Micro, Small and Medium Enterprises in India: An Overview

Diunggah oleh

Adr HRJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Micro, Small and Medium Enterprises in India: An Overview

Diunggah oleh

Adr HRHak Cipta:

Format Tersedia

Micro, Small and Medium

Enterprises in India

An overview

What they actually are?

The commonly used criteria at the

international level to define SMEs are

the number of employees, total net

assets, sales and investment level.

The European Union makes a general

distinction between self-employment,

micro,small and medium sized

businesses based on the following

criteria:

And the criteria is-

0 Self-employed

2-9 Micro business

10-49 Small business

50-249 Medium-size business

In the Indian context, micro, small and

medium enterprises are defined as..

It is based on the investment

investment in plant and machinery (for

manufacturing enterprise) and on

equipments for enterprises providing or

rendering services.

Criteria in India-

Micro enterprise-investment does not

exceed 25 lakh rupees.

Medium enterprise- more than five

crores but not upto ten crores.

Small enterprise- more than 25 lakhs

rupees but doe not exceed 5 crores.

In case of services-

a micro enterprise- not upto 10 lakh

rupees.

a small enterprise- more than 10 lakh

but not upto 2 crore rupees.

a medium enterprise- more than 2

crores but not upto 5 crores.

Importance of the MSME sector

The contribution of micro, small and medium

enterprises (MSME) sector to

manufacturing output, employment and exports

of the country is quite significant.

The MSME sector employs about 42 million

persons in over 13 million units throughout

the country.

There are more than 6000 products, ranging

from traditional to high-tech items, which are

being manufactured by the Indian MSMEs.

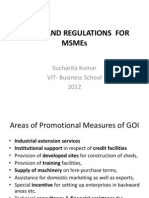

Specific policy measures initiated for

boosting MSMES-

Reservation of items for exclusive

manufacturing in small sector.

Preferential credit support measures.

Fiscal concessions.

Infrastructural development like

development of industrial estates,

testing labs, common facility centres.

Entrepreneurship development

PERFORMANCE AND CONTRIBUTION

OF MSMEs.

13 Million MSMEs

> 8000 products

MSMEs

31 Million

Employment

40% Exports

45% industrial

production

Micro, Small and Medium Enterprises

Development Act, 2006

salient features.

1. Industry replaced by enterprise which

include service enterprises also.

2. Ambit of sector enlarged to cover

medium enterprises.

3. Constitution of MSME Board.

4. Simplification of registration

procedure.

5. Progressive credit support.

6. Penalty for delayed payments.

7. Provision for exit policy.

Institutional Support Structure

for MSMEs in India

At Federal Level

1. Ministry of MSMEs

2. Small Industries

Development

Organisation

(SIDO)

3. National Small

Industries

Corporation(NSIC)

4. Khadi & Village

Industries

Commission(KVIC)

5. Coir Board

6. Entrepreneurship

Development

Institutions (EDIs)

MSMEs

At State Level

1. Directorate of

Industries

2. District Industries

Centres

3. State Finance

Corporation

4. State Industrial

Development

Corporation

5. Technical

Consultancy

Organisations

6. Entrepreneurship

Development

Institutions

Others

1. Industry

Associations

2. NGOs

3. Banks/Financial

Institutions

MAJOR SCHEMES

FOR

MSMEs SUPPORT

Credit Support

1. Public sector banks advised to double the

flow of credit to MSMEs within 5 years

(20% annual growth)

2. A minimum of 40% of bank credit

earmarked for priority sector lending which

includes loans to MSEs

3. Specialised SME Bank branches in industrial

clusters for smooth flow of credit to MSMEs

4. One Time Settlement (OTS) scheme for

settling NPAs of MSMEs

Technological Support

Credit Linked Capital Subsidy Scheme

for Technology Upgradation

Scheme meant to improve quality of

products by technology upgradation.

Investment upto INR 10 million

(US$ .250,000) eligible for support

with subsidy upto 15% on

investment.

Contd.

