Country Risk

Diunggah oleh

SanaFatima0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

38 tayangan42 halamanRisk management involves identifying all significant risks and evaluating potential frequency and severity of losses. The size and structure of the country's external debt in relation to its economy is a key factor. The role of foreign sources of capital in meeting the nation's financing needs is also an important consideration.

Deskripsi Asli:

Judul Asli

11. Country Risk

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPTX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniRisk management involves identifying all significant risks and evaluating potential frequency and severity of losses. The size and structure of the country's external debt in relation to its economy is a key factor. The role of foreign sources of capital in meeting the nation's financing needs is also an important consideration.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

38 tayangan42 halamanCountry Risk

Diunggah oleh

SanaFatimaRisk management involves identifying all significant risks and evaluating potential frequency and severity of losses. The size and structure of the country's external debt in relation to its economy is a key factor. The role of foreign sources of capital in meeting the nation's financing needs is also an important consideration.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 42

Country Risk

Types of Risk Facing Businesses

Price risk Credit risk Pure risk

Output price risk Input price risk

Commodity price risk

Exchange rate risk

Interest rate risk

Damage to assets

Legal liability

Worker injury

Employee benefits

Enterprise Risk Management

The holistic approach to assessing, measuring

and managing the different types of risk to

which an organisation is exposed.

Operational Risk

Credit Risk

Business Risk

Market Risk

Country risk

Risk Management

For any type of risk, the risk management

process involves a number of key steps

1. Identify all significant risks

2. Evaluate potential frequency and severity of losses

3. Develop and select methods for managing risk

4. Implement risk management methods chosen

5. Monitor performance and suitability of risk management

methods and strategies on an ongoing basis

Risk Management Methods

Three main methods of managing risk

Loss control

Loss financing

Internal risk reduction

Loss control and internal risk reduction usually

involve decisions to invest (or forego investing)

resources to reduce expected losses

Loss financing decisions relate to how to pay for

losses if they do occur

Factors Affecting Country Risk

Macroeconomic Factors

The first of these factors is the size and structure of the

countrys external debt in relation to its economy.

More specifically:

The current level of short-term debt and the potential

effect that a liquidity crisis would have on the ability of

otherwise creditworthy borrowers in the country to

continue servicing their obligations.

To the extent the external debt is owed by the public

sector, the ability of the government to generate sufficient

revenues, from taxes and other sources, to service its

obligations.

The condition and vulnerability of the countrys current

account is also an important consideration, including:

The level of international reserves held by Central Bank

The importance of commodity exports as a source of

revenue, the existence of any price stabilization

mechanisms, and the countrys vulnerability to a downturn

in either its export markets or the price of an exported

commodity.

The potential for sharp movements in exchange rates and

the effect on the relative price of the countrys imports and

exports. (Iceland)

The role of foreign sources of capital in meeting the

countrys financing needs is another important

consideration for country risk, including:

The countrys access to international financial markets and the

potential effects of a loss of market liquidity. (Greece)

The countrys relationships with private sector creditors, including

the existence of loan commitments and the attitude among bankers

toward further lending to borrowers in the country.

The countrys current standing with multilateral and official creditors,

including the ability of the country to qualify for and sustain an

International Monetary Fund (IMF) or other suitable economic

adjustment program.

The trend in foreign investments and the countrys ability to attract

foreign investment in the future.

The opportunities for privatization of government-owned entities.

Past experience has highlighted the importance

of a number of other important

macroeconomic considerations, including:

The degree to which the economy of the country may be

adversely affected through the contagion of problems in

other countries.

The size and condition of the countrys banking system,

including the adequacy of the countrys system for bank

supervision and any potential burden of contingent

liabilities that a weak banking system might place on the

government.

The extent to which state-directed lending or other

government intervention may have adversely affected the

soundness of the countrys banking system, or the structure

and competitiveness of the favoured industries or

companies.

Social, Political, and Legal Climate

The analysis of country risk should also take into

consideration the countrys social, political, and legal

climate including:

The countrys natural and human resource potential.

