Chapter 15

Diunggah oleh

Rajashekhar B BeedimaniHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter 15

Diunggah oleh

Rajashekhar B BeedimaniHak Cipta:

Format Tersedia

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Chapter 15

Sourcing Decisions in a Supply Chain

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Learning Objectives

Understand the role of sourcing in a supply chain

Discuss factors that affect the decision to outsource a supply

chain function

Identify dimensions of supplier performance that affect total cost

Structure successful auctions and negotiations

Describe the impact of risk sharing on supplier performance and

information distortion

Design a tailored supplier portfolio

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

The Role of Sourcing in a Supply Chain

Sourcing is the set of business processes required to purchase

goods and services

Outsourcing

Offshoring

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

The Role of Sourcing in a Supply Chain

Outsourcing questions

Will the third party increase the supply chain surplus relative

to performing the activity in-house?

How much of the increase in surplus does the firm get to

keep?

To what extent do risks grow upon outsourcing?

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

The Role of Sourcing in a Supply Chain

Figure 15-1

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Supplier Scoring and Assessment

Supplier performance should be compared on the basis of the

suppliers impact on total cost

There are several other factors besides purchase price that

influence total cost

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Supplier Selection

Identify one or more appropriate suppliers

Contract should account for all factors that affect supply chain

performance

Should be designed to increase supply chain profits in a way that

benefits both the supplier and the buyer

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Design Collaboration

About 80% of the cost of a product is determined during design

Suppliers should be actively involved at this stage

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Procurement

A supplier sends product in response to orders placed by the

buyer

Orders placed and delivered on schedule at the lowest possible

overall cost

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Sourcing Planning and Analysis

Analyze spending across various suppliers and component

categories

Identify opportunities for decreasing the total cost

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Cost of Goods Sold

Cost of goods sold (COGS) represents well over 50 percent of

sales for most major manufacturers

Purchased parts a much higher fraction than in the past

Companies have reduced vertical integration and outsourced

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Benefits of Effective Sourcing Decisions

Better economies of scale through aggregated

More efficient procurement transactions

Design collaboration can result in products that are easier to

manufacture and distribute

Good procurement processes can facilitate coordination with

suppliers

Appropriate supplier contracts can allow for the sharing of risk

Firms can achieve a lower purchase price by increasing

competition through the use of auctions

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

In-House or Outsource

Increase supply chain surplus through

Capacity aggregation

Inventory aggregation

Transportation aggregation by transportation intermediaries

Transportation aggregation by storage intermediaries

Warehousing aggregation

Procurement aggregation

Information aggregation

Receivables aggregation

Relationship aggregation

Lower costs and higher quality

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Factors Influencing Growth of Surplus by a

Third Party

Scale

Large scale it is unlikely that a third party can achieve further

scale economies and increase the surplus

Uncertainty

If requirements are highly variable over time, third party can

increase the surplus through aggregation

Specificity of assets

If assets required are specific to a firm, a third party is unlikely

to increase the surplus

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Factors Influencing Growth of Surplus by

a Third Party

Specificity of Assets Involved in Function

Low High

Firm scale Low High growth in surplus Low to medium growth in

surplus

High Low growth in surplus No growth in surplus

unless cost of capital is

lower for third party

Demand

uncertainty

for firm

Low Low to medium growth in

surplus

Low growth in surplus

High High growth in surplus Low to medium growth in

surplus

Table 15-1

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Risks of Using a Third Party

The process is broken

Underestimation of the cost of coordination

Reduced customer/supplier contact

Loss of internal capability and growth in third-party power

Leakage of sensitive data and information

Ineffective contracts

Loss of supply chain visibility

Negative reputational impact

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Third- and Fourth-Party

Logistics Providers

Third-party logistics (3PL) providers performs one or more of the

logistics activities relating to the flow of product, information, and

funds that could be performed by the firm itself

A 4PL (fourth-party logistics) designs, builds and runs the entire

supply chain process

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Third- and Fourth-Party

Logistics Providers

Service Category Basic Service Some Specific Value-Added Services

Transportation Inbound, outbound by

ship, truck, rail, air

Tendering, track/trace, mode conversion, dispatch, freight pay,

contract management

Warehousing Storage, facilities

management

Cross-dock, in-transit merge, pool distribution across firms,

pick/pack, kitting, inventory control, labeling, order fulfillment,

home delivery of catalog orders

Information

technology

Provide and maintain

advanced

information/computer

systems

Transportation management systems, warehousing management,

network modeling and site selection, freight bill payment,

automated broker interfaces, end-to-end matching, forecasting,

EDI, worldwide track and trace, global visibility

Reverse logistics Handle reverse flows Recycling, used-asset disposition, customer returns, returnable

