Su08 11

Diunggah oleh

wanazizwanmadDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Su08 11

Diunggah oleh

wanazizwanmadHak Cipta:

Format Tersedia

Marcon International, Inc.

Vessels and Barges for Sale or Charter Worldwide

August 2011

P.O. Box 1170 9 NW Front Street, Suite 201 Coupeville, WA 98239 U.S.A. Telephone (360) 678 8880 Fax (360) 678-8890 E Mail: info@marcon.com http://www.marcon.com

Supply & Tug Supply Boat Market Report

Following is a breakdown of available supply and tug supply vessels we currently have as shipbrokers officially listed for sale worldwide. Not included are those available on a private and confidential basis.

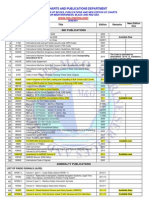

Tug Supply Boats

Under 3,000 4,000 5,000HP 5,000 6,000HP 6,000 7,000HP 7,000 8,000HP 8,000 9,000HP 9,000 10,000HP 10,000 12,000HP 12,000HP Plus 3,000HP 4,000HP

Total

12 26 19 8 20 7 Jan 1999 5 20 9 Jan 2000 5 20 14 Jan 2002 7 18 15 Jan 2003 9 15 15 Jan 2004 5 13 8 Jan 2005 10 13 13 Jan 2006 8 22 18 Jan 2007 8 18 7 Jan 2008 3 21 8 Jan 2009 3 17 14 5 23 19 Aug 2009 5 26 21 Nov 2009 5 25 22 Feb 2010 6 33 26 May 2010 5 31 31 Aug 2010 5 31 35 Nov 2010 4 31 36 Feb 2011 1 15 26 May 2011 3 21 31 Aug 2011 Worldwide 0 2 1 Aug 2011 - U.S. 3 19 30 Aug 2011 Foreign 1978 1982 1990 Avg. Age Worldwide - 1981 1983 Avg. Age U.S. 1978 1982 1991 Avg. Age Foreign 6 7 13 For Charter Worldwide 0 0 0 For Charter U.S. 6 7 13 For Charter Foreign Up Since Last Report

Feb 1997 Jan 1998

19 11 9 10 10 6 9 26 13 17 17 19 28 48 47 41 38 40 36 20 23 0 23 1996 1996 23 1 22

8 14 9 6 8 3 4 5 5 8 15 8 7 19 8 6 13 5 6 10 7 9 11 6 6 7 5 8 8 6 8 8 1 11 8 8 12 13 15 14 15 16 15 16 18 15 20 18 20 18 20 21 18 26 19 18 25 17 17 25 19 17 23 0 0 0 19 17 23 1982 1988 1990 1982 1988 1990 12 21 14 1 0 0 11 21 14 Down Since Last Report

0 0 0 0 1 3 2 3 4 3 0 2 5 6 6 6 8 9 9 9 5 0 5 1982 1982 4 0 4

2 0 0 0 2 1 8 3 2 2 3 4 7 9 12 7 8 9 10 7 8 0 8 1986 1986 19 0 19

2 4 2 2 2 3 14 14 10 10 13 16 20 20 1 22 24 27 30 26 27 0 27 1991 1991 18 0 18

110 67 59 82 89 76 82 108 95 87 82 102 147 180 167 194 203 221 218 163 177 3 174

137 2 135

Market Overview

Of 10,958 vessels and 3,580 barges tracked by Marcon, 2,596 are supply and tug supply boats. Tug supply boats officially on the market for sale have decreased from 203 to 177 vessels over the one year period since August 2010, and is up 8.59%, or 14 vessels from May. At the time of this report, 48 tug supply boats for sale were either built within the last 10 years or are newbuilding re-sales. 68.36% of the tug supply boats are 25 years of age or over. Counterbalancing these old ladies are 17 newbuilding resales, in the 4,000BHP over 12,000BHP range, scheduled for delivery in 2011 and 2012. Other vessels not officially on the market may be able to be developed on a private and confidential basis. 62.96% of foreign and 100% of U.S. flag supply / tug supply boats we have officially listed for sale are direct from Owners. So far in 2011, actual sales price of all vessels and barges sold by Marcon has averaged 93.65% vs. 2010s 86.31% and 2009s 93.12%.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

The number of platform supply boats for sale increased 6.12% from 98 to 104 since August of last year. There was a seven vessel decrease in supply boats on the sales market since our last report in May. As of the time of this latest report, Marcon International has available 16 supply boats built within the last ten years, which includes 4 newbuilding re-sales scheduled for delivery in 2011 and 2012. 73 PSVs, or 70.19%, are 25 years of age or older, with the oldest PSV listed built in 1967.

Platform Supply Boats

Under 150* 150 160 160 170 170 180 180 190 190 200 200 220* 220 240* 240 Plus Total

Feb 1997 Jan 1998 Jan 1999 Jan 2000 Mar 2001 Jan 2002 Jan 2003 Jan 2004 Jan 2005 Jan 2006 Jan 2007 Jan 2008 Jan 2009 Aug 2009 Nov 2009 Feb 2010 May 2010 Aug 2010 Nov 2010 Feb 2011 May 2011 Aug 2011 - Worldwide Aug 2011 - U.S. Aug 2011 Foreign Avg. Age Worldwide Avg. Age U.S. Avg. Age Foreign For Charter Worldwide For Charter U.S. For Charter Foreign Up Since Last Report

7 2 2 2 4 2 4 2 2 5 6 2 3 3 2 3 5 4 4 3 2 2 0 2 1984 1984 4 0 4

1 1 2 3 5 6 7 7 6 3 1 2 5 5 3 3 4 4 5 4 5 6 3 3 1999 1991 2008 4 0 4

5 7 6 13 16 17 20 13 15 12 8 7 6 11 12 13 14 12 14 13 10 10 5 5 1978 1979 1976 8 0 8

7 5 5 12 12 12 16 10 9 7 5 5 6 10 11 12 12 11 11 7 5 5 2 3 1986 1983 1988 1 0 1

13 5 7 17 16 17 22 32 67 60 29 23 32 29 36 35 36 46 54 48 34 31 13 18 1979 1978 1979 14 3 11

8 0 3 4 3 2 5 7 16 9 6 3 7 10 11 12 13 16 20 15 11 7 2 5 1989 2004 1983 2 0 2

6 5 6 9 3 5 5 19 8 7 3 4 6 8 8 5 5 10 16 13 10 11 2 9 1992 1999 1991 5 2 3

5 6 8 1 2 13 21 19 18 20 23 22 18 15 7 8 1988 1981 1993 6 0 6

4 6 4 4 5 9 11 15 14 13 21 16 16 17 1 16 1995 2010 1994 19 3 16

29 25 31 60 59 61 79 90 132 115 70 51 72 98 115 117 121 136 168 141 111 104 35 69

63 8 55

Down Since Last Report

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Platform & Tug Supply Locations

Caribbean 3.1% Mediterranean 5.2% Latin Am erica 5.5% Canada 0.3%

Southeast Asia 23.1%

By Arrangem ent 5.9%

Far East 7.9% Mid East 16.2%

Europe 7.9%

The dominant location for second-hand tonnage on the market has shifted again back to Southeast Asia with 23.1%, followed by the Mid East with 16.2%, while the U.S. has dropped down to 15.2%, followed by Africa with 9.7%. By arrangement or where location is unknown makes up 5.9%. The rest of the globe makes up the final 29.9% of locations. EMDs are the principal U.S. main engine suppliers to this sector and power 49 of the Supply & Tug Supply Vessels listed for sale, followed by CATs in 37. GM powers 17 vessels. MaK leads foreign manufacturers with 26, then 25 Nohab/Polar Nohab, 24 Wartsila, 14 Yanmar, 13 Bergen and 75 units powered by other engines. In addition to those for sale, Marcon has 200 straight supply and tug supply vessels listed for charter worldwide, down 19 from May.

Africa 9.7%

U.S. 15.2%

Crude Oil Prices

US$ WTI - Cushing, Oklahoma Brent - Europe Jan 11 $89.17 $96.52 Feb 11 $88.58 $103.72 Mar 11 $102.86 $114.64 Apr 11 $109.53 $123.26 Aug 11 $86.33 $110.22 Source: Energy Information Administration, Office of Oil and Gas. May 11 $100.90 $114.99 Jun 11 $96.26 $113.83 Jul 11 $97.30 $116.97

Natural Gas

Est. Average Wellhead Prices

Price ($ per Mcf) Price ($ per MMBtu) Jan 11 $4.08 $3.96 Feb 11 $4.23 $4.11 Mar 11 $3.96 $3.80 Apr 11 $3.98 $3.87 May 11 $4.12 $4.00 Jun 11 $4.19 $4.08 Jul 11 $4.27 $4.16 Aug 11 $4.20 $4.09

Source: Energy Information Administration, Office of Oil and Gas.