The willingness and ability of the government to

recognize economic or budgetary problems and

implement appropriate remedial action.

The degree to which political or regional factionalism

or armed conflicts are adversely affecting government

of the country.

Any trends toward government-imposed price, interest

rate, or exchange controls

Social, Political, and Legal Climate

The degree to which the countrys legal system can be relied

upon to fairly protect the interests of foreign creditors and

investors.

The accounting standards in the country and the reliability and

transparency of financial information.

The extent to which the countrys laws and government policies

protect parties in electronic transactions and promote the

development of technology in a safe and sound manner.

The extent to which government policies promote the effective

management of the institutions exposures.

The level of adherence to international legal and business

practice standards

Institution-Specific Factors

Finally, an institutions analysis of country risk should take into

consideration factors relating to the nature of its actual (or approved)

exposures in the country including, for example:

The institutions business strategy and its exposure management plans for

the country.

The mix of exposures and commitments, including the types of

investments and borrowers, the distribution of maturities, the types and

quality of collateral, the existence of guarantees, whether exposures are

held for trading or investment, and any other distinguishing characteristics

of the portfolio.

The economic outlook for any specifically targeted industries within the

country.

The degree to which political or economic developments in a country are

likely to affect the institutions chosen lines of business in the country.

For instance, the unemployment rate or changes in local bankruptcy laws

may affect certain activities more than others.

Institution-Specific Factors

For an institution involved in capital markets, its susceptibility to

changes in value based on market movements. As the market value of

claims against a foreign counterparty rise, the counterparty may

become less financially sound, thus increasing the risk of nonpayment.

This is especially true with regard to over-the-counter derivative

instruments.

The degree to which political or economic developments are likely to

affect the credit risk of individual counterparties in the country.

For example, foreign counterparties with healthy export markets or

whose business is tied closely to supplying manufacturing entities in

developed countries may have significantly less exposure to the local

countrys economic disruptions than do other counterparties in the

country.

The institutions ability to effectively manage its exposures in a country

through in-country or regional representation, or by some other

arrangement that ensures the timely reporting of, and response to,

any problems.

Foreign Direct Investment Theory

and Political Risk

Ch 18

18-15

Sustaining and Transferring

Competitive Advantage

In deciding whether to invest abroad, management must first determine

whether the firm has a sustainable competitive advantage that enables it

to compete effectively in the home market.

The competitive advantage must be firm-specific, transferable, and

powerful enough to compensate the firm for the potential disadvantages

of operating abroad (foreign exchange risks, political risks, and increased

agency costs).

There are several competitive advantages enjoyed by MNEs.

18-16

Sustaining and Transferring

Competitive Advantage

Economies of scale and scope:

Can be developed in production, marketing, finance, research and

development, transportation, and purchasing

Large size is a major contributing factor (due to international and/or domestic

operations)

Managerial and marketing expertise:

Includes skill in managing large industrial organizations (human capital and

technology)

Also encompasses knowledge of modern analytical techniques and their

application in functional areas of business

18-17

Sustaining and Transferring

Competitive Advantage

Advanced technology:

Includes both scientific and engineering skills

Financial strength:

Demonstrated financial strength by achieving and

maintaining a global cost and availability of capital

This is a critical competitive cost variable that

enables them to fund FDI and other foreign

activities

18-18

Sustaining and Transferring

Competitive Advantage

Differentiated products:

Firms create their own firm-specific advantages by producing and

marketing differentiated products

Such products originate from research-based innovations or heavy

marketing expenditures to gain brand identification

Competitiveness of the home market:

A strongly competitive home market can sharpen a firms competitive

advantage relative to firms located in less competitive ones

This phenomenon is known as the diamond of national advantage and

has four components

18-19

Where to Invest?

The decision about where to invest abroad is influenced by behavioral factors.

The decision about where to invest abroad for the first time is not the same

as the decision about where to reinvest abroad.

In theory, a firm should identify its competitive advantages, and then search

worldwide for market imperfections and comparative advantage until it finds

a country where it expects to enjoy a competitive advantage large enough to

generate a risk-adjusted return above the firms hurdle rate.

