Lecture 4 - Bond Portfolio Management

Diunggah oleh

Anh ThoDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Lecture 4 - Bond Portfolio Management

Diunggah oleh

Anh ThoHak Cipta:

Format Tersedia

Lecture 4 -

Bond Portfolio Management

2

Topics

Passive bond portfolio management.

What is portfolio immunization.

Facts about interest rate risk.

Duration.

Using duration for the purpose of immunization.

Active bond portfolio management.

3

Bond portfolio management

There are two types of bond portfolio management:

Passive:

following bond indexes such as Citigroup World

Government Bond Index

Value weighted index of fixed-rate gov bonds with maturity >

1 year

Immunization

To protect the net worth of financial institutions such as

banks against shocks due to interest rate fluctuations.

To ensure the ability of institutions such as pension funds to

fulfil their obligations.

Active: interest rate forecasting, search for mispriced

bonds.

4

Immunization

Constitutes a protection of the net worth from

interest rate fluctuations.

MV(equity) = f(MV(assets) - MV(debt))

Are the liabilities of banks long term or short term

liabilities? What about the banks assets?

How would a rise in the interest rates (for various

maturities) affect the market value of the banks

stocks?

5

Immunization

Example: 2003 was a good year for both stocks and bonds.

The S&P 500 increased by 25%.

The value of assets of the US pension funds increased by

more than 100 billion dollars!

But the PV of their obligations grew by much more, so that

they entered an actuary deficit.

The reason was a sharp decline in the interest rate

(Greenspan ear). Why?

The average obligation of the funds was for 15 years, whereas

the average life of the assets (mainly bonds but also stocks)

was 5 years. (why did they invest in stocks?).

6

Immunization

We can think of it as follows: After the decline in the

interest rate, in order to be able to fulfil their

obligations they had to invest more money relative to

before the interest rate decline.

In general a low interest rate environment is

problematic for pension funds since its more difficult

to finance future obligations.

Facts about interest rate risk

(price risk)

Recall that the price of a bond depends on the

various interest rates.

The bonds YTM is a weighted average of the various

interest rates for different maturities.

7

8

Facts about interest rate risk

(price risk)

There is a negative relation between bond prices and

the interest rates. Importantly, when we hear that

bond yields increased the meaning is that their

prices fell.

The relation between a bonds price to its YTM

(which is an average of the interest rates) is convex.

Facts about interest rate risk

(price risk)

The prices of long term bonds are more sensitive to

changes in the interest rates than the prices of short

term bonds.

To be more specific: the sensitivity of a bond to

changes in its YTM (which is an average of the

interest rates) is higher for long term bonds.

As time to maturity increases, that sensitivity rises

but at diminishing rates.

9

Facts about interest rate risk

(price risk)

The higher the coupon rate:

The higher the bonds YTM:

10

11

Facts about interest rate risk

(price risk)

We see that the the price sensitivity of bonds to

changes in the interest rates is affected by many

factors, all related to the effective time in which the

cash flows are received.

We need one measure which will summarize the

sensitivity of the bonds price to changes in its YTM

(i.e. the average interest rate).

This measure is called duration.

12

Duration

Duration is a measure for the effective time in which

the stream of cash flows is received.

It is a weighted average of the time of each payoff

where the weights are approximately the fraction of

the value of the payoff relative to the value of all the

payoffs (i.e. the bonds price).

13

Duration

The weight of time t is given by

And the duration is

This is called Macaulay duration.

t

t

t

w CF

y ice = + ( ) 1 Pr

t w t D

T

t

=

=

1

CF Cash Flow for period t t =

14

Duration

The Macauly duration:

For a zero coupon bond the duration equals the time to

maturity.