Marcon Sales News

Capital Signal Company Limited of Trinidad sold the survey/supply vessel Native Pride (ex-Grampian Supporter, Grampian Freedom, Maersk Puncher) to a Panamanian tanker owner on private terms. Native Pride was built in 1976 by J. Pattje of Holland. She measures 207' x 46' x 19' with draft of about 16' at 1,942mtdw. The vessel is powered by two MAK 6M452AKs producing a total of 3,200BHP driving twin fixed pitch propellers. She is also fitted with one Ulstein TV90 400BHP tunnel bow thruster. Electrical generation is provided by three Detroit Diesel auxiliaries producing 600kVa. Native Pride is classed DNV +1A1, Ice Class C, Safety Standby Rescue. Marcon brokered the sale to Capital Signal in 2008 and was sole broker in this transaction.

Worldwide Sale & Purchase News

Sartor Offshore announced that Ocean Flower has been sold to new Greek owners Environmental Marine Services for an undisclosed price. The company gave no details about client involved in the transaction. Ocean Flower is a Rescue/Standby vessel. The vessel, formerly Normand Flower, was built in 1974 at Volharding Shipyard Waterhuizen. She was built as a standard PSV for Solstrand. In 1985 the vessel was lengthened and converted to also act as an MRV vessel with Fire Fighting, Oil Recovery and Standby/ Rescue/ ERRV. With azimuth thruster, HiLift Rudder System and C/P/Bow Thruster she has very good station keeping capabilities, all handled by a modern Joystick system. Ocean Flower is a modern Offshore Support Vessel with special design ensuring the vessel is efficient for all her operations. Vessel has also been used for Sub Sea operations like VSP and Seabed Seismic operations. Vessel has been renamed Aegis I.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Canadian OSV operators Atlantic Towing have confirmed the purchase of the AHTS Asso Ventidue (22) from Italian owners Augusta Offshore SpA which is now renamed the Atlantic Raven. Built in 1999 at Orskov Shipyard, Denmark, the vessel will now fly the Barbados flag. Measuring 246.0' loa x 211.2' lbp x 59.0' beam x 26.2' depth x 19.68' loaded draft, she is powered by four Bergen BRM6 totaling 14,400BHP and creates a 169T Bollard Pull. The vessel is now classed by DNV under the notation 1A1 ICE-C Tug Supply Vessel Fire Fighter II OILREC SF E0 DYNPOS-AUTR DK(+) HL(2.5). The vessel is equipped with a Brattvaag SL270WX/2BSL300WX - Triple Drum waterfall (1 towing drum and 2 A.H. drums). The vessel was repainted in Leith and was planning to head back to Canada.

The AHTS Norwich Service has been sold from Tidewater to Egyptian owners Red Sea International and renamed Red Sea Norwich. The vessel was built in 1983 at Clelands Shipbuilders; Wallsend,UK. It measures 196.8' loa x 175.7' lbp x 43.5' beam x 17.6' depth x 14.80' loaded draft and is powered by twin Mirrlees 6MB275 total 4,226BHP at 900RPM.

The AHTS Doc Tide II (ex Jaramac 68) has been sold by Tidewater to UAE buyers, Canada Shipping LLC. Built in 1983 at McDermotts yard in Louisiana, the vessel measures 205.0' loa x 42.0' beam x 16.5' depth x 7.60' light draft x 14.00' loaded draft and is powered by two EMD 16-645E7 creating a total of 6,140BHP. It comes equipped with a Fritz Culver FCSL 150W/150W winch with 150T of line pull and combined a Bollard Pull of 70mt. The new owners were reportedly extensively overhauling the vessel this summer with ABS in attendance, which issued a new 5 year certificate in July. The vessel was renamed Fatema. The Mexican flagged platform supply vessel Jan Tide has been sold by Tidewater to unknown buyers. It had been working in the Mexican oil patch during recent times until being laid up. The vessel measured 194.0' loa x 180.0' lbp x 40.0' beam x 14.0' depth x 11.99' loaded draft and was built in 1983 at McDermott, New Iberia LA. Farstad Shipping ASA has, through its wholly owned subsidiary P/R International Offshore Services ANS, reached an agreement to sell the PSV vessel Lady Christine for reportedly $5m to unknown buyers. Delivery of the vessel to the new owner is expected to take place in October 2011. The Norwegian flagged vessel is ME202 design, was built in 1985 at Australian Shipbuilding in Fremantle, measures 68m x 17.5m beam and has a deadweight of 2,368T. It can carry 1,300T of deck cargo on 500m2 (35mx14.3m) clear deck with a deck load of 5Tm2 (7T/m2 aft). The sale of the vessel will give a booked profit of approx. NOK 11 million in the 4th quarter 2011. PSV Amarco Cheetah (ex Asean Maru, Stirling Albion, Edda Sartor) has reportedly been sold by Japanese based Dokai Marine Systems to Brunei registered Amarco Services Sdn Bhd for an undisclosed price. It is understood that the vessel was on a long term lease purchase contract to Amarco prior to formal handover. The vessel was renamed Amarco Cheetah from Asean Maru several years ago. The Panamanian flagged vessel was built in 1982 at Schw. Cassens; Emden, Germany and measures 196.1' loa x 170.7' lbp x 47.7' beam x 17.9' depth x 15.25' loaded draft.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Japanese owners Sanko Steamship Co. Ltd have sold their DP 2 rated AHTS Sanko Dolphin (ex Jaya Valiant 2) to Chinese OSV owners Shenzhen Huawei Offshore for in excess of $17 million. The vessel was built 2005 at Fuijan and Jayas yard in Singapore. Measuring 70m x 16.8m x 7.5m depth, it is powered by two Wartsila 6L32 creating a total of 8,160BHP. Classed with ABS and flagged by Liberia, the vessel has now been renamed Huacai.

Malaysian owners Petra Perdana have sold their 150T Bollard Pull anchor handlers Petra Admiral and Petra Majestic to Ukrainian buyers Sea Dynasty Ltd for an undisclosed price. The pair was built at the Labroy/Drydocks owned PT Nanindah Mutiara Shipyard in Batam in 2010. Measuring 72.5m x 17m x 7.5m depth, they are powered by twin MAK 9M32C creating a total of 12,240BHP at 600RPM. The vessels are classed ABS with the notation + A1 + DPS-2 + AMS + ACCU (E) Anchor Handling, Offshore Support, FiFi & Tow Service. Both are equipped with 350T Brake Double Drum waterfall winches. Malaysia-based OSV shipbuilder Nam Cheong has sold three of nine 5,150BHP Anchor Handling Towing Supply vessels that are currently being built for stock. Contracts worth a total $38 million have been secured for the vessels with a new Singapore customer, Sentinel Marine Pte Ltd. Though Nam Cheong's main shipbuilding facility is in Malaysia, the ABS class AHTS vessels are currently being built as part of a series in one of the three Chinese shipyards contracted by Nam Cheong. With a length of 59m, each vessel has a bollard pull of 62T. The vessels are scheduled for delivery to Sentinel Marine between the second and fourth quarters of 2012. These contracts are expected to contribute positively to the earnings of the Group for the financial years ending 2011 and 2012. Despite market concerns of an oversupply of smaller offshore support vessels, we continue to see a demand for AHTS and by securing these new contracts, it confirms again our market prediction for a continued demand for AHTS. We are even more pleased that this contract comes from a new Singapore-based company, signaling an expansion of our customer base, said Mr. Leong Seng Keat, Nam Cheong's Executive Director. Following on from this news - Nam Cheong Ltd, won a new contract for the sale and charter of a 5,220BHP Anchor Handling Towing Supply vessel worth RM41.4 million (about S$16.8 million). The contracts represent the fourth vessel sold in a month and the expansion of Nam Cheong's customer base, this time with Omni Marissa (L) Inc, an active Malaysian offshore marine company that specializes in various logistics, oil and gas services for oil and gas companies in Asia Pacific. Executive Director Leong Seng Keat said: We continue to enjoy the benefits flowing from Malaysia's expanding oil and gas ventures, and are pleased to have gained another new customer in a short span of time. In addition, we note that oil majors continue to invest in equipment and vessels essential for exploration and production activities, and we expect a rising demand for smaller AHTS vessels, he said when announcing the contracts. Leong said despite recent market volatility and talk of another downturn, our ability to secure another contract within a month speaks volumes of the confidence that our customers have placed in us. With our four decades of track record and experience, we are in a good position to accurately predict market demands and build the vessels ahead of time to suit the needs of our customers, he said. Like the previous three vessels, the newly-sold 5,220BHP AHTS vessel, which is nearing completion, is also being built as part of the group's built-to-stock series in one of Nam Cheong's subcontracted yards in China. The ABS class vessel has an overall length of 60 meters and achieved a bollard pull of 71.1 tons in a recent sea trial. It is scheduled for delivery next month. With this latest contract, Nam Cheong's order book has increased to 11 vessels, with total contract value of about RM590 million. Of these, six vessels are scheduled for delivery in the second half of this year and five will be delivered next year.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Neptune Marine Pacific have entered into a MOA to sell their ROV Supporter (ex ROV Supplier, Bodo Supplier, Uragano Secondo, Bonnie One, Busy Bee, Maersk Shipper) for $2.4m that included the Remotely Operated Vehicle. As yet, the buyers identity is unknown. The vessel was built in 1972 at Fijge Werft Frederickshaven, in Denmark and rebuilt in 2008.

