Special Treatment of Fringe Benefits

Diunggah oleh

Martin EstreraHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Special Treatment of Fringe Benefits

Diunggah oleh

Martin EstreraHak Cipta:

Format Tersedia

Presented by:

SUSAN D. TUSOY

Asst. Chief, Assessment Division

RR 19-Davao City

1

Legal Basis:

Sec. 33 of the Tax Code

RR 2-98

RR 3-98

RR 8-2000

RR 10-2000

RR 5-2008

RR 5-2011

RMC 20-2011

Imposition of Tax

A final tax of 32% effective Jan. 1, 2000 on the grossed-

up monetary value of fringe benefit furnished or

granted to the employee (except rank and file

employees) by the employer (whether an individual or

a corporation)

Grossed-Up Monetary Value (GMV)

Shall be determined by dividing the monetary value of

the FB by 68% (effective Jan. 1, 2000);

It represents the whole amount of income realized by

the employee which includes the net amount of money

or the net monetary value of the property plus the

amount of tax otherwise due from the employee but

paid by the employer.

Illustration

ABC Co. provides housing allowance to its manager at P6,800

per quarter.

FBT is computed as follows:

GMV = (P6,800 / 68%) = P10,000

FBT = GMV x 32%

= (P10,000 x 32%)

= p3,200.00

Summary

Given to employee - P 6,800

Paid to BIR - 3,200

Fringe Benefit Expense - P10,000

Exception

If the fringe benefits are required by

the nature of or necessary to the

trade, business or profession of the

employer, or when the fringe benefit is

required by the nature of, or necessary

to the trade, business or profession of

the employer or when it is for the

convenience or advantage of the

employer.

Fringe Benefits defined

means any good, service or other benefit

furnished or granted in cash or in kind

by an employer to an individual

employee (except rank and file

employees), such as, but not limited

to the following:

Fringe Benefits

(1)Housing;

(2)Expense Account;

(3)Vehicle of any kind;

(4)Household personnel, such as maid, driver and others

(5)Interest on loan at less than market rate to the extent

of the difference between the market rate and actual

rate granted;

Fringe Benefits (cont..)

(6) Membership fees, dues and other expenses borne by

the employer for the employee in social and athletic /

clubs or other similar organizations;

(7) Expenses for foreign travel;

(8) Holiday and vacation expenses;

(9) Educational assistance to the employee or his

dependents; and

(10) Life or health insurance and other non-life insurance

premiums or similar amounts in excess of what the law

allows.

Fringe Benefits Not Subject to Fringe

Benefits Tax

1. FB which are authorized and exempted from

income tax under the Code or under any special

law

2. Contributions of the employer for the benefit of

the employee to retirement, insurance and

hospitalization benefit plans;

3. Benefits given to the rank and file, whether

granted under a collective bargaining agreement

or not;

Fringe Benefits Not Subject to Fringe

Benefits Tax

4. De minimis benefits

5. If the grant of fringe benefits to the employee is

required by the nature of, or necessary to the

trade, business or profession of the employer; or

6. If the grant of the fringe benefits is for the

convenience of the employer.

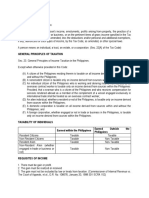

DE MINIMIS BENEFITS

(as amended by RR 5-2011)

a) Monetized unused vacation leave credits of employees

not exceeding 10 days during the year

b) Monetized value of vacation and sick leave leave

credits paid to government officials and employees

c) Medical cash allowance to dependents

Not exceeding P750/employee/semester or

P125/month

DE MINIMIS BENEFITS

d) Rice subsidy of P1,500 or 1 sack of 50 kg rice per month

amounting to not more than P 1,500.

e.) Uniform and clothing allowance not exceeding

P4,000/ annum

f.) Actual medical assistance, e.g. medical

allowance to cover medical and healthcare needs,

annual medical/executive check-up, maternity

assistance, and routine consultations, not exceeding

P10,000 per annum (RR 5-2011)