container management, repair/refurbish

Other 3PL services Brokering, freight forwarding, purchase-order management, order

taking, loss and damage claims, freight bill audits, consulting,

time-definite delivery

International Customs brokering, port services, export crating, consolidation

Special

skills/handling

Hazardous materials, temperature controlled, package/parcel

delivery, food-grade facilities/equipment, bulk

Table 15-2

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Using Total Cost to

Score and Assess Suppliers

Performance

Category

Category Components Quantifiable?

Supplier price Labor, material, overhead, local taxes, and compliance costs Yes

Supplier terms Net payment terms, delivery frequency, minimum lot size,

quantity discounts

Yes

Delivery costs All transportation costs from source to destination, packaging

costs

Yes

Inventory costs Supplier inventory, including raw material, in process and finished

goods, in-transit inventory, finished goods inventory in supply

chain

Yes

Warehousing cost Warehousing and material handling costs to support additional

inventory

Yes

Quality costs Cost of inspection, rework, product returns Yes

Reputation Reputation impact of quality problems No

Other costs Exchange rate trends, taxes, duties Yes

Support Management overhead and administrative support Difficult

Supplier capabilities Replenishment lead time, on-time performance, flexibility,

information coordination capability, design coordination capability,

supplier viability

To some

extent

Table 15-3

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Comparing Suppliers Based on Total Cost

28 . 086 , 1 1 000 , 1 300 2

2 2 2

= +

NORMSINV(0.95) 1,086.28 =1,787

Annual material cost = 1,000 x 52 x 1 = $52,000

Average cycle inventory = 2,000/2 = 1,000

Annual cost of holding cycle

inventory = 1,000 x 1 x 0.25 = $250

Standard deviation of ddlt =

Safety inventory required

with current supplier =

Annual cost of holding safety

inventory = 1,787 x 1 x 0.25 = $447

Annual cost of using current

supplier = 52,000 + 250 + 447 = $52,697

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

6 300

2

+1,000

2

4

2

= 4,066.94

NORMSINV(0.95) 4,066.94 = 6,690

Comparing Suppliers Based on Total Cost

Annual material cost = 1,000 x 52 x 0.97 = $50,440

Average cycle inventory = 8,000/2 = 4,000

Annual cost of holding cycle

inventory = 4,000 x 0.97 x 0.25 = $970

Standard deviation of ddlt =

Safety inventory required

with current supplier =

Annual cost of holding safety

inventory = 6,690 x 0.97 x 0.25 = $1,622

Annual cost of using current

supplier = 50,440 + 970 + 1,622 = $53,032

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Supplier Selection

Auctions and Negotiations

Supplier selection can be performed through competitive bids,

reverse auctions, and direct negotiations

Supplier evaluation is based on total cost of using a supplier

Auctions:

Sealed-bid first-price auctions

English auctions

Dutch auctions

Second-price (Vickery) auctions

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Supplier Selection

Auctions and Negotiations

Factors influence the performance of an auction

Is the suppliers cost structure private (not affected by factors

that are common to other bidders)?

Are suppliers symmetric or asymmetric; that is, ex ante, are

they expected to have similar cost structures?

Do suppliers have all the information they need to estimate their

cost structure?

Does the buyer specify a maximum price it is willing to pay for

the supply chain?

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Supplier Selection

Auctions and Negotiations

Collusion among bidders

Second-price auctions are particularly vulnerable

Can be avoided with any first-price auction

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Basic Principles of Negotiation

The difference between the values of the buyer and seller is the

bargaining surplus

The goal of each negotiating party is to capture as much of the

bargaining surplus as possible

Have a clear idea of your own value and as good an estimate of

the third partys value as possible

Look for a fair outcome based on equally or equitably dividing

the bargaining surplus

A win-win outcome

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Contracts, Risk Sharing, and

Supply Chain Performance

How will the contract affect the firms profits and total supply chain

profits?

Will the incentives in the contract introduce any information

distortion?

How will the contract influence supplier performance along key

performance measures?

