Ed Ias 12

Diunggah oleh

Asad MehmoodDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ed Ias 12

Diunggah oleh

Asad MehmoodHak Cipta:

Format Tersedia

No.

2009-11 10 April 2009

Hot Topic

Update on major accounting and auditing activities

IASB issues Exposure Draft on Income Tax

Contents Overview ............................................... 1 Summary of proposed changes to IAS 12 ............................................... 1 Differences between IFRS and U.S. GAAP ............................................. 2 Next steps ............................................. 3

Overview

On 31 March 2009, the International Accounting Standards Board (IASB) issued an Exposure Draft, Income Tax (the Exposure Draft) which, if adopted, would replace International Accounting Standard 12, Income Taxes (IAS 12). The objectives of the IASBs project on income taxes are to 1) satisfy requests to clarify various aspects of IAS 12 and 2) reduce the existing differences between IAS 12 and FASB Statement No. 109, Accounting for Income Taxes (Statement 109). The project on income taxes was originally a joint project with the Financial Accounting Standards Board (FASB). In August 2008, the FASB announced it was indefinitely suspending its deliberations on the income tax project. While the FASB does not have any current plans to amend Statement 109, it plans to solicit feedback on the IASBs Exposure Draft through an Invitation to Comment because of the possibility that some or all US public companies may be permitted or required to adopt IFRS at some future date pursuant to the Securities and Exchange Commissions Roadmap. Based on the feedback received on the Invitation to Comment, the FASB is expected to decide whether to add a project to its

agenda that could result in the adoption in the US of the IASBs revised standard on accounting for income taxes. Because the possibility exists that US companies may have to apply the IASBs revised standard on accounting for income taxes in the future, it is important for interested parties to understand the IASBs Exposure Draft and to monitor future developments. We encourage interested parties to provide comments to the IASB that will assist in the development of a high quality accounting standard. Comments are due to the IASB by 31 July 2009. In addition, we encourage constituents to provide feedback to the FASB on its Invitation to Comment when it is issued. A copy of the Exposure Draft can be obtained from the IASBs website at www.IASB.org.

Summary of proposed changes to IAS 12

The accompanying Supplement to IFRS Outlook publication, ED Income Tax A proposal to replace IAS 12, provides a summary of the changes to the accounting for income taxes proposed in the IASBs Exposure Draft, including a more detailed discussion of the most important changes to IAS 12.

IASB issues Exposure Draft on Income Tax

Differences between IFRS and U.S. GAAP

The accounting for income taxes under IFRS and U.S. GAAP are broadly similar because IAS 12 and Statement 109 share the same principles. Despite the similarities, several differences currently exist between IFRS and U.S. GAAP. One of the IASBs primary objectives of the project on income taxes was to reduce the existing differences between IAS 12 and Statement 109. Accordingly, many of the changes to IAS 12 proposed in the Exposure Draft, if adopted, will result in convergence between IFRS and U.S. GAAP. If the Exposure Draft is adopted as currently drafted, the following differences between IFRS and U.S. GAAP will be substantially eliminated as IFRS would be consistent with current practice under U.S. GAAP:

Many differences between IFRS and U.S. GAAP accounting for income taxes will remain if the Exposure Draft is adopted as currently drafted, including:

Accounting for uncertain tax positions U.S. GAAP requires a two-step process that separates the recognition criteria from measurement. A benefit is recognized when it is more likely than not to be sustained based on the technical merits of the position (excluding any consideration of detection risk). The amount of the benefit to be recognized is based on the largest amount of tax benefit that is greater than 50% likely of being realized upon ultimate settlement. The IASBs Exposure Draft proposes a one-step process whereby uncertain tax positions are measured using the probability-weighted average amounts of possible outcomes, assuming the tax authorities have full knowledge of all relevant information and will examine the issues. The proposed model does not have a threshold for determining whether an uncertain tax position should be recognized (other than materiality).

transferred between entities in different tax jurisdictions that remain within the consolidated group. IFRS requires taxes paid on intercompany profits to be recognized as incurred and requires deferred taxes to be recognized on basis differences of assets transferred between entities in different tax jurisdictions that remain within the consolidated group.

