In Come Surance PDF 8015605034051624231

Diunggah oleh

Sanjay C BhattHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

In Come Surance PDF 8015605034051624231

Diunggah oleh

Sanjay C BhattHak Cipta:

Format Tersedia

IDBI Federal Life Insurance Company Limited Registered Office: 1st Floor Trade View, Oasis Complex, Kamala

city, P.B. Marg, Lower parel (W), Mumbai - 400013, India IRDA Registration No: 135 Website: www.idbifederal.com Toll-Free : 18001025005 (For non-MTNL subscribers) /1800221120 (for MTNL subscribers)

IDBI Federal Incomesurance Endowment and Money Back Plan - What if Analysis (Product Unique Identification No - 135N010V01)

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of IDBI Federal Life Insurance Company Limited. If your policy offers guaranteed returns then these will be clearly marked guaranteed in the illustration shown below. If your policy offers variable returns then the illustration will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

Details of Person to be Insured Date of illustration Name of the person to be insured Date of birth of the person to be insured Age of person to be insured (in years) Gender of the person to be insured Details of Policy Owner Name of the policy owner Date of birth of the policy owner Age of the policy owner (in years) Gender of the policy owner Plan Details Plan option Policy term (in years) Premium payment period (in years) Premium payment mode Sum insured (in Rs) Instalment premium (in Rs) Service tax and education cess (in Rs) Total installment premium (in Rs) Guaranteed annual payout option Sanjay bhatt 15-Jul-1976 35 Male 04-Jul-2012 Mahek bhatt 20-Nov-2000 11 Female Average 10 year G-Sec rate in the last 5 2 years Year 2010 2009 2008 2007 2006 Rate 7.86% 7.6% 7.92% 7.78% 7.11%

Lump Sum Cover Option

15 10 Annual 425000 39232 1212 40444 Annual payout option

Guaranteed Benefits (in Rs) Policy Year

Projected Guaranteed Benefit @ 8.91 % (in Rs) Guaranteed Special 6 Annual Death Benefit Surrender Value Payout (eoy) (eoy) 448375 471750 495125 518500 541875 565250 588625 612000 635375 658750 0 29631 64201 96900 134959 189720 242552 304606 375883 457173 501968 418965 328058 229245 119893

Annualised Service Total Payment Premium Tax (in Rs) Additional Minimum Annual (in Rs) (in Rs) (boy) Annual Sum Insured Payout (boy) (boy) Payout (eoy) (eoy) 39232 39232 39232 39232 39232 39232 39232 39232 39232 39232 1212 606 606 606 606 606 606 606 606 606 40444 39838 39838 39838 39838 39838 39838 39838 39838 39838 425000 425000 425000 425000 425000 425000 425000 425000 425000 425000 425000 340000 255000 170000 85000 85000 85000 85000 85000 85000 46750 46750 46750 46750 46750

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

131750 131750 131750 131750 131750

658750 527000 395250 263500 131750

Important Notes 1)The "what if analysis" is for information only. 2)The Average 10 year G-Sec rates are published by FIMMDA. 3)The FIMMDA G-Sec rates are indicative rates and doesn't reflect any trend for the future. 4)The FIMMDA G-Sec rate in future will depend on the prevailing economic conditions and market developments. 5)The plan offers some guaranteed benefits which are marked as "Guaranteed". 6)Special surrender values are not guaranteed and can change from time to time and are applicable if all due premiums have been paid. 7)The premium stated is for a healthy individual and would be subject to underwriting. 8)eoy refers to payment at end of year 9)boy refers to payment at the begining of year 10) The premiums you pay are eligible for deduction from your income up to a limit of Rs. 100,000 per year under Sec 80C of the Income Tax Act, 1961, and the benefits you receive may qualify for tax exemption under Sec 10 (10D) of the Income Tax Act, 1961. 11) The Finance Bill, 2012 has proposed that Deduction from income under Sec 80C of Income Tax Act 1961, for premiums payable on life insurance policies shall be available only to the extent of 10% of the Sum Insured. Exemption under Sec 10 (10D) of Income Tax Act 1961, on benefits received under life insurance policies 2012, shall be available only if the premium payable in any of the years is not more than 10% of the Sum Insured. Death benefit is always tax-free under sec 10(10D) of Income Tax Act, 1961. 12) Please note that tax laws may change from time to time. You are always advised to consult your tax advisor for details.

