Are Public Sector Undertakings Drag On India Economy

Diunggah oleh

Jivaansha SinhaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Are Public Sector Undertakings Drag On India Economy

Diunggah oleh

Jivaansha SinhaHak Cipta:

Format Tersedia

Are Public Sector Undertakings Drag On Indias Economy?

Col. Pramod Singh 11233 Lt. Col. Sanjay Kumar 11243 Virendra Pareek 11264 Shatmanyu Singh - 11270

Definition

government owned corporation is Undertaking

termed as a Public Sector

(PSU). It refers to companies in which the

government (either the federal Union Govt or the State or Territorial Govts or both) own a

majority (51% or more) of the company

equity.

What is the public sector?

Air India SAIL BHEL BSNL Indian Oil Corporation Hindustan Motors

Need for Public Sector

To promote rapid economic development through creation and expansion of infrastructure To generate financial resources for development To promote redistribution of income and wealth To create employment opportunities To promote balanced regional growth To encourage the development of small-scale and ancillary industries, and To promote exports on the one side and import substitution, on the other.

Role Of Public Sector

Filling the Gaps in Capital Goods Employment Balanced Regional Development Contribution to Public Exchequer Export Promotion and Foreign Exchange Earnings Import Substitution Research and Development

Performance of Public Sector

Share in GDP rose from 8% in 1960 to over 25% in 1993/94 In 94 more than 1000 public sector enterprises, 800 of which owned by state

Problems faced by Public Sector

Poor Project Planning Over-capitalization Excessive Overheads Overstaffing Failure to generate adequate profits Low Capacity Utilisation Lack of Professional management Lack of a Proper Price Policy

To some, a well-performing PSU is an oxymoron. The root cause, it is argued, lies in their ownership structure. The argument goes like this: a private sector owner treats the business as his own. Thus, the private sector is efficient and performs well. Therefore, the panacea to all that troubles the public sector is privatisation.

The issues are far more complex. First, if the ownership structure is the root cause of all inefficiencies, then how do we explain away the performance of Singapore Airlines and SingTel, which are in effect PSUs. The second issue: most successful global corporations have dispersed ownership with no dominant owner. Third, there are numerous poorperforming private sector companies. Indeed, some of the PSUs of today were ailing private sector units of yesterday. And last, the recent financial prairie fire in the US was sparked by the private sector. Ironically, the massive rescue package came from the US government. The notion that the private sector is innately efficient and the public sector is inherently inefficient needs a second look.

Singapore Airlines is a PSU. It is profitable, efficient and well performing. The largest shareholder in Volkswagen is the state of Lower Saxony in Germany. The case of Pohang Iron and Steel Company (Posco) is even more startling. The World Bank rejected the loan application of the Korean government for setting up a steel plant in Pohang then a fishing village. No wonder, Korea neither had deposits of iron ore nor coking coal. The Korean government took the help of a consortium of Japanese bankers and set up Posco as a State Owned Enterprise (SOE). It is now the third largest producer of steel and doubtlessly one of the most efficient. It was only in 2000 that the company was fully privatised.

Many of todays success stories in the developing world began life as SOEs. Even in the developed world France, for instance, Renault, Alcatel, EdF, Thomson and Elf were SOEs for a long time, as were Rolls Royce and British Aerospace in the UK.

There is little difference between Singapore Airlines and Air-India in their ownership structures. The difference lies in the governance, style of management, empowerment, attitude to customer service and results produced by its leadership teams.

Red tapes, bureaucracy, risk aversion, administered pricing systems, ineffective governance structures, inability to hire the best talent because of poor compensation, political interference, absence of objectivity in appointments of managers and corruption are among the many reasons that cause PSUs to underperform.

To sum it all up, we can say that bureaucracy is the real drag on Indias economy and not PSUs. As shown by the previous example, they have the capability to outshine everyone else, they just need some good leaders at the top/

Thank you.

