Disclosure in Financial Statements - Notes To Accounts

Diunggah oleh

eknath2000Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Disclosure in Financial Statements - Notes To Accounts

Diunggah oleh

eknath2000Hak Cipta:

Format Tersedia

Disclosure in Financial Statements Notes to Accounts

Introduction The users of the financial statements need information about the financial position and performance of the bank in making economic decisions. They are interested in its liquidity and solvency and the risks related to the assets and liabilities recognised on its balance sheet and to its off balance sheet items. In the interest of full and complete disclosure, some very useful information is better provided, or can only be provided, by notes to the financial statements. The use of notes and supplementary information provides the means to explain and document certain items, which are either presented in the financial statements or otherwise affect the financial position and performance of the reporting enterprise. Recently, a lot of attention has been paid to the issue of market discipline in the banking sector. Market discipline, however, works only if market participants have access to timely and reliable information, which enables them to assess banks activities and the risks inherent in these activities. Enabling market discipline may have several benefits. Market discipline has been given due importance under Basel II framework on capital adequacy by recognizing it as one of its three Pillars. Summary of Significant Accounting Policies and Notes to Accounts is shown under Schedule 17 and Schedule 18 respectively, to maintain uniformity.

Minimum Disclosures Disclosures are to be shown in the Notes to Accounts comprehensively. Banks are required to disclose the accounting policies adopted by them along with Notes to Accounts in their financial statements which includes Basis of Accounting, Transactions involving Foreign Exchange, Investments Classification, Valuation, etc, Advances and Provisions thereon, Fixed Assets and Depreciation, Revenue Recognition, Employee Benefits, Provision for Taxation, Net Profit, etc.

Disclosure Requirements Market discipline deals with capital adequacy, risk exposures, risk assessment processes and key business parameters which provide a consistent and understandable disclosure framework that enhances comparability. Banks are required to comply with the AS 1 on Disclosure of Accounting Policies issued by ICAI. Apart from the 16 detailed prescribed schedules to the balance sheet, banks are required to furnish the following information in the Notes to Accounts:

Details of Single Borrower Limit (SGL)/ Group Borrower Limit (GBL) exceeded by the bank. Unsecured Advances Disclosure of Penalties imposed by RBI Accounting Standard 5 Net Profit or Loss for the period, prior period items and changes in accounting policies. Accounting Standard 9 Revenue Recognition Accounting Standard 15 Employee Benefits Accounting Standard 17 Segment Reporting Accounting Standard 18 Related Party Disclosures Accounting Standard 21 Consolidated Financial Statements (CFS) Accounting Standard 22 Accounting for Taxes on Income Accounting Standard 23 Accounting for Investments in Associates in Consolidated Financial Statements Accounting Standard 24 Discontinuing Operations Provisions and Contingencies Disclosure of complaints Awards passed by the Banking Ombudsman Disclosure of Letters of Comfort (LoCs) issued by banks The PCR (ratio of provisioning to gross non-performing assets) should be disclosed in the Notes to Accounts to the Balance Sheet. Bancassurance Business Concentration of Deposits, Advances, Exposures and NPAs Sector-wise NPAs Movement of NPAs Off-balance Sheet SPVs sponsored Unamortised Pension and Gratuity Liabilities Disclosures on Remuneration Disclosures relating to Securitisation

Anda mungkin juga menyukai

- Tax 2Dokumen2 halamanTax 2Fish Ing0% (5)

- Motion To Dismiss-Fleury Chapter 7 BankruptcyDokumen5 halamanMotion To Dismiss-Fleury Chapter 7 Bankruptcyarsmith718Belum ada peringkat

- Topic 03 - Double Entry SystemDokumen37 halamanTopic 03 - Double Entry SystemNorainah Abdul GaniBelum ada peringkat

- 15gift and Estate Tax - Katzenstein - Fall 2002Dokumen95 halaman15gift and Estate Tax - Katzenstein - Fall 2002proveitwasmeBelum ada peringkat

- 10 The Down Re It StructureDokumen13 halaman10 The Down Re It StructureCorkn BottlesBelum ada peringkat