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Contracts for Product Availability and

Supply Chain Profits

Independent actions taken by two parties in a supply chain often

result in profits that are lower than those that could be achieved if

the supply chain were to coordinate its actions

Three contracts that increase overall profits by making the supplier

share some of the buyers demand uncertainty are

Buyback or returns contracts

Revenue-sharing contracts

Quantity flexibility contracts

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Buyback Contracts

Allows a retailer to return unsold inventory up to a specified

amount at an agreed upon price

The manufacturer specifies a wholesale price c and a buyback price

b

The manufacturer can salvage $s

M

for any units that the retailer

returns

The manufacturer has a cost of v per unit produced and the retail

price is p

Expected manufacturing profit = O* (c v) (b s

M

)

expected overstock at retailer

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Buyback Contracts

Wholesale

Price c

Buyback

Price b

Optimal

Order

Size for

Music

Store

Expected

Profit for

Music

Store

Expected

Returns

to

Supplier

Expected

Profit for

Supplier

Expected

Supply

Chain

Profit

$5 $0 1,000 $3,803 120 $4,000 $7,803

$5 $2 1,096 $4,090 174 $4,035 $8,125

$5 $3 1,170 $4,286 223 $4,009 $8,295

$6 $0 924 $2,841 86 $4,620 $7,461

$6 $2 1,000 $3,043 120 $4,761 $7,804

$6 $4 1,129 $3,346 195 $4,865 $8,211

$7 $0 843 $1,957 57 $5,056 $7,013

$7 $4 1,000 $2,282 120 $5,521 $7,803

$7 $6 1,202 $2,619 247 $5,732 $8,351

Table 15-4

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Buyback Contracts

Holding-cost subsidies

Manufacturers pay retailers a certain amount for every unit held

in inventory over a given period

Encourage retailers to order more

Price support

Manufacturers share the risk of product becoming obsolete

Guarantee that in the event they drop prices they will lower

prices for all current inventories

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Revenue-Sharing Contracts

Manufacturer charges the retailer a low wholesale price c and

shares a fraction f of the retailers revenue

Allows both the manufacturer and retailer to increase their

profits

Results in lower retailer effort

Requires an information infrastructure

Information distortion results in excess inventory in the supply

chain and a greater mismatch of supply and demand

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Revenue-Sharing Contracts

CSL* = probability (demand O*) =

C

u

C

u

+C

o

=

(1 f ) p c

(1 f ) p s

R

Expected manufacturers profits = (c v)O*

+ fp(O* expected overstock at retailer)

Expected retailer profit

+s

R

expected overstock at retailer cO*

= (1 f ) p(O* expected overstock at retailer)

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Revenue-Sharing Contracts

Wholesale

Price c

Revenue

-Sharing

Fraction

f

Optimal

Order

Size for

Music

Store

Expected

Overstock

at Music

Store

Expected

Profit for

Music

Store

Expected

Profit for

Supplier

Expected

Supply

Chain

Profit

$1 0.30 1,320 342 $5,526 $2,934 $8,460

$1 0.45 1,273 302 $4,064 $4,367 $8,431

$1 0.60 1,202 247 $2,619 $5,732 $8,350

$2 0.30 1,170 223 $4,286 $4,009 $8,295

$2 0.45 1,105 179 $2,881 $5,269 $8,150

$2 0.60 1,000 120 $1,521 $6,282 $7,803

Table 15-5

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Quantity Flexibility Contracts

Allows the buyer to modify the order (within limits) after observing

demand

Better matching of supply and demand

Increased overall supply chain profits if the supplier has flexible

capacity

Lower levels of information distortion than either buyback

contracts or revenue sharing contracts

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Quantity Flexibility Contracts

Expected quantity purchased by retailer, Q

R

| | ) ( 1 ) ( Q F Q q qF + =

(

|

.

|

\

|

|

.

|

\

|

+

o

o

q

F

Q

F

s s

(

|

.

|

\

|

|

.

|

\

|

=

o

o

o

q

f

Q

f

s s

Expected quantity sold by retailer, D

R

| | ) ( 1 Q F Q =

|

.

|

\

|

|

.

|

\

|

+

o

o

o

q

f

Q

F

s s

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Quantity Flexibility Contracts