(Previous: Actual yearly medical benefits not exceeding

P10,000/annum).

g) Laundry allowance not exceeding P 300.00/

month

h) Employees achievement awards in the form of

tangible personal property other than cash or gift

certificate with annual value not exceeding

P10,000 under established written plan which

does not discriminate in favor of highly paid

employees;

DE MINIMIS BENEFITS

DE MINIMIS BENEFITS

i.) Gifts given during Christmas and major

anniversary celebrations not exceeding

P5,000/annum/employee

j.) Daily meal allowance for overtime work and

night/graveyard shift not to exceed 25% of the

basic minimum wage on a per region basis (RR 5-2011)

(previous: daily meal allowance for overtime work not exceeding 25% of

the basic minimum wage) .

DE MINIMIS BENEFITS

Deleted provision under RR 5-2011

flowers, fruits, books, or similar items given to employer under special

circumstances, e.g., on account of illness, marriage, birth of a baby, etc.

DE MINIMIS BENEFITS

All other benefits given by employers which are

not included in the above enumeration shall not

be considered as de minimis benefits, and

hence, shall be subject to:

Income tax / WT on Compensation for rank

and file employees and

Fringe benefit tax for supervisory and

managerial positions

DE MINIMIS Rules

DE MINIMIS BENEFITS conforming to the

ceiling shall not be considered in determining the

P 30,000

the excess over the respective ceilings shall be

considered as part of the other benefits and

the employee receiving it will be subject to tax

only on the excess over the P30,000.

Manner of Payment

The tax imposed is payable by the employer

Manual Filing / payment

Due date is on or before the 10th day of the month

following the quarter in which the withholding was

made

EFPS Filing/ePayment

Due date is on or before the fifteenth (15

th

) day of the

month following the quarter in which the withholding

was made

Use BIR FORM 1603

The end

Anda mungkin juga menyukai

- Fringe Benefits TaxDokumen3 halamanFringe Benefits TaxGrace EspirituBelum ada peringkat

- Fringe Benefit TaxDokumen11 halamanFringe Benefit TaxJonard Godoy75% (4)

- How to calculate FBT in the PhilippinesDokumen69 halamanHow to calculate FBT in the PhilippinesLeandrix Billena Remorin Jr75% (4)

- Chapter 3 Fringe & de Minimis BenefitsDokumen6 halamanChapter 3 Fringe & de Minimis BenefitsNovelyn Hiso-anBelum ada peringkat

- BIR How To Compute Fringe Benefit Tax REL PARTYDokumen69 halamanBIR How To Compute Fringe Benefit Tax REL PARTYRyoBelum ada peringkat

- De-Minimis-Benefits-2024Dokumen1 halamanDe-Minimis-Benefits-2024Love Heart BantilesBelum ada peringkat

- Fringe Benefit DeminimisDokumen12 halamanFringe Benefit DeminimisMa. Angelica Celina MoralesBelum ada peringkat

- 1601 CDokumen8 halaman1601 CMhyckee GuinoBelum ada peringkat

- RR 5-2011 (De Minimis Benefits)Dokumen4 halamanRR 5-2011 (De Minimis Benefits)CARATASBelum ada peringkat

- Tax Guide for Minimum Wage Earners and IndividualsDokumen41 halamanTax Guide for Minimum Wage Earners and IndividualsAllan BacudioBelum ada peringkat

- De Minimis BenefitsDokumen2 halamanDe Minimis BenefitsClaudine SumalinogBelum ada peringkat

- Philippines Withholding Tax on Compensation GuideDokumen3 halamanPhilippines Withholding Tax on Compensation Guiderobin pilarBelum ada peringkat

- Fringe Benefits Tax and de Minimis Benefits: ObjectivesDokumen11 halamanFringe Benefits Tax and de Minimis Benefits: ObjectivesChristelle JosonBelum ada peringkat

- Withholding TaxDokumen10 halamanWithholding TaxAngelo ChiucoBelum ada peringkat

