Introduction To Investment: Bruce Viney

Diunggah oleh

frieda20093835Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Introduction To Investment: Bruce Viney

Diunggah oleh

frieda20093835Hak Cipta:

Format Tersedia

1

Introduction to

Investment

Bruce Viney

Director of Training and Client Services

http://www.sqa.org.uk/files_ccc/

Training_Presentation.PPT

2

Why we are here.

Exam (syllabus valid from 1 October 2006)

60 minutes

50 Questions

Multiple choice

Pass mark is 70%

3

Programme/Syllabus

Workbook

Chapter

Content Questions

in exam*

1 Financial Services in the UK 8

2 Asset Classes 13

3 Derivatives 2

4 Financial Products 6

5 Pooled Funds 9

6 Investment Wrappers 2

7 Financial Services Regulation 8

8 Taxation 2

Total 50

* plus/minus 2

4

Introduction

CHAPTER 1

The Role of the Financial Markets

Financial Institutions

Londons Markets

The Bank of England

The UK Economy

The Role of Financial Markets

Savers

Borrowers

Companies

Governments

Surplus capital,

looking for a return

Need capital

The Role of Financial Markets

Savers

Borrowers

Companies

Governments

Capital Markets Money Markets

BANKS

Financial Markets

SHARE

MARKETS

BOND

MARKETS

7

Financial Market stages

onward trading of

shares at market

price

Company

issue

shares

at

2.20 each

PRIMARY

MARKET

SECONDARY

MARKET

8

Financial Institutions

Retail banks and building societies

Investment banks

Pension funds

Insurance companies

Fund managers

Stockbrokers

Custodians

Credit card companies

Londons Markets

Soft commodities

Financial futures

Traded Options

Non-ferrous

Non-precious

Brent crude

Gas oil

Natural gas

UK equities and corporate bonds

Gilts

Overseas equities and bonds

Insurance market

10

Date Event

1773 Brokers create The Stock Exchange

1986 Big Bang - major reforms

1995 Tradepoint starts in competition with LSE

1997 SETS - electronic order book

2001 Listed as a quoted company

London Stock Exchange

Policy 60m

Synd A 20m

The Lloyds Market

Syndicate

Clients

Broker

Members

15m

15m

10m

Syndicate

Syndicate

Syndicate

12

World Securities Markets

NYSE

Nasdaq

Euronext

Japan

Deutsche Borse

13

Economics

Categorising Economies

Gross Domestic Product

Gross National Product

Balance of Payments

Inflation

PSNCR

Market

Mixed

Open

State controlled

14

Gross Domestic Product

Market value of goods and services

produced in a country

Measure of the level of economic

activity

Three ways of representing:

Total GDP

GDP per head (per capita)

GDP growth

15

Gross National Product

GNP for the UK is the GDP:

Plus interest, profits, and dividends

received from abroad by UK residents

Less income earned in the UK by overseas

residents

Balance of Payments

Measures the difference between money flowing into

and out of the country

Imports Exports

visible

invisible invisible

visible

C

u

r

r

e

n

t

a

c

c

o

u

n

t

17

Inflation

What is it?

Problems caused by inflation

Measurement

headline RPI

underlying RPIX

harmonised HICP

Caused by an increase in the money

supply?

What is money?

Bank of England

Three core purposes:

maintain integrity and value of the currency

maintain stability of financial system

seek to ensure the effectiveness of the UKs financial

sector

Intervenes in the forex market (in accordance with

govt policy)

Bank for

Commercial banks

Government

Sets interest rates through the Monetary Policy

Committee (MPC)

Interest Rates

Short term interest rates are set by the MPC

MPC are to use interest rates to meet a set inflation target

(currently 2.5%)

Interest rates are changed as a result of Bank of

Englands dealings with banks

customer

bank

Bank of England

bank bank

%

%

%

%

% %

MPC control this rate

LIBOR

Government Borrowing

Government income from taxation

Government expenditure

Difference is called:

Public sector net cash requirement (PSNCR)

21

Foreign Exchange

Market in currencies

No central market

London is the largest centre

Dominated by banks

Types of contract

spot

forward

22

Companies, Capital and Asset

Classes

CHAPTER 2

Equities

Corporate actions

LSE trading and settlement

Bonds

Money market instruments

Company administration

23

Security

General term for any type of financial instrument (usually)

traded on an investment exchange.

Bonds

Equities

Part ownership = shares Debt in the form of IOUs

In the UK, capital market securities are generally held in

registered form whilst money market instruments are

issued in bearer form

Equity types

Equity

type

Voting rights Dividend

Ordinary

Preference

The two main equity types in the UK are ordinary and

preference shares

Preference shares have preference over ordinary

shares in terms of:

Dividend payment

Repayment on winding up

Variable, not guaranteed

Fixed, not guaranteed

(can be cumulative)

Yes

No

25

Why own shares?