For a coupon bond the duration is shorter than the time to

maturity

PV

y

CF

t

D

T

t

t

t

=

+

=

1

]

) 1 (

[

15

Duration - example

Consider a 4 year bond, CR 10%, paid once a year, Par

1000 and YTM = 8.36%

501 . 3

0836 . 1

1100

0836 . 1

100

0836 . 1

100

0836 . 1

100

4

0836 . 1

1100

3

0836 . 1

100

2

0836 . 1

100

1

0836 . 1

100

4 3 2

4 3 2

=

+ + +

+ + +

= D

16

Duration

Duration has another meaning too: it is the elasticity

of the bonds price to changes in the average interest

rate.

That is, by what % (approximately) the bond price will

change when the YTM will change by 1% (say from

10% to 10.1% due to a change in the average interest

rate.

17

Duration as elasticity

Define y=YTM and Y=1+y

The YTM elasticity is:

18

Duration as elasticity

dY

dP

P

Y

Y

dY

P

dP

=

|

.

|

\

|

|

.

|

\

|

= =

Y in change %

P in change %

Elasticity

= =

+

= =

=

=

= |

.

|

\

|

= =

= =

(

=

=

(

= =

=

T

t

T

t

t

t

t

t

t

T

t

t

T

t

t

t

T

t

t

t

T

t

t

t

D P

Y

CF

t

Y

CF

t

P

Y

Y CF t

P

Y

dY Y CF d

P

Y

dY

Y

CF

d

P

Y

dY

dP

P

Y

Y

CF

P

1 1

1

1

1 1

1

1

/

/

/ Elasticity

: bond coupon a For

19

Is duration a good proxy for the change in the

bonds value in response to change in the

central bank rate?

The mathematical definition above shows us that duration is

the percentage change in the bond price in response to a

change in its YTM, i.e. the average interest rate.

This average of interest rates can change for example due to

changes in expected future interest rates.

The question is whether duration is a good enough proxy for

the percentage change in the bonds price in response to the

central bank interest rate?

20

Is duration a good enough proxy for the

percentage change in the bonds price in

response to the central bank interest rate?

If the central bank reduced the short term interest

rate by 0.25%, what will happen to the longer term

interest rates?

They will decline because the future short term

interest rates are expected to be lower (the interest

rate is very persistent statistically).

Moreover, portfolio managers will change the

composition of their portfolio into more long term

bonds, which will increase their prices and reduce

long term interest rates.

Is duration a good enough proxy for the

percentage change in the bonds price in

response to the central bank interest rate?

So all the yield curve will change in the same direction

and so the average interest rates.

Conclusion: duration is a good proxy to the percentage

change in the bond price in response to a change in the

central bank rate.

21

22

Duration and volatility

Note that long duration bonds have more volatile

returns (HPRs) not only due to a stronger response of

their prices to changes in the central bank rate but

also to changes in expectations for the future interest

rate and inflation.

Therefore when the macroeconomic uncertainty is

larger, the relative risk (price risk) of long duration

bonds is higher (relative to short duration bonds).

23

Duration rules

The duration of a zero coupon bond is equal

to its time to maturity.

The higher the coupon rate the duration__

The longer the time to maturity the longer

the duration.

The higher the YTM of a coupon bond the ___

the duration.

24

Low YTM and volatility

When yields are low as they are today (causing

duration to be higher) and high uncertainty, the

expected return (HPR) to volatility ratio is relatively

low.

Of course in equilibrium investors will not be willing

to hold bonds unless they offer a sufficiently

attractive expected return (the alternative asset

classes also offer low expected returns these days).

25

The effect of the coupon rate on

duration an example

Consider a 4-year coupon bond, CR 10% paid once a

year, par 1000 and YTM=8.36%

What will happen if the CR is 20%?

