International Trade

Diunggah oleh

Rashmi GandhiJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

International Trade

Diunggah oleh

Rashmi GandhiHak Cipta:

Format Tersedia

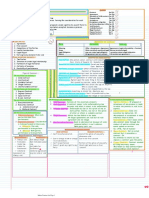

Theories of Internationa l Trade

4-2

Learning Objectives

To understand the traditional arguments of how and why international trade improves the welfare of all countries To review the history and compare the implications of trade theory from the original work of Adam Smith to the contemporary theories of Michael Porter To examine the criticisms of classical trade theory and examine alternative viewpoints of which business and economic forces determine trade patterns between countries

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-3

Evolution of Trade Theories

McGraw-Hill/Irwin International Business, 5/e

Mercantilism Absolute advantage (Classical) Comparative advantage Factor Proportions Trade International Product Cycle New Trade Theory National competitive advantage

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-4

Mercantilism: mid-16th century

A nations wealth depends on accumulated treasure

Gold and silver are the currency of trade

Theory says you should have a trade surplus.

Maximize export through subsidies. Minimize imports through tariffs and quotas

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Flaw: restrictions, impaired growth

McGraw-Hill/Irwin International Business, 5/e

4-5

Defining mercantilism

McGraw-Hill/Irwin International Business, 5/e

trade theory holding that nations should accumulate financial wealth, usually in the form of gold (forget things like living standards or human development) by encouraging exports and discouraging imports

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-6

Theory of absolute advantage

Adam Smith: Wealth of Nations (1776) argued: Capability of one country to produce more of a product with the same amount of input than another country A country should produce only goods where it is most efficient, and trade for those goods where it is not efficient Trade between countries is, therefore, beneficial Assumes there is an absolute balance among McGraw-Hill/Irwin 2005 The McGraw-Hill Companies, Inc., All Rights Reserved. nations International Business, 5/e

4-7

Theory of absolute advantage

destroys the mercantilist idea since there are gains to be had by both countries party to an exchange questions the objective of national governments to acquire wealth through restrictive trade policies measures a nations wealth by the living standards of its people

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-8

Theory of absolute advantage

PPF Production Possibility Frontier

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-9

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-10

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-11

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-12

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-13

Theory of comparative advantage

David Ricardo: Principles of Political Economy (1817)

Extends free trade argument Efficiency of resource utilization leads to more productivity Should import even if country is more efficient in the products production than country from which it is buying. Look to see how much more efficient. If only comparatively efficient, than import.

Makes better use of resources Trade is a positive-sum game

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-14

Theory of comparative advantage

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-15

Comparative advantage and the gains from trade

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-16

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-17

Comparative advantage: Bollywood

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-18

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-19

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-20

Assumptions and limitations

Driven only by maximization of production and consumption Only 2 countries engaged in production and consumption of just 2 goods? What about the transportation costs? Only resource labour (that too, nontransferable) No consideration for learning theory

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-21

Factor proportions theory

Heckscher (1919) - Olin (1933) Theory Export goods that intensively use factor endowments which are locally abundant Corollary: import goods made from locally scarce factors

Note: Factor endowments can be impacted by government policy - minimum wage

Patterns of trade are determined by differences in factor endowments - not productivity Remember, focus on relative advantage, not absolute advantage

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-22

Factor proportions theory

trade theory holding that countries produce and export those goods that require resources (factors) that are abundant (and thus cheapest) and import those goods that require resources that are in short supply Example:

Australia lot of land and a small population (relative to its size) So what should it export and import? McGraw-Hill/Irwin 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

International Business, 5/e

4-23

Factor Proportions Trade Theory Considers Two Factors of Production

Labor

Capital

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-24

Factor Proportions Trade Theory

A country that is relatively labor abundant (capital abundant) should specialize in the production and export of that product which is relatively labor intensive (capital intensive)

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-25

The Leontief Paradox

The Test:

Could Factor Proportions Theory be used to explain the types of goods the United States imported and exported?

The Method:

Input-output analysis

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-26

The Leontief Paradox

The Findings:

The U.S. exported labor-intensive products and imported capitalintensive products.

The Controversy:

Findings were the opposite of what was generally believed to be true!