Testing Centres for Quality Certification

Tool Rooms and Training Centres for

skill upgradation

Incentive scheme for obtaining ISO

Certification by MSEs

Marketing Assistance and Export

Promotion

1. Support for participation in trade fairs and

exhibitions national as well as

international.

2. Training programmes on packaging for

exports.

3. Purchase preference in Government

procurement.

4. Market Development Assistance Scheme for

publicity, market studies and adoption of

modern market practices

Cluster Development Programme

Cluster formation has been considered

important for MSME development. A

cluster may be defined as a local

agglomeration of enterprises (mainly

SMEs, but often also ncluding some

large enterprises), which are producing

and selling a range of relatedand

complementary products and services

International Cooperation Programme

Provides exposure to MSMEs to the

latest technologies, manufacturing

practices prevalent in their fields in

different countries.

Encourages their participation in

international exhibitions for exports.

Factors affecting MSMEs

Accessing adequate and timely

financing on competitive terms,

particularly longer tenure loans.

Accessing credit on easy terms has

become difficult in the backdrop of

current global financial crisis which has

held back the growth of SMEs and

impeded overall growth

andDevelopment.

Contd.

factors that include policy,

legal/regulatory framework (in terms of

recovery,bankruptcy and contract

enforcement), institutional weaknesses

(absence ofgood credit appraisal and

risk management/ monitoring tools),

and lack ofreliable credit information on

SMEs

Contd.

It has become difficult for lenders to be able

to assess risk premiums properly,creating

differences in the perceived versus real risk

profiles of SMEs.

Access to skilled manpower, R&D facilities

and marketing channels is limited

Availability of finance at cheaper rates, skills

about decision-making and good

management and accounting practices, and

access to modern technology.

Bribery,corruption,red tapism.

Challenges before MSMEs

Problem of skilled manpower.

Inadequate credit assistance.

Irregular supply of raw material.

Absence of organised marketing.

Lack of machinery and equipment.

Absence of adequate infrastructure.

Competition from large-scale units and imported

articles.

Other problems like poor project planning,

managerial inadequacies, old and orthodox designs,

high degree of obsolescence and huge number of

bogus concerns etc.

Thank you.

A presentation by-

Raveena kaushal

Bba 4

th

sem

Anda mungkin juga menyukai

- Micro, Small and Medium Enterprises in India: An OverviewDokumen23 halamanMicro, Small and Medium Enterprises in India: An OverviewBharti KumariBelum ada peringkat

- Presentation On MSME'sDokumen19 halamanPresentation On MSME'sKunal PuriBelum ada peringkat

- MsmeDokumen17 halamanMsmeRajeev SrivastavaBelum ada peringkat

- MsmeDokumen17 halamanMsmeHimanshu KashyapBelum ada peringkat

- Incentives and Schemes Associated With MsmesDokumen15 halamanIncentives and Schemes Associated With MsmesGangadhar MamadapurBelum ada peringkat

- MSMEDokumen36 halamanMSMEBHANUPRIYABelum ada peringkat

- MsmeDokumen17 halamanMsmeshamirun ShahniBelum ada peringkat

- Msme ActDokumen20 halamanMsme Actsirisha_reddy2209Belum ada peringkat

- Growth of Micro, Small & Medium Enterprises in IndiaDokumen19 halamanGrowth of Micro, Small & Medium Enterprises in Indiarishisingh9Belum ada peringkat

- Policy and Regulations For MsmesDokumen13 halamanPolicy and Regulations For MsmesNithin KannanBelum ada peringkat

- Sme'S Past, Present & FutureDokumen109 halamanSme'S Past, Present & Futureqwertyuiop_6421100% (2)

- Msme IndiaDokumen23 halamanMsme IndiaJYOTIBelum ada peringkat

- Accounts-Small Scale IndustriesDokumen7 halamanAccounts-Small Scale IndustriesdevugoriyaBelum ada peringkat

- Overview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityDokumen30 halamanOverview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityMehedi HasanBelum ada peringkat

