Jubilee celebrations.

Earlier this week Tesco said it had

added an extra 1bn to sales,

although its like-for-like sales in con-

trast fell 1.5 per cent in the quarter.

If you take the quarter as a whole it

is pretty much like for like in terms of

good news and bad news, added

King. The good news of a special

royal occasion, a few weeks of decent

Sainsbury says

it beat rivals

but shares fall

BY KASMIRA JEFFORD

weather, and a few bank holidays, and

the bad news of some challenging and

unseasonable weather.

King defended the slowdown on the

previous quarter, when the supermar-

ket giant saw a like-for-like growth of

2.6 per cent, saying it continued to

beat the market by some margin.

Sainsburys said it was winning mar-

ket share in its core general merchan-

dise and clothing categories, as

non-food sales continued to grow

faster than food. The retailer enjoyed

the strongest ever sales week on

clothing, helped by a new collection

of its Gok for TU womenswear range.

King offered some hope on con-

sumer outlook, pointing to fuel prices

which showed no year-on-year rise.

Grocery industry up

on jubilee weekend

BY LAUREN DAVIDSON

THE DIAMOND jubilee injected a

dose of cheer into the UK grocery

retail industry, boosting sales by an

impressive 12.5 per cent in the week

running up to the festive weekend,

according to insights firm Nielsen.

The successful seven days came

on top of another bumper week,

when grocery sales jumped 5.7 per

cent due to the warm weather and

the launch of the Olympic torch

relay.

The two weeks surpassed the

growth rate earlier in May, when

sales were subdued by the cold and

wet weather.

Overall, May was a month of

better momentum across food

retailing, with the major

supermarkets issuing a deluge of

cash savings and discounts.

Promotional spend remains at 35

per cent of overall basket sales at

the grocery multiples, said Mike

Watkins, Nielsens senior manager

for retailer services.

Justin King said results were in line with expectations

J Sainsbury PLC

13Jun 7Jun 8Jun 11 Jun 12Jun

282.5

285.0

280.0

287.5

290.0

292.5

295.0 p 283.50

13Jun

Sainsburys rise in sales was steady but shy of expectations, with the

shares reecting a tinge of disappointment... The numbers were boosted by

including the Jubilee weekend, unlike Tesco, and progress in clothing

and online remained notably strong.

ANALYST VIEWS

Sainsbury did continue to outperform the market and its same store

sales are around three per cent ahead of its key rival Tesco. But Sainsburys dif-

ferential over Tesco may be starting to narrow and it is noteworthy that

this statement included the Queens Diamond Jubilee.

A very slightly below consensus for Sainsbury but, in truth, this is a

decent like-for-like sales performance, given the awful weather in April. We

remain buyers with a target price of 350p.

DID SAINSBURYS RESULTS

DISAPPOINT?

Interviews by Kasmira Jefford

RICHARD HUNTER HARGREAVES LANSDOWNE

CLIVE BLACK SHORE CAPITAL

PHILIP DORGAN PANMURE GORDON

THURSDAY 14 JUNE 2012

6

NEWS

cityam.com

Book your once-in-a-lifetime experience now

Call: 0844 879 8507

Click: www.thomascooklondon2012.com/city

Visit: 800 stores nationwide

*Price is per person based on two people sharing a twin or double room. All bookings are subject to availability. Terms and conditions apply.

Thomas Cook still has guaranteed

luxury hotel and category A

tickets to the Opening Ceremony

of the London 2012 Olympic

Games. Including two nights

accommodation at a 5 star

central London hotel, breakfast,

accredited coach travel, dining

at a London restaurant and the

services of a Programme Manager.

Opening Ceremony

& 5* Hotel

From 4999pp*

A once-in-a-lifetime

opportunity to be

at the London 2012

Opening Ceremony

A once-in-a-lifetime

oppor

A once-in-a-lifetime

y to be tunit oppor

A once-in-a-lifetime

y to be

oppor

at the

Opening Cer

y to be tunit oppor

the London 2

Opening Cer

y to be

012 London 2

emony rre

Thomas Cook still has guaranteed

luxury hotel and category A

tickets to the Opening Cer

of the London 2012 Olympic

Games. Including two nights

accommodation at a 5 star

Thomas Cook still has guaranteed

luxury hotel and category A

emo ets to the Opening Cer re

of the London 2012 Olympic

Games. Including two nights

accommodation at a 5 star

Thomas Cook still has guaranteed

emony

central London hotel, br

accr

at a London r

services of a Pr

Opening Cer

& 5* Hotel

o Fro

eakfas tral London hotel, br re

edited coach travel, dining rre

estaurant and the London r re

ogramme Mana vices of a Pr ro

emony Opening Cer

& 5* Hotel

om 4999pp*

eakfast,

edited coach travel, dining

estaurant and the

. ager r.

