Current Account Surpluses Likely To Continue - Nippon

Diunggah oleh

Benjamin BöttgerDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Current Account Surpluses Likely To Continue - Nippon

Diunggah oleh

Benjamin BöttgerHak Cipta:

Format Tersedia

Sat Takehiro [ProfiIe] Economy

Like 0

SimpIe view / print

Home > Currents

Current Account SurpIuses LikeIy to

Continue

Japan ran up a trade deficit in 2011 for the first time in 31 years. The current account, which includes the

income account and other items, remained in the black, but its surplus shrank considerably. Sat Takehiro,

chief economist for Japan at Morgan Stanley MUFG Securities, examines whether further trade deficits will

push the current account into the red.

n 2011, Japan's trade balance registered a deficit for the first time in 31 years. This has sparked a

lively debate about the nation's ability to retain a surplus in its current account. Some market

participants argue that the surplus will dwindle and may turn into a deficit in just two or three years.

At Morgan Stanley MUFG Securities Co., Ltd. we do not subscribe to that view, however. t is

difficult to say precisely how long the current account will remain in the black, but in any case a

modest amount of red ink in the trade balance will not easily produce current account deficits in

Japan's case. This is because Japan is by far the world's largest holder of net foreign assetsin

excess of 250 trillion. These assets produce a steady inflow of dividends, interest payments, and

other such income gains, which are recorded in the income balance of the current account and can

offset deficits in the trade balance. With surpluses in the current account building up year after year,

net foreign assets are also accumulating through a positive feedback loop.

According to a rough estimate, the current account surpluses can be expected to last at least

another 10 or 20 years. One market implication of this is that, for the foreseeable future, the

government will be able to cover its budget deficits by relying solely on domestic funds. Long-term

interest rates should, accordingly, hold steady at a low level.

Factors Producing BIack Ink

A number of factors are working together to make it unlikely that the current account will fall into a

deficit. First, Japan's exports have remained buoyant; a fact that runs counter to the assumption that

exports would decline in the wake of shifting manufacturing oversees to respond to the yen's record

high exchange rate. This positive outcome is a result of the strength of Japan's capital goods and

Connect with Nippon.com

Latest updates

The Road to True Democracy in

Myanmar | Japan's Ambassador

for the WeIfare of Ethnic

Minorities in Myanmar Discusses

the ChaIIenge of Democratization

Looking Ahead in Promoting Free

Trade and Sustaining Japan's

Defense Industry

Lu Xun and Japan

Leading the Fight Against

Radioactive PoIIution

China's ExternaI Economic

Cooperation: Ties to the Mekong

Region

Thoughts on MartiaI Arts,

Education, and VaIues

China's Foreign PoIicy:

Continuity and Change

Photos

Videos/immersive photos

ENGLISH | | | | FRANAS | ESPAOL

FROM THE PUBLSHER

raw materials, and its proximity to Asian neighbors. Companies have indeed been steadily moving

an increasing share of their production overseas, but statistics show that Japanese exports

continued to expand during this same period (Figure 1).

A second factor, on the import side, is related to energy. t is true that there will be an increase in

imports of energy resources now that Japan's nuclear power stations are out of operation, and this

will negatively impact the country's current account. But the value of these additional imports, at

worst, will not exceed about 1% of Japan's gross domestic product. Energy imports alone are thus

unlikely to produce a large recurring deficit in the trade balance.

Third, in the income account, a large portion of the outflow from Japan consists of dividend

payments, which play a cushioning role because they can be reduced during a business downturn.

Structurally, they are a countercyclical factor, reducing the impact of swings in the business cycle.

n addition, the inflow into Japan from the more than 250 trillion in net foreign assets tend to

remain relatively stable despite changes in overseas interest rates. Given these circumstances,

Japan's income account has a strong tendency to stay in the black.

Fourth, the excess of savings in the private sector's saving-investment ratio is likely to last. There

has been a popular assumption that the graying of Japanese society will force families to tap into

their savings, but in fact the household saving rate has tended to increase or at least hold steady.

Corporate savings have also been sustained despite the deflationary conditions. Why has the

household saving rate not fallen even as Japan's population gets older? One possible answer may

be that senior citizens are continuing to build up savings even after retirement, reflecting their

serious concerns about the future.