- Government Schemes Under: Gokul Mahesh HarshaDokumen11 halamanGovernment Schemes Under: Gokul Mahesh HarshaGokul KarwaBelum ada peringkat

- Unit-1 The Micro-Small and Medium Enterprises (Msmes) Are Small Sized Entities, Defined inDokumen36 halamanUnit-1 The Micro-Small and Medium Enterprises (Msmes) Are Small Sized Entities, Defined inBhaskaran BalamuraliBelum ada peringkat

- Devi Ahiya VishwavidyalayaDokumen12 halamanDevi Ahiya VishwavidyalayaJayeshAgrawalBelum ada peringkat

- Unit 2Dokumen47 halamanUnit 2Harini SaiBelum ada peringkat

- National Small Industries CorporationDokumen12 halamanNational Small Industries CorporationMohith RajBelum ada peringkat

- Module-5: Amity School of BusinessDokumen32 halamanModule-5: Amity School of BusinessGangadhar MamadapurBelum ada peringkat

- ZGM Nsic Ravi KumarDokumen59 halamanZGM Nsic Ravi KumarVinay ChagantiBelum ada peringkat

- NSIC: Functions and Support Provided by National Small Industries Corporation LTDDokumen13 halamanNSIC: Functions and Support Provided by National Small Industries Corporation LTDsankasturkarBelum ada peringkat

- What Are MSME Its RoleDokumen8 halamanWhat Are MSME Its RoleNeet 720Belum ada peringkat

- Small Business ManagementDokumen77 halamanSmall Business ManagementParamiedu Finance100% (1)

- SME Financing in Myanmar (8 September 2013)Dokumen19 halamanSME Financing in Myanmar (8 September 2013)THAN HANBelum ada peringkat

- MSMEs and Socio Economic DevelopmentDokumen2 halamanMSMEs and Socio Economic DevelopmentNageswara Rao VemulaBelum ada peringkat

- Unit No. 3: Understanding Ownership Structure: Definition ofDokumen77 halamanUnit No. 3: Understanding Ownership Structure: Definition ofmekhalasmitBelum ada peringkat

- W-03Problem and Prospects of MSMEs in IndiaDokumen15 halamanW-03Problem and Prospects of MSMEs in IndiaRavi AgarwalBelum ada peringkat

- SME Financing (2007 Format)Dokumen48 halamanSME Financing (2007 Format)Sirsanath BanerjeeBelum ada peringkat

- Sidbi Training 13.12.23-15.12.23Dokumen45 halamanSidbi Training 13.12.23-15.12.23nikitasonkar92Belum ada peringkat

- An Assignment On Indian Legal System in Respect To The SME SectorDokumen5 halamanAn Assignment On Indian Legal System in Respect To The SME SectorAbhra MukherjeeBelum ada peringkat

- Attachment Financial InstitutionsDokumen12 halamanAttachment Financial InstitutionsSanjeeva TejaswiBelum ada peringkat

- Small & Medium Enterprise Development (Sme) : Hessie P. Martin Sarah Maharaj March, 2009Dokumen34 halamanSmall & Medium Enterprise Development (Sme) : Hessie P. Martin Sarah Maharaj March, 2009منظور سولنگیBelum ada peringkat

- Powerpoint GST 106Dokumen10 halamanPowerpoint GST 106kennykazeem20Belum ada peringkat

- Micro, Small & Medium Enterprises Development Institute: (Branch) Autonagar VisakhapatnamDokumen32 halamanMicro, Small & Medium Enterprises Development Institute: (Branch) Autonagar VisakhapatnamGangadhar MamadapurBelum ada peringkat

- Micro, Small & Medium Enterprises Development Institute: (Branch) Autonagar VisakhapatnamDokumen32 halamanMicro, Small & Medium Enterprises Development Institute: (Branch) Autonagar VisakhapatnamGangadhar MamadapurBelum ada peringkat

- Report To Start IndustryDokumen33 halamanReport To Start IndustryPuneet SinghBelum ada peringkat

