Lecture 1-2013

Diunggah oleh

anksri070 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

22 tayangan11 halamansabe it on

Judul Asli

Copy of Lecture 1-2013

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inisabe it on

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

22 tayangan11 halamanLecture 1-2013

Diunggah oleh

anksri07sabe it on

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 11

Financial Accounting

Book Keeping is an art of recording the financial transactions

in a simple manner.

Accounting is the art of recording , classifying and

summarizing in a significant manner and in terms of money ,

transactions and events which are , in part atleast , of financial

character and interpreting the results thereof.

THE ACCOUNTING PROCESS

Identifying of Transactions

Recording in Journals

Classifying : Posting in Ledgers

Summarizing : Preparing Final Accounts

Interpretation & Analysis

INPUTS

Business Transactions (e.g. purchases sales,

receipts and payments etc)

External events (e.g. fire, changes in tax

laws etc)

PROCESSING

Accounting Principles

Accounting Standards

Management Estimates

Laws and Regulations (e.g. Companies Act and

Income Tax Act)

Transaction Processing Conventions

Accounting Records

OUTPUT

Profit and Loss Account

Balance Sheet

Cash Flow Statement

Explanatory Notes

Management Commentary

Special Reports and Analysis

Tax Returns

Regulatory Filings

USERS

Shareholders

Managers

Suppliers

Creditors

Employees

Government

Regulators

Investors

Security Analysts

Rating Agencies

Academicians & Researchers

CLASSIFICATION OF ACCOUNTING

Accounting

Cost

Accounting

Management

Accounting

Financial

Accounting

Accounting Concepts

These are the assumptions which are fundamental to the

accounting practice and are based on logical considerations.

Separate Entity Concept

Money Measurement Concept

Accounting Period Concept

Going Concern Concept

Cost Concept

Conservatism or Prudence Concept

Materiality or Relevance Concept

Consistency Concept

Matching Concept

Accrual Basis of Accounting

Double Entry Concept

Timeliness Concept

Revenue Recognition

Accounting Equation

According to the Double Entry Concept there should

be a debit for every credit and a credit for every debit.

Claims = Economic Resource

Capital (+) Liabilities = Assets

[Capital+ Revenues-Expenses-Drawings-

Dividends] + Liabilities = Assets

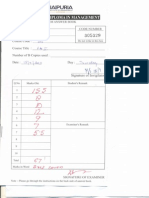

Q1. Show the working of the double entry system in the form of accounting

equation.

1 Rakesh starts business with cash Rs 5 lac ; furniture Rs 50,000 ; loan from

friend Akash Rs 1,00,000 ; goods Rs 25,000 ; building Rs 5 lac

2 He purchases stock having value of Rs 50,000 at a trade discount of 10%

from Jamnalal , half the amount was paid is cash immediately.

3 He sold goods worth Rs 30,000 at Rs 45,000 to Jaichand on cash basis.

4 Cleared off the dues to Jamnalal .

5 Sold a part of the old furniture valuing Rs 10,000 at Rs 8,000.

6 Paid electricity bill of Rs 2,000

7 Paid staff salary Rs 7,000

8 Opened a current account at PNB and deposited Rs 2,50,000 in that

account.

9 Repays the loan taken from Akash through cheque.

10 Withdraws Rs 10,000 in cash and goods worth Rs 15,000 for personal use.

11 Took a loan of Rs 5 lac from SBI

Accounting Equation

Capital + Liabilities = Assets

Loan from + Jamnalal =

Akash

Building +Furniture + Goods + Cash

1 10,75,000 + 1,00,000 + 0 = 5,00,000 + 50,000 + 25,000 + 6,00,000

2 0 + 0 + 22,500 = 0 + 0 + 45,000+ (22,500)

10,75,000 + 1,00,000 + 22,500 = 5,00,000 + 50,000 + 70,000 + 5,77,500

3 15,000 + 0 + 0 = 0 + 0 + (30,000) + 45,000

10,90,000 + 1,00,000 + 22,500 = 5,00,000 + 50,000 + 40,000 + 6,22,500

4 0 + 0 + (22,500) = 0 + 0 + 0 + (22,500)

10,90,000 + 1,00,000 + 0 = 5,00,000 + 50,000 + 40,000 + 6,00,000

5 (2,000) + 0 + 0 = 0 +(10,000) + 0 + 8,000

10,88,000 + 1,00,000 + 0 = 5,00,000 + 40,000 + 40,000 + 6,08,000

6 (2,000) + 0 + 0 = 0 + 0 + 0 + (2,000)