Expected quantity overstock

at manufacturer

Expected retailer profit = D

R

p + Q

R

D

R

( )

s

R

Q

R

c

Expected manufacturer profit = Q

R

c + Q Q

R

( )

s

M

Q v

= Q

R

D

R

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Quantity Flexibility Contracts

o |

Wholesale

Price c

Order

Size

O

Expected

Purchase

by

Retailer

Expected

Sale by

Retailer

Expected

Profits

for

Retailer

Expected

Profits

for

Supplier

Expected

Supply

Chain

Profit

0.00 0.00 $5 1,000 1,000 880 $3,803 $4,000 $7,803

0.05 0.05 $5 1,017 1,014 966 $4,038 $4,004 $8,416

0.20 0.20 $5 1,047 1,023 967 $4,558 $3,858 $8,416

0.00 0.00 $6 924 924 838 $2,841 $4,620 $7,461

0.20 0.20 $6 1,000 1,000 955 $3,547 $4,800 $8,347

0.30 0.30 $6 1,021 1,006 979 $3,752 $4,711 $8,463

0.00 0.00 $7 843 843 786 $1,957 $5,056 $7,013

0.20 0.20 $7 947 972 936 $2,560 $5,666 $8,226

0.40 0.40 $7 1,000 1,000 987 $2,873 $5,600 $8,473

Table 15-6

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Contracts to Coordinate

Supply Chain Costs

Differences in costs at the buyer and supplier can lead to decisions

that increase total supply chain costs

A quantity discount contract may encourage the buyer to purchase

a larger quantity which would result in lower total supply chain

costs

Quantity discounts lead to information distortion because of order

batching

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Contracts to Increase Agent Effort

In many supply chains, agents act on behalf of a principal and the

agents efforts affect the reward for the principal

A two-part tariff offers the right incentives for the dealer to exert

the appropriate amount of effort

Threshold contracts increase information distortion

Offer threshold incentives over a rolling horizon

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Contracts to Induce

Performance Improvement

A buyer may want performance improvement from a supplier who

otherwise would have little incentive to do so

A shared-savings contract provides the supplier with a fraction of

the savings that result from performance improvement

Effective in aligning supplier and buyer incentives when the

supplier is required to improve performance and most of the

benefits of improvement accrue to the buyer

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Design Collaboration

50-70% of spending at a manufacturer comes from procurement

80% of the cost of a purchased part is fixed in the design phase

Design collaboration with suppliers can result in reduced cost,

improved quality, and decreased time to market

Design for logistics, design for manufacturability

Modular, adjustable, dimensional customization

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

The Procurement Process

The process in which the supplier sends product in response to

orders placed by the buyer

Main categories of purchased goods

Direct materials

Indirect materials

Procurement process for direct materials should be designed to

ensure that components are available in the right place, in the

right quantity, and at the right time

Focus for indirect materials should be on reducing transaction cost

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Differences Between Direct

and Indirect Materials

Direct Materials Indirect Materials

Use Production Maintenance, repair, and

support operations

Accounting Cost of goods sold Selling, general, and

administrative expenses

(SG&A)

Impact on production Any delay will delay

production

Less direct impact

Processing cost relative

to value of transaction

Low High

Number of transactions Low High

Table 15-7

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Product Categorization

Figure 15-2

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Designing a Sourcing Portfolio: Tailored

Sourcing

Options with regard to whom and where to source from

Produce in-house or outsource to a third party

Will the source be cost efficient or responsive

Onshoring, near-shoring, and offshoring

Tailor supplier portfolio based on a variety of product and market

characteristics

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Designing a Sourcing Portfolio: Tailored

Sourcing

Responsive

Source

Low-Cost Source

Product life cycle Early phase Mature phase

Demand volatility High Low

Demand volume Low High

Product value High Low

Rate of product

obsolescence

High Low

Desired quality High Low to medium

Engineering/design

support

High Low

Table 15-8

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Designing a Sourcing Portfolio: Tailored

Sourcing

Onshore Near-shore Offshore

Rate of

innovation/product

variety

High Medium to High Low

Demand volatility High Medium to High Low

Labor content Low Medium to High High

Volume or weight-to-

value ratio

High High Low

Impact of supply chain

disruption

High Medium to High Low

Inventory costs High Medium to High Low

Engineering/manageme

nt support

High High Low

Table 15-9

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Risk Management in Sourcing

Inability to meet demand on time

An increase in procurement costs

Loss of intellectual property

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Making Sourcing Decisions in Practice

Use multifunction teams

Ensure appropriate coordination across regions and business units

Always evaluate the total cost of ownership

Build long-term relationships with key suppliers

C

o

p

y

r

i

g

h

t

2

0

1

3

D

o

r

l

i

n

g

K

i

n

d

e

r

s

l

e

y

(

I

n

d

i

a

)

P

v

t

.

L

t

d

.

Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. Kalra

Summary of Learning Objectives

Understand the role of sourcing in a supply chain

Discuss factors that affect the decision to outsource a supply chain

function

Identify dimensions of supplier performance that affect total cost

Structure successful auctions and negotiations

Describe the impact of risk sharing on supplier performance and

information distortion

Design a tailored supplier portfolio

Anda mungkin juga menyukai

- Chapter 14Dokumen48 halamanChapter 14Rajashekhar B BeedimaniBelum ada peringkat

- Chapter 13Dokumen58 halamanChapter 13Rajashekhar B BeedimaniBelum ada peringkat

- Session 16B Chapter10 Chopra 5thedDokumen26 halamanSession 16B Chapter10 Chopra 5thedNIkhilBelum ada peringkat

- Session 12 Chapter 15 Chopra 5thedDokumen43 halamanSession 12 Chapter 15 Chopra 5thedBhanu Pratap67% (3)

- Chapter 11Dokumen89 halamanChapter 11Rajashekhar B Beedimani100% (2)

- Chapter2 CHopraDokumen34 halamanChapter2 CHopraDivyesh Parmar100% (2)

- Session 11 Chapter 5 Chopra 5thedDokumen28 halamanSession 11 Chapter 5 Chopra 5thedNIkhilBelum ada peringkat

- Chapter 16Dokumen30 halamanChapter 16Rajashekhar B BeedimaniBelum ada peringkat

- SCM Chapter 1Dokumen42 halamanSCM Chapter 1Md. Sabuj HossenBelum ada peringkat

- Session 15 Chapter 4 Chopra 5thedDokumen41 halamanSession 15 Chapter 4 Chopra 5thedNIkhil100% (1)

- Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraDokumen18 halamanSupply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraMd. Rezaul Islam TusharBelum ada peringkat

- Session 12 Chapter 15 Chopra 5thedDokumen43 halamanSession 12 Chapter 15 Chopra 5thedshetupucBelum ada peringkat

- Chopra Scm5 Ch12Dokumen76 halamanChopra Scm5 Ch12Gurunathan MariayyahBelum ada peringkat

- ! SCM Chopra Chapters 1-17Dokumen406 halaman! SCM Chopra Chapters 1-17Bibekananda Panda33% (6)

- SCM ch01Dokumen49 halamanSCM ch01summiasaleemBelum ada peringkat

- Supply Chain Drivers and Metrics Chapter OutlineDokumen28 halamanSupply Chain Drivers and Metrics Chapter OutlineTia MejiaBelum ada peringkat

- Chapter 1Dokumen33 halamanChapter 1projects_masterz100% (1)

- Chopra Scm5 Ch03 GeDokumen49 halamanChopra Scm5 Ch03 GeAmna Khan100% (1)

- Designing Distribution Networks and Applications To Online Sales-Supply ChainDokumen56 halamanDesigning Distribution Networks and Applications To Online Sales-Supply ChainArjun DasBelum ada peringkat

- Test Bank Supply Chain Management 5th Edition ChopraDokumen26 halamanTest Bank Supply Chain Management 5th Edition Choprabachababy0% (1)

- Chapter-4 (Supply Chain)Dokumen57 halamanChapter-4 (Supply Chain)MD Rakib MiaBelum ada peringkat

- Supply Chain Drivers & Key MetricsDokumen45 halamanSupply Chain Drivers & Key MetricsMatee Khan0% (1)

- Chopra Scm5 Ch01 GeDokumen31 halamanChopra Scm5 Ch01 Geফয়সাল হোসেন100% (1)

- Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraDokumen15 halamanSupply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraMD Rakib MiaBelum ada peringkat

- Chapter 6 - Supply Chain Technology, Managing Information FlowsDokumen26 halamanChapter 6 - Supply Chain Technology, Managing Information FlowsArman100% (1)

- SCM For 2016 - 2017Dokumen7 halamanSCM For 2016 - 2017Neha JhaBelum ada peringkat

- Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraDokumen47 halamanSupply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraMohammed AhmedBelum ada peringkat

- Understanding The Supply Chain: Powerpoint Presentation To Accompany Chopra and Meindl Supply Chain Management, 5EDokumen37 halamanUnderstanding The Supply Chain: Powerpoint Presentation To Accompany Chopra and Meindl Supply Chain Management, 5EZohaib AhmadBelum ada peringkat

- Inventory Management: Supply Chain Management - Janat ShahDokumen46 halamanInventory Management: Supply Chain Management - Janat ShahPreeti Jain-singhalBelum ada peringkat