Treatment of temporary differences that arise on the initial recognition of assets acquired or liabilities assumed outside of a business combination (e.g., an asset acquisition) Under U.S. GAAP, deferred taxes are recognized for temporary differences arising on the initial recognition of assets acquired or liabilities assumed outside of a business combination. For example, if the amount paid for an asset differs from its tax basis, the consideration paid is allocated between the asset and deferred tax using a simultaneous equation approach. Under the model proposed in the IASBs Exposure Draft, the asset acquired will be valued under the respective IFRS recognition guidance and deferred tax will be recognized for the temporary difference between this amount and the tax basis of the asset. The difference between the consideration paid and the total recognized amounts (i.e., the aggregate of amounts recognized for the asset and the deferred tax) represents a premium or allowance that will be recorded as an offsetting adjustment to the deferred tax amount recognized.

Definitions of tax basis, temporary difference, tax credit and investment tax credit Accounting for deferred taxes related to investments in foreign subsidiaries and foreign corporate joint ventures Accounting for deferred tax liabilities related to investments in domestic subsidiaries and domestic corporate joint ventures Approach to recognizing and assessing the realizability of deferred tax assets Allocation of income taxes to items charged or credited directly to other comprehensive income and equity Allocation of income taxes to entities in a consolidated tax group when an entity within that group prepares separate financial statements Treatment of alternative minimum tax systems Classification of deferred taxes on the balance sheet

Accounting for deferred tax assets related to investments in domestic subsidiaries and domestic corporate joint ventures Under U.S. GAAP, deferred tax assets are recognized for deductible temporary differences on the outside basis of investments in domestic subsidiaries and corporate joint ventures that are essentially permanent in duration only if it is apparent that the temporary difference will reverse in the foreseeable future. As proposed in the IASBs Exposure Draft, recognition of deferred tax assets for outside-basis differences will be required. Accounting for the tax effects of intercompany transfers of non-monetary assets U.S. GAAP requires taxes paid on intercompany profits to be deferred and prohibits the recognition of deferred taxes on basis differences of assets

In addition to the differences described above, IFRS would continue to differ from U.S. GAAP in other aspects of accounting for income taxes, such as the:

Measurement of deferred taxes on foreign non-monetary assets Tax rate applied to undistributed profits of subsidiaries Use of substantively enacted versus enacted tax laws and rates

Hot Topic No. 2009-11, 10 April 2009

IASB issues Exposure Draft on Income Tax

Treatment of special deductions and investment tax credits Accounting for the tax effects of sharebased payments Accounting for the tax effects of leveraged leases

Next steps

The IASB plans to review the feedback provided by constituents and will determine whether to make revisions to the proposed standard. The IASB has a goal of issuing a final standard in 2010. The FASB is expected to issue an Invitation to Comment in the second quarter of 2009 that includes the IASBs Exposure Draft. Based on the feedback received, the FASB is expected to decide whether to add a project to its agenda that could result in the FASB adopting the IASBs revised standard on accounting for income taxes.

Certain of the remaining differences between U.S. GAAP and IFRS would have been eliminated under the FASBs tentative conclusions before it decided to cease its efforts on the project. Further discussion of the differences between IFRS and U.S. GAAP that will be eliminated and those that will remain if the Exposure Draft, as currently drafted, becomes a final standard is provided in the Basis for Conclusions on the Exposure Draft.

Attachment Supplement to IFRS Outlook: ED Income Tax A proposal to replace IAS 12

Your gateways to Ernst & Young Your gateways to Ernst & Young technical accounting guidance technical accounting guidance

AccountingLink at ey.com/us/accountinglink offers easy access AccountingLink at ey.com/us/accountinglink offers easy access to many of the publications produced by our US Professional to many of the publications produced by our US Professional Practice Group. AccountingLink is available to clients free of charge. Practice Group. AccountingLink is available free of charge.

Ernst & Young LLP Ernst & Young LLP Assurance | Tax | Transactions | Advisory Assurance | Tax | Transactions | Advisory

2009 Ernst & Young LLP. 2009 Ernst & Young LLP. All Rights Reserved. All Rights Reserved. SCORE No. XX0000 SCORE No. BB1733