- 3.4 New Govt - Schemefor MSMEDokumen23 halaman3.4 New Govt - Schemefor MSMEvaibhavBelum ada peringkat

- Library Assignment Business Environment (302) TOPIC-Challenges and Strategies For MSME's in IndiaDokumen5 halamanLibrary Assignment Business Environment (302) TOPIC-Challenges and Strategies For MSME's in IndiaHeer BatraBelum ada peringkat

- Definitions of Micro, Small & Medium Enterprises in Accordance With TheDokumen13 halamanDefinitions of Micro, Small & Medium Enterprises in Accordance With TheJaasindah MirBelum ada peringkat

- Likeliness of SME's in Adopting E-Commerce: Chapter 1: Industry Profile and Company ProfileDokumen58 halamanLikeliness of SME's in Adopting E-Commerce: Chapter 1: Industry Profile and Company ProfileAnusha simhadriBelum ada peringkat

- An Assignment On Small Industries Development Bank of India (SIDBI)Dokumen13 halamanAn Assignment On Small Industries Development Bank of India (SIDBI)Pooja Gujarathi50% (2)

- Sidbi: PRESENTED BY: Prabhdeep Singh RahulDokumen20 halamanSidbi: PRESENTED BY: Prabhdeep Singh RahulPradyumnaAshritBelum ada peringkat

- Adfiap International Ceo Forum Vii-"Sustainable Smes Through Value Chain Financing"Dokumen22 halamanAdfiap International Ceo Forum Vii-"Sustainable Smes Through Value Chain Financing"mds89Belum ada peringkat

- Major Schemes FOR Msme'S SupportDokumen9 halamanMajor Schemes FOR Msme'S SupportShamma DhanawatBelum ada peringkat

- SIDBIDokumen12 halamanSIDBISuraj JayBelum ada peringkat

- Small Scale Industrial Undertakings NewDokumen29 halamanSmall Scale Industrial Undertakings NewMohit AgrawalBelum ada peringkat

- Micro Small and Medium EnterprisesDokumen2 halamanMicro Small and Medium EnterprisesGvganesh BabuBelum ada peringkat

- 566 - Viren Mehra, Sec C B.com (Hons) Sem 4Dokumen10 halaman566 - Viren Mehra, Sec C B.com (Hons) Sem 4Viren MehraBelum ada peringkat

- Current Affairs: Upsc Cse 2021 NOV 2020: PART-3: Extra Notes On MsmeDokumen10 halamanCurrent Affairs: Upsc Cse 2021 NOV 2020: PART-3: Extra Notes On MsmeStudentBelum ada peringkat

- Erode 09022019Dokumen82 halamanErode 09022019Mainak SahaBelum ada peringkat

- Unit 2Dokumen133 halamanUnit 2RahmathnishaBelum ada peringkat

- Adfiap International Ceo Forum Vii-"Sustainable Smes Through Value Chain Financing"Dokumen22 halamanAdfiap International Ceo Forum Vii-"Sustainable Smes Through Value Chain Financing"RushadIraniBelum ada peringkat

- Module ThreeDokumen56 halamanModule ThreeAnn Amitha AntonyBelum ada peringkat

- Shekhar Ibhrampurkar Summer Internship Project ReportDokumen93 halamanShekhar Ibhrampurkar Summer Internship Project Reportayansur1986Belum ada peringkat

- MICRO AND SMALL ProjectDokumen17 halamanMICRO AND SMALL ProjectJapgur Kaur100% (1)

- Small Scale Industries Small Scale Industries (SSI) Are Those Industries in Which Manufacturing, ProvidingDokumen9 halamanSmall Scale Industries Small Scale Industries (SSI) Are Those Industries in Which Manufacturing, Providingakhil krishnvanshi YadavBelum ada peringkat

- NA - Session 22 - Micro, Small and Medium Enterprises in IndiaDokumen12 halamanNA - Session 22 - Micro, Small and Medium Enterprises in IndiaSumit GuptaBelum ada peringkat