Voting

Income dividends

Capital growth

Trade perks

Risks

Price

Liquidity

Issuer

26

Corporate Actions

Types of action

mandatory

voluntary

mandatory with options

Examples

bonus issue (to increase the liquidity of shares)

dividend (to distribute profits)

takeover offer (to acquire the shares)

rights issue (to raise funds)

27

Rights Issues

Company raising additional finance

new shares are issued

existing shareholders can buy them first

(pre-emptive rights)

Upon receipt of a rights letter a shareholder

has to decide upon their course of action

Calculating the ex price

A company announces a 1:5 rights issue at 3.50.

If the cum market price of the underlying shares is 4.00,

what is the theoretical ex price of the shares?

Before

Rights

After

Number

of shares

Price per

share

Total

value

5

1

6

4.00

3.92

3.50

20.00

3.50

23.50

23.50

6

How much is the right to buy a share worth?

29

Bonus Issues

Free shares

The effect on share price?

Why would a company do it?

Calculating the ex price

There is a 1:1 bonus issue.

The market price of the shares before the capitalisation is

12.00.

What is the theoretical ex price of the shares?

Before

Scrip

After

Number

of shares

Price per

share

Total

value

1

1

2

12.00

6.00

0.00

12.00

0.00

12.00

12

2

31

Cash dividends

What is a dividend

Payment/distribution to shareholders from

realised profits

Interim and final dividend

Timetable

Feb

Dividend

announced

Wed 8

March

Ex-dividend

day

Fri 10

March

Record

Day

(Books closed day)

Dividend

Payment date

Fri 10

May

ex div cum div

AGM

Tues 7

May

Listing on the Stock Exchange

The main advantages are:

Takeovers using shares to fund the acquisition of other cos

Employees stock options can be used to retain key staff

Capital - access to a large pool of capital

The main disadvantages are:

Short termism impatience and emphasis on short term goals

Regulations disclosure requirements are more stringent

Status/prestige assist companys trading prospects

Threat of takeover anyone can become a part owner

Listing

Full list Alternative

Investment

Market

Trading history Minimum 3

years

No minimum

Market

capitalisation

Minimum

700,000

No minimum

Public holding At least 25% No minimum

34

Indices

Indices enable investors to:

measure performance of a market

use as a benchmark to judge actively managed

portfolios

trade futures and options based on them

The main indices on LSE equities are:

FTSE 100

FTSE 250

FTSE Actuaries 350

FTSE All Share Index

FTSE Indices

1

100

350

c900

FTSE 100

FTSE 250

FTSE Small Cap

FTSE All Share

36

World Markets

Securities

New York

NASDAQ

London

Euronext (Paris)

Tokyo

Deutsche Borse

Hong Kong

Indices

Dow Jones

S&P 500

NASDAQ Composite

Nikkei 225

CAC 40

Xetra DAX

Hang Seng

37

Broker

Broker

Buyer

Seller

Order driven

Buyer

Seller

Broker

Broker

Market Maker

Quote driven

Domestic Equity Market

38

Domestic Equity Market

SETS

FTSE 100; FTSE 100 reserve stocks; stocks removed from FTSE

100.

SETSmm

FTSE 250 shares not on SETS, order book plus one or more

market makers

SEAQ

fully listed shares, not on SETS or SETSmm, with two or more

market makers

AIM shares with two or more market makers

39

SETS

Buy & sell orders displayed (price/time priority)

Standard settlement

Visible to all but only member firms can input and

delete orders

40

41

SEAQ

Market makers show prices and sizes

Two way prices (bid, offer, spread)

Touch strip

42

43

Equity Settlement

Broker

Market

Maker

shares

Settlement

Trade

Buy me 1000 PJC

plc shares

Contract Note

44

CREST is an electronic settlement system

Mainly settles UK equities, corporate loan

stock and gilts

Dematerialised/uncertificated settlement

45

Member

Crest Structure

Investors

Companies

Bank

Registrar

Regulators

Revenue(s)

46

Bonds

A bond is a tradeable loan

Issuer promises to:

repay the loan at a future date (on

maturity)

pay interest at a defined rate (usually fixed)

Issuer might be the British government

bonds are called gilt edged securities

Issuer might be a company

47

Corporate Bonds

Domestic Foreign Eurobond

Issued by home

company to home

investors in home

currency

Issued by overseas

company to home

investors in home

currency

Issued to many

investors in any

currency

international issues

48

Other bonds - features

Zero Coupon Bonds

Convertibles

Gilts

Interest (coupon)

gross annual interest on the nominal value (100)

paid semi annually

Repayment (redemption)

Classification by DMO

Short Less than 7 years

Medium 7-15 years

Long More than 15 years

Issue by DMO

bid basis (auction to those on an Approved List)

individuals may submit non-competitive bids (up to 500,000)

Secondary Market

GEMMS or DMO/Computershare service

50

Yields

Flat Yield

Example: Treasury 2006 6% is currently

trading at 102, calculate the flat yield

A 3.6%

B 4.9%

C 5.9%

D 6.0%

annual coupon x 100%

----------------------

market price

51

Money market instruments

Money market instruments are forms of

short term tradeable debt. The products you

need to be aware of are:

