Cost Concepts Slides

Diunggah oleh

Evan BenedictHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cost Concepts Slides

Diunggah oleh

Evan BenedictHak Cipta:

Format Tersedia

2-1

Cost Concepts

Cost Object: Any end to which a cost is assigned Ex: a Product, a Project, a Customer, a Department

Irwin/McGraw-Hill

2-2

Cost Concepts

Manufacturing Costs (Product Costs)

Conversion Costs

Direct Materials Prime Costs Direct Labor Manufacturing Overhead

Non-manufacturing Costs (Period Costs)

Marketing or Selling Costs Administrative Costs

Irwin/McGraw-Hill

2-3

Manufacturing Costs

Direct Materials Direct Labor Manufacturing Overhead

The Product

Irwin/McGraw-Hill

2-4

Direct Materials

Those materials that become an integral part of the product and that can be conveniently traced directly to it.

Example: A radio installed in an automobile

Irwin/McGraw-Hill

2-5

Direct Labor

Those labor costs that can be easily traced to individual units of product.

Example: Wages paid to automobile assembly workers

Irwin/McGraw-Hill

2-6

Manufacturing Overhead

Manufacturing costs that cannot be traced directly to specific units produced.

Examples: Indirect labor and indirect materials

Wages paid to employees who are not directly involved in production work.

Examples: maintenance workers, janitors and security guards.

Irwin/McGraw-Hill

Materials used to support the production process.

Examples: lubricants and cleaning supplies used in the automobile assembly plant.

2-7

Nonmanufacturing Costs

Marketing and selling costs . . .

Costs necessary to get the order and deliver the

product.

Administrative costs . . .

All executive, organizational, and clerical costs.

Irwin/McGraw-Hill

2-8

Manufacturing Cost Flows

Costs

Material Purchases Direct Labor

Balance Sheet Inventories

Raw Materials Work in Process

Income Statement Expenses

Manufacturing Overhead

Finished Goods

Cost of Goods Sold

Selling and Administrative

Irwin/McGraw-Hill

Period Costs

Selling and Administrative

2-9

Cost Classifications for Predicting Cost Behavior

How a cost will react to changes in the level of business activity.

Total variable costs

change when activity changes.

Total fixed costs

remain unchanged when activity changes.

Irwin/McGraw-Hill

2-10

Total Variable Cost

Your total long distance telephone bill is based on how many minutes you talk.

Total Long Distance Telephone Bill Minutes Talked

Irwin/McGraw-Hill

2-11

Variable Cost Per Unit

The cost per long distance minute talked is constant. For example, 10 cents per minute.

Per Minute Telephone Charge Minutes Talked

Irwin/McGraw-Hill

2-12

Total Fixed Cost

Your monthly basic telephone bill probably does not change when you make more local calls.

Monthly Basic Telephone Bill Number of Local Calls

Irwin/McGraw-Hill

2-13

Fixed Cost Per Unit

The average cost per local call decreases as more local calls are made.

Monthly Basic Telephone Bill per Local Call Number of Local Calls

Irwin/McGraw-Hill

2-14

Cost Classifications for Predicting Cost Behavior

Behavior of Cost (within the relevant range)

Cost Variable In Total Total variable cost changes as activity level changes. Total fixed cost remains the same even when the activity level changes. Per Unit Variable cost per unit remains the same over wide ranges of activity. Fixed cost per unit goes down as activity level goes up.

Fixed

Irwin/McGraw-Hill

2-15

Cost Behavior

Fixed costs are usually characterized by:

a. Unit costs that remain constant. b. Total costs that increase as activity decreases. c. Total costs that increase as activity increases. d. Total costs that remain constant.

Irwin/McGraw-Hill

2-16

Cost Behavior

Variable costs are usually characterized by:

a. b. c. Unit costs that decrease as activity increases. Total costs that increase as activity decreases. Total costs that increase as activity increases.

d.

Irwin/McGraw-Hill

Total costs that remain constant.

2-17

Direct Costs and Indirect Costs

Direct costs

Costs that can be

Indirect costs

Costs cannot be easily

easily and conveniently traced to a unit of product or other cost objective.

Examples: direct

and conveniently traced to a unit of product or other cost object.

Example:

material and direct labor

manufacturing overhead

Irwin/McGraw-Hill

2-18

Differential Costs and Revenues

Costs and revenues that differ among alternatives.

Example: You have a job paying $1,500 per month in your hometown. You have a job offer in a neighboring city that pays $2,000 per month. The commuting cost to the city is $300 per month.