10,86,000 + 1,00,000 + 0 = 5,00,000 + 40,000 + 40,000 + 6,06,000

7 (7,000) + 0 + 0 = 0 + 0 + 0 + (7,000)

10,79,000 + 1,00,000 + 0 = 5,00,000 + 40,000 + 40,000 + 5,99,000

Accounting Equation

Capital + Liabilities = Assets

Loan from +Jamnalal +Loan =

Akash SBI

Building +Furniture + Goods + Cash + PNB

10,79,000

+

1,00,000 + 0 + 0 = 5,00,000 + 40,000 + 40,000 + 5,99,000 + 0

8 0 + 0 + 0 + 0 = 0 + 0 + 0 + (2,50,000) + 2,50,000

10,79,000

+

1,00,000 + 0 + 0 = 5,00,000 + 40,000 + 40,000 +3,49,000+2,50,000

9 0 + (1,00,000) + 0 + 0 = 0 + 0 + 0 + 0 + (1,00,000)

10,79,000

+

0 + 0 + 0 = 5,00,000 + 40,000 +40,000 + 3,49,000+1,50,000

10 (25,000)+ 0 + 0 + 0 = 0 + 0 + ( 15,000) + (10,000)+ 0

10,54,000

+

0 + 0 + 0 = 5,00,000 + 40,000 + 25,000 +3,39,000 +1,50,000

11 0 + 0 + 0 + 5,00,000= 0 + 0 + 0 + 5,00,000 + 0

10,54,000

+

0 + 0 + 5,00,000= 5,00,000 + 40,000 +25,000 +8,39,000 +1,50,000

Thank You

Anda mungkin juga menyukai

- A Mother's Guide to Addition & SubtractionDari EverandA Mother's Guide to Addition & SubtractionPenilaian: 5 dari 5 bintang5/5 (1)

- Accounting TerminologiesDokumen17 halamanAccounting TerminologiesWena BeeBelum ada peringkat

- Fundamental Accounting EquationDokumen6 halamanFundamental Accounting EquationWena BeeBelum ada peringkat

- Problem 1 Accounting EquationDokumen8 halamanProblem 1 Accounting EquationMarjon DimafilisBelum ada peringkat

- Accounting Equation With PrepaidDokumen2 halamanAccounting Equation With PrepaidRaaied JafferBelum ada peringkat

- Accounting Equation LECTUREDokumen4 halamanAccounting Equation LECTUREgoharmahmood203Belum ada peringkat

- Answers To CH 2 - FTW ProblemsDokumen14 halamanAnswers To CH 2 - FTW ProblemsJuanito Jr. LagnoBelum ada peringkat

- 01 Activity 02 Basic AccountingDokumen4 halaman01 Activity 02 Basic AccountingKim Ahn ObuyesBelum ada peringkat

- Solution 786526Dokumen38 halamanSolution 786526Anvesha AgarwalBelum ada peringkat

- Principle of Accounting Assignment NUSTDokumen2 halamanPrinciple of Accounting Assignment NUSTAbdul RehmanBelum ada peringkat

- Accounting BasicsDokumen22 halamanAccounting BasicsKonrad Lorenz Madriaga UychocoBelum ada peringkat

- Show That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRDokumen3 halamanShow That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRLysss Epssss0% (2)

- Project AppraisalDokumen34 halamanProject AppraisalWilly Mwangi KiarieBelum ada peringkat

- Accounting Equation - DPP 05 - (Aarambh 2.0 2024)Dokumen4 halamanAccounting Equation - DPP 05 - (Aarambh 2.0 2024)Kanishk SawaliyaBelum ada peringkat

- Financial-Accounting April 2022Dokumen8 halamanFinancial-Accounting April 2022Rupesh SinghBelum ada peringkat

- MAA - AssignmentDokumen12 halamanMAA - Assignmentshweta rawatBelum ada peringkat

- The Accounting Process 7th EditionDokumen9 halamanThe Accounting Process 7th EditionPaula Anyssa Tobias BerbaBelum ada peringkat

- Accounting Equation: There Is A Credit."Dokumen15 halamanAccounting Equation: There Is A Credit."palkachhillarBelum ada peringkat

- ASPL3 Activity 3-6 DoneDokumen7 halamanASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- Accounting Basics Fundamental Accounting ConceptsDokumen13 halamanAccounting Basics Fundamental Accounting ConceptsFredalyn Joy VelaqueBelum ada peringkat

- Financial Accounting AssignmentDokumen5 halamanFinancial Accounting AssignmentHimanshu DhanukaBelum ada peringkat