- Lead Schedule: Refer To The Attached Sample Bank Confirmation TemplateDokumen4 halamanLead Schedule: Refer To The Attached Sample Bank Confirmation TemplateChristian Dela CruzBelum ada peringkat

- Tax Accounting Acc 3400 Chapter ExamsDokumen188 halamanTax Accounting Acc 3400 Chapter Examshmgheidi100% (2)

- CCHT 1041prep2010 1Dokumen152 halamanCCHT 1041prep2010 1purpelBelum ada peringkat

- Jurisdictions PDFDokumen4 halamanJurisdictions PDFCredServicos SABelum ada peringkat

- Credit Management - A Conceptual FrameworkDokumen30 halamanCredit Management - A Conceptual Frameworkeknath200050% (2)

- Asset Liability Management in BanksDokumen29 halamanAsset Liability Management in Bankseknath2000Belum ada peringkat

- Treasury and Fund Management in BanksDokumen40 halamanTreasury and Fund Management in Bankseknath2000100% (2)

- Kakada Aarti-Bhajani MalikaDokumen48 halamanKakada Aarti-Bhajani Malikaeknath2000100% (3)

- Tesco Credit AgreementDokumen25 halamanTesco Credit AgreementM.r. KhanBelum ada peringkat

- A Private Investor's Guide To GiltsDokumen36 halamanA Private Investor's Guide To GiltsFuzzy_Wood_PersonBelum ada peringkat

- Sole Trading Concern / Sole: ProprietorshipDokumen41 halamanSole Trading Concern / Sole: ProprietorshipRohit BhattaraiBelum ada peringkat

- Tax Obligations For Individuals and CorporDokumen4 halamanTax Obligations For Individuals and Corporgabriel6lambokBelum ada peringkat

- Presentation By: Sneha Shah Kunal Bhatt Sri Harsha Reddy Swetha Rani Puneeth Gupta Anshu Bafna Santosh Kumar & Hardik DeliwalaDokumen18 halamanPresentation By: Sneha Shah Kunal Bhatt Sri Harsha Reddy Swetha Rani Puneeth Gupta Anshu Bafna Santosh Kumar & Hardik DeliwalaharrdiikBelum ada peringkat

- Spotting Fraud During The Bankruptcy ProcessDokumen4 halamanSpotting Fraud During The Bankruptcy ProcessBSA3Tagum MariletBelum ada peringkat

- Consolidated Financial Statements - IFRS 10Dokumen3 halamanConsolidated Financial Statements - IFRS 10akii ramBelum ada peringkat

- FAR 1 NotesDokumen7 halamanFAR 1 NotesDavEriKevBelum ada peringkat

- Manual For Finance QuestionsDokumen55 halamanManual For Finance QuestionsMShoaibUsmani100% (1)

- USPS OIG Management Advisory - Benchmarking Mail Distribution To CarriersDokumen15 halamanUSPS OIG Management Advisory - Benchmarking Mail Distribution To CarriersbsheehanBelum ada peringkat

- Sole Trading Concern Sole ProrietorshipDokumen2 halamanSole Trading Concern Sole ProrietorshipAMIN BUHARI ABDUL KHADER0% (1)

- Dimensions of Cash Flow Management: Prof. N. C. KarDokumen74 halamanDimensions of Cash Flow Management: Prof. N. C. KarAshokBelum ada peringkat

- Executors AccountsDokumen5 halamanExecutors AccountskennedyBelum ada peringkat

- Fas 140Dokumen142 halamanFas 140nolandparkBelum ada peringkat

- Futures 1Dokumen66 halamanFutures 1shivaBelum ada peringkat

- Trust Tax Return 2019 PDFDokumen16 halamanTrust Tax Return 2019 PDFIsabelle Che KimBelum ada peringkat

- GPF Bill Form 48Dokumen8 halamanGPF Bill Form 48ChristoDeepthiBelum ada peringkat

- Instruments For Financing Working CapitalDokumen6 halamanInstruments For Financing Working CapitalPra SonBelum ada peringkat