Differential revenue is: $2,000 $1,500 = $500

Irwin/McGraw-Hill

2-19

Differential Costs and Revenues

Costs and revenues that differ among alternatives.

Example: You have a job paying $1,500 per month in your hometown. You have a job offer in a neighboring city that pays $2,000 per month. The commuting cost to the city is $300 per month.

Differential revenue is: $2,000 $1,500 = $500 Differential cost is: $300

Irwin/McGraw-Hill

2-20

Opportunity Costs

The potential benefit that is given up when one alternative is selected over another.

Example: If you were not attending college, you could be earning $15,000 per year. Your opportunity cost of attending college for one year is $15,000.

Irwin/McGraw-Hill

2-21

Sunk Costs

Sunk costs cannot be changed by any decision. They are not differential costs and should be ignored when making decisions. Example: You bought an automobile that cost $10,000 two years ago. The $10,000 cost is sunk because whether you drive it, park it, trade it, or sell it, you cannot change the $10,000 cost.

Irwin/McGraw-Hill

2-22

Different Costs for Different Purposes

Value Chain Operations Traditional Product Costs

Research and Development Production Marketing Customer Service Production Production

Marketing

Customer Service

Pricing Decisions Product Mix Strategic Profitability

Tactical Decisions

External Financial Reporting

Irwin/McGraw-Hill

2-23

Inventory Flows

Beginning balance $$

Additions $$$

Available $$$$$

_

Withdrawals $$$

=

Ending balance $$

Irwin/McGraw-Hill

2-24

Product Costs - A Closer Look

Raw Materials

Beginning raw materials inventory Raw materials purchased Raw materials available for use in production Ending raw materials inventory Raw materials used in production

Manufacturing Costs

Direct materials + Direct labor + Mfg. overhead = Total manufacturing costs

Work In Process

Beginning work in process inventory Total manufacturing costs Total work in process for the period Ending work in process inventory Cost of goods manufactured.

+ =

+ =

Irwin/McGraw-Hill

2-25

Product Costs - A Closer Look

Work In Process

Beginning work in process inventory Manufacturing costs for the period Total work in process for the period Ending work in process inventory Cost of goods manufactured

Finished Goods

Beginning finished goods inventory + Cost of goods manufactured = Cost of goods available for sale - Ending finished goods inventory Cost of goods sold

+ = =

Irwin/McGraw-Hill

2-26

Resource Flows

Beginning raw materials inventory was $32,000. During the month, $276,000 of raw material was purchased. A count at the end of the month revealed that $28,000 of raw material was still present. What is the cost of direct material used? a. $276,000 b. $272,000 c. $280,000 d. $ 2,000

Irwin/McGraw-Hill

2-27

Resource Flows

Direct materials used in production totaled $280,000. Direct Labor was $375,000 and factory overhead was $180,000. What were total manufacturing costs incurred for the month? a. $555,000 b. $835,000 c. $655,000 d. Cannot be determined.

Irwin/McGraw-Hill

2-28

Resource Flows

Beginning work in process was $125,000. Manufacturing costs incurred for the month were $835,000. There were $200,000 of partially finished goods remaining in work in process inventory at the end of the month. What was the cost of goods manufactured during the month? a. $1,160,000 b. $ 910,000 c. $ 760,000 d. Cannot be determined.

Irwin/McGraw-Hill

Anda mungkin juga menyukai

- s13 Intro Race and CrimeDokumen24 halamans13 Intro Race and CrimeEvan BenedictBelum ada peringkat

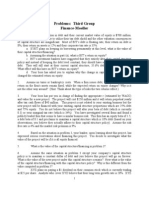

- Problems: Third Group Finance-MoellerDokumen4 halamanProblems: Third Group Finance-MoellerEvan BenedictBelum ada peringkat

- BudgetingDokumen70 halamanBudgetingEvan BenedictBelum ada peringkat

- Chap 005Dokumen127 halamanChap 005Evan BenedictBelum ada peringkat

- CH 16 StudentDokumen15 halamanCH 16 StudentEvan BenedictBelum ada peringkat

- Chap 008Dokumen45 halamanChap 008Evan BenedictBelum ada peringkat

- Phil Final SGDokumen1 halamanPhil Final SGEvan BenedictBelum ada peringkat

- Chap 010Dokumen48 halamanChap 010Evan BenedictBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- CCNV Vs Reid - DigestedDokumen3 halamanCCNV Vs Reid - DigestedRoosevelt GuerreroBelum ada peringkat

- Sodexho Meal VouchersDokumen7 halamanSodexho Meal VouchersManoj TirmareBelum ada peringkat

