ABC

Diunggah oleh

Sagnik BiswasHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ABC

Diunggah oleh

Sagnik BiswasHak Cipta:

Format Tersedia

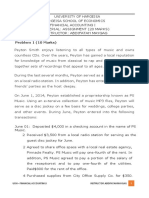

BALANCE SHEET

MAR'13

MAR'12

YoY

( Cr.)

( Cr.)

%Change

123.08

122.48

0.49%

Total Reserves

28,625.68

24,668.60

16.04%

Shareholder's Funds

29,142.72

25,223.02

15.54%

0.00

0.00

0.00%

900.00

900.00

0.00%

6,371.03

4,430.06

43.81%

Deferred Tax Assets / Liabilities

242.22

133.01

82.11%

Other Long Term Liabilities

502.03

376.35

33.39%

Long Term Trade Payables

0.00

0.00

0.00%

285.92

275.05

3.95%

8,301.20

6,114.47

35.76%

Trade Payables

16,730.65

15,607.76

7.19%

Other Current Liabilities

15,181.30

15,638.39

-2.92%

Parameter

EQUITY AND LIABILITIES

Share Capital

Share Warrants &

Outstandings

Long-Term Borrowings

Secured Loans

Unsecured Loans

Long Term Provisions

Total Non-Current Liabilities

Current Liabilities

Short Term Borrowings

734.53

2,936.72

-74.99%

Short Term Provisions

3,741.86

3,926.14

-4.69%

Total Current Liabilities

36,388.34

38,109.01

-4.52%

Total Liabilities

73,832.26

69,446.50

6.32%

0.00

0.00

0.00%

Gross Block

11,985.73

10,557.59

13.53%

Less: Accumulated Depreciation

3,670.59

2,942.61

24.74%

6.93

6.93

0.00%

8,308.21

7,608.05

9.20%

-3.07

-3.07

0.00%

Capital Work in Progress

491.05

697.53

-29.60%

Intangible assets under

development

105.79

61.15

73.00%

Pre-operative Expenses

pending

0.00

0.00

0.00%

Assets in transit

0.00

0.00

0.00%

10,522.70

9,084.71

15.83%

3,664.11

4,055.55

-9.65%

Other Non Current Assets

39.08

127.56

-69.36%

Total Non-Current Assets

23,127.87

21,631.48

6.92%

ASSETS

Non-Current Assets

Less: Impairment of Assets

Net Block

Lease Adjustment A/c

Non Current Investments

Long Term Loans & Advances

Current Assets Loans &

Advances

Currents Investments

5,580.69

6,787.19

-17.78%

Inventories

2,064.18

1,776.62

16.19%

Sundry Debtors

22,613.01

18,716.94

20.82%

Cash and Bank

1,455.66

1,778.12

-18.13%

Other Current Assets

11,791.10

11,922.81

-1.10%

Short Term Loans and Advances

7,156.45

6,819.27

4.94%

Total Current Assets

50,661.09

47,800.95

5.98%

Net Current Assets (Including

Current Investments)

14,272.75

9,691.94

47.26%

Total Current Assets Excluding

Current Investments

45,080.40

41,013.76

9.92%

43.30

14.07

207.75%

Total Assets

73,832.26

69,446.50

6.32%

Contingent Liabilities

5,144.49

2,102.63

144.67%

Total Debt

8,834.21

9,895.77

-10.73%

Book Value (in )

466.12

404.24

15.31%

Adjusted Book Value (in )

310.75

269.50

15.31%

Miscellaneous Expenses not

written off

Profit & Loss

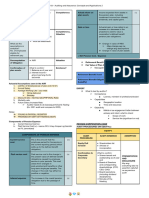

Parameter

MAR'13

( Cr.)

MAR'12

( Cr.)

Change %

Gross Sales

61,470.86

53,737.78

14.39%

Less :Inter divisional transfers

0.00

0.00

0.00%

Less: Sales Returns

0.00

0.00

0.00%

597.60

567.26

5.35%

60,873.26

53,170.52

14.49%

Increase/Decrease in Stock

-1,138.30

-523.50

-117.44%

Raw Materials Consumed

27,536.64

24,988.94

10.20%

818.07

687.89

18.92%

Employee Cost

4,436.32

3,666.09

21.01%

Other Manufacturing Expenses

18,718.62

14,039.54

33.33%

General and Administration

Expenses

3,132.73

2,721.49

15.11%

Selling and Distribution Expenses

186.28

181.50

2.63%

Miscellaneous Expenses

850.56

1,064.24

-20.08%

0.00

0.00

0.00%

Total Expenditure

54,540.92

46,826.19

16.48%

PBIDT (Excl OI)

6,332.34

6,344.33

-0.19%

Other Income

2,045.67

1,377.77

48.48%

Operating Profit

8,378.01

7,722.10

8.49%

Less: Excise

Net Sales

EXPENDITURE:

Power & Fuel Cost

Expenses Capitalised

Interest

1,102.45

767.31

43.68%

PBDT

7,275.56

6,954.79

4.61%

818.47

699.46

17.01%

6,457.09

6,255.33

3.23%

254.06

55.00

361.93%

Profit Before Tax

6,711.15

6,310.33

6.35%

Provision for Tax

1,800.50

1,853.83

-2.88%

PAT

4,910.65

4,456.50

10.19%

Extraordinary Items

0.00

0.00

0.00%

Adj to Profit After Tax

0.00

0.00

0.00%

152.39

105.68

44.20%

5,063.04

4,562.18

10.98%

Equity Dividend (%)

925.00

825.00

12.12%

Earnings Per Share (in

)