501 . 3

0836 . 1

1100

0836 . 1

100

0836 . 1

100

0836 . 1

100

4

0836 . 1

1100

3

0836 . 1

100

2

0836 . 1

100

1

0836 . 1

100

4 3 2

4 3 2

=

+ + +

+ + +

= D

501 . 3 24 . 3

0836 . 1

1200

0836 . 1

200

0836 . 1

200

0836 . 1

200

4

0836 . 1

1200

3

0836 . 1

200

2

0836 . 1

200

1

0836 . 1

200

4 3 2

4 3 2

< =

+ + +

+ + +

=

macaulay

D

26

The effect of the YTM on duration

an example

Suppose that the bond from the example above

had YTM=25%

501 . 3 35 . 3

25 . 1

1100

25 . 1

100

25 . 1

100

25 . 1

100

4

25 . 1

1100

3

25 . 1

100

2

25 . 1

100

1

25 . 1

100

4 3 2

4 3 2

< =

+ + +

+ + +

= D

27

Modified duration

Duration is the elasticity of the bond price with respect to its

YTM (average interest rates). It is the percentage change in the

price divided by the percentage change in the 1+YTM.

So, if for example the rate of change in the YTM (average of

interest rates) was 1%, say from 10% to 10.1% then the

duration tells us by what rate the bond price will change.

However, it is conventional to talk about changes in YTM and

changes in interest rates rather than about the % change in

these variables (so we will say that the YTM increased by 10bp

or 0.1 percentage point).

Therefore let us define the modified duration which will tell us

the % change in the bond price in response to a change (not

rate of change) in the YTM.

28

Modified duration

Recall that:

so

Define modified duration as

so

dY

dP

P

Y

Y

dY

P

dP

D =

|

.

|

\

|

|

.

|

\

|

= =

Y in change %

P in change %

YTM A =

A

*

D -

P

P

YTM

YTM

D

Y

Y

D

Y

Y

D

P

P

A

|

.

|

\

|

+

=

= A

|

.

|

\

|

=

|

.

|

\

|

A

=

|

.

|

\

|

A

1

|

.

|

\

|

+

=

YTM

D

D

1

*

29

Modified duration

So modified duration is the regular duration divided

by 1+YTM.

30

Modified duration - example

Consider a 4-year bond, par 1000, CR 4%, YTM 5%,

price 964.54. Assume that the yield curve is flat at 5%.

The duration of the bond is:

The modified duration is:

7704 . 3

54 . 964

05 . 1

1040

4

54 . 964

05 . 1

40

3

54 . 964

05 . 1

40

2

54 . 964

05 . 1

40

1

4 3 2

=

|

.

|

\

|

+

|

.

|

\

|

+

|

.

|

\

|

+

|

.

|

\

|

= D

591 . 3

05 . 1

7704 . 3

*

= = D

31

Suppose that the interest rate increased by 0.25%

(25 bp) and that the yield curve remained flat:

A direct calculation shows that the bond price will

decline by 0.892%:

% 898 . 0 00898 . 0 0025 . 0 591 . 3 % 25 . 0 591 . 3

*

= = = = A =

A

y D

P

P

93 . 955

0525 . 1

1000

0525 . 1 0525 . 0

1

0525 . 0

1

40

4

= +

(

= P

32

Yield

Price

Duration

Pricing Error

from convexity

Duration and Convexity

33

Correction for Convexity

=

(

+

+ +

=

n

t

t

t

t t

y

CF

y P

Convexity

1

2

2

) (

) 1 ( ) 1 (

1

Correction for Convexity:

] ) ( [

2

1

2 *

y Conveixity y D

P

P

A + A =

A

34

The duration of a portfolio

Note: PV1 is the value of our holdings of bond 1, not necessarily that bonds

price

923 . 7

1300

2 200 9 1100

=

+

=

p

D

For example, the duration of a portfolios which

consists of 2 bonds, one with D=9 and price 1100

and the other with D=2 and price 200 is:

Total

n n

p

PV

D PV D PV D PV

D

+ + +

=

...

2 2 1 1

35

The duration of a levered portfolio

Assume that a portfolio managers invested in the above

2 bonds but also took a loan (issued bonds) with D=5

and PV of 1000.

.

