BR Act 1949

Diunggah oleh

dranita@yahoo.comJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

BR Act 1949

Diunggah oleh

dranita@yahoo.comHak Cipta:

Format Tersedia

Introduction

The Banking companies act, presently known as banking regulation act was

enacted owing to safeguard the interest of depositors, control abuse of power

by some bank personnel controlling the banks in particular and to the

interest of Indian economy in general.

The Banking Regulation Act was passed as the Banking Companies Act 1949

and came into force w.e.f 16.3.49. Subsequently it was changed to Banking

Regulations Act 1949 wef 01.03.66.

However, it should be remembered that this act does not supersede the

provision of companies act or any other law for the time being in force in

respect of banking business.

1. Definition of Banking.

2. Form of Business.

3. Provision of Capital

4. Management

5. Maintenance of Liquid Assets.

6. Licensing of Banks.

7. Opening of New Banks.

8. Provision Regarding Loans and Advances.

9. Inspection of Banks.

10.Powers of the Reserve Bank of India.

11.Returns to Be Submitted.

12.Acquisition of Business.

13.Mergers/Amalgamations.

14.Winding up of Banking Companies.

Banking:

Sec 5 (b) of the Act defines Banking as,

Accepting for the purpose of lending or investment, of deposits of money

from the public, repayable on demand or other wise, and withdrawable by

cheque , draft, order or otherwise.

Banking Company:

Sec 5 (c) of the Act defines Banking as,

A company which transacts the business of banking in India.

Banks can only do the business which is mentioned u/s 5 (c) and 6 of the Act.

It consist of :-

1. Main Functions/Business.

2. Subsidiary functions/Business.

Main Functions

1. The borrowing , raising or taking up money.

2. The lending of money with or without security.

3. The granting and issuing of letters of credit or various

kinds, travelers cheque etc.

4. Drawing, making, accepting, discounting, buying, selling,

collecting, and dealing in bills of exchange, hundies,

promissory notes, coupons etc.

5. Buying, selling, and dealing in bullion/species.

6. The buying and selling of foreign exchange including

foreign bank notes.

The acquiring, holding, issuing on commission ,

underwriting and dealing in stock, funds, shares,

debentures, bonds, securities, and investment of all kinds.

The purchasing and selling of bonds, scripts, and other

forms of securities on behalf of constituents or others.

The negotiating of loans and advances.

The receiving of all kinds of loans, scripts or valuables or

deposit or for safe custody or otherwise.

The providing of safe deposit vaults.

The collecting and transmitting of money and securities.

Subsidiary Functions/Business:

1. It may act as an agent of the government, local

authority or person.

2. It may contract for public and private loans and

negotiate and issue the same.

3. Effecting, insuring, guaranteeing, underwriting, and

participating in managing and carrying out of any issue,

public or private.

4. Carrying on agency business of any description.

5. Carrying on and transacting every kind of guarantee

and indemnity business.

6. Managing, selling and realizing any property which

may come into its possession in satisfaction of any of its

claims

Secondary Functions

7. It may acquire hold and deal with any property or

any right or title or interest in any such property

which may form the security for any loan or advance.

8. It may undertake and execute trusts.

9. It can undertake the administration of estates as

executor, trustee or otherwise.

10. It may establish, support and aid associations ,

institutions , funds , trusts etc for the benefits of its

present and past employees and may grant money

for charitable purposes.

1. A bank cannot carrying on trading activities. (Sec 8)

2. It cannot hold any immovable property except for its

own use exceeding 7 years.(Sec 9)

3. Prohibition of employment of managing agents and

restrictions on certain forms of employment .(Sec 10)

Management:

According to Sec 10 A, it has to constitute the board of directors in such a way

that not less than 51 % of the total number of members consist of,

a) have special knowledge or practical experience in Accountancy,

agriculture , rural economy, banking, economics and law. At least 2 of them

have in cooperation and small scale industry.

b) they shall not have any substantial interest or connection with anyone

of any company or firm.

Any director of the company can hold the office continuously for the period

not exceeding 8 years.

Chairman:

It should have a Director as its whole time or part time chairman

of the banking company. He can hold the office for a period not exceeding 5

years.

Statutory liquidity ratio:

According to Sec 24, Every banking company in India is required to maintain

cash, gold, or unencumbered approved security, valued at a price not

exceeding the current market price and not less than 23 % of its time and

demand liabilities.