Treasury bills

Commercial paper

Certificates of Deposit

52

Treasury bills

Short term zero coupon bonds

Maturities generally after 3 months

Issued weekly by the DMO on behalf of the

Treasury

Sold at a discount to their face value

53

Commercial paper

Short term unsecured debt

Usually zero coupon therefore issued at a discount

Usually high nominal value

A CP programme specifies a total amount that can be

issued and may have an end date

CP programme

issue limit 150m

end date 2008

Date Issue Term

Mar 2006 100m 6mth

Apr 2006 50m 3mth

Oct 2006 75m 6mth

Jan 2007 75m 3mth

54

Certificates of Deposit (CD)

Investor A

Investor B

Bank

Company types

All companies

public

(plc)

private

(ltd)

fully

listed

AIM

listed

unquoted

56

Company Administration

Company

Shareholders

Memorandum

Articles

Company Directors

Executive

Non-executive

Meeting types:

AGM

EGM

ARTICLES:

Shareholders rights

Borrowing powers

Dividends

Meetings

Directors

Winding up

MEMORANDUM:

Name of Co

Domicile

Authorised Share Capital

Statement of liability

Objects

PLC or not.

57

Derivatives

CHAPTER 3

Futures

Options

58

Futures

An agreement to buy or sell a specified

quantity of a specified asset at an

agreed price on an agreed date

Exchange traded and on standardised

terms

For example: Futures on metals, oil,

agricultural products

Motives: Hedge or Speculate

59

Futures Terminology

Long = buy a future

Short = sell a future

Open = enter into a futures position

Close = trade out of a futures position

60

Options

A contract that gives the right but not

the obligation to buy or sell a specified

quantity of an underlying asset at a

specified price within a specified period

Call option = the right to buy

Put option = the right to sell

An example of an Equity Call Option

PJC plc

1000 shares

Market price 105p

I grant you

The right to buy

1,000 PJC plc shares

From me

At a price of 100p

Within 3 months

Writer

Holder

Option Premium

Call Option (10p per share)

(100)

Options terminology

Consider an equity call option with a strike price of 100p and

premium of 10p. The underlying share is currently valued at

105p

strike 100p

Price

Time

105p

breakeven 110p

in the money

out of the money

at the money

63

Options Terminology

Call Option

Put Option

In the money

At the money

Out of the money

Breakeven

64

Financial Products

CHAPTER 4

Deposits and loans

Interest rates

Mortgages

Insurance and Pensions

National Savings and Investments

65

Deposits and loans

Deposits

Fixed term v Instant access

Interest

Gross v Net

R85 enables payment gross

Loans

Bank loans

Secured v Unsecured

Overdrafts

Authorised v Unauthorised

Credit cards

66

Interest Rates

Quoted rate v Effective rate

Steps to turn quoted into effective

1. Quoted expressed as a decimal

2. Divided by number of periods per year

3. Added to one

4. To the power of the number of periods per

year

5. Subtract one and times by 100

67

Mortgages

Secured loan on property

Mortgage types

Repayment

Interest only

Mortgage interest

Fixed

Capped

Discounted

Variable

Redemption penalties

Other types

Endowment

Pension linked

ISA

Unit linked

Flexible

68

Insurance and Pensions

Life policies

Term v Whole of life

With profit (incl unit linked) v non profit

Pensions

State

Basic v Second

Occupational

Defined benefit v defined contribution

Private/Personal

Stakeholder

69

National savings products

National Savings accounts:

Easy Access a/c (instant access)

Investment a/c (one month notice)

Premium bonds

Random prize

Other products

Fixed Interest Savings Certs

Fixed Rate Savings Bonds

Paid Gross

but taxable.

Paid Gross

But taxable

Tax free.

Paid on maturity

Tax free up to

15,000 per issue.

Taxable,

Paid net of 20%

70

Pooled Funds

CHAPTER 5

Unit Trusts

OEICs

Investment Trusts

Rationale of Collective Investment

Fund Manager

Advertise

5,000

Ive got a spare five thousand,

I think Ill invest in a UK equity fund.

Shares/units in

collective invt

72

Role of the FSA

Authorised v unauthorised

Onshore v offshore

Unit Trusts - Basics

Investors

(1,000)

Fund Manager

5,000 x 1,000

1 million units

x 500p per unit

Investments

Trustee

Investments

Markets

Makes investment decisions

Prices the units

Deals with investors

Legal owner of the trust property

Safeguards assets

Monitors the manager

Securities Funds - most common

Money Market funds

Futures and Options funds

Geared F&O

Warrant funds

Property funds

Fund of funds

Feeder Funds

Umbrella Funds

Limited issue funds

Principal protected funds

Mixed funds

Types of Unit Trust

Authorised/regulated funds

Buying more Units

Fund Manager

Trustee

Investments

FM prices Bid Offer

UK Equity 485 515

5,150

1 000 units

x 515p per unit

Another 1,000 units

created (open

ended)

Creation of more units?

Fund Manager

Trustee

Investments

10,000 units 9,000 units

Buyers Sellers

Create 1,000 units

Investments

Markets

77

How to price a unit

Prices calculated by the managers

FSA rules

prices based on net asset value at the most

recent valuation

calculate separate bid and offer prices although

single pricing is possible

maximum offer price = creation price plus initial

charge

Offer price tend to include an initial charge - around

5-6% on top of allowances for stamp duty and

brokerage

78

What is an OEIC ?