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1Dari EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1Belum ada peringkat

- Chapter-3 - Company Profile & Industry ProfileDokumen11 halamanChapter-3 - Company Profile & Industry ProfileAdr HRBelum ada peringkat

- Chapter No. Name of The Concept NoDokumen1 halamanChapter No. Name of The Concept NoAdr HRBelum ada peringkat

- Data Analysis and InterpretationDokumen28 halamanData Analysis and InterpretationAdr HRBelum ada peringkat

- Chapter 5Dokumen9 halamanChapter 5Adr HRBelum ada peringkat

- Creating Competitive Smes in India: Presented By: Dhariti Walia (10810021) Saryu Kamra (10810056) Yuki Jain (10810074)Dokumen27 halamanCreating Competitive Smes in India: Presented By: Dhariti Walia (10810021) Saryu Kamra (10810056) Yuki Jain (10810074)Adr HRBelum ada peringkat

- Chapter 2Dokumen9 halamanChapter 2Adr HRBelum ada peringkat

- Chapter 4-ProjectDokumen11 halamanChapter 4-ProjectAdr HRBelum ada peringkat

- QuestionsDokumen5 halamanQuestionsAdr HRBelum ada peringkat

- Role of SMEDokumen7 halamanRole of SMEAdr HRBelum ada peringkat

- Revised IntroductionDokumen13 halamanRevised IntroductionAdr HRBelum ada peringkat

- ReferencesDokumen1 halamanReferencesAdr HRBelum ada peringkat

- Fulltext01 PDFDokumen75 halamanFulltext01 PDFAdr HRBelum ada peringkat

- Chapter 5-ProjectDokumen4 halamanChapter 5-ProjectAdr HRBelum ada peringkat

- Chapter 3-ProjectDokumen18 halamanChapter 3-ProjectAdr HRBelum ada peringkat

- Chapter 2-ReviewDokumen8 halamanChapter 2-ReviewAdr HRBelum ada peringkat

- Questionnaire Recruitment: Name of The Employee: Designation: Experience: DepartmentDokumen2 halamanQuestionnaire Recruitment: Name of The Employee: Designation: Experience: DepartmentAdr HRBelum ada peringkat

- Chapter 4-Data & AnalysisDokumen18 halamanChapter 4-Data & AnalysisAdr HRBelum ada peringkat

- Chapter 3-Company ProfileDokumen7 halamanChapter 3-Company ProfileAdr HRBelum ada peringkat

- Chapter 1-Recruitment ProcessDokumen8 halamanChapter 1-Recruitment ProcessAdr HRBelum ada peringkat

- RAMSCRAM-A Flexible RAMJET/SCRAMJET Engine Simulation ProgramDokumen4 halamanRAMSCRAM-A Flexible RAMJET/SCRAMJET Engine Simulation ProgramSamrat JanjanamBelum ada peringkat

- Series R: 3 Piece Ball Valves With Integrated Handle DN8 - DN50 Butt Weld, Threaded, Socket Weld and Flanged VersionDokumen2 halamanSeries R: 3 Piece Ball Valves With Integrated Handle DN8 - DN50 Butt Weld, Threaded, Socket Weld and Flanged VersionАртем КосовBelum ada peringkat

- E34-1 Battery Charging and Dishcharging BoardDokumen23 halamanE34-1 Battery Charging and Dishcharging BoardGanesa MurthyBelum ada peringkat

- Role of Quick Response To Supply ChainDokumen15 halamanRole of Quick Response To Supply ChainSanuwar RashidBelum ada peringkat

- EverServ 7700 M77XX Quick Reference GuideDokumen2 halamanEverServ 7700 M77XX Quick Reference GuidetangocharliepdxBelum ada peringkat

- TMIS07 - Kalam Internship - S7 Tesla MindsDokumen3 halamanTMIS07 - Kalam Internship - S7 Tesla MindsDMJ JonesBelum ada peringkat