- Private Equity Transactions: Overview of A Buy-Out: International Investor Series No. 9Dokumen20 halamanPrivate Equity Transactions: Overview of A Buy-Out: International Investor Series No. 9CfhunSaatBelum ada peringkat

- Long Form Audit ReportDokumen10 halamanLong Form Audit Reportchitrank10100% (3)

- Securities and Exchange Commission (SEC) - Formn-54aDokumen2 halamanSecurities and Exchange Commission (SEC) - Formn-54ahighfinanceBelum ada peringkat

- Investements AccountingDokumen9 halamanInvestements AccountingShiyas FazalBelum ada peringkat

- Witholding TaxDokumen33 halamanWitholding TaxBfp Basud Camarines NorteBelum ada peringkat

- Sample Audit ReportsDokumen44 halamanSample Audit Reportsyeosuf100% (1)

- AUDITING of Banks FinalDokumen50 halamanAUDITING of Banks Finaljeards24100% (2)

- 10 Depreciation and Income TaxDokumen53 halaman10 Depreciation and Income TaxDyahKuntiSuryaBelum ada peringkat

- Bank and Financial Institution Act 2073 2017 PDFDokumen101 halamanBank and Financial Institution Act 2073 2017 PDFNisha RaiBelum ada peringkat

- InternationalLaw DisposiitonOfSecuriteisDokumen79 halamanInternationalLaw DisposiitonOfSecuriteisravenmailmeBelum ada peringkat

- How To Register A Corporation With The Securities and Exchange CommmnissionDokumen2 halamanHow To Register A Corporation With The Securities and Exchange CommmnissionAnonymous JqiHOYWmsBelum ada peringkat

- ICE CDS White PaperDokumen21 halamanICE CDS White PaperRajat SharmaBelum ada peringkat

- Financial StatementsDokumen1 halamanFinancial Statementsaashir chBelum ada peringkat

- Advanced Scenario 6 - Quincy and Marian Pike (2018)Dokumen10 halamanAdvanced Scenario 6 - Quincy and Marian Pike (2018)Center for Economic ProgressBelum ada peringkat

- Concurrent AuditDokumen7 halamanConcurrent AuditCA Harsh Satish UdeshiBelum ada peringkat

- Partnership PDFDokumen10 halamanPartnership PDFaayush21Belum ada peringkat

- Toyota Industrial Trucks U. S. A., Inc. v. Citizens National Bank of Evans City v. Promat Corporation, 611 F.2d 465, 3rd Cir. (1979)Dokumen12 halamanToyota Industrial Trucks U. S. A., Inc. v. Citizens National Bank of Evans City v. Promat Corporation, 611 F.2d 465, 3rd Cir. (1979)Scribd Government DocsBelum ada peringkat

- Portfoliopractice IFRS Accounting of Pension ObligationsDokumen24 halamanPortfoliopractice IFRS Accounting of Pension ObligationsvalentbrBelum ada peringkat

- TWDV Remaininguseful Lifeof Asset: A. PMA Test - Income vs. Capital Receipt (Tree or Fruit)Dokumen3 halamanTWDV Remaininguseful Lifeof Asset: A. PMA Test - Income vs. Capital Receipt (Tree or Fruit)Kelvin Lim Wei LiangBelum ada peringkat

- Shall File A Return Under OathDokumen17 halamanShall File A Return Under OathMixx MineBelum ada peringkat

- PrivateSide Modernization TrainingGuideDokumen30 halamanPrivateSide Modernization TrainingGuiderutbutBelum ada peringkat

- SEBI Role and FunctionsDokumen28 halamanSEBI Role and FunctionsAnurag Singh100% (4)

- Business PlanDokumen14 halamanBusiness PlanMira PhFeBelum ada peringkat

- Important Banking GK PDFDokumen26 halamanImportant Banking GK PDFPriya BanothBelum ada peringkat

- Dividend Assignment 1212Dokumen3 halamanDividend Assignment 1212yatin rajputBelum ada peringkat

- Diploma in Accountancy and Government Accounting FinalDokumen100 halamanDiploma in Accountancy and Government Accounting Finalmulenga lubemba100% (2)