Anda mungkin juga menyukai

- Playing the Long Game: How to Save the West from Short-TermismDari EverandPlaying the Long Game: How to Save the West from Short-TermismPenilaian: 1 dari 5 bintang1/5 (1)

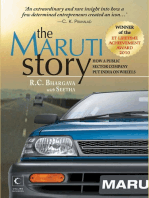

- The Maruti Story: How A Public Sector Company Put India On WheelsDari EverandThe Maruti Story: How A Public Sector Company Put India On WheelsPenilaian: 3 dari 5 bintang3/5 (1)

- 11 - Findings Conclusion and Suggestion PDFDokumen16 halaman11 - Findings Conclusion and Suggestion PDFManpreet singhBelum ada peringkat

- Daramola John Olaleke ND 2 CorrectedDokumen59 halamanDaramola John Olaleke ND 2 CorrectedIbidoja olayemiBelum ada peringkat

- PSU and DisinvestmentDokumen40 halamanPSU and DisinvestmentPritesh JainBelum ada peringkat

- Privatisation and Commercialisation of Government Enterprises inDokumen4 halamanPrivatisation and Commercialisation of Government Enterprises inabiola soliuBelum ada peringkat

- Essay On Public Sector EnterprisesDokumen10 halamanEssay On Public Sector EnterprisesVenkata Mahendra PrasadBelum ada peringkat

- A Critique of Recent Governance Reforms of State-Owned Enterprises in The Philippines and Their Proposed ImprovementsDokumen39 halamanA Critique of Recent Governance Reforms of State-Owned Enterprises in The Philippines and Their Proposed ImprovementsJybell Anne PoBelum ada peringkat

- Introduction To Public SectorDokumen12 halamanIntroduction To Public SectorIshika AroraBelum ada peringkat

- Framework Author: Michael E. Porter Year of Origin: Originating Organization: The Competitive Advantage of Nations Book Objective (Edit by Souvik)Dokumen13 halamanFramework Author: Michael E. Porter Year of Origin: Originating Organization: The Competitive Advantage of Nations Book Objective (Edit by Souvik)KAPIL MBA 2021-23 (Delhi)Belum ada peringkat

- ECONDokumen7 halamanECONJohn WilliamsBelum ada peringkat

- Has Privatization Promoted Efficiency in EthiopiaDokumen28 halamanHas Privatization Promoted Efficiency in Ethiopiaatinkut SintayehuBelum ada peringkat

- Samsung Case - FinalDokumen16 halamanSamsung Case - FinalAna Roa0% (2)

- The Role of Business GroupsDokumen20 halamanThe Role of Business GroupsBren OngBelum ada peringkat

- Privatisation in IndiaDokumen5 halamanPrivatisation in IndiaGaurav KumarBelum ada peringkat

- Unit 3 - Mncs & Business SectorsDokumen69 halamanUnit 3 - Mncs & Business SectorsNikiBelum ada peringkat

- Katoch Bahri State EnterprisesDokumen30 halamanKatoch Bahri State Enterprisesrahul sharmaBelum ada peringkat

- Multinational EnterprisesDokumen33 halamanMultinational EnterprisesDiana AlexandraBelum ada peringkat

- MTI Business in IndiaDokumen13 halamanMTI Business in IndiamahtaabkBelum ada peringkat

- Business Public Sector Private Sector Non-Profit OrganizationsDokumen10 halamanBusiness Public Sector Private Sector Non-Profit OrganizationsKriti GuptaBelum ada peringkat

- 526Dokumen17 halaman526Malcolm ChristopherBelum ada peringkat

- Basu (2005) Reinventing Public Enterprises and Its Management As The Engine of Development and Growth PDFDokumen15 halamanBasu (2005) Reinventing Public Enterprises and Its Management As The Engine of Development and Growth PDFlittleconspiratorBelum ada peringkat

- PDF Lesson 1 Good GovernanceDokumen16 halamanPDF Lesson 1 Good GovernanceAngela MacailaoBelum ada peringkat

- The Role of Government Incorporate Governance Perspectives From The UkDokumen34 halamanThe Role of Government Incorporate Governance Perspectives From The UkDita putri AdilaBelum ada peringkat

- Final Term Questions Asian ManagementDokumen12 halamanFinal Term Questions Asian ManagementLinh Tran Ha DieuBelum ada peringkat

- Xs - Zu: Multinational Companies (MNC'S) Impact On Indian EconomyDokumen7 halamanXs - Zu: Multinational Companies (MNC'S) Impact On Indian EconomyNur AbibahBelum ada peringkat

- Master of Business Administration-MBA Semester 4 MB0053 - International Business Management AssignmentDokumen8 halamanMaster of Business Administration-MBA Semester 4 MB0053 - International Business Management AssignmentNisha NishadBelum ada peringkat

- Privatization in India Issues and EvidenceDokumen18 halamanPrivatization in India Issues and EvidencePradeep Kumar RevuBelum ada peringkat