Ernst & Young refers to a global organization of member firms of Ernst & Young Global Limited, Ernst & Young refers to a global entity. Ernst & member firms client-serving member Limited, each of which is a separate legal organization of Young LLP is aof Ernst & Young Globalfirm each of in the is a located which US. separate legal entity. Ernst & Young LLP is a client-serving member firm located in the US. This publication has been carefully prepared but it necessarily contains information in summary This and is therefore intended for prepared but it necessarily contains information in summary formpublication has been carefullygeneral guidance only; it is not intended to be a substitute for form and is therefore intended for general guidance only; it is not intended to be a substitute detailed research or the exercise of professional judgment. The information presented in this for detailed research not be construed as legal, tax, accounting, or any other professional advice publication shouldor the exercise of professional judgment. The information presented in this or GAAIT-Client Edition contains Ernst & Youngs comprehensive GAAIT-Client Edition contains Ernst & Youngs comprehensive publication should not LLP can accept no responsibility for loss occasioned to any person acting service. Ernst & Youngbe construed as legal, tax, accounting, or any other professional advice or proprietary technical guidance, as well as all standard-setter content. service. Ernst & Young LLP can accept no material in this publication. You should person acting or refraining from action as a result of any responsibility for loss occasioned to anyconsult with proprietary technical guidance, as well as all standard-setter content. or refraining from action as professional advisors familiar publication. You should consult with GAAIT-Client Edition is available through a paid subscription. Ernst & Young LLP or other a result of any material in this with your particular factual situation for GAAIT-Client Edition is available through a paid Hot Topic No. 2009-11, 10 April 2009 LLPspecific audit, tax or other matters before makingparticular factual situation for 3 subscription. Ernst & Young advice concerning or other professional advisors familiar with your any decision. advice concerning specific audit, tax or other matters before making any decision.

Our Global IFRS website at ey.com/ifrs offers online resources Our Global IFRS website at ey.com/ifrs offers online resources that provide more detail about IFRS, as well as issues to consider that provide more detail about IFRS, as well as issues to consider as you research the potential impact of IFRS on your company. as you research the potential impact of IFRS on your company.

Issue 36 / April 2009

Supplement to IFRS outlook

ED Income Tax A proposal to replace IAS 12

Background

On 31 March 2009 the International Accounting Standards Board (IASB) published an Exposure Draft (ED) of an International Financial Reporting Standard (IFRS) intended to replace IAS 12 Income Taxes. Comments are invited, to be received by 31 July 2009. The IASBs income taxes project was originally a joint project with the US Financial Accounting Standards Board (FASB), undertaken as part of the IASBs and FASBs short-term convergence project aimed at eliminating differences between US GAAP and IFRS. Accounting for income taxes seemed an ideal topic for convergence. IAS 12 is based on the temporary difference approach developed by the FASB and used in the US standard FAS 109. However, the project proceeded rather slowly and the FASB announced last year that it had suspended indenitely its deliberations on the income taxes project. The FASB has indicated that it will solicit input from US constituents by issuing an Invitation to Comment containing the IASBs ED. It will then decide whether to undertake a project that would eliminate differences in the accounting for income taxes by adopting the proposed new IFRS.

Main changes

The ED covers the following areas. We consider the proposals in italics as the most important changes from IAS 12, and address them in more detail below. Denitions of tax basis and temporary difference Exceptions to the temporary difference approach (elimination of the initial recognition exception) Measurement of deferred tax assets and liabilities Recognition of deferred tax assets Allocation of tax to components of comprehensive income or equity Balance sheet classication Uncertain tax positions Denitions of tax credit and investment tax credit Other miscellaneous changes Disclosures Transitional and rst-time adoption provisions

Denition of tax basis and temporary difference IAS 12 currently requires the tax base of an asset or liability to reect the manner in which the entity expects to recover the asset (or settle the liability). This effectively makes deferred tax a function of management intent, which the IASB has striven to eliminate from other areas of nancial reporting. The ED proposes replacing the term tax base with tax basis, dened in the ED as the measurement, under applicable substantively enacted tax law, of an asset, liability or other item. The tax basis of an asset is determined by the tax consequences of selling it for its carrying amount at the reporting date. The tax basis of a liability is determined by the tax consequences of settling it for its carrying amount at the reporting date. At present, a temporary difference is simply the difference between the carrying amount of an item and its tax base. The ED redenes a temporary difference as the difference between the carrying amount of an item and its tax basis that the entity expects will affect taxable prot when the carrying amount of the related asset or liability is recovered or settled (or, in the case of items other than assets or liabilities, will affect taxable prot in the future). In effect, this means that in some cases, the entitys expectations determine the measurement of deferred tax, so that the IASB has not been able to remove management intent from the picture entirely. Exceptions to the temporary difference approach IAS 12 currently provides that deferred tax should not be recognised on some temporary differences arising on the initial recognition of assets and liabilities. This initial recognition exception (or IRE) as it has become generally known can appear