emony

o Fro

om 4999pp*

Book your once-in-a-lifetime experience now

Call: 0844 879 8507

Click: .thomascooklondon20 www

isit: V 800 es stor nationwide

Book your once-in-a-lifetime experience now

0844 879 8507

2.com/ 1 .thomascooklondon20 city

nationwide

US RETAIL sales fell for a second

straight month in May and

wholesale prices dropped by the

most in three years, raising chances

of further action by the Federal

Reserve to shore up the recovery.

Retail sales slipped 0.2 per cent as

demand for building materials

sagged and declining gasoline

prices weighed on receipts at

service stations, a Commerce

Department report showed.

DEPUTY Prime Minister Nick Clegg

yesterday backed claims that the

Liberal Democrats were threatened

with negative media coverage in the

hope they would curb their criticism

of Rupert Murdochs bid for BSkyB.

Clegg told the Leveson inquiry

that an executive associated with

News Corporation recommended

the party did not oppose the bid for

BSkyB: [Lib Dem MP] Norman Lamb

was told that it would be good for

the Liberal Democrats to be open to

the bid, otherwise we would expect

no favourable treatment from the

Murdoch press. Norman was quite

agitated about that.

Referring to the first time he met

Rupert Murdoch at a dinner party

in 2009 he said: I was at the very

end of the table where the

children sit, so to speak.

Clegg admitted having lunch

with News Corp lobbyist Fred

Michel in September 2010 but said

it was because their children went

to school together. Even though

Clegg was in government by this

point he insisted they did not

discuss the BSkyB bid at the meal.

Meanwhile Scottish First Minister

Alex Salmond told the inquiry that

he believed journalists from The

Observer had accessed his personal

bank details in 1999.

Clegg claims

Lib Dems were

threatened

BY JAMES WATERSON

HECTOR Sants warned yesterday that

the new Bank of England head will

have an impossible job to do, thanks

to laws passing through parliament

that hand power over financial stabil-

ity and banking supervision to the

governor.

We could be concerned that the

operational task given to the governor

as an individual of course that will

be a new governor by the time the

reforms come into place is

just too great, said the outgo-

ing chief exec of the FSA

watchdog. I think the risk is

that operationally this is

going to be too

difficult for one

person to man-

age.

The plans to

give the gover-

nor extra

responsibilities

have already

been criticised

Sants says new

Bank governor

job is too hard

BY MARION DAKERS

by the Labour party, with shadow

chancellor Ed Balls and predecessor

Alistair Darling saying the new boss

needs to be superhuman to fulfil his

duties.

Sants also claimed yesterday that the

bank run on Northern Rock could

have been prevented if the Bank of

England had taken his advice.

He said it was a pity that the Bank

refused to help Lloyds to buy strug-

gling Northern Rock in 2008.

I think that would have made a dif-

ference, it would have avoided the

queues at Northern Rock and it would

have changed the general climate in

relation to the old building society sec-

tor that had moved into the banking

sector, he told the BBC in an inter-

view.

Sants also argued that UK

banks are hoarding cash because

of market pressures, rather than

due to regulatory burdens as the

firms themselves have claimed.

WPP directors suffer

after drawn out row

WHILE the strongest and least

surprising shareholder revolt was

directed at Sir Martin Sorrells pay

package yesterday, WPPs directors

did not escape unscathed.

More than a fifth of investors

rejected the re-election of

remuneration committee chair

Jeffrey Rosen and non-executive

directors Ruigang Li and Koichiro

Naganuma, in a further sign of

BY LAUREN DAVIDSON

shareholder discontent with the ad

companys management.

Almost 22 per cent declined to back

Rosens re-election to the board. Lis

position was rejected by 27.8 per

cent of shareholders, while 29.7 per

cent voted against Naganumas

directorship.

Just under 12 per cent of WPPs stake

holders declined to back the re-

election of Philip Lader, the

companys chairman.