- Why Is It Important To Consider Uncertainty When Evaluating Supply Chain DesignDokumen3 halamanWhy Is It Important To Consider Uncertainty When Evaluating Supply Chain DesignAkshay_Raja_94150% (2)

- Chapter 11 Managing Economies of Scale in A Supply ChainDokumen90 halamanChapter 11 Managing Economies of Scale in A Supply ChainM Iqbal Muttaqin100% (1)

- Chopra scm6 Inppt 05Dokumen22 halamanChopra scm6 Inppt 05abdulaziz alazzazBelum ada peringkat

- Chopra Scm5 Tif Ch13Dokumen23 halamanChopra Scm5 Tif Ch13Madyoka RaimbekBelum ada peringkat

- Sunil ChopraDokumen44 halamanSunil ChopraA SBelum ada peringkat

- Coyle 9e CH 01Dokumen20 halamanCoyle 9e CH 01HASHEMBelum ada peringkat

- Chopra scm5 Tif ch03Dokumen19 halamanChopra scm5 Tif ch03Madyoka Raimbek100% (2)

- CH 1 OM&CompetitivenessDokumen22 halamanCH 1 OM&CompetitivenessNatarajan AncBelum ada peringkat

- Coyle 9e CH 04 RevDokumen29 halamanCoyle 9e CH 04 RevKatherine Joyce BautistaBelum ada peringkat

- Ch11.Managing Economies of Scale in A Supply Chain - Cycle InventoryDokumen65 halamanCh11.Managing Economies of Scale in A Supply Chain - Cycle InventoryFahim Mahmud100% (1)

- Chapter 6 Designing Global Supply Chain NetworksDokumen22 halamanChapter 6 Designing Global Supply Chain NetworksRashadafaneh100% (1)

- Chapter2 141205152118 Conversion Gate02 PDFDokumen34 halamanChapter2 141205152118 Conversion Gate02 PDFMohammed AhmedBelum ada peringkat

- Chopra Scm5 Tif Ch09Dokumen26 halamanChopra Scm5 Tif Ch09Madyoka RaimbekBelum ada peringkat

- CPIM Detailed Scheduling and Planning Material RequirementsDokumen9 halamanCPIM Detailed Scheduling and Planning Material RequirementsTannelsBelum ada peringkat

- Chopra4 - PPT - ch13 - Slides of Chapter 13 - Supply Chain Management (SCM)Dokumen22 halamanChopra4 - PPT - ch13 - Slides of Chapter 13 - Supply Chain Management (SCM)Tia MejiaBelum ada peringkat

- MBA0810 OM 17 Purchase Supply ManagementDokumen22 halamanMBA0810 OM 17 Purchase Supply ManagementBhavanams RaoBelum ada peringkat

- Chopra Scm6 Inppt 13Dokumen63 halamanChopra Scm6 Inppt 13arpitBelum ada peringkat

- Chopra Chapter - 3Dokumen28 halamanChopra Chapter - 3Muhammad Zaid MehmoodBelum ada peringkat

- Layout Strategies Powerpoint PresentationDokumen29 halamanLayout Strategies Powerpoint PresentationstanisBelum ada peringkat

- Supply Chain Management Chopra 4th Solut PDFDokumen6 halamanSupply Chain Management Chopra 4th Solut PDFAkash Kyal0% (1)

- Supply Chain Management - An Overview - RGDokumen71 halamanSupply Chain Management - An Overview - RGprakashinaibs100% (2)

- BSCM Q&aDokumen82 halamanBSCM Q&aRanadip Madhu100% (2)

- Supply Chain Management Homework 1 ToDokumen51 halamanSupply Chain Management Homework 1 ToTan NguyenBelum ada peringkat

- Supply Chain Network Design OptimizationDokumen50 halamanSupply Chain Network Design OptimizationĐỗ TúBelum ada peringkat

- Chapter 1 - Understanding The Supply ChainDokumen29 halamanChapter 1 - Understanding The Supply Chainissafakhoury0318Belum ada peringkat

- Strategic Aspects in Supply Management Florian Schupp 06.05Dokumen50 halamanStrategic Aspects in Supply Management Florian Schupp 06.05Shashi WableBelum ada peringkat

- Outsourcing Logistics OperationsDokumen16 halamanOutsourcing Logistics OperationsBushra HakimBelum ada peringkat