somewhat arbitrary, but it is essentially a pragmatic solution to what were seen as inappropriate accounting consequences of the temporary difference approach in some circumstances. The EDs proposals in this area are complex. The IASB has concluded that the initial recognition exception could no longer be justied conceptually. On the other hand, it clearly wanted to avoid the accounting consequences which the exemption seeks to prevent. Accordingly, the initial recognition exception is abolished, with deferred tax being recognised on all temporary differences, whenever they arise, except that a deferred tax liability is not recognised on the initial recognition of goodwill. Where a temporary difference arises on the initial recognition of an asset or liability, the asset or liability should be disaggregated into: the asset or liability, excluding any entity-specic tax effects; and the entity-specic tax effects broadly, the extent to which the tax treatment of an item in the hands of the entity places the entity in a better or worse position than taxpayers as a whole. The former amount becomes the carrying amount of the asset or liability. Deferred tax is recognised on any temporary difference arising from this carrying amount. Where an asset or liability is recognised other than in a business combination or in a transaction that affects comprehensive income, equity or taxable prot, the entity also recognises a premium or allowance (the difference between the amount paid for an asset, or received for a liability, and its carrying amount together with any associated deferred tax asset or liability). Such a premium or allowance is offset against the deferred tax balance.

ED Income Tax: a proposal to replace IAS 12

The impact of this, in net terms, is that the former initial recognition exception is retained, in the sense that any deferred tax recognised on initial recognition of an asset or liability, other than in a business combination or a transaction that affects comprehensive income, equity or taxable prot, is immediately offset by a premium or allowance. Allocation of tax to components of comprehensive income or equity IFRS currently requires current tax and deferred tax to be charged or credited in other comprehensive income (OCI) or directly in equity if the tax relates to items that were credited or charged, whether in the current or previous period, in OCI or directly in equity. Subsequent changes to those amounts are also allocated to OCI or equity as applicable, a treatment commonly referred to as backward tracing. The ED proposes that any change to a tax asset or liability relating to an item accounted for in an earlier period should generally be recognised in prot or loss, without any backward tracing. However, the current requirement for backward tracing of share-based payment transactions is retained, (i.e., any tax deduction received in excess of the cumulative expense for an award is accounted for in equity). Unusually, the ED also presents for comment an alternative method of allocation based on the current standard, but with more specic guidance than in the current standard on the methodology of allocation between components. The IASB does not propose to adopt this alternative approach, but, nevertheless seeks commentators views on it. Uncertain tax positions Uncertain tax positions arise where there is an uncertainty as to the meaning of the law, the applicability of the law to a particular transaction, or both. IAS 12 does not explicitly address the recognition and

measurement of uncertain tax positions, although it notes that the principles of IAS 37 Provisions, Contingent Assets and Contingent Liabilities may be relevant to the disclosure of tax-related contingent assets and contingent liabilities. As a result, practice in this area has been varied. The ED proposes that entities measure uncertain tax positions on an expected outcome basis (i.e., at the probability weighed average of expected outcomes). The ED proposes that entities should disclose information about the major sources of estimation uncertainties relating to tax effects to enable users to assess the possible nancial effects of the estimation uncertainties and their timing (for example, the effects of unresolved disputes with the tax authorities), including: a description of the uncertainty; and an indication of its possible nancial effects on amounts recognised for taxes and the timing of those effects. These proposals, which greatly increase the disclosures required for what are typically sensitive issues, may prove one of the most contentious aspects of the ED. Transitional and rst-time adoption provisions Existing IFRS preparers are generally required to apply the proposed new standard retrospectively. However, the new requirements for the allocation of tax to components of prot or loss, OCI or equity must be applied prospectively from the date of the rst opening statement of nancial position. Where deferred tax has not been recognised on items due to the initial recognition exception, the new requirements that replace the initial recognition exception are applied as if the items concerned had been acquired for their carrying amounts outside a business combination at the date of the rst opening statement of nancial position.