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-27

Product life-cycle Theory

R.Vernon (1966)

trade theory holding that a company will begin by exporting its product and later undertake foreign direct investment as the product moves through its lifecycle As products mature, both location of sales and optimal production changes Affects the direction and flow of imports and exports Globalization and integration of the economy makes this theory less valid

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-28

Product life cycle theory

Fig 4.5

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-29

The Product Cycle and Trade Implications Increased emphasis on technologys impact on product cost Explained international investment Limitations

Most appropriate for technologybased products Some products not easily characterized by stages of maturity Most relevant to products produced through mass production

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-30

New trade theory

In industries with high fixed costs:

Specialization increases output, and the ability to enhance economies of scale increases Learning effects are high. These are cost savings that come from learning by doing

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-31

New trade theory applications

Typically, requires industries with high, fixed costs

World demand will support few competitors

Competitors may emerge because of First-mover advantage

Economies of scale may preclude new entrants Role of the government becomes significant

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

Some argue that it generates government

4-32

The theory attempts to analyze the reasons for a nations success in a particular industry Porter studied 100 industries in 10 nations

Theory of national competitive advantage

postulated determinants of competitive advantage of a nation based on four major attributes

Factor

McGraw-Hill/Irwin International Business, 5/e

endowments Demand conditions Related and supporting industries

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-33

Porters diamond

Success occurs where these attributes exist. More/greater the attribute, the higher chance of success The diamond is mutually reinforcing

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-34

Factor endowments

Factor endowments:- A nations position in factors of production such as skilled labor or infrastructure necessary to compete in a given industry Basic factor endowments Advanced factor endowments

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-35

Basic factor endowments

Basic factors: Factors present in a country

Natural resources Climate Geographic location Demographics

While basic factors can provide an initial advantage they must be supported by advanced factors to maintain success

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-36

Advanced factor endowments

Advanced factors: Are the result of investment by people, companies, government and are more likely to lead to competitive advantage If a country has no basic factors, it must invest in advanced factors

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-37

Advanced factor endowments

communications skilled labor research Technology education

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-38

Demand conditions

Demand: creates capabilities creates sophisticated and demanding consumers Demand impacts quality and innovation

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-39

Related and supporting industries

Creates clusters of supporting industries that are internationally competitive Must also meet requirements of other parts of the Diamond

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-40

Firm Strategy, Structure and Rivalry

Long term corporate vision is a determinant of success Management ideology and structure of the firm can either help or hurt you Presence of domestic rivalry improves a companys competitiveness

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-41

Determinants of Competitive Advantage in nations

Fig 4.8

Chance

Company Strategy, Structure, and Rivalry

Two external factors that influence the four determinants.

Factor Conditions Related and Supporting Industries

Demand Conditions

Government

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-42

Porters Theory-predictions

Porters theory should predict the pattern of international trade that we observe in the real world

Countries should be exporting products from those industries where all four components of the diamond are favorable, while importing in those areas where the components are not favorable

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw-Hill/Irwin International Business, 5/e

4-43

Implications for business

Location implications:

First-mover implications:

Disperse production activities to countries where they can be performed most efficiently Invest substantial financial resources in building a first-mover, or early-mover advantage

Promoting free trade is in the best interests of the home-country, not always in the best interests of the firm, even though, many McGraw-Hill/Irwin 2005 The McGraw-Hill Companies, Inc., All Rights Reserved. firms promote open markets International Business, 5/e

Policy implications:

4-44

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-45

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

4-46

India in the global competitiveness report

McGraw-Hill/Irwin International Business, 5/e

2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Anda mungkin juga menyukai

- DAV Question BankDokumen79 halamanDAV Question BankSantosh SrivastavaBelum ada peringkat

- A1170870172 - 23417 - 30 - 2019 - Worksheet - SICI PDFDokumen2 halamanA1170870172 - 23417 - 30 - 2019 - Worksheet - SICI PDFadarsh rajBelum ada peringkat

- Depreciation Solution PDFDokumen10 halamanDepreciation Solution PDFDivya PunjabiBelum ada peringkat

- Notes CompleteDokumen238 halamanNotes Completemukesh_kumar_47Belum ada peringkat

- Chapter 2 Recruitment and Placement by Imran AfzalDokumen8 halamanChapter 2 Recruitment and Placement by Imran AfzalImran MirzaBelum ada peringkat