- Fringe Benefits, de Minimis, Convenience of EmployerDokumen2 halamanFringe Benefits, de Minimis, Convenience of Employerlossesabound100% (1)

- Bsa1202 FS2122 Incometax 04Dokumen9 halamanBsa1202 FS2122 Incometax 04Katring O.Belum ada peringkat

- De minimis benefits and FBT presentation in ITRDokumen2 halamanDe minimis benefits and FBT presentation in ITRANGEL MAE LINABAN GONGOBBelum ada peringkat

- Unit 4 - Inclusions & Exclusions To Gross Comp IncomeDokumen8 halamanUnit 4 - Inclusions & Exclusions To Gross Comp IncomeJoseph Anthony RomeroBelum ada peringkat

- Importance of Withholding Tax SystemDokumen7 halamanImportance of Withholding Tax SystemALAJID, KIM EMMANUELBelum ada peringkat

- RR 05-11 (Further Amendments To RR2-98 and RR3-98) de MinimisDokumen5 halamanRR 05-11 (Further Amendments To RR2-98 and RR3-98) de MinimisMatthew TiuBelum ada peringkat

- RR 5-2011Dokumen5 halamanRR 5-2011RB BalanayBelum ada peringkat

- Chapter 10 Compensation IncomeDokumen4 halamanChapter 10 Compensation IncomeJason MablesBelum ada peringkat

- Chapter 3 Taxation Part 1Dokumen28 halamanChapter 3 Taxation Part 1Alhysa Rosales CatapangBelum ada peringkat

- De Minimis Benifit AssignmentDokumen9 halamanDe Minimis Benifit AssignmentJoneric RamosBelum ada peringkat

- Summary Fringe BenefitDokumen3 halamanSummary Fringe BenefitElaine ReyesBelum ada peringkat

- Fringe Benefits DefinitionDokumen3 halamanFringe Benefits DefinitionTheodore DolarBelum ada peringkat

- Taxation Module 3 5Dokumen57 halamanTaxation Module 3 5Ma VyBelum ada peringkat

- De Minimis BenefitsDokumen1 halamanDe Minimis BenefitsEduard RiparipBelum ada peringkat

- De Minimis Benefits Tax RulesDokumen4 halamanDe Minimis Benefits Tax RulesGeromil HernandezBelum ada peringkat

- Additional P10,000 Nontaxable de Minimis Benefits Effective January 1, 2015Dokumen1 halamanAdditional P10,000 Nontaxable de Minimis Benefits Effective January 1, 2015Dennis VelasquezBelum ada peringkat

- Legal Opinion de MinimisDokumen6 halamanLegal Opinion de MinimisjoyiveeongBelum ada peringkat

- 11 Tax Exempt de Minimis Benefits To EmployeesDokumen2 halaman11 Tax Exempt de Minimis Benefits To EmployeesAdrian Mark GomezBelum ada peringkat

- Updated RR 2-98 Sec 2.78.1 (A) CompensationDokumen5 halamanUpdated RR 2-98 Sec 2.78.1 (A) CompensationJaymar DetoitoBelum ada peringkat

- Gross Income: Learning ObjectivesDokumen12 halamanGross Income: Learning ObjectivesClaire BarbaBelum ada peringkat

- Week 3 Fringe Benefits Part 2 2023Dokumen30 halamanWeek 3 Fringe Benefits Part 2 2023Arellano Rhovic R.Belum ada peringkat

- De Minimis and FringeDokumen1 halamanDe Minimis and FringeAlicia Jane NavarroBelum ada peringkat

- Withholding Tax GuideDokumen21 halamanWithholding Tax GuideAna Carmela Nitro ColoBelum ada peringkat

- De Minimis BenefitsDokumen3 halamanDe Minimis BenefitsanneBelum ada peringkat

- MMMMDokumen9 halamanMMMMABMachineryBelum ada peringkat

- TAXATION OF EMPLOYEE INCOMEDokumen6 halamanTAXATION OF EMPLOYEE INCOMEShane Mark CabiasaBelum ada peringkat