Hector Sants is worried the new

Bank boss has an impossible job

INTEREST rate growth on

mortgages steadied in May,

according to Bank of England

figures out yesterday though

economists warned this is likely to

be a temporary and uneven pause

in the long-term rise in rates.

Homeowners with the riskiest

loans saw a jump in rates last

month. Banks and building

societies offering a two-year

mortgage with a 90 per cent loan to

value ratio hiked rates 25 basis

points to 6.04 per cent last month

up from 5.45 per cent in January.

Homeowners with long-term

loans enjoy a rate hike pause

BY MARION DAKERS

But rates on a five-year mortgage

with a 75 per cent loan to value fell

two basis points to 4.27 per cent,

just 11 basis points higher than at

the start of the year.

The average interest rate on cash

ISAs, meanwhile, remained at 0.66

per cent, up just 11 basis points in

the year to date.

With banks yet to pass on fully

their rises in funding costs, this

pause is only likely to be temporary

hence the comments from two

MPC members this week that the

Bank should be thinking about

doing more to alleviate tight credit

conditions, said Capital Economics

chief UK economist Vicky Redwood.

THURSDAY 14 JUNE 2012

7

NEWS

cityam.com

Interest rates on safer mortgages were steady last month under Sir Mervyn Kings watch

JEFFREY ROSEN PHILIP LADER

Former White

House deputy chief

of staff Philip

Lader, now a senior

adviser to Morgan

Stanley, has been

WPP chairman

since 2001. While

he maintained

WPP had exercised

best commercial

judgment and

was acting in the

best interest of

shareholders,

Lader conceded in

the run up to the

general meeting

that the board

would be willing to

reassess Sorrells

pay if shareholders

voiced dissent.

21.8%

voted against

re-election

11.81%

voted against

re-election

Jeffrey Rosen,

chairman of WPPs

compensation

committee, has

faced criticism for

his involvement in

Sorrells pay rise.

Before joining the

WPP board in

2004, Rosen was

at Wasserstein

Perella where he

advised on WPPs

financial

restructuring in

1992 leading

shareholder

advisory group Pirc

to question the pay

chairmans

independence in

his dealings with

the ad company.

A

FTER getting bruised by a

67 per cent revolt over its

remuneration report, Cairn

Energy must be hoping

that Nautical Petroleum has

more biddable shareholders. The

announcement yesterday of an

agreement for Cairn to acquire

the North Sea-focused firm at

450p a share still needs 75 per

cent of Nauticals share owners to

vote in favour if it is to go ahead.

That may have seemed a foregone

conclusion, but the share price of

Nautical ended the day above

460p, while Cairn dipped 1.1 per

cent, indicating the possibility of

a counteroffer.

While the deal has the

support of Nauticals board,

only 8.89 per cent of

shareowners are irrevocably

committed to vote for the

scheme. Another 18.36 per cent

have expressed an intention to

vote for it, but could still have

their heads turned by another

bidder. The Aim-listed firm has

just three shareholders that

declare holdings of over three

per cent, and these only total

23.75 per cent of votes between

them, so there are lots of small

shareholders to win over before

the deal is sealed.

This uncertainty is a sign of

the energy in the North Sea oil

and gas companies at the

moment, where promising but

costly prospects like the Catcher

field are helping to drive

consolidation among a large

number of small players. Cairn

itself already acquired Agora Oil

& Gas for 280m this April, and

between the two would own a 30

per cent stake in Catcher, which

is expect to cost 1bn-1.8bn to

bring onstream.

But thats not to say that the

exploration and production

company is refocusing on the

North Sea. It hopes to use

medium-term revenues from

Catcher and similar discoveries,

where first oil is planned for as

soon as 2015, to fund its

operating focus on frontier

basin explorations in Greenland,

Lebanon and Cyprus. It just has

to hope that Nauticals owners

think this is their best offer.

Marc Sidwell is City A.M.s

managing editor.

SHARES in Aim-listed North Sea explorer

Nautical rocketed 55.16 per cent yesterday

after larger oil firm Cairn made a 414m

bid for the company.

Nauticals shares soared above the 450p

offer price to close at 462p after it

announced the recommended approach,

signalling that investors are eyeing up a

counter-offer.