In August, the Office of Fair Trading (OFT) accepted undertakings to address the competition concerns arising from the completed acquisition of Subsea 7 Inc by Acergy S.A. (since renamed Subsea 7 S.A.). As a result, the merger will not be referred to the Competition Commission. Under the terms of the undertakings, the pipelay vessel, the Acergy Falcon, will be sold to Grup Servicii Petroliere SA (GSP). In December 2010, the OFT announced that it would consider undertakings in lieu of a reference to the Competition Commission after its investigation found that the merger raised competition concerns in the North Sea area. These concerns related to the provision of small diameter rigid pipelay services alone, and projects which required the provision of both small diameter rigid pipelay and diving services. The OFT's investigation found that Acergy S.A. and SubSea 7 Inc were two of three major firms who competed closely in these two areas. The OFT carefully assessed and consulted publicly on the proposed undertakings, as well as on the suitability of GSP as a purchaser of the Acergy Falcon. This included ensuring that GSP had formed an association with Bibby Offshore Holdings Limited, a provider of Diving Support Vessels, allowing the two firms to jointly offer pipelay services with diving services in the North Sea. Ali Nikpay, OFT Senior Director and Decision Maker in this case, said: Our investigation identified competition concerns resulting from this merger, however, the sale of the Acergy Falcon will restore pre-merger levels of competition. We believe that GSP, in an association with Bibby, is a suitable purchaser for the vessel. The Acergy Falcon was built in 1976 by IHC in Holland, measures 153m length x 21m breadth and has the following capabilities: J-lay 75T up to 14-inch pipe diameter, 2,000T onboard pipe storage, 1,600T below deck storage carousel, 64T crane, accommodation for 141 persons and two workclass ROVs. Sealink has sold two offshore support vessels. One vessel has been sold for RM 55 million to undisclosed buyers while the other was sold for RM 32 million to Logistine, Malaysia, an associate company of Sealink Group. The seismic vessel Fairfield Encounter (ex Sea Emerald, Sea Fortune, Encounter Bay) was sold by Fairfield Industries Inc to undisclosed buyers. In a colorful history, the vessel was built in 1973 at Langsten Slip, Norway as a North Sea rig tender and salvage tug. In 1981 it moved to work the oilfield in Indonesia. Four years later it left the legitimate commercial service and began running illegal drugs from Asia. In 1988 the US Coast Guard seized the vessel heading toward Vancouver Island. The Washington National Guard bought the vessel at auction in 1989 and it was then donated to Seattle Maritime Academy in 1995. Though foreign built and previously Panamanian flagged, the vessel was reflagged to US and gained Coastwise trading privileges prior to being donated to the academy. Fairfield bought the vessel in late 2001 and moved it to the US Gulf for conversion to a seismic vessel. The vessel measures 188.6' loa x 165.5' lbp x 36.0' beam x 17.8' depth x 16.30' loaded draft and is powered by two B&W 18V23HG creating a total 4,860BHP. Marcon brokered the 2001 sale of this vessel to Fairfield Industries. It has been reported that Global Offshore Services (formerly Garware Offshore Services) have sold their AHTS Garware I to unknown buyers. Built in 1983 at Maroil in Singapore for $4.5m, the unit is powered by twin Wartsila 12V22 main engines creating 4,810BHP. The current sales price was not reported, but is believed to be around the $1m region.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Swire Pacific reported in their first half figures the sale of four J-Class AHTSs and one seismic survey vessel that contributed HK$69m in the first half of 2011. The seismic vessel sold the was Pacific Titan (ex Lady Pauline) which measures 211.0' loa x 181.1' lbp x 60.7' beam x 19.6' depth x 16.90' loaded draft and was built in 1982 at Teraoka, Japan. The vessel was sold to the Singapore based Reflect Geophysical Pte Ltd. The vessel has now been renamed Reflect Scorpio. Earlier this year, Swire sold their Pacific Javelin, now renamed An Wei, Pacific Spear, now renamed An Rong, and the Wira Keris, now renamed An Ju. All three were sold to Ocean Tankers of Singapore Pte. Also Swire recently completed the sale of the Pacific Scimitar to UK registered Union Maritime Ltd and renamed Top Fenders 2. The Saudi flagged PSV Zamil Latifah has been sold by Zamil Offshore Services Co Ltd to unknown buyers. The vessel was built in 1982 at Kanmon Zosen K.K. - Shimonoseki and measures 196.8' loa x 185.1' lbp x 41.1' beam x 16.4' depth x 11.94' loaded draft. The vessel is powered by two Daihatsu 6DSM32 totaling 4,200BHP at 620RPM, driving fixed pitch 4-blade prop(s) in kort nozzles. Originally it was an AHTS but was converted to a work / maintenance / hook-up vessel. Miclyn Express Offshore announced the purchase of three new Offshore Support Vessels. A Seismic Support Vessel has been purchased against a three year firm contract in Indonesia commencing in August 2011 and including 5 x 1 year extension options. The three OSVs were purchased for an aggregate price of US$ 18.5m and the firm value of the three contracts is US$ 29.4m. The AHTS Smit Lubaun was purchased by Smit International just as it was completed in the shipyard prior to delivery. The 60 x 16m, twin Yanmar 8N280M powered vessel was originally commissioned by Ocean Marine Egypt as the Ocean Dohab and registered to the Dominica flag; but changed hands back in June whilst undergoing the finishing touches at the Guangxi Guijiuang shipyard. The vessel is now Singapore flagged. Further to an announcement/press release of June 2011 in relation to the vessels receipt of its maritime class certification from Det Norske Veritas, the Board of Directors of Otto Marine Limited has announced that it has entered into a letter of intent dated 10 August 2011 to sell the AHTS Deep Sea 1 to an unrelated third party. The vessel was built in 2010 by PT Batamec and registered in Singapore under Singapore flag. The purchase price is US$ 90,000,000. Under the terms of the letter of intent, the Buyers will pay a 10% deposit to Otto within 30 days from the date of the letter of intent. The Company and the Buyers shall mutually agree upon all other terms and conditions pertaining to the sale of the vessel and shall execute a Memorandum of Agreement upon the payment of the Deposit. This was the first AHTS cancelled by Mosvold. The DP2 rated construction support vessel Acergy Hawk (ex Pacific Constructor, Seaway Hawk) has been sold by Subsea 7 MS Ltd to Malaysian based Bumi Armada for a reported price of around $9.5m. Originally built in 1978 by Mitsubishi Heavy. Ind., Kobe, Japan, the vessel measures 308.7' loa x 294.0' lbp x 61.7' beam x 22.1' depth x 17.65' loaded draft, the vessel is powered by two Daihatsu 6DSM32 creating a total 4,200BHP at 600RPM. On the back deck, the main crane is rated for 240T at 14m to an 84m water depth. It can accommodate 140 persons in 12 single cabins, 51 double cabins and 8 four berth cabins and personnel can be airlifted via helicopter off its Sikorksy S-61N rated helipad. The vessel is classed with DNV. It was recently working in West Africa but is expected to transfer to the Asian arena after delivery. At the time of writing the vessel had just left Mauritius en route Singapore.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Norwegian operator DOF ASA completed the sale of one new building Skandi Kochi (Hull No. 081 at Cochin Shipyard) to Troms Offshore AS. This transaction was completed in July. The vessel is an Aker PSV 09 CD design and now renamed Troms Capella. The reported newbuild price was $54m, so the expectation is that it sold for a premium over this number. For more details on the Troms Capella see Delivery section. Singapore based owners Swiber Holdings Ltd have sold their 1973 built AHTS Swiber Captain (ex Dea Captain, Power Express, Muhammed Ali) to Myanmar based Injynn Development Co Ltd. Constructed at Schepsw. Bodewes, Holland as the Smit Lloyd 47 and rebuilt in 1994, the 180 LOA x 40.3 beam vessel is powered by twin Industrie 8D7HDN main engines creating 4,000BHP and a bollard pull of 43mt. The vessel has been renamed Injynn Captain and flagged with the Sierra Leone registry. It is reported that Dutch owners Vroon Offshore have sold their 2010 built DP2 rated UT755LN design PSV VOS Prevail to Singapore based operators Chellsea Pte Ltd. Built at Cochin in India, the vessel measures 73.6m x 16m x 7m depth and is powered by twin Bergen C25:33L6P creating 5,450BHP. The vessel has been renamed Durga Devi. Handover was undertaken in Esjberg. The sales price is unknown. Singapore builders and owners Jaya Holdings Ltd. recently sold their 2010 built DP rated AHTS Jaya Anchor to Indonesian buyers Logindo Samudramakmur. Constructed at Jayas subsidiary yard in China, Guangzhou Hangtong, the 58.7m x 14.6m x 5.5m unit is powered by Wartsila 9L20 main engines creating 4,800BHP whilst driving twin CPP in kort nozzles. Equipped with a double drum waterfall winch with a 150T line pull and 200T brake, it is capable of a bollard pull of 60T. Vessel has been renamed Logindo Braveheart and now flies the Indonesian flag.