- Revenue Regulation NoDokumen38 halamanRevenue Regulation NolalararafafaBelum ada peringkat

- Wala LangDokumen5 halamanWala LangHOSPITAL EMERGENCY ROOMBelum ada peringkat

- Revenue Memorandum Circular No. 50-2018: Quezon CityDokumen18 halamanRevenue Memorandum Circular No. 50-2018: Quezon CityKyleZapanta100% (1)

- Withholding Tax GuideDokumen6 halamanWithholding Tax GuideAnselmo Rodiel IVBelum ada peringkat

- Fringe Benefit TaxDokumen4 halamanFringe Benefit TaxJoshua Stalin SelvarajBelum ada peringkat

- Importance of Withholding Tax SystemDokumen14 halamanImportance of Withholding Tax SystemAcademic Stuff100% (1)

- Tax Chapter 10, 11, 12Dokumen13 halamanTax Chapter 10, 11, 12Sheraldine MendozaBelum ada peringkat

- M5-P1-Compensation Income-Students'Dokumen49 halamanM5-P1-Compensation Income-Students'micaella pasion100% (1)

- Fringe BenefitsDokumen24 halamanFringe Benefitsmildred ramirezBelum ada peringkat

- Salary Includes: U/s 17Dokumen14 halamanSalary Includes: U/s 17Ansh NayyarBelum ada peringkat

- Module 3.1 Fringe Benefits and de Minimis BenefitsDokumen4 halamanModule 3.1 Fringe Benefits and de Minimis BenefitsGabs SolivenBelum ada peringkat

- Income-Taxation 3Dokumen44 halamanIncome-Taxation 3Maria Maganda MalditaBelum ada peringkat

- Exclusions From Gross Income: (13 Month Pay, de Minimis Benefits, GSIS, SSS, MEDICARE, and Other Contribution)Dokumen12 halamanExclusions From Gross Income: (13 Month Pay, de Minimis Benefits, GSIS, SSS, MEDICARE, and Other Contribution)KathBelum ada peringkat

- Annualized Withholding TaxDokumen22 halamanAnnualized Withholding Taxsai78Belum ada peringkat

- LECT 1 IncomeDokumen4 halamanLECT 1 IncomeFredalyn Joy VelaqueBelum ada peringkat

- Tax Facts For IndividualsDokumen9 halamanTax Facts For Individualsred20055Belum ada peringkat

- TAXATION OF INDIVIDUAL INCOMEDokumen3 halamanTAXATION OF INDIVIDUAL INCOMESaya PascualBelum ada peringkat

- Compensation Income and Fringe Benefit Tax. ReviewerDokumen4 halamanCompensation Income and Fringe Benefit Tax. RevieweryzaBelum ada peringkat

- 1040 Exam Prep Module VI: Standard and Itemized DeductionsDari Everand1040 Exam Prep Module VI: Standard and Itemized DeductionsBelum ada peringkat

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsDari Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsBelum ada peringkat

- Comelec Resolution 10057 - General Instructions For BEI For 2016 National and Local ElectionsDokumen42 halamanComelec Resolution 10057 - General Instructions For BEI For 2016 National and Local ElectionsDeped Tambayan100% (3)

- SomethingDokumen15 halamanSomethingMartin EstreraBelum ada peringkat

- SonglistDokumen1 halamanSonglistMartin EstreraBelum ada peringkat

- SonglistDokumen1 halamanSonglistMartin EstreraBelum ada peringkat

- Admin Law OutlineDokumen10 halamanAdmin Law OutlineMartin EstreraBelum ada peringkat

- CS140 OutlineDokumen2 halamanCS140 OutlineMartin EstreraBelum ada peringkat

- Revenue Regulations on Taxation of Compensation Income and Fringe BenefitsDokumen1 halamanRevenue Regulations on Taxation of Compensation Income and Fringe BenefitsMartin EstreraBelum ada peringkat