Entities transitioning to IFRS are also generally required to apply the proposed new standard retrospectively. However, the new requirements for the allocation of tax to components of prot or loss, OCI or equity must be applied prospectively from the date of transition to IFRS. Moreover, entities with a transition date before the date on which any nal standard is issued may apply the current IAS 12 for periods presented that begin before that date. A rst-time adopter of IFRS may apply the new requirements that replace the initial recognition exception with full retrospective effect. Alternatively, it may disaggregate an asset or liability into an amount excluding any entity-specic tax effects and the entityspecic tax effects as at the date of transition to IFRS.

Business impact

The proposed amendments will affect virtually all tax-paying entities, given the pervasiveness and materiality of income tax items on the nancial statements. Entities will need to assess the effects of these amendments across the entire spectrum of their tax life cycle tax planning, tax provision, tax compliance and tax controversy. The proposals in the ED surrounding the accounting for and disclosure of uncertain tax positions may have far-reaching data gathering, documentation, and support implications to the entity as well as affect an entitys dealings with tax authorities worldwide.

ED Income Tax: a proposal to replace IAS 12

Ernst & Young Assurance | Tax | Transactions | Advisory

About Ernst & Young Ernst & Young is a global leader in assurance, tax, transaction and advisory services. Worldwide, our 135,000 people 130,000 are united by our shared values and an unwavering commitment to quality. We We make a differencehelping our our make a difference by by helping people, people, ourand our and our wider our clients clients wider communities communities achieve their potential. achieve potential. For more information, please visit www.ey.com www.ey.com. Ernst & Young refers to the global organization of member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. About Ernst & Youngs International Financial Reporting Standards Group The move to International Financial Reporting Standards (IFRS) is the single most important initiative in the financial reporting world, the impact of which stretches far beyond accounting to affect every key decision you make, not just how you report it. We have developed the global resources people and knowledge to people and knowledge to support our client teams. And we work to give you the benefit of our broad sector experience, our deep subject matter knowledge and the latest insights from our work worldwide. Its how Ernst & Young makes a difference.

www.ey.com/ifrs

2009 EYGM Limited. All Rights Reserved. EYG no. AU0261

In line with Ernst & Youngs commitment to minimise its impact on the environment, this document has been printed on paper with a high recycled content. This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Neither EYGM Limited nor any other member of the global Ernst & Young organization can accept any responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication. On any specific matter, reference should be made to the appropriate advisor.

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Deferred Tax - A Finance Director's GuideDokumen66 halamanDeferred Tax - A Finance Director's GuideAsad MehmoodBelum ada peringkat

- P1 Full Course NotesDokumen170 halamanP1 Full Course NotesKelly Tan Xue LingBelum ada peringkat

- Ifrs 3 Business CombinationsDokumen5 halamanIfrs 3 Business CombinationsAsad MehmoodBelum ada peringkat

- Ifrs 1 First-Time Adoption On International Financial Reporting StandardDokumen9 halamanIfrs 1 First-Time Adoption On International Financial Reporting StandardAsad MehmoodBelum ada peringkat

- Important Notice: Literature (Spanish) 0488 Igcse For Examination in 2008Dokumen22 halamanImportant Notice: Literature (Spanish) 0488 Igcse For Examination in 2008Asad MehmoodBelum ada peringkat

- ACCA F1 Study NotesDokumen8 halamanACCA F1 Study Notessmillig0% (1)

- Pakistan Exams Cie Final Timetable May Jun 2011 Zone4Dokumen16 halamanPakistan Exams Cie Final Timetable May Jun 2011 Zone4Asad MehmoodBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- KPMG Ifrs17Dokumen186 halamanKPMG Ifrs17nvtcmnBelum ada peringkat

- Test Bank For International Accounting 5th Edition by DoupnikDokumen24 halamanTest Bank For International Accounting 5th Edition by DoupnikAllen Sylvester100% (34)

- 15 - 16 Accounting Concepts and PrinciplesDokumen39 halaman15 - 16 Accounting Concepts and PrinciplesKyeien100% (1)

- Intermediate Accounting 1st Edition Gordon Test BankDokumen39 halamanIntermediate Accounting 1st Edition Gordon Test Banktalipesangelicalhyfac100% (30)

- EY Applying IFRS in Consumer Products and RetailDokumen27 halamanEY Applying IFRS in Consumer Products and RetailAnonymous JqimV1EBelum ada peringkat