Charter News

Mermaid Marine Australia Ltd announced that the company has been awarded two contracts by Woodside in respect of the Mermaid Sound (pictured) and the Mermaid Strait, for the provision of offshore marine support to Woodsides FPSO operations in the North West Shelf. The contracts are both for a term of three years firm, with two options of one year each. The Mermaid Sound will commence its new contract on the 15th of June 2011. The Mermaid Strait is currently under construction and is expected to be delivered in April 2012. The Mermaid Resolution will act as the lead in vessel in respect of the Mermaid Strait contract. The combined contract value is approximately A$60 million for the firm period, with further upside should the options be exercised. The Mermaid Sound, a 50m diesel electric Offshore Support Vessel, has been successfully supporting FPSOs off Exmouth Gulf for the past four years. The Mermaid Strait is a 53m DP1 OSV and a second generation version of the Mermaid Sound. MMAs marine project group has specifically designed the Mermaid Strait to include modifications that improve the safety of the vessel, especially when working in close quarters with large tankers, and offer more flexibility in relation to the range of functions the vessel can perform. The Mermaid Strait has a fuel efficient and cost effective diesel electric drive system, increased capacities to meet growing logistical needs and improved machinery specification to enhance reliability. MMA Managing Director, Mr. Jeff Weber said: The Mermaid Strait is a testament to MMAs ability to critically assess the operation of its current fleet and transfer those learnings into practical design modifications in respect of our second generation vessels. The charter of the Mermaid Sound and Mermaid Strait to Woodside is a strong endorsement of MMAs operating capability and we are very pleased to support Woodsides operations on the North West Shelf.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Eidesvik Offshore has been awarded a five year Charter Party Contract by Statoil for the Platform Supply Vessel Viking Avant. The contract has further three yearly options for extension. Statoil has at the same time awarded Eidesvik Shipping AS, a subsidiary of Eidesvik Offshore ASA, a two year Charter Party Contract for the PSV Viking Lady (pictured). The contract has two yearly options for extension. Eidesvik has worked for Statoil for more than 30 years. We are convinced that the outstanding performance of our offshore personnel during all these years has been an important factor in the award of these contracts, says President and CEO Jan Fredrik Meling. Viking Avant was awarded Ship of the Year in 2004 with its Avant design. Viking Avant is built with bridge and engine aft, contrary to all previously built PSVs. When designing this vessel, the main emphasis was put on important criteria, such as reduced motions and noise in the superstructure due to location of the bridge, improved quality of onboard working hours for the crew, better quality of off-duty time onboard and better light conditions in living and working areas, as all of these are located above main deck. Viking Lady is Eidesvik`s third vessel of Avant design with all the advantages listed above. Further Viking Lady is by international media and specialists claimed to be the world's most environmentally friendly ship. Viking Lady employs a dual-fuel LNG/diesel electric power plant which reduces NOx emission significantly. The ship has also installed a fuel cell of 320kW output and, like the main engines, is fuelled by LNG. This provides a significant portion of the base load when the ship is stationary. With the contract of Viking Lady, all three Eidesvik vessels of Avant design will be in service for Statoil in different locations on the Norwegian continental shelf. Topaz Energy and Marine, a leading oilfield services group, has recently signed long-term vessel support contracts with prominent clients totaling US$ 160 million. Topazs cable-lay vessel, the TEAM Oman (pictured) has been contracted to ABB for a five year wind farm support contract plus options. The work will commence in early 2012 and involves a significant upgrade to the vessel which will enable her to carry out all interconnector and repair work in the wind farm industry. This award is in direct continuation of a successful two year charter in the North Sea renewable energy sector for ABB AB, High Voltage Cables. In the Arabian Gulf, the newly built anchor-handling tug supply vessel, the Topaz Khubayb has been awarded a three year contract plus options with Saudi Aramco. Topaz operates in Saudi Arabia through a joint venture with the GENTAS Group. Roy Donaldson, Chief Operating Officer of Topaz Marine, said: We are delighted to announce these two new contracts with prestigious clients that both fit well with Topazs strategic growth objectives. The prominent and fast growing Saudi Arabian market is an exciting area for the company as is the renewable energy space. Together the contracts are worth more than US$ 160 million including customer options. Silk Holdings Bhd's unit Jasa Merin (Malaysia) Sdn Bhd has entered into an RM24m (US$ 7.84M/equiv US$ 21,500 per day) contract with Talisman Malaysia Ltd for the provision of one anchor handling tug supply vessel. Silk said the contract was for a year with two extension options of one year each, exercisable at the discretion of the charterer and subject to prior approval from Petronas. In a filing to Bursa Malaysia in June, it said the contract was expected to commence in July 2011. Silk said the contract was expected to contribute positively to its earnings and assets for the financial year ending July 31, 2012. The name of the unit is unknown. Jasa currently operates nine AHTSs. Malaysian owners Tanjung Offshore Bhd has won long-term charter contracts from Petronas Carigali Sdn Bhd for the provision of three offshore support vessels. The charter contracts of between one to three primary years awarded to its wholly-owned subsidiary, Tanjung Offshore Services Sdn Bhd, are valued at RM50 million. There were options to extend the contracts for further period of up to two years, Tanjung Offshore said in a filing to Bursa Malaysia recently. The long term contracts are expected to contribute positively to its earnings and net assets for the financial year ending Dec 31, 2011 and beyond.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

Marcon International, Inc.

Supply Vessel Market Report August 2011

Tug owners and operators Smit Singapore have been awarded a tug standby contract much like the four units that were stationed off the coasts of Britain (until recently) by the Shipping Corporation of India in an Emergency Response and Rescue role. The committee of secretaries in the Union government decided to post an emergency towing vessel on the western coast. Director-General of Shipping SB Agnihotri said that the Shipping Corporation of India has hired an emergency towing vessel for the western coast from Singaporebased ship salvaging firm, Smit, at a cost of Rs 15 crore for this year. The 2008 built, 6,000BHP tug, Smit Lumba, was activated in July. It has specialized crew, can deal with any emergency and can tow away drifting vessels. It will ensure that situations like MV Wisdom grounding do not recur, said Agnihotri. Shipping Department officials said the Coast Guard normally attends to emergencies first. This tug will be at their beck and call. It will be posted on the western coast near Mumbai. Plans are also afoot to post similar such tugs along the eastern and southern coasts of the country from next year in case a ship drifts away like MV Wisdom did. A major disaster was averted at Mumbai when MV Wisdom broke from her tug while being towed to Alang; it almost hit the Bandra-Worli sea link, said a senior Shipping Ministry official. The Coast Guard, city police, BMC and MSRDC, which owns the sea link, spent anxious moments on June 12 as the ship drifted towards the sea link. Solstad Offshore ASA (SOFF) has signed a contract with Saipem Ltd for use of the Construction Service Vessel (CSV) Normand Oceanic. The duration of the contract is 150 days with commencement end of June 2011. The commercial terms are confidential between the parties, but are in line with present market level for such vessel. Normand Oceanic is a large CSV, delivered from the yard in April 2011. She is specially designed for deepwater operations worldwide. She has a 400T crane suitable for work on water depths down to 3,000 meters, DP class 3 and a work deck of more than 2,100m2. Also Solstad Offshore ASA (SOFF) has through its subsidiary, Solstad Offshore Asia Pacific Ltd, in Singapore been awarded the following charter contracts: Nor Spring (AHTS, 2008 built, 8,000BHP) is contracted to Saipem Singapore for a firm period of 180 days with charterers option to extend for a further 120 days. Commencement of charter will be in September 2011. The contract for Nor Chief (AHTS, 2008 built, 10,800BHP) has been extended with its current charterer, ENI, Egypt, for a period of 30 months. Commencement of the new charter will be mid August 2011. For Nor Supporter (AHTS, 2005 built, 8,000BHP) Murphy Sarawak Oil Company Ltd, Malaysia has declared their option to extend the contract for a further 12 months from end of August 2011. Total value of the firm part of these contracts is approximately USD 22.5 million. GC Rieber Shipping and the subsea contractor Technocean has agreed on a one year extension of the charter regarding the Subsea IMR and light CSV vessel Polar Prince. The time-charter with Technocean for the 1999 built vessel Polar Prince has been extended to September 2012. The vessel is engaged in subsea operations related to installations of offshore wind farms in the North Sea. We are pleased with the renewal of the contract and the extension fits with our overall fleet plan going forward, comments CEO of GC Rieber Shipping, Irene Waage Basili. Technocean is a subsidiary of the subsea service company Reef Subsea. GC Rieber Shipping owns 50% of Reef Subsea. Rem Offshore entered into a charter agreement for OCV Rem Forza. The firm period of the contract is six months, with further options of six months. Commencement of contract is in August, immediately after the vessel is finished with ongoing work. In addition, Rem Offshore ASA has entered into a contract agreement with Saipem Ltd for the AHTS/ROV vessel Rem Gambler. The firm contract period will be five months, with further options up to three months. Commencement of the contract is immediately. Total value for the firm periods is approx NOK 100 million.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

10

Marcon International, Inc.