- Chapter 6 - FunctionsDokumen3 halamanChapter 6 - Functionshassoon221 / حسوون٢٢١Belum ada peringkat

- Straight Line and Written Down Value Depreciation MethodsDokumen5 halamanStraight Line and Written Down Value Depreciation MethodsFalak SagarBelum ada peringkat

- XII Mathematics Sample Paper (2022-23) by Amit BajajDokumen7 halamanXII Mathematics Sample Paper (2022-23) by Amit BajajNiranjan GaneshBelum ada peringkat

- Index: S. NO. Page. NoDokumen728 halamanIndex: S. NO. Page. NoShruti RajBelum ada peringkat

- Sets and FunctionsDokumen3 halamanSets and FunctionsvknarlaBelum ada peringkat

- Physics Smart Notes Part-1Dokumen22 halamanPhysics Smart Notes Part-1rashmi kohliBelum ada peringkat

- I Basic Maths Hand BookDokumen34 halamanI Basic Maths Hand BookKarina Rathore0% (1)

- 3.CA Foundation MCQ Book by Aditya SharmaDokumen187 halaman3.CA Foundation MCQ Book by Aditya SharmaVinayak DhakaBelum ada peringkat

- 1 - The Indian Contract Act - 1872Dokumen16 halaman1 - The Indian Contract Act - 1872Sahil100% (2)

- Job Analysis Questionnaire: Page 1 of 24Dokumen24 halamanJob Analysis Questionnaire: Page 1 of 24abusyed alhasanBelum ada peringkat

- All Icai MCQ FinalDokumen57 halamanAll Icai MCQ FinalAbhay KumarBelum ada peringkat

- B.CAT Economics MCQsDokumen42 halamanB.CAT Economics MCQsGhalib HussainBelum ada peringkat

- CA FOUNDATION STATISTICSDokumen69 halamanCA FOUNDATION STATISTICSVipul Parekh100% (1)

- Foundation MCQ 2012Dokumen337 halamanFoundation MCQ 2012shivam kumarBelum ada peringkat

- CA Foundation Eco & BCK English BookDokumen179 halamanCA Foundation Eco & BCK English BookRaghav SomaniBelum ada peringkat

- Revision Notes: TrackDokumen23 halamanRevision Notes: TrackHANSBelum ada peringkat

- DepreciationDokumen15 halamanDepreciationYash AggarwalBelum ada peringkat

- A Study On Talent Identification and Management With Reference To Congruent Solutions PVT LTDDokumen114 halamanA Study On Talent Identification and Management With Reference To Congruent Solutions PVT LTDSmiley Jyothi VaishnavBelum ada peringkat

- Last 1.5 Day Revision QuestionsDokumen1.657 halamanLast 1.5 Day Revision QuestionsRidhima AggarwalBelum ada peringkat

- 2 Year (Full Book) : Career Prep EngineeringDokumen14 halaman2 Year (Full Book) : Career Prep EngineeringThe Route SchoolBelum ada peringkat

- Simple InterestDokumen3 halamanSimple InterestNisar HussainBelum ada peringkat

- CA FOUNDATION MATHEMATICS EXAM 2022 QUESTIONSDokumen12 halamanCA FOUNDATION MATHEMATICS EXAM 2022 QUESTIONSTaxation and Documentation ServicesBelum ada peringkat

- Green HRM Approach to Environmental SustainabilityDokumen9 halamanGreen HRM Approach to Environmental SustainabilityFaruque Abdullah RumonBelum ada peringkat

- The Nature of ContractDokumen2 halamanThe Nature of ContractCurious BandiBelum ada peringkat

- ECO-Self Examination Questions PDFDokumen66 halamanECO-Self Examination Questions PDFadnan sheikBelum ada peringkat

- Relations and FunctionsDokumen4 halamanRelations and Functionsscholars learningBelum ada peringkat

- Maths Revision: Key Concepts from Chapters 1-15Dokumen54 halamanMaths Revision: Key Concepts from Chapters 1-15Himanshu SinghBelum ada peringkat

- SQP-4 EconomicsDokumen6 halamanSQP-4 EconomicsAsha BhardwajBelum ada peringkat

- CA Foundation (ECO & BCK - Orginal)Dokumen16 halamanCA Foundation (ECO & BCK - Orginal)Lukesh Singh100% (1)