- Accounting EquationDokumen11 halamanAccounting EquationVidhya UnniBelum ada peringkat

- Explanation of Accounting EquationDokumen4 halamanExplanation of Accounting Equationlakhan619Belum ada peringkat

- Accounting Equation SolutionsDokumen5 halamanAccounting Equation SolutionsBhjan GargBelum ada peringkat

- Chapter 1Dokumen19 halamanChapter 1Phạm Thị Anh ThuBelum ada peringkat

- Housing Price in UkDokumen3 halamanHousing Price in UkenginiboeerBelum ada peringkat

- Week 3 Tutorial SolutionsDokumen19 halamanWeek 3 Tutorial SolutionswainikitiraculeBelum ada peringkat

- 1.0 Question 1 (CLO 1) : 2 External Users of Accounting InvestorsDokumen2 halaman1.0 Question 1 (CLO 1) : 2 External Users of Accounting InvestorsSufian Abd RahimBelum ada peringkat

- Ratio Analysis Questions & AnswersDokumen10 halamanRatio Analysis Questions & AnswersNaveen ReddyBelum ada peringkat

- COGM5 Final RequirementDokumen24 halamanCOGM5 Final RequirementLadignon IvyBelum ada peringkat

- Accounting Assignment1Dokumen4 halamanAccounting Assignment1Muhammad HannanBelum ada peringkat

- Practice Problems2Dokumen48 halamanPractice Problems2vipinkala1100% (1)

- 6 CHDokumen27 halaman6 CHjafariBelum ada peringkat

- Soal AKM 2015Dokumen24 halamanSoal AKM 2015Siti Armayani RayBelum ada peringkat

- Chapter 2 DoneDokumen30 halamanChapter 2 Doneellyzamae quiraoBelum ada peringkat

- Ibf KeyDokumen2 halamanIbf KeyEdelvies Mae BatawangBelum ada peringkat

- October 24 2022 DiscussionDokumen4 halamanOctober 24 2022 Discussionbunniecaronan113003Belum ada peringkat

- Accounting EquationDokumen11 halamanAccounting EquationMahmudul Hassan RohidBelum ada peringkat

- Basic Accounting NotesDokumen17 halamanBasic Accounting NotesAdilrabia rslBelum ada peringkat

- Group 2 Cash Budget N4ba2503Dokumen3 halamanGroup 2 Cash Budget N4ba2503nuraz3169Belum ada peringkat

- Directions:: Assets Liabilities Cash Supplies Equipment Furniture Leasehold Improvements Accounts Payable Notes PayableDokumen9 halamanDirections:: Assets Liabilities Cash Supplies Equipment Furniture Leasehold Improvements Accounts Payable Notes PayablejayBelum ada peringkat

- Financial-Accounting April 2022Dokumen7 halamanFinancial-Accounting April 2022Rupesh SinghBelum ada peringkat

- Cash Flow StatementDokumen9 halamanCash Flow StatementPiyush MalaniBelum ada peringkat

- Retazo WorksheetDokumen6 halamanRetazo Worksheetmendezein24Belum ada peringkat

- DK Goel Solutions Class 12 Accountancy Volume 2 Chapter 5 - Accounting RatiosDokumen2 halamanDK Goel Solutions Class 12 Accountancy Volume 2 Chapter 5 - Accounting RatiosSidh JainBelum ada peringkat

- Accounting Equation & JournalDokumen8 halamanAccounting Equation & JournalShilpa MinhasBelum ada peringkat

- Japc Worksheet AGUST 31, 2017Dokumen6 halamanJapc Worksheet AGUST 31, 2017Dy Ju Arug ALBelum ada peringkat

- Assignment-Self Service LaundryDokumen11 halamanAssignment-Self Service LaundryRowellPaneloSalapare100% (1)

- Cost of Capital 2Dokumen79 halamanCost of Capital 2Mohammed IjasBelum ada peringkat

- ACCT1101 Week 1 Practical SolutionsDokumen4 halamanACCT1101 Week 1 Practical SolutionskyleBelum ada peringkat

- Internal Assignment (April 2022 Examination) Financial Accounting and AnalysisDokumen6 halamanInternal Assignment (April 2022 Examination) Financial Accounting and AnalysisNageshwar SinghBelum ada peringkat

- Figures and Illustrations - Financial RatiosDokumen19 halamanFigures and Illustrations - Financial RatioscamillaBelum ada peringkat

- Session 3-2019Dokumen6 halamanSession 3-2019pankaj tiwariBelum ada peringkat

- Financial Accounting (Bbaw2103)Dokumen10 halamanFinancial Accounting (Bbaw2103)tachaini2727Belum ada peringkat