Supply Vessel Market Report August 2011

Offshore services provider Alam Maritim Resources has clinched two contracts worth RM20.16m ($6.72m) to hire out two vessels. Malaysia-based Alam Maritim won tenders from Petronas Carigali to provide one accommodation vessel and from a local oil and services firm to provide one unit workboat. The Petronas Carigali contract is for 138 days with extension options and the second contract is for 30 days without extension options. The contracts. are expected to positively contribute to the earnings and net assets of Alam Maritime for the financial year ending 31 December 2011, Alam Maritim said in a statement. Bourbon Offshore announced the signing of a five-year marine charter agreement with CGGVeritas for six new seismic support and assistance vessels that will be delivered at the end of 2012. Following a tender procedure, Bourbon has decided to build these vessels at Grandweld Shipyards in Dubai. These vessels will be used to support the fleet of CGGVeritas seismic survey vessels operating all over the world, providing them with the requisite ancillary services including crew change, fuel delivery, storage, assistance and support during in-sea maintenance operations. We are delighted to have been chosen by CGGVeritas, which comes as further confirmation of Bourbons capacity to adapt to meet the needs of its clients, announced Christian Lefvre, CEO of Bourbon. At the same time, this agreement emphasizes Bourbons recognized expertise in the design and management of oil and gas marine services vessels. The construction of a new segment of vessels for our fleet fits perfectly with the investments we are making under the BOURBON 2015 strategic plan. JeanGeorges Malcor, CEO of CGGVeritas, said: This agreement to charter vessels to support our seismic acquisition operations is another step in our ambitious plan to improve the performance of our fleet and streamline the number of our maritime partners. CGGVeritas will benefit from the expertise of the Bourbon group and its commitment to the highest standards of operating quality and safety worldwide. Reflecting Bourbons constant quest for innovation, these 53-meter-long vessels will have hybrid propulsion consisting of two classic diesel engines to move at speed for transit work and two electric engines that are very precise and economical in terms of energy, for escort and support work for the seismic survey vessels. Ever focused on the satisfaction of its clients, Bourbon has already set up a department dedicated to the efficient management of these contracts and vessels, supervised by one of its Shipmanagement subsidiaries. With this new segment of Support Vessels, Bourbon is continuing to implement the investments announced for its BOURBON 2015 Leadership Strategy plan and extends the range of services offered by its fleet. Through its Brazilian subsidiary, Norskan Offshore, DOF has signed a contract with Petrobras for Skandi Botafogo. The contract will commence in third quarter 2011 and has a firm duration of two years. Skandi Botafogo is an AHTS of UT 722 L design built in Brazil in 2006.

Orders

Havila Shipping has won a tender with Statoil for delivering platform supply services. The contract is a permanent five-year deal with an option for a further three years. In order to deliver this service Havila Shipping will build a Havyard 833 L platform supply vessel at Havyard Ship Technology`s shipyard in Leirvik, Norway. The newbuild contract is worth NOK 360 million (US$ 66 million). The ship is due to be delivered in December 2012. The Havyard 833 L is a large and modern PSV design with a focus on operational costs and economy, large, flexible capacities for freight of various types of cargo, good comfort for the crew and environmentally friendly design. This version is specially designed for the demands that Statoil put forward for this particular contract. Havila Shipping has ordered a new platform supply vessel and chartered it long-term to Statoil. It will be the seventh vessel that Njal Saevik-led Havila operates on a long-term basis with Statoil.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

11

Marcon International, Inc.

Supply Vessel Market Report August 2011

GulfMark Offshore, Inc. reports the initiation of a vessel construction program. The first three vessels in the program will be built by Remontowa Shipbuilding SA in Gdansk, Poland, and consist of two 1,000 square meter deck area platform supply vessels of the MMC887CD design and one MMC879CD design with a deck area of over 800 square meters. The vessels have been designed to meet requirements for supporting deepwater and harsh environment activities, and are expected to operate in the North Sea market. The first MMC887CD vessel is expected to be delivered in the second quarter of 2013. The second MMC887CD vessel and the MMC879CD vessel are expected to be delivered in the third quarter of 2013. The total cost of these three vessels is anticipated to be $120 million dollars. Bruce Streeter, President and CEO, commented, We are excited about the initiation of our new construction program. Global market and economic conditions over the past three years gave us enough concerns to hold back on building new vessels. However, recent oil and gas finds in the North Sea, a drilling focus on frontier areas and the announcement of more than 60 new offshore drilling rigs in 2011 gives us the confidence to initiate the building of vessels designed for this developing market. Forward contract visibility and increasing opportunities in areas demanding large sophisticated vessels indicate a strong potential for these additions to our fleet. Funding for these first three vessels in the program will be through cash on hand and cash flow generated from operations during the construction period. Anticipated cash commitments for this program over the next three calendar years are $20 million during 2011, $55 million during 2012 and $45 million during 2013. As of June 30, 2011, the company had $114 million of cash on hand and $10 million drawn on its $175 million of revolving credit facility. GulfMark says it anticipates announcing additional vessels to this program over the next few quarters. Singapore Technologies Engineering announced recently that its ST Marine unit won a shipbuilding contract worth about S$171million from Swire Pacific Offshore Operations (Pte) Ltd. (Swire Pacific Offshore), a wholly owned subsidiary of Swire Pacific Limited. The contract covers the building and outfitting of four anchor handling tug supply (AHTS) vessels. Swire Pacific Offshore will furnish the major equipment for ST Marine's installation, including main engines, thrusters, switchboard and automation, cranes, A-frame, stern rollers and deck machinery. Work begins immediately with the first AHTS, measuring 92m by 22m, expected to be delivered by the first half of 2013 and the fourth by the first half of 2014. The four vessels will be able to support the latest generation of deepwater harsh environment semi-submersible offshore drilling rigs. They will also have adequate tank capacities and clear deck space of about 650m2 for other offshore applications. The vessels will adopt the latest dynamic positioning technology and will be Special Purpose Ship 2008 compliant. In March this year, ST Marine successfully delivered Pacific Finder, a 68m Seismic Survey Vessel (photo) to Swire Pacific Offshore. The vessel is successfully deployed for marine seismic survey in shallow waters for oil and gas clients in the Asia Pacific region. Swire Pacific Offshore owns and operates 77 offshore support vessels, with a further 17 new vessels on order for delivery throughout 2011 and 2014. Its fleet has an average age profile of less than nine years. It operates vessels in every major oil exploration region outside of North America. Swire Pacific Offshore is committed to owning and operating a modern fleet of offshore support vessels. The recent order with ST Marine is testament to our commitment for quality, reliability and environmentally friendly fuel efficiently designed vessels. ST Marine is our shipyard of choice for these new building orders based upon their previous performance, commitment and dependability to deliver on time. We are very pleased to be working with the ST Marine team, said Brian Townsley, Managing Director, Swire Pacific Offshore. We are delighted and honored to be entrusted with this opportunity to work with Swire Pacific Offshore again. Swire, one of the world's largest owners and operators of offshore support vessels, is a forward-looking and very professional company and we are thankful for the role to enhance and grow their fleet to support their customers in the burgeoning offshore oil and gas industry. This contract is not only a testament to ST Marine's capability as a shipbuilder of choice but an affirmation that our partnership with Swire Pacific Offshore is growing from strength to strength, said Ng Sing Chan, President, ST Marine.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

12

Marcon International, Inc.

