Ser2014 Budget Presentation Template

Diunggah oleh

Betriz AfrizolDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ser2014 Budget Presentation Template

Diunggah oleh

Betriz AfrizolHak Cipta:

Format Tersedia

APPENDIX A

COMPANY / DIVISION NAME

2014 Budget Presentation

Business Planning framework

Input

1 Strategic direction and targets 2 Market & Economic scan 3 Competitor assessment 4 SWOT analysis 5 Current year performance, achievements and lessons learnt 6 7

Output

Detailed financial forecasts Initiatives and key priorities

8

9

Human resource requirements

Risks and mitigating steps Success summary (if applicable)

10

11 12

Human resource capabilities (if applicable)

Refreshed BU strategy and road to results (if required)

Strategic direction and financial targets

Financial Targets for 2014 Budget

Revenue EBIT EBIT margin PBT PBT margin PATNCI PATNCI margin RM xxM RM xxM X% RM xxM X% RM xxM X%

Strategic Direction

Enablers for focus

- Eg. Recruit x key staff - -------- --------

Strategic initiatives

- Eg. Establish X 3S units - -------- ---------

CAPEX

Free Cashflow

RM xxM

RM xxM

Market and Economic Analysis

Please provide an analysis of the relevant markets and economic outlook. The analysis should focus on key drivers of growth and profitability Key points to cover:

Relevant market definition Historical market size and growth Forecast market size and growth Key growth drivers, including economic and demographic outlook Key profitability drivers, including price/ cost trends

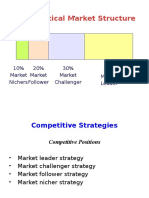

Competitor assessment and analysis

Please provide an analysis of the relevant competitors. The analysis should focus on both financial and strategic assessments Key points to cover:

Key target segments, reputation with customers Financials: Revenue, profitability

Major actions over the past year(s)

Strengths and weaknesses Planned or rumoured actions Current and future strategy

SWOT analysis

Internal factors

Operational/technical performance Communication and organization structure Human resource competencies

External factors

Governmental regulation and law Environment Communities Economic situation

Strengths

Competencies and capabilities

- E.g. process, technical, knowledge etc.

Opportunities

Market opportunities

- E.g. NAPc.

Unique advantage and key differentiation from competitors

- E.g. value-added services, high-quality product etc.

New business opportunities

- E.g. New technology, EV cars etc.

Weaknesses

Weak points and limitations

- E.g. technical, human resource etc.

Threats

Market threats

- E.g. Change of regulations, new entrants etc

Areas of performance that are below average benchmark

New business threats

- E.g.new technology etc.

Current year achievements

Award/Recognitions

Customer Satisfaction

Human Capital

Others

Strategies & New Initiatives

State the broad strategies to be undertaken Strategies must be reflected in the financial performance and HR planning

Top 5 Critical Issues & Strategic Action Plans

Critical Issues (& Target) Strategic Action Plans (& KPIs) Impact to Finance and HR plans

Positive Impact Negative Impact

By whom (& When)

1.

2.

3.

4.

5.

Financial performance- Trends in operations

Revenue historical and rolling 3-yr forecast ( 3 years actual + Budget + 2 years forecast)

10

5

To include other relevant trends e.g. average selling price

2011 2012 2013 2014 2015 2016

PBT historical and rolling 3-yr forecast

8 6 4 2

CAG R

CAG R

0

PBT margin %

2011

xx%

2012

xx%

2013

xx%

2014

xx%

2015

xx%

2016

xx%

Financial performance highlights

2013 Overall 2011A 2012A Budget Forecast 2014B 2015F 2016F 2017F 2018F

Revenue EBIT EBIT (%)

Gross profit GP Margin (%) PBT PAT Operating Expenses Operating Expenses (%) Net Gearing Ratio

Free Cash Flow Operating Cash Flow

Capex Please ensure that the figures above are for the 12 months period (January to December) for the respective years.

Key assumption on financial forecasts

List key assumptions used to make financial forecasts: Not to be

presented in these slides, but to be stated in the BP excel financial template

Financial performance- Cashflow

2012A 2013E 2014B 2015F 2016F 2017F 2018F Remarks

Cash generated from operations Tax Interest paid/ received Cashflow from operating activities (i) Purchase of fixed assets Proposed investments/ expansion plans Others Cashflow from investing activities (ii) Bank borrowings obtained Repayment of bank borrowings Intercompany advances/ repayment Others Cashflow from financing activities (iii) Net Cashflow (i) + (ii) + (iii) Cash at beginning of year Cash at end of year

Please ensure that the figures above are for the 12 months period (January to December) for the respective years.

