Pricing, Competition and Market Structure BUSI 7130 / 7136

Diunggah oleh

Ali NAJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Pricing, Competition and Market Structure BUSI 7130 / 7136

Diunggah oleh

Ali NAHak Cipta:

Format Tersedia

Pricing, Competition and

Market Structure

BUSI 7130 / 7136

How does our pricing strategy fit into this

framework? What economic principles apply?

Porters Five Forces Model

Supplier Power

Substitutes and Complements

Internal Rivalry Buyer Power

New Entrants

Market Structure Internal rivalry

Market structure and pricing decisions are closely

related. But how to define the market?

The degree to which the firm gets to choose price

is determined in large part by market structure.

There are two extreme cases: perfect competition

and monopoly.

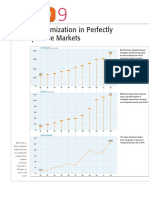

Perfect Competition

Conditions necessary:

Large numbers of buyers and sellers

Homogeneous product

Free entry and exit

Perfect information

Perfect Competition cont.

Demand curve for any given firm is

horizontal. Price is set by market at P

e

Firm can sell as much or as little as desired

at market price, but nothing if they raise P.

P

e

S

D

D P

e

Monopoly

Conditions necessary

Single seller of product

No close substitutes

Significant barriers to entry

There are few examples of perfect

competition and pure monopoly.

Most firms have a differentiated product,

and there are substitutes.

Pricing in Perfect Competition

Do not choose price.

Choose output quantity. TC includes

opportunity cost of capital invested.

What will be our profit (loss) from our

output decision?

Should we produce now? (SR)

Should we stay in the industry? (LR)

Pricing in a Monopoly

Profit maximization will be achieved by

setting price so that MC=MR.

It is not reached by setting price as

high as possible.

Like any firm, the monopolist is

constrained by their demand curve.

One cannot choose both P and Q.

The Shut-Down Rule

At what point should the firm cease

production of a certain item?

When might it pay to produce at a loss?

In SR, many costs are fixed. Just because a

firm is making losses, it does not necessarily

mean it should shut down (short run), or even

go out of business (long-run).

The Shut-Down Rule cont.

Profit = TR TC; TR=P*Q, TC = VC + FC

(TR - VC) - FC = [(P - AVC)Q] FC

Separate out fixed costs, focus on variable elements

As long as P>AVC, there is a positive contribution to

fixed costs.

If firm shuts down (Q = 0), then Profit = - FC

If shut down: Firm has a loss of fixed costs.

The Shut-Down Rule cont.

In SR, firm may minimize losses by continuing to

produce.

If losses are expected permanently, get out.

Case of multiple products:

C = FC + VC

1

+ VC

2

The Shut-Down Rule cont.

1. H = (TR

1

- TVC

1

) + (TR

2

- TVC

2

) - FC

2. H = (P

1

*Q

1

- AVC

1

*Q

1

) + (P

2

*Q

2

- AVC

2

*Q

2

) - FC

3. H = [(P

1

- AVC

1

)*Q

1

]+ [(P

2

- AVC

2

)*Q

2

] - FC

Results:

1. SR - each product should be produced if P

i

>AVC

i

2. In LR, the firm should continue operating only if

expected H>=0 (Profits are non-negative)

Price Discrimination

Selling the same good to different people at

different prices

Conditions necessary:

Identifiable customer groups with differing

price elasticities

Maintain separation of groups--prevent

resale.

Types of Price Discrimination

First degree

Identify and charge each customer

what they are willing to pay. Limit:

D = MR, no consumer surplus.

Second degree

Quantity discounts. Volume

purchases are given lower prices.

Need to measure goods and

services bought by consumers.

Types of Price Discrimination

Third degree

Segment markets in some way. Charge

all in the segment the same prices.

Treat each segment as a separate

market then do MR=MC in each

Are coupons as a price discrimination

mechanism?

Oligopoly Strategies

Common theme - Rivalrous behavior

Pricing - limit pricing - set prices low as

signal to possible entrants or other

competitors your willingness and ability

to defend your market share.

Must have credibility.

Trading SR profit for more profits later

Oligopoly Strategies cont.

Use the legal / regulatory systems

File patent application

Challenge business charter application

File regulatory challenge

Pre-emptive entry - Wal-Mart

Oligopoly Strategies cont.

Capacity and production

Announce capacity expansion

Revise/modify products - more

difficult to copy

Advertising

Raise cost of entry for others

Oligopoly and Monopolistic Competition

Oligopoly

Few sellers - usually large ones

Recognized interdependence in

pricing and output decisions

Need to consider response of rivals in

pricing decisions

Typically significant barriers to entry

Oligopoly and Monopolistic Competition

Monopolistic Competition

Large number of interdependent

sellers

Differentiated product

Good substitutes

Easy entry and exit

Oligopoly and Monopolistic Competition

Most U.S. industries are one or the other

Oligopoly: many heavy manufacturing

Autos, steel, chemicals, pharmaceuticals

Monopolistic Competition

Service companies, retail stores, large

corporations (McDonalds, Wendys)

The important point is that demand is

downward sloping

Cartels

Illegal in the U.S. - encouraged in much

of the world.