Supply Vessel Market Report August 2011

Singapore-listed STX OSV will net NOK 750m ($140m) to build two 4,800DWT PSVs for Norways Island Offshore. STX OSV will deliver the pair from its Brevik shipyard in Norway in the first and third quarters of 2013 respectively. The contract for the second vessel is subject to certain conditions being fulfilled by the end of the third quarter of this year. The hulls will be built by STX OSV Braila in Romania. The Rolls Royces UT 776 CD design has a length of 96.8 meters with a beam of 20 meters. The UT 776 CD design is optimized for harsh weather operations, with enhanced focus on safety, and environmental friendly operations. Island Offshore presently has six new buildings of the proven design under construction. When the new building program is finished, Island Offshore will have ten vessels in operation of the proven UT 776 CD design. Rolls-Royce recently said it has also won a 15 million order to design and equip two offshore service vessels for the company. The vessels, of the Rolls-Royce UT775 E design, will be chartered by Brazils state oil company Petrobras and are designed specifically for carrying fluids and solid cargo to and from offshore oil and gas platforms. They will be built by Estaleiro Ilha S.A. in Brazil, for delivery in 2013, and feature a fully-integrated equipment system from Rolls-Royce, including ship propulsion, deck machinery, and vessel control systems. Atle Gaas, Rolls-Royce, General Manager Sales Offshore Service Vessels, said: This is an important contract for Rolls-Royce, and reflects our strong position in the Brazilian offshore industry. The combination of our leading edge ship designs together with fully integrated equipment systems is able to meet the demanding requirements of the offshore sector. These latest vessels feature a range of advanced equipment, which will enable Brasil Supply and Petrobras to operate safely and efficiently in the challenging sea conditions off the coast of Brazil. Rolls-Royce opened a state-of-the-art Marine Service Centre in Niteri near Rio in 2009, providing round the clock support to customers throughout the region. In total, more than 650 Rolls-Royce designed UT vessels are in service around the world. Farstad Shipping ASA has, through its wholly owned subsidiary Farstad Supply AS, reached an agreement with STX OSV AS to build two Anchor Handling Offshore Service vessels of the type UT 731 CD. Contract value is approx. NOK 1.2 billion. The vessels are designed by Rolls Royce Marine with a total length of 87.4 meters and breadth of 21.0 meters. Bollard pull will be approx. 260 tons and installed power is approx. 24,000BHP. The vessels will be built according to DNV's strictest environmental class - Clean Design - and will be arranged for safe and efficient deepwater operations. The newbuilds are of the same design as the four Langsten previously delivered to Farstad during 2009-2010. The steel hulls will be built in Romania and outfitting yard will be STX OSV Langsten in Tomrefjord. Delivery of the vessels will be April and June 2013 respectively. These newbuilds are part of Farstad's fleet renewal and focus on the segment for deepwater activities. With this latest order Farstad will have eight vessels under construction at a contract value of NOK 3.2 billion. Rolls-Royce has noted that this is a 50 million contract to it for design work and equipping the vessels. The Rolls-Royce UT 731 CD vessels are designed to work in extreme environmental conditions and carry out operations in water as deep as 3,000m. The order includes a fully integrated equipment system from Rolls-Royce, including deck machinery, vessel control systems and a diesel-electric hybrid propulsion system. This will be fitted on both vessels to maximize efficiency, reduce fuel burn and cut emissions. Great Offshore in India has recently placed an order for three offshore support vessels from Pinky Shipyard, a subsidiary of Bharati Shipyard Limited. The yard is located in Goa, West India.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

13

Marcon International, Inc.

Supply Vessel Market Report August 2011

Colombo Dockyard of Sri Lanka has gained a contract from a Singapore-based owner to build four 78m multipurpose PSV ships, each of 3,600dwt and is to be classed with NKK. The yard said that the owner has asked to remain confidential but is based in Singapore. The Chairman of Colombo Dockyard PLC, Mangala Yapa speaking to the press disclosed that this deal is to the tune of US $ 110 million. These MPSVs are designed by Seatech Solutions International (S) Pte Ltd of Singapore and incorporates an oil recovery arrangement and operate as advanced PSVs as well as light construction support vessel, complying to SPS Code 2008 & Clean Design requirements of NKK, Dynamic Positioning, Fire Fighting Capability, Oil Recovery Capability, Capability to support ROV operations and these vessels shall be designed and built to accommodate 50T Active Heave Compensated Crane, an A-frame and helideck. The 78m LOA x 17m x 8m depth x 5.5m design draft MPSV will have an endurance of 35 days and a cruising range of about 9,200 nautical miles. Designed for unrestricted operation worldwide and with an outstanding speed of 14.5 knots, the 3,600T dwt vessel can get to the desired location around the world as quickly as possible, minimizing downtime. Twin controllable pitch propellers, twin high lift flap rudders and transverse bow and stern thrusters provide good maneuverability and station keeping ability. The vessel is controlled from twin maneuvering consoles fitted in the wheelhouse, forward and aft stations with joy-stick controls. The vessel shall also be equipped with advanced dynamic positioning (DPS B) system which assures safe and more efficient operations while working in close proximity to oil platforms and rigs, even under harsh weather conditions. Being equipped with a fully automated bridge layout with alarm monitoring systems for periodic single man bridge operation, the vessel is classed with BRS1 notation. The vessel is fitted with automated installations enabling machinery spaces to remain periodically unattended in all sailing conditions including maneuverings, qualifying it to be assigned with M0 notation. The vessel is designed to have an enhanced accommodation area for 50 persons. These accommodation areas are well-appointed and are aesthetically designed with special attention being made to noise and vibration levels and crew comfort onboard the vessel, thereby meeting compliance to NVC(c)* notation of the classification society. The vessel is also classed with In Water Survey denoting the vessel could be operated without being drydocked for five years. Due to this, surveying the underwater parts of the vessel could be carried out while it is still afloat instead of having to drydock for examination of the under water areas, as is conventionally done. This is a huge saving for the Owner. In addition, the vessel is also equipped with Tail Shaft monitoring system (SCM) which is a huge advantage for the Owner in his quest for monitoring of temperature and condition in the tail shafts. In addition to the dry bulk carrying capability, the vessel is also capable of carrying methanol, which is a low flash point liquid. In order to prevent any fire risks, a special deck foam fire fighting and prevention system has been installed for safety. This vessel shall be another green, eco-friendly vessel to be built by the yard, with lower fuel consumption, reduced NOx and greenhouse gas emissions. In addition, the MPSV shall also be fully equipped with a number of eco-friendly measures. The plan approval and survey during construction will be performed Class NKK of Japan. This project will be yet another first for Colombo Dockyard and Sri Lankan Shipbuilding; i.e. the first NK Class vessel(s) built by Sri Lanka and Colombo Dockyard PLC, epitomizing the evergrowing relationship between Japan and Sri Lanka. The owner of the newbuilds appears to be an existing customer of the yard, and the indications are that the new contract resulted from the owners satisfaction with the yards work on two AHTS vessels that are currently being built at Colombo Dockyard. (Colombo is currently building two AHTS - Hulls No. 219 for Eagle High Ltd and Hull No. 220 for True Wisdom Ltd both registered in Samoa. The Group Owner is unknown.) These ships had been slightly delayed, said reports, because of late delivery of anchor handling winches manufactured in China by a Norwegian/Singapore based supplier, but the AHTS ships will be handed over in mid-October and end-November, 2011. Colombo Dockyard has built four multi-purpose PSVs, with three more under construction for another Singapore-based company.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

14

Marcon International, Inc.

Supply Vessel Market Report August 2011

Singapore's Keppel Singmarine landed two orders for a total of seven offshore support vessels to be built at its Brazilian facility. One of the orders is for a PSV and has been placed as a speculative order by the shipyard's own Brazilian ship-owning arm. The other vessels are offshore tugs being built for industry stalwart Smit, with all seven vessels to be built at the company's new 7.6-hectare shipyard in Santa Catarina state at a total cost of S$140 million. The first contract is for a large-sized MTD 9045P-DE design PSV placed by Keppel Offshore & Marine's Brazilian shipowning arm, Guanabara Navegacao. The vessel is the first speculative newbuild in its fleet. Keppel expects the vessel will be offered for bareboat charter or sale upon delivery. The ABS-Classed unit is 94.2m by 19.8m wide. It features a large deadweight capacity in excess of 4,500 tons and a 1,000m2 deck space. The DP2 vessel is equipped with a diesel-electric propulsion system and accommodation for 26 crew members. The second contract entails building a series of six 45T bollard pull twin-screw azimuth stern drive harbor tugboats for Smit's Brazilian offshoot Rebocadores do Brasil (Smit Rebras). The work scope for the contract includes detailed design and engineering work and the purchase of all equipment. The first tugboat will be delivered in the fourth quarter of 2012, followed by the remaining five at three-month intervals. These Robert Allandesigned tugboats will be deployed by Smit Rebras to work at key ports across Brazil. The new facility in Brazil is also able to fabricate offshore steel structures and support major projects undertaken by Keppels BrasFELS yard in Angra dos Reis. Hoe Eng Hock, executive director of KSM Brasil said: Petrobras will need over 100 Brazilian-built offshore support vessels by 2020, to facilitate the exploration and development of the Santos Basins deep water pre-salt fields. We see a growing market for purpose-built support vessels that can operate safely and efficiently offshore Brazil. ASL Marine Holdings Ltd. reports that its wholly-owned subsidiary ASL Shipyard Pte Ltd has secured new shipbuilding contracts worth a total of approximately S$131 million for the construction of eleven vessels for deliveries between the fourth quarter of 2012 and the third quarter of 2013. Two additional North Sea Standby Emergency and Response vessels will be built at the ASL Marine's Singapore shipyard for a repeat customer. Nine Anchor Handling Towing Supply Vessels will be built at the group's shipyard in Guangdong province, China. WM Offshore a subsidiary of Wintermar Offshore Marine (WINS) Tbk, has ordered another platform supply vessel for deepwater drilling operation. The 76m platform supply, oil recovery, safety standby vessel of about 3,500dwt is expected to be delivered in June 2012 and will be deployed to support deepwater drilling and operations of the oil and gas industry in Indonesia. PT Wintermar, a subsidiary of WINS, has been awarded a two-year contract from Total E&P Indonesie, to provide a supply vessel commencing in 2012. The contract is valued about US$6.5 million and will commence February 2012. WINS group has won 23 new tenders in the first five months of 2011 amounted US$104 million. The yard of build is unknown. New operators Bluesea/Cleaves Marine of Norway are understood to have ordered six PSVs, Rolls Royce designed UT-776CD, with a 4,800dwt from China Petroleum Liaohe Equipment Company (CPLEC), China. China Petroleum Liaohe Equipment Company is a subsidiary company of China National Petroleum Corporation (CNPC) and it is one of the main equipment manufacturers of CNPC. The core business of CPLEC is land & offshore petroleum equipment manufacture and engineering solutions. Harvey Gulf International Marines Board of Directors approved construction of the first United States flagged LNG Offshore Supply Vessels. Chairman & CEO Shane J. Guidry stated that this is another example of Harvey Gulfs commitment to meet clients future needs. Mr. Guidry said that a contract will be awarded to a US shipyard on or before August 28, 2011. The SV310DF vessels, designed by STX Marine Inc., will be dual-fuel with LNG capacity for seven days with three engines at full RPM. In addition, vessels will carry 5,520 tons of deadweight at load line and a transit speed of 13kn. Mr. Guidry stated that, with the stringent Governmental demands for both reduced emissions and clean burning energy use, Harvey Gulf decided to make the capital investment of US$ 100 million for two vessels.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

15

Marcon International, Inc.