- Ublic AND Private Sector Presented By:-Jayashree. Komal Agrawal Harshit HardikDokumen25 halamanUblic AND Private Sector Presented By:-Jayashree. Komal Agrawal Harshit HardikSurya ReddyBelum ada peringkat

- Impact of Multinational Corporation On Indian EconomyDokumen22 halamanImpact of Multinational Corporation On Indian EconomyfatimamominBelum ada peringkat

- Economics Project 2018Dokumen17 halamanEconomics Project 2018Shashwat SinghBelum ada peringkat

- Business Studies: Class 12Dokumen45 halamanBusiness Studies: Class 12madhuBelum ada peringkat

- Porter Diamond ModelDokumen4 halamanPorter Diamond ModelNikhil AnandBelum ada peringkat

- DisinvestmentDokumen2 halamanDisinvestmentBhupendra Singh VermaBelum ada peringkat

- Research On The Global Economy TopicsDokumen2 halamanResearch On The Global Economy TopicsShenne MinglanaBelum ada peringkat

- Privatisation in IndiaDokumen10 halamanPrivatisation in IndiaGowtham Muthukkumaran ThirunavukkarasuBelum ada peringkat

- 20CH10064 - Sneha MajumderDokumen16 halaman20CH10064 - Sneha MajumderRashi GoyalBelum ada peringkat

- Failure of Public Sector Enterprises A CDokumen15 halamanFailure of Public Sector Enterprises A Cniloy biswasBelum ada peringkat

- Public Private and Joint SectorsDokumen11 halamanPublic Private and Joint SectorskocherlakotapavanBelum ada peringkat

- Porter's Diamond Model: Why Some Nations Are Competitive and Others Are NotDokumen4 halamanPorter's Diamond Model: Why Some Nations Are Competitive and Others Are NotAmitabha SinhaBelum ada peringkat

- STD 12 Economics (Project 2)Dokumen45 halamanSTD 12 Economics (Project 2)SkottayyBelum ada peringkat

- Business and Environment - noPWDokumen5 halamanBusiness and Environment - noPWcitizendenepal_77Belum ada peringkat

- Unit - 2 Economic Structure of IndiaDokumen15 halamanUnit - 2 Economic Structure of Indiaamudala_rajeshvarmaBelum ada peringkat

- Disinvestment in IndiaDokumen32 halamanDisinvestment in IndiaDixita ParmarBelum ada peringkat

- The Impact of Privatization and Commercialization in NigeriaDokumen12 halamanThe Impact of Privatization and Commercialization in Nigeriagolden abidemBelum ada peringkat

- Paradigm SalaryDokumen22 halamanParadigm SalaryramchanderBelum ada peringkat

- Corporate Strategy and Foreign Direct InvestmentDokumen20 halamanCorporate Strategy and Foreign Direct InvestmentSammir MalhotraBelum ada peringkat

- Disinvestment Synopsis ImpDokumen10 halamanDisinvestment Synopsis ImpSarita GautamBelum ada peringkat

- Corporate Gov. AreaDokumen16 halamanCorporate Gov. AreaAsare WilliamBelum ada peringkat

- Emerging Challenge of IR in IndiaDokumen13 halamanEmerging Challenge of IR in IndiaSapna Rai50% (2)

- Quiz SolutionsDokumen1 halamanQuiz SolutionsMitesh KumarBelum ada peringkat

- Disinvestment and PrivatisationDokumen30 halamanDisinvestment and PrivatisationSantosh MashalBelum ada peringkat

- Disinvestment and PrivatisationDokumen40 halamanDisinvestment and Privatisationpiyush909Belum ada peringkat

- Park ANalysis To NepalDokumen11 halamanPark ANalysis To NepalSubham DahalBelum ada peringkat

- Public Private Joint and Co Operative SectorsDokumen16 halamanPublic Private Joint and Co Operative SectorssrirammaliBelum ada peringkat

- Eco Prject PrivDokumen12 halamanEco Prject PrivSwayam SethiyaBelum ada peringkat

- Chapter-1: Working CapitalDokumen47 halamanChapter-1: Working Capitalchhita mani sorenBelum ada peringkat

- How State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaDari EverandHow State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaBelum ada peringkat

- Winning the Long Competition: The Key to the Next American CenturyDari EverandWinning the Long Competition: The Key to the Next American CenturyBelum ada peringkat