In practice, firms have been observed to follow a sequential search pattern as

described in the behavioral theory of the firm.

18-20

Where to Invest?

The decision to invest abroad is influenced by behavioral factors.

The decision about where to invest abroad for the first time is not the

same as the decision about where to reinvest abroad.

In theory, a firm should identify its competitive advantages. Then it should

search worldwide for market imperfections and comparative advantage

until it finds a country where it expects to enjoy a competitive advantage

large enough to generate a risk-adjusted return above the firms hurdle

rate.

18-21

Exhibit 18.3 The FDI Sequence: Foreign Presence and

Foreign Investment

18-22

How to Invest Abroad:

Modes of Foreign Investment

Exporting versus production abroad:

There are several advantages to limiting a firms activities to

exports as it has none of the unique risks facing FDI, Joint Ventures,

strategic alliances and licensing with minimal political risks

The amount of front-end investment is typically lower than other

modes of foreign involvement

Some disadvantages include the risks of losing markets to imitators

and global competitors

18-23

How to Invest Abroad:

Modes of Foreign Investment

Licensing and management contracts versus control of assets

abroad:

Licensing is a popular method for domestic firms to profit from foreign

markets without the need to commit sizeable funds

However, there are disadvantages which include:

License fees are lower than FDI profits

Possible loss of quality control

Establishment of a potential competitor in third-country markets

Risk that technology will be stolen

18-24

How to Invest Abroad:

Modes of Foreign Investment

Management contracts are similar to licensing,

insofar as they provide for some cash flow from a

foreign source without significant foreign

investment or exposure

Management contracts probably lessen political

risk because the repatriation of managers is easy

International consulting and engineering firms

traditionally conduct their foreign business on the

basis of a management contract

18-25

How to Invest Abroad:

Modes of Foreign Investment

Joint venture versus wholly owned subsidiary:

A joint venture is here defined as shared ownership in a foreign

business

Some advantages of a MNE working with a local joint venture partner

are:

Better understanding of local customs, mores and

institutions of government

Providing for capable mid-level management

Some countries do not allow 100% foreign ownership

Local partners have their own contacts and reputation

which aids in business

18-26

How to Invest Abroad:

Modes of Foreign Investment

However, joint ventures are not as common as 100%-owned foreign

subsidiaries as a result of potential conflicts or difficulties including:

Increased political risk if the wrong partner is chosen

Divergent views about the need for cash dividends, or

the best source of funds for growth (new financing

versus internally generated funds)

Transfer pricing issues

Difficulties in the ability to rationalize production on a

worldwide basis

18-27

How to Invest Abroad:

Modes of Foreign Investment

Greenfield investment versus acquisition:

A greenfield investment is defined as establishing a

production or service facility starting from the ground

up

Compared to a greenfield investment, a cross-border

acquisition is clearly much quicker and can also be a

cost effective way to obtain technology and/or brand

names

Cross-border acquisitions are however, not without

pitfalls, as firms often pay too high a price or utilize

expensive financing to complete a transaction

18-28

How to Invest Abroad:

Modes of Foreign Investment

The term strategic alliance conveys different meanings to different

observers.

In one form of cross-border strategic alliance, two firms exchange a share

of ownership with one another.

A more comprehensive strategic alliance, partners exchange a share of

ownership in addition to creating a separate joint venture to develop and

manufacture a product or service

Another level of cooperation might include joint marketing and servicing

agreements in which each partner represents the other in certain markets.