- CAPE Pure Mathematics Unit One Paper OnesDokumen121 halamanCAPE Pure Mathematics Unit One Paper OnesVedant SeepersadBelum ada peringkat

- Use Code:: Bharat - GuptaDokumen11 halamanUse Code:: Bharat - GuptaArjìt GåútãmBelum ada peringkat

- Test 2 Maths & Stats-R2 June23 (Que)Dokumen8 halamanTest 2 Maths & Stats-R2 June23 (Que)AISHWARYA DESHMUKHBelum ada peringkat

- Nptel DomainDokumen71 halamanNptel DomainDr. Rama Satish K VBelum ada peringkat

- Business EconomicsDokumen171 halamanBusiness EconomicsSubhamBelum ada peringkat

- Chapter-1 SetsDokumen16 halamanChapter-1 SetsYogesh Kumar PandeyBelum ada peringkat

- The Contract Act 1872Dokumen53 halamanThe Contract Act 1872Nchumthung JamiBelum ada peringkat

- Measuring National Income Through GDP, GNP & NNPDokumen5 halamanMeasuring National Income Through GDP, GNP & NNPAkshit Kumar100% (1)

- Quadratic Equation Solving ProblemsDokumen7 halamanQuadratic Equation Solving ProblemsNishant GargBelum ada peringkat

- CA Fou Imp QuestionDokumen48 halamanCA Fou Imp QuestionAbhay KumarBelum ada peringkat

- Raambaan Series Question BankDokumen137 halamanRaambaan Series Question BankArish HilalBelum ada peringkat

- CA FOUNDATION MATHEMATICSDokumen87 halamanCA FOUNDATION MATHEMATICSPratham SakpalBelum ada peringkat

- The Infuence of Occupational Stress On Employee Performance in Selected Government Offices in Cotabato City KAURAK GROUPDokumen102 halamanThe Infuence of Occupational Stress On Employee Performance in Selected Government Offices in Cotabato City KAURAK GROUPDonnalene Torion KaurakBelum ada peringkat

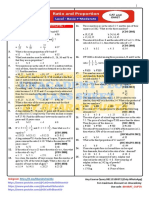

- Ratio and Proportion Practice SheetDokumen6 halamanRatio and Proportion Practice SheetArjìt GåútãmBelum ada peringkat

- An Overview of Green Human Resource Management PracticesDokumen7 halamanAn Overview of Green Human Resource Management PracticesIJRASETPublicationsBelum ada peringkat

- CA Foundation (BMRS - Original)Dokumen19 halamanCA Foundation (BMRS - Original)Lukesh Singh100% (1)

- BCK Full MCQDokumen50 halamanBCK Full MCQShruti JhaBelum ada peringkat

- Sets, Relation and Functions: Basic MathematicsDokumen27 halamanSets, Relation and Functions: Basic MathematicsJayakrishnan SukumaranBelum ada peringkat

- GRSE Coffee Table BookDokumen122 halamanGRSE Coffee Table BookMrityunjoy MazumdarBelum ada peringkat

- Indian Contract Act-John.V.SugumaranDokumen47 halamanIndian Contract Act-John.V.Sugumaranjv_suguBelum ada peringkat

- CA - Foundation MCQ BookDokumen187 halamanCA - Foundation MCQ BookManisha KumariBelum ada peringkat

- Class 12 Economics Chapter 5 Important Extra Questions Human Capital Formation in IndiaDokumen11 halamanClass 12 Economics Chapter 5 Important Extra Questions Human Capital Formation in IndiaBhumi SalujaBelum ada peringkat

- Micro Economics NotesDokumen88 halamanMicro Economics NotesTikMoj TubeBelum ada peringkat

- Relations and FunctionsDokumen4 halamanRelations and FunctionsAnuj YaduvanshiBelum ada peringkat

- International Trade TheoriesDokumen46 halamanInternational Trade TheoriesChiranjay BiswalBelum ada peringkat

- Theories of International Trade ExplainedDokumen28 halamanTheories of International Trade Explainedsomag83Belum ada peringkat

- Client Growth ReportDokumen2 halamanClient Growth ReportRashmi GandhiBelum ada peringkat