FTSE 250-listed Cairn plans to acquire

firms to balance out its high-risk and so far

unsuccessful exploration projects in

Greenland. The firm bought Agora Oil &

Gas for $450m in April, pointing to a taste

for the relative stability of the North Sea.

The acquisition will give Cairn access to

near-term sustainable cash-flow to help

fund future activities, said Cairns chief

executive Simon Thomson.

Analysts at Peel Hunt said the deal was

too cheap, wait for more, despite the 51

per cent premium to Nauticals Tuesday

closing price, as the deal fails to give full

value to the firms potential oil deposits.

Other analysts, such as Canaccord

Genuity, said the two firms were a good

fit, and that potential rival bidders are like-

ly to have already studied and discounted

Nautical. Cairn has already secured accept-

ances from investors owning 27.25 per

cent of Nautical shares.

Cairns 414m

approach sends

Nautical soaring

BY MARION DAKERS

CAIRN worked with nancial

adviser Rothschild to make its

bid for Nautical. James Smith, a

long-time adviser to Cairn and

director of Rothschilds oil and

gas team, took the lead.

Smith counts French oil major

Total and Bowleven among his

clients. Rothschild has advised

Cairn Energy on 11 transactions

during the past decade, includ-

ing its $6bn sale of Indian

assets to Vedanta.

Nautical turned to Investec, its

nancial adviser and joint bro-

ker, along with RBC Capital

Markets.

Chris Sim and Neil Elliott led

the team at Investec. The pair,

who moved over with

Evolution at the start of the

year, brought the Nautical

mandate with them. Sim and

Elliott also advise Coal of

Africa, Circle Oil and Afferro

Mining.

Tim Chapman and Matthew

Coakes at RBC act as joint bro-

ker for Nautical.

By Lisa Moravec

ADVISERS CAIRN BID FOR VEDANTA

ROTHSCHILD, INVESTEC AND

RBC CAPITAL MARKETS

THE INTERNETS biggest shake

up is one step closer after the

list of submissions for new

domain names was yesterday

unveiled.

ICANN (Internet Corporation

for Assigned Names and

Numbers) revealed the 1,930

website domains applied for

including .blog, .youtube and

.bbc which will hit the world

wide web from early 2013

alongside the usual websites

ending in .com and .co.uk.

Corporate giants including

Google, Amazon and Apple have

all applied for domain names,

but not all brands were

convinced, with Kelloggs and

Coca Cola refusing to take part.

At a cost of $185,000 (119,000)

to apply, plus a $25,000 annual

renewal charge, the process has

faced criticism from companies

and trade bodies.

Stephen Ewart, marketing

manager at Names.co.uk,

said: Our concern is that

this could lead to more

Facebook-style walled

gardens as big brands

seek to keep you in their

own areas of the internet. It

could be viewed as a silent

privatisation of the web.

But Peter Dengate Thrush,

former ICANN chairman, told

City A.M., This is about running

a piece of the internet

infrastructure. Think of it like

this: everyone wants to fly,

but not everyone needs to

run an airline.

He added: This is the

biggest change there has

ever been for the

internet.

City Hall applied for the

domain name .London and

claims the brand will

create jobs and

deliver business

benefits to the

capital.

BY LAUREN DAVIDSON

Once people get used to it, I

think it will be a good thing for

some firms, as long as its done effective-

ly. Its good for marketing, but I imagine

it will be expensive so many companies

who might want to try it will not be able

to afford it.

These views are those of the individuals above andnot necessarily those of their company

DANE NOAKES

LONDON MARKET DYNAMICS

DO YOU THINK THE NEW DOMAIN NAME RULES WILL BE

GOOD FOR BUSINESS? Interviews by William Orr and Lisa Moravec CITYVIEWS

Cairn chairman Bill Gammell sets his sights on North Sea

Nautical Petroleum PLC

13Jun 7Jun 8Jun 11 Jun 12Jun

300

350

400

450

500 p

462.00

13 Jun

THURSDAY 14 JUNE 2012

8

NEWS

cityam.com

NEW8 FROM THE

CTY OF LONDON

ADVERT8EMENT

The evenl launches Cc|c|ratc tnc Citq. jcur !aqs in tnc Squarc Mi|c

(21 24 }une), vhich fealures an exciling rogramme of moslly

free evenls, including a chamagne 'sun-dovner' on Tover

ridge, aclivilies al lhe arbican Cenlre, family enlerlainmenl al

lhe Cheaside Fayre, nev exhibilions, Cily valks and lalks, and

music in Cily churches.