IDBI Federal Life Insurance Co Ltd Registered Office: 1st Floor Trade View, Oasis Complex, Kamala city, P.B. Marg, Lower parel (W), Mumbai - 400013, India IRDA Registration No: 135 Toll-free number: 1800-102-5005 (for non-MTNL subscribers)/ 1800-22-1120 (for MTNL subscribers)

Insurance is the subject matter of the solicitation

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Electronic Delivery Challan: 18132819 Boughout 8/2/2019 BillableDokumen2 halamanElectronic Delivery Challan: 18132819 Boughout 8/2/2019 BillableSanjay C BhattBelum ada peringkat

- List of Candidates Called For Spot Admission in M.sc. Cell and Molecular BiologyDokumen3 halamanList of Candidates Called For Spot Admission in M.sc. Cell and Molecular BiologySanjay C BhattBelum ada peringkat

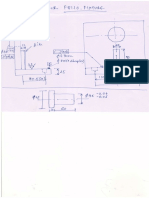

- 8120 FixtureDokumen1 halaman8120 FixtureSanjay C BhattBelum ada peringkat

- Specmanual 08 Final 01 PDFDokumen199 halamanSpecmanual 08 Final 01 PDFSaravanan NatesanBelum ada peringkat

- T02 NsaDokumen2 halamanT02 NsaSanjay C BhattBelum ada peringkat

- MasterCam Basic 2D DesignDokumen44 halamanMasterCam Basic 2D Designmiguel187Belum ada peringkat

- Splines: Side Splines For Soft Holes in Fittings-Sae J499aDokumen4 halamanSplines: Side Splines For Soft Holes in Fittings-Sae J499aSanjay C BhattBelum ada peringkat

- WT93 DD PitchAngleScale Rev00 090715Dokumen1 halamanWT93 DD PitchAngleScale Rev00 090715Sanjay C BhattBelum ada peringkat

- 01 Set Angle RingDokumen1 halaman01 Set Angle RingSanjay C BhattBelum ada peringkat

- Denford G and M Programming For CNC MillDokumen98 halamanDenford G and M Programming For CNC MillBiljana Đurin MarkovićBelum ada peringkat

- Bearing A14Dokumen2 halamanBearing A14Vignesh Raju ReddyBelum ada peringkat

- Facsimile: Gi A Di A Mond Dos SierDokumen1 halamanFacsimile: Gi A Di A Mond Dos SierSanjay C BhattBelum ada peringkat

- Eurozone GDPDokumen2 halamanEurozone GDPSanjay C BhattBelum ada peringkat

- WeldingDokumen129 halamanWeldingAnilkumar Cm93% (15)

- Crabtree ListDokumen4 halamanCrabtree ListKiran SwaiBelum ada peringkat

- India RTO Form30Dokumen3 halamanIndia RTO Form30Pranav SrivastavaBelum ada peringkat

- Is 1730Dokumen11 halamanIs 1730minnalmaruthu4611Belum ada peringkat

- Mini Ostrich BrochureDokumen2 halamanMini Ostrich BrochureSEC MachinesBelum ada peringkat

- Sap Code Description Size Qty SR Nos + Marking On ComponentDokumen1 halamanSap Code Description Size Qty SR Nos + Marking On ComponentSanjay C BhattBelum ada peringkat

- European Standard EN 288-1: 1992 + A1: 1997 Has The Status of A DIN StandardDokumen9 halamanEuropean Standard EN 288-1: 1992 + A1: 1997 Has The Status of A DIN StandardSanjay C BhattBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Cdcs Ornek TestDokumen24 halamanCdcs Ornek TeststupidBelum ada peringkat

- Metabical Case Study SolutionDokumen4 halamanMetabical Case Study Solutionparoengineer100% (7)

- List of Organisations Issued Compliance Certificates2017Dokumen58 halamanList of Organisations Issued Compliance Certificates2017Ogochukwu83% (6)

- Progress Payment ProceduresDokumen5 halamanProgress Payment Proceduresjeanneth lontocBelum ada peringkat

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Dokumen8 halamanItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Manish MishraBelum ada peringkat