- Ifwla PresentationsDokumen157 halamanIfwla PresentationsAlok AnandBelum ada peringkat

- Project Management: Presentation by Ashalakshmi RKDokumen58 halamanProject Management: Presentation by Ashalakshmi RKDheeraj KannanBelum ada peringkat

- Recruitment, Selection and Placement: Module - 3Dokumen13 halamanRecruitment, Selection and Placement: Module - 3Rajashekhar B BeedimaniBelum ada peringkat

- Measurement Concepts in Business Research: Chapter - 6Dokumen8 halamanMeasurement Concepts in Business Research: Chapter - 6Rajashekhar B BeedimaniBelum ada peringkat

- Sales PromotionDokumen13 halamanSales PromotionRajashekhar B BeedimaniBelum ada peringkat

- Communication Presentation 1Dokumen13 halamanCommunication Presentation 1Rajashekhar B BeedimaniBelum ada peringkat

- BRM chp07Dokumen12 halamanBRM chp07Rajashekhar B BeedimaniBelum ada peringkat

- TestingDokumen21 halamanTestingdamarugaBelum ada peringkat

- Recruitment NotificationDokumen24 halamanRecruitment NotificationRajashekhar B BeedimaniBelum ada peringkat

- International Financial Markets and Instruments: Module - 4Dokumen10 halamanInternational Financial Markets and Instruments: Module - 4Rajashekhar B BeedimaniBelum ada peringkat

- ChandruDokumen27 halamanChandruSidhant BhayanaBelum ada peringkat

- Business Research DesignsDokumen76 halamanBusiness Research DesignsRavishankar UlleBelum ada peringkat

- Business Environment IipmDokumen142 halamanBusiness Environment IipmRajashekhar B BeedimaniBelum ada peringkat

- BRM chp05Dokumen48 halamanBRM chp05Rajashekhar B BeedimaniBelum ada peringkat

- Comp IntroDokumen84 halamanComp IntroRavi Kumar MogilsettiBelum ada peringkat

- Hypothesis TestingDokumen31 halamanHypothesis TestingRajashekhar B BeedimaniBelum ada peringkat

- Business Research Data Analysis PPT 111111020701 Phpapp02Dokumen40 halamanBusiness Research Data Analysis PPT 111111020701 Phpapp02Deepanshu ChamoliBelum ada peringkat

- Business Research MethodsDokumen42 halamanBusiness Research MethodsRajashekhar B BeedimaniBelum ada peringkat

- BRM chp02Dokumen33 halamanBRM chp02Rajashekhar B BeedimaniBelum ada peringkat

- BRM chp10Dokumen48 halamanBRM chp10Rajashekhar B BeedimaniBelum ada peringkat

- BRM chp04Dokumen16 halamanBRM chp04Rajashekhar B BeedimaniBelum ada peringkat

- BRM chp03Dokumen11 halamanBRM chp03Rajashekhar B BeedimaniBelum ada peringkat

- Res. MethodDokumen100 halamanRes. Methodhimanshug_43Belum ada peringkat

- BRM chp09Dokumen37 halamanBRM chp09Rajashekhar B BeedimaniBelum ada peringkat

- BRM chp01Dokumen17 halamanBRM chp01Rajashekhar B BeedimaniBelum ada peringkat

- Role of Marketing Research and ProcessDokumen59 halamanRole of Marketing Research and ProcessRajashekhar B BeedimaniBelum ada peringkat

- Business Research Methods: Univariate StatisticsDokumen55 halamanBusiness Research Methods: Univariate StatisticsRajashekhar B BeedimaniBelum ada peringkat

- Business Research Methods: Questionnaire DesignDokumen30 halamanBusiness Research Methods: Questionnaire DesignRajashekhar B BeedimaniBelum ada peringkat

- Business Research Methods: Editing and CodingDokumen19 halamanBusiness Research Methods: Editing and CodingRajashekhar B BeedimaniBelum ada peringkat

- CH 18Dokumen12 halamanCH 18Rajashekhar B BeedimaniBelum ada peringkat

- Research Methodology - IDokumen48 halamanResearch Methodology - IswathravBelum ada peringkat

- Measures of Association and Bivariate AnalysisDokumen66 halamanMeasures of Association and Bivariate Analysisramki66666Belum ada peringkat

- Case - 07 - Royal Beginnings BrideDokumen10 halamanCase - 07 - Royal Beginnings BrideChetali HedauBelum ada peringkat

- DredgingDokumen57 halamanDredgingHilur Muhammed100% (1)