Cash Reserve:

Sec 18 of the Act lays down that every banking company should maintain

4.25% of total of its time and demand deposits in the form of cash reserves

with RBI.

Difference Between SLR and CRR:

SLR restricts the banks leverage in pumping more money into

the economy. On the other hand, CRR, or cash reserve ratio, is the portion of

deposits that the banks have to maintain with the Central Bank to reduce liquidity

in economy. Thus CRR controls liquidity in economy while SLR regulates credit

growth in the Economy.

The other difference is that to meet SLR, banks can use cash,

gold or approved securities whereas with CRR it has to be only cash. CRR is

maintained in cash form with central bank, whereas SLR is money deposited in

govt. securities.CRR is used to control inflation.

1. Election of New Directors.

2. Maintaining Cash Reserves.

3. Power to issue license to new banks.

4. Power to cancel license.

5. Power to give permission for starting new branches.

6. Power of inspection.

7. Power to issue directions.

8. Power to control management.

9. Power to advice banks.

10. Power to call for information.

11. Power to grant moratorium. (Suspension of specific activity)

12. Power to control advances.

13. Power to appoint liquidator.

Every banking company in India should obtain a license from the RBI

before commencing the business. It will grant license only after the detailed

inspection considering so many factors.

It should obtain prior permission from Reserve Bank of India for opening

new place of business either in or abroad and also for changing the location.

Financial sector Reforms

To develop the financial sector especially banking sector in India,

the government of India constituted a nine member team under the

chairmanship of Sri.Narasimham (Former governor of RBI). The committee

tabled their report in the parliament on 17

th

December 1991.

The objectives are:

1. To examine the existing structure of the financial system and its different

components.

2. To suggest proposals for improving the efficiency and effectiveness of the

existing system.

3. To review the existing supervisory arrangement relating to the various entities

in the financial sector and make recommendations for make sure appropriate

and effective supervision.

4. To evaluate the existing legislative structure and to suggest necessary

amendments for implementing the recommendations.

Key Suggestions:

Reduction in CRR and SLR

Phasing out Directed Credit Programmes

Interest Rate Deregulation

Structural Reorganization of Banks

Change in the Control Structure of Banks

Establishment of ARF tribunal

Change in Classification of Assets

Allowing Banks to raise Capital

Liberalization of Capital Markets

Reduction in the SLR and CRR:

One of the most important recommendations made by

the committee was a drastic reduction in CRR and SLR

Committee noted that the high amount of CRR and SLR

was hindering the productivity of Banks considerably

SLR was recommended to reduce from 38.5 % to 25%

and CRR was recommended to be reduced to 15% to a

range of 3-5% by 1996-97

Directed Credit Programs:

The committee acknowledged the role of these programs in

extending the reach of Banking system to the neglected

sectors of the economy

However, it also called for re-examination of the present

relevance of these programs, especially for those sectors

which had become self-sufficient

Accordingly, the committee proposed that the directed

credit committees should be phased out

It also called for a re-defining of the priority sector

Interest Rate Deregulation:

The Committee observed that the prevailing structure

of administered rates was highly complex and rigid

and called for deregulating it so that it reflects the

emerging market conditions

However, it warned against instant deregulation and

suggested that the rates be brought in line with the

market rates gradually over a period of time

The Committee also recommended phasing out

Concessional Interest rates

Structural Reorganization of Banks:

In regard to the structure of the Banking System, The

Committee believed that the structure should consist of:

3-4 Banks (Including SBI) becoming International Banks

8 to 10 national banks with a network of branches

throughout the country engaged in 'universal' banking

Local banks whose operations would be generally confined

to a specific region

Rural banks (including RRBs) whose operations would be

confined to the rural areas and whose business would be

predominantly engaged in financing of agriculture and

allied activities

The move towards this revised system should be market

driven and based on profitability considerations and

brought about through a process of mergers and

acquisitions

The Committee also called on the Government to stop

further nationalization of Banks

It also proposed that there be no bar to start new banks in

the private sector being set up provided they conform to the

start-up capital and other requirements

It also called for liberalizing the process of foreign banks

entering the country

Control of Banks:

The committee recommended that RBI should be the sole

authority in-charge of controlling the Banks

It also called for greater autonomy to be given to Public

sector banks.