The net worth of the portfolio is 300.

Note that a liability is a negative asset.

If, for example, the bonds YTM is 5% then the modified

duration is 16.82%.

66 . 17

300

5 1000 2 200 9 1100

=

+

=

p

D

36

The duration of a levered portfolio

Notice that there is no meaning here for effective time

to maturity since the duration of the portfolio is larger

than any of the assets and liabilities.

The meaning: a rise of 1% (100 bp) in the interest rate

will case a decline of 16.28% in the portfolio value

(approximately).

If the liability had D=12 then

The meaning: due to the leverage a rise of 1% in the

interest rate will cause a rise of 5.39% in the portfolio

value.

% 39 . 5 , 66 . 5

300

12 1000 2 200 9 1100

*

= =

+

= D D

p

37

The duration of a bank

The issue of duration is highly important for financial

institutions which their net worth is sensitive to

interest rate fluctuations, and primarily for banks.

38

A banks duration example

Assume that bank Z has the following assets:

Loans with PV 100 million and D=5.

A daily credit line of 50 million and D=?

Mortgages of 250 million with D=15.

And the following liabilities:

Deposits by the public PV 150 million, D=2.

Current accounts of 10 million, D=?

Savings accounts, PV 200 million, D=10.

What is the banks duration?

39

A banks duration example

The net worth of the bank is 40 million, hence:

So if for some reason the interest rate will rise by

1%, the bank will lose approximately 48.75% of its

net worth (say that modified duration is close to

the duration).

A rise of 2-3% in the interest rate will almost

eliminate the net worth of the bank!

Precisely for this reason, banks make sure their

duration does not deviate by much from 0!

75 . 48

40

10 200 0 10 2 150 15 250 0 50 5 100

=

+ +

=

Equity

D

40

A banks duration example

Suppose that the bank wants to change its duration to

0 (i.e. to immunize itself). What should it do?

There are several possibilities, for example reducing

the mortgages by selling some of them to another

bank for cash (this will constitute a reduction in the

asset duration).

Start a marketing campaign for savings programs

(increasing the duration of liabilities).

Suppose it wants to act in the first way. How many

mortgages it will have to sell?

41

A banks duration example

Search for X such that:

M X

X X

D

Equity

130

0

40

10 200 0 10 2 150 15 ) 250 ( 0 ) 50 ( 5 100

=

=

+ + +

=

42

Immunization and rebalancing

Several factors can cause a change in duration and

undo the immunization of the bank:

Changes in the interest rate. E.g. a rise in the interest rate

will reduce the duration of the assets and liabilities but not

necessarily to the same extent.

The mere passage of time.

Right after a coupon payment what happens to duration?

Hence the portfolio needs to be rebalanced

occasionally (theoretically continuously) so that the

bank remains immunized.

Anda mungkin juga menyukai

- Financial Risk Management: A Simple IntroductionDari EverandFinancial Risk Management: A Simple IntroductionPenilaian: 4.5 dari 5 bintang4.5/5 (7)

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Dari EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Belum ada peringkat

- Lecture 5312312Dokumen55 halamanLecture 5312312Tam Chun LamBelum ada peringkat

- 10 InclassDokumen50 halaman10 InclassTBelum ada peringkat

- 2268Dokumen43 halaman2268asmaBelum ada peringkat

- Bond Price VolatilityDokumen63 halamanBond Price VolatilityJithesh JanardhananBelum ada peringkat

- Bond Valuation: Case: Atlas InvestmentsDokumen853 halamanBond Valuation: Case: Atlas Investmentsjk kumarBelum ada peringkat

- Unit 3 - Term Structure of Interest Rates Slides 2022Dokumen53 halamanUnit 3 - Term Structure of Interest Rates Slides 2022ndonithando2207Belum ada peringkat

- Understanding the Yield CurveDokumen14 halamanUnderstanding the Yield CurveAmirBelum ada peringkat

