As-Ad Model 19032007 02

Diunggah oleh

footyshah0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

6 tayangan8 halamanAS/AD Model, macroeconomics

Judul Asli

as-ad_model_19032007_02

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAS/AD Model, macroeconomics

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

6 tayangan8 halamanAs-Ad Model 19032007 02

Diunggah oleh

footyshahAS/AD Model, macroeconomics

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 8

Quantity Theory of Money

Why should the Quantity Theory of Money

(QTM) be Introduced?

The QTM can be viewed as a special case of the

economic theory behind the LM curve.

The equation behind the LM curve is that the

real supply for money (M/P)

s

is equal to the real

demand for money, and the demand of money

depends on the transaction demand (i.e., it

depends positively on output Y) and the

speculative demand (i.e., it depends negatively

on interest rate r)

Why should the Quantity Theory of Money

(QTM) be Introduced?

A simple version of the QTM ignores the effects

of interest rate and postulates that M/P = kY,

where K is a positive constant.

The advantage of the QTM is that it explicitly

brings in the relationship between the price level

and the money supply and output.

This is important because as remarked by Milton

Friedman, Inflation is always and everywhere a

monetary phenomenon. Without the QTM, it is

hard to discuss inflation.

Empirical Relevance of the QTM

How well does the QTM fit the empirical

data, given that we ignore the effects of

interest rate? Some variants of the QTM

have been applied to many economies,

including Hong Kong and China. It is

known that the QTM works very well.

To empirically test the model, usually we

need to modify the QTM a bit.

Empirical Relevance of the QTM

M/P = kY can be expressed in the form of

m p = y,

where m is the % change in M,

p is the % change in P, and

y is the % change in Y.

(Note that the growth rate of k must be zero because it is

a constant.)

Alternatively, p = m y, i.e., inflation is positively related

to growth rate in money supply and negatively related to

output growth.

Empirical Relevance of the QTM

More advanced theories tell us that the real

demand for money is better described by M/P

e

,

where P

e

is expected inflation rate. This is

because we dont know what inflation is going to

be, and so we can only form expectation of it. In

practice, expected inflation rate depends on past

values of actual inflation. Due to this

complication, more sophisticated versions of the

QTM assume that inflation depends on current

and past values of the growth rates of M and Y.

This version of the QTM can explain more than

99% of the changes in prices in Hong Kong.

Earlier Versions of the QTM

Historically, the QTM has another form:

MV = PY, where V is the velocity of money. It

is supposed to measure how often the money

stock turns over in each period. Alternatively,

we can write V = nominal GDP/nominal money

supply, i.e., V = PY/M.

MV = PY should be treated as an identity,

rather than an equation, because by the

definition of V, it must always true. When there

are changes in M, P, or Y, then V may have to

adjust.

Earlier Versions of the QTM

Empirically, the V in the identity above

need not be a constant.

If we impose the assumption that V is a

constant, then we have the QTM, which

can be tested empirically. The new version

of the QTM is M/P = kY, where k = 1/V.

Anda mungkin juga menyukai

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1091)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Foe - PP v. Tomines - 9october2017Dokumen4 halamanFoe - PP v. Tomines - 9october2017Faith Roslyndale Fidés100% (1)

- Chapter 14 Chemical EquilibriumDokumen29 halamanChapter 14 Chemical EquilibriumlynloeBelum ada peringkat

- Recount TextDokumen17 halamanRecount TextalunaBelum ada peringkat

- Thrift BanksDokumen15 halamanThrift BanksHarry Decillo100% (1)

- M 1.2 RMDokumen16 halamanM 1.2 RMk thejeshBelum ada peringkat

- Bareilly Ki Barfi Full Movie DownloadDokumen3 halamanBareilly Ki Barfi Full Movie Downloadjobair100% (3)

- 5 - Data Room Procedure TemplatesDokumen8 halaman5 - Data Room Procedure TemplatesnajahBelum ada peringkat

- Art App Finals OutputDokumen3 halamanArt App Finals OutputChariz Kate DungogBelum ada peringkat

- Battleship PotemkinDokumen7 halamanBattleship PotemkinMariusOdobașa100% (1)

- Process Audit Manual 030404Dokumen48 halamanProcess Audit Manual 030404azadsingh1Belum ada peringkat

- Mind Map The Process of WritingDokumen1 halamanMind Map The Process of WritingBIBB-0622 NISHA JONGBelum ada peringkat

- Applied LingDokumen11 halamanApplied Lingحسام جدوBelum ada peringkat

- Interjections Worksheet PDFDokumen1 halamanInterjections Worksheet PDFLeonard Patrick Faunillan Bayno100% (1)

- BÀI TẬP ÔN HSG TỈNHDokumen12 halamanBÀI TẬP ÔN HSG TỈNHnguyễn Đình TuấnBelum ada peringkat

- Jacob Marries Leah and RachelDokumen1 halamanJacob Marries Leah and RacheljellyB RafaelBelum ada peringkat

- Group No. - Leader: MembersDokumen7 halamanGroup No. - Leader: MembersJONATHAN NACHORBelum ada peringkat

- Bay Marshalling BoxesDokumen4 halamanBay Marshalling BoxesSimbu ArasanBelum ada peringkat

- Stellar Nations ResumeDokumen7 halamanStellar Nations ResumeAndré Luiz CarneiroBelum ada peringkat

- Morality and Pedophilia in LolitaDokumen5 halamanMorality and Pedophilia in LolitaDiana Alexa0% (1)

- Aol2 M6.1Dokumen5 halamanAol2 M6.1John Roland CruzBelum ada peringkat

- 5990 3285en PDFDokumen16 halaman5990 3285en PDFLutfi CiludBelum ada peringkat

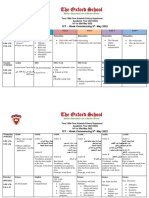

- Term 3 Mid-Term Assessment ScheduleDokumen9 halamanTerm 3 Mid-Term Assessment ScheduleRabia MoeedBelum ada peringkat

- Niche Market Tourism (Autosaved) PowerPointDokumen83 halamanNiche Market Tourism (Autosaved) PowerPointkamilahBelum ada peringkat

- Unit - 3 Consignment: Learning OutcomesDokumen36 halamanUnit - 3 Consignment: Learning OutcomesPrathamesh KambleBelum ada peringkat

- CaseLaw RundownDokumen1 halamanCaseLaw RundownTrent WallaceBelum ada peringkat

- Acctg 604 Basic Framework of Mas Cost Managemet PDFDokumen55 halamanAcctg 604 Basic Framework of Mas Cost Managemet PDFKookie100% (1)

- The SacrificeDokumen3 halamanThe SacrificeRoseann Hidalgo ZimaraBelum ada peringkat

- Samsung MobileDokumen80 halamanSamsung Mobiledeepkamal_jaiswalBelum ada peringkat

- Reincarnated As A Sword Volume 12Dokumen263 halamanReincarnated As A Sword Volume 12Phil100% (1)

- PM Plan Template For PresentationDokumen3 halamanPM Plan Template For Presentationjamal123456Belum ada peringkat