- 05271/MFP YPR SPL Sleeper Class (SL)Dokumen2 halaman05271/MFP YPR SPL Sleeper Class (SL)Rdx BoeBelum ada peringkat

- Green Team Work PlanDokumen2 halamanGreen Team Work PlanScott FranzBelum ada peringkat

- MC0085 MQPDokumen20 halamanMC0085 MQPUtpal KantBelum ada peringkat

- 1 s2.0 S0955221920305689 MainDokumen19 halaman1 s2.0 S0955221920305689 MainJoaoBelum ada peringkat

- I. Ifugao and Its TribeDokumen8 halamanI. Ifugao and Its TribeGerard EscandaBelum ada peringkat

- Dimitris Achlioptas Ucsc Bsoe Baskin School of EngineeringDokumen22 halamanDimitris Achlioptas Ucsc Bsoe Baskin School of EngineeringUCSC Students100% (1)

- Statistics 2Dokumen121 halamanStatistics 2Ravi KBelum ada peringkat

- Teacher Resource Disc: Betty Schrampfer Azar Stacy A. HagenDokumen10 halamanTeacher Resource Disc: Betty Schrampfer Azar Stacy A. HagenRaveli pieceBelum ada peringkat

- OpenGL in JitterDokumen19 halamanOpenGL in JitterjcpsimmonsBelum ada peringkat

- Filtomat M300Dokumen4 halamanFiltomat M300Sasa Jadrovski100% (1)

- Miso Soup Miso Soup Miso Soup: Ingredients Ingredients IngredientsDokumen8 halamanMiso Soup Miso Soup Miso Soup: Ingredients Ingredients IngredientsEllie M.Belum ada peringkat

- Alpha Tech India Limited - FinalDokumen4 halamanAlpha Tech India Limited - FinalRahul rBelum ada peringkat

- Where Business Happens Where Happens: SupportDokumen19 halamanWhere Business Happens Where Happens: SupportRahul RamtekkarBelum ada peringkat

- Chapter 5 - Shear and Diagonal Tension On Beams PDFDokumen55 halamanChapter 5 - Shear and Diagonal Tension On Beams PDFJhe Taguines100% (1)

- (Walter Podolny, JR., John B. Scalzi) Construction PDFDokumen354 halaman(Walter Podolny, JR., John B. Scalzi) Construction PDFJuan Carlos CastroBelum ada peringkat

- Tesla - Electric Railway SystemDokumen3 halamanTesla - Electric Railway SystemMihai CroitoruBelum ada peringkat

- CFA L1 Ethics Questions and AnswersDokumen94 halamanCFA L1 Ethics Questions and AnswersMaulik PatelBelum ada peringkat

- Revised Study Material - Economics ChandigarhDokumen159 halamanRevised Study Material - Economics ChandigarhvishaljalanBelum ada peringkat

- Perrys Chemical Engineering Handbook 7th Edition PriceDokumen3 halamanPerrys Chemical Engineering Handbook 7th Edition PriceSteven Valentius0% (12)

- User Manual - Wellwash ACDokumen99 halamanUser Manual - Wellwash ACAlexandrBelum ada peringkat

- SoC Showdown: Snapdragon 810 Vs Exynos 7420 Vs MediaTek Helio X10 Vs Kirin 935 - AndroidAuthority - PDDokumen19 halamanSoC Showdown: Snapdragon 810 Vs Exynos 7420 Vs MediaTek Helio X10 Vs Kirin 935 - AndroidAuthority - PDArpit SharmaBelum ada peringkat

- Faithful Love: Guitar SoloDokumen3 halamanFaithful Love: Guitar SoloCarol Goldburg33% (3)

- Portfolio Sandwich Game Lesson PlanDokumen2 halamanPortfolio Sandwich Game Lesson Planapi-252005239Belum ada peringkat

- Writofsummons ForrevisionpurposesonlyDokumen7 halamanWritofsummons ForrevisionpurposesonlyNuur KhaliilahBelum ada peringkat