Open Ended Investment Company

Also known as an ICVC (Investment Company

with Variable Capital)

Invests money on behalf of its shareholders in

shares and bonds

79

Key elements of an OEIC

Variable capital base

Shareholders are direct owners of the company

Shares are traded at a single price (at NAV)

Authorised Corporate Director instead of Manager

Depository instead of Trustee

An OEIC is a UK company that can repurchase its own shares

on demand

Investment Trusts

Investors

Investment Trust

5,000 x 1,000

5 million 1 ord shares

Investments

Depository

Investments

Markets

Trade

Price tends to be at a discount to the

net asset value of the company. This

discount narrows in a bull market and

widens in a bear market

81

Exchange Traded Funds (ETFs)

Index tracking funds

Open ended

Structured as a company

Listed on exchanges (such as the LSEs

extraMARK)

Trade at net asset value

82

Collective investments comparison

Feature Unit Trust Invt Trust OEIC/

ICVC

ETF

Open/

closed ended

open closed open open

Legal structure/

Investment unit

Trust/

unit

Company/

share

Company/

share

Company/

share

Price based on Net asset

value

Demand and

supply

Net asset

value

Net asset

value

Bid/offer or single

price

Bid/offer Bid/offer Single price Bid/offer

Investments

purchased from

Fund manager Stock market Authorised

corporate

director

Stock market

Investments held by Trustee Authorised

depositary

Authorised

depositary

Custodian

83

Hedge Funds

Unregulated schemes

High investment entry levels

Flexible investment style, including

gearing

Fees are performance related

84

Investment Wrappers

CHAPTER 6

ISAs/PEPs

Child Trust Funds

85

ISAs

Designed to replace PEPs

no tax on income or capital gains

An ISA is a tax free wrapper that can be

applied to a wide range of products

Up to 2 components as follows

Cash

Stocks & Shares

ISA limits

Mini ISA

Stocks &

shares

4,000 p.a.

Cash

3,000 p.a.

Maxi ISA

Stocks &

shares

no limit

Cash 3,000 p.a

7,000 p.a

87

Child Trust Funds

For children born on or after 1 Sept 2002

Money cannot be withdrawn until child turns

18 (child can manage from 16)

Government starts CTF with 250 (500 for

lower income families)

Can add up to 1200 per annum

Savings, shares or stakeholder accounts

No tax on income or gains

88

Regulation

CHAPTER 7

FSMA 2000

Money Laundering

Insider Dealing and Market Abuse

Takeovers and Mergers

89

UK Financial Regulation

The UKs main financial regulator is the Financial

Services Authority (FSA)

The FSA operates under the Financial Services and

Markets Act 2000 (FSMA 2000)

The Act states that any person (firm) conducting

regulated activities in the UK must be authorised by the

FSA or exempt

Certain individuals within the firm must also be approved

by the FSA for their roles

The FSA have written a handbook which must be

complied with to avoid prosecution

90

The FSAs four objectives

Maintaining confidence

Promoting public awareness

Appropriate protection for consumers

Reduce scope for financial crime

91

Approved persons regime

Certain people working for an authorised person

(firm) must be approved by the FSA for their role.

The 27 separate controlled functions (jobs) that

require approval are grouped under five categories:

Governing functions (e.g. Directors)

Required control functions (e.g. MLRO)

Systems and controls functions

Significant management functions

Customer functions

92

Key statutes governing financial services

Financial Services and Markets Act 2000

Proceeds of Crime Act 2002 and ML Regs 2003

Anti-money laundering

Criminal Justice Act 1993

Money Laundering

Definition

3 stages

ML Regs 2003: Financial institution procedures :

identify new clients

record keeping

internal reporting

internal controls to prevent the firm being used for

money laundering

POCA 02 Offences:

concealing; arrangements that you know or suspect is

to acquire, retain, use/control criminal property;

acquire, use or possess criminal property; failure to

report; tipping off

Suspicion reporting process

Employee => MLRO => SOCA

Insider Dealing

If an individual who

possesses inside

information from a

primary or secondary

insider

Deals

Encourages

others to deal

Tell others the

information

95

Market abuse

Offence under FSMA 2000

Includes : Using

information not

generally available to

others

Regular user test

employed to establish

guilt or innocence

96

There are two main concerns regarding a

takeover and different regulatory bodies are

in place to address each concern:

Is the takeover anti competitive?

Are shareholders treated fairly?

Takeovers and Mergers

Competition Commission

Panel on Takeovers and Mergers

97

Takeovers and Competition

CC

The Office of Fair Trading considers

whether a proposed takeover might be anti-

competitive.