18-29

Foreign Direct Investment Originating in

Developing Countries

In recent years, developing countries with

large home markets and some entrepreneurial

talent have spawned a large number of rapidly

growing and profitable MNEs

These MNEs have not only captured large

shares of their home markets, but also have

tapped global markets where they are

increasingly competitive

18-30

Foreign Direct Investment Originating in

Developing Countries

The Boston Consulting Group has identified six

major corporate strategies employed by these

emerging market MNEs

Taking brands global

Engineering to innovation

Leverage natural resources

Export business model

Acquire offshore assets

Target a niche

18-31

Defining Political Risk

In order for an MNE to identify, measure, and

manage its political risks, it needs to define

and classify these risks which include

Firm-specific risks

Country-specific risks

Global-specific risks

18-32

Assessing Political Risk

At the macro level, prior to under-taking

foreign direct investment, firms attempt to

assess a host countrys political stability and

attitude toward foreign investors

At the micro level, firms analyze whether their

firm-specific activities are likely to conflict

with host-country goals as evidenced by

existing regulations

18-33

Predicting Risks

Predicting firm-specific risk

Different foreign firms operating within the same

country may have very different degrees of

vulnerability to changes in host-country policy or

regulations

Predicting country-specific risk

Political risk analysis is still an emerging field,

though firms need to attempt to conduct this

analysis

18-34

Firm-Specific Risks

Governance risks

Governance risk is the ability to exercise effective control over an

MNEs operations within a host countrys legal and political

environment

Historically, conflicts of interest between objectives of MNEs and host

governments have arisen over such issues as the firms impact on

economic development, the environment, control over export

markets, balance of payments (to name a few)

The best approach to conflict management is to anticipate problems

and negotiate understanding ahead of time

18-35

Firm-Specific Risks

Negotiating Investment Agreements

An investment agreement spells out specific rights

and responsibilities of both the foreign firm and

the host government

The presence of the MNE is as often sought by

development-seeking host governments

An investment agreement should define policies

on a wide range of financial and managerial issues

18-36

Operating Strategies after the FDI Decision

Although an investment agreement creates obligations on the

part of both foreign investor and host government, conditions

change and agreements are often revised in the light of such

changes

The firm that sticks rigidly to the legal interpretation of its

original agreement may well find that the host government

first applies pressure in areas not covered by the agreement

and then possibly reinterprets the agreement to conform to

the political reality of that country

18-37

Operating Strategies after the FDI Decision

Some key areas of consideration include:

Local sourcing

Facility location

Control of transportation

Control of technology

Control of markets

Brand name and trademark control

Thin equity base

Multiple-source borrowing

18-38

Country-Specific Risk: Transfer Risk

Country-specific risks affect all firms, domestic

and foreign, that are resident in a host country

The main country-specific political risks are

transfer risk and cultural and institutional risks

18-39

Country-Specific Risk: Transfer Risk

Transfer risk is defined as limitations on the MNEs ability to

transfer funds into and out of a host country without

restrictions

When a government runs short of foreign exchange and

cannot obtain additional funds through borrowing or

attracting new foreign investment, it usually limits transfers of

foreign exchange out of the country, a restriction known as

blocked funds

18-40

Exhibit 18.6 Management Strategies for Country-

Specific Risks

18-41

Country-Specific Risk: Cultural and Institutional

Risks

When investing in some of the emerging markets, MNEs that

are resident in the most industrialized countries face serious

risks because of cultural and institutional differences

including:

Differences in allowable ownership structures

Differences in human resource norms

Differences in religious heritage

Nepotism and corruption in the host country

Protection of intellectual property rights

Protectionism

18-42

Global-Specific Risks

Global specific risks faced by MNEs have come to the

forefront in recent years

The most visible recent risk was, of course, the attack by

terrorists on the twin towers of the World Trade Center in

New York on September 11, 2001.

In addition to terrorism, other global-specific risks include the

antiglobalization movement, environmental concerns, poverty

in emerging markets and cyber attacks on computer

information systems

Anda mungkin juga menyukai

- International Financial Management - An OverviewDokumen30 halamanInternational Financial Management - An Overviewutp100% (1)

- International EntrepreneurshipDokumen4 halamanInternational EntrepreneurshipSudhir Kumar Yadav100% (1)

- Foreign Exchange Risk ManagementDokumen65 halamanForeign Exchange Risk ManagementBhanu Pratap Singh Bisht100% (2)

- Ipology: The Science of the Initial Public OfferingDari EverandIpology: The Science of the Initial Public OfferingPenilaian: 5 dari 5 bintang5/5 (1)