Conditions helpful:

Small number of firms

Homogeneous product

Entry barriers

Similarity of members

Cartels cont.

Problems with cartels:

Cheating on agreement

Price cutting behavior

Tend to fall apart

Note: When might firms in an industry

ask for (demand) regulation?

Pricing Strategies

Profit maximizing rule:

Set production at level where MR = MC

Non - Maximizing pricing rules

there are a variety of these

Cost-Plus Pricing

Many forms and widespread

Markup = P = cost (1 + X%)

X can range widely - 33% to 150%

Cost could be MC, AVC, or estimated

constant. It would be best if Markup was

determined via the rule

P - cost

cost

p

p

1 c

c

+

Pricing Example:

Birds Eye Case of frozen salmon. Suppose

their cost function was: TC($)=20000+75Q

Fixed cost is _______, MC is_________

Marketing study estimates price elasticity of

demand is more elastic (-2.5) for one group

(ex: caterers), lower for other (-2.0)

Optimal Price Markup rule

Optimal markup is a function of price elasticity

P = MC *

P

1

= $124.99 (Group 1 price)

Next, consider customers in group 2

p

p

1 c

c

+

66 . 1 75

1.5 -

2.5 -

75 = P1 - =

|

.

|

\

|

Optimal price markup example cont.

Use optimal markup rule again

P = MC

P

2

= $150 to group 2 customers

p

p

1 c

c

+

0 . 2 75

1.0 -

2.0 -

75 = P2 - =

|

.

|

\

|

Optimal Price markup conclusion

General rule: Managers should charge lower price to

customers with more elastic demand (Give them

bigger discounts)

Charge higher price to those with lower price elasticity

those with more inelastic demand

So Group 1 (elasticity of -2.5) is charged a lower price

($125) than group 2 (elasticity of -2.0, price of $150)

Positioning psychology: List price is X, discount from

that.

Cost-Plus Pricing cont.

Example: Winston Co. produces specialized

fishing equipment fly fishing rods; multiple

segments (Introductory to high-end)

Production cost $200 - $300

Markup 50-100% $100 - $300

List price $300 - $600

How does pricing affect image in marketplace?

What are estimated underlying price elasticities?

What about out-sourcing? Which parts?

Markup Pricing in Groceries

Source: Mansfield, p.464 (1992) industry averages

Product Markup Product Markup

Coffee 5% Cold Cuts 30%

Soft Drinks 5% Fresh Fruit 45%

Cereal 10% Fresh Veg. 45%

Soup 10% Spices 50%

Ice Cream 20% Proprietary

Drugs

50%

Pricing for Multi-Product Firm

Two products, x and y. TR

firm

= TR

x

+ TR

y

If there are any spillovers from x to y, then

you may get complications.

MR =

TR

Q

TR

Q

TR

Q

x

x

x

x

y

x

d

d

d

d

d

d

= +

MR =

TR

Q

TR

Q

TR

Q

y

y

y

y

x

y

d

d

d

d

d

d

= +

Multi-Product Firm cont.

The two terms on the right side of the

equation represent interactions. They can be

either positive or negative.

If x and y are complementary goods, the

effect is positive.

If x and y are substitutes, the effect is

negative. One units gain is the others loss.

Two part pricing

Charge P = MC

charge a fixed fee to extract some of the

consumer surplus

Examples:

country clubs

health clubs

electricity providers

Declining block pricing

Charging different prices according to

how much is purchased

Attempt to extract consumer surplus

and transfer value to company

Auction pricing models

Standard auction model

multiple bidders compete with each other

start at some low price, then successive bids

raise price until someone wins

Dutch auction model

start at a high price, lower it until someone bids

ex: dutch flower auctions

How to extract consumer surplus?

How does the development of online business

affect this analytic tool? How does the Internet

change the economic principles that apply?

Porters Five Forces Model

Supplier Power

Substitutes and Complements

Internal Rivalry Buyer Power

New Entrants

Market structure and the Internet

Traditional industry structure paradigm?

Structure, time and place?

Firm size, customer access and service?

Pricing, and reputation online:

Music for Econ, link below:

Music For Econ

who is competing with whom?

Internet and demand issues

Role of customer service and customer

loyalty online: e-loyalty?

Consumer demand issues - which goods

to buy online, which in person?

How to price online?

Does this signal the end of the Brand?

Pricing and the Internet

Traditional pricing paradigm?

Access to demand data...

Measurement of demand elasticities?