David Woouon, Lord Mayor of lhe Cily of London and Palron of

Celebrale lhe Cily, said: Cc|c|ratc tnc Citq ui|| |c a ucn!crju|

sncucasc cj cur ucr|!-c|ass arts an! cu|turc, an! | an surc tnat tnc jrcc

ccnccrt ui|| gct it c[ tc a rcusing start!

News, info and offers at www.cityofIondon.gov.uk/eshot

Jnin thc crnwds in Gui!dha!!

Yard (picturcd), EC2, nn

Thursday 21 Junc Irnm 6pm Inr a

Ircc, npcn air pcrInrmancc nI

Tchaiknvsky's thundcrnus 1812

Ovcrturc, pcrInrmcd by

musicians Irnm Gui!dha!! 5chnn!

nI Music & Drama.

Fnr mnrc dctai!s gn tn www.visiuhccity.cn.uk/cu!turc2012

I think that it could be a suc-

cessful marketing strategy, but

only a handful of companies will be able

to afford it, so it could be beneficial for

them. However, it will have little or no

effect on the smaller companies who cant

afford it.

DAMIEN HING

FIRST STATE INVESTMENT

I think a lot of major companies

are happy with their domain

names and if you play around with it, it

could have an effect on your corporate

branding, and so its a dangerous game to

play. As a managing director of a major com-

pany I would be resistant to it.

LES VENUS

THRESHOLD INITIATIVE

Changing face of internet as

list of .brand sites revealed

BOTTOM

LINE

MARC SIDWELL

North Sea energy sparks talk of a counteroffer

Peter Dengate Thrush

led the web reforms

Credit subject to acceptance. Credit is provided by external finance companies as determined by DFS. 4 years interest free credit from date of order. Delivery charges apply. After event prices apply from 11.06.12 - see instore or online for details. Headrest optional extra. Accent

cushions not included unless otherwise stated. Mobile charges may apply when calling 0800 110 5000. DFS is a division of DFS Trading Ltd. Registered in England and Wales No 01735950. Redhouse Interchange, Doncaster, DN6 7NA.

Visit your nearest store, order direct at www.dfs.co.uk or call free on 0800 110 5000 24 hours a day, 7 days a week

4 years interest free credit on everything

Or pay nothing until January 2013 then take 3 years

interest free credit

0

%

REPRESENTATIVE

APR

No deposit with 4 years interest free credit. 48 equal monthly payments of 31.22. Or pay nothing until January 2013 then 36 equal monthly payments of 41.63. 0% APR. Total 1499.

50%

OFF

RIVO COLLECTION

SOFAS

ACTION

CHAISE END SOFA

WITH BED AND STORAGE

HALF PRICE

1499

HEADREST OPTIONAL EXTRA

AFTER EVENT PRICE

2998

31.22

A MONTH

NO DEPOSIT

NO INTEREST

EVER

half price

ends Sunday

RUBICON worked with WH Ireland, its advis-

er since oating on Aim in 2006, during the

acquisition of Fly540. Head of corporate

nance James Joyce led the team alongside

Nick Field.

Joyce, a chartered accountant, is an expert

in the sector and counts Australian carrier

Skywest among his clients, as well as aircraft

leasing companies Aviation PLC and Capital

Lease Aviation.

He previously worked at Arthur Andersen

and the London Stock Exchange, and prior

to joining WH Ireland spent ve years at a

venture capital and corporate advisory rm.

Lonrho was advised by new broker and

adviser Jefferies Hoare Govett, which is

replacing Panmure Gordon.

Managing director Sara Hale is the rms

lead corporate broker, while Michael

Collinson in the consumer investment bank-

ing team is the lead sector banker.

Hale is also on the team that picked up the

broking mandate at potash rm Sirius

Minerals in April, and has advised

Hargreaves Services, Avis and Taylor

Wimpey in recent transactions.

Collinson, who moved to Jefferies from RBS

last year, runs the consumer industries

group of global banking and markets with

Robert Foster.

ADVISERS RUBICONS PURCHASE OF FLY540 FROM LONRHO

JAMES JOYCE

WH IRELAND

Rebekah Brooks bailed after

court date over hacking scandal

REBEKAH Brooks made a

preliminary appearance in a

London court yesterday, accused of

hindering a police investigation

into phone hacking and

corruption by staff at British

tabloids.