The OFT could result in the bid being

referred to the Competition Commission

The Competition Commission decides on

whether the takeover should be allowed to

proceed, any restrictions required and the

like

OFT

98

Takeovers and shareholders

The Panel on Takeovers and Mergers (POTAM or

PTM) ensures that all shareholders are treated

fairly

Their rulebook is known as the Takeover Code or

Blue Book

The rulebook principles state:

Shareholders of a target company must be treated

equally in all respects during an offer

Dont bid for a company unless you intend to, and

can afford to, go through with the bid

Directors should make decisions by considering

what is best for shareholders, not themselves

99

Takeovers key %s

30%

Effective

control

50%

Actual

control

Must make a bid for the remaining

shares in the company

0%

100%

SARs prevent the following:

(1) 10% or more

(2) Within 7 calendar days

(3) From more than one source

(4) Resultant shareholding is 15% or more

Takeover of a Listed Company

Offer

document

dispatched

28

days

Bid

announced

through

Stock Exchange

21

First

closing

39

Final

target

company

announcements

46

Final

revision

0

Final

closing

60

101

Other Regulations

Data Protection Act

8 principles especially adequate, relevant and not

excessive

Complaints

System required and Financial Ombudsman

Service can compel firms to pay up to 100,000

Compensation

Financial Services Compensation Scheme payout

maximum of 48,000

102

Taxation

CHAPTER 8

Income tax

Capital Gains Tax

Inheritance Tax

Stamp Duty

103

Taxation

Income tax

Capital gains tax

Inheritance tax

Paid on income, potentially

including investment income

Potentially payable on the

sale of an investment

Potentially payable on

investments held at death

104

Income Tax

Salary

Profits from running a business

Dividends

Interest

From an employer

Individuals or

partnerships

From companies

From banks/building societies/bonds

105

Income Tax

Income

5,035

10%

22%

40%

Personal allowance

Lower rate

Basic rate

Higher rate

2,150

33,300

33,301

106

Taxation (Income)

Tax is usually deducted at source.

salaries PAYE

savings income (interest)

basic rate of 20% is automatically deducted

dividend income

basic rate of 10% is automatically deducted

107

Taxation (CGT)

Capital Gains

Shares

Bonds (some)

Property

Antiques

Exemptions

Main home

Gilts

Cars

108

Taxation (CGT)

Allowance of 8,800 for the year

CGT only paid on gains above the allowance

Any losses can be carried forward

Paid at the investors marginal rate of 10%, 20%

or 40%

109

Inheritance Tax

A certain amount is exempt

threshold of 285,000

anything left to a spouse

anything left to a charity

items given away more than seven years before

death

IHT charged at 40%

110

Stamp Duty/SDRT/SDLT

0.5% on the purchase of shares

1% on homes >120,000

3% on homes >250,000

4% on homes >500,000

111

End of Course

Anda mungkin juga menyukai

- Stock Markets Overview: - Stockholders Are The Legal Owners of ADokumen32 halamanStock Markets Overview: - Stockholders Are The Legal Owners of AGaurav JindalBelum ada peringkat

- Mutual Funds: Concept and CharacteristicsDokumen179 halamanMutual Funds: Concept and CharacteristicssiddharthzalaBelum ada peringkat

- Financial Institutions and Derivatives Markets GuideDokumen54 halamanFinancial Institutions and Derivatives Markets GuideMark LimBelum ada peringkat

- L5 Exchange and IndexDokumen27 halamanL5 Exchange and Indexnarendran ramanBelum ada peringkat

- Presentation on Capital and Securities MarketsDokumen30 halamanPresentation on Capital and Securities Marketspriyankshah_bkBelum ada peringkat

- Chapter2 - Organization and Functioning of Securities MarketsDokumen74 halamanChapter2 - Organization and Functioning of Securities MarketsBerhanu ShankoBelum ada peringkat

- Sources of Finance & Capital StructureDokumen66 halamanSources of Finance & Capital StructurejkwabenaBelum ada peringkat

- What Is A Derivative? An Overview of Financial Markets The Role of Financial Markets Ways To Think About Derivatives Buying and Short-SellingDokumen20 halamanWhat Is A Derivative? An Overview of Financial Markets The Role of Financial Markets Ways To Think About Derivatives Buying and Short-SellingZhuangKaKitBelum ada peringkat

- Carbon TradingDokumen32 halamanCarbon TradingCarlos ChangBelum ada peringkat

- Capital Market: Overview & OperationsDokumen37 halamanCapital Market: Overview & OperationsEldho VargheseBelum ada peringkat

- How To Trade Stocks and BondsDokumen28 halamanHow To Trade Stocks and Bondsmohitjainrocks100% (1)

- 3 How Securities TradeDokumen29 halaman3 How Securities TradeMd parvezsharifBelum ada peringkat

- LintnerDokumen51 halamanLintneramt801Belum ada peringkat

- Msa l1 Organisation of The Securities MKTDokumen34 halamanMsa l1 Organisation of The Securities MKTSam GosaBelum ada peringkat

- Must Business School: Mirpur University of Science and Technology (Must), Azad KashmirDokumen77 halamanMust Business School: Mirpur University of Science and Technology (Must), Azad KashmirSadia KhanBelum ada peringkat

- 2 Financial Markets and InstrumentsDokumen31 halaman2 Financial Markets and InstrumentsMd parvezsharifBelum ada peringkat

- Welcome: To Islamabad Stock ExchangeDokumen32 halamanWelcome: To Islamabad Stock ExchangeAfshan GulBelum ada peringkat