Supply Vessel Market Report August 2011 Supply Vessels Worldwide

According to Lloyds Register Fairplay Sea-Web, as of August 9, 2011, there were 6,190 sea-going supply vessels over 100GRT worldwide. This is up 1.24% or 76 vessels since our last report in May. Total horsepower of this fleet is 32,898,472BHP. This is up 419,466BHP or 1.29% since our last report. The largest national fleet of supply vessels worldwide in horsepower and count sails under U.S. registry. The U.S. operates 920 sea-going supply vessels over 100GRT, or 14.86% of the world market, totaling 3,868,086 horsepower (11.76% of the global horsepower) with a 15 year average age. The registry with the youngest supply fleet is Denmark with two 2011 built vessels, total 3,862BHP.

Top 50 Sea-Going Supply Vessel Fleets By Units as of August 2011 According to Lloyds Register

Flag Worldwide United States Of America Singapore Panama Malaysia Vanuatu Norway China, People's Republic Of Mexico Unknown India St Vincent & The Grenadines Brazil United Arab Emirates Indonesia Nigeria United Kingdom Bahrain Marshall Islands Italy Luxembourg Cyprus Norway (Nis) Bahamas Liberia Belize Egypt Denmark (Dis) Russia Azerbaijan Iran France (Fis) Comoros Vietnam Isle Of Man Trinidad & Tobago Qatar Honduras Canada Kazakhstan Cayman Islands Antigua & Barbuda Netherlands Saudi Arabia Turkmenistan Venezuela Kuwait Australia Thailand Dominica St Kitts & Nevis Total BHP % 32,898,472 100.00% 3,868,086 11.76% 3,006,179 9.14% 1,658,018 5.04% 1,578,912 4.80% 1,817,232 5.52% 2,580,431 7.84% 1,191,143 3.62% 824,332 2.51% 603,830 1.84% 987,808 3.00% 887,265 2.70% 1,090,591 3.32% 496,081 1.51% 511,621 1.56% 425,953 1.29% 589,871 1.79% 464,634 1.41% 444,151 1.35% 475,582 1.45% 508,710 1.55% 548,069 1.67% 679,328 2.06% 557,539 1.69% 452,782 1.38% 326,048 0.99% 207,091 0.63% 680,731 2.07% 463,508 1.41% 284,966 0.87% 161,985 0.49% 300,623 0.91% 127,927 0.39% 225,223 0.68% 445,745 1.35% 68,169 0.21% 157,115 0.48% 74,703 0.23% 324,659 0.99% 96,621 0.29% 183,915 0.56% 305,634 0.93% 184,440 0.56% 86,955 0.26% 100,933 0.31% 57,574 0.18% 91,846 0.28% 84,209 0.26% 84,305 0.26% 95,487 0.29% 70,746 0.22% #SVs % 6,190 100.00% 920 14.86% 476 7.69% 387 6.25% 315 5.09% 287 4.64% 233 3.76% 231 3.73% 219 3.54% 209 3.38% 200 3.23% 181 2.92% 165 2.67% 163 2.63% 161 2.60% 124 2.00% 111 1.79% 101 1.63% 82 1.32% 82 1.32% 80 1.29% 70 1.13% 69 1.11% 62 1.00% 59 0.95% 58 0.94% 55 0.89% 51 0.82% 50 0.81% 49 0.79% 45 0.73% 42 0.68% 42 0.68% 41 0.66% 36 0.58% 36 0.58% 35 0.57% 35 0.57% 32 0.52% 30 0.48% 28 0.45% 28 0.45% 28 0.45% 27 0.44% 26 0.42% 26 0.42% 24 0.39% 24 0.39% 23 0.37% 22 0.36% 21 0.34% Avg BHP Avg Age 5,315 1995 4,204 1996 6,316 2006 4,284 1989 5,012 2005 6,332 1998 11,075 2004 5,156 1994 3,764 1991 2,889 1984 4,939 1994 4,902 1997 6,610 2003 3,043 1988 3,178 1991 3,435 1986 5,314 1995 4,600 1998 5,416 2003 5,800 1992 6,359 2010 7,830 2004 9,845 2003 8,993 1997 7,674 1998 5,622 1987 3,765 1985 13,348 1999 9,270 1994 5,816 1988 3,600 1983 7,158 2004 3,046 1982 5,493 1993 12,382 1999 1,894 1987 4,489 1998 2,134 1970 10,146 1988 3,221 1995 6,568 2002 10,916 2001 6,587 1999 3,221 1991 3,882 1986 2,214 1979 3,827 2000 3,509 1995 3,665 2005 4,340 1987 3,369 1979

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

16

Marcon International, Inc.

Supply Vessel Market Report August 2011 New Construction, Shipyard and Conversion News

New construction continues, but at a declining pace. According to Fairplay, as of 1 August 2011, there were 8,340 ships over 299GRT on the World Orderbook. This is down 179 or 2.10% from 8,519 May. Of the 8,340 ships recorded on order, 611 (up 2) are Offshore Supply Vessels and 167 (up 9) are designated as Offshore Other. Of the 611 OSVs under construction, China leads the Orderbook with a total of 188 (down 10) OSVs being built. They are followed by India at 74, Singapore 51, Malaysia 47, USA 41, 33 Brazil, 26 Romania, Indonesia 25, Norway 17, 13 each Japan and the UAE, Poland 10, Italy and Vietnam 9 each, 8 each Spain and the Netherlands, 6 each Russia, Sri Lanka and Thailand, South Korea and Turkey 3 each, 2 each Australia, Finland, the Philippines and Saudi Arabia, and 1 each Egypt, France, Greece, Iran, Nigeria, South Africa and the Ukraine. The 611 OSVs on the order books represents 9.87% of the global OSV fleet of sea-going vessels over 100GRT which has an average age of 17 years.

Worldwide Offshore Supply Vessels On Order Over 299 GRT

200 175 150 125 100 75 50 25 0 China (PRC) India Singapore Malaysia USA Brazil Romania Indonesia Norway Japan UAE Poland Italy Vietnam Netherlands Spain Russia Sri Lanka Thailand South Korea Turkey Australia Finland Philippines Saudi Arabia Egypt France Greece Iran Nigeria South Africa Ukraine

Credit: Fairplay New buildings Online 8/11

The below graph shows the estimated delivery dates for those OSVs on order.

Delivery Dates Worldwide Orderbook For Offshore Supply Vessels Over 299 GRT 175 150 125 100 75 50 25 0 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2

Credit: Fairplay New building Online 8/11

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

17

Marcon International, Inc.

Supply Vessel Market Report August 2011

CAT power leads by far the propulsion packages, with engines in 148 OSVs followed by Cummins in 89, Wartsila in 65, Bergens and MaK 35, Yanmar 30, MAN-B&W 19, General Electric and Niigata 17 each, 10 M.T.U., 7 Mitsubishi, Daihatsu 4, 3 Chinese Standard Type, 2 Guangzhou and Hyundai Himsen, Rolls Royce and Weifang with 1 each. Engines were not listed for 127 OSVs.

Engine Types Worldwide Orderbook For Offshore Supply Vessels Over 299 GRT 150

125

100

75

50

25

0 Chinese Std Type GE Marine M.T.U. Daihatsu Guangzhou Unknown Hyundai Himsen Rolls Royce Caterpillar MAN-B&W Mitsubishi Cummins Bergens Wartsila Weifang Yanmar Niigata MaK

Credit: Fairplay Newbuilding Online 8/11

The highest portion of OSVs over 299GRT being built worldwide are in the 3 4,000HP category with 102 OSVs, or 16.7% of those OSVs where the horsepower is listed. Followed by 12.4% being built in the 5 6,000HP and 9.2% in the 4 5,000HP categories. Three OSVs are shown under 1,000BHP, but this is most likely because most of the OSVs being built in this horsepower range will be under 299GRT.