The Committee believed that the internal organization

should be the prerogative of the management of the

Individual Banks

For the medium and large national banks the Committee

proposed a three-tier structure in terms of head office, a

Zonal office and branches

For very large banks, a four tier-structure was proposed,

with the addition of a regional office along with the three

mentioned above

Establishment of ARF tribunal:

Those days, the proportion of bad debts and non-performing

assets of the public sector banks and Development financial

institutes was very high.

The committee recommended the establishment of an Asset

Reconstruction Fund (ARF)

The suggestion was that the ARF would take over the

proportion of the bad and doubtful debts from the banks

and financial institutes.

All bad and doubtful debts of the banks were to be

transferred in a phased manner to ensure smooth and

effective functioning of the ARF

The committee also suggested the formation of special

tribunals to recover loans granted by the bank

Liberalisation of Capital Markets:

The Committee suggested that there should be no

need to obtain any prior permission to issue capital

It also called for the office of the Controller of capital

issues to be abolished

The Committee also recommended that the Capital

markets should be opened for Foreign Portfolio

Investments

Effect of Recommendations and Suggestions:

1. Reduction in SLR and CRR:

The government announced its decision to reduce the SLR in stages over

a three year from 39.5 % to 25% and to reduce the CRR over a four year

period to the level less than 10.

2. Interest Rate Policy:

The banks will have the freedom to set their interest rates. This type of

deregulation of interest rate is implemented to stimulate healthy competition

among banks and to encourage their operational efficiency.

3. Prudential Accounting Standards:

A prudential system of income recognition, asset classification and

provisioning of bad dept was introduced.

Anda mungkin juga menyukai

- Banking Regulation Act 1949Dokumen28 halamanBanking Regulation Act 1949m_dattaias83% (6)

- Debt Reduction Calculator - 20CRDokumen7 halamanDebt Reduction Calculator - 20CRSuhailBelum ada peringkat

- Banking and Allied Laws ReviewerDokumen25 halamanBanking and Allied Laws Revieweramun dinBelum ada peringkat

- Basics of InsuranceDokumen26 halamanBasics of Insurancedranita@yahoo.comBelum ada peringkat

- Russell1000FinancialServices Membership ListDokumen4 halamanRussell1000FinancialServices Membership Listmerc2Belum ada peringkat

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDokumen2 halamanUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)

- Banking LawDokumen19 halamanBanking LawAmado Vallejo IIIBelum ada peringkat

- Manual of Rules and Regulations For Cooperatives With Savings and Credit ServicesDokumen24 halamanManual of Rules and Regulations For Cooperatives With Savings and Credit ServicesRamel Goles100% (4)

- Final Accounts of Banking CompaniesDokumen78 halamanFinal Accounts of Banking Companiespushkar73% (26)

- Classification of VehiclesDokumen35 halamanClassification of Vehiclesdranita@yahoo.com0% (1)

- Solved Pacific Coast Fisheries Corporation Issued More Than 5 Percent ofDokumen1 halamanSolved Pacific Coast Fisheries Corporation Issued More Than 5 Percent ofAnbu jaromiaBelum ada peringkat

- Synopsis: T.Y. Banking & Insurance Core Banking SolutionDokumen49 halamanSynopsis: T.Y. Banking & Insurance Core Banking SolutionjignaparmarBelum ada peringkat

- International Financial Market InstrumentsDokumen21 halamanInternational Financial Market InstrumentsJASVEER S86% (21)

- Banking Laws SummaryDokumen13 halamanBanking Laws SummaryTwentyBelum ada peringkat

- Characteristics of Bank Regulations Act 1949Dokumen8 halamanCharacteristics of Bank Regulations Act 1949ankita16_wlsn100% (1)

- Theories of Exchange RateDokumen37 halamanTheories of Exchange Ratedranita@yahoo.comBelum ada peringkat

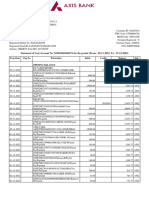

- Account Statement PDFDokumen12 halamanAccount Statement PDFSudip MukherjeeBelum ada peringkat

- Study of Risk Management in Selected Indian Banks: Synopsis ONDokumen7 halamanStudy of Risk Management in Selected Indian Banks: Synopsis ONRavi JoshiBelum ada peringkat