- Solutions On Capital BudgetingDokumen25 halamanSolutions On Capital BudgetingASH GAMING GamesBelum ada peringkat

- Cash Budget: Aizel Joy A. Tampos 12-ABM A February 5, 2017Dokumen3 halamanCash Budget: Aizel Joy A. Tampos 12-ABM A February 5, 2017AJBelum ada peringkat

- Measures of Leverage: Abhishek SinhaDokumen30 halamanMeasures of Leverage: Abhishek Sinhadev guptaBelum ada peringkat

- Cost of Capital 1Dokumen77 halamanCost of Capital 1vijayadarshini vBelum ada peringkat

- Minimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 YearsDokumen4 halamanMinimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 Yearsjagan pawanismBelum ada peringkat

- fm2 COPY1Dokumen17 halamanfm2 COPY1anksri07Belum ada peringkat

- Lecture 2Dokumen39 halamanLecture 2anksri07Belum ada peringkat

- CRM 3Dokumen4 halamanCRM 3anksri07Belum ada peringkat

- CRM1Dokumen3 halamanCRM1anksri07Belum ada peringkat

- Bhushan Steel LTD.: Margins On Income On Total IncomeDokumen2 halamanBhushan Steel LTD.: Margins On Income On Total Incomeanksri07Belum ada peringkat

- CRM4Dokumen7 halamanCRM4anksri07Belum ada peringkat

- HR PlanningDokumen19 halamanHR Planninganksri07Belum ada peringkat

- Marketing Management - Market SegmentationDokumen26 halamanMarketing Management - Market SegmentationAmit TatedBelum ada peringkat

- Marketing Mix ProjectDokumen8 halamanMarketing Mix Projectanksri07Belum ada peringkat

- Effect of Advertisement On The Buying Behavior of Cosmetics in FemalesDokumen25 halamanEffect of Advertisement On The Buying Behavior of Cosmetics in Femalesanksri07Belum ada peringkat

- FM WCM AnalysisDokumen44 halamanFM WCM Analysisanksri07Belum ada peringkat

- Healthcare Operations Management: Chapter 2. History of Performance ImprovementDokumen20 halamanHealthcare Operations Management: Chapter 2. History of Performance Improvementanksri07Belum ada peringkat

- Group B-2 Operation Management ProjectDokumen17 halamanGroup B-2 Operation Management Projectanksri07Belum ada peringkat

- Recruitment Process of Reliance Life InsuranceDokumen48 halamanRecruitment Process of Reliance Life Insuranceanksri07Belum ada peringkat

- TCSDokumen2 halamanTCSanksri07Belum ada peringkat

- Marketing Mix ProjectDokumen8 halamanMarketing Mix Projectanksri07Belum ada peringkat

- O.M. Projects Instructions - 2013-14Dokumen3 halamanO.M. Projects Instructions - 2013-14anksri07Belum ada peringkat

- WASH ProposalDokumen87 halamanWASH Proposalanksri07100% (1)

- TCSDokumen2 halamanTCSanksri07Belum ada peringkat

- 150 5605Dokumen6 halaman150 5605bhuramacBelum ada peringkat

- Hospital Operations Management and Gandhian IdealsDokumen8 halamanHospital Operations Management and Gandhian Idealsanksri07Belum ada peringkat

- 2009 Jan Om Health 373Dokumen374 halaman2009 Jan Om Health 373anksri07Belum ada peringkat

- IntroductionDokumen17 halamanIntroductionanksri07Belum ada peringkat

- OPFormatWord FY01MWLayoutDokumen23 halamanOPFormatWord FY01MWLayoutanksri07Belum ada peringkat

- Book Review On Ignited Minds FinalDokumen13 halamanBook Review On Ignited Minds Finalanksri07100% (1)

- Book Review On Ignited MindsDokumen13 halamanBook Review On Ignited Mindsanksri07100% (1)

- Single Conductor Re Head InstructionsDokumen14 halamanSingle Conductor Re Head Instructionsanksri07Belum ada peringkat

- UntitledDokumen1 halamanUntitledAshok SiriBelum ada peringkat

- GeologyDokumen2 halamanGeologyanksri07Belum ada peringkat

- Adjective Clauses: Relative Pronouns & Relative ClausesDokumen4 halamanAdjective Clauses: Relative Pronouns & Relative ClausesJaypee MelendezBelum ada peringkat