79.80

72.77

9.65%

Book Value (in )

466.12

404.24

15.31%

Depreciation

Profit Before Taxation &

Exceptional Items

Exceptional Income /

Expenses

Profit Balance B/F

Appropriations

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Software ManagementDokumen37 halamanSoftware ManagementSagnik BiswasBelum ada peringkat

- Business Plan (Details)Dokumen26 halamanBusiness Plan (Details)Sagnik BiswasBelum ada peringkat

- Financial Institutes & Markets: 2010 MBA (N)Dokumen4 halamanFinancial Institutes & Markets: 2010 MBA (N)Sagnik BiswasBelum ada peringkat

- International Finance (Sagnik Biswas)Dokumen3 halamanInternational Finance (Sagnik Biswas)Sagnik BiswasBelum ada peringkat

- IEM 2ndterm SM Assignment (Sagnik Biswas)Dokumen10 halamanIEM 2ndterm SM Assignment (Sagnik Biswas)Sagnik BiswasBelum ada peringkat

- Net Profitability Ratio Net Profit/Sales MARCH 2013, NPR 8.99% MARCH 2012, NPR 9.59%Dokumen13 halamanNet Profitability Ratio Net Profit/Sales MARCH 2013, NPR 8.99% MARCH 2012, NPR 9.59%Sagnik BiswasBelum ada peringkat

- Storage Area Network SANDokumen39 halamanStorage Area Network SANSagnik BiswasBelum ada peringkat

- AbstractDokumen1 halamanAbstractSagnik BiswasBelum ada peringkat

- Ad-Hoc Network: Guided By:-Sriman SrichandanDokumen20 halamanAd-Hoc Network: Guided By:-Sriman SrichandanSagnik BiswasBelum ada peringkat

- Smart CardDokumen1 halamanSmart CardSagnik BiswasBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Chapter 4 Statement of Financial PositionDokumen4 halamanChapter 4 Statement of Financial PositionDaniel Tan KtBelum ada peringkat

- Franking Account WorkpaperDokumen6 halamanFranking Account WorkpaperCarol YaoBelum ada peringkat

- FM W10a 1902Dokumen9 halamanFM W10a 1902jonathanchristiandri2258Belum ada peringkat

- In Final Fulfillment of The Curriculum Requirements inDokumen56 halamanIn Final Fulfillment of The Curriculum Requirements inangelonoyasam16Belum ada peringkat

- UOH FA I Group Assignment Feb22 PDFDokumen8 halamanUOH FA I Group Assignment Feb22 PDFidiris OmerBelum ada peringkat

- Chap001 - Changing Role of Managerial Accounting in Global Business EnvironmentDokumen31 halamanChap001 - Changing Role of Managerial Accounting in Global Business EnvironmentEmy Syah67% (3)

- Cost SheetDokumen21 halamanCost SheetSmriti SahuBelum ada peringkat

- IAS 32 Financial Instruments - PresentationDokumen3 halamanIAS 32 Financial Instruments - PresentationAKBelum ada peringkat

- ACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonDokumen7 halamanACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonAbdelmonim Awad OsmanBelum ada peringkat

- Correction ActivityDokumen5 halamanCorrection ActivityGlizette SamaniegoBelum ada peringkat

- Construction Accounting and FranchiseDokumen3 halamanConstruction Accounting and FranchiseAdam SmithBelum ada peringkat

- Dba 302 Financial Management Supplementary TestDokumen3 halamanDba 302 Financial Management Supplementary Testmulenga lubembaBelum ada peringkat

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDokumen26 halamanWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulBelum ada peringkat

- Valuation of Securities Rajesh ShahDokumen30 halamanValuation of Securities Rajesh ShahHarsh SoniBelum ada peringkat

- A001 - PartnershipDokumen22 halamanA001 - PartnershipDesiree Dawn GabalesBelum ada peringkat

- Book 123Dokumen3 halamanBook 123Andres WijayaBelum ada peringkat

- Exercises 02 INTACC2 Jackson Kervin Rey GDokumen12 halamanExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- Kunci JWB pkt2. 3 PDsuburDokumen45 halamanKunci JWB pkt2. 3 PDsuburSyifa FaBelum ada peringkat

- Steps in The Manual Accounting Process (Accounting Cycle)Dokumen50 halamanSteps in The Manual Accounting Process (Accounting Cycle)hyunsuk fhebieBelum ada peringkat

- Lived Assets GTSTDokumen45 halamanLived Assets GTSTgaurav tiwariBelum ada peringkat

- 01Dokumen14 halaman01NarinderBelum ada peringkat

- $R3M2NK4Dokumen26 halaman$R3M2NK4Hasan Mohammad MahediBelum ada peringkat

- Financial Analysis of Yahoo IncDokumen28 halamanFinancial Analysis of Yahoo IncSrinu GattuBelum ada peringkat

- Assignment 1 - DLF Data - xlsx-2Dokumen30 halamanAssignment 1 - DLF Data - xlsx-2ashishBelum ada peringkat

- CH PDFDokumen68 halamanCH PDFFabrienne Kate Eugenio LiberatoBelum ada peringkat

- Aec64 Audit 2 Notes-22-24Dokumen3 halamanAec64 Audit 2 Notes-22-24Althea RubinBelum ada peringkat

- Example of BookkepingDokumen8 halamanExample of BookkepingMathew Visarra0% (1)

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDokumen4 halamanKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaBelum ada peringkat

- This Study Resource Was Shared Via: B. Working Capital ManagementDokumen9 halamanThis Study Resource Was Shared Via: B. Working Capital ManagementGerry Sajol50% (2)