- Managing Interest Rate RiskDokumen32 halamanManaging Interest Rate RiskHenry So E Diarko100% (1)

- Duration & ConvexityDokumen18 halamanDuration & ConvexityHrishikesh Malu100% (3)

- Bond Prices and Yields: Mcgraw-Hill/IrwinDokumen47 halamanBond Prices and Yields: Mcgraw-Hill/IrwinAboAdham100100Belum ada peringkat

- Duration: Measuring Interest Rate SensitivityDokumen19 halamanDuration: Measuring Interest Rate SensitivityALBelum ada peringkat

- BondsDokumen26 halamanBondsPranav SanturkarBelum ada peringkat

- Bond Price Volatility: Dr. Himanshu Joshi FORE School of Management New DelhiDokumen51 halamanBond Price Volatility: Dr. Himanshu Joshi FORE School of Management New Delhiashishbansal85Belum ada peringkat

- The Structure of Interest RatesDokumen72 halamanThe Structure of Interest RatesMarwa HassanBelum ada peringkat

- Bond Prices and Yields: Mcgraw-Hill/IrwinDokumen24 halamanBond Prices and Yields: Mcgraw-Hill/IrwinAshutosh KalraBelum ada peringkat

- Valuation of Bonds and SharesDokumen45 halamanValuation of Bonds and SharessmsmbaBelum ada peringkat

- Bond RiskDokumen31 halamanBond RiskSophia ChouBelum ada peringkat

- The Duration MeasureDokumen38 halamanThe Duration MeasureKatrina Vianca DecapiaBelum ada peringkat

- Chapter Five: Interest Rate Determination and Bond ValuationDokumen38 halamanChapter Five: Interest Rate Determination and Bond ValuationMikias DegwaleBelum ada peringkat

- Investment Analysis and Portfolio Management: Lecture 6 Part 2Dokumen35 halamanInvestment Analysis and Portfolio Management: Lecture 6 Part 2jovvy24Belum ada peringkat

- Bond Prices Yields FundamentalsDokumen40 halamanBond Prices Yields FundamentalssaysuuBelum ada peringkat

- UntitledDokumen29 halamanUntitledDEEPIKA S R BUSINESS AND MANAGEMENT (BGR)Belum ada peringkat

- Bond ValuationDokumen57 halamanBond ValuationRajib BurmanBelum ada peringkat

- Intermediate Finance Session 9 Chapter 18 Key ConceptsDokumen56 halamanIntermediate Finance Session 9 Chapter 18 Key ConceptsrizaunBelum ada peringkat

- FINA5520 Risk Management and Interest RatesDokumen46 halamanFINA5520 Risk Management and Interest RatesthelittlebirdyBelum ada peringkat

- Bonds DurationDokumen31 halamanBonds DurationAashima GroverBelum ada peringkat

- Valuation and Factors Affecting Bonds and SharesDokumen71 halamanValuation and Factors Affecting Bonds and SharesRubal GargBelum ada peringkat

- BondsDokumen55 halamanBondsfecaxeyivuBelum ada peringkat

- Valuation of Securities: Key ConceptsDokumen53 halamanValuation of Securities: Key ConceptsKshitishBelum ada peringkat

- BOND VALUATION Week 4Dokumen43 halamanBOND VALUATION Week 4desblahBelum ada peringkat

- F303 - Intermediate Investments: Interest Rate Sensitivity and Bond DurationDokumen19 halamanF303 - Intermediate Investments: Interest Rate Sensitivity and Bond Durationhussain_nBelum ada peringkat

- Duration PDFDokumen8 halamanDuration PDFMohammad Khaled Saifullah CdcsBelum ada peringkat

- Lec 10Dokumen26 halamanLec 10danphamm226Belum ada peringkat

- Term Structure of Interest RatesDokumen44 halamanTerm Structure of Interest RatesmasatiBelum ada peringkat