A large crowd of photographers

and reporters greeted the arrival

at court of the 44-year-old, a

former editor of both the News of

the World and The Sun.

Brooks is charged with

concealing material from

detectives carrying out a major

BY HARRY BANKS

inquiry into alleged criminal

activities at News International, the

British newspaper arm of Rupert

Murdochs News

Corp where she

was chief

executive until

last year.

Police say

she was

involved in

the removal

of boxes of

archive

records

from its

London

headquarters, concealing material

from detectives, and hiding

documents, computers and other

electronic equipment.

Brooks, her racehorse trainer

husband Charlie, her secretary and

three other staff from News

International face charges of

conspiracy to pervert the course of

justice.

Brooks spoke only to confirm

her address and date of birth

before being granted bail. The cases

of all the defendants were sent to

Southwark Crown Court where the

next hearing will be on 22 June.

Rebekah Brooks is the ex-editor of the

News of the World

THURSDAY 14 JUNE 2012

10

NEWS

cityam.com

The new

jobs website

for London

professionals

T

h

e

n

e

w

j

o

b

s

w

e

b

s

i

t

e

f

o

r

L

o

n

d

o

n

p

r

o

f

e

s

s

i

o

n

a

l

s

C

I

T

Y

A

M

C

A

R

E

E

R

S

.

c

o

m

Network Rail falls short of punctuality targets

DISAPPOINTING train delays, a poor

performance for freight customers,

irate operators but at least there

are fewer rail replacement buses,

said the UK rail watchdog yesterday.

The Office of Rail Regulation

(ORR) said it was very disappointed

by Network Rails customer service

in the last year, as the authority in

charge of Britains train network fell

short of many punctuality goals.

More than a third of train

BY MARION DAKERS

operators were dissatisfied or very

dissatisfied with Network Rail, up

five percentage points, while the

number of customers satisfied or

very satisfied fell by the same

amount to 43 per cent.

The watchdog, which last month

threatened Network Rail with a

record 24m fine if its performance

fails to improve, complained in its

quarterly report that the group needs

to be more proactive.

While Network Rail met targets for

cancellations on regional and long

distance routes, it missed goals for

London and the south east, where 2.4

per cent of journeys were cancelled

or had significant delays.

Network Rail missed its targets for

freight punctuality by some 11 per

cent, but the efforts to improve mean

the ORR wont impose a fine.

On the bright side, the rail authori-

ty has ensured that engineering work

has disrupted fewer journeys than

expected, and has scaled back the use

of rail replacement buses by changing

routes when tracks are closed.

EASYJET founder Sir Stelios Haji-

Ioannous bid to launch a low-cost air-

line in Africa took a step forward

yesterday as his cash shell partner

bought regional carrier Fly540.

Rubicon, the investment vehicle

that started life as a software compa-

ny, paid $85.7m (55m) to take over

Fly540 from Lonrho, the London-list-

ed African conglomerate that spent

six years establishing the airline in

Kenya, Tanzania, Ghana and Angola.

The firm hopes to start operations

under the FastJet brand name and

orange livery within three to four

months of the deal being approved by

investors, said chief executive desig-

nate Ed Winter.

Having Fly540 massively de-risks

our launch, Winter, a former easyJet

executive and founder of no-frills car-

rier Go, told City A.M. Its a small air-

line, with 10 planes, but the potential

for expansion is enormous.

Its the optimum time to develop

low cost air travel in Africa. Its the

last frontier for airlines. Wealth is

being spread across much greater sec-

tions of society, but the road and rail

links remain difficult.

He stressed that FastJet will operate

to European standards, in the wake of

a fatal crash in Nigeria prompting

safety concerns in the industry.

Under yesterdays deal, Stelios takes

a five per cent stake in Rubicon with

Stelios takes a

stake in African

low-cost airline

BY MARION DAKERS

an option for a further 10 per cent,

while Lonrho remains involved with a

73.7 per cent holding in the firm.

Stelios will take a non-executive seat

on the Rubicon board, and has grant-

ed the firm a ten-year licence to use

the FastJet name.

Past experience shows by halving

fares, a successful low-cost carrier can

encourage those people, who have

never previously travelled by air, to

fly, said Stelios yesterday.