- Writing A Curriculum Vitae - 2 KTDokumen8 halamanWriting A Curriculum Vitae - 2 KTsbg007hiBelum ada peringkat

- Presentation For Viva 2016Dokumen65 halamanPresentation For Viva 2016rakeshkeniBelum ada peringkat

- IRES 2016 Terms Conditions PDFDokumen4 halamanIRES 2016 Terms Conditions PDFIvan Angelo A. AlbeusBelum ada peringkat

- A Study On The Causes and Impact of Unemployment in IndiaDokumen5 halamanA Study On The Causes and Impact of Unemployment in IndiaGAMING Zone .Belum ada peringkat

- 1 Recruitment Service Level AgreementsDokumen5 halaman1 Recruitment Service Level AgreementsHassan ShaikBelum ada peringkat

- DOCUMENT: JCPS, JCTA Tentative Salary AgreementDokumen9 halamanDOCUMENT: JCPS, JCTA Tentative Salary AgreementCourier JournalBelum ada peringkat

- Employment and Industrial Relations LAW L213 Distance StudentsDokumen74 halamanEmployment and Industrial Relations LAW L213 Distance StudentsNicodemus bupe mwimba100% (1)

- Paulding Progress May 18, 2016Dokumen28 halamanPaulding Progress May 18, 2016PauldingProgressBelum ada peringkat

- Time Charter PartyDokumen10 halamanTime Charter PartyJoshua Davis DalusBelum ada peringkat

- N5 Entrepreneurship and Business ManagementDokumen23 halamanN5 Entrepreneurship and Business ManagementCytone Siweya100% (1)

- Teachers Qualities As ProfessionalDokumen5 halamanTeachers Qualities As ProfessionalGievel Enoroba LopezBelum ada peringkat

- Project Safety Management SystemDokumen16 halamanProject Safety Management SystemrosevelvetBelum ada peringkat

- PM Kisan Maan Dhan YojanaDokumen1 halamanPM Kisan Maan Dhan YojanaRadhey Shyam KumawatBelum ada peringkat

- The Process Theories of MotivationDokumen22 halamanThe Process Theories of MotivationjanBelum ada peringkat

- Human Resource ManagementDokumen39 halamanHuman Resource ManagementAnaghaPuranik100% (1)

- Past PaperDokumen12 halamanPast PapershahzadBelum ada peringkat

- The Petitioner and Rizal Cement Co., Inc. Are Sister CompaniesDokumen11 halamanThe Petitioner and Rizal Cement Co., Inc. Are Sister CompaniesopislotoBelum ada peringkat

- NMIMS Global Access Organizational Behaviour Course AssignmentDokumen6 halamanNMIMS Global Access Organizational Behaviour Course AssignmentIshita ChadhaBelum ada peringkat

- Proposed SP ordinance guidelines for COVID-19 workplace safetyDokumen7 halamanProposed SP ordinance guidelines for COVID-19 workplace safetyJudeRamosBelum ada peringkat

- JL HR Rasuna Said Kav.20 Tower 12A-E, Jakarta Selatan 12950Dokumen2 halamanJL HR Rasuna Said Kav.20 Tower 12A-E, Jakarta Selatan 12950Hani ZeinBelum ada peringkat

- United Nations Personal History: Do Not Write in This SpaceDokumen5 halamanUnited Nations Personal History: Do Not Write in This SpaceMARIMBO FrancineBelum ada peringkat

- Competency theory job behaviors traitsDokumen19 halamanCompetency theory job behaviors traitsvvasimm6413Belum ada peringkat

- BECIL Recruitment Office AssistantsDokumen1 halamanBECIL Recruitment Office AssistantsKabya SrivastavaBelum ada peringkat

- Tma1 BMG531 031100165Dokumen35 halamanTma1 BMG531 031100165Mye SahimanBelum ada peringkat

- KNPC Interview Invitation On 14th January 2012Dokumen6 halamanKNPC Interview Invitation On 14th January 2012Amar FirdausBelum ada peringkat

- Manufacturing in The UK: LUBS 1610: Research Skills For Economists Brandon Lamam 200636808Dokumen9 halamanManufacturing in The UK: LUBS 1610: Research Skills For Economists Brandon Lamam 200636808Brandon LamamBelum ada peringkat

- Unemployment in India Types, Causes & Govt SchemesDokumen58 halamanUnemployment in India Types, Causes & Govt SchemesSai harshaBelum ada peringkat

- Exploring Retention Factors in Gen y EngineersDokumen18 halamanExploring Retention Factors in Gen y EngineersuriiiBelum ada peringkat