- Entrepreneurship Chapter 5 - Identifying and Analyzing Domestic and International OpportunitiesDokumen5 halamanEntrepreneurship Chapter 5 - Identifying and Analyzing Domestic and International OpportunitiesSoledad Perez90% (10)

- International BusinessDokumen372 halamanInternational BusinessRong FangBelum ada peringkat

- International Business in AfricaDokumen57 halamanInternational Business in AfricaMario LuceroBelum ada peringkat

- Chap 6Dokumen29 halamanChap 6Arif.hossen 30Belum ada peringkat

- Chapter 5 EntrepreneurshipDokumen34 halamanChapter 5 EntrepreneurshipMuhammad IrfanBelum ada peringkat

- International Marketing Environment International Marketing EnvironmentDokumen72 halamanInternational Marketing Environment International Marketing Environmentsahil oberoiBelum ada peringkat

- Political EnvironmentDokumen13 halamanPolitical EnvironmentSneha ShekarBelum ada peringkat

- International Business EnvironmentDokumen32 halamanInternational Business EnvironmentAks Sinha100% (1)

- Inm 3-1Dokumen32 halamanInm 3-1abhinandBelum ada peringkat

- Country AnalysisDokumen72 halamanCountry AnalysisKushal PandyaBelum ada peringkat

- Political Risk AnalysisDokumen25 halamanPolitical Risk AnalysisMurali DarenBelum ada peringkat

- Electronic MarketingDokumen17 halamanElectronic MarketingMuhammad NaveedBelum ada peringkat

- Lec 11Dokumen33 halamanLec 11Tabish AhmedBelum ada peringkat

- Multinational Financial Management: An Overview: South-Western/Thomson Learning © 2003Dokumen30 halamanMultinational Financial Management: An Overview: South-Western/Thomson Learning © 2003Nafisa Afsana TaskiaBelum ada peringkat

- International Financial Management An OverviewDokumen25 halamanInternational Financial Management An OverviewVinayrajBelum ada peringkat

- IFM N RMDokumen89 halamanIFM N RMdeepaksinghalBelum ada peringkat

- Part-1. International Business-An OverviewDokumen20 halamanPart-1. International Business-An OverviewAmIt SinhaBelum ada peringkat

- Country and Political Risk AnalysisDokumen18 halamanCountry and Political Risk AnalysisFariha AdilaBelum ada peringkat

- Key Terms: - Financial Disintermediation - Securitization - Financial Deregulation - Capital MarketsDokumen15 halamanKey Terms: - Financial Disintermediation - Securitization - Financial Deregulation - Capital Marketssubash1111@gmail.comBelum ada peringkat

- Int - MRKT.CH - 3Dokumen17 halamanInt - MRKT.CH - 3Ebsa AdemeBelum ada peringkat

- International Financial ManagementDokumen12 halamanInternational Financial ManagementJitender KumarBelum ada peringkat

- Country Evaluation & SelectionDokumen28 halamanCountry Evaluation & SelectionLilith JejiBelum ada peringkat

- IBE NDIM Country Risk and Evaluation Lecture 21Dokumen22 halamanIBE NDIM Country Risk and Evaluation Lecture 21Kunal AgarwalBelum ada peringkat

- International Purchasing Environment Doc2Dokumen5 halamanInternational Purchasing Environment Doc2Eric Kipkemoi33% (3)

- Group Assignment OF MBADokumen5 halamanGroup Assignment OF MBARAVI SHARMA-DM 21DM163Belum ada peringkat

- CH 6 With Doc NotesDokumen14 halamanCH 6 With Doc NotesIsraa MostafaBelum ada peringkat

- International Financial Management Chapter 1Dokumen30 halamanInternational Financial Management Chapter 1vavnishBelum ada peringkat

- Factors Influencing Selection of Entry Mod1Dokumen2 halamanFactors Influencing Selection of Entry Mod1owahiduzzamanBelum ada peringkat

- Introduction To International FinanceDokumen26 halamanIntroduction To International FinancesamgoshBelum ada peringkat