- Introduction To Bond ValuationDokumen24 halamanIntroduction To Bond ValuationVarun SinghBelum ada peringkat

- Lecture 3Dokumen29 halamanLecture 3Nurfaiqah AmniBelum ada peringkat

- 4 - Term Structures TheoriesDokumen15 halaman4 - Term Structures Theoriesmajmmallikarachchi.mallikarachchiBelum ada peringkat

- IcrddcDokumen7 halamanIcrddcapi-213789026Belum ada peringkat

- Chapter Three Interest Rates in The Financial SystemDokumen40 halamanChapter Three Interest Rates in The Financial SystemKalkayeBelum ada peringkat

- Duration Convexity Bond Portfolio ManagementDokumen49 halamanDuration Convexity Bond Portfolio ManagementParijatVikramSingh100% (1)

- Bond valuation and yield analysisDokumen35 halamanBond valuation and yield analysisTanmay MehtaBelum ada peringkat

- Third Party Issuer: ABS Vs MBS When You Invest in Mortgage-Backed (MBS) and Asset-Backed (ABS) Securities You AreDokumen4 halamanThird Party Issuer: ABS Vs MBS When You Invest in Mortgage-Backed (MBS) and Asset-Backed (ABS) Securities You AreElla Marie WicoBelum ada peringkat

- Use Duration and Convexity To Measure RiskDokumen4 halamanUse Duration and Convexity To Measure RiskSreenesh PaiBelum ada peringkat

- Term Structure of Interest RatesDokumen21 halamanTerm Structure of Interest RatestoabhishekpalBelum ada peringkat

- Bond TheoremDokumen27 halamanBond TheoremparulkakBelum ada peringkat

- Interest Rate TutorialsDokumen81 halamanInterest Rate TutorialsdvobqvpigpwzcfvsgdBelum ada peringkat

- Bond Portfolio Management StrategiesDokumen36 halamanBond Portfolio Management StrategiesMuhammad HarisBelum ada peringkat

- Riding The Yield Curve 1663880194Dokumen81 halamanRiding The Yield Curve 1663880194Daniel PeñaBelum ada peringkat

- Understanding Bond Price VolatilityDokumen37 halamanUnderstanding Bond Price VolatilityHarpreetBelum ada peringkat

- 14 Fixed Income Portfolio ManagementDokumen60 halaman14 Fixed Income Portfolio ManagementPawan ChoudharyBelum ada peringkat

- Chapter 1 Overview of Debt SecuritiesDokumen64 halamanChapter 1 Overview of Debt SecuritiesHồng Nhung PhạmBelum ada peringkat

- Financial Management - Bonds 2014Dokumen34 halamanFinancial Management - Bonds 2014Joe ChungBelum ada peringkat

- DurationDokumen5 halamanDurationNiño Rey LopezBelum ada peringkat

- Valuation of BondsDokumen91 halamanValuation of BondsraymondBelum ada peringkat

- Bond Duration 2Dokumen9 halamanBond Duration 2Mian Qamar Ul ZamanBelum ada peringkat

- Bonds Overview Pricing YieldDokumen40 halamanBonds Overview Pricing YieldRajesh Chowdary ChintamaneniBelum ada peringkat

- High-Q Financial Basics. Skills & Knowlwdge for Today's manDari EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manBelum ada peringkat

- Chapter 4 Supplement Process Costing Using The FIFO Method: True/FalseDokumen38 halamanChapter 4 Supplement Process Costing Using The FIFO Method: True/FalseRashedul Islam PaponBelum ada peringkat

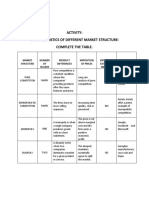

- Characteristics of Different Market Structures TableDokumen2 halamanCharacteristics of Different Market Structures TableJustine PadohilaoBelum ada peringkat

- Yap Ke Huat & Ors V Pembangunan Warisan MurniDokumen16 halamanYap Ke Huat & Ors V Pembangunan Warisan MurniZawani RahimBelum ada peringkat