ResiIience of Income Account SurpIuses

Among the foregoing factors, the black ink in the income account may be undermined by the recent

downward movement in overseas interest rates. The investment yield on foreign assets is currently

somewhat under 3%, but many economists expect future yields to fall due to the downtrend in long-

term interest rates. f we look, for instance, at the foreign securities in foreign exchange reserves,

which are part of net foreign assets, we find that many are longer-term securities; by maturity

composition, 56.6% are from one year to less than five years, 26.7% are for five years or more, and

only 17.7% are for under one year. We may take it for granted that many of them are investments in

US Treasuries. The five-year interest rate in the United States is currently in the vicinity of 1%. f we

use the simple assumption that when the securities mature they will be reinvested in instruments

with the same maturity period, we find that average investment returns will fall to the level of 1%

within five years from now.

t needs to be noted, though, that the black ink in the income account has proven to be fairly

Category archives

PoIitics Economy

Sci-tech Society

CuIture DaiIy Iife

PopuIar content

Enjoying Life One Day at a Time:

A Grandma and Her Cat (Photos)

The Rise of China and Its

Significance for East Asia

Steve Jobs and Japan

MEXT: What is it Good For?

Thoughts on MartiaI Arts,

Education, and VaIues

Forum 2000 (Part II)

"Chinese" Writing in East Asia

(Part One)

China's Foreign PoIicy: Continuity

and Change

The Death PenaIty in Japan

Higher Education and the

Japanese Disease

From the staff

Loss of an InternationaI ReIations

Leader

Arabic transIator wanted

A day in the Iife of Nippon.com

Job offer: J-E transIator

impervious to the downtrend in US long-term interest rates over the past 20 years or so (Figure 2).

The underlying cause of this can be summed up in two points.

First, among the items in the income account, the ratio of yields on securities have undergone a

long-term decline in their share of the total, while dividend receipts are now becoming more

prominent. Some of the dividends come from overseas stock investment, but others are a return on

profits from manufacturing subsidiaries established in other countries. With the shift of production

offshore, the manufacturing sector has seen its exports of finished products decline. At the same

time, however, these overseas profit dividends, which are closely attuned to trends in the global

economy, have increased. Thus while downward movement in overseas interest rates may

squeeze yields on overseas securities investment, the surplus in the income account is being

propped up by the growth of dividend receipts.

The second point is that Japan's net foreign assets have continued to swell even as overseas

interest rates have fallen. These additional assets have helped keep the income account in the

black at times when yields on securities come under pressure. The net foreign assets stood at

about 100 trillion 15 years ago but have since grown by 2.5 times, to the vicinity of 250 trillion

(Figure 3). As a result, even if yields on securities had been cut in half, overall investment returns

would still have increased as a result of the growth in net assets by 2.5 times. This shows that a

mechanism is in operation that prevents black ink in the current account from being easily

influenced by a decline in overseas interest rates.

Over the medium to long term we can naturally expect investment managers in the private and

public sectors to take steps to boost returns by diversifying their portfolios through investment in

Asian and other securities markets with considerable growth potential. n fact, the Ministry of

Finance recently announced that it would purchase a modest amount of Chinese government

bonds. While this is an example of portfolio diversification in the public sector, it is safe to assume

that the same thing is going on in many quarters of the private sector.

Domestic Funds Can Finance FiscaI Deficits

My conclusion, therefore, is that because of Japan's huge accumulation of net foreign assets, the

surpluses in the current account are structurally solid and will not easily turn into deficits. Measured

in dollars, these foreign assets have climbed to 3 trilliona level far above the assets held by

other countries (Figure 4). f movements in exchange rates are disregarded, a surplus in the current

account translates directly into a corresponding increase in net foreign assets. And the larger stock

of assets then produces more income gains in the current account.

As long as the current account stays in the black, the government should be able to finance its

fiscal deficits solely with domestic funds, relying on the private sector's excess of saving over

investment. A debt crisis, in other words, will not easily emerge. To be sure, a constant effort must

be made to bring public finance back into equilibrium, thereby lowering the risk of a fiscal crisis.

This is an issue the government leadership views quite seriously. But, unlike the debt crises of

southern Europe, there is little likelihood in Japan of debt-financing problems emerging for

macroeconomic reasons.

Like 0

Profile

Sat Takehiro

Chief economist at Morgan Stanley MUFG Securities Co., Ltd., and head of its nterest

Rate Strategy in Japan section. After graduating in 1985 from Kyoto University, where he

majored in economics, he began his career at Sumitomo Bank. n 1999 he joined Morgan

Stanley Securities, and has served in his present posts since 2010.

reIated articIes

Pursuing Comprehensive Reform of Japan's SociaI

Security and Taxation Systems

PoIiticaI StabiIity Is the Key to the Yen's Future

EIpida and the FaiIure of Japan Inc.

Kitagami Keir, Vice Minister of Economy, Trade, and

Industry

Japanese Business ModeI No Longer Brings ResuIts

Can Japanese EIectronics Firms Find the Spark They

Need?

A Year of HistoricaI Turning Points?

Saving EIectricity to Save Yen

LATEST ARTICLES

Thoughts on MartiaI Arts, Education, and VaIues

Foreign Nurses and Care Workers in Japan: Reform

Needed

Upgrading Japan's PoIicy Toward Iran

EIpida and the FaiIure of Japan Inc.

page top

(Originally written in Japanese on March 16, 2012.)