- Sem in Finance-Notes To Final Exam Readings Part 2Dokumen82 halamanSem in Finance-Notes To Final Exam Readings Part 2hantrankha75Belum ada peringkat

- Organization and Functioning of Securities Markets: Questions To Be AnsweredDokumen33 halamanOrganization and Functioning of Securities Markets: Questions To Be AnsweredAaryaAustBelum ada peringkat

- Comprehensive Guide to Unit Trust FundamentalsDokumen132 halamanComprehensive Guide to Unit Trust FundamentalsMohd Hatif KamailBelum ada peringkat

- Week 2: Investment VehiclesDokumen37 halamanWeek 2: Investment Vehiclesmike chanBelum ada peringkat

- Money Markets Chapter Explains Short-Term Financial InstrumentsDokumen66 halamanMoney Markets Chapter Explains Short-Term Financial InstrumentsAykaBelum ada peringkat

- Lecture 1 The Investment EnvironmentDokumen43 halamanLecture 1 The Investment Environmentnoobmaster 0206Belum ada peringkat

- Trading and Settlement ProcedureDokumen41 halamanTrading and Settlement ProcedureAshray BhandaryBelum ada peringkat

- Final Project Group Members: Duaa Khan (L1F20ADBA0053) Ariba Asif (L1F20ADBA0080) Hassan Asghar (L1F20ADBA0094) Usman Javed (L1F20ADBA0067)Dokumen13 halamanFinal Project Group Members: Duaa Khan (L1F20ADBA0053) Ariba Asif (L1F20ADBA0080) Hassan Asghar (L1F20ADBA0094) Usman Javed (L1F20ADBA0067)usmanBelum ada peringkat

- Inside Financial Markets: Khader ShaikDokumen71 halamanInside Financial Markets: Khader ShaikDaviBelum ada peringkat

- FM04 Equity MKT 0217Dokumen62 halamanFM04 Equity MKT 0217Derek LowBelum ada peringkat

- Extra Reading Lect 5 The Capital Markets and Money Markets UWLDokumen34 halamanExtra Reading Lect 5 The Capital Markets and Money Markets UWLOv NomaanBelum ada peringkat

- Original Cse 1Dokumen31 halamanOriginal Cse 1api-3825789100% (1)

- Investment Analysis and Portfolio Management Seventh Edition by Frank K. Reilly & Keith C. BrownDokumen75 halamanInvestment Analysis and Portfolio Management Seventh Edition by Frank K. Reilly & Keith C. BrownUsman KWLBelum ada peringkat

- Money Market and Capital MarketDokumen36 halamanMoney Market and Capital Marketmisakisakura1102Belum ada peringkat

- 1.2 Primary and Secondary - Market Indices - IPODokumen12 halaman1.2 Primary and Secondary - Market Indices - IPONatasha GhazaliBelum ada peringkat

- Equity Markets IntroductionDokumen39 halamanEquity Markets IntroductionRohit KattamuriBelum ada peringkat

- JAIIB CAPITAL MARKET GUIDEDokumen48 halamanJAIIB CAPITAL MARKET GUIDEKumar JayantBelum ada peringkat

- Financial Management: FIN 534 An Overview of Financial Management and The Financial EnvironmentDokumen21 halamanFinancial Management: FIN 534 An Overview of Financial Management and The Financial EnvironmentMaria BraswellBelum ada peringkat

- Chapter 4 Explains Primary and Secondary Securities MarketsDokumen49 halamanChapter 4 Explains Primary and Secondary Securities MarketslooksvivekBelum ada peringkat

- CH 04Dokumen33 halamanCH 04Mohammad FahimBelum ada peringkat

- Lecture 3 Equity Market 1 PDFDokumen39 halamanLecture 3 Equity Market 1 PDFJoannaBelum ada peringkat

- Topic 4 Securities MarketsDokumen43 halamanTopic 4 Securities MarketsOne AshleyBelum ada peringkat

- Insidefinmkts KSV FullDokumen71 halamanInsidefinmkts KSV FullDaviBelum ada peringkat

- EBF 1023 Basic Finance: Asas KewanganDokumen41 halamanEBF 1023 Basic Finance: Asas Kewanganlim hyBelum ada peringkat

- Ch.2 - Financial InstitutionsDokumen21 halamanCh.2 - Financial InstitutionsbodyelkasabyBelum ada peringkat

- An Introduction To Treasury Management: David ChefneuxDokumen39 halamanAn Introduction To Treasury Management: David ChefneuxJerome RandolphBelum ada peringkat

- CH 4 Securities Market Matter To All Investors 2020Dokumen30 halamanCH 4 Securities Market Matter To All Investors 2020Abdihamid AliBelum ada peringkat

- Objectives: at The End of The Session You Will Be Able ToDokumen70 halamanObjectives: at The End of The Session You Will Be Able ToManoj Narayan KatkarBelum ada peringkat

- Note1 PDFDokumen23 halamanNote1 PDFCedric WongBelum ada peringkat

- Smo Chapter 1 & 2Dokumen34 halamanSmo Chapter 1 & 229.Kritika SinghBelum ada peringkat