- Free Session CallDokumen1 halamanFree Session CallRashmi GandhiBelum ada peringkat

- RoutineDokumen3 halamanRoutineRashmi GandhiBelum ada peringkat

- 3 5LinearProgDokumen12 halaman3 5LinearProgRagav SridharBelum ada peringkat

- Beloved of DushyantDokumen2 halamanBeloved of DushyantRashmi GandhiBelum ada peringkat

- Men's PerceptionDokumen3 halamanMen's PerceptionRashmi GandhiBelum ada peringkat

- Client Growth ReportDokumen2 halamanClient Growth ReportRashmi GandhiBelum ada peringkat

- Linear Programming Linear ProgrammingDokumen67 halamanLinear Programming Linear ProgrammingDrRitu MalikBelum ada peringkat

- Famous Women in Islamic HistoryDokumen20 halamanFamous Women in Islamic Historyalqudsulana8980% (5)

- Medical Supply Transportation Problem OptimizationDokumen30 halamanMedical Supply Transportation Problem OptimizationDrRitu MalikBelum ada peringkat

- Simplex MethodDokumen45 halamanSimplex MethodRashmi GandhiBelum ada peringkat

- India 2008sep18 SriAurobindo enDokumen35 halamanIndia 2008sep18 SriAurobindo enRashmi GandhiBelum ada peringkat

- Modern ThoughtDokumen26 halamanModern ThoughtRashmi GandhiBelum ada peringkat

- Set2 - Transport & NetworkDokumen155 halamanSet2 - Transport & NetworkRashmi GandhiBelum ada peringkat

- Transportation Problem-1Dokumen58 halamanTransportation Problem-1Kautzar Satrio83% (12)

- Christian MysticismDokumen27 halamanChristian MysticismRashmi Gandhi100% (2)

- Brand BuildingDokumen126 halamanBrand Buildingerfan1980Belum ada peringkat

- Introduction To DesignDokumen29 halamanIntroduction To DesignRashmi GandhiBelum ada peringkat

- 3 International BusinessDokumen48 halaman3 International BusinessRashmi GandhiBelum ada peringkat

- MNC IndustryDokumen42 halamanMNC IndustryRashmi GandhiBelum ada peringkat

- Runes - The Elder Futhark: Pictur E Name Lette R Meanin G Symbolic Meanings AND Association SDokumen5 halamanRunes - The Elder Futhark: Pictur E Name Lette R Meanin G Symbolic Meanings AND Association SRashmi GandhiBelum ada peringkat

- Chapter 1Dokumen19 halamanChapter 1Adeel PervezBelum ada peringkat

- Claire Sun-Ok Choi-The Art of Paper QuillingDokumen100 halamanClaire Sun-Ok Choi-The Art of Paper QuillingPaulo SantosBelum ada peringkat

- Chap14 (Debbie)Dokumen27 halamanChap14 (Debbie)Vishnu AgrahariBelum ada peringkat

- 3 International BusinessDokumen48 halaman3 International BusinessRashmi GandhiBelum ada peringkat

- Book of Magic: The Pleasure Dome Wod ExpansionDokumen41 halamanBook of Magic: The Pleasure Dome Wod ExpansionRashmi GandhiBelum ada peringkat

- Forest Lawn CemeteryDokumen11 halamanForest Lawn CemeteryRashmi GandhiBelum ada peringkat

- Prahladrai Dalmia Lions College of Commerce and EconomicsDokumen17 halamanPrahladrai Dalmia Lions College of Commerce and EconomicsRashmi GandhiBelum ada peringkat

- Characteristics of Service Sector ManagementDokumen18 halamanCharacteristics of Service Sector ManagementRashmi Gandhi0% (1)

- Demand Analysis of MaggiDokumen9 halamanDemand Analysis of MaggiGauravOberoi50% (2)

- Advanced Macroeconomic Theory Lecture NotesDokumen205 halamanAdvanced Macroeconomic Theory Lecture Notesbizjim20067960100% (1)

- Extended Essay EconomicsDokumen76 halamanExtended Essay EconomicsSya Kamal100% (1)

- Economics For Managers Sample PaperDokumen4 halamanEconomics For Managers Sample PaperghogharivipulBelum ada peringkat