Capital Expenditure 2014

No Item Justification Amount (RMmil)

A) For upkeep & enhancement of existing operations (for sustaining of existing business) 1

2

3 4 Sub-total B) For expansion & new business

1

2 3 4 Sub-total Grand Total

HR Manpower Planning 2014 - 2018

DEPARTMENT/FU NCTION

Sales Marketing Operations Finance & Admin HR Others (pls specify) Total 2013 BUDGET X X X X X X X 2013 ACTUAL X X X X X X X 2014 BUDGET X X X X X X X 2015 Projectio n X X X X X X X 2016 Projection X X X X X X X 2017 Projection X X X X X X X 2018 Projection X X X X X X X

Manpower justifications for immediate year:

10

Risk assessment Summary of top 5 risks

No. Key risks Category Net risk rating Very significant Risk action plan for additional risk treatments Detailed evaluation to identify critical spare parts and provide standby stock or arrange with supplier Replacement program over 5 years Hire experienced maintenance engineer Upgrade current waste water treatment facilities to meet the requirements Explore alternative technology eg. Microbe and organic method Budget (Provided in the forecast?) US$3 million Provided in the forecast Breakdown of critical equipment Aged equipment between 18 to 25 years Limited spare parts suppliers in this region Average breakdown of 200 hours per month due to ineffective maintenance program Operation

Environmental regulations Regulations on waste water treatment may be tighten in the next 3 years Amendment to the regulations is currently with the government and when pass will require stringent treatment to the discharge of waste water

Regulatory

High

US$20 millions Not provided in forecast uncertain of the timing of enforcement of this law

3 4 5

Regulatory Operation Legal

High High Medium

THANK YOU

Prepared by : Reviewed by : Approved by :

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- 13.1 Case StudyDokumen2 halaman13.1 Case StudyPac Kotcharag100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Cash Sales Document GuideDokumen28 halamanCash Sales Document GuideRanjeet SinghBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Art of SellingDokumen8 halamanThe Art of SellingpratherdcBelum ada peringkat

- 193 Sarmiento Vs CA, 394 SCRA 315 (2002)Dokumen1 halaman193 Sarmiento Vs CA, 394 SCRA 315 (2002)Alan GultiaBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- 1robern Development Corporation v. People's Landless AssociationDokumen18 halaman1robern Development Corporation v. People's Landless AssociationLoisse VitugBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Business Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONDokumen20 halamanBusiness Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONJhudiel Dela ConcepcionBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Porters Five Force ModelDokumen4 halamanPorters Five Force Modelnaveen sunguluru50% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Tally Erp 9.0 Material Value Added Tax (VAT) in Tally Erp 9.0Dokumen86 halamanTally Erp 9.0 Material Value Added Tax (VAT) in Tally Erp 9.0Raghavendra yadav KM100% (5)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Blackstone - A Primer For Today's Secondary PE Market - Fall 2017v7Dokumen18 halamanBlackstone - A Primer For Today's Secondary PE Market - Fall 2017v7zeScribdm15Belum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Ais 205 - Chapter 1 PDFDokumen15 halamanAis 205 - Chapter 1 PDFFarhana Ayuni AzmanyaziBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Product Management UNIT I JNTUKDokumen36 halamanProduct Management UNIT I JNTUKletter2vilBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- FILIPINO Deed of Absolute Sale, Acknowledgment Receipt and SPADokumen7 halamanFILIPINO Deed of Absolute Sale, Acknowledgment Receipt and SPAJecky Delos ReyesBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Sales.07.Nietes V CADokumen3 halamanSales.07.Nietes V CAQuina IgnacioBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- No Accounting Document Generated: No Accounting Document Generated: Based On The Purchase Order and The Quantity Actually ReceivedDokumen5 halamanNo Accounting Document Generated: No Accounting Document Generated: Based On The Purchase Order and The Quantity Actually ReceivedAmanBelum ada peringkat

- Hindustan UnileverDokumen61 halamanHindustan UnileverravikantgaurBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Saint Gobain - Sales Trainee ProgramDokumen3 halamanSaint Gobain - Sales Trainee ProgramPrabhat KarwalBelum ada peringkat

- Mba PDFDokumen39 halamanMba PDFKmj MuheetBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- 1 - Intro To Marketing - Concepts and TrendsDokumen19 halaman1 - Intro To Marketing - Concepts and TrendsPiyash PrinceBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Harmonized Standard Chart of Account For CoopsDokumen31 halamanHarmonized Standard Chart of Account For CoopsVelmor Vela Joy CustodioBelum ada peringkat

- Manila Mandarin Hotels Vs CommissionerDokumen2 halamanManila Mandarin Hotels Vs CommissionerEryl Yu100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Grade 7 Term 2 Social ScienceDokumen101 halamanGrade 7 Term 2 Social ScienceVarshLokBelum ada peringkat

- Economics AssignmentDokumen16 halamanEconomics AssignmentPushpit Khare100% (1)

- Problem 1:: Caf 1 Accounting EquationDokumen7 halamanProblem 1:: Caf 1 Accounting EquationSerish ButtBelum ada peringkat

- 2014 Metabo Katalog GB LRDokumen291 halaman2014 Metabo Katalog GB LRTh Nattapong100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- 21 Tips For Upselling Guest Rooms in Hotel Front OfficeDokumen2 halaman21 Tips For Upselling Guest Rooms in Hotel Front Officetesfaneh mengistuBelum ada peringkat

- Bhogadi Road Near Birihundi Yesh Valley View LAYOUT - MysoreDokumen3 halamanBhogadi Road Near Birihundi Yesh Valley View LAYOUT - MysoreRanjan Patali JanardhanaBelum ada peringkat

- 3420 3421Dokumen3 halaman3420 3421Eong Huat Corporation Sdn BhdBelum ada peringkat

- Economics School Based AssignmentDokumen28 halamanEconomics School Based AssignmentTiseannaBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Business Ethics NotesDokumen10 halamanBusiness Ethics NotesbethBelum ada peringkat

- 4P's of Berger Paints Bangladesh LimitedDokumen24 halaman4P's of Berger Paints Bangladesh Limitedনিশীথিনী কুহুরানীBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)