Ability to conduct pricing experiments

Ability to spot market changes - and

move quickly (perhaps)

Access to bigger customer base

Will prices be lower online?

Firm structure and the Internet

Are traditional firm structure concepts

now irrelevant?

Economies of scale? Scope?

How does this affect firm incentives to

vertically integrate (or de-integrate)?

Central role of transaction costs...

Anda mungkin juga menyukai

- Pricing Strategies and TacticsDokumen33 halamanPricing Strategies and Tacticssathvik RekapalliBelum ada peringkat

- Pricing Strategies and TacticsDokumen142 halamanPricing Strategies and TacticsKRITIKA NIGAMBelum ada peringkat

- Market Structure - Internal Rivalry: Pricing in Perfect CompetitionDokumen10 halamanMarket Structure - Internal Rivalry: Pricing in Perfect CompetitionlavamgmcaBelum ada peringkat

- 6Dokumen9 halaman6abadi gebru100% (1)

- Market Structures HandoutDokumen10 halamanMarket Structures HandoutSuzanne HolmesBelum ada peringkat

- At Monocomp Mono OligopolyDokumen23 halamanAt Monocomp Mono OligopolyNIKNISHBelum ada peringkat

- Competition & Pure MonopolyDokumen36 halamanCompetition & Pure MonopolyChadi AboukrrroumBelum ada peringkat

- Monopolistic: A2 (Axis Achievers)Dokumen36 halamanMonopolistic: A2 (Axis Achievers)Saket AgarwalBelum ada peringkat

- Section 10 - BMIK 2023 - FinalDokumen38 halamanSection 10 - BMIK 2023 - Final10622006Belum ada peringkat

- CIS Microeconomics Exam ThreeDokumen4 halamanCIS Microeconomics Exam ThreeVictoriaBelum ada peringkat

- Content List: Chapter 13 & 14 Class NotesDokumen9 halamanContent List: Chapter 13 & 14 Class NotesRanjit KumarBelum ada peringkat

- Lesson MarketDokumen60 halamanLesson MarketAGRAWAL UTKARSHBelum ada peringkat

- Market Structures Recap Lecture (FLT) 2Dokumen72 halamanMarket Structures Recap Lecture (FLT) 2Cheng KysonBelum ada peringkat

- An Overview of Monopolistic CompetitionDokumen9 halamanAn Overview of Monopolistic CompetitionsaifBelum ada peringkat

- Price Analytics: Dr. Keerti Jain NIIT University, NeemranaDokumen88 halamanPrice Analytics: Dr. Keerti Jain NIIT University, NeemranaTushar GoelBelum ada peringkat

- Monopolistic and OligopolyDokumen47 halamanMonopolistic and Oligopolybhasker4uBelum ada peringkat

- A2 Price Makers and TakersDokumen6 halamanA2 Price Makers and Takerspunte77Belum ada peringkat

- Monopolistic CompetitionDokumen11 halamanMonopolistic CompetitionHeoHamHốBelum ada peringkat

- 1.5.monopolistic CompetitionDokumen13 halaman1.5.monopolistic CompetitionManhin Bryan KoBelum ada peringkat

- Session 19 20 Pricing LevelDokumen25 halamanSession 19 20 Pricing LevelRaman SainiBelum ada peringkat

- Chapter FourDokumen97 halamanChapter FourYashBelum ada peringkat

- Pure Competition in Short Run - NotesDokumen6 halamanPure Competition in Short Run - Notessouhad.abouzakiBelum ada peringkat

- Pricing Tactics: Lecturer Sri Maryati, Se, MsiDokumen24 halamanPricing Tactics: Lecturer Sri Maryati, Se, MsiAgnes Meilina SinagaBelum ada peringkat

- Economics For Managers: Wwu MünsterDokumen100 halamanEconomics For Managers: Wwu MünsterAditya SrivastavaBelum ada peringkat

- Class 5 UNIT 7-THE FIRM AND ITS CUSTOMERSDokumen4 halamanClass 5 UNIT 7-THE FIRM AND ITS CUSTOMERSSara Martin VelaBelum ada peringkat

- Managerial Economics & Business StrategyDokumen31 halamanManagerial Economics & Business StrategyYokie RadnanBelum ada peringkat

- Market Structure and Pricing ModelsDokumen18 halamanMarket Structure and Pricing ModelsNor RezaBelum ada peringkat

- Econ This IsDokumen11 halamanEcon This Isbeasteast80Belum ada peringkat

- HC3 Market StructuresDokumen37 halamanHC3 Market StructuresMartijnBrouwers1987Belum ada peringkat

- Group6report Market Structure and PricingDokumen73 halamanGroup6report Market Structure and PricingMichael SantosBelum ada peringkat