- Tentative Agreement Overview 2021.12.01Dokumen7 halamanTentative Agreement Overview 2021.12.01WWMTBelum ada peringkat

- Offer LetterDokumen9 halamanOffer LetterAkshay SakharkarBelum ada peringkat

- Republic of The Philippines Supreme Court ManilaDokumen24 halamanRepublic of The Philippines Supreme Court ManilaAlan Vincent FontanosaBelum ada peringkat

- Banner Human Resources Position Control User Guide 8.12.1Dokumen621 halamanBanner Human Resources Position Control User Guide 8.12.1Steven FowlerBelum ada peringkat

- CA Inter Short Notes 2019 20 PDFDokumen89 halamanCA Inter Short Notes 2019 20 PDFPrashant KumarBelum ada peringkat

- Annual Report JockeyDokumen84 halamanAnnual Report JockeyVenugopal PyneniBelum ada peringkat

- Tennant V Smith (Surveyor of Taxes)Dokumen3 halamanTennant V Smith (Surveyor of Taxes)Shivanjani KumarBelum ada peringkat

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDokumen1 halamanHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayBelum ada peringkat

- Ce Law Reviewer 3456Dokumen11 halamanCe Law Reviewer 3456Cancer GamingBelum ada peringkat

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Dokumen3 halaman1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikBelum ada peringkat

- Salary Perquisites 4Dokumen25 halamanSalary Perquisites 4Nitin GargBelum ada peringkat

- Induction & Orientation FinalDokumen32 halamanInduction & Orientation FinalSwapnali RajputBelum ada peringkat

- Benefits in Kind Public Ruling No 11-2019Dokumen30 halamanBenefits in Kind Public Ruling No 11-2019BETTY BALANBelum ada peringkat

- Updates (Company Update)Dokumen5 halamanUpdates (Company Update)Shyam SunderBelum ada peringkat

- Incentive SchemeDokumen4 halamanIncentive Schemerahulravi4u100% (1)

- Corporate Income Tax GuideDokumen46 halamanCorporate Income Tax GuideCanapi AmerahBelum ada peringkat

- SRS Annual ReportDokumen236 halamanSRS Annual Reportkaushal patelBelum ada peringkat

- Taxation Law 1994-2006Dokumen242 halamanTaxation Law 1994-2006Zina CaidicBelum ada peringkat

- Kanet General Contractor P.L.C.: Daily Loborer Payment SheetDokumen41 halamanKanet General Contractor P.L.C.: Daily Loborer Payment SheetYohannes AssefaBelum ada peringkat

- AIA Ecp MCP Brochure MyDokumen50 halamanAIA Ecp MCP Brochure Mykevin900100% (5)

- Week 3 Case Digests Page 57Dokumen137 halamanWeek 3 Case Digests Page 57Andrew Mercado NavarreteBelum ada peringkat

- HRM Report Bank AlfalahDokumen31 halamanHRM Report Bank AlfalahMirza MunirBelum ada peringkat

- Training Program PlanDokumen11 halamanTraining Program Planapi-300097966Belum ada peringkat

- Bem Formkpm 98 2007 MoaDokumen90 halamanBem Formkpm 98 2007 Moaaizad hanifBelum ada peringkat

- Info Sys Salary SlipDokumen2 halamanInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- QuizDokumen15 halamanQuizAdityaHridayBelum ada peringkat

- Employee HandbookDokumen26 halamanEmployee HandbookMichael Addington50% (2)

- Governance AssignmentDokumen11 halamanGovernance AssignmentAnonymous xtuM4xBelum ada peringkat

- Fringe Benefit Tax CalculatorDokumen4 halamanFringe Benefit Tax CalculatorKenneth Bryan Tegerero Tegio100% (1)

- Basic Concepts of TaxationDokumen9 halamanBasic Concepts of TaxationAyush BholeBelum ada peringkat