- Current & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj EtahDokumen6 halamanCurrent & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj Etahvishnu guptaBelum ada peringkat

- Banking FINALS ReviewerDokumen20 halamanBanking FINALS ReviewerKringle Lim - DansalBelum ada peringkat

- KYC NormsDokumen38 halamanKYC Normsdranita@yahoo.com100% (2)

- Corporate Banking: 11/04/21 Om All Rights Reserved. 1Dokumen180 halamanCorporate Banking: 11/04/21 Om All Rights Reserved. 1Pravah ShuklaBelum ada peringkat

- Islamic Banking And Finance for Beginners!Dari EverandIslamic Banking And Finance for Beginners!Penilaian: 2 dari 5 bintang2/5 (1)

- Banking Regulation Act 1949Dokumen5 halamanBanking Regulation Act 1949Rushikesh GaikwadBelum ada peringkat

- Banking Regulation Act 1949: 16 March 1949Dokumen21 halamanBanking Regulation Act 1949: 16 March 1949Sai AdarshBelum ada peringkat

- Banking Regulation Act 1949: 16 March 1949Dokumen26 halamanBanking Regulation Act 1949: 16 March 1949Preeti SinghBelum ada peringkat

- Objectives of Bank RegulationDokumen15 halamanObjectives of Bank RegulationParul RamaniBelum ada peringkat

- New Microsoft Word DocumentDokumen18 halamanNew Microsoft Word DocumentAnkita DharodBelum ada peringkat

- Banking Regulation Act 1949 & Role of RBI: Amiya Kumar Sahoo Innovation-The Business SchoolDokumen30 halamanBanking Regulation Act 1949 & Role of RBI: Amiya Kumar Sahoo Innovation-The Business SchoolGopal PrasadBelum ada peringkat

- Banking Regulation ActDokumen19 halamanBanking Regulation Actgattani.swatiBelum ada peringkat

- Unit - 1: Legal Framework of Regulation of BanksDokumen71 halamanUnit - 1: Legal Framework of Regulation of BanksRajesh GuptaBelum ada peringkat

- Cma Final - Banking LawDokumen25 halamanCma Final - Banking Lawray100% (1)

- Principles and Practices of BankingDokumen24 halamanPrinciples and Practices of BankingVasu DevanBelum ada peringkat

- Summary of Y. H. Malegam Committee Report 2011Dokumen5 halamanSummary of Y. H. Malegam Committee Report 2011Alok SinghBelum ada peringkat

- Legal FrameworkDokumen17 halamanLegal Frameworkpoojaguptainida1Belum ada peringkat

- 20004ipcc Paper5 Cp6.CrackedDokumen122 halaman20004ipcc Paper5 Cp6.CrackedNitteshdas ChatergiBelum ada peringkat

- Khanna Committee IonsDokumen15 halamanKhanna Committee Ionsvikas1978Belum ada peringkat

- Final Accounts of Banking CompaniesDokumen28 halamanFinal Accounts of Banking CompaniesAmit_Agarwal_7219Belum ada peringkat

- Module-III Banking Regulation: Course OutlineDokumen36 halamanModule-III Banking Regulation: Course OutlineSanjay ParidaBelum ada peringkat

- Financial Statements of Banking CompaniesDokumen122 halamanFinancial Statements of Banking CompaniesBiswajit PaulBelum ada peringkat

- Enhanced Regulatory Power To Supersede Board of DirectorsDokumen6 halamanEnhanced Regulatory Power To Supersede Board of DirectorsAnonymous uurrtSaBelum ada peringkat

- Banking Regulations: Presented by Suresha, Uedesh, Unni, Ujjwal, Vjay, Vinoth, VirankumarDokumen27 halamanBanking Regulations: Presented by Suresha, Uedesh, Unni, Ujjwal, Vjay, Vinoth, VirankumarVinoth KumaravadivelBelum ada peringkat

- Session 04Dokumen4 halamanSession 04KEERAT SIDHUBelum ada peringkat

- Banking Regulation Act, 1949Dokumen8 halamanBanking Regulation Act, 1949Animesh BawejaBelum ada peringkat

- 12 - Chapter 6, Mergers and Acquisitions in The Indian Banking SectorDokumen6 halaman12 - Chapter 6, Mergers and Acquisitions in The Indian Banking SectorRakesh Prabhakar ShrivastavaBelum ada peringkat