Rubicons Richard Blakesley, who

will remain a director at the enlarged

firm, said the purchase of Fly540 fits

his investment firms requirements

for an exciting deal with real growth

opportunities, adding that he looked

forward to an extremely challenging

and rewarding time, and learning

more about the industry.

n Stelios started out working in his

familys shipping business in Greece

n He founded easyJet in 1995, and his

family remains a major shareholder

n His car hire firm easyCar is set to launch

a car-sharing scheme in London this year

n There are also two easyGyms, based in

Wood Green and Slough

n Other projects include DVD rental,

airport bus transfers, pizza delivery,

affordable watches and office space

EASY DOES IT

Stelios will take a five per cent stake in Rubicon, which is launching FastJet

DELL yesterday outlined plans to

slash more than $2bn (1.3bn) in

costs over the next three years,

primarily from the supply chain

and sales group, as it sharpens its

focus on the technology needs of

corporations.

Software and services are a key

growth area, Dell executives told

analysts at a conference in Texas

yesterday. The corporate software

and services business is on track for

average annual growth of 10 per

cent until fiscal 2016, it said.

Dells shares have fallen 15 per

cent in 2012, suppressed by

disappointing quarterly earnings

and fears that mobile devices are

eroding PC spending.

Dell to slash its

costs by $2bn

BY CITY A.M. REPORTER

OPEC is expected to leave its

production ceiling unchanged at

30m barrels a day at todays meeting.

The move is expected despite

Saudi facing pressure from fellow

members of the Organization of the

Petroleum Exporting Countries

(OPEC) group to cut oil output in a

bid to prevent a further slide in

crude prices.

Brent crude traded just over $97 a

barrel yesterday having peaked this

year at $128 in March.

Our policy is to defend the

production ceiling agreed in

December of 30m barrels a day,

said Venezuelan oil minister Rafael

Ramirez.

Oil production

set to stay same

BY KATIE HOPE

Credit subject to acceptance. Credit is provided by external finance companies as determined by DFS. 4 years interest free credit from date of order. Delivery charges apply. After event prices apply from 11.06.12 - see instore or online for details. Headrest optional extra. Accent

cushions not included unless otherwise stated. Mobile charges may apply when calling 0800 110 5000. DFS is a division of DFS Trading Ltd. Registered in England and Wales No 01735950. Redhouse Interchange, Doncaster, DN6 7NA.

Visit your nearest store, order direct at www.dfs.co.uk or call free on 0800 110 5000 24 hours a day, 7 days a week

4 years interest free credit on everything

Or pay nothing until January 2013 then take 3 years

interest free credit

0

%

REPRESENTATIVE

APR

No deposit with 4 years interest free credit. 48 equal monthly payments of 31.22. Or pay nothing until January 2013 then 36 equal monthly payments of 41.63. 0% APR. Total 1499.

50%

OFF

RIVO COLLECTION

SOFAS

ACTION

CHAISE END SOFA

WITH BED AND STORAGE

HALF PRICE

1499

HEADREST OPTIONAL EXTRA

AFTER EVENT PRICE

2998

31.22

A MONTH

NO DEPOSIT

NO INTEREST

EVER

half price

ends Sunday

IN BRIEF

Berwin Leighton Paisner revenue up

City law firm Berwin Leighton Paisner

yesterday announced an eight per cent

rise in revenue for its 2011-2012 financial

year. BLP posted turnover of 246m up

from 229m last year. The firm benefited

from its international presence, with rev-

enues outside the UK up by 45 per cent.

Tillman fights for Croydon store

Allders of Croydon, the department

stored bought by entrepreneur Harold

Tillman in 2005, is in crisis talks with its

landlords to reduce its rent and stave off

administration. Tillman is said to have

requested a rent-free period from its

landlord Jupiter properties, and asked

Croydon Council for a business rates-free

period.

Esprit chairman steps down

Joachim Korber, the chairman of Esprit

Holdings resigned yesterday, dealing a

double blow to the clothing retailer a day

after its chief executive Ronald van der Vis

stepped down in a move that wiped out

nearly a quarter of the companys share

price. The resignations have cast a cloud

over the companys HK$18bn (1.4bn)

restructuring plan and put it on the radar

of private equity buyers.