- Reaction On The 83RD Post Graduate Course On Occupational Health and SafetyDokumen1 halamanReaction On The 83RD Post Graduate Course On Occupational Health and SafetyEdcelle SabanalBelum ada peringkat

- BattleRope Ebook FinalDokumen38 halamanBattleRope Ebook FinalAnthony Dinicolantonio100% (1)

- 4.1 Genetic Counselling 222Dokumen12 halaman4.1 Genetic Counselling 222Sahar JoshBelum ada peringkat

- Rules and IBA Suggestions On Disciplinary ProceedingsDokumen16 halamanRules and IBA Suggestions On Disciplinary Proceedingshimadri_bhattacharje100% (1)

- Dermatome, Myotome, SclerotomeDokumen4 halamanDermatome, Myotome, SclerotomeElka Rifqah100% (3)

- Module 4 Business EthicsDokumen4 halamanModule 4 Business EthicsddddddaaaaeeeeBelum ada peringkat

- 05 The Scriptures. New Testament. Hebrew-Greek-English Color Coded Interlinear: ActsDokumen382 halaman05 The Scriptures. New Testament. Hebrew-Greek-English Color Coded Interlinear: ActsMichaelBelum ada peringkat

- Axis Bank - Hoam LoanDokumen21 halamanAxis Bank - Hoam LoansonamBelum ada peringkat

- Basic Trigonometric FunctionDokumen34 halamanBasic Trigonometric FunctionLony PatalBelum ada peringkat

- Young Entrepreneurs of IndiaDokumen13 halamanYoung Entrepreneurs of Indiamohit_jain_90Belum ada peringkat

- 0606 - s03 - 2 - 0 - QP PENTING KE 2Dokumen8 halaman0606 - s03 - 2 - 0 - QP PENTING KE 2Titin ChayankBelum ada peringkat

- Kierkegaard, S - Three Discourses On Imagined Occasions (Augsburg, 1941) PDFDokumen129 halamanKierkegaard, S - Three Discourses On Imagined Occasions (Augsburg, 1941) PDFtsuphrawstyBelum ada peringkat

- Course-Outline EL 102 GenderAndSocietyDokumen4 halamanCourse-Outline EL 102 GenderAndSocietyDaneilo Dela Cruz Jr.Belum ada peringkat

- MathTextbooks9 12Dokumen64 halamanMathTextbooks9 12Andrew0% (1)

- δ (n) = u (n) - u (n-3) = 1 ,n=0Dokumen37 halamanδ (n) = u (n) - u (n-3) = 1 ,n=0roberttheivadasBelum ada peringkat

- Contents:: Project ProgressDokumen22 halamanContents:: Project ProgressJosé VicenteBelum ada peringkat

- Watchitv Portable: Iptv Expert Analysis Application: Key ApplicationsDokumen5 halamanWatchitv Portable: Iptv Expert Analysis Application: Key ApplicationsBen PoovinBelum ada peringkat

- Art 3-6BDokumen146 halamanArt 3-6BCJBelum ada peringkat

- List of Festivals in India - WikipediaDokumen13 halamanList of Festivals in India - WikipediaRashmi RaviBelum ada peringkat

- World Bank Case StudyDokumen60 halamanWorld Bank Case StudyYash DhanukaBelum ada peringkat

- Dispeller of Obstacles PDFDokumen276 halamanDispeller of Obstacles PDFLie Christin Wijaya100% (4)

- Si493b 1Dokumen3 halamanSi493b 1Sunil KhadkaBelum ada peringkat

- Case StudyDokumen3 halamanCase StudyAnqi Liu50% (2)

- BS Assignment Brief - Strategic Planning AssignmentDokumen8 halamanBS Assignment Brief - Strategic Planning AssignmentParker Writing ServicesBelum ada peringkat

- HRM - Case - British AirwaysDokumen2 halamanHRM - Case - British AirwaysAbhishek Srivastava100% (1)

- Pitch PDFDokumen12 halamanPitch PDFJessa Mae AnonuevoBelum ada peringkat

- Servicenow Rest Cheat SheetDokumen3 halamanServicenow Rest Cheat SheetHugh SmithBelum ada peringkat

- A Research Presented To Alexander T. Adalia Asian College-Dumaguete CampusDokumen58 halamanA Research Presented To Alexander T. Adalia Asian College-Dumaguete CampusAnn Michelle PateñoBelum ada peringkat

- Natural Language Processing Projects: Build Next-Generation NLP Applications Using AI TechniquesDokumen327 halamanNatural Language Processing Projects: Build Next-Generation NLP Applications Using AI TechniquesAnna BananaBelum ada peringkat