- CH 04Dokumen32 halamanCH 04sabariaz5309Belum ada peringkat

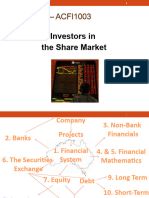

- ACFI1003 - Topic 8 Investors and The Share MarketDokumen48 halamanACFI1003 - Topic 8 Investors and The Share Marketshotboi69Belum ada peringkat

- FE1 Chapter 2Dokumen31 halamanFE1 Chapter 2Hùng PhanBelum ada peringkat

- International Equity Markets OverviewDokumen24 halamanInternational Equity Markets OverviewsapnanibBelum ada peringkat

- Overview of Key Financial System Concepts - Markets, Instruments, Participants & RegulatorsDokumen50 halamanOverview of Key Financial System Concepts - Markets, Instruments, Participants & RegulatorsshahyashrBelum ada peringkat

- Capital Market Efficiency and Capital Markets in IndiaDokumen33 halamanCapital Market Efficiency and Capital Markets in IndiaSamikshya MohantyBelum ada peringkat

- Part III Money Market (Revised For 2e)Dokumen31 halamanPart III Money Market (Revised For 2e)Harun MusaBelum ada peringkat

- Bond MathsDokumen193 halamanBond Mathsmeetniranjan14Belum ada peringkat

- Money Markets ExplainedDokumen42 halamanMoney Markets ExplainedSaberBelum ada peringkat

- Fixed Income MarketsDokumen69 halamanFixed Income Marketsniravthegreate999Belum ada peringkat

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKDari EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKBelum ada peringkat

- Developing Clear Learning Outcomes and Objectives PDFDokumen6 halamanDeveloping Clear Learning Outcomes and Objectives PDFfrieda20093835Belum ada peringkat

- Cardamom Rice Pudding Recipe PDFDokumen1 halamanCardamom Rice Pudding Recipe PDFfrieda20093835Belum ada peringkat

- Current Cost Accounting (CCA) - Objective and EvaluationDokumen36 halamanCurrent Cost Accounting (CCA) - Objective and Evaluationfrieda20093835Belum ada peringkat

- Weekly Online Discussions Rubric Eme5050Dokumen1 halamanWeekly Online Discussions Rubric Eme5050frieda20093835Belum ada peringkat

- MCQ on Accounting ErrorsDokumen1 halamanMCQ on Accounting Errorsfrieda20093835Belum ada peringkat

- What is accounting information and why is it importantDokumen17 halamanWhat is accounting information and why is it importantfrieda20093835Belum ada peringkat

- Ch1 Introduction To UK Tax System 2019Dokumen11 halamanCh1 Introduction To UK Tax System 2019frieda20093835Belum ada peringkat

- Chapter 1 Assessment MaterialDokumen1 halamanChapter 1 Assessment Materialfrieda20093835Belum ada peringkat

- Banana CakeDokumen1 halamanBanana Cakefrieda20093835Belum ada peringkat

- 01Dokumen12 halaman01priyaa03Belum ada peringkat

- Current Value Accounting - AccountingToolsDokumen3 halamanCurrent Value Accounting - AccountingToolsfrieda20093835Belum ada peringkat

- What Exactly Happens To Your Brain When You MeditateDokumen11 halamanWhat Exactly Happens To Your Brain When You Meditatefrieda20093835Belum ada peringkat

- Thomps 0324182813 1Dokumen24 halamanThomps 0324182813 1dehammoBelum ada peringkat

- 6179 22435 1 PB PDFDokumen9 halaman6179 22435 1 PB PDFJeffrey Ian M. KoBelum ada peringkat

- 01Dokumen12 halaman01priyaa03Belum ada peringkat

- MCQ on Accounting ErrorsDokumen1 halamanMCQ on Accounting Errorsfrieda20093835Belum ada peringkat

- KWLDokumen1 halamanKWLfrieda20093835Belum ada peringkat

- Ey The Audit Mandatory Rotation Rule The State of The ArtDokumen33 halamanEy The Audit Mandatory Rotation Rule The State of The Artfrieda20093835Belum ada peringkat

- 46933764Dokumen33 halaman46933764frieda20093835Belum ada peringkat

- 6179 22435 1 PB PDFDokumen9 halaman6179 22435 1 PB PDFJeffrey Ian M. KoBelum ada peringkat

- IFRS3 Andtherevised IAS27Dokumen18 halamanIFRS3 Andtherevised IAS27lilyanamaBelum ada peringkat

- 357Dokumen34 halaman357heroe3awanBelum ada peringkat

- 9825041Dokumen48 halaman9825041frieda20093835Belum ada peringkat

- Accounting Information Systems Implementation and Management Accounting ChangeDokumen14 halamanAccounting Information Systems Implementation and Management Accounting Changefrieda20093835Belum ada peringkat

- IAS 16 and The Revaluation Approach - Reporting Property Plant AnDokumen30 halamanIAS 16 and The Revaluation Approach - Reporting Property Plant Anfrieda20093835Belum ada peringkat