[2012.04.20]

Site policy | Copyright | Privacy policy | Site map | Contact | About us

2012 Nippon Communications Foundation

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- 40 Easy Ways To Make Money QuicklyDokumen3 halaman40 Easy Ways To Make Money QuicklyDotan NutodBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Design and Development 1Dokumen4 halamanDesign and Development 1asderbvaBelum ada peringkat

- Eae 7501-Msc Entrepreneurship & Innovation Assignment Guidance NotesDokumen5 halamanEae 7501-Msc Entrepreneurship & Innovation Assignment Guidance Notesknowledge factory0% (1)

- Cost Accounting (Chapter 1-3)Dokumen5 halamanCost Accounting (Chapter 1-3)eunice0% (1)

- TCS India Process - Separation KitDokumen25 halamanTCS India Process - Separation KitT HawkBelum ada peringkat

- EY - Robotic Process Automation (RPA) in InsuranceDokumen25 halamanEY - Robotic Process Automation (RPA) in InsuranceEric LinderhofBelum ada peringkat

- Case Study - New Product LineDokumen16 halamanCase Study - New Product LineJemarse GumpalBelum ada peringkat

- Feed and Farm Supply Business PlanDokumen43 halamanFeed and Farm Supply Business PlanAbdi Ahmed Yuya100% (2)

- FA GP5 Assignment 1Dokumen4 halamanFA GP5 Assignment 1saurabhBelum ada peringkat

- 2021 Jce Business StudiesDokumen6 halaman2021 Jce Business StudiesMalack Chagwa100% (2)

- Notice To Terminate - 16 June 2023Dokumen2 halamanNotice To Terminate - 16 June 2023Mary Nove PatanganBelum ada peringkat

- A Primer On The Impact of The New Economic Stimulus Laws and IRC 409A On Executive Compensation in Mergers and AcquisitionsDokumen48 halamanA Primer On The Impact of The New Economic Stimulus Laws and IRC 409A On Executive Compensation in Mergers and AcquisitionsArnstein & Lehr LLPBelum ada peringkat

- Foreign Exchange MarketDokumen73 halamanForeign Exchange MarketAmit Sinha100% (1)

- Building The Resilience of Small Coastal BusinessesDokumen60 halamanBuilding The Resilience of Small Coastal BusinessesMona PorterBelum ada peringkat

- Bhavani. K - Pay Roll Management - Not SubmittedDokumen52 halamanBhavani. K - Pay Roll Management - Not SubmittedLakshmi priya GBelum ada peringkat

- Risk Management For E-BusinessDokumen33 halamanRisk Management For E-BusinessDediNirtadinataAlQudsyBelum ada peringkat

- E3 Operating AuditingDokumen21 halamanE3 Operating AuditingPaupauBelum ada peringkat

- Fintech and The Transformation of The Financial IndustryDokumen9 halamanFintech and The Transformation of The Financial Industryrealgirl14Belum ada peringkat

- Why Average Cost Curve IsDokumen2 halamanWhy Average Cost Curve IsHasinaImamBelum ada peringkat

- Mini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyDokumen44 halamanMini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyImran AnsariBelum ada peringkat

- Final Admission Circular-On Campus - 19.07.23Dokumen4 halamanFinal Admission Circular-On Campus - 19.07.23zaher shuvoBelum ada peringkat

- DB 1 - Marketing Management - V2Dokumen3 halamanDB 1 - Marketing Management - V2NanthaBelum ada peringkat

- Journal Article of EnterprunershipDokumen5 halamanJournal Article of EnterprunershipSeleselamBefekerBelum ada peringkat

- TC2014 15 NirdDokumen124 halamanTC2014 15 Nirdssvs1234Belum ada peringkat

- Types of Maintenance and Their Characteristics: Activity 2Dokumen7 halamanTypes of Maintenance and Their Characteristics: Activity 2MusuleBelum ada peringkat

- The 2010 Standards of Professional Practice (SPP)Dokumen204 halamanThe 2010 Standards of Professional Practice (SPP)JP MacatdonBelum ada peringkat

- Soal Uts Abm 2 - Sesi 1Dokumen2 halamanSoal Uts Abm 2 - Sesi 1alyaa rabbaniBelum ada peringkat

- Cost Volume Profit Analysis Lecture NotesDokumen34 halamanCost Volume Profit Analysis Lecture NotesAra Reyna D. Mamon-DuhaylungsodBelum ada peringkat

- Canara BankDokumen2 halamanCanara Banklinsonjohny34Belum ada peringkat

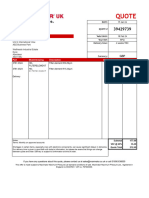

- Maximator Quote No 39429739Dokumen1 halamanMaximator Quote No 39429739William EvansBelum ada peringkat