- ACCA Strategic Business Reporting (SBR) Achievement Ladder Step 4 Questions & AnswersDokumen10 halamanACCA Strategic Business Reporting (SBR) Achievement Ladder Step 4 Questions & AnswersAdam MBelum ada peringkat

- Topic 11 - Revenue - IFRS 15 - v2022Dokumen31 halamanTopic 11 - Revenue - IFRS 15 - v2022trangdoan.31221023445Belum ada peringkat

- Las Normas NIIF Ilustradas Parte ADokumen10 halamanLas Normas NIIF Ilustradas Parte AJoaquin CallisayaBelum ada peringkat

- IPSAS Vs IFRS AU1506 PDFDokumen8 halamanIPSAS Vs IFRS AU1506 PDFEar TanBelum ada peringkat

- Online Learning ModuleDokumen7 halamanOnline Learning ModuleAnnie RapanutBelum ada peringkat

- Accounting Theory Chapter 4Dokumen4 halamanAccounting Theory Chapter 4ghldcBelum ada peringkat

- CFAS MODULE and Ass PDFDokumen86 halamanCFAS MODULE and Ass PDFhellokittysaranghaeBelum ada peringkat

- Achieving Hedge Accounting in Practice Under Ifrs9Dokumen236 halamanAchieving Hedge Accounting in Practice Under Ifrs9Jorge Da MataBelum ada peringkat

- Day 6 P2 MockDokumen8 halamanDay 6 P2 MockAbdul HaseebBelum ada peringkat

- 2011 Accounting Standards in NigeriaDokumen70 halaman2011 Accounting Standards in Nigeriaoluomo1100% (1)

- Chapter 9Dokumen30 halamanChapter 9desy adawiyahBelum ada peringkat

- Financial Accounting For Islamic Banking Products: Learning ObjectivesDokumen21 halamanFinancial Accounting For Islamic Banking Products: Learning ObjectivesAbdelnasir HaiderBelum ada peringkat

- IFRS - 9 - Implementation - Guideline - Revised - by-ICPAK 2017 PDFDokumen65 halamanIFRS - 9 - Implementation - Guideline - Revised - by-ICPAK 2017 PDFRafik Belkahla100% (1)

- Final Output in Applied Auditing 2: Submitted byDokumen23 halamanFinal Output in Applied Auditing 2: Submitted bychosBelum ada peringkat

- School of Accounting and Finance: Sample ExaminationDokumen4 halamanSchool of Accounting and Finance: Sample ExaminationChenyu HuangBelum ada peringkat

- Basic Accounting QuestionnaireDokumen4 halamanBasic Accounting QuestionnaireSamuel FerolinoBelum ada peringkat

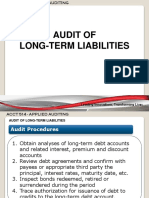

- Audit of Long-Term LiabilitiesDokumen43 halamanAudit of Long-Term LiabilitiesEva Dagus0% (1)

- New KitDokumen195 halamanNew KitRamu BhandariBelum ada peringkat

- IasDokumen62 halamanIasHAKUNA MATATABelum ada peringkat

- Deloitte 2023Dokumen216 halamanDeloitte 2023Septian Sobat kalianBelum ada peringkat

- Applying The Restatement Approach Under IAS 29 Financial Reporting in Hyperinflationary EconomiesDokumen6 halamanApplying The Restatement Approach Under IAS 29 Financial Reporting in Hyperinflationary EconomiesIssa BoyBelum ada peringkat

- 2014 Stage 3 Open Safari Case Study Adapted For The IFRS For SMEsDokumen21 halaman2014 Stage 3 Open Safari Case Study Adapted For The IFRS For SMEsAnonymous 7ZYHilDBelum ada peringkat

- NIIF Completas 2019 Libro Rojo Ilustrado Parte C PDFDokumen2.602 halamanNIIF Completas 2019 Libro Rojo Ilustrado Parte C PDFvagonet21Belum ada peringkat

- Creative Accounting: A Literature Review: Brijesh YadavDokumen13 halamanCreative Accounting: A Literature Review: Brijesh YadavAnonymous ckTjn7RCq8Belum ada peringkat

- For The Interim Six Month Period Ended June 30, 2011 (In United States Dollars)Dokumen32 halamanFor The Interim Six Month Period Ended June 30, 2011 (In United States Dollars)alexandercuongBelum ada peringkat