- 1 1 BondsDokumen10 halaman1 1 BondsyukiyurikiBelum ada peringkat

- Fix-5.0 SP1 Vol-7Dokumen233 halamanFix-5.0 SP1 Vol-7TraderCat SolarisBelum ada peringkat

- Section 110 SPV Taxation (Grant Thornton)Dokumen27 halamanSection 110 SPV Taxation (Grant Thornton)adrianpturner100% (1)

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionDari EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionBelum ada peringkat

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryDari EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryBelum ada peringkat

- Credit Derivatives and Structured Credit: A Guide for InvestorsDari EverandCredit Derivatives and Structured Credit: A Guide for InvestorsBelum ada peringkat

- Financial Reporting StandardsDokumen16 halamanFinancial Reporting StandardsAhMed MahMoudBelum ada peringkat

- WRK IFRS SMEsDokumen109 halamanWRK IFRS SMEsMazhar Ali JoyoBelum ada peringkat

- Disclosure in Financials Statements PDFDokumen31 halamanDisclosure in Financials Statements PDFVinit AgrawalBelum ada peringkat

- RBI Guidelines On Currency ManagementDokumen16 halamanRBI Guidelines On Currency Managementeknath2000Belum ada peringkat

- Law of Limitation in BankingDokumen13 halamanLaw of Limitation in Bankingeknath2000100% (1)

- Communication Skills For BankersDokumen12 halamanCommunication Skills For Bankerseknath2000Belum ada peringkat

- Law of LimitationDokumen31 halamanLaw of Limitationeknath2000100% (1)

- Various Methods of Payment in International TradeDokumen63 halamanVarious Methods of Payment in International Tradeeknath2000Belum ada peringkat

- Mergers and AcquisitionsDokumen34 halamanMergers and Acquisitionseknath2000Belum ada peringkat

- DN 01Dokumen13 halamanDN 01anantjadhav2006Belum ada peringkat

- CASA Centric StrategyDokumen40 halamanCASA Centric Strategyeknath2000Belum ada peringkat

- Banking Regulations Act 1949Dokumen26 halamanBanking Regulations Act 1949eknath2000Belum ada peringkat

- 20 Qualities of Effective Cooperative LeadersDokumen2 halaman20 Qualities of Effective Cooperative Leaderseknath2000Belum ada peringkat

- BusinessetiquetteDokumen20 halamanBusinessetiquetteakhilchibberBelum ada peringkat

- Marketing and Customer ServiceDokumen109 halamanMarketing and Customer Serviceeknath2000Belum ada peringkat

- Legal and Regulatory Aspects of BankingDokumen216 halamanLegal and Regulatory Aspects of Bankingeknath2000Belum ada peringkat

- Characteristic of SME IndustryDokumen5 halamanCharacteristic of SME Industryeknath2000100% (1)

- BusinessetiquetteDokumen20 halamanBusinessetiquetteakhilchibberBelum ada peringkat

- Risk Management System in BanksDokumen50 halamanRisk Management System in Bankseknath2000Belum ada peringkat

- Preparation Readying For Sales MeetingDokumen18 halamanPreparation Readying For Sales Meetingeknath2000Belum ada peringkat

- Marketing and Customer ServiceDokumen109 halamanMarketing and Customer Serviceeknath2000Belum ada peringkat

- Jaiib Module ADokumen25 halamanJaiib Module Aeknath2000Belum ada peringkat

- 02.contemporary BankerDokumen12 halaman02.contemporary Bankereknath2000Belum ada peringkat

- Master Direction On Import of Goods and ServicesDokumen31 halamanMaster Direction On Import of Goods and Serviceseknath2000Belum ada peringkat

- Prudential Norms On Income Recognition, Asset ClassificationDokumen16 halamanPrudential Norms On Income Recognition, Asset Classificationeknath2000Belum ada peringkat

- Ekadashi Mahatmya-01 - MarathiDokumen50 halamanEkadashi Mahatmya-01 - Marathieknath2000100% (3)

- Ekadashi Mahatmya-02 - MarathiDokumen46 halamanEkadashi Mahatmya-02 - Marathieknath2000Belum ada peringkat