- Introduction To International Business 1. Definition of International BusinessDokumen25 halamanIntroduction To International Business 1. Definition of International BusinessSanghamitra DasBelum ada peringkat

- IFM Chapter 17 - Class PresentationDokumen15 halamanIFM Chapter 17 - Class PresentationCecilia Ooi Shu QingBelum ada peringkat

- External Strategic Management Audit Written ReportDokumen4 halamanExternal Strategic Management Audit Written ReportIVYAYBSBelum ada peringkat

- CH 3 The Political Economic EnvironmentDokumen22 halamanCH 3 The Political Economic Environmentmohamed samirBelum ada peringkat

- Country Risk Analysis: Dr. Sangeeta YadavDokumen22 halamanCountry Risk Analysis: Dr. Sangeeta YadavAmit BarmanBelum ada peringkat

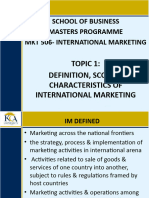

- TOPIC 1 - DeFN, Scope N Characteristics Fo IMDokumen24 halamanTOPIC 1 - DeFN, Scope N Characteristics Fo IMJudy kiarieBelum ada peringkat

- Global Marketing Opportunities Correct NotesDokumen6 halamanGlobal Marketing Opportunities Correct NotesViraja GuruBelum ada peringkat

- Country Risk AnalysisDokumen33 halamanCountry Risk AnalysisnishgudsBelum ada peringkat

- Foreign Market Entry StrategiesDokumen6 halamanForeign Market Entry StrategiesJaved KhanBelum ada peringkat

- The Effects of TNCS' Activities0Dokumen38 halamanThe Effects of TNCS' Activities0Yervant BaghdasarianBelum ada peringkat

- International Expansion and Global Market Opportunity AssessmentDokumen18 halamanInternational Expansion and Global Market Opportunity AssessmentKimberly Ann SurdellaBelum ada peringkat

- Notes On External Strategic Management AuditDokumen7 halamanNotes On External Strategic Management AuditGabrielle TabarBelum ada peringkat

- International FinanceDokumen26 halamanInternational FinanceRk BainsBelum ada peringkat

- Introduction To International MarketingDokumen87 halamanIntroduction To International MarketingMukul KumarBelum ada peringkat

- Presentation On: Chapter - 3Dokumen54 halamanPresentation On: Chapter - 3rajvee18Belum ada peringkat

- Nature and Structure of Business EnvironmentDokumen26 halamanNature and Structure of Business EnvironmentAvleen KaurBelum ada peringkat

- Guide For Identifying Financial RisksDokumen3 halamanGuide For Identifying Financial RisksbillpaparounisBelum ada peringkat

- IB Environment 03 Dec 2022Dokumen45 halamanIB Environment 03 Dec 2022mcle reyBelum ada peringkat

- International Business Strategy, Country Evaluation and SelectionDokumen42 halamanInternational Business Strategy, Country Evaluation and SelectionArchit GargBelum ada peringkat

- EBM-640 International Business: Dr. Shamsher Singh PH.D (Management) M.B.A., PGD-Exp-Imp, PGD-HRMDokumen32 halamanEBM-640 International Business: Dr. Shamsher Singh PH.D (Management) M.B.A., PGD-Exp-Imp, PGD-HRMrandhiryadavBelum ada peringkat

- Multinational Corporations in The World EconomyDokumen20 halamanMultinational Corporations in The World EconomyKishan KurmiBelum ada peringkat

- Strategic Management: WelcomeDokumen45 halamanStrategic Management: WelcomeAli ShanBelum ada peringkat

- International Financial ManagementDokumen12 halamanInternational Financial ManagementNoor Preet KaurBelum ada peringkat

- Global Business Management Political Risk and Negotiation Strategy Bba - IvDokumen27 halamanGlobal Business Management Political Risk and Negotiation Strategy Bba - IvSHAMRAIZKHANBelum ada peringkat

- Marketing Concepts 1Dokumen5 halamanMarketing Concepts 1kenoBelum ada peringkat

- Smooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1Dari EverandSmooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1Belum ada peringkat