- All About BankingDokumen31 halamanAll About BankinggoyaltarunBelum ada peringkat

- Banking Law and Practice Units-2Dokumen52 halamanBanking Law and Practice Units-2പേരില്ലോക്കെ എന്തിരിക്കുന്നുBelum ada peringkat

- Npa Management ToolsDokumen11 halamanNpa Management ToolsSK MishraBelum ada peringkat

- CM - CHPT 1 NOTESDokumen12 halamanCM - CHPT 1 NOTESPranav ChandaneBelum ada peringkat

- Discussion On Relevant Banking Laws - 231123 - 131341Dokumen29 halamanDiscussion On Relevant Banking Laws - 231123 - 131341Christine BernalBelum ada peringkat

- Banking Sector ReformsDokumen6 halamanBanking Sector ReformsM Abdul MoidBelum ada peringkat

- Unit-2 Notes Financial Market Chinmay MamDokumen28 halamanUnit-2 Notes Financial Market Chinmay Mamvivek singhBelum ada peringkat

- Security and Exchange Board of IndiaDokumen7 halamanSecurity and Exchange Board of IndiaBharath BangBelum ada peringkat

- The Securities and ExchangeDokumen22 halamanThe Securities and ExchangeHappy AnthalBelum ada peringkat

- General Knowledge Today - 22 PDFDokumen2 halamanGeneral Knowledge Today - 22 PDFniranjan_meharBelum ada peringkat

- Bank Regulation: Citations VerificationDokumen5 halamanBank Regulation: Citations Verificationsbajaj23Belum ada peringkat

- Bank Company Act, 1991Dokumen57 halamanBank Company Act, 1991Akhter Uj Jaman GalibBelum ada peringkat

- Public Sector BanksDokumen47 halamanPublic Sector Bankspoorvi agrawalBelum ada peringkat

- Banking LawsDokumen10 halamanBanking LawsJulius MilaBelum ada peringkat

- SEBI Regulations For Merchant BankersDokumen3 halamanSEBI Regulations For Merchant Bankerspraveena DBelum ada peringkat

- 18MBAFM301: Mr. Varun K Assistant Professor Department of Business Administration MITE, MoodbidriDokumen36 halaman18MBAFM301: Mr. Varun K Assistant Professor Department of Business Administration MITE, MoodbidriHariprasad bhatBelum ada peringkat

- Credit Monitoring ArrangementDokumen15 halamanCredit Monitoring ArrangementAbhi_IMK100% (1)

- Financial Sector ReformsDokumen15 halamanFinancial Sector Reformslearnerme129Belum ada peringkat

- The Securities and Exchange Board of India (SEBI)Dokumen33 halamanThe Securities and Exchange Board of India (SEBI)kharyarajulBelum ada peringkat

- Banking Sector ReformsDokumen27 halamanBanking Sector ReformsArghadeep ChandaBelum ada peringkat

- Internship Report On Kanchepuram Central Cooperative BankDokumen28 halamanInternship Report On Kanchepuram Central Cooperative BankSanjay Soupboy50% (2)

- Holdco Regulation (Cleaned) - Final For Issuance 3Dokumen27 halamanHoldco Regulation (Cleaned) - Final For Issuance 3idrisngrBelum ada peringkat

- SEBI Act, 1992Dokumen26 halamanSEBI Act, 1992saif aliBelum ada peringkat

- SEBI - Securities and Exchange Board of IndiaDokumen6 halamanSEBI - Securities and Exchange Board of IndiaRAVI RAUSHAN JHABelum ada peringkat

- Unit 2 - The Bank Regulatory EnvironmentDokumen60 halamanUnit 2 - The Bank Regulatory EnvironmentBikash BhattaraiBelum ada peringkat

- Remaining of Banking LawDokumen17 halamanRemaining of Banking LawKillspreeBelum ada peringkat

- Banking Regulation Act 1949Dokumen35 halamanBanking Regulation Act 1949sidd2450Belum ada peringkat

- Central Bank of IndiaDokumen5 halamanCentral Bank of Indiagauravbansall567Belum ada peringkat

- Offer Curves & Terms of TradeDokumen19 halamanOffer Curves & Terms of Tradedranita@yahoo.com0% (1)

- Regional Rural BanksDokumen6 halamanRegional Rural Banksdranita@yahoo.comBelum ada peringkat