Seven pc refuse Johnston pay deal

Almost seven per cent of voters

declined to back Johnstons Press remu-

neration report at the publishers annual

general meeting yesterday. At the meet-

ing, chief executive Ashley Highfield said

the papers which recently switched from

daily to weekly were showing an average

increase of 77 per cent over their previous

daily sales, despite some price increases.

JD SPORTS, the sports fashion and

trainers retailer, yesterday posted a

sales rise of 1.2 per cent but warned

its recent acquisition of Blacks Leisure

could lose up to 15m this year.

Sales of sports goods rose by 1.2

per cent in the 19 weeks to 9 June,

the firm said, while fashion sales

jumped by three per cent.

JD said gross margins, however,

continued to be under pressure,

particularly in the first half of the

year, in part due to retailers continu-

ing to slash prices on the high street.

The retailer saw 2.2m wiped off

its profits last year following its

20m acquisition of Blacks, which it

inherited with a severe lack of

stocks and an excessive and over-

rented store portfolio.

It expects the level of operating

loss in the Blacks business this year

to amount to 10m with the poten-

tial for a further up to 5m charge

for restructuring.

While the business continues to

restructure its store portfolio and

operate with legacy buying deci-

JD Sports sales

rise but warns

on Blacks loss

BY KASMIRA JEFFORD

sions, it is difficult to be more pre-

cise on the short term outlook, but

we remain of the view that Blackss

market position can be exploited

profitably in the medium term, it

said in a statement.

The company, which has been step-

ping up its expansion overseas,

remained upbeat about its prospects

for growth, saying it was exception-

ally well positioned to take advan-

tage of any opportunities, both in

the UK and internationally.

Freddie George, analyst at Seymour

Pierce, said he expects half year

results to be markedly down but still

maintained his full year profit fore-

cast of 68m.

JD Sports Fashion PLC

13Jun 7Jun 8Jun 11 Jun 12Jun

620

640

660

680

700 p

615.50

13Jun

INDITEX, the Spanish fashion

retailer behind Zara and Massimo

Dutti, has posted a sharp rise in

first quarter earnings amidst

volatile conditions and poor

consumer demand in Europe.

Sales rose to 3.4bn (2.8bn) in

the three months to 30 April, up

15 per cent on last year while net

profit jumped by 30 per cent to

432m, outstripping consensus

forecasts by 11 per cent.

Analysts said the retailer was

benefiting from producing more

of its products in home markets

and North America, sheltering it

Zara owner Inditex bucks EU

gloom with sharp profits rise

BY KASMIRA JEFFORD from adverse exchange rates and

higher labour costs being passed

on from China.

Simon Irwin, analyst at Liberu

Capital said Inditexs flexible

model centred at its Galacia

headquarters where designs can

be changed quickly and stock

altered has helped it get ahead of

competitors.

It opened 91 new stores during

the quarter, including its flagship

Zara outlet on Fifth Avenue in

New York, bringing its total estate

to 5,618 at 30 April 2012.

Shares in the group, now Spains

largest by market value, rose 11

per cent to 75.1 yesterday.

THURSDAY 14 JUNE 2012

12

NEWS

cityam.com

meantimebrewing.com

Unilke most beers, Meantime matures for longer and

remains unpasteurised to ensure the fullest possible avour.

London Porter - BORN Greenwich. LIVES London.

CRAFT Brewer Andrew Dickson uses seven malts for the beer that fuelled the Industrial Revolution.

LOVES Game, most meats, fowl & cheese like Camembert.

Jacek Jagodka - BORN Stalowa Wola, Poland. LIVES London.

CRAFT Personal Trainer & Stuntman in Captain America & X-Men.

LOVES Nottinghill Gate, appearing on Dating in the Dark & London Porter.

P

h

o

t

o

g

r

a

p

h

y

:

T

o

m

S

t

o

d

d

a

r

t

TAKE YOUR TIME. DRINK RESPONSIBLY.

The Duchess of Cambridge wore a Zara dress the day after her wedding

G

E

T

T

Y

THE MARKET for top European corpo-

rate bond issues has continued its

recovery to hit its highest year-to-date

point since 2009.

The value of investment grade cor-

porate debt issued reached 86.68bn

(70bn) for the year to 12 June, up 38.6

per cent from the same period last

year, according to Thomson Reuters.

German car group Porsche was the

top fee payer an indicator of the

size of the issues on 14.7m.

It was followed by Enel, Italys

largest utility company, on 9.8m, and

Saint-Gobain, the major French build-