- JBS - Annual and Sustainability Report 2016Dokumen144 halamanJBS - Annual and Sustainability Report 2016JBS RIBelum ada peringkat

- Mesc Spe 74 002Dokumen6 halamanMesc Spe 74 002Pranesh BhatBelum ada peringkat

- The Speeding BulletDokumen4 halamanThe Speeding BulletRainna YangBelum ada peringkat

- Bursa Malaysia Toolkit - Materiality Assessment (2nd Edition)Dokumen41 halamanBursa Malaysia Toolkit - Materiality Assessment (2nd Edition)kacaribuantonBelum ada peringkat

- Full Download Solution Manual For Managing Operations Across The Supply Chain 3rd Edition PDF Full ChapterDokumen36 halamanFull Download Solution Manual For Managing Operations Across The Supply Chain 3rd Edition PDF Full Chapterscrotalfilietyhakbc100% (18)

- Documents: Search Books, Presentations, Business, Academics..Dokumen10 halamanDocuments: Search Books, Presentations, Business, Academics..Rakesh Sharma0% (1)

- Mcdonalds Marketing Mix Info.Dokumen13 halamanMcdonalds Marketing Mix Info.Shaon MatinBelum ada peringkat

- HavmorDokumen7 halamanHavmorKunal Jana0% (1)

- New AI Based Vegetable Price/arrival/demand Forecasting Model & A Superior Vegetable Trading Business in IndiaDokumen16 halamanNew AI Based Vegetable Price/arrival/demand Forecasting Model & A Superior Vegetable Trading Business in IndiaDumitru MihaiBelum ada peringkat

- Oracle Procurement Cloud 2018 Implementation EssentialsDokumen42 halamanOracle Procurement Cloud 2018 Implementation EssentialsCristina PuriceBelum ada peringkat

- Global Procurement Policy Version 1.1. CleanDokumen21 halamanGlobal Procurement Policy Version 1.1. CleanRodrigo ArbacheBelum ada peringkat

- Exam Collaborate Session For Exam Revision New-1Dokumen28 halamanExam Collaborate Session For Exam Revision New-1zachbeef0% (1)

- Management Accounting: Student EditionDokumen27 halamanManagement Accounting: Student EditionDinda OktavianiBelum ada peringkat

- IATA Cargo Ops 2023 TrendsDokumen9 halamanIATA Cargo Ops 2023 TrendsCCV CCVBelum ada peringkat

- Imlux CDDokumen11 halamanImlux CDRTVIK SHARMABelum ada peringkat

- Facility Location Model: A Case Study: Miguel Limão BergerDokumen10 halamanFacility Location Model: A Case Study: Miguel Limão BergerMainak SarkarBelum ada peringkat

- Purchasing System Investigation ProposalDokumen3 halamanPurchasing System Investigation ProposalArthur Angelo RamosBelum ada peringkat

- Strategic Sourcing & Material ManagementDokumen53 halamanStrategic Sourcing & Material ManagementPower IsoBelum ada peringkat

- ERP PepsicoDokumen24 halamanERP PepsicoPreeti Dhillon100% (20)

- Mintec Analytics OverviewDokumen6 halamanMintec Analytics OverviewFelipe TavaresBelum ada peringkat

- 2.purchase ReportDokumen3 halaman2.purchase ReportRam SundarBelum ada peringkat

- MS Industrial Engineer ResumeDokumen1 halamanMS Industrial Engineer Resumeb.sabiri6445Belum ada peringkat

- INVESTASI & LOGISTIK Sri RahardjoDokumen66 halamanINVESTASI & LOGISTIK Sri RahardjoWendra NovaBelum ada peringkat

- Reference Form 2016Dokumen270 halamanReference Form 2016MillsRIBelum ada peringkat

- Green Procurement PolicyDokumen3 halamanGreen Procurement PolicyDarius PavriBelum ada peringkat

- Scor 10 MetricsDokumen179 halamanScor 10 MetricsJorge Motta100% (3)

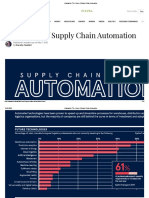

- The Future of Supply Chain AutomationDokumen15 halamanThe Future of Supply Chain AutomationAndrey MatusevichBelum ada peringkat

- MASTER THESIS Adhesive bonding selection for automotive applicationsDokumen1 halamanMASTER THESIS Adhesive bonding selection for automotive applicationsChâu An NguyễnBelum ada peringkat