- Chapter - I: Introduction: Part - I: Nature and Methodology of EconomicsDokumen8 halamanChapter - I: Introduction: Part - I: Nature and Methodology of EconomicsshafistoreBelum ada peringkat

- Budget Constrain and Indifference CurveDokumen46 halamanBudget Constrain and Indifference CurveSAKIB12Belum ada peringkat

- OPEC Oil Production GameDokumen2 halamanOPEC Oil Production GameCCAV13Belum ada peringkat

- Chapter 3 SolutionsssssDokumen22 halamanChapter 3 SolutionsssssBharat SinghBelum ada peringkat

- Competition Law SyllabusDokumen5 halamanCompetition Law SyllabusRajivCoolBelum ada peringkat

- Chap008 Cost MinimizationDokumen36 halamanChap008 Cost MinimizationAnugragha SundarBelum ada peringkat

- Marx's Theory of Crisis (Book)Dokumen198 halamanMarx's Theory of Crisis (Book)Iman Ganji100% (1)

- Philippe Van Parijs - What (If Anything) Is Intrinsically Wrong With Capitalism (1984)Dokumen18 halamanPhilippe Van Parijs - What (If Anything) Is Intrinsically Wrong With Capitalism (1984)guilmoura100% (1)

- Mid Term Exam ECONDokumen24 halamanMid Term Exam ECONsakebradford100% (1)

- 10e 06 Chap Student WorkbookDokumen23 halaman10e 06 Chap Student WorkbookMarielle Aria SantosBelum ada peringkat

- KWCh06 4 Applying Consumer and Producer Surplus The Efficiency Costs of A Tax EdwardDokumen8 halamanKWCh06 4 Applying Consumer and Producer Surplus The Efficiency Costs of A Tax EdwardAbraham Odoi GeraldBelum ada peringkat

- Managerial Economics - Course OutlineDokumen4 halamanManagerial Economics - Course OutlinekartikBelum ada peringkat

- Microeconomics in 25 Slides or LessDokumen28 halamanMicroeconomics in 25 Slides or LessAnkit GuptaBelum ada peringkat

- Eco 162 - Quiz 1 FEB 2014Dokumen3 halamanEco 162 - Quiz 1 FEB 2014Luqman LatifBelum ada peringkat

- Game Theory Introduction and Applications - Graham RompDokumen295 halamanGame Theory Introduction and Applications - Graham Romp1234lmnop123493% (14)

- (New Directions in Modern Economics Series) Turan Subasat (Ed.) - The Great Financial Meltdown - Systemic, Conjunctural or Policy-Created - Edward Elgar Pub (2016)Dokumen372 halaman(New Directions in Modern Economics Series) Turan Subasat (Ed.) - The Great Financial Meltdown - Systemic, Conjunctural or Policy-Created - Edward Elgar Pub (2016)Джон Ф. О'ДоннелBelum ada peringkat

- Fed Money Supply ChapterDokumen4 halamanFed Money Supply ChapterVanu VanujanBelum ada peringkat

- Economics of Market FailureDokumen4 halamanEconomics of Market FailureMithila SeneviratneBelum ada peringkat

- Review of Quiz 4 on Monopsony and Labour MarketsDokumen7 halamanReview of Quiz 4 on Monopsony and Labour MarketsTumi Mothusi100% (1)

- Hubbard Efficiency and Market FailureDokumen53 halamanHubbard Efficiency and Market FailureSyed Masroor Hussain ZaidiBelum ada peringkat

- ECONOMICS (856Dokumen8 halamanECONOMICS (856Princess Soniya100% (1)

- Piero Sraffa's Political Economy PDFDokumen426 halamanPiero Sraffa's Political Economy PDFBlancaLain100% (2)

- Practice Question Test 1Dokumen10 halamanPractice Question Test 1Chuah Chong YangBelum ada peringkat

- RatexDokumen5 halamanRatexAppan Kandala VasudevacharyBelum ada peringkat

- Optimal Output and Profits for Pretzel PlantDokumen6 halamanOptimal Output and Profits for Pretzel PlantOrn PhatthayaphanBelum ada peringkat

- Demand and Supply AnalysisDokumen9 halamanDemand and Supply AnalysisManash JRBelum ada peringkat