- ABNT NBR 6330 2020 - General Purpose Carbon Steel Wire RodDokumen12 halamanABNT NBR 6330 2020 - General Purpose Carbon Steel Wire RodElton Felipe Gularte dos SantosBelum ada peringkat

- OfferLetter SignedDokumen19 halamanOfferLetter SignedNalin bhattBelum ada peringkat

- Ablockers Fitness 101Dokumen10 halamanAblockers Fitness 101iqbal kamilBelum ada peringkat

- Qdoc - Tips - Kunci Jawaban Supply Chain Management Presales SpeDokumen19 halamanQdoc - Tips - Kunci Jawaban Supply Chain Management Presales SpeEyuBelum ada peringkat

- Master The Data: An Introduction To Accounting Data: A Look BackDokumen81 halamanMaster The Data: An Introduction To Accounting Data: A Look Backsalsabila.rafy-2021Belum ada peringkat

- FA Work BookDokumen59 halamanFA Work BookUnais AhmedBelum ada peringkat

- Sps Agner v. BPIDokumen2 halamanSps Agner v. BPIKarla Lois de GuzmanBelum ada peringkat

- Maruti suzuki Ambal Auto ExperienceDokumen26 halamanMaruti suzuki Ambal Auto Experience18UGCP078 SUJITHBelum ada peringkat

- Ac 418 Group AssignmentDokumen6 halamanAc 418 Group AssignmentJacob PossibilityBelum ada peringkat

- Business DirectoryDokumen4 halamanBusiness DirectoryRegunathan PadmanathanBelum ada peringkat

- Chapter 3 PlanningDokumen29 halamanChapter 3 PlanningDagm alemayehuBelum ada peringkat

- Welder Job Clearance Card for Ali QurbanDokumen43 halamanWelder Job Clearance Card for Ali QurbanDhanush NairBelum ada peringkat

- Catalog Central Parts Warehouse Plow Parts 2018 - 19Dokumen132 halamanCatalog Central Parts Warehouse Plow Parts 2018 - 19BillBelum ada peringkat

- Busm4696 Political Economy of International Business Cover SheetDokumen14 halamanBusm4696 Political Economy of International Business Cover SheetThuỳ Dung0% (1)

- Blue Danube Si Green HydrobenDokumen11 halamanBlue Danube Si Green HydrobenDiana AchimescuBelum ada peringkat

- Organizing Global Marketing ProgramsDokumen19 halamanOrganizing Global Marketing ProgramsSabin ShresthaBelum ada peringkat

- GN Cement Industry 05022021 RevDokumen97 halamanGN Cement Industry 05022021 RevNetaji Dasari100% (1)

- KohlerDokumen25 halamanKohlertousif AhmedBelum ada peringkat

- s3879661 A1 Slides mktg1420-1Dokumen15 halamans3879661 A1 Slides mktg1420-1Huy Quang100% (1)

- Onondaga County 2021 BudgetDokumen424 halamanOnondaga County 2021 BudgetNewsChannel 9Belum ada peringkat

- Economics Assignment IDokumen2 halamanEconomics Assignment IDEVASISHBelum ada peringkat

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDokumen71 halamanIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuBelum ada peringkat

- Excel calendarDokumen28 halamanExcel calendarThanh LêBelum ada peringkat

- Prosthetid Hand Pugh MethodDokumen91 halamanProsthetid Hand Pugh MethodFaddhila FadhilaBelum ada peringkat

- BCIF - Ver7 Back With SignatureDokumen1 halamanBCIF - Ver7 Back With SignatureKatrina JarabejoBelum ada peringkat

- Esemen AsrsDokumen25 halamanEsemen AsrsAtiqah Binti Abu HassanBelum ada peringkat

- Financial Accounting CH 2Dokumen12 halamanFinancial Accounting CH 2Karim KhaledBelum ada peringkat