Summary of Horsepower Fairplay Worldwide Offshore Supply Vessels Orderbook over 299GRT

OSVs Under 1,000HP 3 1,000 1,999HP 16 2,0002,999HP 42 3,0003,999HP 102 4,0004,999HP 56 5,0005,999HP 76 6,0006,999HP 48 7,0007,999HP 31 8,0008,999HP 17 9,0009,999HP 12 Over 10,000HP 54 Unk. 154 Total 611

Deliveries

Vroon Offshore took delivery of VOS Vigilant in June. VOS Vigilant, a field-support vessel, is the penultimate in a series constructed for Vroon at the Astilleros Zamakona Shipyard, Pasaia. She will join Vroons extensive fleet of modern vessels providing a range of emergency response and cargo support to the offshore industry. The vessel has a length of 60m, a beam of 12.7m and a rescue draft of 4.5m. She has a GRT of 1,734 tons and a NRT of 520 tons. On August 10, 2011, at 14:33 local time in Vietnam the AHTS Skandi Saigon was delivered to Aker Dof Deepwater AS by STX Vung Tau. The Skandi Saigon is a new generation high powered anchor handling vessel designed for field installation operations across a wide range of water depths and environmental conditions. The Skandi Saigon measures 75m x 17.4m x 8.5 depth The vessel is sister to the Skandi Emerald and Skandi Peregrino.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

18

Marcon International, Inc.

Supply Vessel Market Report August 2011

US flagged and built OSV AL Kat was delivered from Thoma Sea shipbuilders to new owners JG Marine in July. Measuring 220.0' loa x 210.1' lbp x 48.0' beam x 16.0' depth x 13.50' loaded draft, the vessel is powered by twin CAT 3516 totaling 4,000BHP at 1,600RPM. Propulsion is provided by Rolls Royce Z Drives in kort nozzles. The vessel is notated DP2 with ABS. TransAtlantic received delivery of Magne Viking AHTS vessel from the Astilleros Zamakona S.A shipyard in Spain. The vessel will be flagged in the Danish register of ships, DIS. Magne Viking is the third new-build in a series of four, which are being built at the Spanish shipyard. The last vessel in the series, TransBarents, is expected to be delivered in 2012. The vessel series is specifically designed to meet demands for efficient, safe and environmentally friendly offshore management in Barents Sea and areas with severe ice conditions. Magne Viking has the following technical data: AHTS, Ice 1A, standby vessel, oil recovery, clean design. Deck area 750m2, length 85m by beam 22m, 4,500 deadweight tons and complies with the most up-to-date regulations pertaining to oil clearing. Ultrapetrol Bahamas have taken delivery of their new PSV UP Jasper reportedly at a newbuild cost of $21.7m from Wison (Nantong) Heavy Industry in China. Measuring 87.4m x 19m x 8m depth, the vessel is powered by twin EMD 16-710-G7B engines creating around 8,000BHP. It is likely the vessel will join the rest of Ultrapetrol Bahamas fleet operating in Brazil Recently delivered by the Drydocks World shipyard in Nanindah, Indonesia, the anchor handling offshore support vessel Crest Olympus has been built for Singapore based Pacific Crest Pte. Ltd. at a contract value of $20.4 million, excluding owner furnished equipment. Crest Olympus has a length of 76m, beam of 18.5m and draft of 6.8m. With a bollard pull of 150T, the vessel has DP2 capability and is of fire fighting class 1. The vessel is equipped with deck machinery from Rolls-Royce Marine, a Caterpillar 9M32 main engine, Kawasaki side thruster and Berg propulsion. It is designed by Wartsila Ship Design and classified by ABS. The owner is part of Pacific Radiance Group. Deep Sea Supply took delivery of their DP 1 rated Sea Badger, a newbuilding AHTS from ABG Shipyard, India. Sea Badger is the seventh delivery in a series of nine newbuilding AHTS vessels from ABG. The vessel is a Sea-tech P-729 design with twin Yanmar main engines with 6,800BHP of output. The Deep Sea Supply fleet now consists of 13 AHTS and eight PSVs, in total 21 vessels. In addition to this, Deep Sea Supply also has another three vessels under construction. The current fleet of vessels currently operates in the North Sea spot market, West Africa, Mediterranean, South East Asia and Brazil. Sarawak Slipways has delivered a long list of anchor handling tugs and offshore vessels for petroleum producers around the world. In mid-June this year, the yard completed sea trials on one of their larger vessels. The 61m by 14m, Nautika Resolute is designated an offshore utility vessel and was built to a design by Wrtsil Ship Design of Singapore, and powered by twin Cummins QSK60-Ms. Accommodation is provided for 12 crew and 58 passengers. The registered owner is Ocean Offshore Marine. Vessel has a design speed of 12kn but achieved 13.5kn during sea trials. The positive hull design is driven through the water by a pair of IMO2 and EPA2 compliant Cummins QSK60M engines with modular common rail fuel systems. Each 1,640kW engine turns up to 1,800RPM into Twin Disc MGX5600 gears with 5:04:1 reduction. The shafts turn four-blade fixed pitch propellers with 1,900mm diameters. Tankage is provided for 600 tons of fuel and 250 tons of water. On the after deck, a pair of ten ton winches supplements capabilities of a crane with a capacity of eight tons at 12 meters. Nautika Resolute is built to ABS class.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

19

Marcon International, Inc.

Supply Vessel Market Report August 2011

The Ungundja, the first of ten DP-3, 100-meter GPA 696 IMR (Inspection, Maintenance & Repair) vessels, was recently delivered by China's Zheijang Shipyard, part of the Sinopacific Shipbuilding Group, to Paris-based Bourbon Offshore. Classed by Bureau Veritas, the vessels were designed by naval architectural and marine engineering firm Guido Perla & Associates, Inc. (GPA), Seattle, Wash. GPA delivered the concept design, regulatory package, and final design for IMR vessels. The highly maneuverable DP-3 and FiFi-1 certified GPA 696 IMR vessels are equipped with three 1,686kW azimuthing drives, two 843kW tunnel bow thrusters, one 843kW drop-down azimuthing bow thruster delivered by Schottel and six 1,235kW Cummins generators, as well as one 1,235kW auxiliary generator and one 450kW emergency generator. The configuration of the environmentally friendly diesel-electric propulsion system, including two engine and two electrical rooms, creates full redundancy in accordance with DP-3 requirements. The diesel-electric propulsion system also results in reduced maintenance cost and improved stationkeeping at offshore installations, and significantly increases crewmember safety. Because of its design and standardization, the GPA 696 IMR series can compete with more expensive, similar-sized vessels, reducing operational cost to the customer by up to 20%, according to Guido Perla & Associates. The deck equipment of the 100 meter vessels includes one 150MT at 10m radius main crane, which can lower packages to a depth of 3,000 meters and one 40MT at 9m radius deck crane. Both cranes, with built-in swell compensation systems, cover the entire 1,200m2 deck surface to ensure handling and storage of packages over the entire area. The SOLAS-certified IMR vessels also have significant below-deck cargo capacities, capable of carrying 380m3 of methanol, 2,541m3 ships ballast, 1,080m3 fuel oil and 749m3 fresh water. The vessels are also equipped with a helideck designed for a Super Puma Helicopter EC225. A key benefit of these vessels is the capability to adapt to different operational needs and can serve as a stimulation vessel, rescue vessel, hotel vessel or provide light intervention on wells while offering modern conditions aboard with meeting rooms, offices, lounges and comfortable cabins. The vessel design allows two ROVs, which can be used at the same time; maximum deck cargo 2,080MT, with an equivalent 18,512m-MT deadweight vertical moment; and accommodations for 105 people on board under comfortable working conditions. The vessel could also function as a mini-FPSO vessel due to increased freight loading capacity with a storage capacity of 24,000bbls of crude oil or as an Oil Well Intervention vessel. One of the remarkable features of these vessels is the ability to operate both cranes and both ROVs simultaneously over the complete operating envelope of the vessel without any restrictions. These vessels are certified to satisfy both the current IMO deterministic and probabilistic damage stability requirements. The Stril Merkur (C-450) has been delivered to the Norwegian shipowner, Simon Mkster Shipping. After successfully passing the period of sea trials, the ship is bound for Stavanger, Norway, where said owner operates. The Stril Merkur is a stand-by vessel, which will operate for Norwegian state company, StatoilHydro, in a field of oil rigs in the North Sea, giving multifunctional support in all duties of rescue and salvage, fire-fighting, waste collection, supply of materials etc. With its 97.55m length and 19.20m beam, the Stril Merkur is the largest and one of the most complex vessels built in Gondans facilities in Figueras (Castropol) to date. American Eagle Tankers, the Malaysian headquartered business, through its US subsidiaries AET Offshore Services Inc and AET Lightering Services LLC, recently saw its new AET Innovator launched by Leevac Industries at Jennings in Louisiana. It is reported that it is Leevacs Hull No. 354 and measures 187 x 46 and powered by twin CAT engines creating 3,000BHP. Delivery is expected in September 2011 with a sister due in December 2012, being Hull No. 355. AET Offshore currently operates five US flag OSV units built around the late 1970s to early 1980s.

www.marcon.com

Details believed correct, not guaranteed. Offered subject to prior sale or charter.

20

Marcon International, Inc.

Supply Vessel Market Report August 2011