- Audit SkillsDokumen36 halamanAudit Skillsfrieda20093835Belum ada peringkat

- Example 1 PDFDokumen1 halamanExample 1 PDFfrieda20093835Belum ada peringkat

- Ias 38Dokumen4 halamanIas 38frieda20093835Belum ada peringkat

- Financial Statements Study and Assessment Guide: 2013 AAT Accounting QualificationDokumen13 halamanFinancial Statements Study and Assessment Guide: 2013 AAT Accounting Qualificationfrieda20093835Belum ada peringkat

- Home Student Resources Chapter 7 Multiple Choice QuestionsDokumen10 halamanHome Student Resources Chapter 7 Multiple Choice Questionsfrieda20093835100% (1)

- PDFDokumen196 halamanPDFHazelle CarmeloBelum ada peringkat

- Principles of Accounts: Paper 7110/01 Multiple ChoiceDokumen5 halamanPrinciples of Accounts: Paper 7110/01 Multiple ChoiceNanda SinghBelum ada peringkat

- Ecofys 2014 Potential For Shore Side Electricity in EuropeDokumen111 halamanEcofys 2014 Potential For Shore Side Electricity in EuropeCarlos DiazBelum ada peringkat

- Equity Valuation:: Applications and ProcessesDokumen24 halamanEquity Valuation:: Applications and Processestuba mukhtarBelum ada peringkat

- 0823.HK The Link REIT 2008-2009 Annual ReportDokumen201 halaman0823.HK The Link REIT 2008-2009 Annual ReportwalamakingBelum ada peringkat

- Hyperinflation and Current Cost Accounting ProblemsDokumen4 halamanHyperinflation and Current Cost Accounting ProblemsMaan CabolesBelum ada peringkat

- National Income Models with Government and Net ExportsDokumen13 halamanNational Income Models with Government and Net ExportsKratika PandeyBelum ada peringkat

- Memo To Client Regarding Choice of Business EntityDokumen6 halamanMemo To Client Regarding Choice of Business EntityAaron Burr100% (2)

- Money, Measures of Money Supply, and Quantity Theory of MoneyDokumen8 halamanMoney, Measures of Money Supply, and Quantity Theory of MoneyMayank AroraBelum ada peringkat

- KBC Trial BalanceDokumen9 halamanKBC Trial Balanceapi-2486948440% (1)

- Counsel VP M&A Real Estate in Chicago IL Resume Roger BestDokumen3 halamanCounsel VP M&A Real Estate in Chicago IL Resume Roger BestRogerBestBelum ada peringkat

- 3 Cash - Lecture Notes PDFDokumen11 halaman3 Cash - Lecture Notes PDFJohn Paul EslerBelum ada peringkat

- Breaking Into Wall Street - SyllabusDokumen16 halamanBreaking Into Wall Street - SyllabusRajkumar35100% (1)

- Financial Management 1 0Dokumen80 halamanFinancial Management 1 0Awoke mulugetaBelum ada peringkat

- B326 AouDokumen12 halamanB326 AouMuhammad AshrafBelum ada peringkat

- CSR E-BookDokumen153 halamanCSR E-BookMilan Malik100% (2)

- The Effect On Five Forces Model in Banking and Financial IndustryDokumen21 halamanThe Effect On Five Forces Model in Banking and Financial IndustryMay Myat ThuBelum ada peringkat

- OFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisDokumen34 halamanOFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisThanhdat VoBelum ada peringkat

- Accounting Policies and Procedures ManualDokumen32 halamanAccounting Policies and Procedures ManualAdmire Mamvura100% (2)

- Groupon Inc Case AnalysisDokumen8 halamanGroupon Inc Case Analysispatrick wafulaBelum ada peringkat

- 1) Introduction: Currency ConvertibilityDokumen34 halaman1) Introduction: Currency ConvertibilityZeenat AnsariBelum ada peringkat

- Limit Pricing, Entry Deterrence and Predatory PricingDokumen16 halamanLimit Pricing, Entry Deterrence and Predatory PricingAnwesha GhoshBelum ada peringkat

- GFM Mock QuestionsDokumen13 halamanGFM Mock QuestionsBhanu TejaBelum ada peringkat

- Managerial Economics:: According To Spencer and SiegelmanDokumen10 halamanManagerial Economics:: According To Spencer and SiegelmankwyncleBelum ada peringkat

- Resources On The Basis of 5MsDokumen6 halamanResources On The Basis of 5Mssaksi76@gmail.com100% (3)

- Customer Satisfaction of Life Insurance CompaniesDokumen7 halamanCustomer Satisfaction of Life Insurance CompaniesGudiyaBelum ada peringkat

- AP Investments Quizzer QDokumen55 halamanAP Investments Quizzer QLordson Ramos75% (4)

- Financial Statement Analysis TechniquesDokumen16 halamanFinancial Statement Analysis Techniqueskarim abitagoBelum ada peringkat

- 1.1 Company Profile: Financial Anlysis of DLF LTDDokumen125 halaman1.1 Company Profile: Financial Anlysis of DLF LTDAkash VariaBelum ada peringkat

- Break Even New2Dokumen39 halamanBreak Even New2thomasBelum ada peringkat