- Small Bowel Bleeding Aug2015Dokumen23 halamanSmall Bowel Bleeding Aug2015dranita@yahoo.comBelum ada peringkat

- Carnosine BookletDokumen40 halamanCarnosine Bookletdranita@yahoo.comBelum ada peringkat

- Life & General InsuranceDokumen59 halamanLife & General Insurancedranita@yahoo.comBelum ada peringkat

- INCOTERMS and Export ProcedureDokumen40 halamanINCOTERMS and Export Proceduredranita@yahoo.comBelum ada peringkat

- Green & White RevolutionDokumen16 halamanGreen & White Revolutiondranita@yahoo.com100% (3)

- Foreign CapitalDokumen15 halamanForeign Capitaldranita@yahoo.comBelum ada peringkat

- Fera and FemaDokumen18 halamanFera and Femadranita@yahoo.comBelum ada peringkat

- Export Marketing1Dokumen38 halamanExport Marketing1dranita@yahoo.comBelum ada peringkat

- Matsushita Case StudyDokumen4 halamanMatsushita Case Studydranita@yahoo.comBelum ada peringkat

- Downloadstatement 2Dokumen3 halamanDownloadstatement 2aamir shaikhBelum ada peringkat

- Audit of Cash - Exercise 1 (Solution)Dokumen10 halamanAudit of Cash - Exercise 1 (Solution)Aby ReedBelum ada peringkat

- Ifr 11 23 2019 PDFDokumen108 halamanIfr 11 23 2019 PDFKaraBelum ada peringkat

- Sabeetha Final ProjectDokumen52 halamanSabeetha Final ProjectPriyesh KumarBelum ada peringkat

- Address ProofDokumen4 halamanAddress ProofYash GaurkarBelum ada peringkat

- Challan No. 143767 Challan No. 143767 Challan No. 143767Dokumen1 halamanChallan No. 143767 Challan No. 143767 Challan No. 143767Hassam AhmadBelum ada peringkat

- The Differences Between Japanese and Chinese Banking SystemDokumen5 halamanThe Differences Between Japanese and Chinese Banking SystemwainhuiBelum ada peringkat

- Mba 3042F: Management of Banks Cia 1: Description: Financial Performance Analysis of A Central Bank and AXIS BankDokumen15 halamanMba 3042F: Management of Banks Cia 1: Description: Financial Performance Analysis of A Central Bank and AXIS BankNehal SharmaBelum ada peringkat

- Internship ReportDokumen63 halamanInternship Reportimislamian0% (1)

- Opening PageDokumen10 halamanOpening PageHd SecretariatBelum ada peringkat

- Bajaj FinservDokumen3 halamanBajaj FinservManmeet KumarBelum ada peringkat

- Statement of Axis Account No:923010035321735 For The Period (From: 15-06-2023 To: 15-07-2023)Dokumen2 halamanStatement of Axis Account No:923010035321735 For The Period (From: 15-06-2023 To: 15-07-2023)Usha DeviBelum ada peringkat

- Quote - Q2024268Dokumen2 halamanQuote - Q2024268SinikiweBelum ada peringkat

- Bank Statement: Account Number: 19267853 Sort Code: 040605 Statement For: 1 Nov 2023 - 30 Nov 2023Dokumen1 halamanBank Statement: Account Number: 19267853 Sort Code: 040605 Statement For: 1 Nov 2023 - 30 Nov 2023aamir zahoorBelum ada peringkat

- Reading Material Dec2020Dokumen14 halamanReading Material Dec2020jyottsnaBelum ada peringkat

- 11 Quiz 1 (Trade)Dokumen2 halaman11 Quiz 1 (Trade)Melanie PermijoBelum ada peringkat

- Working Capital Policy and ManagementDokumen64 halamanWorking Capital Policy and ManagementUy SamuelBelum ada peringkat

- Kuk 235Dokumen24 halamanKuk 235Kuk-Punjabi SamacharBelum ada peringkat

- الشيك الالكترونيDokumen14 halamanالشيك الالكترونيMalak TerbecheBelum ada peringkat

- CSs List For Upload On WebsiteDokumen153 halamanCSs List For Upload On WebsitePrincespragti PatilBelum ada peringkat

- Passbookstmt PDFDokumen4 halamanPassbookstmt PDFGarth GBelum ada peringkat