- Report 203Dokumen97 halamanReport 203Jivaansha SinhaBelum ada peringkat

- Bail Bond ListDokumen1 halamanBail Bond ListJivaansha SinhaBelum ada peringkat

- Uday Mohanlal Acharya V State of Maharashtra-2001 5 SCC 453Dokumen12 halamanUday Mohanlal Acharya V State of Maharashtra-2001 5 SCC 453Jivaansha Sinha100% (1)

- 2010 STPL (Web) 1020 SCDokumen29 halaman2010 STPL (Web) 1020 SCJivaansha SinhaBelum ada peringkat

- Prahlad Singh Bhati Vs NCT Delhi and Anr-JT 2001 4 SC 116Dokumen3 halamanPrahlad Singh Bhati Vs NCT Delhi and Anr-JT 2001 4 SC 116Jivaansha SinhaBelum ada peringkat

- Principles and Practices of Management: DR (Capt) C M ChitaleDokumen96 halamanPrinciples and Practices of Management: DR (Capt) C M ChitaleJivaansha SinhaBelum ada peringkat

- A Hindu Joint Family SetupDokumen17 halamanA Hindu Joint Family SetupJivaansha SinhaBelum ada peringkat

- It & Ites A: Presentation BY J.K.OkeDokumen38 halamanIt & Ites A: Presentation BY J.K.OkeJivaansha SinhaBelum ada peringkat

- Maslow's - The Hierarchy of Needs Theory: IV. DirectionDokumen36 halamanMaslow's - The Hierarchy of Needs Theory: IV. DirectionJivaansha SinhaBelum ada peringkat

- Anticipatory Bail: From Wikipedia, The Free EncyclopediaDokumen21 halamanAnticipatory Bail: From Wikipedia, The Free EncyclopediaJivaansha SinhaBelum ada peringkat

- Marketing: An Introduction: Chapter SevenDokumen31 halamanMarketing: An Introduction: Chapter SevenJivaansha SinhaBelum ada peringkat

- It & Ites A: Presentation BY J.K.OkeDokumen39 halamanIt & Ites A: Presentation BY J.K.OkeJivaansha SinhaBelum ada peringkat

- Sales Management Is The Attainment ofDokumen84 halamanSales Management Is The Attainment ofJivaansha SinhaBelum ada peringkat

- Banking: A J.K.Oke PresentationDokumen38 halamanBanking: A J.K.Oke PresentationJivaansha SinhaBelum ada peringkat

- Jayant K. OkeDokumen38 halamanJayant K. OkeJivaansha SinhaBelum ada peringkat

- Basic Concepts of MicroeconomicsDokumen21 halamanBasic Concepts of MicroeconomicsJivaansha Sinha88% (8)

- HealthcareDokumen20 halamanHealthcareJivaansha SinhaBelum ada peringkat

- BopDokumen24 halamanBopJivaansha SinhaBelum ada peringkat

- Commercial Banking: A Presentation BY J.K.OkeDokumen31 halamanCommercial Banking: A Presentation BY J.K.OkeJivaansha SinhaBelum ada peringkat

- A'NagarretailDokumen62 halamanA'NagarretailJivaansha SinhaBelum ada peringkat

- What Is Sales ManagementDokumen27 halamanWhat Is Sales ManagementJivaansha SinhaBelum ada peringkat

- What Is Personal SellingDokumen34 halamanWhat Is Personal SellingJivaansha SinhaBelum ada peringkat

- Selecting Salespeople: Prepared By: Brian RutherfordDokumen15 halamanSelecting Salespeople: Prepared By: Brian RutherfordJivaansha SinhaBelum ada peringkat

- Marketing Research - 3Dokumen8 halamanMarketing Research - 3Jivaansha SinhaBelum ada peringkat

- What Is A Product: Marketing MarketDokumen18 halamanWhat Is A Product: Marketing MarketJivaansha SinhaBelum ada peringkat

- Marketing Research - 6Dokumen11 halamanMarketing Research - 6Jivaansha SinhaBelum ada peringkat

- CRM SlidesDokumen32 halamanCRM SlidesJivaansha SinhaBelum ada peringkat

- Marketing Research - 4Dokumen8 halamanMarketing Research - 4Jivaansha SinhaBelum ada peringkat

- Marketing Research - 5Dokumen9 halamanMarketing Research - 5Jivaansha SinhaBelum ada peringkat