- Wording CGLDokumen16 halamanWording CGLabielcahyaBelum ada peringkat

- Culled Primarily From The Lectures of Atty. Amado E. TayagDokumen19 halamanCulled Primarily From The Lectures of Atty. Amado E. TayagLiene Lalu NadongaBelum ada peringkat

- Bridge Development Offer For Willow Springs LandDokumen3 halamanBridge Development Offer For Willow Springs LandDavid GiulianiBelum ada peringkat

- IC-26 Accounts For Life InsuranceDokumen623 halamanIC-26 Accounts For Life InsuranceVasu Pandiarajan100% (1)

- Research PaperDokumen2 halamanResearch PaperKarl BellezaBelum ada peringkat

- New Script: Special Enrollment Period: Call Opening: Call PurposeDokumen5 halamanNew Script: Special Enrollment Period: Call Opening: Call PurposeZaarib AliBelum ada peringkat

- Math For Business and Finance An Algebraic Approach 1st Edition Slater Solutions ManualDokumen37 halamanMath For Business and Finance An Algebraic Approach 1st Edition Slater Solutions Manualhenrycpwcooper100% (15)

- Mediclaim Policy DetailsDokumen18 halamanMediclaim Policy DetailsNikitha sureshBelum ada peringkat

- DMI DMI0030179395 Agreement 1704150274296Dokumen17 halamanDMI DMI0030179395 Agreement 1704150274296debnathdebabrata123Belum ada peringkat

- Domiciliary Treatment - Claim Form - Borl: Details of Primary InsuredDokumen1 halamanDomiciliary Treatment - Claim Form - Borl: Details of Primary InsuredHimanshu Chouksey100% (1)

- AHMAD ALMOTAILEG CV 2021 03 v1Dokumen7 halamanAHMAD ALMOTAILEG CV 2021 03 v1wajahat khanBelum ada peringkat

- Uhura Company Has Decided To Expand Its Operations The BookkeepDokumen1 halamanUhura Company Has Decided To Expand Its Operations The BookkeepM Bilal SaleemBelum ada peringkat

- They Still Haven't Told YouDokumen14 halamanThey Still Haven't Told Youicosahedron_manBelum ada peringkat

- Chapter 2 Summary Financial Statement AnalysisDokumen5 halamanChapter 2 Summary Financial Statement AnalysisAzlanBelum ada peringkat

- FINC6013 Workshop 5 Questions & SolutionsDokumen6 halamanFINC6013 Workshop 5 Questions & SolutionsJoel Christian MascariñaBelum ada peringkat

- American Home Assurance V Chua FACTS: Antonio Chua Renewed The Fire Insurance For Its Stock-In-Trade of His Business, Moonlight EnterprisesDokumen3 halamanAmerican Home Assurance V Chua FACTS: Antonio Chua Renewed The Fire Insurance For Its Stock-In-Trade of His Business, Moonlight EnterprisesKaren YuBelum ada peringkat

- NICA Class-Action LawsuitDokumen18 halamanNICA Class-Action LawsuitCasey FrankBelum ada peringkat

- This Is Your Declarations Page Commercial Auto Insurance Coverage SummaryDokumen2 halamanThis Is Your Declarations Page Commercial Auto Insurance Coverage SummaryDan To100% (2)

- Principles of Management Project ReportDokumen64 halamanPrinciples of Management Project ReportAndree Chara83% (6)

- Insurance Process FlowDokumen1 halamanInsurance Process Flowprobnoblem100% (3)

- Poram 9 - Cif Po in Packed FormDokumen8 halamanPoram 9 - Cif Po in Packed FormWaihong lamBelum ada peringkat

- Fringe Benefits TaxDokumen16 halamanFringe Benefits TaxTresbelle VueBelum ada peringkat

- Actuarial Mathematics and Life-Table StatisticsDokumen57 halamanActuarial Mathematics and Life-Table Statisticszane2104Belum ada peringkat

- Book Chapter 5: Guaranty and SuretyshipDokumen16 halamanBook Chapter 5: Guaranty and SuretyshipNash PazBelum ada peringkat

- 62a5847c3c1e1955c2fbb246 All SignDokumen42 halaman62a5847c3c1e1955c2fbb246 All SignANURAG TYAGIBelum ada peringkat