- Ekadashi Mahatmya-01 - MarathiDokumen50 halamanEkadashi Mahatmya-01 - Marathieknath2000100% (3)

- Income Recognition, Asset Classification and Provisioning Norms For The Urban Cooperat Ive BanksDokumen10 halamanIncome Recognition, Asset Classification and Provisioning Norms For The Urban Cooperat Ive Banksramsundar_99Belum ada peringkat

- The Accounting EquationDokumen14 halamanThe Accounting EquationErickk EscanooBelum ada peringkat

- Public Economics: Budget & Its TypesDokumen24 halamanPublic Economics: Budget & Its TypesMahesh Rasal0% (1)

- Questions For Advanced AccountingDokumen3 halamanQuestions For Advanced AccountingHelena ThomasBelum ada peringkat

- Loans WebquestDokumen3 halamanLoans Webquestapi-288392955Belum ada peringkat

- PNB Vs SAYODokumen1 halamanPNB Vs SAYOMico Maagma Carpio0% (1)

- Intrest Rate StructureDokumen12 halamanIntrest Rate StructureMohit KumarBelum ada peringkat

- 0452 s07 Ms 3 PDFDokumen10 halaman0452 s07 Ms 3 PDFAbirHudaBelum ada peringkat

- What Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityDokumen8 halamanWhat Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityNikhil GandhiBelum ada peringkat

- CIBIL Decision MatrixDokumen3 halamanCIBIL Decision MatrixsureshkayambuBelum ada peringkat

- Chaechapter 7 SolutionsDokumen16 halamanChaechapter 7 Solutionsmadddy_hydBelum ada peringkat

- Syllabus Macro 1Dokumen5 halamanSyllabus Macro 1pratyush1984100% (1)

- World Trade: An Overview: Slides Prepared by Thomas BishopDokumen36 halamanWorld Trade: An Overview: Slides Prepared by Thomas BishopAbu Naira HarizBelum ada peringkat

- Lecture 2Dokumen38 halamanLecture 2Tiffany TsangBelum ada peringkat

- Summary of Money Market and Monetary Operations in IndiaDokumen1 halamanSummary of Money Market and Monetary Operations in IndiaSubigya BasnetBelum ada peringkat

- Book Keeping and Accounts Past Paper Series 2 2011Dokumen6 halamanBook Keeping and Accounts Past Paper Series 2 2011Aggelos Ispirli0% (1)

- CHAPTER 1 International EconomicsDokumen48 halamanCHAPTER 1 International EconomicsToulouse18Belum ada peringkat

- Term Paper - LLCDokumen9 halamanTerm Paper - LLCapi-115328034Belum ada peringkat

- Quiz Feedback - CourseraDokumen7 halamanQuiz Feedback - CourseraVictoriaLukyanova0% (1)

- Ias 37Dokumen4 halamanIas 37kikiBelum ada peringkat

- Lecture 3Dokumen25 halamanLecture 3Balu BhsBelum ada peringkat

- What Is Public Good & Type of PublicDokumen11 halamanWhat Is Public Good & Type of Publicsyahidah_putri88Belum ada peringkat

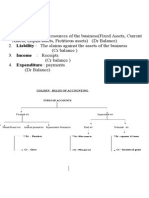

- 1.cash Basis 2.accrual Basis: Golden Rules of AccountingDokumen4 halaman1.cash Basis 2.accrual Basis: Golden Rules of AccountingabinashBelum ada peringkat

- AssignmentDokumen4 halamanAssignmentshahin317Belum ada peringkat

- Financial MarketsDokumen32 halamanFinancial MarketsArief Kurniawan100% (1)

- Third World CountryDokumen3 halamanThird World Countryapi-285429731Belum ada peringkat

- Winding Up of A CompanyDokumen16 halamanWinding Up of A CompanysanamahewishBelum ada peringkat

- Sample Lending Agreement 3Dokumen1 halamanSample Lending Agreement 3cam8992Belum ada peringkat

- Use The Following Information For Questions 1 and 2Dokumen5 halamanUse The Following Information For Questions 1 and 2Jane Michelle Eman0% (2)