- FA3PDokumen4 halamanFA3PdainokaiBelum ada peringkat

- Explanation of PDIC CoverageDokumen5 halamanExplanation of PDIC CoverageMercy Rebua AragonBelum ada peringkat

- ChallanDokumen1 halamanChallanShilesh GargBelum ada peringkat

- Sample 25M LinkedinDokumen6 halamanSample 25M LinkedinAakash MaratheBelum ada peringkat

- Bank Nationalization, Financial Savings, and Economic DevelopmentDokumen17 halamanBank Nationalization, Financial Savings, and Economic DevelopmentHarshit BhardwajBelum ada peringkat

- Case UnileverDokumen4 halamanCase UnileverLan AnhBelum ada peringkat

- Baddebt Recovery PBDDDokumen3 halamanBaddebt Recovery PBDDsubhashis deBelum ada peringkat

- Accounting, Organizations and Society: Brian Bratten, Ross Jennings, Casey M. SchwabDokumen19 halamanAccounting, Organizations and Society: Brian Bratten, Ross Jennings, Casey M. Schwabsisnawaty sabatinyBelum ada peringkat

- Protect Your Family From A Life of CompromisesDokumen28 halamanProtect Your Family From A Life of CompromisesBharatBelum ada peringkat

- Case Study On VodafoneDokumen3 halamanCase Study On VodafoneAhsan MehmoodBelum ada peringkat

- State Bank of India - Wikipedia, The Free EncyclopediaDokumen9 halamanState Bank of India - Wikipedia, The Free EncyclopediaSai BabaBelum ada peringkat

- Silahis Marketing Corp V IACDokumen2 halamanSilahis Marketing Corp V IACpurplebasketBelum ada peringkat

- Esclatran Transport Services: 32 Rizal St. Benedicto Jaro, Iloilo CityDokumen5 halamanEsclatran Transport Services: 32 Rizal St. Benedicto Jaro, Iloilo CityRheneir Mora50% (8)

- Ratan Tata: Early LifeDokumen4 halamanRatan Tata: Early LifeckBelum ada peringkat

- Merger Control 2010: The International Comparative Legal Guide ToDokumen7 halamanMerger Control 2010: The International Comparative Legal Guide ToRickmh89Belum ada peringkat

- 8531Dokumen9 halaman8531Mudassar SaqiBelum ada peringkat

- L 2 Ss 5 Los 16Dokumen5 halamanL 2 Ss 5 Los 16Edgar LayBelum ada peringkat

- Credit Management of NCC Bank Ltd.Dokumen69 halamanCredit Management of NCC Bank Ltd.death_heaven100% (1)

- IAS Plus: IFRS 8 Operating SegmentsDokumen4 halamanIAS Plus: IFRS 8 Operating SegmentsScarlet FoxBelum ada peringkat

- What Is Costing?Dokumen27 halamanWhat Is Costing?wickygeniusBelum ada peringkat

- Corporate RestructuringDokumen10 halamanCorporate RestructuringKARISHMAATA2100% (1)

- Certificate of IncorporationDokumen1 halamanCertificate of IncorporationPritam685Belum ada peringkat

- ICF SEA ICF RegionalIslamic Crowdfunding in SEAArticle Islamic Crowd Funding in Singapore and IndonesiaDokumen7 halamanICF SEA ICF RegionalIslamic Crowdfunding in SEAArticle Islamic Crowd Funding in Singapore and IndonesiaKetoisophorone WongBelum ada peringkat

- Corporate Governance in VietnamDokumen69 halamanCorporate Governance in Vietnamhi_monestyBelum ada peringkat

- Satyam ScamDokumen2 halamanSatyam ScamabeerBelum ada peringkat

- Promisory Note ExampleDokumen1 halamanPromisory Note Exampleapi-300362811Belum ada peringkat

- Pengaruh Motivasi Kerja Terhadap Kualitas Karyawan Toko Buku Gramedia Matraman JakartaDokumen26 halamanPengaruh Motivasi Kerja Terhadap Kualitas Karyawan Toko Buku Gramedia Matraman JakartaArianti AgustinBelum ada peringkat

- Absolute Assignment For Value PDFDokumen2 halamanAbsolute Assignment For Value PDFRuby Ricafrente VioletaBelum ada peringkat

- Bank Code ListDokumen10 halamanBank Code ListAnandha Kumar RathinamBelum ada peringkat

- MSI Turkish Defence Review January 2018Dokumen92 halamanMSI Turkish Defence Review January 2018SzERGBelum ada peringkat