- Pricing Products: Pricing Considerations and StrategiesDokumen33 halamanPricing Products: Pricing Considerations and StrategiesjbaksiBelum ada peringkat

- Chapter 5 - Market StructureDokumen19 halamanChapter 5 - Market Structurejosephyoseph97Belum ada peringkat

- Pure CompetitionDokumen9 halamanPure Competitioncindycanlas_07Belum ada peringkat

- Profit MaximazationDokumen36 halamanProfit MaximazationFrank BabuBelum ada peringkat

- Production in Perfectly Competitive MarketsDokumen47 halamanProduction in Perfectly Competitive MarketsH Man SharifBelum ada peringkat

- "You Don't Sell Through Price. You Sell The Price" Price Is The Marketing-Mix Element That Produces Revenue The Others Produce CostDokumen22 halaman"You Don't Sell Through Price. You Sell The Price" Price Is The Marketing-Mix Element That Produces Revenue The Others Produce Cost200eduBelum ada peringkat

- Economics Exam Notes - MonopolyDokumen5 halamanEconomics Exam Notes - MonopolyDistingBelum ada peringkat

- Microecon Chapter Twelve NotesDokumen2 halamanMicroecon Chapter Twelve NotesVictoriaBelum ada peringkat

- 2010 Chpt11answersDokumen6 halaman2010 Chpt11answersMyron JohnsonBelum ada peringkat

- Market StructureDokumen19 halamanMarket StructureNazmul HudaBelum ada peringkat

- Monopoly Oligopoly Monopolistic Competition Perfect CompetitionDokumen8 halamanMonopoly Oligopoly Monopolistic Competition Perfect CompetitionDerry Mipa SalamBelum ada peringkat

- Lecture - 01. PURE COMPETITION: Handout - 1Dokumen11 halamanLecture - 01. PURE COMPETITION: Handout - 1sofia100% (1)

- MarketDokumen42 halamanMarketSnn News TubeBelum ada peringkat

- Business Economics Session 2 - Market StructuresDokumen24 halamanBusiness Economics Session 2 - Market StructuresNeha GuptaBelum ada peringkat

- Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldDokumen28 halamanPrepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldZahra Ijaz100% (1)

- Monopolistic CompetitionDokumen29 halamanMonopolistic CompetitionJuanita CabigonBelum ada peringkat

- Chapter II Lecture NoteDokumen20 halamanChapter II Lecture NoteKalkidan NigussieBelum ada peringkat

- Accounting Approaches To PricingDokumen7 halamanAccounting Approaches To PricingErick AloyceBelum ada peringkat

- Managerial Economics: An Analysis of Business IssuesDokumen20 halamanManagerial Economics: An Analysis of Business IssuesROSHAN_25Belum ada peringkat

- Monopolistic CompetitionDokumen10 halamanMonopolistic CompetitionBhushanBelum ada peringkat

- MANAGERIAL DECISION-MAKING IN Perfectly Competitive MarketDokumen10 halamanMANAGERIAL DECISION-MAKING IN Perfectly Competitive Marketjetro mark gonzalesBelum ada peringkat

- BUS 207 Final NotesDokumen7 halamanBUS 207 Final NotesappleBelum ada peringkat

- MonopolyDokumen4 halamanMonopolyAmgad ElshamyBelum ada peringkat

- Pricing MethodsDokumen20 halamanPricing MethodsNilesh TahilramaniBelum ada peringkat

- Lecture 16 Market Structures-Perfect CompetitionDokumen41 halamanLecture 16 Market Structures-Perfect CompetitionDevyansh GuptaBelum ada peringkat

- OligopolyDokumen32 halamanOligopolyAnj SelardaBelum ada peringkat

- Chapter 10 Stud VerDokumen27 halamanChapter 10 Stud VerSurya PanwarBelum ada peringkat

- Unit 8-Revenue Analysis and Pricing PoliciesDokumen17 halamanUnit 8-Revenue Analysis and Pricing PoliciesGayl Ignacio TolentinoBelum ada peringkat

- Chapter 9 SUMMARY SECTION CDokumen4 halamanChapter 9 SUMMARY SECTION ClalesyeuxBelum ada peringkat

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionDari EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionPenilaian: 4 dari 5 bintang4/5 (10)

- Marketing Design and Innovation AssignmentDokumen25 halamanMarketing Design and Innovation Assignmentpalashdon6100% (1)

- Advice For Professional Practitioners ReportDokumen1 halamanAdvice For Professional Practitioners Reportpalashdon6Belum ada peringkat

- 4 Servqual and Model of Service Quality GapsDokumen14 halaman4 Servqual and Model of Service Quality GapsNipathBelaniBelum ada peringkat

- Working Knowledge: How Organizations Manage What They Know: InvitationDokumen15 halamanWorking Knowledge: How Organizations Manage What They Know: InvitationJamesIgroBelum ada peringkat